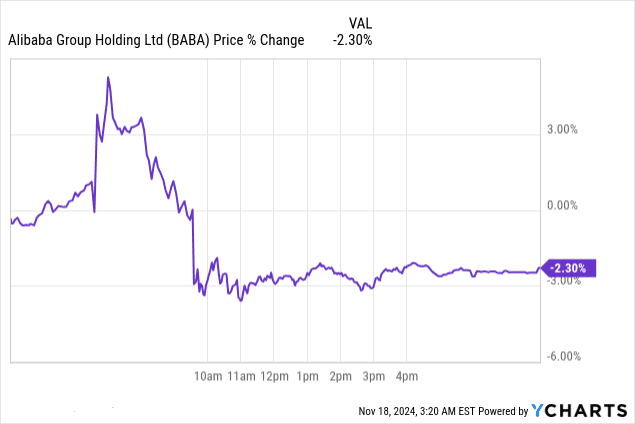

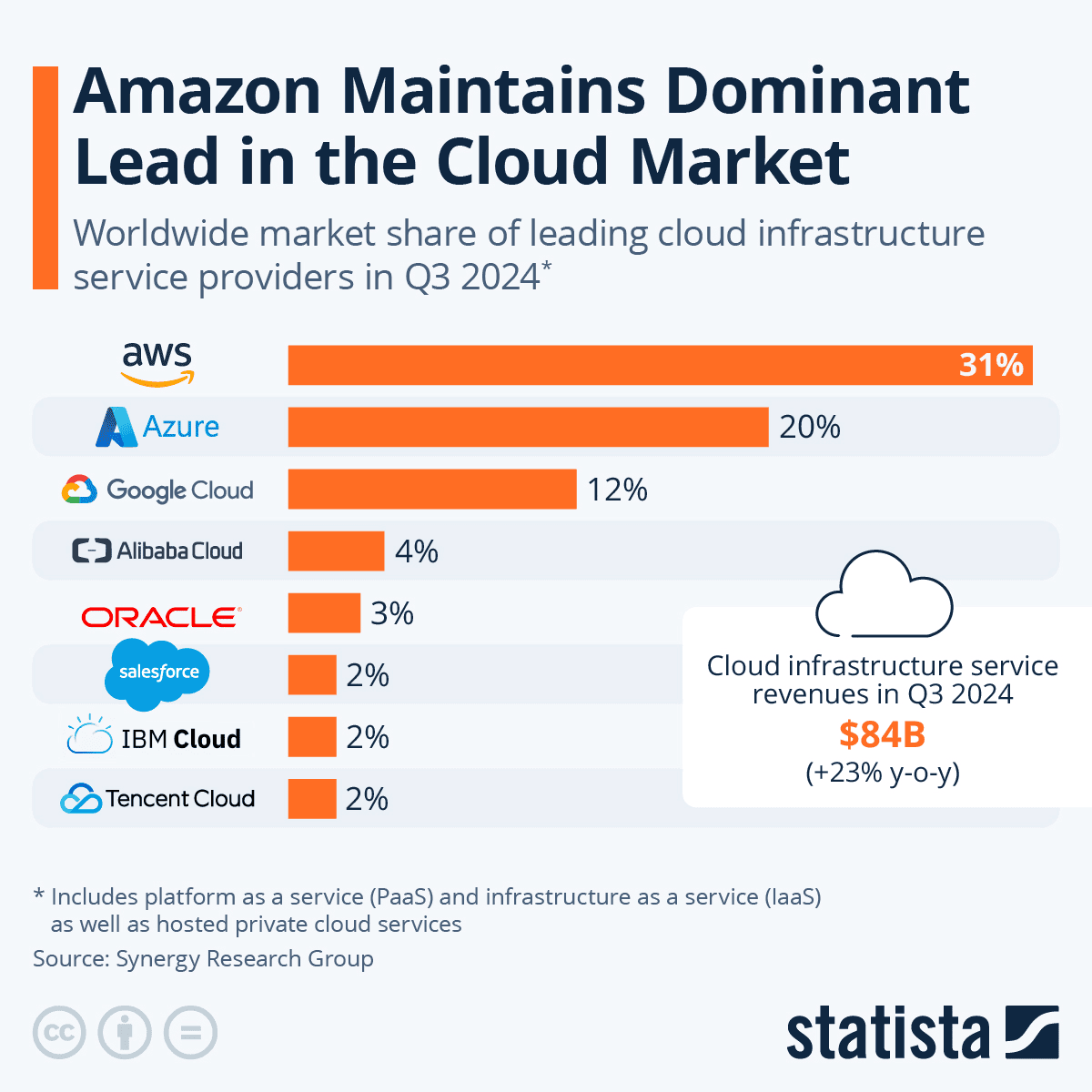

Alibaba's Q2 FY2025 results reflect a -2.3% post-earnings stock price dip, driven by mixed performance metrics and competitive pressures. Despite a 5% YoY revenue increase to $32.71 billion, a $498.84 million shortfall weighed on market sentiment. Strong GAAP EPS ($2.51, beating by $0.95) and net income growth (+63% YoY to RMB 43.5 billion) showcased profitability improvements, but rising investments cut adjusted EBITA by 5%. Key growth in international commerce (+29% YoY) and AI-related cloud revenues (triple-digit gains) highlight strategic advancements. Yet, slower domestic e-commerce (+1%) and a limited global cloud market share (4% vs. AWS's 31%) tempered investor confidence.

Source: Ycharts.com

I. BABA Earnings Overview Q3 2024

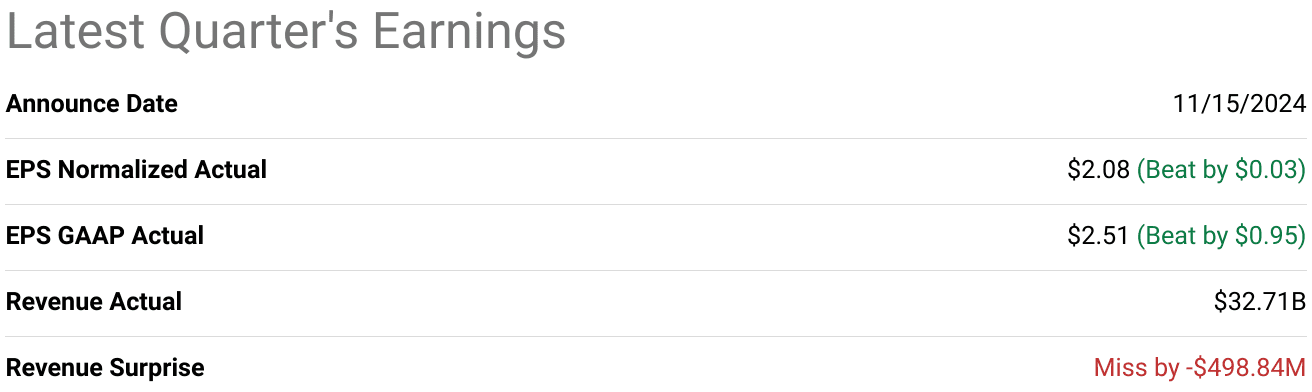

Alibaba's Q2 FY2025 earnings presented mixed results. Revenue reached $32.71 billion, a 5% year-over-year (YoY) increase, but fell short of expectations by $498.84 million. However, profitability metrics were strong, with a GAAP EPS of $2.51, beating forecasts by $0.95, and non-GAAP EPS of $2.08, exceeding estimates by $0.03. Net income surged 63% YoY to RMB 43.5 billion, bolstered by gains in equity investments and reduced impairments. Margins varied: gross margin improved slightly due to better monetization, while adjusted EBITA fell 5% YoY due to rising investments in e-commerce and AI infrastructure.

Source: seekingalpha.com

E-commerce remained a cornerstone of Alibaba’s performance. China commerce retail revenue grew modestly by 1% YoY to RMB 99 billion, with customer management revenue (CMR) increasing 2%, driven by a new 0.6% software service fee and expanded adoption of the AI-powered Quanzhantui marketing tool. International commerce shone with 35% YoY growth in retail to RMB 25.6 billion, driven by AliExpress Choice and expansion in Europe and the Gulf. Overall, international commerce revenue surged 29% YoY, demonstrating robust cross-border momentum.

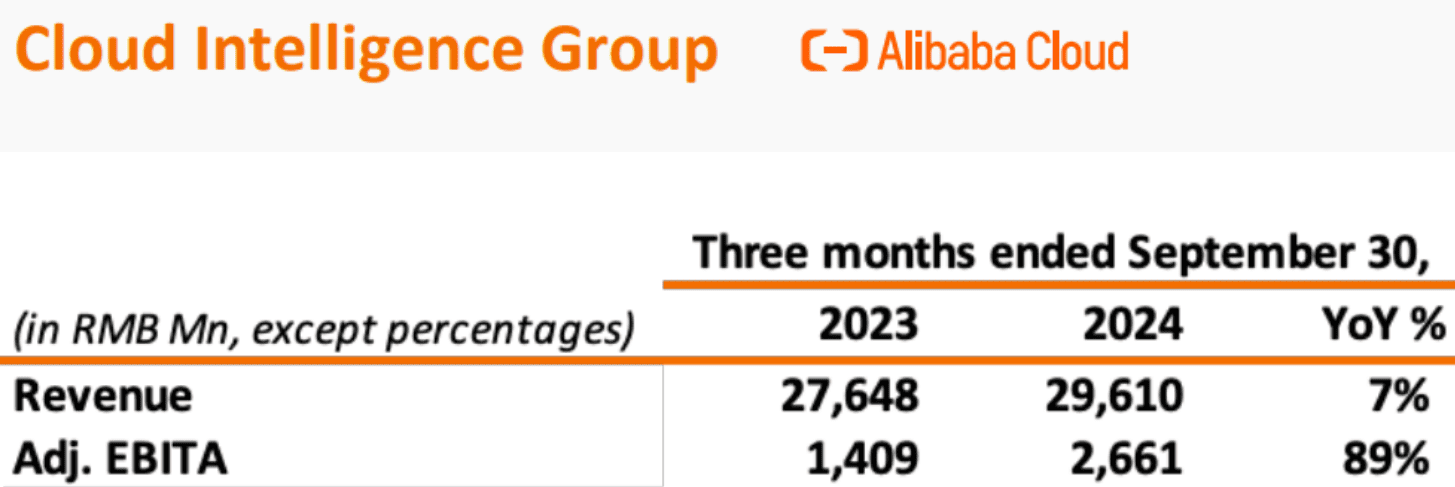

Cloud computing saw steady growth, with revenue increasing 7% YoY to RMB 29.6 billion, driven by double-digit public cloud growth and triple-digit gains in AI-related products for the fifth consecutive quarter. Adjusted EBITA for the cloud business nearly doubled, increasing 89% YoY to RMB 2.7 billion, supported by an improved revenue mix and operational efficiencies. These results underscore Alibaba's strategy to leverage AI as a driver of cloud adoption, positioning itself as a leading provider of AI-enabled cloud solutions.

Source: September Quarter 2024 Presentation

Logistics and digital media contributed more modestly. Cainiao's revenue rose 8% YoY to RMB 24.6 billion, propelled by cross-border fulfillment services, though adjusted EBITA declined 94% YoY due to investments in infrastructure. Digital media revenue remained flat at RMB 5.7 billion, with Youku narrowing losses through improved cost efficiency and higher advertising revenue.

II. Product & Market Dynamics

Alibaba continues to refine its product offerings, leveraging innovative AI-driven tools to bolster e-commerce and cloud capabilities. The Quanzhantui AI-powered marketing tool saw growing adoption among merchants, enhancing platform-wide monetization through improved marketing efficiency. Additionally, Alibaba introduced the AliExpressDirect model, streamlining international e-commerce by utilizing local inventories for faster delivery. Another notable launch was its AI-powered B2B search engine, which simplifies global sourcing for small and medium enterprises (SMEs). These enhancements have been well-received, as evidenced by a 29% YoY increase in Alibaba International Digital Commerce (AIDC) revenue, driven largely by cross-border business expansion.

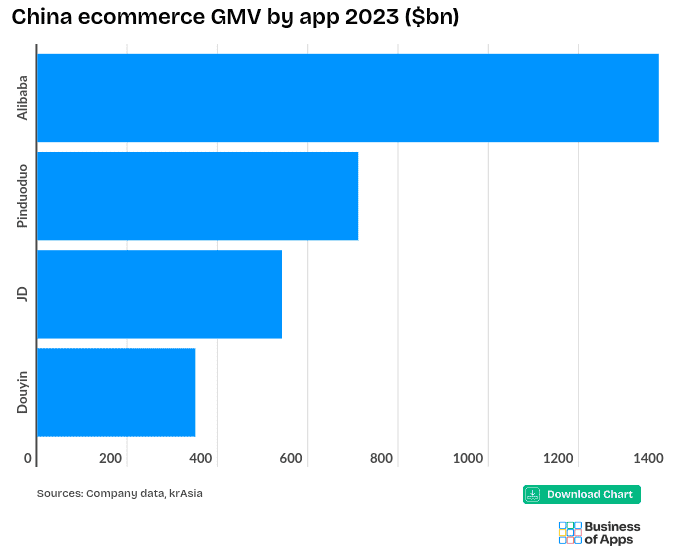

However, Alibaba faces mounting pressure in an increasingly competitive landscape. In domestic e-commerce, rivals like JD.com, Pinduoduo, and Douyin are innovating aggressively. JD.com, while behind Alibaba in gross merchandise volume (GMV) at $542 billion (2023) compared to Alibaba's $1.377 trillion, leads in revenue, reflecting a higher focus on premium pricing and logistics efficiency. Pinduoduo’s $711 billion GMV in 2023, marked by an annual growth of 53%, highlights its success with direct-to-consumer models and rural market penetration. Meanwhile, Douyin’s thriving live-commerce ecosystem is capturing significant consumer attention, reshaping purchasing patterns in the Chinese market.

Source: businessofapps.com

Internationally, Alibaba faces stiff competition from Amazon, which dominates global e-commerce and cloud markets. In Q3 2024, Amazon Web Services (AWS) retained a 31% global cloud market share, far ahead of Alibaba's 4% share. Despite achieving 7% YoY growth in its cloud revenue, Alibaba’s cloud business is dwarfed by Amazon and Microsoft Azure (20% share). Alibaba’s strategy to expand its AI-driven public cloud products, which reported triple-digit YoY revenue growth for the fifth consecutive quarter, positions it as a strong contender for future cloud growth in China.

Pricing strategies reveal a shift. Alibaba’s introduction of a 0.6% software service fee for merchants reflects its focus on enhancing monetization. However, rebates for small merchants suggest a balancing act between profitability and market competitiveness. In response to rivals’ gains, Alibaba also improved user retention through loyalty programs like 88VIP, which grew to 46 million members this quarter, and expanded its e-commerce reach via streamlined logistics with Cainiao.

Despite these advancements, Alibaba’s market share in some segments, particularly cloud computing and international e-commerce, remains limited. To sustain growth, it must outpace competitors in innovation, AI integration, and global expansion while addressing price-sensitive consumer markets.

Source: statista.com

III. BABA Stock Forecast

Alibaba Stock Forecast Technical Analysis

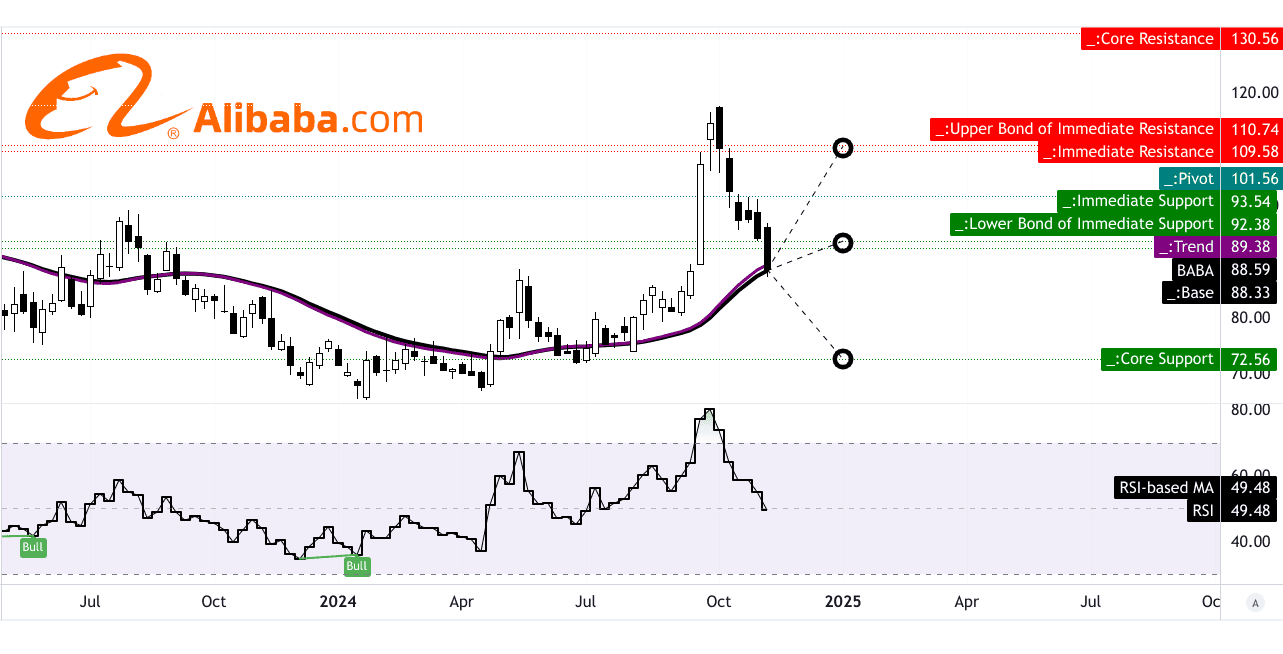

Alibaba’s (BABA) stock is trading at $88.59, slightly below its modified exponential moving average (EMA) trendline of $89.38 and just above its baseline EMA of $88.33, indicating the stock is currently in a consolidation phase. The Relative Strength Index (RSI) at 49.48 reflects a neutral momentum, neither overbought nor oversold, and there are no discernible bullish or bearish divergences. However, the RSI trendline shows a downward slope, hinting at potential weakening in the short term.

Price projections for BABA show Fibonacci retracement levels playing a pivotal role in forecasting the stock's trajectory. An average price target of $94.00 suggests moderate optimism, assuming stability in market conditions and the continuation of its current momentum. In a bullish scenario, if BABA capitalizes on improved market sentiment or positive earnings surprises, the stock could rise to $110.00, derived from projected upward price momentum and Fibonacci extension levels. Conversely, a bearish trend driven by external market shocks or disappointing results might push the stock down to $73.00, near a key Fibonacci support level.

The pivot for the horizontal price channel is $101.56, representing a significant resistance level that Alibaba must break through to confirm an uptrend.

Source: tradingview.com

Alibaba Stock Price Prediction: Market Analysts’ Expectations & Ratings

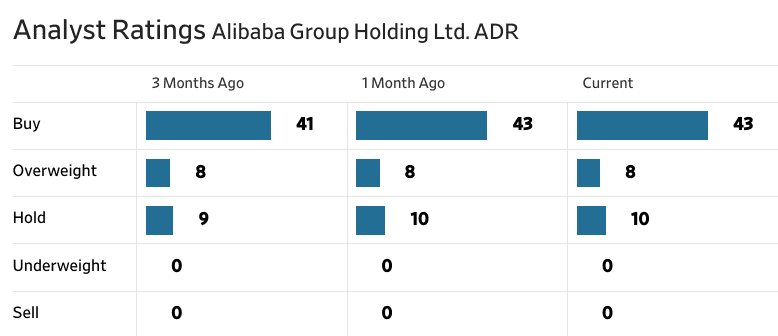

Analysts maintain a predominantly bullish stance on BABA, with 43 buy recommendations and 8 overweight ratings, unchanged over the past month. This strong sentiment underscores confidence in Alibaba’s long-term growth prospects, supported by its dominant e-commerce position and innovations in cloud computing and AI. 10 hold ratings indicate cautious optimism among a minority, likely influenced by persistent geopolitical tensions and macroeconomic challenges.

Analyst price targets reflect a median projection of ¥831.57 ($113.65), signaling substantial upside from the current price. The average target of ¥855.04 ($116.92) aligns with the optimistic technical forecast. The high estimate of ¥1,044.77 ($142.85) indicates potential for significant growth under favorable conditions, such as improved regulatory clarity in China or faster-than-expected recovery in domestic consumer spending.

At the lower end, the ¥597.85 ($81.76) target reflects risks such as intensifying competition, sluggish economic recovery, or adverse policy developments. Nonetheless, the absence of any “sell” or “underweight” ratings suggests analysts broadly view the stock as undervalued at current levels.

Source: WSJ.com

Source: WSJ.com

IV. Alibaba Stock Forecast: Future Outlook

Management's Growth Forecasts and Strategic Initiatives

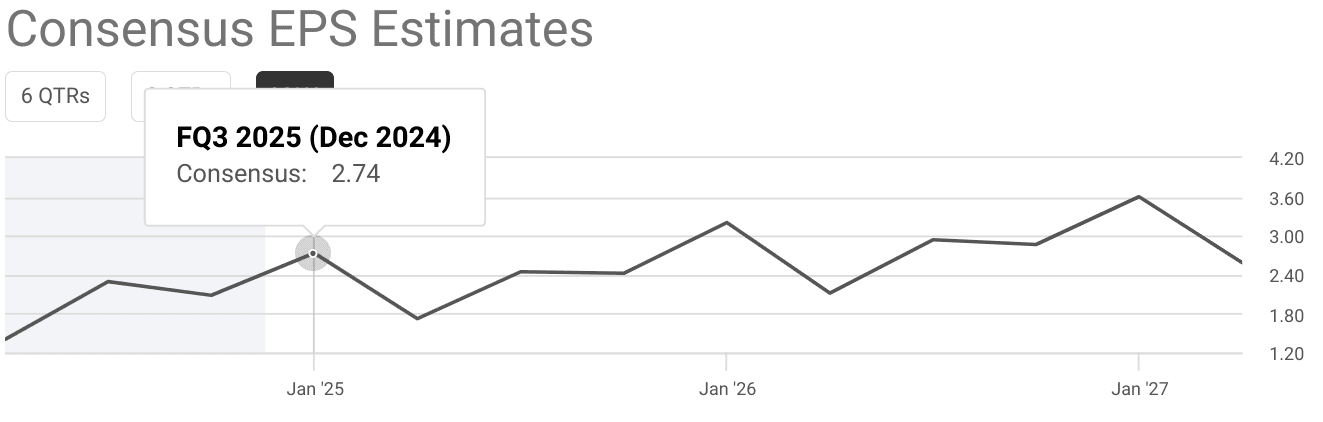

Alibaba has laid out robust strategies for long-term growth, focusing on strengthening its core e-commerce business, advancing cloud and AI capabilities, and expanding internationally. Management is optimistic about revenue growth for fiscal 2025, with consensus estimates for Q3 (Dec 2024) at $38.61 billion (6.69% YoY growth) and Q4 (Mar 2025) at $33.37 billion (8.79% YoY growth). Earnings are projected to grow steadily, with EPS estimates of $2.74 (+3.73% YoY) in Q3 and $1.72 (+22.84% YoY) in Q4.

Source: seekingalpha.com

Key drivers include the user-first strategy on Taobao and Tmall, which achieved an all-time high in monthly active users. Enhanced AI-powered marketing tools like Quanzhantui have significantly increased merchant adoption, improving customer management revenue by 2% year-over-year. Alibaba's 11.11 Global Shopping Festival demonstrated robust GMV growth, indicating strong user engagement and retention efforts.

In its cloud business, revenue grew 7% YoY, driven by triple-digit growth in AI-related products, now accounting for a significant share of public cloud revenue. This aligns with management's belief that AI will become the backbone of industrial transformation. Strategic investments in cloud infrastructure and AI are expected to capture growing demand in China’s evolving digital economy.

Market Trends in Key Sectors

Alibaba’s future is underpinned by favorable macro trends across e-commerce, cloud computing, and logistics:

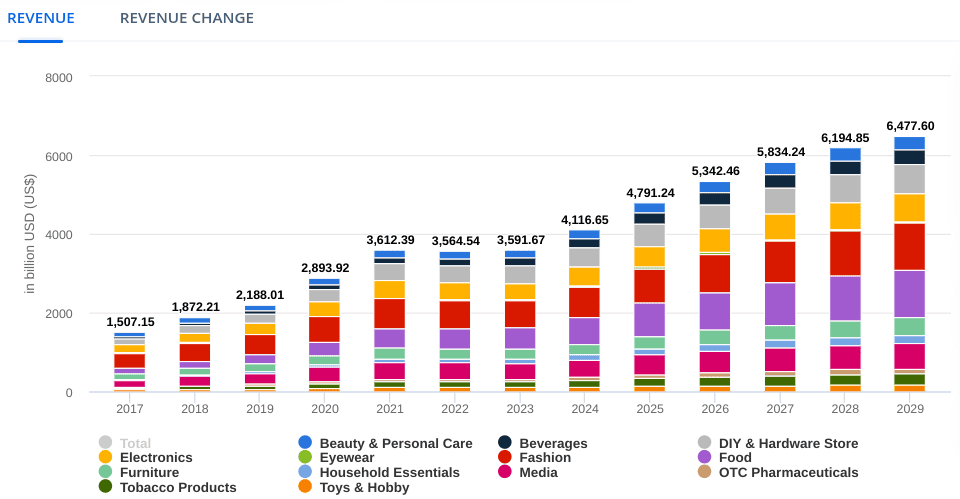

- E-commerce: Revenue in the global e-commerce market is projected to reach $4,117 billion in 2024, with a 9.49% CAGR (2024–2029), reaching $6,478 billion by 2029. China remains the largest contributor, with expected revenue of $1,469 billion in 2024. Alibaba is poised to benefit from these trends, supported by its strong logistics network and innovations like AliExpressDirect, which shortens delivery times through local inventories.

- Cloud Computing: The global public cloud market, projected at $773.30 billion in 2024, is expected to grow at an 18.49% CAGR, reaching $1,806 billion by 2029. AI-driven demand is a major growth driver, and Alibaba Cloud’s leadership in China positions it to capitalize on this opportunity.

- Logistics: With cross-border commerce and fulfillment solutions growing by 8% YoY, Alibaba’s investment in a highly digitalized logistics network ensures synergies with its e-commerce operations, improving efficiency and scalability.

Source: statista.com (Market Outlook: eCommerce)