I. Amazon Earnings Overview Q3 2024

Key Financial Metrics:

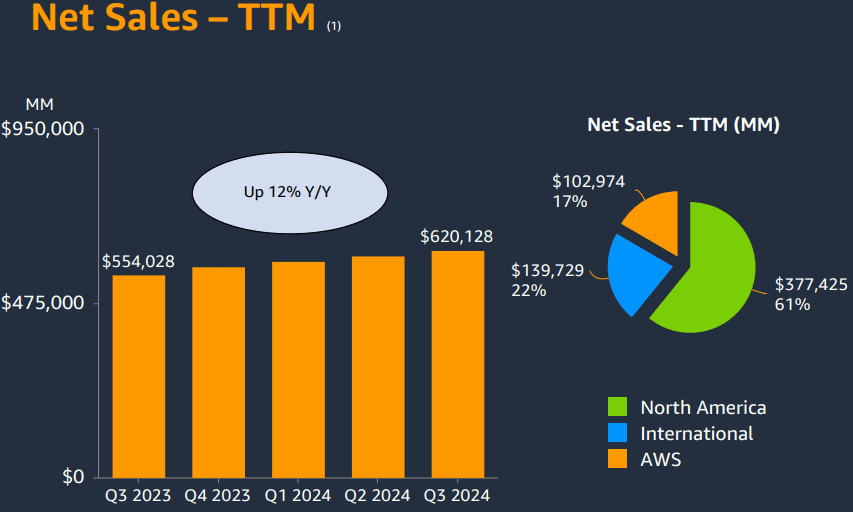

Amazon’s Q3 2024 earnings exceeded expectations, with revenue reaching $158.88 billion, surpassing projections by $1.59 billion, and EPS at $1.43, beating forecasts by $0.29. These results continue Amazon’s strong track record, with 7 beats and only 1 miss for both revenue and EPS over the past two years. Net income showed impressive growth, driven by strategic cost management, and robust operating income surged 56% year-over-year to $17.4 billion, marking a new high.

Source: Webslides_Q324

AMZN Earnings Q3 2024 Revenue Drivers:

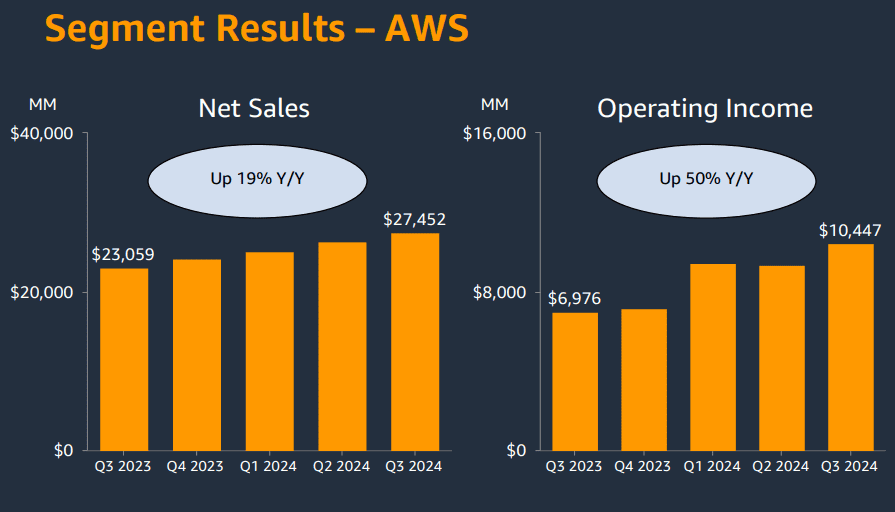

Amazon’s revenue was primarily bolstered by e-commerce, AWS, advertising, and subscription services. E-commerce saw North American sales grow by 9% year-over-year and international sales by 12%. AWS generated $27.5 billion in revenue, growing 19.1% annually and achieving a $110 billion annualized run rate, driven by strong cloud and AI demand. Subscription services (e.g., Prime) saw increased membership, benefiting from successful events like Prime Day. Advertising revenue, at $14.3 billion, rose 18.8%, with growth fueled by innovative ad offerings and increased customer engagement.

Source: Webslides_Q324

Profitability Analysis:

Amazon’s profitability benefitted from margin improvements across all levels. Gross margin increased due to a favorable product mix and logistics efficiencies, while operating and net margins grew from cost-cutting and streamlining operations. Amazon’s cost-reduction efforts included rearchitecting its inbound network and expanding same-day delivery facilities, enabling higher efficiency and lower fulfillment costs. Additionally, enhanced robotics and automation, such as the new Shreveport facility, reduced fulfillment processing times by up to 25% and are expected to cut peak season costs by 25%. Overall, these measures reflect Amazon’s focus on balancing revenue growth with operational efficiency.

II. Product & Market Dynamics

New Products & Services

Amazon’s recent launches, such as enhanced Prime benefits and the latest Kindle lineup, significantly impacted customer engagement and revenue growth. For instance, Amazon introduced unlimited grocery delivery from Whole Foods, Amazon Fresh, and third-party grocery partners, expanding its convenience offerings for $9.99 monthly. This addition, coupled with discounts on fuel, reinforces Amazon’s value proposition for budget-conscious consumers, especially as North America and international sales grew by 9% and 12%, respectively. The company also launched an updated suite of Kindle devices, including the Kindle Scribe with AI-powered features like note summarization, which exceeded sales expectations and contributed to Kindle’s record year of over 20 billion pages read monthly.

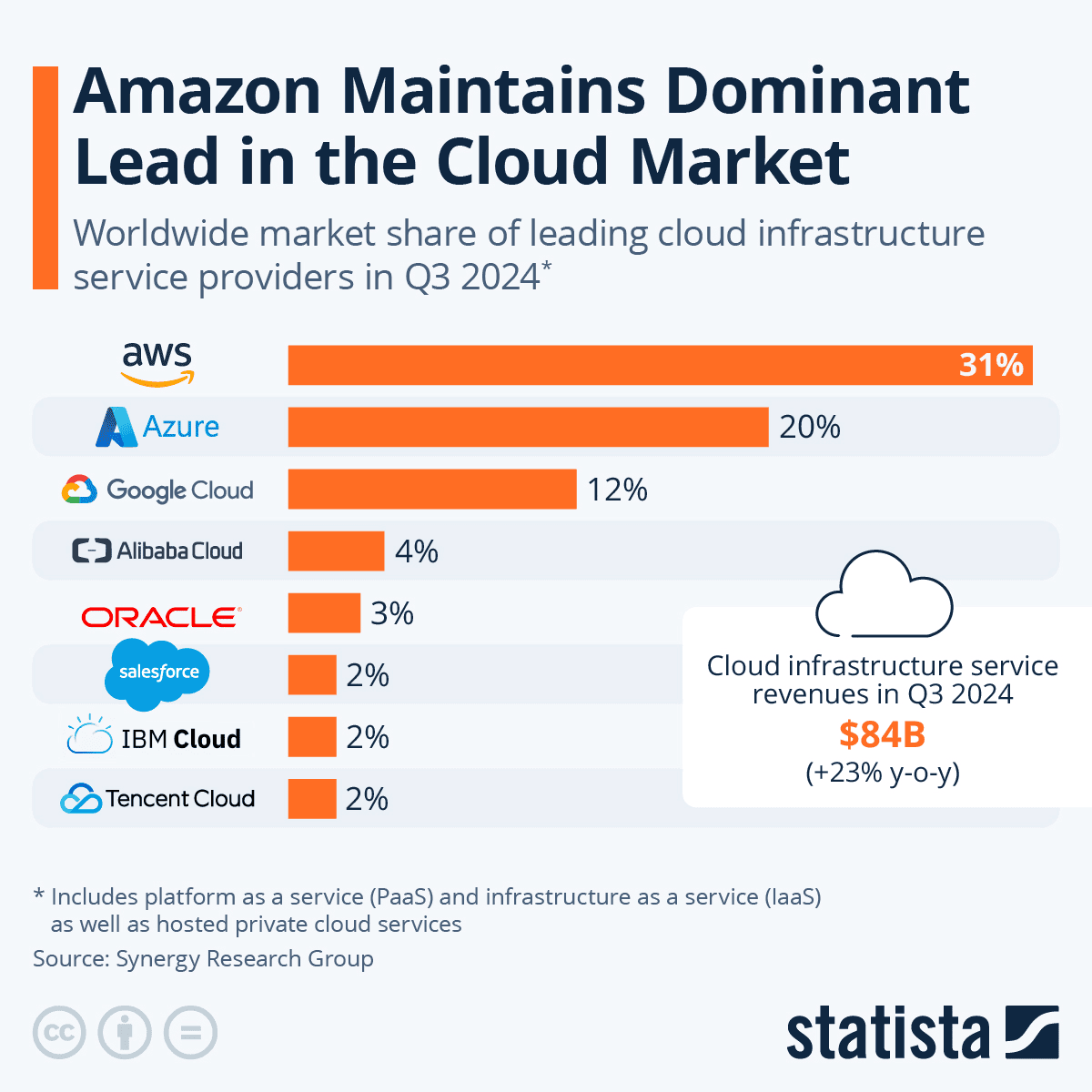

Amazon Web Services (AWS) continues to lead in cloud infrastructure, with a 31% market share, outpacing competitors like Microsoft Azure (20%) and Google Cloud (11%). AWS’s revenue reached $27.5 billion in Q3 2024, marking 19.1% growth year-over-year. Investments in generative AI and custom silicon, such as Trainium and Inferentia chips, cater to escalating AI workloads, providing up to 40% better price performance. Notably, Amazon’s AI initiatives extend across consumer applications (e.g., the shopping assistant Rufus) and internal optimizations, which saved $260 million and 4,500 developer years in project execution.

Source: Statista.com

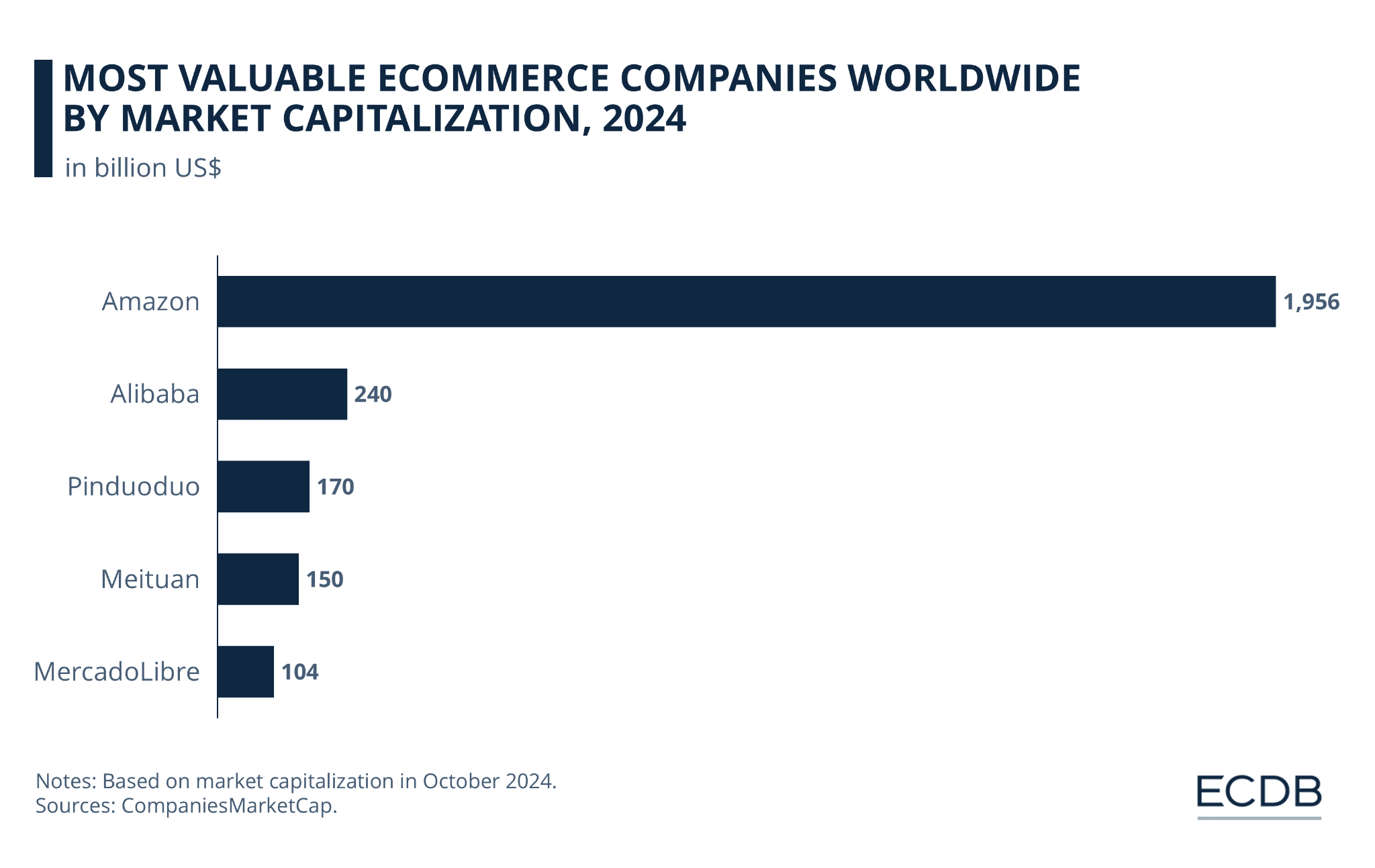

Competitive Landscape

Amazon’s dominance in U.S. e-commerce, capturing over 40% of sales, solidifies its competitive position against major players like Walmart. Amazon’s aggressive pricing and same-day delivery facilities—serving over 40 million customers with a 25% increase year-over-year—heighten consumer loyalty and reduce logistical costs. In Q3 2024, Amazon achieved its highest operating income at $17.4 billion, showcasing a 56% year-over-year increase.

Source: Emarketer

In cloud computing, AWS leverages AI to maintain a competitive edge, with quarterly cloud market spending up 23%, totaling over $84 billion. AWS’s innovations, including Amazon Bedrock for deploying generative AI applications and SageMaker for model training, secure its position as a partner of choice in cloud solutions. This strategic focus on advanced AI services sustains AWS’s leading market share and outpaces growth trajectories of other cloud providers, reinforcing Amazon’s leadership amid a fiercely competitive landscape.

Source: ecommercedb.com

III. Amazon Stock Forecast

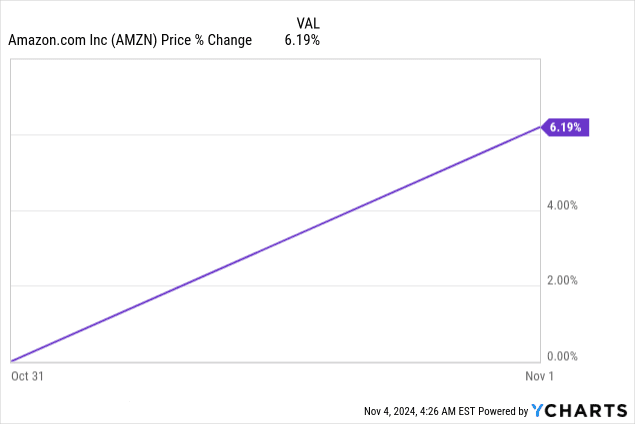

AMZN Stock Price Performance Post-Earnings

Following Amazon's recent earnings release, the stock saw a notable price jump in extended trading, bolstered by better-than-expected revenue and earnings figures. Strong performance in Amazon’s cloud and advertising divisions significantly contributed to this surge, confirming the company’s continued growth in high-margin sectors. This earnings beat drove a 6.2% increase in Amazon's stock price since the announcement, showcasing robust investor confidence. Observing the stock's longer-term trajectory, Amazon's price performance over three months is up 7.5%, with six-month, nine-month, and one-year returns at 10.6%, 24.3%, and 44.5%, respectively. This steady uptrend emphasizes investor optimism and Amazon’s ability to capitalize on strong earnings and cloud growth potential.

Source: Ycharts.com

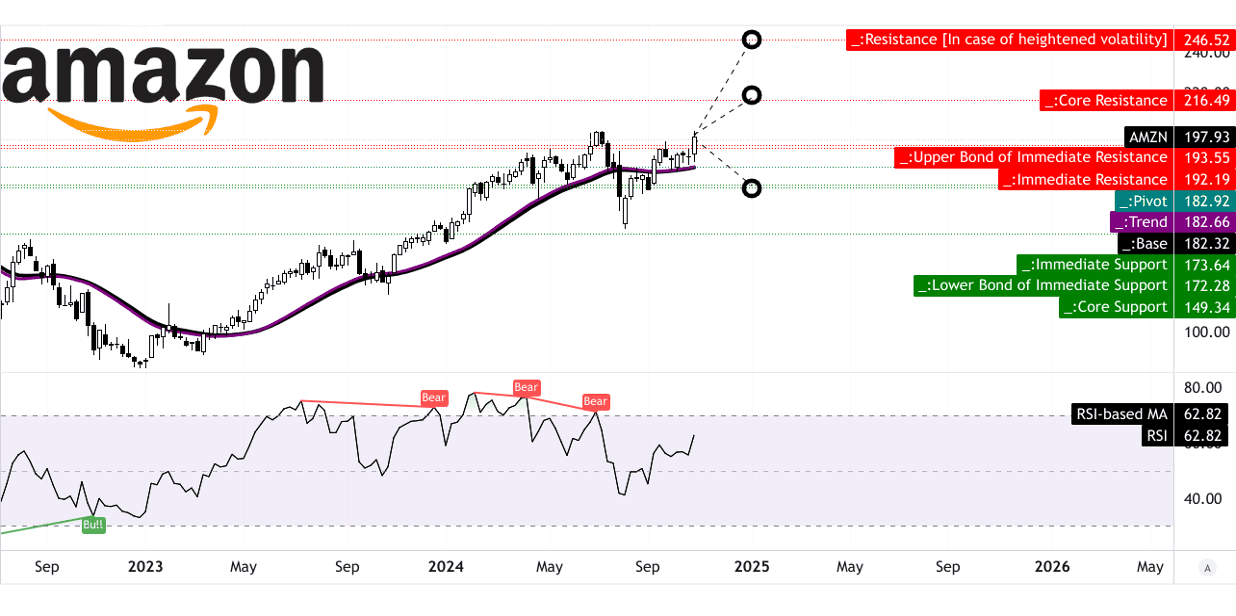

AMZN Stock Forecast

In terms of technical analysis, Amazon's stock has a current trading price of $198, with a trendline support at $182.66, closely aligned with a baseline of $182.32. These modified exponential moving averages indicate near-term support around the $182 level, suggesting it may act as a floor if downward pressure arises. The average price target for Amazon stock by the end of 2024 is $216, based on change-in-polarity momentum projected over Fibonacci retracement levels. If Amazon sustains its bullish trajectory, an optimistic target of $246 is attainable, whereas a pessimistic forecast, assuming downward swings, places the price at $173.

The Relative Strength Index (RSI) for Amazon currently stands at 62.82, trending upward without signs of bullish or bearish divergence, indicating neither overbought nor oversold conditions. The RSI suggests steady momentum, with investors likely to maintain confidence as long as the indicator remains within a healthy range. The stock's pivot point, aligning with the horizontal price channel at $182.92, adds to the robustness of the support levels identified.

Source: tradingview.com

IV. AMZN Stock Forecast: Future Outlook

Management's Growth Forecasts And Strategic Initiatives

Amazon's outlook hinges on robust growth in e-commerce, cloud computing, and strategic investments in technology, aiming for competitive advantages across various sectors. Management's forward-looking guidance emphasizes a net sales forecast for Q4 2024 between $181.5 billion and $188.5 billion, reflecting a 7-11% increase year-over-year. This projection includes a slight negative impact from foreign exchange, yet indicates resilient demand in e-commerce and cloud guidance places operating income in the range of $16.0 billion to $20.0 billion, an improvement from $13.2 billion in Q4 2023.

Amazon continues to prioritize efficiency and customer satisfaction. Recently, it achieved a 25% improvement in inventory distribution and a 25% year-over-year increase in same-day delivery orders. Further, new robotics technology is driving productivity gains by reducing order processing time by up to 25%, underscoring Amazon's commitment to operational optimization.

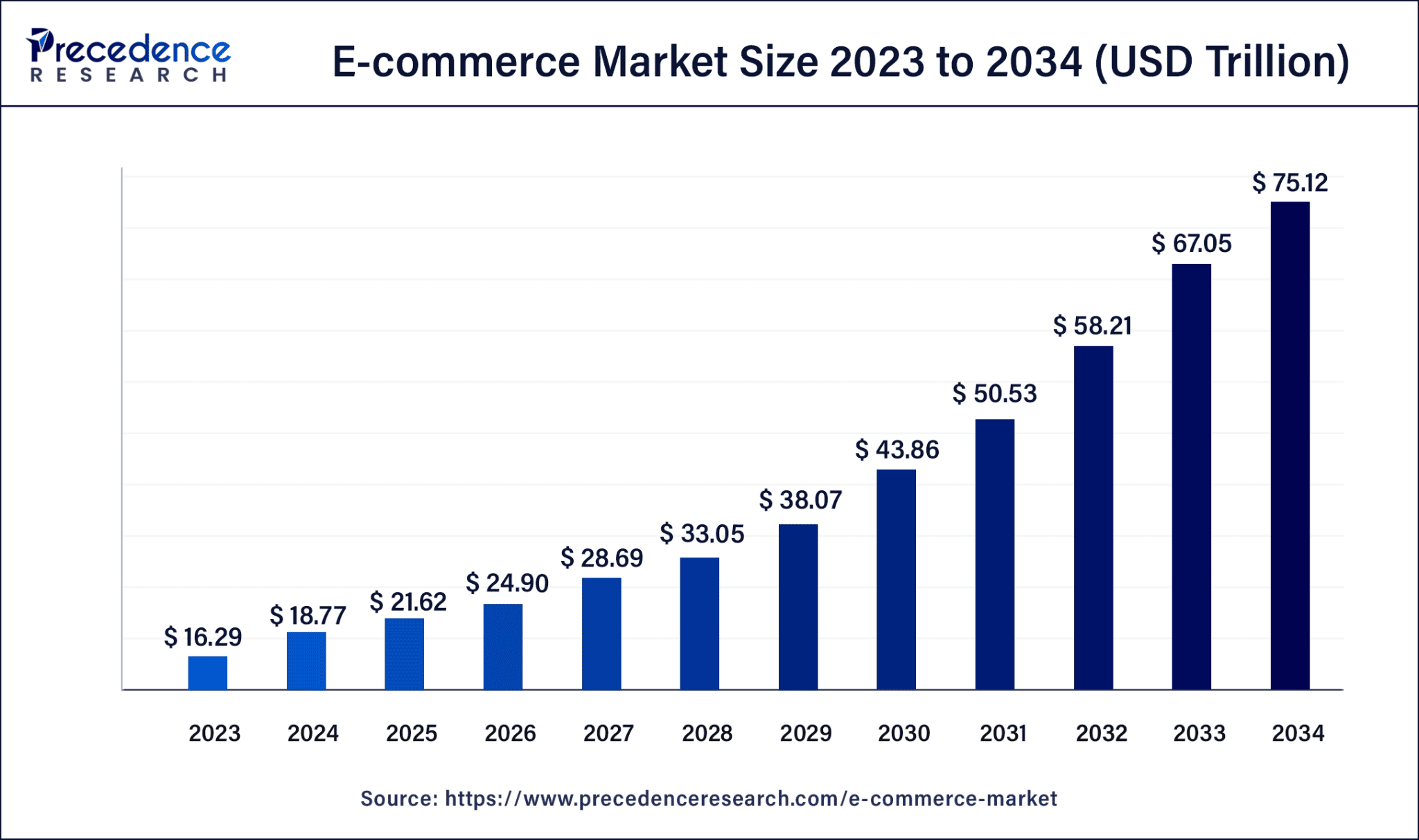

Amazon Stock Forecast: Market Trends And Analysts' Expectations

The company has shown significant growth, reaching a $110 billion annualized revenue rate with a 19.1% increase year-over-year. AWS’s cloud infrastructure and extensive AI capabilities position it as a leading partner for enterprises modernizing operations and adopting generative AI. AWS’s development in proprietary chips, such as the Trainium2, reflects Amazon's focus on cost-effective, high-performance AI solutions. By embedding generative AI across multiple layers—model building, customized model deployment, and customer applications—AWS stands out in the growing cloud market, anticipated to reach $2.3 trillion by 2032.The e-commerce segment leverages its Prime membership model and recent enhancements like unlimited grocery delivery to capture customer loyalty. Amazon’s fulfillment innovations and aggressive pricing policies have bolstered customer retention, essential in a global e-commerce market projected to expand from $18.77 trillion in 2024 to $75.12 trillion by 2034.

Source: precedenceresearch.com

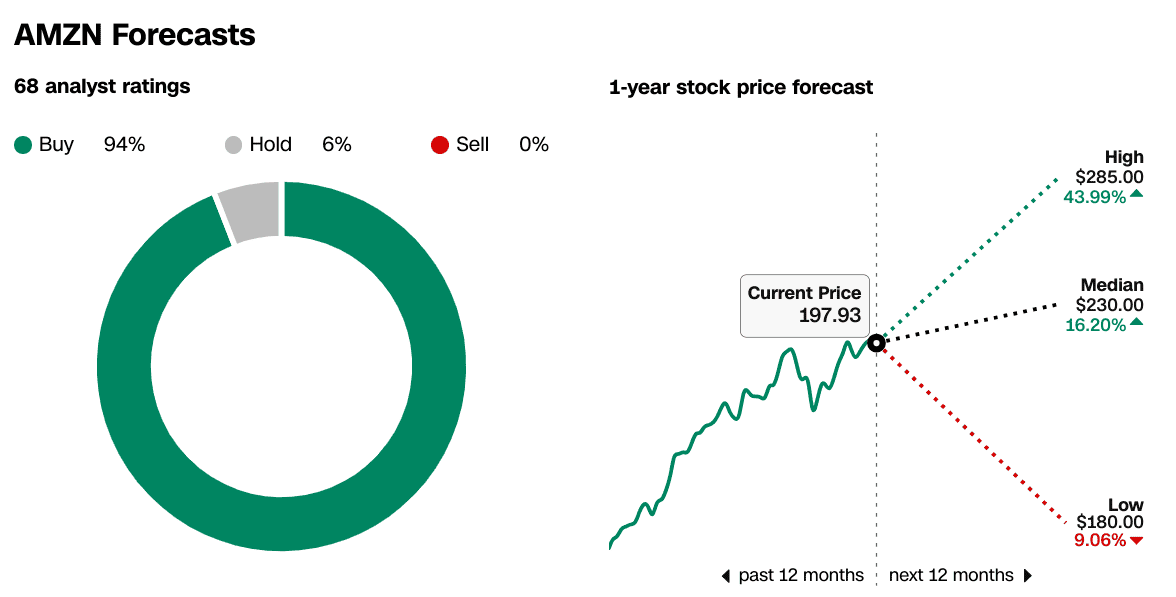

Analyst sentiment remains bullish with analysts rating Amazon stock as a "buy." The stock’s 12-month price forecast ranges from $180 to $285, indicating significant upside potential from its current level near $197. Analysts anticipate an earnings per share (EPS) of $1.46 for Q4 2024, reflecting a 46.39% year-over-year growth. However, challenges persist in the form of fluctuations, inflation, and evolving consumer spending patterns. Amazon’s guidance remains cautious, highlighting substantial uncertainty due to factors like economic conditions and geopolitical risks, which could impact growth in both its e-commerce and cloud businesses.

Source: cnn.com

Source: cnn.com