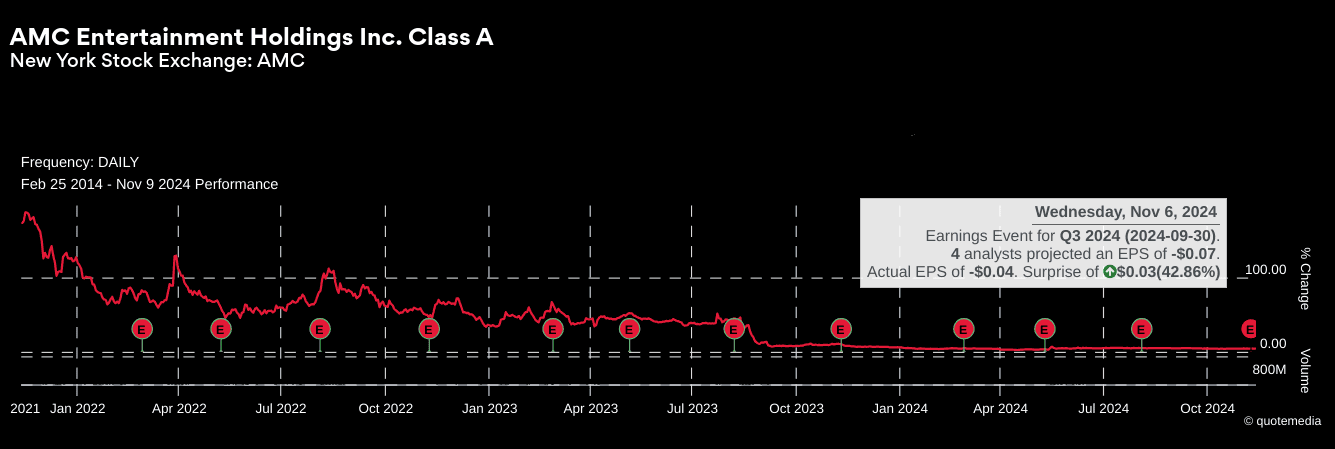

Following AMC's Q3 2024 earnings report, its stock price showed mixed reactions (-4% price return post earnings) as investors balanced optimism with lingering financial challenges. AMC reported improved EBITDA despite lower attendance than pre-pandemic levels, reflecting enhanced operational efficiency. However, the company's projected EPS for upcoming quarters remain negative, reflecting persisting profitability concerns. The market's reception highlights investors’ cautious stance, influenced by rising debt management and strategic capital expenditure plans under AMC’s new G.O. initiative aimed at revitalizing theaters and bolstering premium viewing experiences.

Source: investor.amctheatres.com

I. AMC Earnings Overview Q3 2024

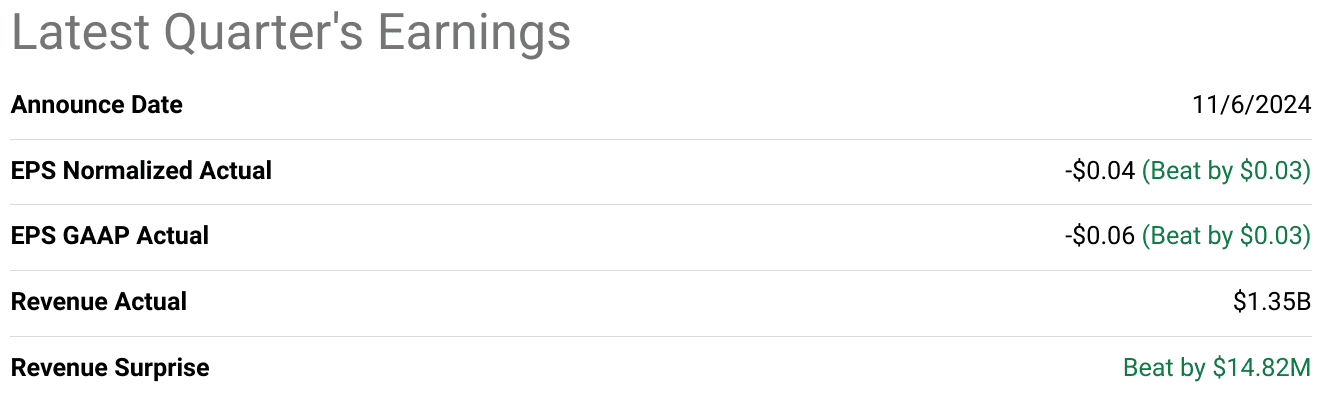

AMC Entertainment's Q3 2024 results exceeded expectations in several key financial metrics. Revenue reached $1.35 billion, surpassing expectations by $14.82 million. Earnings per share (EPS) showed losses in both normalized (-$0.04) and GAAP (-$0.06) terms, but these figures outperformed market expectations by $0.03 in each case. Notably, AMC reduced its net loss by 37% quarter-over-quarter, marking significant progress in narrowing losses from Q2 2024. Gross and net margins reflected this improvement, with operating efficiencies driving a strong recovery in adjusted EBITDA, which was four times higher than in Q2 2024.

AMC Stock Earnings Q3 2024 Revenue Drivers and Market Performance

AMC’s revenue drivers—box office sales, concessions, and memberships—performed well, benefiting from a revitalized film slate and strong consumer demand. In the domestic market, the Q3 2024 box office reached a post-pandemic record of $2.7 billion, increasing 37% from Q2 2024 and slightly surpassing the high-performing Q3 2023. Key releases like Inside Out 2 (2024’s top-grossing film) and blockbuster sequels (Deadpool and Wolverine, Despicable Me 4, Twisters, Beetlejuice Beetlejuice) significantly contributed to this revenue boost. Between mid-June and September, the daily domestic box office outperformed the first five months of 2024 by 82%, highlighting a resurgent demand in the theater industry.

Source: seekingalpha.com

Regional Performance and Strategic Adjustments

AMC’s U.S. revenue grew by 31% over Q2, with premium formats such as IMAX and Dolby Cinema driving high admissions revenue per patron. Conversely, European attendance was weaker, as films like Deadpool and Wolverine underperformed compared to 2023's popular Oppenheimer and Barbie. This regional variance led to a slight decline (60 basis points) in AMC’s North American market share.

Operational Efficiency and Profit Margins

AMC set records for per-patron revenue across admissions and concessions, with food and beverage sales per patron at $7.53 globally, up 14.8% from Q3 2023. Despite attendance being 25% lower than Q3 2019, adjusted EBITDA aligned with pre-pandemic levels, thanks to cost-saving measures and a strong focus on maximizing per-patron revenue. AMC’s debt management initiatives in Q3, extending $2.4 billion in maturities and reducing debt by $345 million in 2024, have solidified its financial position. Ending the quarter with $527 million in cash, AMC plans to leverage a promising Q4 2024 film slate (e.g., Moana 2, Wicked) to sustain growth.

II. Product & Market Dynamics

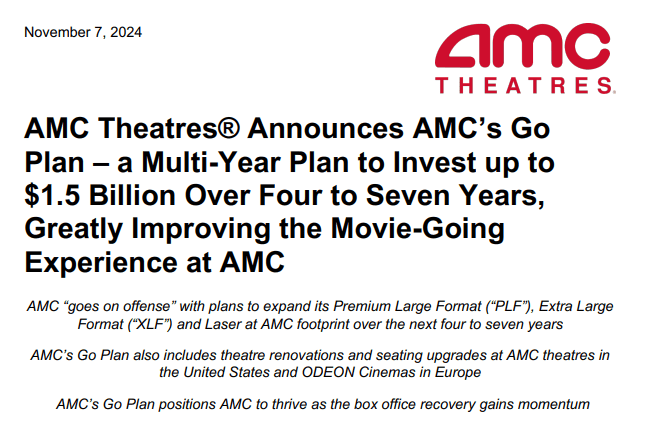

AMC Theatres is leveraging its innovative G.O. Plan to capitalize on the anticipated growth in the theatrical box office, aiming to reshape the cinema experience and differentiate itself in a competitive market. This multi-year, $1–1.5 billion investment focuses on enhancing theater quality and introducing new premium formats, such as laser projectors, redesigned seating, and exclusive large-format screens like XL at AMC. These improvements are designed to attract more patrons by delivering a premium, comfortable viewing experience, which data has shown can yield substantially higher revenue. For instance, AMC’s premium large format (PLF) screens generate, on average, quadruple the revenue of non-PLF screens in the U.S.

Source: investor.amctheatres.com

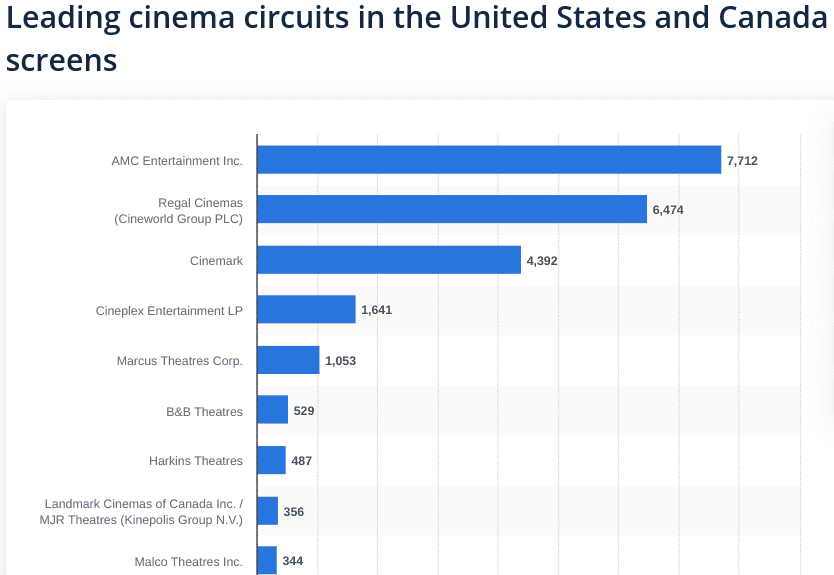

AMC's main competitors, including Regal and Cinemark, have similarly substantial theater footprints—6.47 thousand and 4.39 thousand screens, respectively, across North America. However, AMC aims to stay competitive by expanding its PLF screens, currently holding about 423 in the U.S. (with over 1,000 globally). Their brand-exclusive XL screens will be marketed with additional sight and sound upgrades to differentiate them further. This approach positions AMC against both traditional cinema chains and streaming platforms like Netflix and Disney+, which have challenged theater attendance with convenient home viewing. To incentivize theater visits, AMC plans to combine elevated amenities with a dynamic pricing structure that could include additional charges for XL screens, as tested in Europe.

Source: statista.com

AMC is also adopting a selective renovation strategy focused on high-performing theaters. Renovations, including luxury recliners and wider seating, have historically led to a substantial rise in theater-level EBITDA. For example, recent upgrades at AMC's Burbank 16 and Lincoln Square locations improved customer satisfaction and promise a strong financial return. This selective approach allows AMC to maximize impact by reinvesting in profitable locations while continuing to close underperforming theaters.

The G.O. Plan also underscores AMC’s intention to expand internationally, particularly in Europe through its Odeon brand, where premium formats and newly added LUX theaters will enhance market share. AMC's financial strategy balances growth initiatives with cautious capital management, ensuring that investments are paced by rising EBITDA and possible equity increases. Ultimately, AMC's G.O. Plan strategically targets both local and global market demands, aiming for a sustainable recovery and growth trajectory amid a transforming industry landscape.

III. AMC Stock Forecast

AMC Stock Price Prediction Technical Analysis

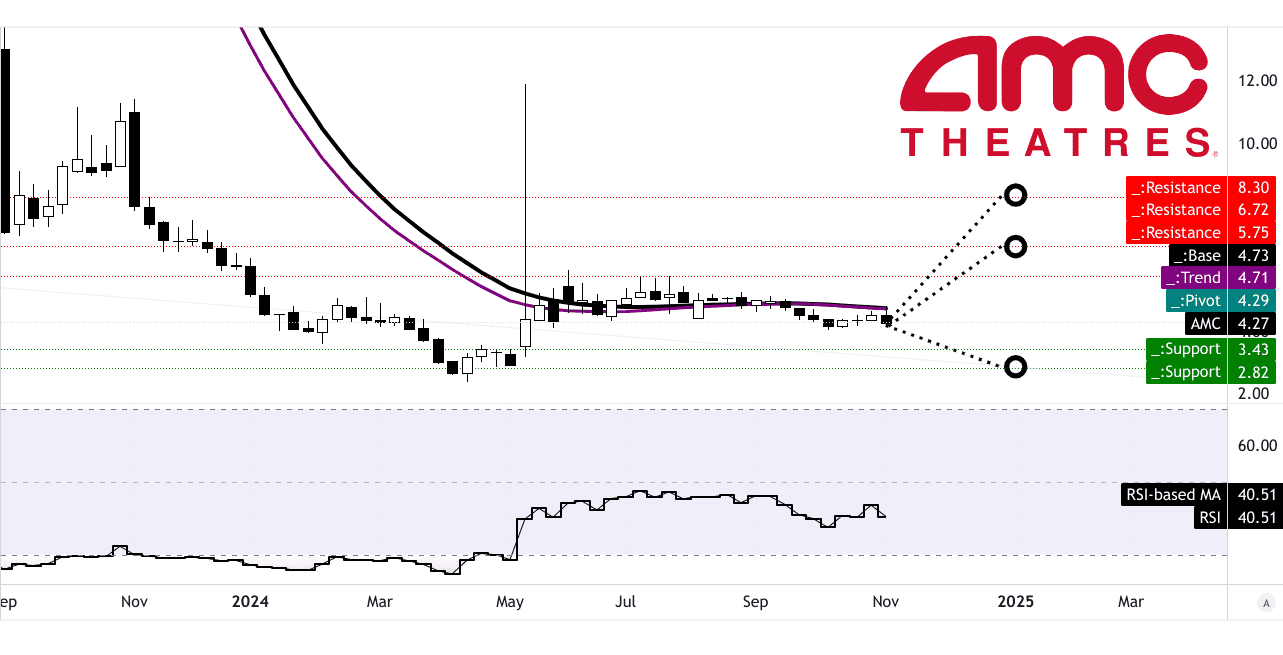

The technical analysis of AMC stock suggests a cautiously optimistic trend, though volatility remains a concern. As of the most recent data, AMC's stock stands at $4.27, with trendline and baseline levels at $4.71 and $4.73, respectively, both based on modified exponential moving averages (EMA). These values show a slightly upward momentum but suggest that the stock is still consolidating around a stable horizontal price channel, with a pivot of $4.29. The stock’s Relative Strength Index (RSI) sits at 40.51, below the neutral 50 mark, indicating that AMC is nearing the oversold threshold, though it shows no clear bullish or bearish divergence and maintains a sideways trend.

Projections for AMC by year-end 2024 show significant price variability based on technical indicators. The average target is $6.70, based on momentum analysis using Fibonacci retracement levels, suggesting that a breakout above the trendline is plausible if AMC sustains upward momentum. The optimistic scenario places the target at $8.30, reflecting strong bullish momentum, whereas the pessimistic projection of $2.80 would require sustained bearish conditions, such as adverse market trends or a failure to execute the company's G.O. Plan.

Source: tradingview.com

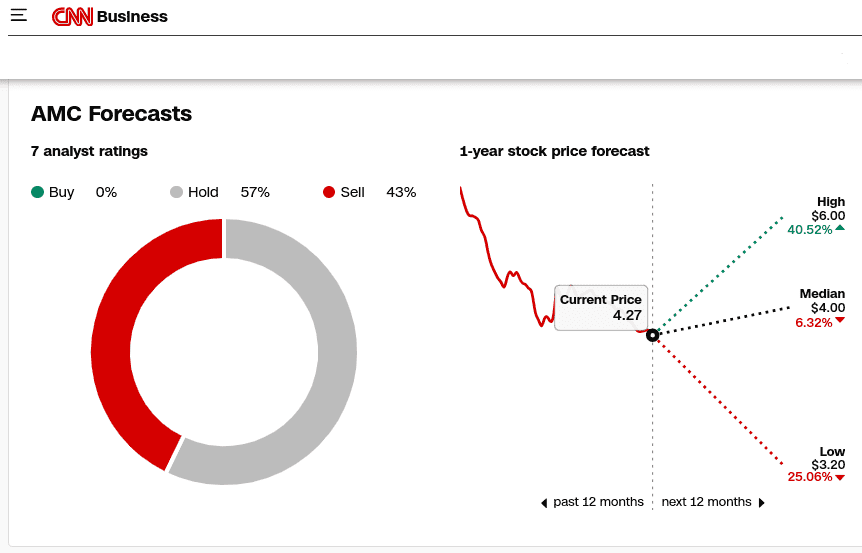

Market analysts provide mixed expectations for AMC's performance. Based on CNN data, seven analysts have evaluated AMC’s stock, with a consensus that reflects caution rather than confidence. Notably, none of the analysts issued a “buy” rating; 57% recommended holding, while 43% advised selling. This distribution points to a low level of market enthusiasm for AMC’s stock in the near term. Price targets over the next year reflect moderate variability, ranging from a high of $6 (a potential 40.52% increase) to a low of $3.20 (a 25.06% decrease). The median forecast of $4 aligns closely with the current price, suggesting limited short-term upside and implying that the market does not foresee a substantial breakout without new positive catalysts.

Source: cnn.com/markets

IV. AMC Stock Forecast: Future Outlook

AMC’s future outlook appears promising, driven by robust growth initiatives and favorable movie industry trends. Management introduced the "G.O. Plan" during the Q3 2024 earnings call, emphasizing a multi-year strategy to improve the theater experience and drive profitability through an investment of $1.0 to $1.5 billion over the next four to seven years. Central initiatives include laser projector upgrades, expanded luxury seating, and increased premium large format (PLF) screens. As of Q3 2024, AMC had upgraded 2,137 screens with laser technology, enhancing visual quality and energy efficiency. Expanding PLFs, such as IMAX and Dolby Cinema, will be a key focus, as these formats yield quadruple the revenue of standard screens. For example, AMC aims to increase IMAX with laser installations from 42 to over two-thirds of its IMAX locations, alongside rolling out the new XL screen brand across Europe and the U.S.

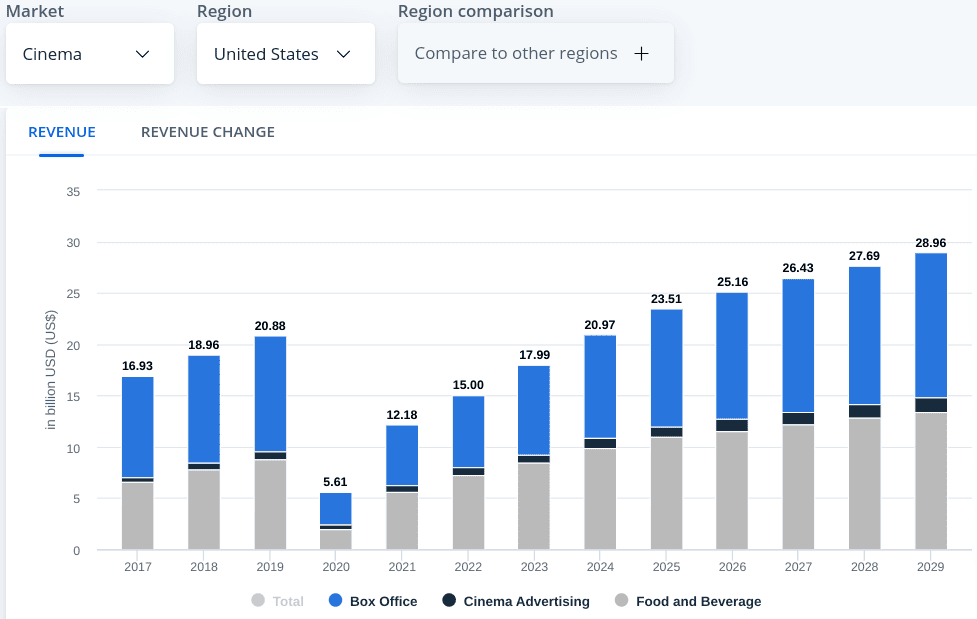

AMC’s strategic goals align with a recovering cinema market, projected to reach $28.96 billion in the U.S. by 2029, growing at a 6.66% CAGR. Viewer engagement is expected to rise, with user penetration anticipated to climb from 58.8% in 2024 to 73.4% in 2029. The forecasted growth in the movie industry offers a favorable environment for AMC’s ambitions, especially as upcoming movie releases, including Avatar 3, Mission: Impossible 8, and Wicked, are projected to bolster theater attendance significantly.

Source: statista.com

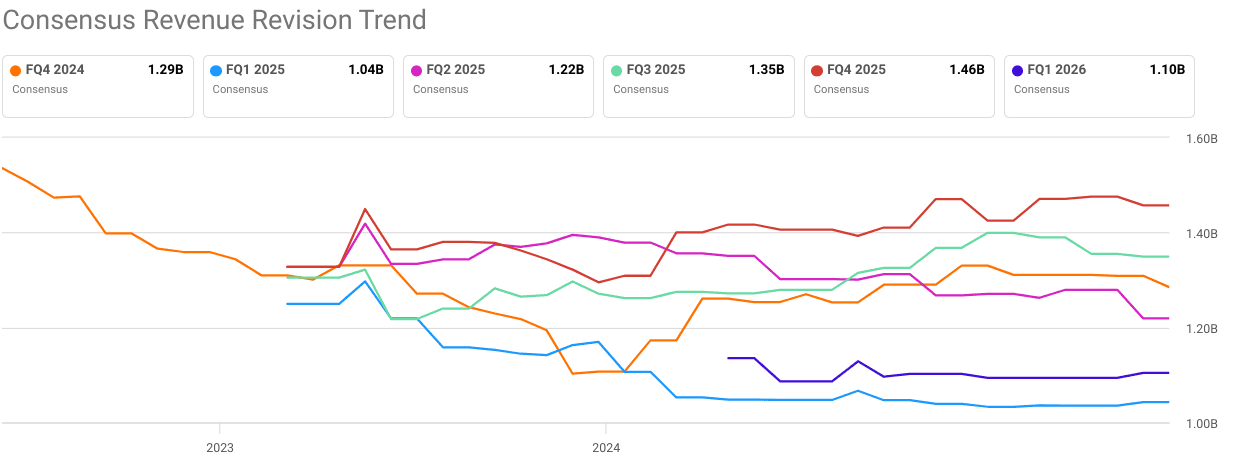

However, challenges remain in meeting profit targets. Despite improvements, AMC’s estimated EPS for Q4 2024 is -$0.17 (69.44% YoY growth), and for Q1 2025, -$0.47 (24.90% YoY growth), indicating continued losses. Revenue forecasts are more positive, with expected growth of 16.35% in Q4 2024 to $1.29 billion and 9.60% growth in Q1 2025 to $1.04 billion. However, AMC must continue managing its debt, as recent revisions show three downward EPS adjustments and four revenue downgrades.

Source: seekingalpha.com