APLD’s stock price remained volatile post-Q2 FY 2025 earnings, trading at $8.37, below its trendline ($8.71). Despite revenue beating expectations by $2.26M (51% YoY growth), the GAAP EPS miss (-$0.66) and $138.7M net loss weighed on investor sentiment. However, the $5B Macquarie partnership and Ellendale campus progress provided long-term optimism, with analysts maintaining a 100% buy rating and a median price target of $11.

I. APLD Earnings Overview Q2 2025

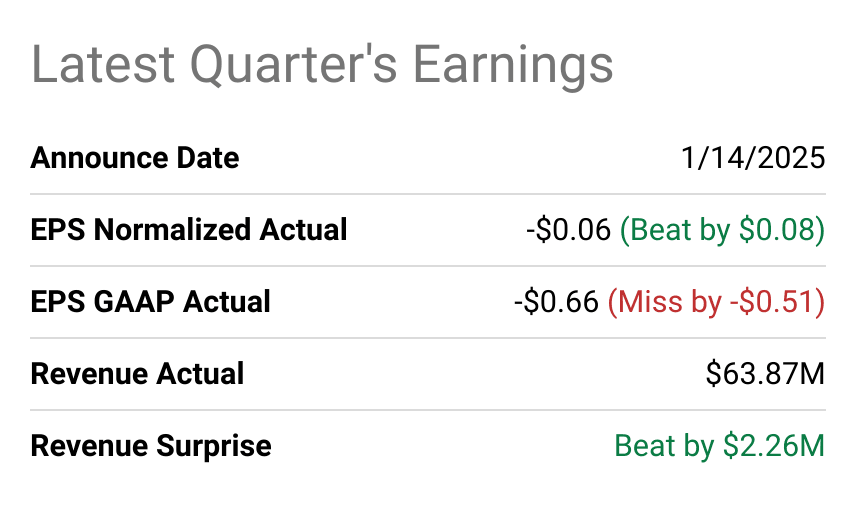

Applied Digital Corporation (APLD) reported mixed financial results for Q2 FY 2025, with revenue outperforming expectations but GAAP earnings per share (EPS) falling short. Revenue for the quarter stood at $63.87M, beating estimates by $2.26M, reflecting a 51% year-over-year (YoY) growth. This growth was primarily driven by the cloud services segment, which contributed $27.7M, and the data center hosting segment, which generated $36.2M. However, the company reported a GAAP EPS of -$0.66, missing expectations by -$0.51, primarily due to an $87.2M loss from fair value adjustments of convertible debt and a $25.4M loss on debt conversion. On a normalized basis, EPS was -$0.06, beating expectations by $0.08.

Source: seekingalpha.com

Net income showed significant YoY deterioration, with a net loss of $138.7M, compared to a smaller loss in the prior year. This was largely attributable to higher operating costs, including a $22.6M increase in cost of revenues (totaling $52.4M) and a $9.5M rise in SG&A expenses (totaling $29.8M). Gross margins improved slightly due to revenue growth, but operating and net margins remained under pressure due to elevated depreciation and amortization (D&A) expenses, which increased to $26.4M, driven by GPU lease amortization in the cloud segment.

Revenue Drivers and Market Performance

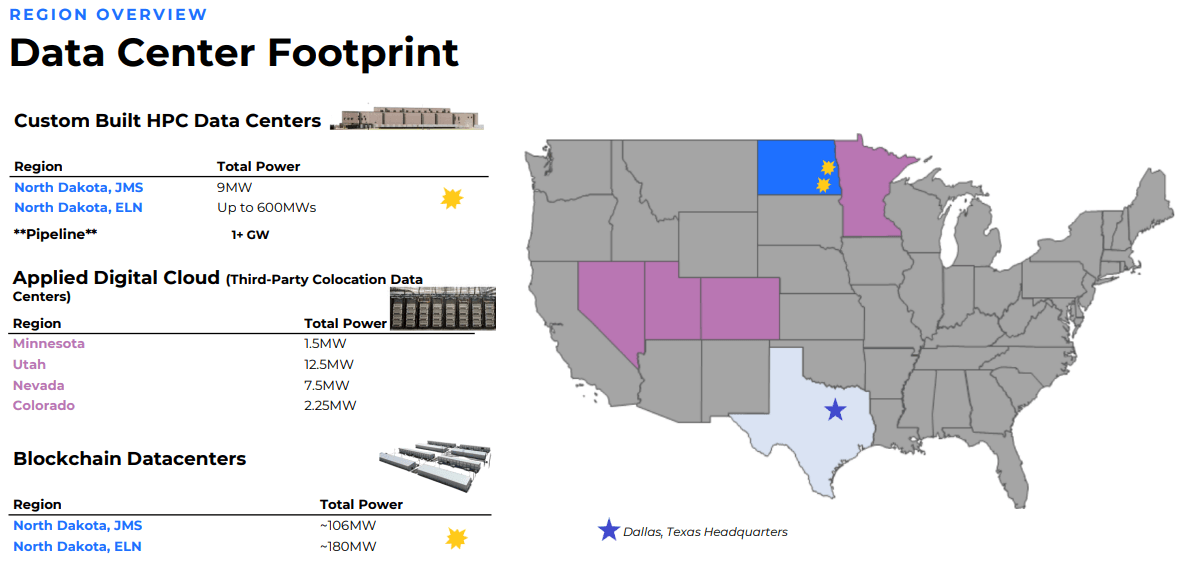

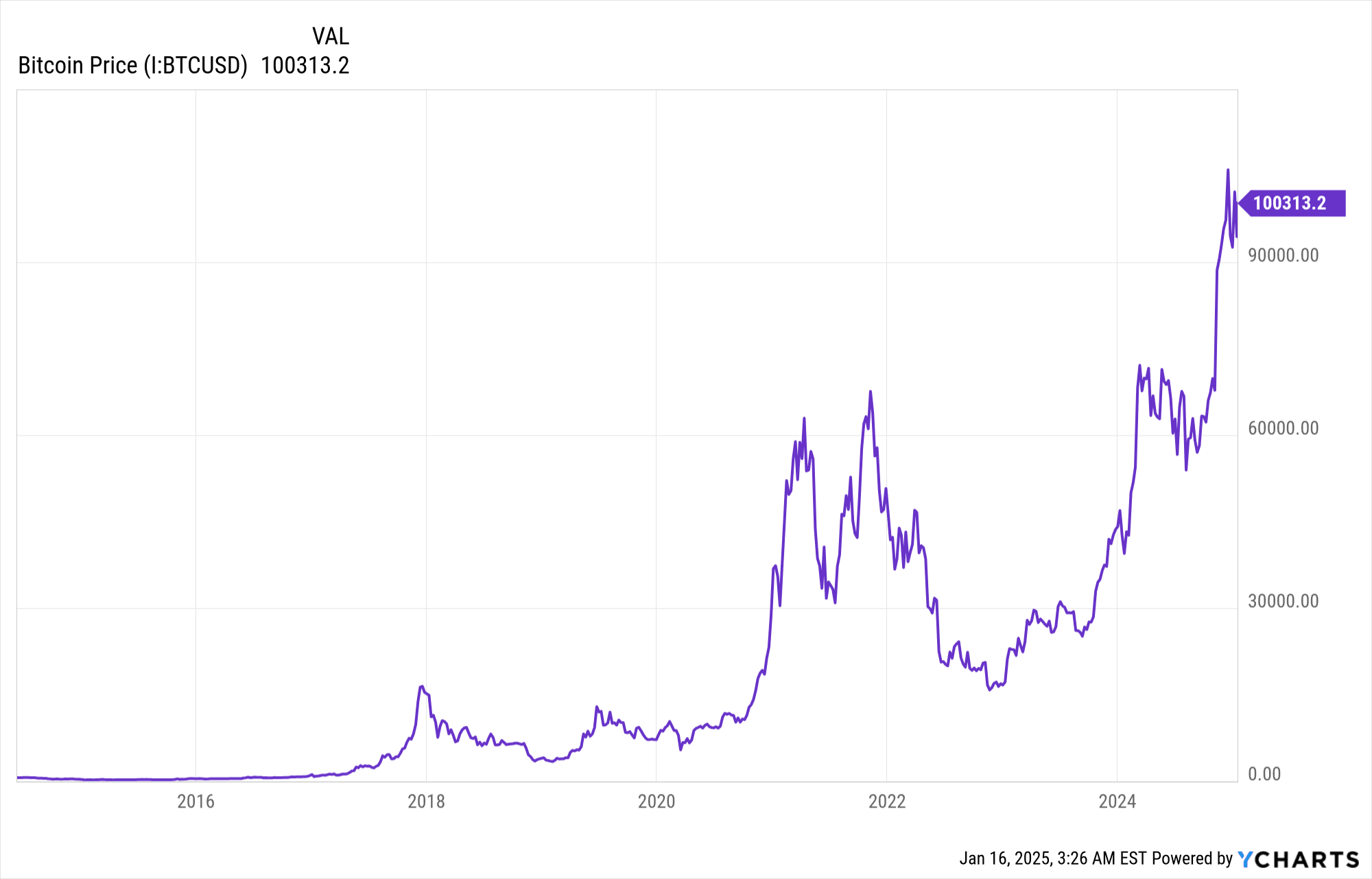

The data center hosting business, operating at full capacity with 286 megawatts across two North Dakota locations, benefited from robust demand in the cryptocurrency sector, particularly with Bitcoin reaching $100,000. Meanwhile, the cloud services segment saw growth due to the deployment of six GPU clusters for AI applications, with ongoing evaluations for next-generation GPU opportunities. The HPC hosting segment also made progress, with the 400-megawatt Ellendale campus reaching a key milestone with the energization of its main substation transformer.

Source: Investor Presentation

A significant highlight was the $5B perpetual preferred equity financing facility with Macquarie Asset Management, which includes $900M allocated to the Ellendale campus and a right of first refusal for an additional $4.1B across future HPC projects. This partnership, alongside earlier investments from CIM Group and NVIDIA, validates APLD’s strategy and lowers its cost of capital.

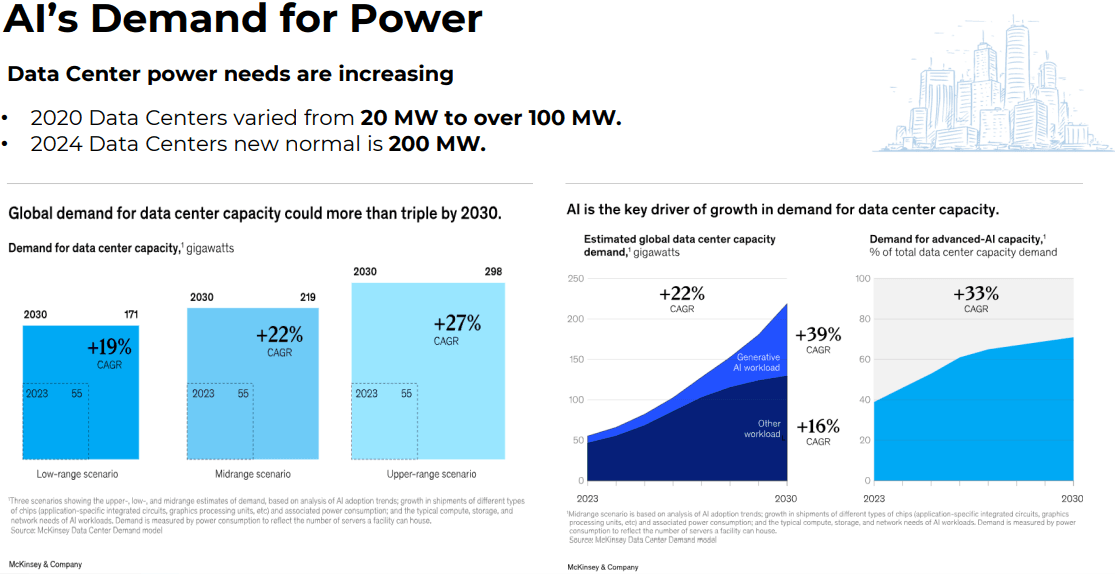

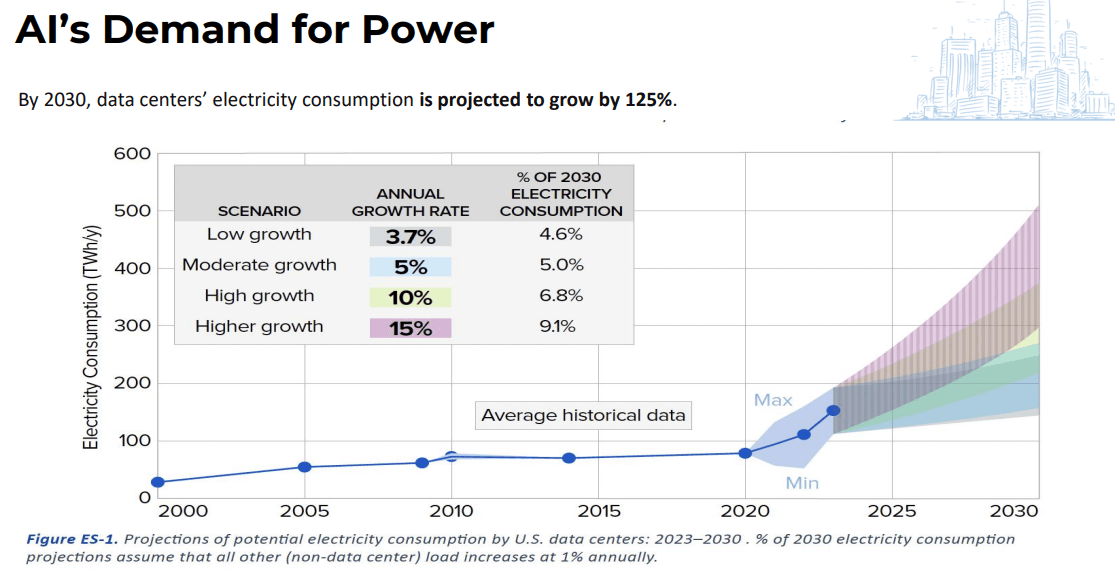

Despite these advancements, APLD faces challenges, including rising interest expenses (up $4.9M to $7.5M) and the lengthy hyperscaler contract process, which delays revenue realization. However, the company remains optimistic about its growth trajectory, supported by $314.6M in cash and equivalents and a $479.6M debt position. With the AI-driven demand for data centers and power shortages projected to reach 36 gigawatts by 2028, APLD’s early investments in infrastructure position it as a key player in the evolving market.

II. Applied Digital Product & Market Dynamics

APLD is making significant strides in AI-focused infrastructure and blockchain-related products, positioning itself as a key player in the high-performance computing (HPC) and data center markets. The company’s cloud services segment, which provides GPU clusters for AI applications, has grown with six clusters operational in Q2 FY 2025, contributing $27.7M in revenue, a 51% YoY increase. APLD is actively evaluating next-generation GPU opportunities, aligning with the surging demand for AI-driven computing power. Additionally, its data center hosting business, with 286 megawatts of capacity across two North Dakota locations, is operating at full capacity, benefiting from Bitcoin’s rise to $100,000 and robust cryptocurrency mining demand.

Source: Investor Presentation

A major innovation is the ongoing construction of the 400-megawatt Ellendale HPC campus, which reached a milestone with the energization of its main substation transformer. This facility, expected to deliver 100 megawatts of critical IT load by 2025, positions APLD to capitalize on the growing demand for hyperscale data centers, particularly in AI and cloud computing. The company’s R-WISH program, which addresses housing and workforce growth in Ellendale, has also garnered recognition, winning the DCD Community Impact Award, a significant achievement for an emerging firm competing against giants like Google and NTT DATA.

Competitive Landscape

APLD operates in a highly competitive market dominated by established players like Equinix, Amazon Web Services (AWS), and DigitalOcean, as well as blockchain-focused firms like Core Scientific. While these competitors have broader geographic reach and larger customer bases, APLD differentiates itself through specialized HPC and AI infrastructure and strategic partnerships. For instance, the $5B perpetual preferred equity financing facility with Macquarie Asset Management not only provides capital but also validates APLD’s growth strategy. This partnership, alongside earlier investments from NVIDIA and CIM Group, strengthens APLD’s position in the Tier 3 data center market.

Source: Investor Presentation

Pricing strategies in the data center industry are increasingly competitive, with hyperscalers demanding cost-efficient solutions. APLD’s focus on low-cost power locations like North Dakota and its ability to secure long-term GPU lease agreements (extended to five years, reducing D&A expenses by $8.5M in Q2) provide a pricing edge. However, the company faces challenges from larger competitors with deeper pockets and more extensive infrastructure.

APLD’s market share in the HPC and AI data center segment is growing, driven by its Ellendale campus and cloud services expansion. The company’s 85% ownership stake in existing and future HPC assets, coupled with the ability to construct over 2 gigawatts of capacity, positions it as a significant player in the U.S. market. However, its geographic footprint remains limited compared to global competitors like Equinix and AWS, which operate across multiple continents.

III. APLD Stock Forecast 2025

APLD Stock Prediction Technical Analysis

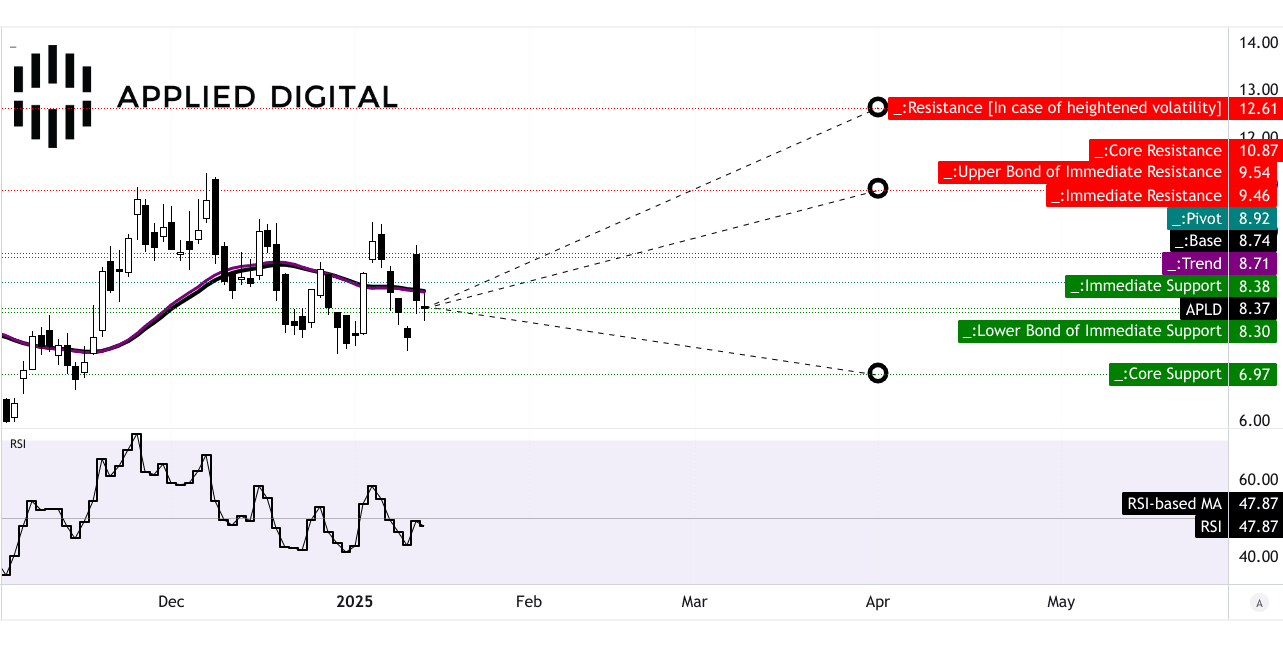

APLD’s stock currently trades at $8.37, below its trendline ($8.71) and baseline ($8.74), both calculated using a modified exponential moving average (EMA). This suggests a neutral to slightly bearish short-term trend. The stock is hovering near the pivot of its current horizontal price channel at $8.92, indicating a key resistance level. A breakout above this level could signal a bullish reversal, while failure to breach it may lead to further consolidation or a pullback. The Relative Strength Index (RSI) stands at 47.87, reflecting a sideways momentum with no immediate overbought or oversold conditions. However, the presence of a bullish divergence (where price trends lower while RSI trends higher) hints at potential upward momentum if buying pressure increases. The absence of a bearish divergence further supports the possibility of a rebound. The average price target for APLD by the end of Q1 2025 is $10.85, representing a 29.6% upside from the current price. This target is based on momentum analysis and Fibonacci retracement/extension levels, considering the stock’s mid- to short-term price swings. The optimistic price target of $12.60 (a 50.5% upside) assumes sustained upward momentum, while the pessimistic target of $7.00 (a 16.4% downside) accounts for potential downward pressure.

Source: tradingview.com

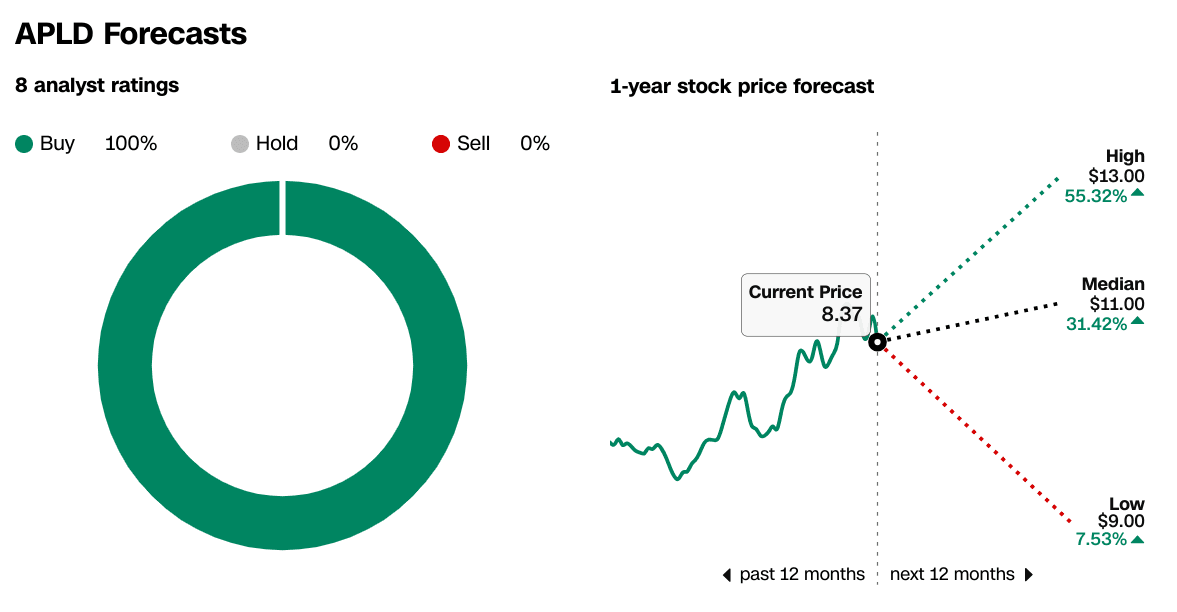

APLD Stock Forecast: Market analysts' expectations & ratings

Analysts are overwhelmingly bullish on APLD, with 100% of the 8 ratings being "Buy" and 0% "Hold" or "Sell". This consensus reflects confidence in the company’s growth trajectory, driven by its AI-focused infrastructure, blockchain-related products, and strategic partnerships like the $5B financing facility with Macquarie Asset Management. For the next 12 months, analysts project a high target of $13 (a 55.3% increase), a median target of $11 (a 31.4% increase), and a low target of $9 (a 7.5% increase). These forecasts are underpinned by APLD’s strong revenue growth (51% YoY in Q2 FY 2025), expanding HPC and cloud services segments, and its ability to capitalize on the AI and blockchain booms.

Source: CNN.com

IV. Applied Digital Stock Forecast: Future Outlook

Management's Growth Forecasts and Strategic Initiatives

Applied Digital’s management has outlined a robust growth strategy centered on AI-driven infrastructure, blockchain-related services, and hyperscale data center development. The company’s Ellendale HPC campus, with 100 megawatts of IT load expected by 2025, is a cornerstone of this strategy. Management emphasized their focus on completing the 100-megawatt data center on time and within budget, which they believe will be a valuable asset for hyperscaler clients. The recent $5B perpetual preferred equity financing facility with Macquarie Asset Management further strengthens their financial position, enabling the development of HPC data center capacity and positioning APLD as a leader in the Tier 3 data center market.

Source: Investor Presentation

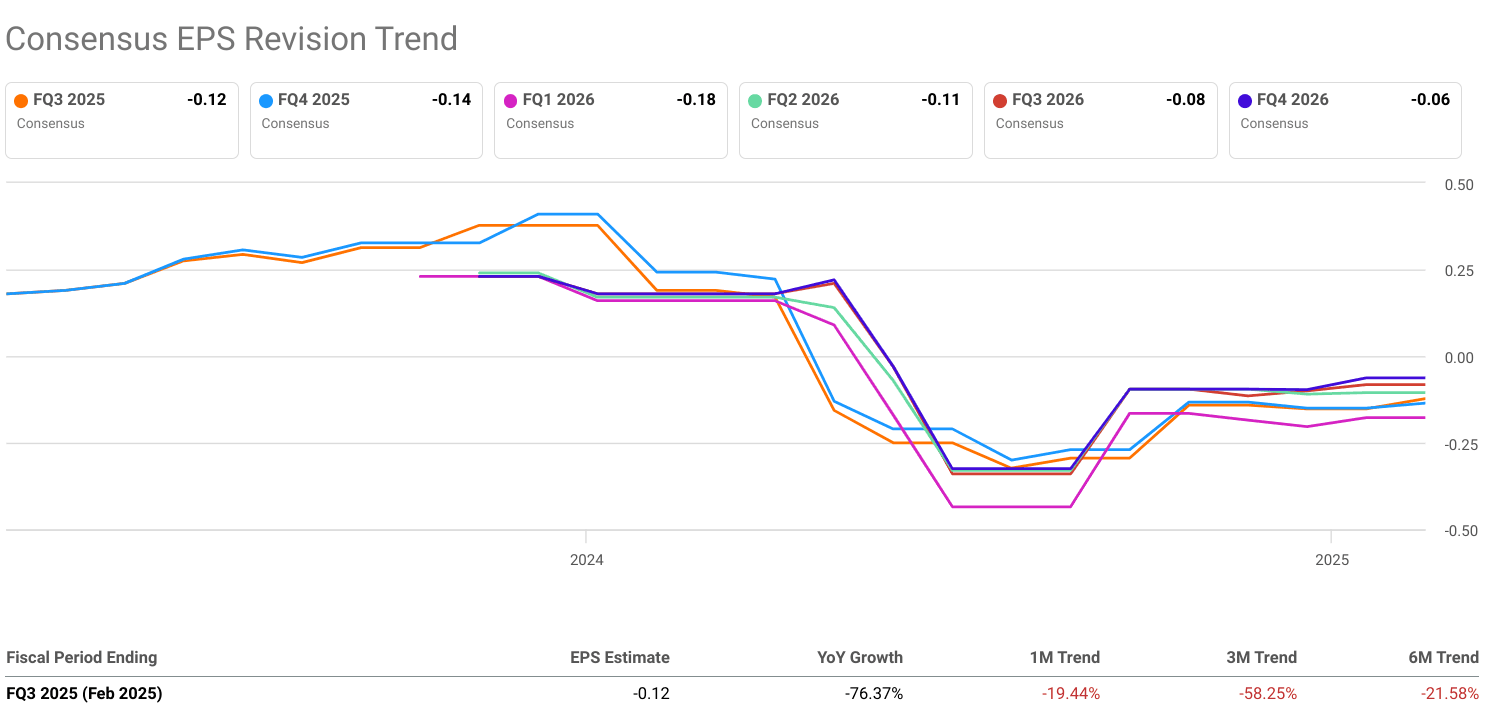

For the upcoming quarters, management expects continued growth in the cloud services segment, driven by the deployment of next-generation GPU clusters for AI applications. The data center hosting segment, operating at full capacity with 286 megawatts, is also expected to benefit from sustained demand in the cryptocurrency sector. Revenue guidance for Q3 FY 2025 projects $62.78M, reflecting 44.82% YoY growth, while EPS is estimated at -$0.12, a 76.37% improvement YoY. These forecasts are supported by six upward EPS revisions and three upward revenue revisions over the last three months, indicating strong analyst confidence.

Source: seekingalpha.com

Market Trends

● The demand for high-performance computing (HPC) infrastructure is surging, driven by the rapid adoption of AI technologies. APLD’s cloud services segment, which contributed $27.7M in Q2 FY 2025, is poised for growth as AI applications require increasingly powerful GPU clusters.

● The global shift toward cloud-based solutions continues to accelerate. APLD’s Ellendale campus and its focus on hyperscale data centers align with this trend, offering scalable infrastructure for enterprise and hyperscale clients.

● With Bitcoin’s price reaching $100,000, demand for blockchain-related services remains robust. APLD’s data center hosting business, operating at full capacity, is a direct beneficiary of this trend.

While APLD’s growth prospects are strong, risks include rising interest expenses (up $4.9M to $7.5M in Q2) and potential delays in securing hyperscaler contracts. However, the company’s strategic partnerships with Macquarie, NVIDIA, and CIM Group, along with its focus on low-cost power locations like North Dakota, mitigate these risks.

Source: Ycharts

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.