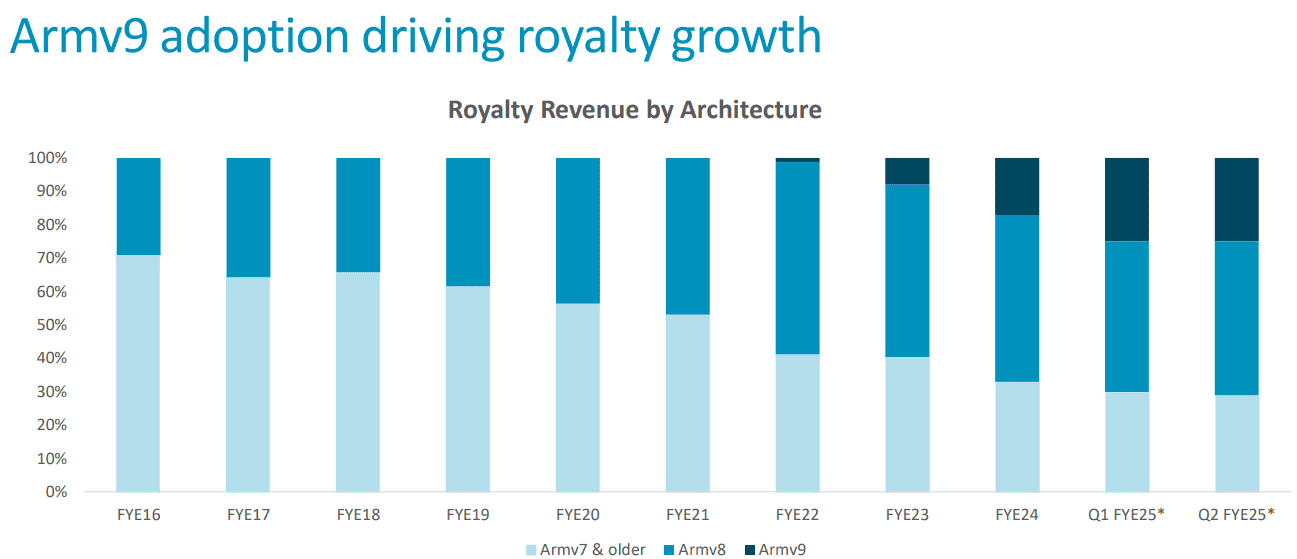

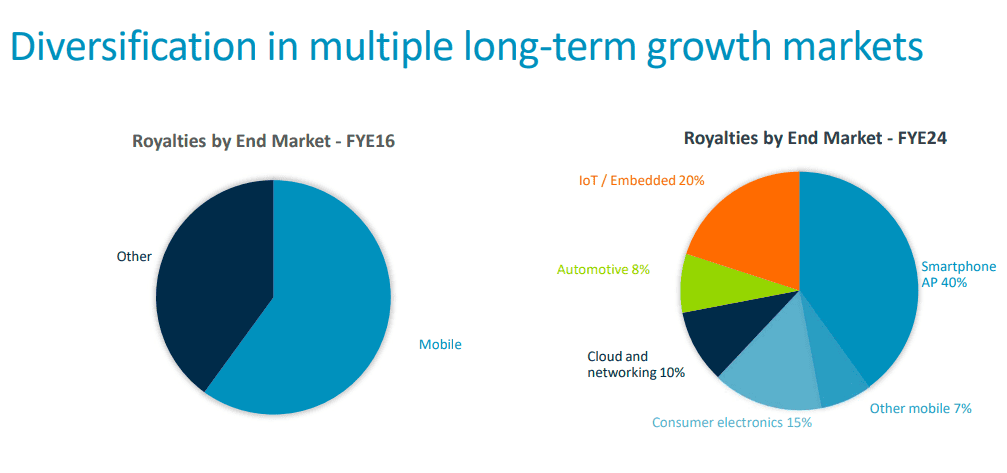

In recent developments, Arm Holdings exceeded financial expectations. Key revenue drivers included a 23% increase in high-margin royalty revenue, primarily from expanding Armv9 architecture adoption in smartphones, automotive, and cloud sectors. Arm saw 40% growth in smartphone royalties, significantly outpacing the 4% rise in unit shipments. The company projects Q3 revenue between $920 million and $970 million and maintains its full-year guidance, despite cautious market sentiment.

I. ARM Earnings Overview Q2 2025

Key Financial Metrics

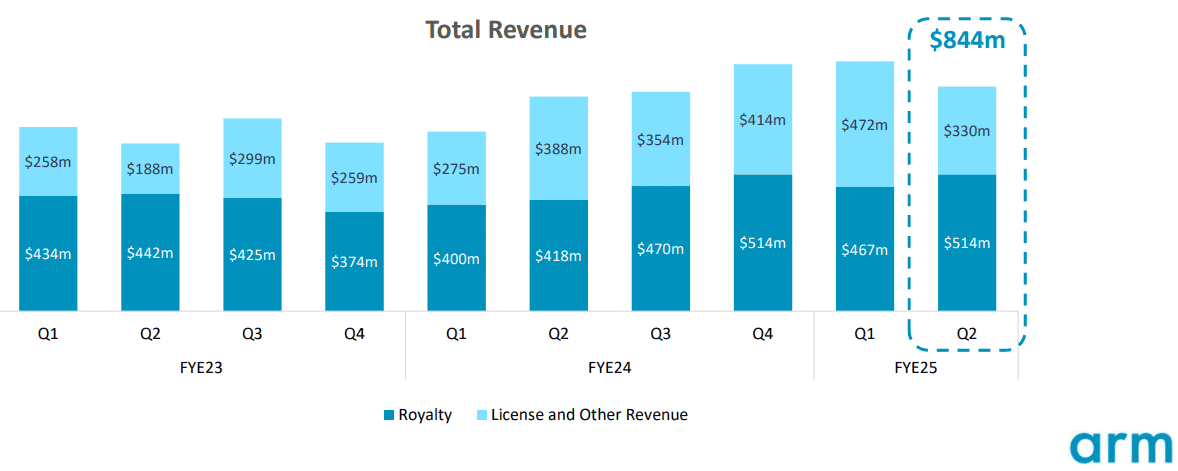

In Q2 FY2025, Arm Holdings posted robust financials, surpassing market expectations. Revenue reached $939 million, beating projections by $32.5 million. Normalized EPS was $0.40, exceeding expectations by $0.05, while GAAP EPS stood at $0.21, also surpassing estimates by $0.04. Net income showed substantial improvement year-over-year, primarily due to high-margin royalty revenues and expanding adoption of Arm's v9 architecture in smartphones and other devices.

Source: Investor_Presentation

ARM Stock Earnings Q2 2025 Revenue Drivers

Arm's revenue breakdown highlights continued strength in royalty and licensing streams. Royalty revenue rose to $514 million, marking a 23% year-over-year increase as Armv9 architecture adoption accelerated across smartphones, automotive, and cloud sectors. Notably, smartphone royalties spiked by 40%, contrasting with a modest 4% increase in smartphone unit shipments, illustrating higher royalties per chip due to Armv9 usage in flagship devices like Apple’s iPhone 16 and MediaTek’s Dimensity 9400. Despite a 15% decline in licensing revenue to $330 million—better than the anticipated 25% drop—the long-term revenue impact remains positive, with annualized contract value (ACV) up 13% year-over-year. This suggests sustained demand for Arm’s designs, particularly in AI and edge computing applications, even as some sectors, such as industrial, face inventory challenges.

Source: Investor_Presentation

Profitability Analysis

Arm’s profitability metrics were bolstered by disciplined cost management and high-margin royalty growth. Gross margins benefited from the revenue shift towards Armv9-based royalties, especially in mobile and automotive sectors. Operating margins improved, largely due to lower-than-anticipated licensing revenue declines and cost efficiencies. While operating expenses are projected to rise by 19% year-over-year to approximately $2.05 billion, Arm is channeling these investments primarily into R&D, underpinning future innovations in AI and edge processing.

Arm’s full-year revenue guidance remains between $3.8 billion and $4.1 billion, reflecting a projected 18%-27% year-over-year increase, driven by high teens growth in royalty revenues. Non-GAAP EPS for FY2025 is expected between $1.45 and $1.65. As Arm strengthens its foothold in mobile, cloud, and automotive markets, its technological edge in AI and edge computing continues to drive demand, positioning the company well for sustained revenue and profitability growth.

II. Product & Market Dynamics

New Products & Services

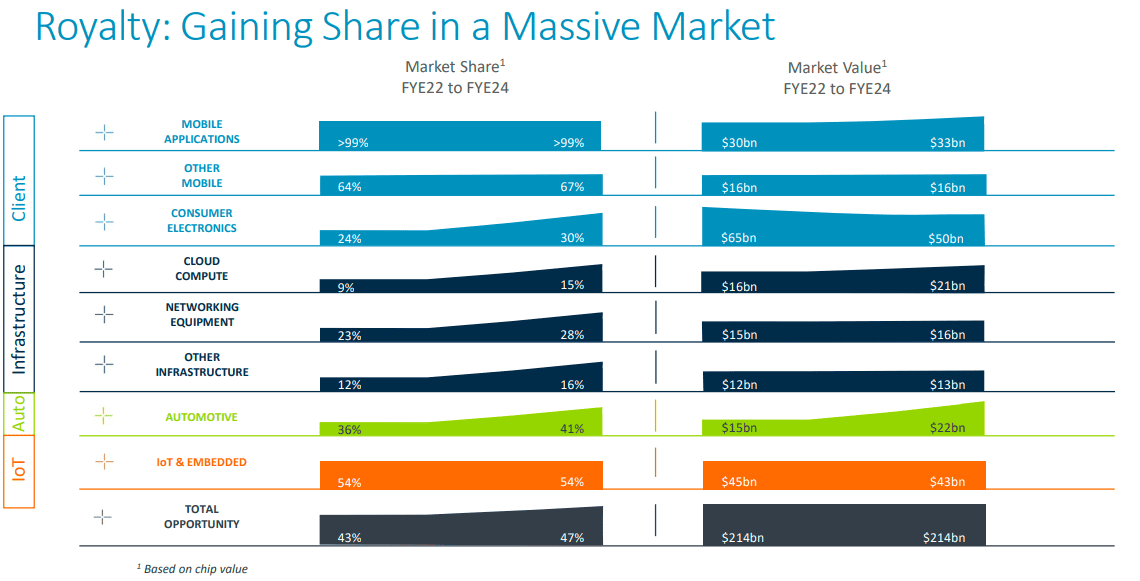

Arm Holdings has introduced several new products and partnerships in 2024 aimed at capitalizing on AI and mobile technology demand. The Armv9 architecture has been central to its recent advancements, now making up 25% of royalty revenue (up from 10% a year prior) and bolstering its positioning in AI workloads across edge to cloud environments. Key partnerships, like the integration with NVIDIA’s Grace Blackwell processors, have solidified Arm’s foothold in data centers, while collaborations with Microsoft’s Azure Cobalt and Google’s GCP Axion signal growing adoption among major cloud providers. Furthermore, Arm’s partnership with GitHub, adding Arm tools to GitHub CoPilot, enhances its reach within the developer community, aligning with its goal of embedding AI capability within all digital chips.

In the PC market, Arm has set an ambitious goal to achieve a 50% share by 2029, aided by Microsoft’s commitment to supporting Arm-based chips in the Windows ecosystem. Currently, Arm holds an 11% share of Windows PCs, with expectations to rise to 20% in notebooks by 2025, driven by demand for energy-efficient processors. If successful, this would challenge x86 incumbents like Intel and AMD, shifting market dynamics as the industry seeks power-efficient and AI-compatible architectures.

Source: Investor_Presentation

Competitive Landscape

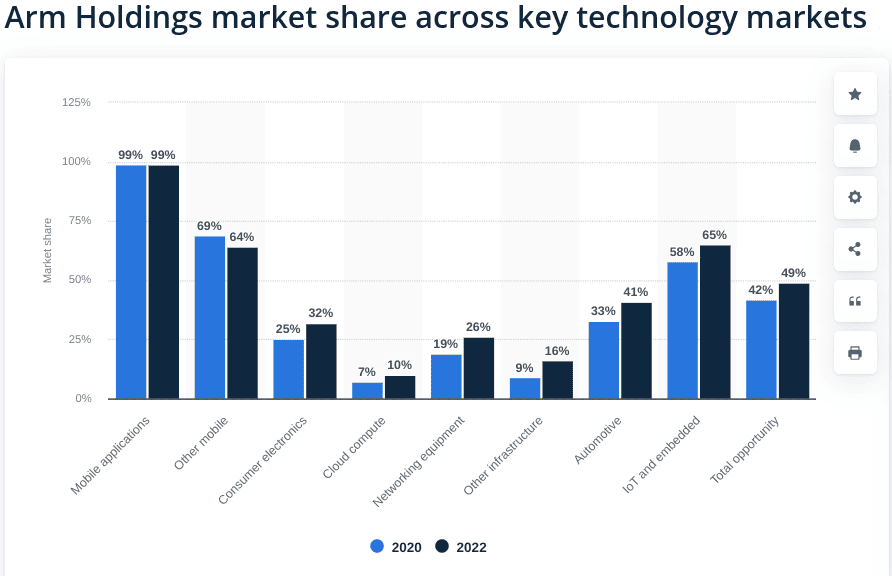

Within the competitive landscape, Arm’s principal rivals include Intel, NVIDIA, and Qualcomm. Arm’s licensing model, which allows extensive customization, differentiates it from Intel and AMD’s proprietary chip designs and enables Arm partners to develop application-specific chips, especially valuable in AI and automotive. Arm’s competitive advantage in mobile applications remains robust, where it commands over 90% market share. However, in the broader semiconductor IP space, NVIDIA’s recent AI acceleration innovations and Qualcomm’s foothold in high-end mobile processors present challenges. Additionally, as Intel attempts to penetrate the mobile and IoT markets, Arm’s dominance may face pressure from x86 solutions as they advance in power efficiency.

Source: statista.com

Arm’s pricing strategy, particularly its CSS (Custom Silicon Solutions) model, has contributed to increased revenue per unit, especially within smartphones, where royalty revenue outpaced unit growth, increasing 40% year-over-year despite only 4% growth in shipments. Arm’s ongoing focus on royalty and licensing fees with flexible pricing aims to sustain its competitive advantage as demand for high-performance, AI-capable chips grows across mobile, IoT, and cloud sectors.

Source: businessresearchinsights.com

III. Arm Stock Forecast

ARM Stock Price Performance Post-Earnings

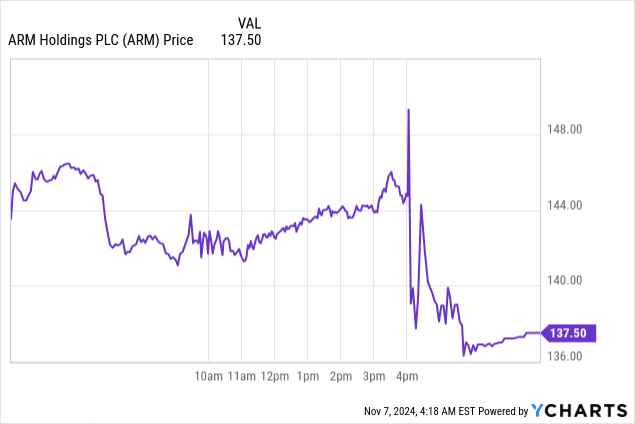

Arm Holdings' stock performance following its fiscal second-quarter earnings report demonstrated mixed reactions from the market. Despite exceeding analysts' estimates in terms of earnings and revenue, Arm's stock price declined in extended trading after the company provided a softer-than-expected sales forecast. However, the company's full-year revenue forecast, while showing growth, was lower than analyst expectations, contributing to the decline in stock price, which fell over 4% in after-hours trading. The disappointing forecast overshadowed the company's improved profitability.

Source: Ycharts.com

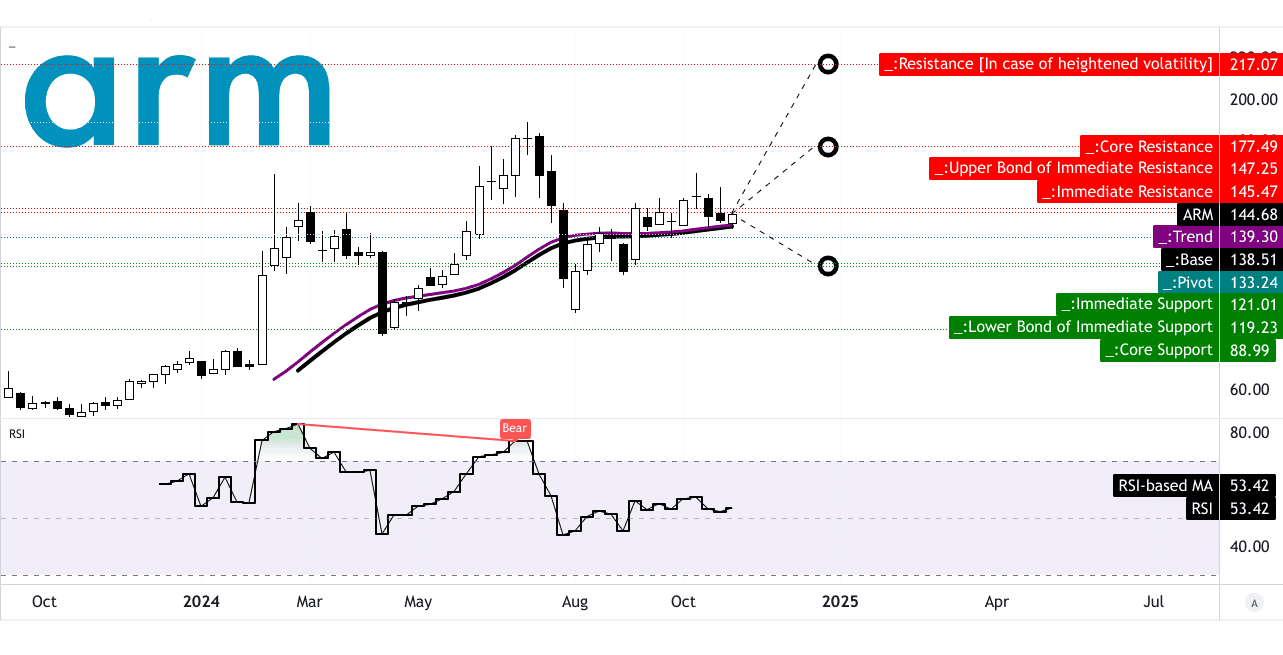

ARM Stock Price Forecast

From a technical analysis perspective, Arm's stock has been exhibiting a range-bound movement with the current price at $144.68, but the trendlines, which are based on modified exponential moving averages (EMA), suggest some vulnerability. The trendline currently stands at $139.30, indicating a slight downward pressure, while the baseline is at $138.51. This suggests that if the price dips below these levels, there could be further downside risk. The pivot of the current horizontal price channel is identified at $133.24, indicating a possible support level if the stock experiences a correction.

The Relative Strength Index (RSI) stands at 53.42, signaling a neutral market sentiment with no clear bullish or bearish divergence. The RSI is trending sideways, indicating that neither buying nor selling pressure is overwhelming at the moment. This lack of strong momentum could suggest that the stock might continue to trade within its current range unless a catalyst drives it beyond this zone.

Looking ahead, analysts have set varying price targets for Arm's stock by the end of 2024. The average target price is $177.00, based on momentum changes and Fibonacci retracement levels. In a more optimistic scenario, the stock could reach as high as $217.00 if the current upward price momentum continues. However, in a pessimistic case, the stock could fall to $119.00, driven by continued downward price momentum.

Source: tradingview.com

IV. ARM Stock Forecast: Future Outlook

Management's Growth Forecasts And Strategic Initiatives

Arm Holdings' outlook is shaped by its strategic initiatives, robust market demand in key segments, and cautiously optimistic guidance. For the third quarter of fiscal year 2025 (ending December 2024), Arm expects revenue between $920 million and $970 million, a midpoint increase of 15.3% year-over-year. Additionally, full-year 2025 revenue guidance remains between $3.8 billion and $4.1 billion, indicating 18% to 27% annual growth. However, this range also reflects caution due to varying licensing deal timings.

Arm's growth strategy centers on capitalizing on the proliferation of AI, mobile, and data center demand. A notable growth driver is Armv9 adoption, with royalty revenue for this platform surging 23% year-over-year and comprising 25% of total royalties. Arm’s collaboration with key players like Apple, MediaTek, NVIDIA, Microsoft, and Google underlines its strength in the mobile and data center markets. For example, Arm-based technologies, including Apple's iPhone 16 processors and NVIDIA’s Grace Blackwell for cloud solutions, are bolstering Arm's relevance in AI applications. In automotive, Arm’s Comprehensive Software Solution (CSS) sees growing adoption, particularly for ADAS and in-vehicle infotainment systems, highlighting the automotive sector's potential as a long-term revenue contributor.

Source: Investor_Presentation

Market Trends And Analysts' Expectations & Ratings

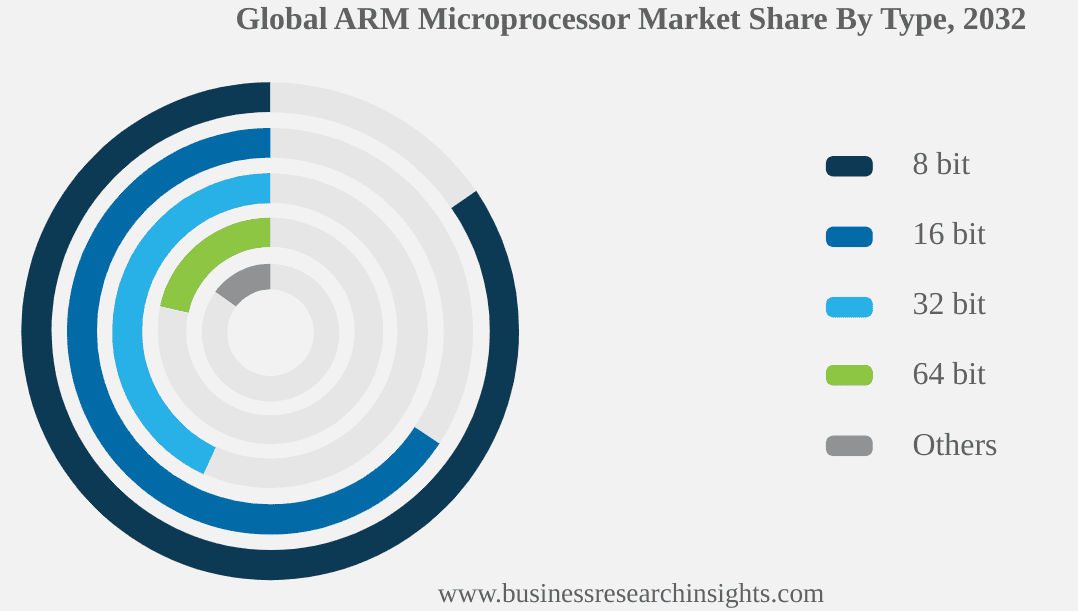

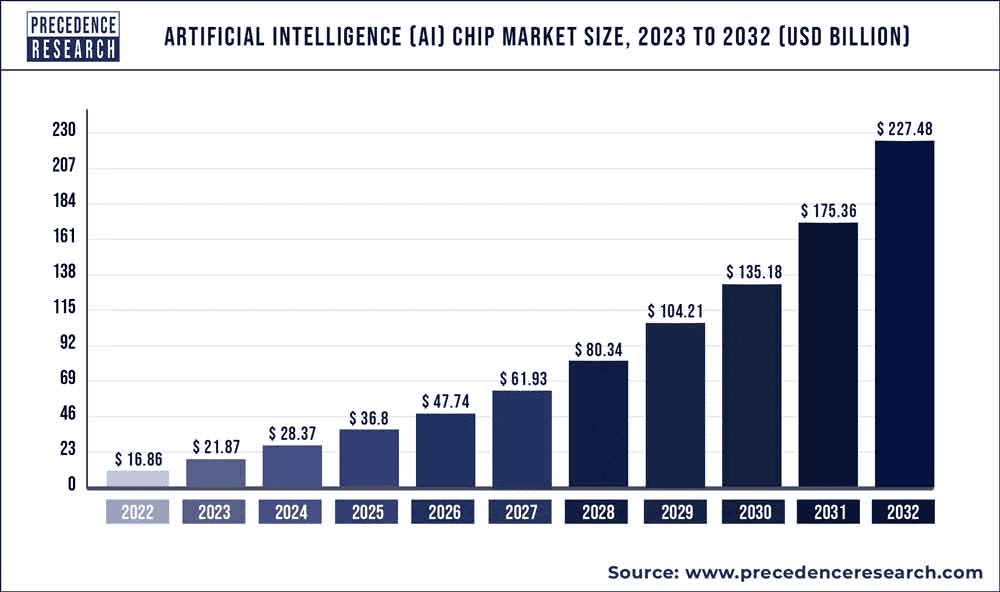

The global Arm microprocessor market is projected to grow at a 7.7% CAGR, from $12.24 billion in 2023 to $23.85 billion by 2032. Whereas, the global AI chip market size, $16.86 billion in 2022, may hit $227.48 billion by 2032 based on a CAGR of 29.72% (2023 to 2032). This market trend aligns with Arm's expansion across mobile, AI, data center, and automotive verticals, with an anticipated increase in CPU demand as more devices incorporate advanced AI capabilities. In smartphones, for example, Arm has seen a 40% rise in royalties year-over-year despite only a 4% rise in unit shipments, indicating higher royalty per unit due to more advanced chips like the Armv9. The potential growth in AI across data centers and cloud platforms also boosts Arm’s revenue expectations, with cloud providers integrating Arm CPUs for efficient and scalable AI applications.

Source: precedenceresearch.com

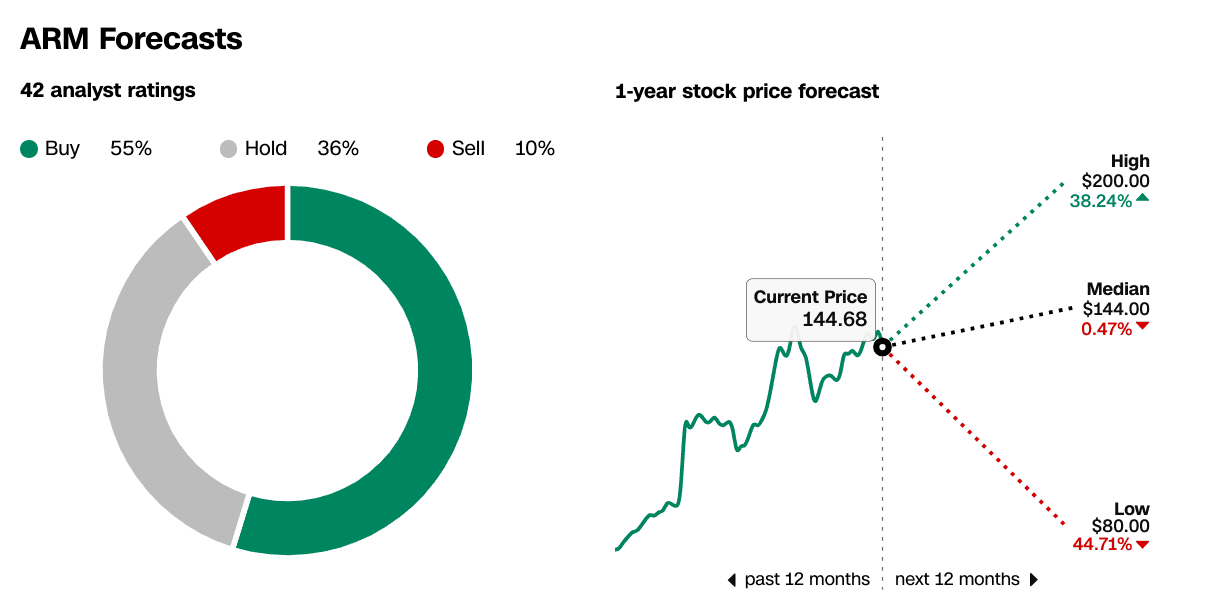

Analysts remain divided, with 55% recommending a buy, 36% holding, and 10% suggesting a sell. The one-year price target consensus shows significant variability, with a high target of $200, median at $144 (near the current price of $144.68), and a low target of $80. This reflects both the company’s growth potential and cautious sentiment regarding market volatility and execution risks in its high-growth areas.

Source: CNN.com

Source: CNN.com