Bank of America’s stock remained flat post-Q4 2024 earnings, driven by strong results: $25.35B revenue (beat by $220.32M) and $0.82 EPS (beat by $0.05). Analysts project a $49.30 average price target for Q1 2025, reflecting 5.95% upside, supported by NII growth, digital adoption, and operating leverage. The stock trades above its $45.30 support level, with an RSI of 59.15, indicating bullish momentum.

Source: Ycharts.com

I. Bank of America Earnings Overview Q4 2024

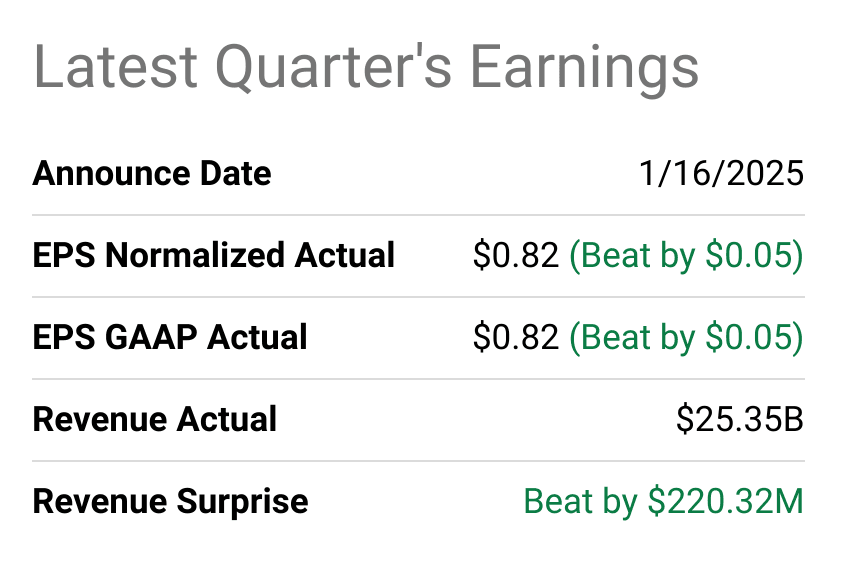

Revenue vs. Expectations

Bank of America (BAC) reported strong Q4 2024 earnings, surpassing revenue and earnings per share (EPS) expectations. Revenue for the quarter stood at $25.35 billion, beating estimates by $220.32 million, while normalized and GAAP EPS both came in at $0.82, exceeding expectations by $0.05. Net income for the quarter was $6.7 billion, reflecting a solid finish to the year. For the full year, BAC generated $102 billion in revenue and $27.1 billion in net income, with EPS at $3.21. Key profitability metrics included an 83 basis points return on assets (ROA) and a 13% return on tangible common equity (ROTCE).

Source: seekingalpha.com

BAC Earnings Q4 2024 Revenue Drivers and Margin Trends

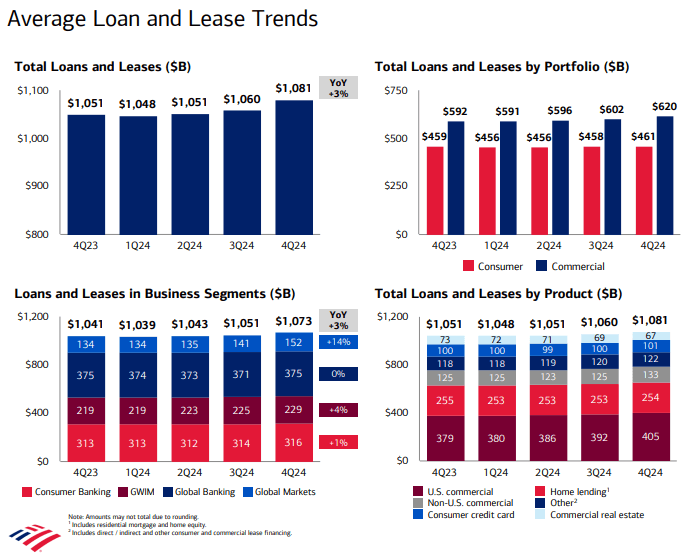

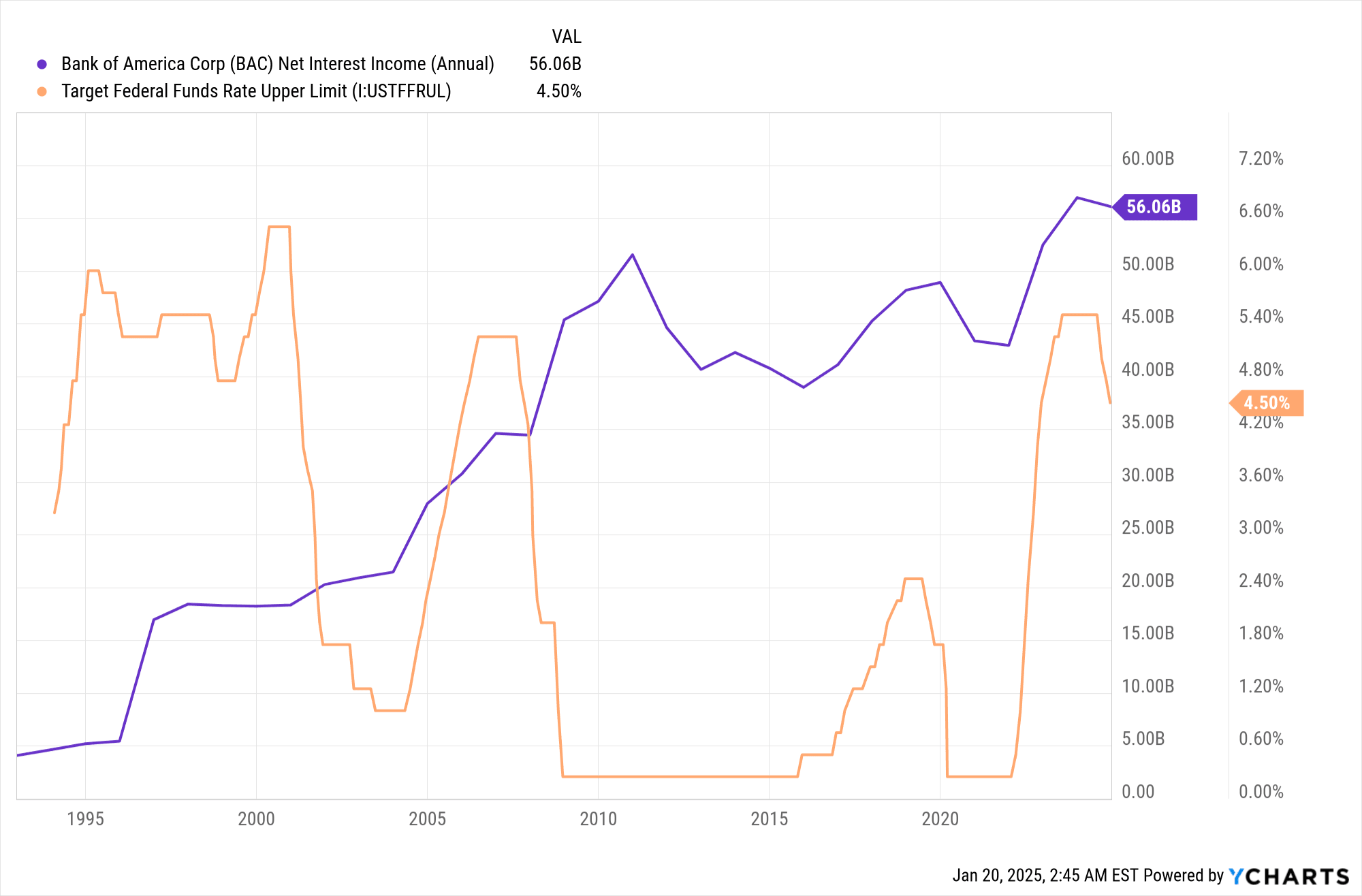

Revenue growth was driven by strong performance across all business segments. Net interest income (NII) rebounded to $14.5 billion (on a fully taxable equivalent basis), up from $13.9 billion in Q2 2024, marking a second consecutive quarter of growth. This was supported by loan growth (up 5% year-over-year in commercial loans) and deposit growth (up $35 billion in Q4). Non-interest income also saw robust growth, with investment banking fees surging 44% year-over-year to $1.7 billion, and sales and trading revenue hitting a Q4 record of $4 billion, up 10% year-over-year. Margins improved as BAC maintained disciplined pricing, with the rate paid on deposits declining to 194 basis points in Q4 from 210 basis points in Q3. This contributed to a 3% increase in NII sequentially. Operating leverage was achieved despite higher expenses, driven by investments in technology, brand, and compliance.

BAC’s year-over-year growth was broad-based. Consumer Banking revenue grew to $10.6 billion, driven by card income and service charges, while Wealth Management revenue rose 15% to $6 billion, supported by asset management fees (up 23%). Global Banking revenue was flat year-over-year, but investment banking fees surged 44%, reflecting strong M&A and capital markets activity. Global Markets revenue (excluding DVA) grew 15%, with sales and trading revenue hitting $4.1 billion, a Q4 record. BAC ended the year with $953 billion in liquidity and a CET1 ratio of 11.9%, well above the regulatory requirement of 10.7%. The bank returned $21 billion to shareholders in 2024, including an 8% increase in dividends.

Source: Presentation Materials_4Q24

II. Bank of America Product & Market Dynamics

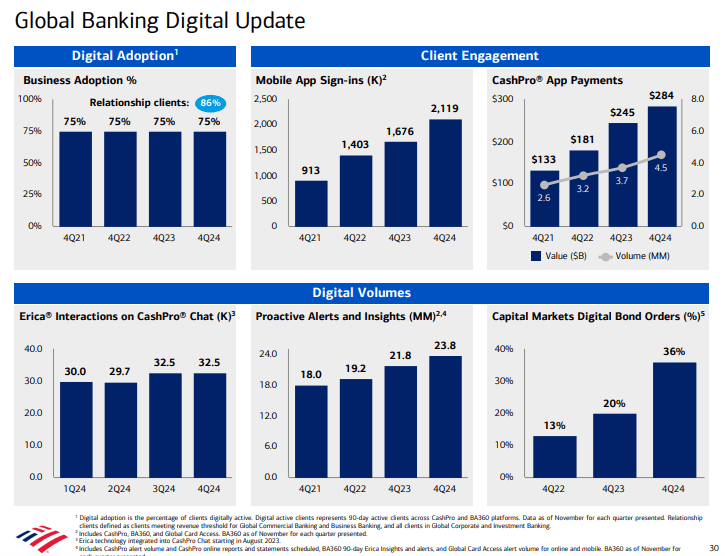

BAC has made significant strides in digital banking and AI-driven services, which have been well-received in the market. The bank’s digital platforms recorded 14 billion logins in 2024, reflecting strong customer engagement. Its AI-driven virtual assistant, Erica, surpassed 2.5 billion interactions since inception, showcasing its growing adoption. Additionally, the CashPro app, a key tool for corporate clients, facilitated over $1 trillion in payments in 2024, underscoring its importance in the digital payments space. BAC also reported that 60% of consumer product sales were conducted digitally in Q4, highlighting the success of its mobile and online banking platforms.

In wealth management, BAC’s Merrill Edge platform crossed $518 billion in client balances, driven by a 22% increase in investment balances year-over-year. The bank added 24,000 new households in 2024, bringing total client balances to $6 trillion. This growth was supported by digital adoption, with 75% of Merrill bank and brokerage accounts opened digitally in Q4. BAC’s focus on integrating banking and wealth management services has also paid off, with 60% of wealth management clients now using banking products.

BAC has been cautious in its approach to cryptocurrency and ESG-related financial products. While it has not aggressively entered the crypto space, it has focused on blockchain technology for secure transactions. In ESG, BAC has continued to invest in renewable energy and affordable housing, which contributed to its 6% effective tax rate in Q4, partly due to tax credits from these initiatives.

Source: Presentation Materials_4Q24

Competitive Landscape

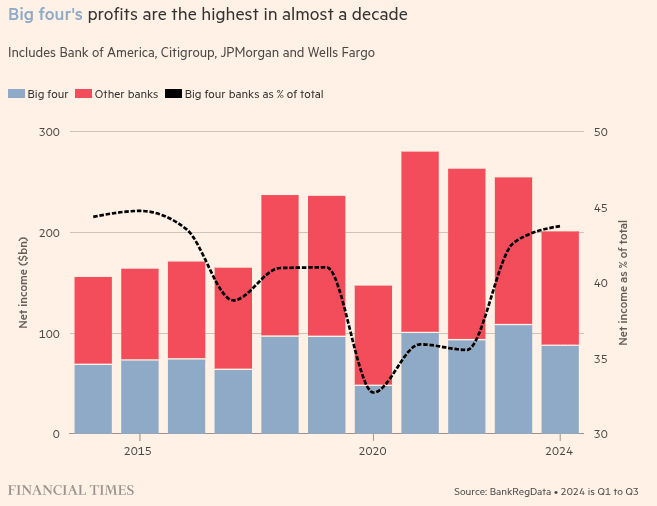

BAC faces stiff competition from JPMorgan Chase, Citigroup, and Wells Fargo, particularly in digital banking and wealth management. JPMorgan, for instance, has heavily invested in its Chase Mobile app and You Invest platform, while Wells Fargo has focused on digital transformation and small business lending. BAC’s pricing strategy has been disciplined, with the rate paid on deposits declining to 194 basis points in Q4 from 210 basis points in Q3, helping it maintain a competitive edge in attracting low-cost deposits.

BAC has gained market share in investment banking, maintaining its 3 position in fees, with a 44% year-over-year growth in Q4. This was driven by strong performance in M&A and capital markets. In contrast, Citigroup has struggled with restructuring costs, while Wells Fargo has faced regulatory challenges. BAC’s sales and trading revenue also hit a Q4 record of $4.1 billion, outperforming peers like JPMorgan, which reported a decline in trading revenue during the same period.

Source: ft.com

BAC’s deposit growth has been a key differentiator, with $35 billion in net deposit growth in Q4, marking six consecutive quarters of growth. This has helped BAC maintain a liquidity buffer of $953 billion, well above competitors. The bank’s commercial loan growth of 5% year-over-year also outpaced industry averages, driven by strong demand in leveraged finance and corporate lending.

In wealth management, BAC’s $6 trillion in client balances positions it as a leader, though JPMorgan’s $4.4 trillion in assets under management remains a close competitor. BAC’s focus on digital engagement and cross-selling banking products has helped it gain an edge in customer retention and acquisition.

III. BAC Stock Forecast 2025

Bank of America Stock Forecast Technical Analysis

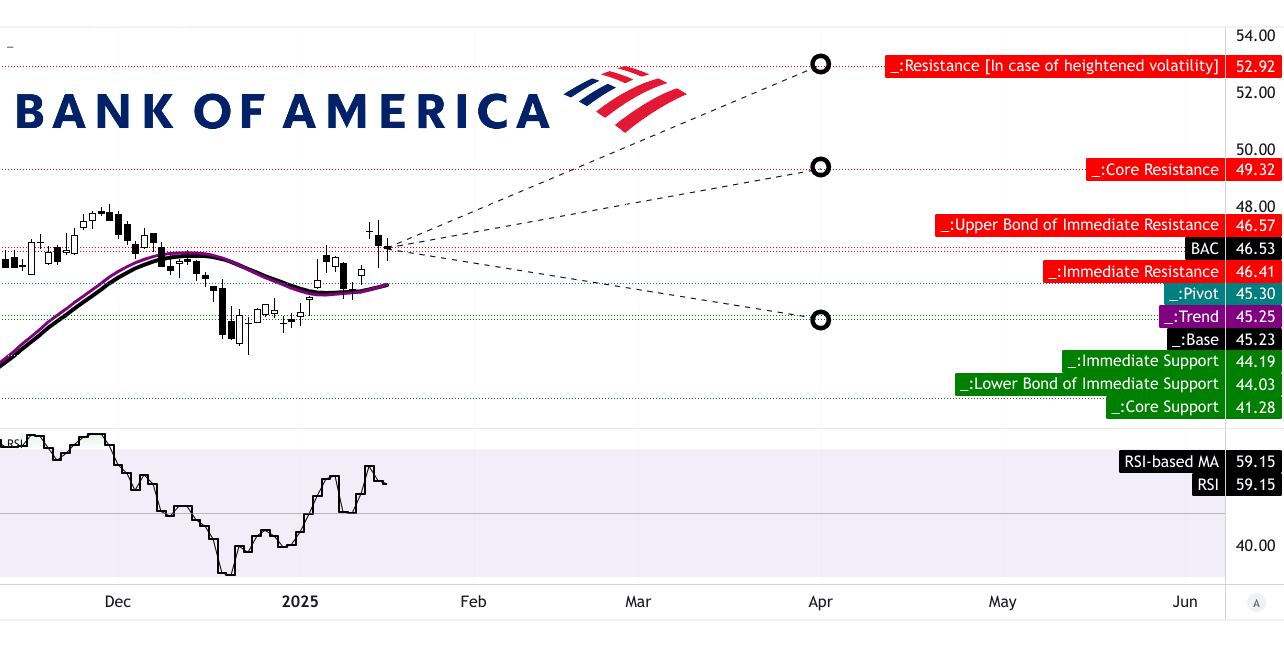

BAC stock, currently priced at $46.53, is trading above its trendline and baseline levels, both at $45.25 and $45.23, respectively, based on a modified exponential moving average (EMA). This indicates a bullish trend in the short to mid-term. The stock is also hovering near the pivot of its current horizontal price channel at $45.30, suggesting strong support at this level. The Relative Strength Index (RSI) stands at 59.15, trending upward but not yet in overbought territory (above 70), which implies room for further price appreciation. There are no bullish or bearish divergences in the RSI, indicating a stable momentum.

Analysts have set an average price target of $49.30 for BAC by the end of Q1 2025, reflecting a 5.95% upside from the current price. This target is based on Fibonacci retracement/extension levels and the momentum of change-in-polarity observed in the mid- to short-term price action. The optimistic price target is $52.90 (a 13.69% increase), driven by upward price momentum, while the pessimistic target is $44.10 (a 5.22% decline), factoring in potential downward momentum.

Source: Tradingview.com

BAC Stock Forecast: Analyst Ratings

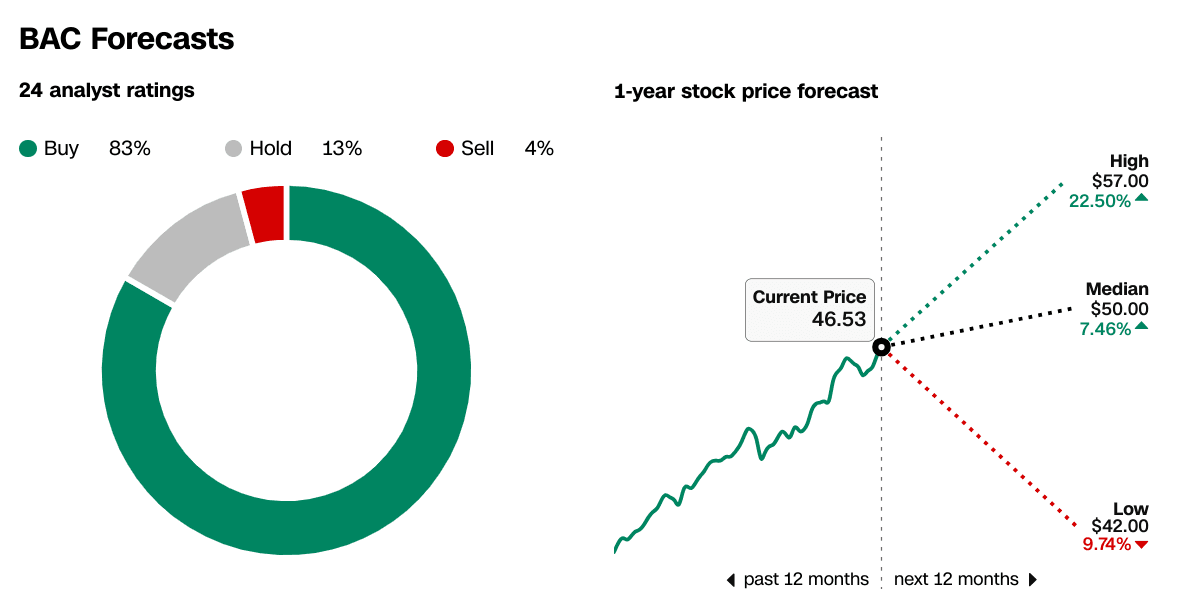

For the next 12 months, analysts project a median price target of $50, representing a 7.46% increase, with a high target of $57 (a 22.50% upside) and a low target of $42 (a 9.74% downside). These forecasts are based on BAC’s strong fundamentals, including its record NII growth, deposit growth, and operating leverage, as highlighted in its Q4 2024 earnings.

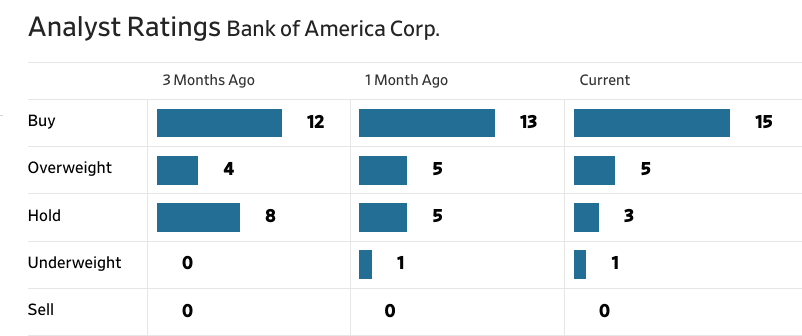

Analyst sentiment for BAC has improved significantly over the past three months. Currently, 83% of analysts recommend a "Buy" rating, up from 75% three months ago, while 13% recommend "Hold" and only 4% suggest "Sell". The number of analysts with a "Buy" rating has increased from 12 to 15, while those with a "Hold" rating have decreased from 8 to 3. This shift reflects growing confidence in BAC’s ability to sustain its revenue growth and profitability, driven by its digital transformation, wealth management growth, and strong balance sheet.

Source: CNN.com

Source: WSJ.com

IV. Bank of America Stock Forecast: Future Outlook

Management’s Growth Forecasts and Strategic Initiatives

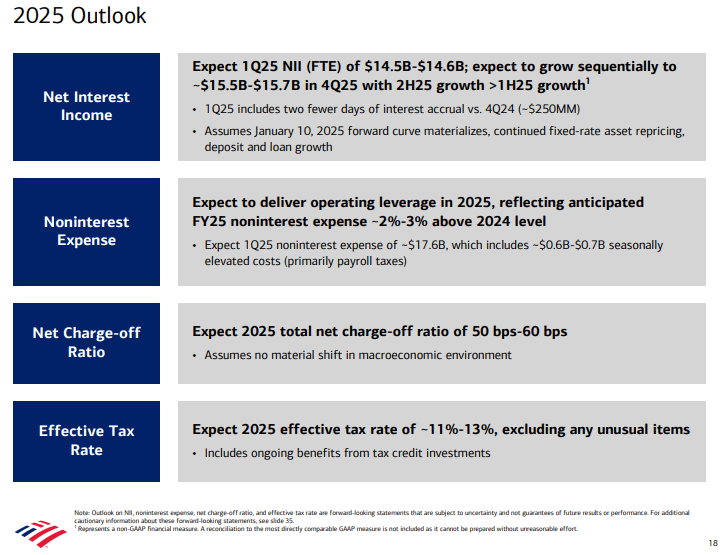

BAC has provided a robust outlook for 2025, anchored by record net interest income (NII) growth and disciplined expense management. Management expects NII to grow 6-7% in 2025, reaching $15.5-$15.7 billion by Q4, driven by loan growth, deposit repricing, and fixed-rate asset repricing. This follows a strong Q4 2024 performance, where NII rose to $14.5 billion (on a fully taxable equivalent basis), marking the second consecutive quarter of growth after bottoming out at $13.9 billion in Q2 2024. The bank anticipates Q1 2025 NII to be $14.5-$14.6 billion, despite two fewer days of interest accrual, which will reduce NII by approximately $250 million.

BAC’s strategic focus on digital transformation and operating leverage remains central to its growth strategy. The bank reported 14 billion digital logins in 2024, with 60% of consumer product sales conducted digitally in Q4. Its AI-driven virtual assistant, Erica, surpassed 2.5 billion interactions, and the CashPro app facilitated over $1 trillion in payments. These innovations are expected to drive further efficiency and customer engagement in 2025. Management also highlighted expense discipline, projecting 2025 noninterest expenses to rise 2-3% year-over-year, with Q1 2025 expenses estimated at $17.6 billion, including $600-$700 million in seasonal payroll tax costs. The bank aims to deliver operating leverage by growing revenue faster than expenses, supported by investments in technology, brand partnerships, and compliance enhancements.

Source: Presentation Materials_4Q24

Consumer Banking Market Trends

BAC’s Consumer Banking segment, which contributed 40% of 2024 earnings, is poised for continued growth. The bank added 200K net new checking accounts in 2024, marking six consecutive years of growth, while investment balances surged 22% to $518 billion. Digital adoption remains a key driver, with 75% of Merrill bank and brokerage accounts opened digitally in Q4. BAC’s deposit franchise also strengthened, with consumer deposits growing to $952 billion by year-end, up from $928 billion in mid-August 2024. The rate paid on deposits declined to 64 basis points, enhancing profitability.

The interest rate environment is expected to remain favorable, with BAC assuming one rate cut in 2025, likely in May or June. This stability supports NII growth, particularly as fixed-rate assets reprice at higher rates. BAC’s credit quality remains strong, with net charge-offs declining to 54 basis points in Q4, and management expects the 2025 net charge-off ratio to remain in the 50-60 basis points range, assuming no material macroeconomic shifts.

Source: Ycharts.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.