- Financial stocks, including banks, generally offer stable returns but face moderate volatility due to economic cycles and regulatory changes.

- Bank stocks typically provide steady dividend yields and lower volatility, reflecting their traditional revenue from interest margins.

- Fintech stocks often promise higher returns but exhibit greater volatility, driven by rapid innovation, market speculation, and regulatory uncertainties.

Source: experian.com

I. What Are Financial Stocks?

Financial stocks encompass a broad category of investments related to the financial services sector. This sector includes various types of companies such as banks, fintech firms, insurance companies, and asset managers.

- Bank Stocks: These represent shares in traditional banking institutions, including commercial banks, investment banks, and savings institutions. Banks primarily generate revenue through interest on loans and fees from financial services.

- Fintech Stocks: Fintech, or financial technology, companies leverage technology to offer innovative financial services. These include payment processors, digital lending platforms, and financial software providers. Fintech stocks often focus on disrupting traditional financial services with new technologies.

- Insurance Stocks: These stocks represent companies that provide various types of insurance, including life, health, property, and casualty insurance. Insurers make money by collecting premiums and investing those funds to generate returns.

- Asset Management Stocks: Companies in this category manage investments on behalf of clients, including mutual funds, hedge funds, and retirement accounts. They earn fees based on assets under management (AUM) and performance.

Why Invest in Financial Stocks?

Investing in financial stocks offers several compelling reasons:

- Benefit from Overall Economic Growth: Financial stocks typically perform well in a growing economy. Banks and insurers benefit from increased borrowing and investment, while asset managers see higher inflows and performance fees. Economic expansion often leads to higher consumer and business spending, driving demand for financial services.

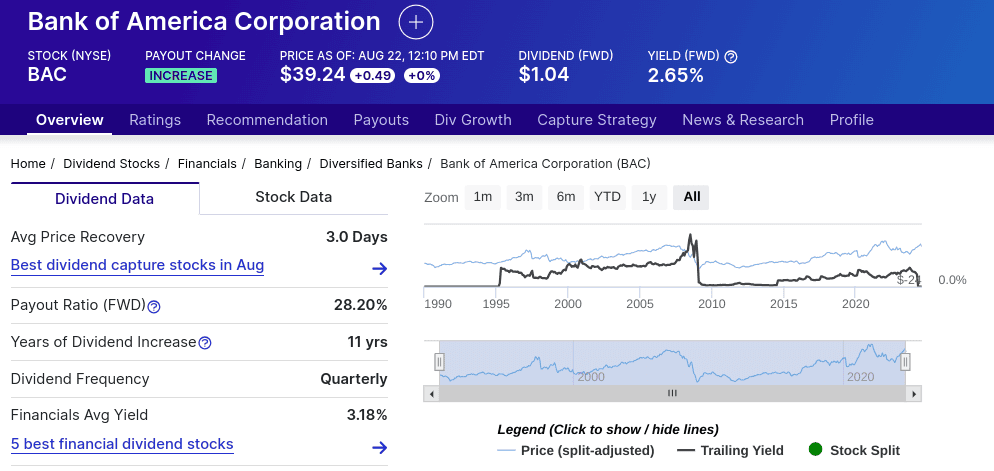

- Steady Dividends from Established Banks: Traditional banks are known for their steady dividend payouts. Established banks, with their stable revenue streams from interest and fees, often provide reliable income to investors through regular dividend payments. This makes them attractive for income-focused investors seeking stability.

[see, Years of Dividend Increase]

Source: dividend.com

- Innovation and Growth in Fintech: Fintech stocks represent high-growth potential due to their innovative solutions and disruptive technologies. These companies often target market inefficiencies and offer scalable digital solutions that can capture significant market share. Investing in fintech stocks allows investors to capitalize on the rapid technological advancements and digital transformation within the financial sector.

- Inflation Hedge: Financial stocks, especially banks and insurers, can act as a hedge against inflation. Banks benefit from rising interest rates during inflationary periods, as they can charge higher interest on loans compared to what they pay on deposits. Insurance companies can adjust premiums to reflect inflation, thus maintaining their profit margins.

- Liquidity: The financial sector is typically characterized by high liquidity. Major banks and financial institutions are heavily traded on stock exchanges, providing investors with the ability to buy and sell shares easily. This liquidity is crucial for investors looking for flexibility and quick entry or exit from positions.

II. Bank Stocks

Top Banks

- JPMorgan Chase (JPM)

- JPMorgan Chase is the largest bank in the U.S. by assets. It provides a wide range of financial services, including investment banking, asset management, and retail banking. Its strong market position is bolstered by a diverse revenue stream and a global footprint.

- JPMorgan Chase's stock price has shown resilience, with recent performance reflecting its robust earnings and strategic acquisitions. Key metrics include a dividend yield of approximately 2.6%, providing steady income to investors.

- Future Outlook: The bank is expected to benefit from economic growth and higher interest rates, enhancing its profit margins from lending activities. Its strong capital position and innovative digital services are likely to support future growth.

- Bank of America (BAC)

- Bank of America is a leading global financial institution offering banking, investing, and wealth management services. It is known for its extensive retail banking network and significant presence in the U.S. financial sector.

- BAC stock has performed well, supported by strong earnings growth and a solid dividend yield of around 2.5%. Recent developments include digital banking advancements and strategic cost management.

- Future Outlook: Bank of America is positioned to capitalize on rising interest rates and a strong U.S. economy, with a focus on expanding its digital footprint and enhancing operational efficiency.

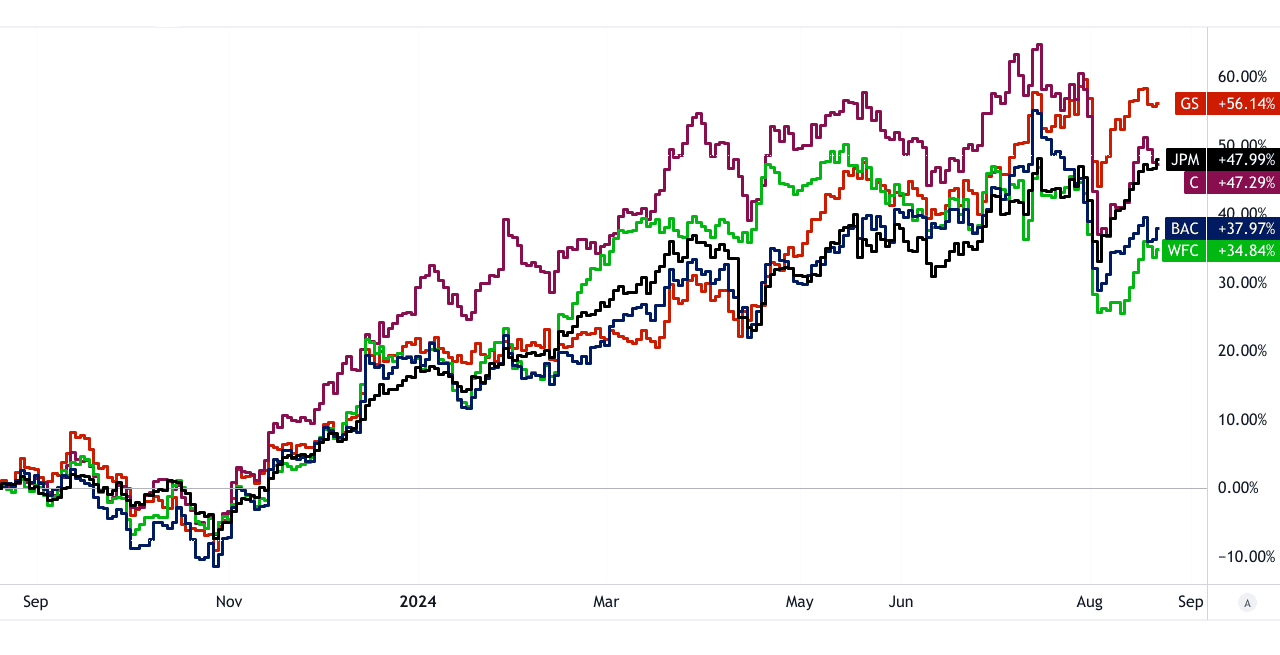

[1Y Price Return]

Source: tradingview.com

- Wells Fargo (WFC)

- Wells Fargo is a major U.S. bank known for its extensive branch network and diverse financial services, including personal and commercial banking. It has faced challenges in recent years but remains a key player in the banking industry.

- WFC stock has been recovering from past regulatory issues, with recent performance reflecting improved operational efficiency and a dividend yield of about 3%. Key metrics highlight its ongoing restructuring efforts.

- Future Outlook: Wells Fargo is expected to continue its recovery, supported by strategic reforms and cost-control measures. Its large market share in retail banking provides a solid foundation for future growth.

- Citigroup (C)

- Citigroup operates globally, offering a wide range of financial services, including consumer banking, corporate banking, and investment services. It has a significant international presence.

- Citigroup’s stock price has shown moderate growth, with a dividend yield of approximately 4.3%. Recent developments include efforts to streamline operations and focus on core markets.

- Future Outlook: Citigroup is focusing on expanding its global reach and enhancing digital capabilities, positioning itself well to benefit from global economic recovery and interest rate changes.

- Goldman Sachs (GS)

- Goldman Sachs is a leading global investment bank known for its expertise in investment banking, securities, and asset management. It caters to high-net-worth individuals and institutional clients.

- GS stock has performed strongly, with a recent dividend yield of around 1.6%. Recent developments include strategic investments in technology and expansion into new markets.

- Future Outlook: Goldman Sachs is expected to continue its strong performance, driven by its leadership in investment banking and strategic investments in technology and market expansion.

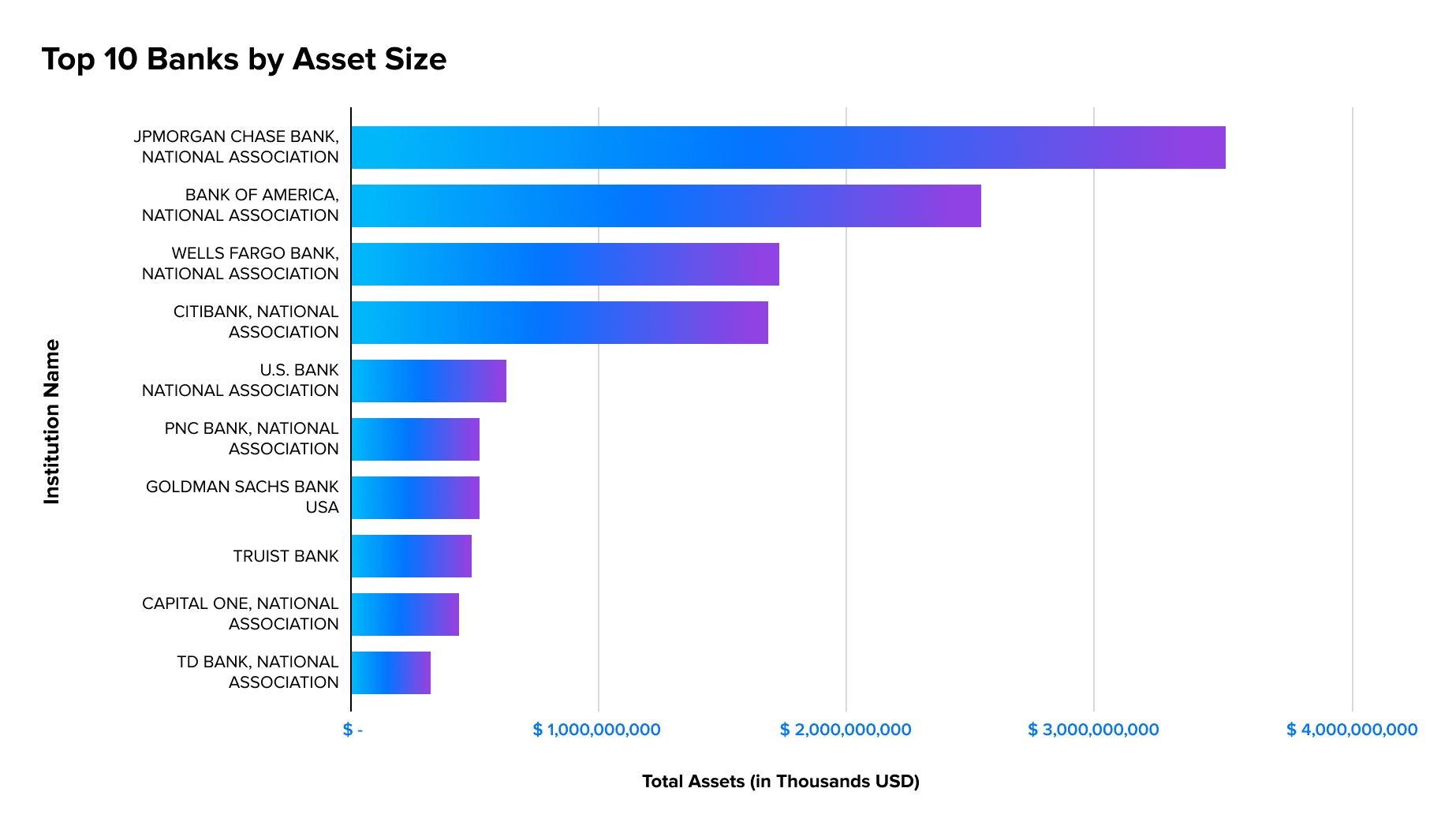

Banks play a crucial role in the financial system by providing essential services such as credit, deposits, and payment processing. They facilitate economic growth by allocating resources to businesses and consumers, managing risk, and supporting financial stability.

[Largest U.S. Banks by Asset Size (Q1 2024)]

Source: mx.com

Regional Bank Stocks

- U.S. Bancorp (USB)

- U.S. Bancorp, the parent company of U.S. Bank, is a major regional bank with a significant presence in the Midwest. It offers comprehensive banking services and is known for its strong community focus.

- USB stock has demonstrated stability with a dividend yield of about 3.1%. Recent initiatives include digital banking enhancements and regional expansion.

- PNC Financial Services (PNC)

- PNC is a leading regional bank with a robust presence in the Eastern U.S., offering retail and commercial banking services. It is known for its strong customer service and comprehensive financial solutions.

- PNC stock has shown consistent performance, with a dividend yield of around 2.8%. Recent developments include the acquisition of BBVA USA, expanding its market reach.

- Truist Financial (TFC)

- Truist, formed from the merger of BB&T and SunTrust, is a major regional bank serving the Southeastern U.S. It provides a wide range of banking and financial services.

- TFC stock has been stable with a dividend yield of approximately 3.3%. Recent developments focus on integrating operations and expanding digital services.

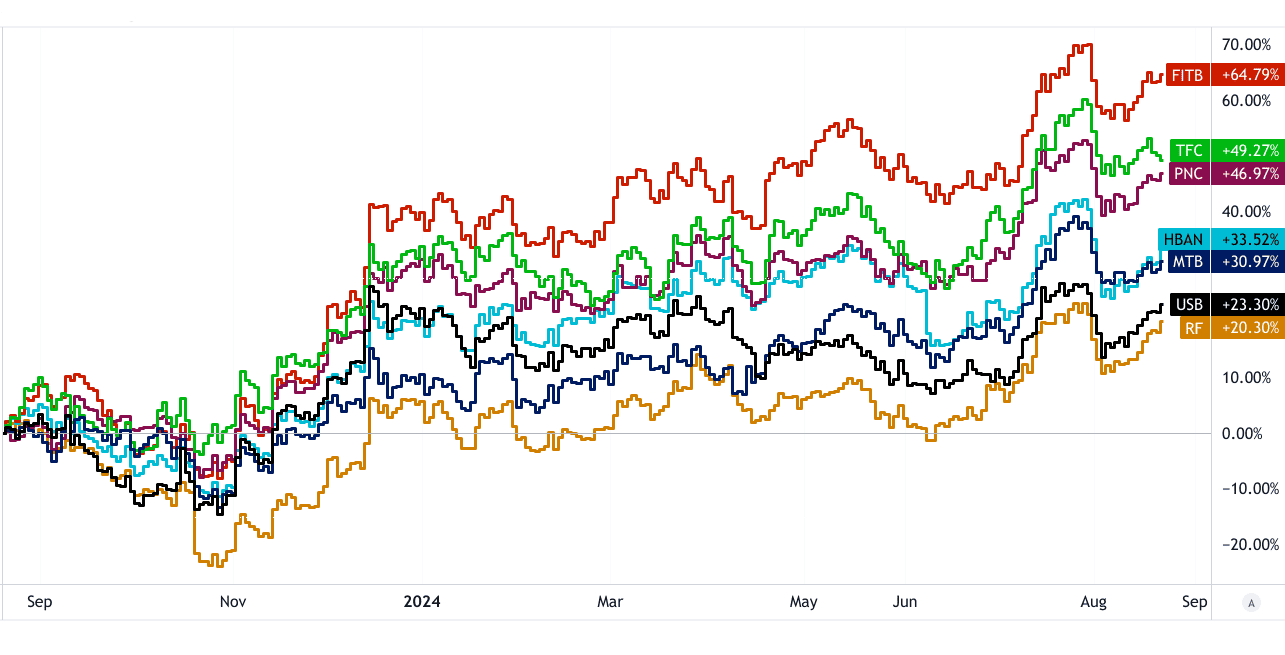

[1Y Price Return]

Source: tradingview.com

- M&T Bank (MTB)

- M&T Bank operates primarily in the Northeastern U.S., offering personal and commercial banking services. It is recognized for its strong regional presence and customer service.

- MTB stock has performed well, with a dividend yield of about 3.4%. Recent developments include expanding its footprint through acquisitions and enhancing digital banking capabilities.

- Fifth Third Bank (FITB)

- Fifth Third Bank is a regional bank with a significant presence in the Midwest and Southeast. It offers a range of banking products and services, focusing on community engagement.

- FITB stock has shown moderate growth, with a dividend yield of around 3.1%. Recent developments include investments in technology and customer service enhancements.

- Huntington Bancshares (HBAN)

- Huntington Bancshares operates in the Midwest, offering banking, investment, and insurance services. It is known for its customer-centric approach and regional strength.

- HBAN stock has performed steadily, with a dividend yield of approximately 3.5%. Recent initiatives include expanding its digital offerings and increasing market penetration.

- Regions Financial (RF)

- Regions Financial serves the Southeastern U.S., providing banking, wealth management, and insurance services. It is noted for its strong regional presence and customer service.

- RF stock has shown consistent performance, with a dividend yield of around 3.2%. Recent developments focus on expanding digital services and enhancing operational efficiency.

Differences Between Regional Banks and Larger Banks

Regional banks typically focus on specific geographic areas, offering personalized services and strong local market knowledge. In contrast, larger banks operate on a national or global scale, providing a broader range of financial services and leveraging economies of scale. Regional banks often emphasize community engagement and localized expertise, while larger banks benefit from extensive resources and global market access.

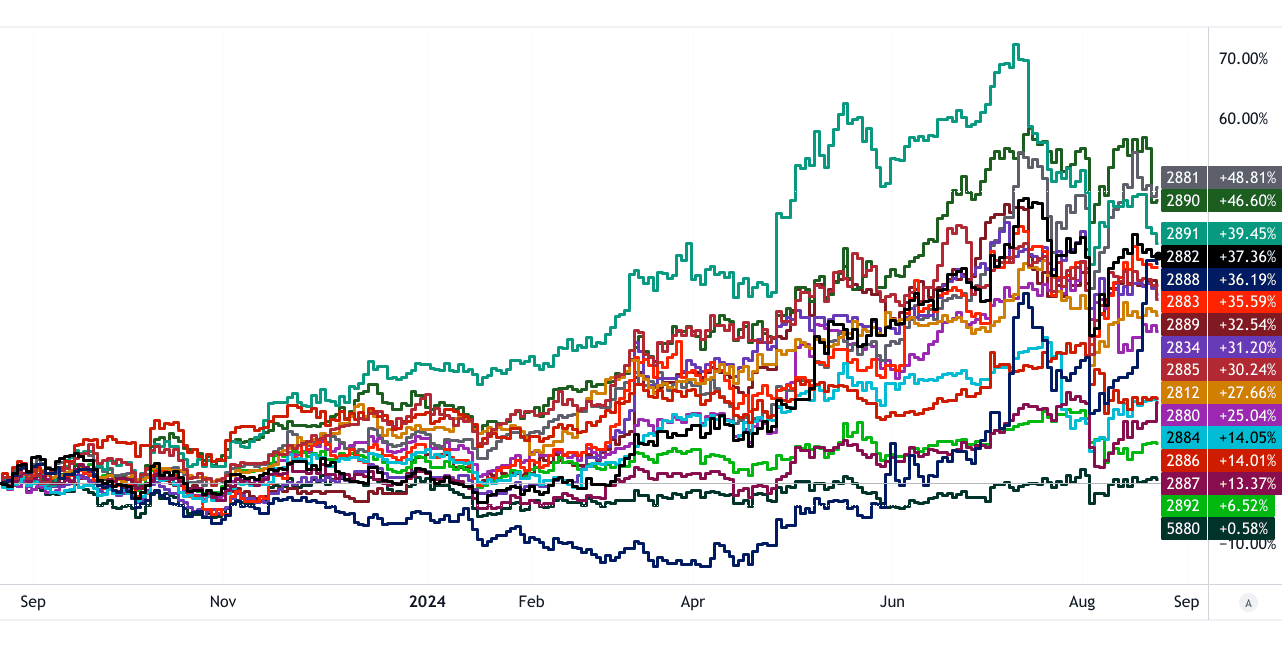

Financial Stocks & Bank Stocks (Taiwan Stocks)

- Cathay Financial Holding (2882)

- A major Taiwanese financial group offering banking, insurance, and investment services. It has a strong market presence in Taiwan and growing international operations.

- Fubon Financial Holding (2881)

- Another leading Taiwanese financial group, providing banking, insurance, and asset management services. It is known for its diversified financial services and strong market position.

- CTBC Financial Holding (2891)

- A prominent Taiwanese financial institution offering comprehensive banking and insurance services. It is noted for its solid domestic presence and expanding international reach.

- Mega Financial Holding (2886)

- Provides banking, insurance, and investment services in Taiwan. It is recognized for its significant domestic market share and increasing global presence.

- KGI Financial Holding (2883)

- Offers banking, securities, and investment services in Taiwan. It is known for its robust financial services and strong market position.

- Shin Kong Financial Holding (2888)

- Provides a range of financial services including banking and insurance, with a notable presence in Taiwan and expanding regional influence.

- Taiwan Business Bank (2834)

- Specializes in commercial banking services in Taiwan, with a focus on serving business clients and regional growth.

- E.SUN Financial Holding (2884)

- Offers comprehensive banking and financial services in Taiwan, known for its strong customer service and growing market share.

- Yuanta Financial Holding (2885)

- Provides banking, securities, and insurance services, with a solid presence in Taiwan and expanding regional operations.

[1Y Price Return]

Source: tradingview.com

- Taishin Financial Holding (2887)

- Offers banking, securities, and asset management services, recognized for its strong domestic presence and expanding international operations.

- Taichung Commercial Bank (2812)

- Provides banking services with a focus on the central Taiwan region, known for its strong local market presence.

- SinoPac Financial Holdings (2890)

- Offers banking and financial services in Taiwan, with a focus on serving individual and corporate clients.

- First Financial Holding (2892)

- Provides banking, insurance, and investment services in Taiwan, known for its solid market presence and comprehensive financial solutions.

- Hua Nan Financial Holdings (2880)

- A major financial group offering banking and insurance services, with a significant presence in Taiwan.

- IBF Financial Holdings (2889)

- Provides a range of financial services including banking and insurance, with a notable presence in Taiwan.

- Taiwan Cooperative Financial Holding (5880)

- Offers banking and financial services, known for its cooperative banking model and strong domestic market presence.

These Taiwanese financial stocks represent a diverse range of banking and financial services, with significant domestic market influence and varying degrees of international exposure.

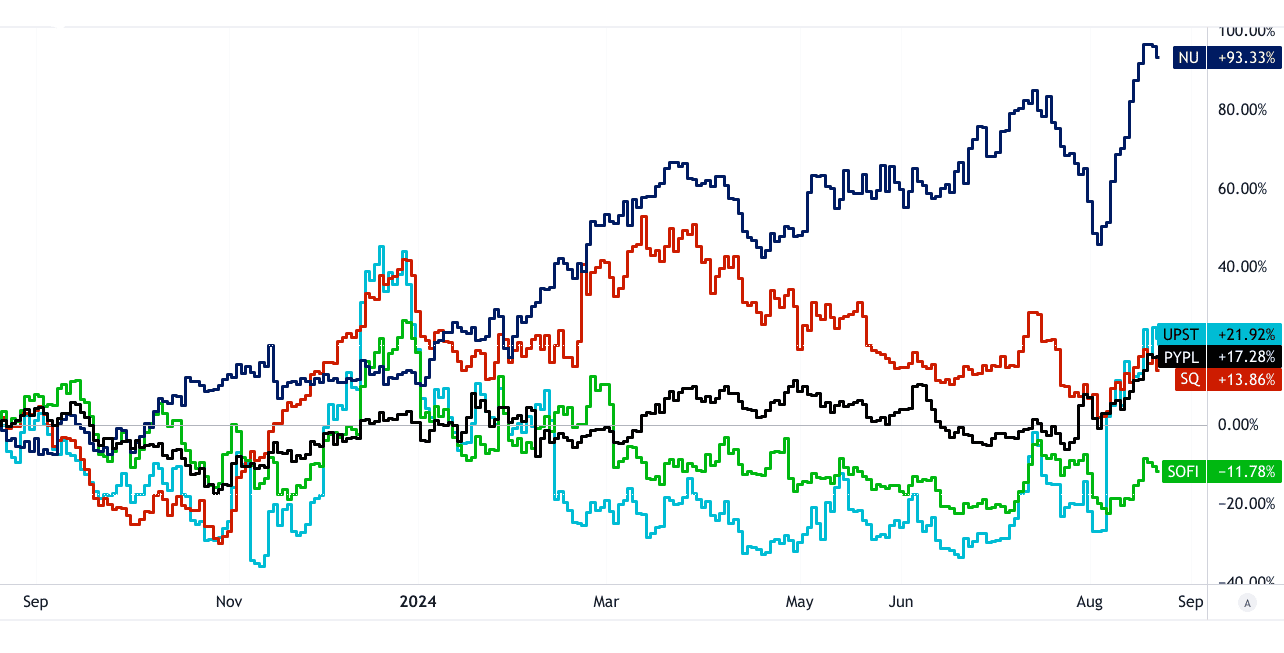

III. Fintech Stocks

Top Fintech Companies

- PayPal (PYPL)

- PayPal operates as a leading digital payments platform, facilitating online transactions, peer-to-peer payments, and mobile payments. It holds a substantial share of the online payments market, with a global presence.

- PayPal’s stock has experienced volatility, reflecting market trends and competitive pressures. Recent developments include strategic partnerships and expanding its cryptocurrency offerings.

- Future Outlook: PayPal is expected to continue expanding its market share by leveraging its strong brand and innovative solutions. Growth areas include increasing its presence in emerging markets and enhancing its digital wallet capabilities.

- Square (SQ)

- Square provides point-of-sale solutions and digital payment processing, catering primarily to small and medium-sized businesses. Its Cash App also offers peer-to-peer payments and investment services.

- Square’s stock has shown significant growth, with a focus on expanding its financial ecosystem. Recent developments involve expanding international operations and integrating new technologies like Bitcoin trading.

- Future Outlook: Square is poised for continued growth, driven by its innovative payment solutions and expanding financial services. Its focus on blockchain technology and international markets presents substantial growth opportunities.

- SoFi Technologies (SOFI)

- SoFi offers a range of financial services, including student and personal loans, investing, and insurance. It positions itself as a digital alternative to traditional financial institutions.

- SoFi’s stock has seen fluctuations due to market conditions and growth investments. Recent developments include acquiring Galileo Financial Technologies to enhance its platform.

- Future Outlook: SoFi’s future looks promising with continued focus on expanding its financial product offerings and integrating new technologies. Its growth strategy includes increasing its user base and diversifying its services.

Source: tradingview.com [1Y Price Return]

Source: tradingview.com [1Y Price Return]

- Upstart Holdings (UPST)

- Upstart uses artificial intelligence to provide personal loan origination services. It aims to disrupt traditional lending by using machine learning to assess credit risk.

- Upstart’s stock has experienced significant volatility due to its growth stage and market conditions. Recent developments include partnerships with banks to expand its loan offerings.

- Future Outlook: Upstart’s future is likely to be driven by its innovative approach to lending and expanding partnerships with financial institutions. Growth in AI and machine learning adoption will be crucial to its continued success.

- Nu Holdings (NU)

- Nu Holdings, based in Brazil, provides digital banking services, including payments, loans, and investment management. It is a leading fintech company in Latin America.

- Nu Holdings has seen strong stock performance, reflecting its rapid growth and increasing market share in Latin America. Recent developments include launching new financial products and expanding its user base.

- Future Outlook: Nu Holdings is well-positioned for continued growth in the Latin American market, leveraging its innovative digital banking solutions and expanding its product offerings.

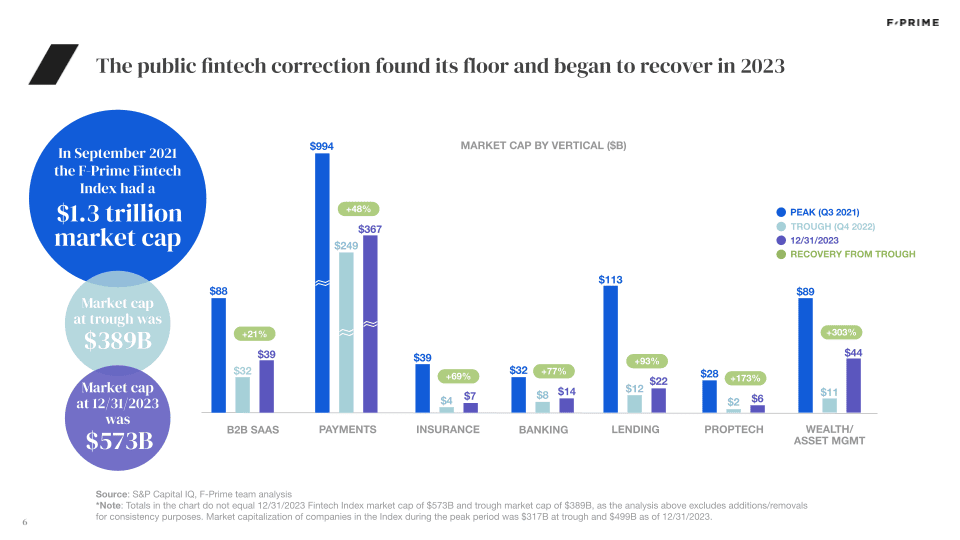

Fintech disrupts traditional finance by offering innovative, digital-first solutions that streamline financial services. It challenges traditional banking models through lower costs, enhanced user experiences, and faster transactions. Fintech companies leverage technology to provide more accessible, flexible, and personalized financial products, reducing reliance on traditional banking infrastructure.

Source: fprimecapital.com

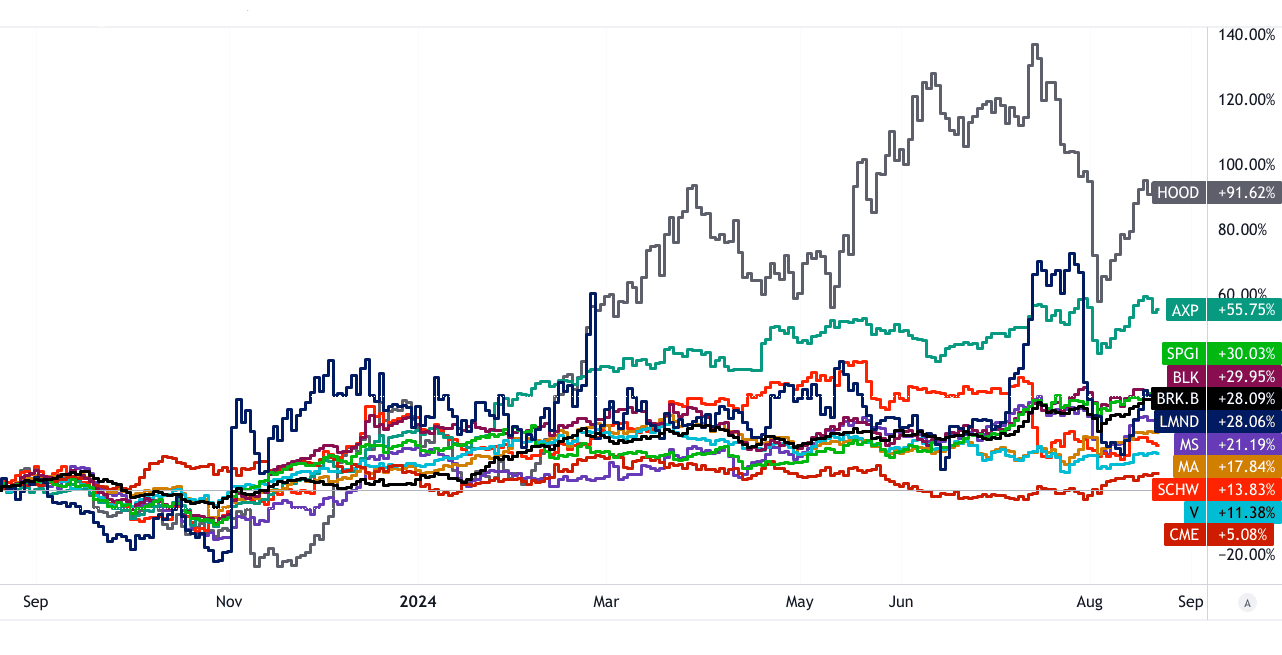

Financial Services Companies

Insurance Stocks:

-

- Berkshire Hathaway (BRK.B): A major player in the insurance industry, providing a diverse range of insurance products and investments. Known for its strong financial stability and significant market presence.

- Lemonade (LMND): A digital insurance company leveraging AI to offer property and casualty insurance. It aims to simplify the insurance process and improve customer experience.

Investment Management Firms:

-

- BlackRock (BLK): The largest asset management firm globally, offering a range of investment products including mutual funds, ETFs, and advisory services. It plays a critical role in global financial markets through its extensive investment portfolio.

- Vanguard: Known for its low-cost index funds and ETFs, Vanguard is a major player in investment management, focusing on providing cost-effective investment solutions to individual and institutional investors.

[1Y Price Return]

Source: tradingview.com

Payment Processing and Financial Services:

-

- Visa (V) and Mastercard (MA): Dominant players in the global payment processing market, providing the infrastructure for electronic payments and transactions. Their networks are integral to the financial ecosystem.

- S&P Global (SPGI): Provides financial market intelligence and analytics, essential for investment decision-making and financial market operations.

- CME Group (CME): Operates global derivatives and futures markets, playing a key role in risk management and price discovery for various asset classes.

- American Express (AXP): Known for its credit card and payment services, offering financial products and services primarily to consumers and businesses.

- Charles Schwab (SCHW): Provides brokerage services, financial planning, and investment management, serving individual investors and institutions.

- Morgan Stanley (MS): A leading global financial services firm offering investment banking, securities, wealth management, and investment management services.

- Robinhood (HOOD): A fintech platform offering commission-free trading and investment services, known for its user-friendly mobile app and democratization of finance.

These companies each play a vital role in providing essential financial services, from investment management to payment processing, impacting both individual and institutional financial activities.

IV. Factors to Consider When Investing in Bank Stocks & Fintech Stocks

Key Differences Between Bank Stocks and Fintech Stocks

- Traditional Banking vs. Innovative Financial Technology: Bank stocks represent traditional financial institutions offering a range of services, including retail banking (e.g., savings and checking accounts), commercial banking (e.g., business loans), investment banking (e.g., underwriting and advisory), and wealth management (e.g., financial planning and investment services). In contrast, fintech stocks focus on innovative financial technologies such as digital payments, online and peer-to-peer (P2P) lending, cryptocurrencies, and robo-advisory services. These innovations disrupt traditional banking by providing more accessible, efficient, and often cheaper financial solutions.

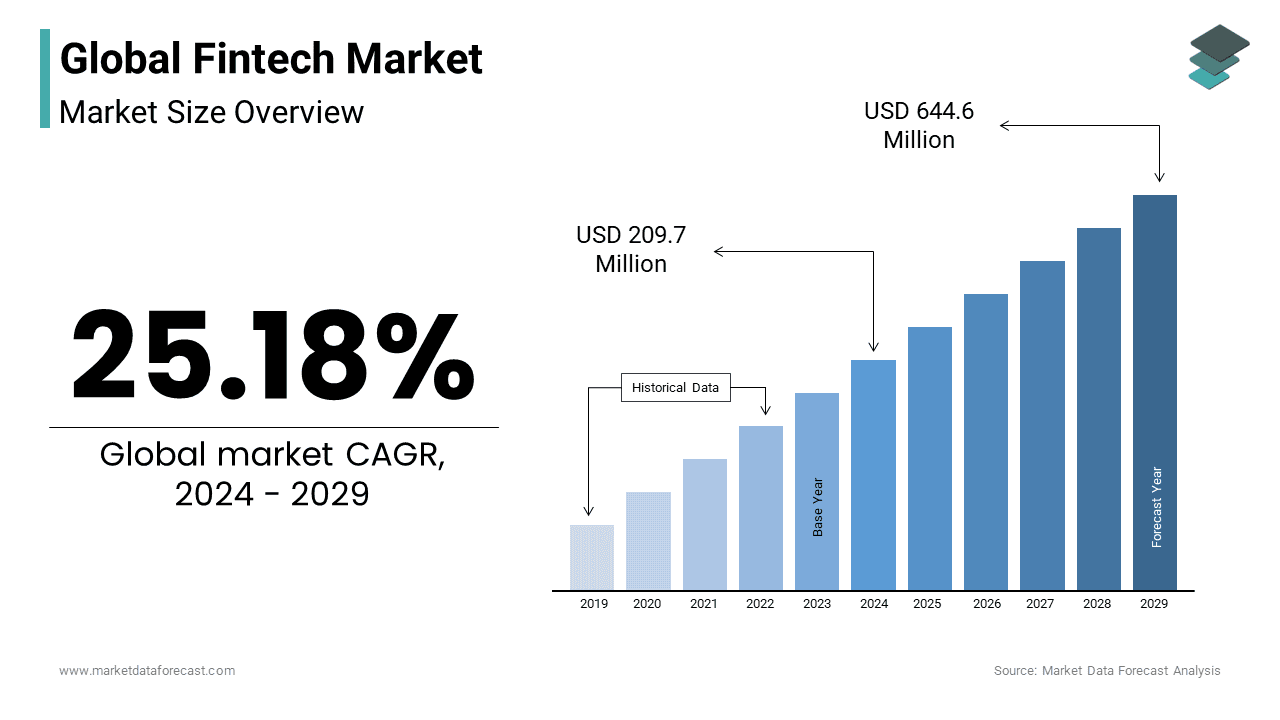

Source: marketdataforecast.com

- Revenue Models: Traditional banks primarily earn revenue through interest rate margins, fees for services, and investment returns. Their revenue is more dependent on the stability of interest rates and the health of the broader economy. Fintech companies, however, often rely on transaction fees, subscription services, and data monetization. Their revenue models are more variable and can be influenced by user growth and technology adoption.

- Stability & Risk Factors: Traditional banks tend to have stable revenue streams and are regulated to ensure financial stability. They face risks related to economic downturns, regulatory changes, and credit risk. Fintech companies, while innovative, are subject to different risks such as technological dependence, cybersecurity threats, and intense competition from both traditional financial institutions and other fintech startups. Their business models may also face regulatory scrutiny and operational risks associated with rapid technology changes.

Factors to Consider When Investing in Bank Stocks

- Economic Conditions & Indicators: The performance of bank stocks is closely tied to macroeconomic conditions. Key indicators include interest rates, inflation rates, and overall economic growth. Higher interest rates typically benefit banks by increasing net interest margins (NIM), while economic downturns can lead to higher loan defaults and reduced lending activity.

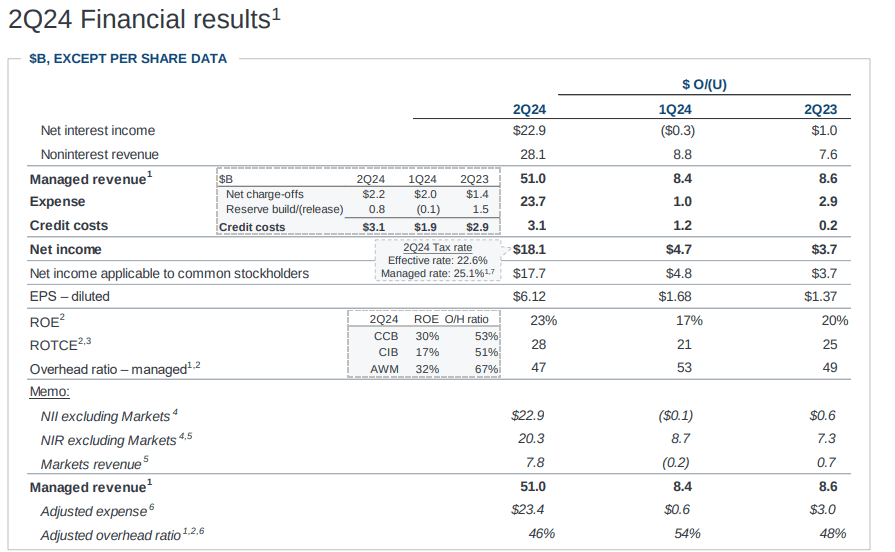

- Bank-Specific Financial Metrics:

- Return on Equity (ROE): Measures how effectively a bank uses shareholders' equity to generate profits. A higher ROE indicates efficient management and profitability.

- Return on Assets (ROA): Indicates how efficiently a bank uses its assets to generate earnings. Higher ROA suggests effective asset management.

- Loan-to-Deposit Ratio: Indicates the proportion of loans a bank has made compared to its deposits. A high ratio suggests aggressive lending but may increase risk.

- Net Interest Margin (NIM): Measures the difference between interest earned on loans and interest paid on deposits. A higher NIM indicates better profitability.

- Non-Performing Assets (NPA): Represents the proportion of loans that are not being repaid as scheduled. A lower NPA ratio indicates better asset quality and credit risk management.

Source: jpmorganchase.com

Factors to Consider When Investing in Fintech Stocks

- Revenue Growth and Profitability: Assess the revenue growth rates and profitability of fintech companies. High revenue growth indicates strong market demand, while profitability reflects the company’s ability to manage costs and scale operations effectively. Evaluate metrics such as gross margins and net income.

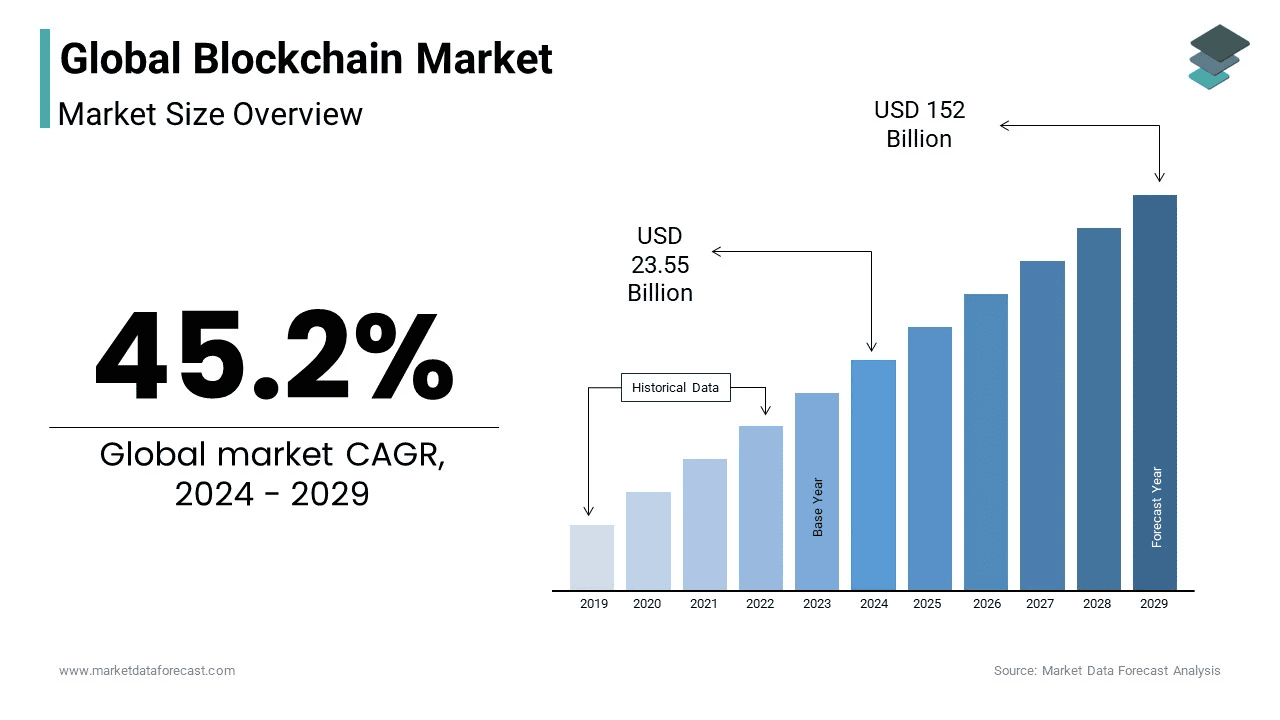

- Innovation and Technology: The success of fintech companies is heavily reliant on their ability to innovate and leverage technology. Consider the company’s investment in research and development, technological advancements, and the adoption of emerging technologies like blockchain and artificial intelligence. Innovation drives competitive advantage and long-term growth potential.

V. Financial Services Industry Trends & Financial Stocks Outlook

The global financial services industry, encompassing banking, fintech, investment management, and insurance, is a vast sector with substantial economic impact. As of 2024, the global financial services market is valued at approximately $34 trillion, with projections indicating a compound annual growth rate (CAGR) of about 7.6% over the next 4 years to hit $45 trillion by 2028. Growth is driven by technological advancements, increasing financial inclusion, and expanding economic activities in emerging markets.

Regional Market Analysis

- North America: Dominates the global financial services market with a mature and well-established sector. The U.S. remains a key player due to its advanced financial infrastructure and innovative fintech ecosystem.

- Europe: Shows strong growth, driven by regulatory advancements and digital transformation. The European Union’s focus on financial integration and technology adoption fuels market expansion.

- Asia-Pacific: Exhibits the highest growth rate, propelled by rapid economic development, increasing urbanization, and rising adoption of digital financial services in countries like China, India, and Southeast Asia.

- Latin America and Africa: Emerging markets are seeing gradual growth due to improving economic conditions and increasing financial inclusion initiatives.

Future Trends

- Digital Transformation: The financial services sector is undergoing a digital revolution. Key technologies include:

- Artificial Intelligence (AI) and Machine Learning: Enhancing customer service, risk assessment, and fraud detection. AI-driven insights help in personalized financial products and predictive analytics.

- Blockchain: Improving transparency, security, and efficiency in transactions and record-keeping. Blockchain technology is also the backbone of cryptocurrencies and smart contracts.

- Cloud Computing: Enabling scalable, flexible, and cost-effective IT infrastructure. Cloud solutions support data storage, processing, and advanced analytics.

Source: marketdataforecast.com

- Sustainability and ESG: Environmental, Social, and Governance (ESG) factors are increasingly integrated into financial decision-making. Investors and financial institutions are focusing on sustainability to address climate risks and promote socially responsible investments.

- Decentralized Finance (DeFi): Emerging as a significant trend, DeFi uses blockchain technology to recreate traditional financial systems in a decentralized manner. It provides financial services without intermediaries, potentially disrupting traditional banking and investment models.

- Embedded Finance: The integration of financial services into non-financial platforms, such as e-commerce and social media, is growing. Embedded finance offers seamless financial solutions within digital ecosystems, enhancing user experience and expanding market reach.

- Increased Focus on Data Privacy and Security Regulations: With rising cyber threats and data breaches, regulatory frameworks are tightening. Compliance with data protection laws such as GDPR and CCPA is crucial for financial institutions to safeguard customer information and maintain trust.

- Personalized Financial Services: Tailoring financial products and services to individual preferences and needs through data analytics and AI. Personalized services enhance customer satisfaction and engagement, driving growth in financial technology adoption.

Long-Term Outlook for Financial Stocks

- FED Interest Rates & Inflation: The Federal Reserve’s monetary policy significantly impacts financial stocks. Rising interest rates typically benefit banks by increasing net interest margins but may weigh on fintech stocks due to higher borrowing costs. Inflation can erode purchasing power but may lead to higher returns on certain financial assets.

Source: washingtonpost.com

- GDP Growth and Consumer Spending: Strong GDP growth and rising consumer spending drive demand for financial products and services. Economic expansion supports increased lending, investment activities, and insurance uptake, positively impacting financial stocks.

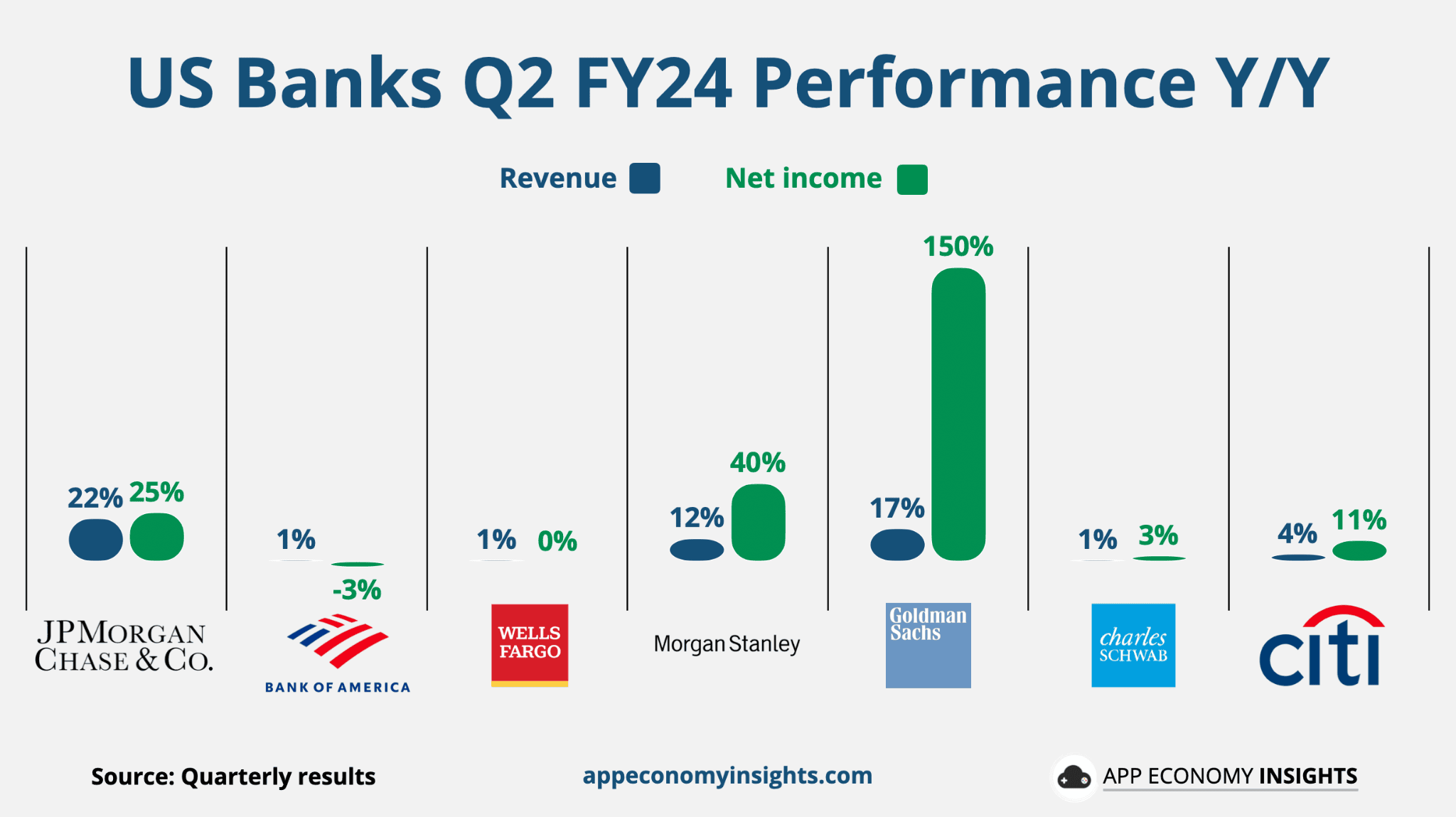

- Major Financial Institutions' Earnings Reports: The performance of large financial institutions, including earnings growth and profitability, influences the broader financial sector. Strong earnings reports signal robust sector health and can boost investor confidence in financial stocks.

Source: appeconomyinsights.com