- Airline stocks offer high return potential, particularly during strong travel demand.

- However, airline stocks are volatile due to factors like fuel prices and economic cycles.

- Airline stocks tend to have moderate liquidity, with major carriers like Delta (DAL) and American Airlines (AAL) trading heavily, while smaller airlines often experience less consistent volume in the market.

Source: architecturaldigest.com

I. What Are Airline Stocks

Airline stocks represent publicly traded shares of companies in the aviation industry, including commercial airlines that offer passenger and cargo services. These stocks are listed on various stock exchanges, providing investors with an opportunity to own a portion of an airline company and benefit from its financial performance.

Why Invest in Airline Stocks?

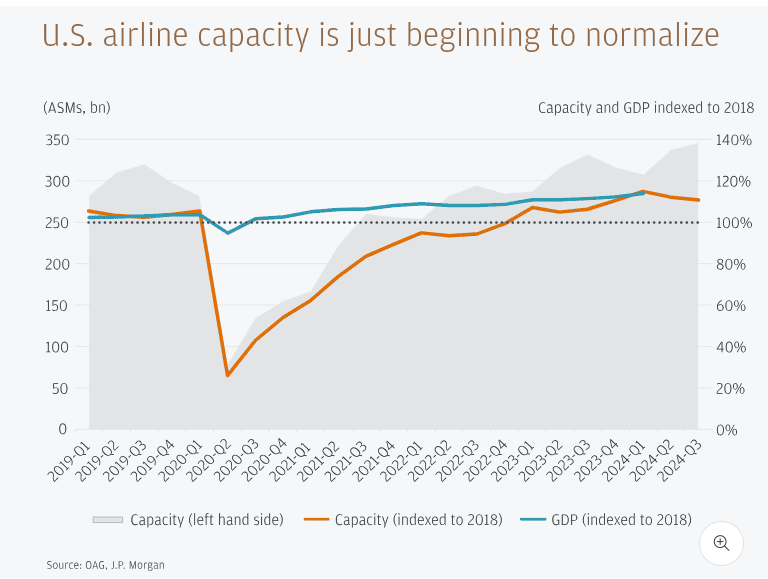

- Post-Pandemic Recovery: Following the severe impact of COVID-19, airline stocks experienced a dramatic decline as travel restrictions halted global movement. In 2023, the aviation sector witnessed a sharp recovery, with the International Air Transport Association (IATA) forecasting global air traffic to reach 92% of pre-pandemic levels by the end of 2024. US domestic airlines like Delta Air Lines (NYSE: DAL) and United Airlines (NASDAQ: UAL) saw revenue growth rates of 25%-35% year-over-year as travel demand surged post-2021.

Source: jpmorgan.com

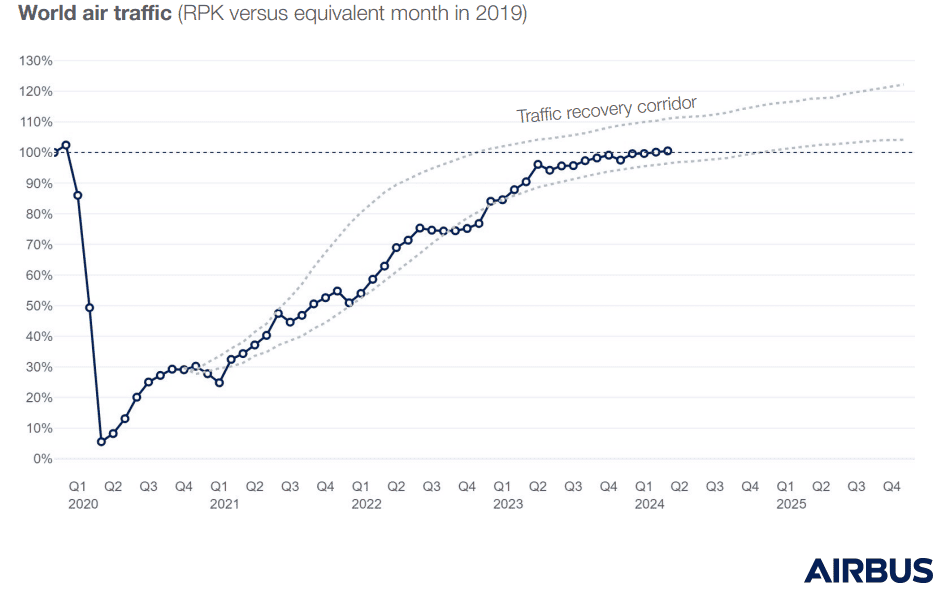

- Rising Travel Demand: The recovery of leisure and business travel has led to increased airline bookings. Global numbers of flight users may hit 1.39bn users by 2029. The uptick in world air traffic is further driven by pent-up consumer demand and increased business travel.

Source: Airbus Global Market Forecast 2024

Source: Airbus Global Market Forecast 2024

- Potential for High Returns: Despite volatility, major airline stocks have historically outperformed during recovery periods. For instance, after the 2008 financial crisis, airline stocks in the US rallied over 60% in two years.

- Exposure to Global and Domestic Markets: Investors gain access to both international and domestic market trends, making airline stocks a diversified investment option. Large US carriers like American Airlines (NASDAQ: AAL) operate globally, benefiting from both market spheres.

II. Best Airline Stocks

Airline Stocks (US Stocks)

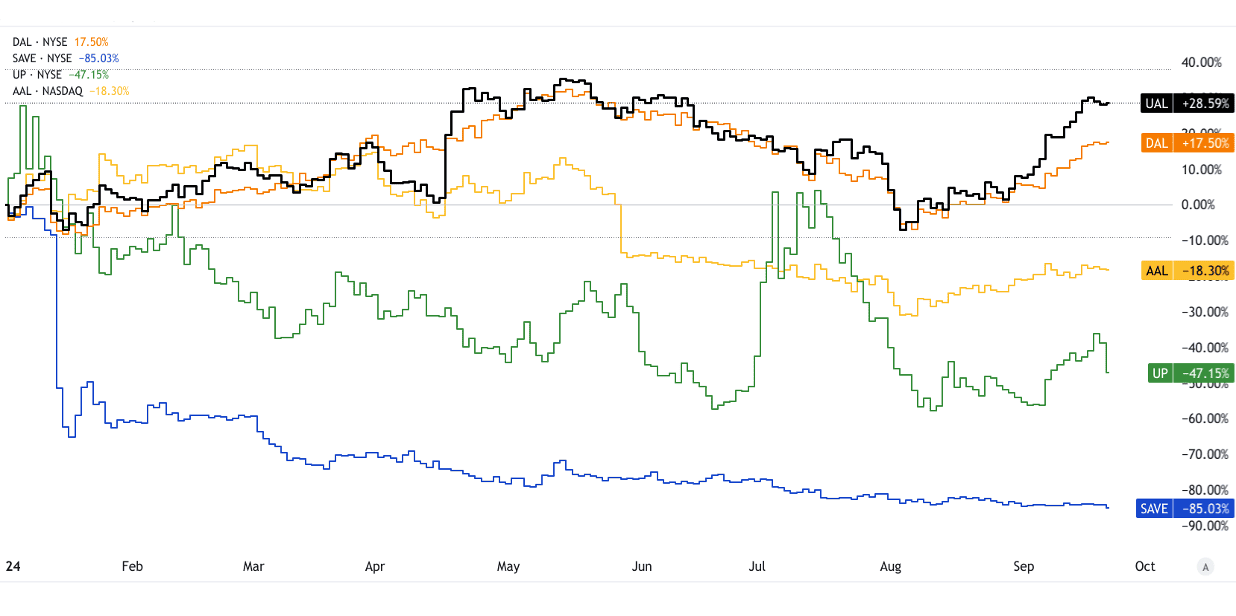

United Airlines Holdings (UAL)

United Airlines operates as a major U.S. airline offering both domestic and international flights. With one of the largest global networks, UAL commands a significant market share, competing with Delta and American Airlines.

In Q2 2024, UAL reported revenue growth of 5.7% year-over-year, driven by strong international travel recovery, especially in transatlantic routes. With the increase in international seat capacity, UAL has positioned itself well for sustained growth. Its plans to expand into Asia and Europe further boost its long-term potential.

Delta Air Lines (DAL)

Delta is the second-largest U.S. airline by market share, operating globally with a strong focus on premium customer experiences. It holds a significant presence in key U.S. hubs like Atlanta and New York.

Delta's diversified revenue streams (premium travel, cargo, and loyalty programs) contributed to a 6.9% year-over-year increase in Q2 2024 revenues. A resurgence in business travel and premium seat demand has helped Delta maintain healthy profit margins, and it forecasts full-year revenue growth. Its long-term strategy includes reducing carbon emissions, and appealing to ESG-conscious investors.

Spirit Airlines (SAVE)

Spirit is a low-cost carrier (LCC) that dominates the ultra-low-cost travel market, primarily within the U.S. and to Latin America. It benefits from the growing demand for affordable travel.

Spirit’s competitive advantage lies in its low operating costs. Its Q2 2024 revenue dropped 10.6% year-over-year, aided by the return of budget-conscious travelers post-pandemic. The ongoing merger with JetBlue could enhance market share and profitability, unlocking synergies by 2024.

Wheels Up Experience (UP)

Wheels Up operates in the private aviation sector, offering on-demand private jets.

With the rise in demand for private travel post-pandemic, Wheels Up saw substantial growth. Despite a 41.4% drop in Q2 2024 revenues, the company is innovating in subscription services, positioning itself well for long-term demand in luxury and corporate travel.

American Airlines Group (AAL)

American Airlines is the largest U.S. airline by fleet size and revenue passenger miles. It has a significant share in both domestic and international routes.

AAL posted a 2% revenue growth in Q2 2024, mainly driven by a recovery in international travel. While facing high debt levels, its aggressive cost-cutting initiatives, alongside improvements in operational efficiency, make it an appealing turnaround story.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

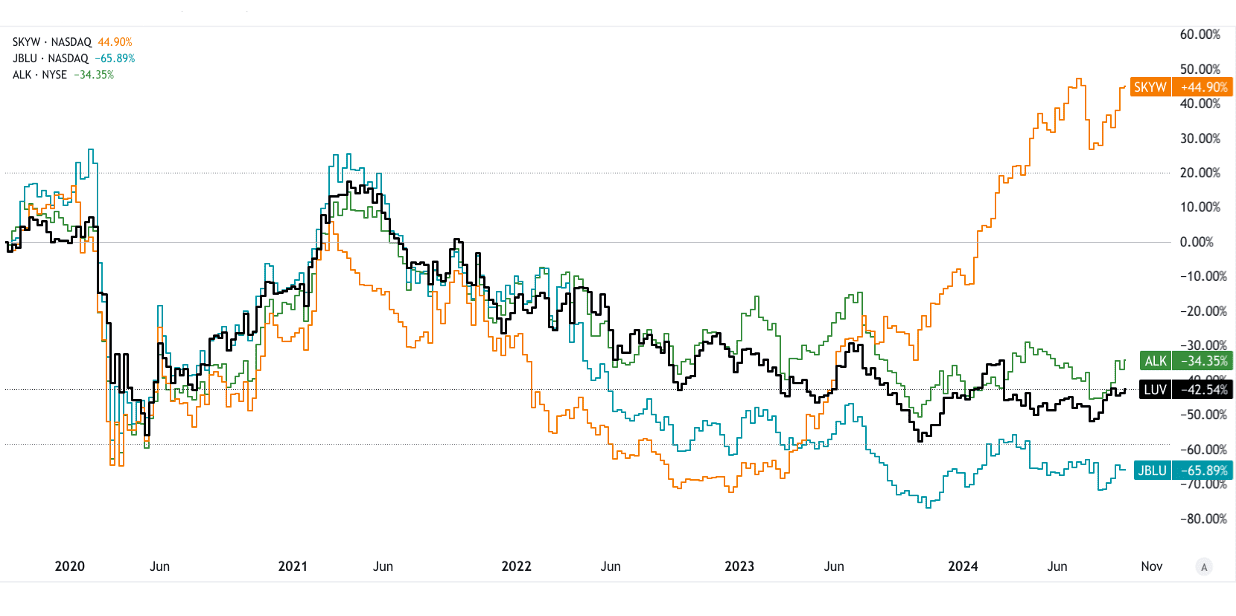

Southwest Airlines (LUV)

Southwest Airlines dominates the U.S. domestic low-cost carrier market, boasting strong brand loyalty. It operates with a unique point-to-point route model rather than the traditional hub-and-spoke system.

Southwest’s operational efficiency, low-cost structure, and exceptional balance sheet (debt/equity ratio) are core strengths. In Q2 2024, revenues grew 4.5% year-over-year, thanks to robust domestic demand. Its strong position in U.S. leisure travel suggests continued resilience.

SkyWest (SKYW)

SkyWest is a regional airline that operates under partnerships with larger carriers like Delta, United, and American.

SkyWest’s reliance on contractual partnerships provides stable revenue streams. In Q2 2024, it saw a 19.5% increase in revenue as demand for regional flights rebounded. As demand for short-haul domestic routes returns, SkyWest is poised for long-term stability.

JetBlue Airways (JBLU)

JetBlue is a hybrid low-cost carrier focused on offering both affordable flights and premium services on select routes. It is well-established in the transcontinental U.S. and Caribbean markets.

JetBlue's merger with Spirit Airlines, expected to close in 2024, positions it for significant market share expansion in the low-cost segment. JetBlue’s Q2 2024 revenues dropped 7%, benefiting from its cost-cutting efforts and rising demand for leisure travel.

Alaska Air Group (ALK)

Alaska Air operates as a premium LCC, mainly focused on the West Coast and Alaska. Its customer loyalty programs and partnerships with international carriers contribute to its strong market position.

ALK posted a 2.1% increase in Q2 2024 revenue, supported by leisure travel demand and its growing loyalty program. The company’s efficient cost management and low debt make it an appealing long-term play.

Source: tradingview.com [5Y_Price_Return]

Source: tradingview.com [5Y_Price_Return]

Hawaiian Airlines (HA)

Hawaiian Airlines is the dominant carrier for routes to and from Hawaii, with a focus on both U.S. mainland and Asia-Pacific markets.

While HA saw challenges due to reduced travel from Asia, its revenues rises as domestic travel rebounded. An expected revival in international tourism and lower fuel costs could bolster its future growth trajectory.

Airline Stocks (Taiwan Stocks)

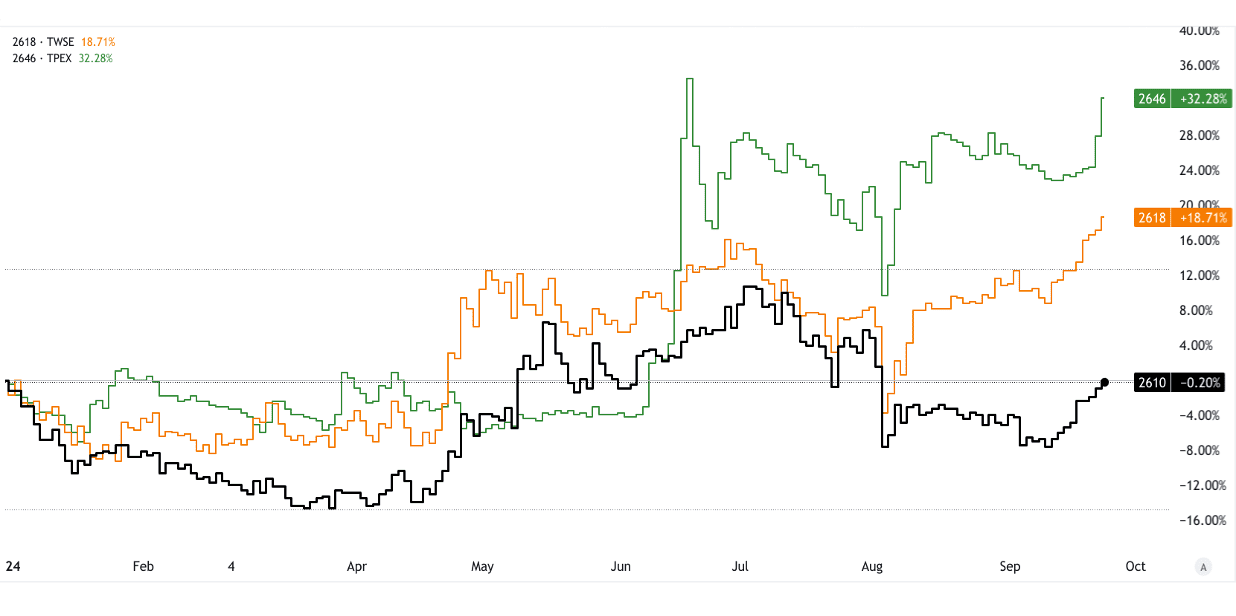

China Airlines (2610)

China Airlines is one of Taiwan’s largest carriers, serving global routes with a focus on Asia and the U.S.

In 2023, China Airlines reported a 25% year-over-year revenue increase, fueled by a recovery in cargo and passenger services. Its fleet expansion plans and growing demand for cross-Pacific routes offer long-term potential.

EVA Airways (2618)

EVA Airways is a premium Taiwanese carrier with a strong presence in the transpacific and Asia-Pacific markets.

EVA has been focused on expanding its premium services and cargo operations. In 2023, EVA’s revenue grew by 41% year-over-year, and it is expected to benefit from the growing demand for premium long-haul flights.

STARLUX Airlines (2646)

STARLUX is a newer Taiwanese airline focused on providing luxury services on long-haul flights, especially between Taiwan and North America.

As a growing luxury carrier, STARLUX's potential lies in the premium travel segment. In 2023, STARLUX posted a 35% revenue growth, driven by rapid expansion in its fleet and route network. Its unique positioning as a premium airline offers strong growth potential.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

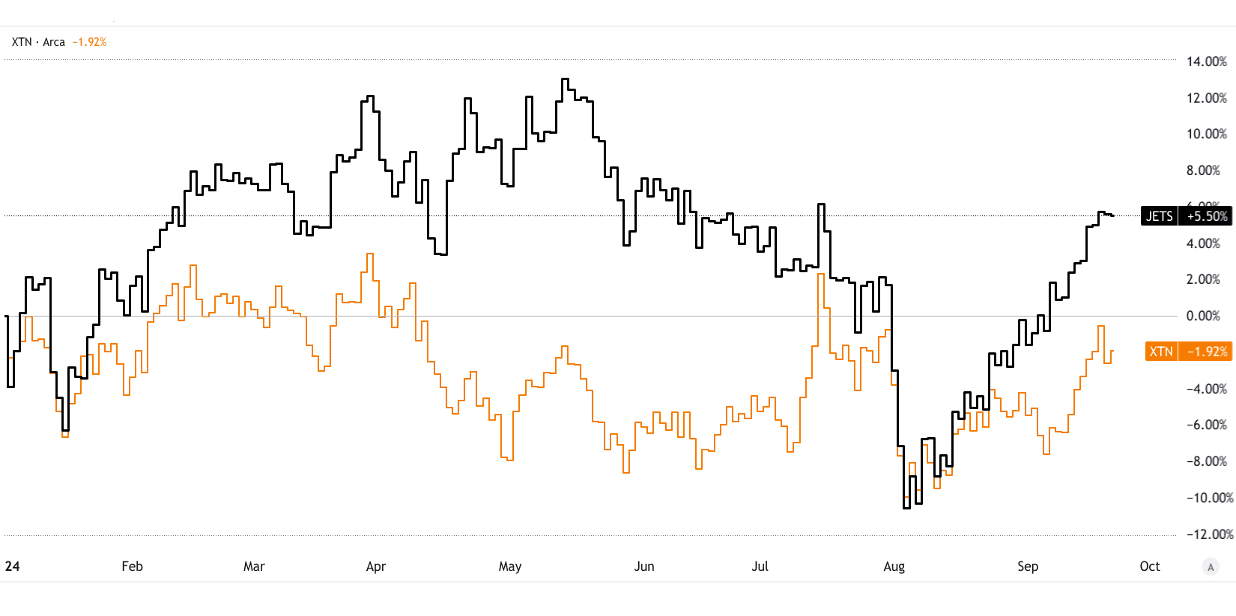

Airline Stock ETFs

U.S. Global Jets ETF (JETS)

Holdings & Exposure: JETS tracks the U.S. Global Jets Index, holding major U.S. airlines like UAL, DAL, LUV, and AAL, alongside international players.

Expense Ratio: 0.60%.

Price Return & Yield: Over the past year, JETS returned 15%, fueled by the recovery in global travel demand.

JETS offers broad exposure to the airline industry, capturing both legacy carriers and low-cost operators. With travel rebounding and a diversified portfolio, JETS is an efficient way to gain exposure to airline recovery without the risk of individual stock selection.

SPDR S&P Transportation ETF (XTN)

Holdings & Exposure: XTN offers exposure to the broader transportation sector, including airlines, railroads, and trucking companies.

Expense Ratio: 0.35%.

Price Return & Yield: XTN has posted an 8.3% return over the past year, with a 0.9% dividend yield.

XTN provides diversification across the transportation sector, offering stability during downturns in specific industries. Its exposure to multiple transportation modes hedges risks while offering upside potential as airline stocks recover.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

III. Factors to Consider When Investing in Airline Stocks

- Economic Cycles and Consumer Confidence: Airlines are highly cyclical, thriving during economic expansions and suffering in recessions. A rise in consumer confidence directly impacts air travel demand. For example, U.S. air travel surged in 2023, with passenger traffic up 11% YoY by mid-2024, nearing pre-pandemic levels. However, geopolitical tensions and inflation can dampen demand in the long term.

- Oil Prices and Fuel Costs: Fuel represents around 30%-40% of an airline's operating costs. In 2023, oil price volatility impacted profit margins for airlines globally. Airlines with fuel hedging strategies, like Southwest (LUV), are better positioned to manage price fluctuations.

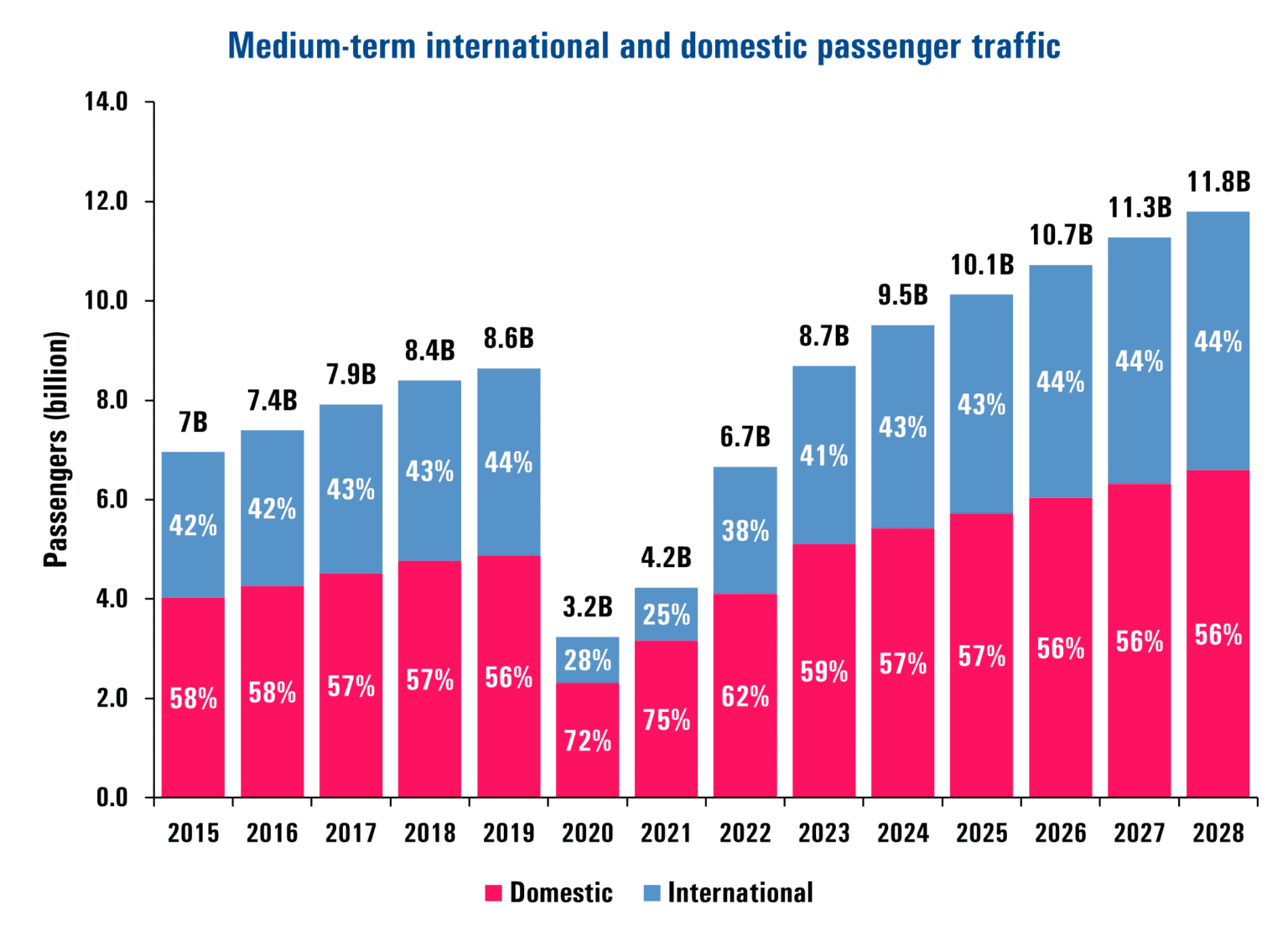

- Supply and Demand for Air Travel: ACI World forecasts a 10% YoY growth in global passenger traffic, reaching 9.5 billion in 2024. However, travel demand varies regionally, with Asia-Pacific expected to grow 13%, while European markets face a slower recovery due to geopolitical challenges.

Source: aci.aero

- Company Financial Health & Operational Efficiency: Strong financial health, evidenced by low debt levels and high operational efficiency, is critical. Delta (DAL) maintains high-profit margins due to its loyalty programs and premium offerings. Operational improvements like digital innovations (e.g., mobile check-ins) help airlines optimize costs and enhance customer experience.

- Airline Mergers and Consolidation: Consolidation, like the planned JetBlue-Spirit merger, can reshape the competitive landscape by enhancing market share and operational synergies, leading to improved profitability.

- Government Regulations & Geopolitical Risks: Airlines are vulnerable to regulations, labor strikes, and events like pandemics. For instance, the Ukraine conflict has reduced flights between Europe and Asia, disrupting international routes.

[How airspace closures triggered by the Russia-Ukraine war are impacting European aviation]

Source: eurocontrol.int

IV. Airline Industry Trends and Airline Stocks Outlook

The airline industry is poised for substantial growth, with global air travel demand recovering rapidly post-pandemic. The market size is projected to reach $0.62 trillion in 2024, with a 4.43% CAGR leading to $0.77 trillion by 2029. Airlines are benefiting from the resurgence in leisure travel, driven by increased vaccination rates and lifted travel restrictions, particularly in the U.S., where revenue is forecast to hit $143 billion in 2024.

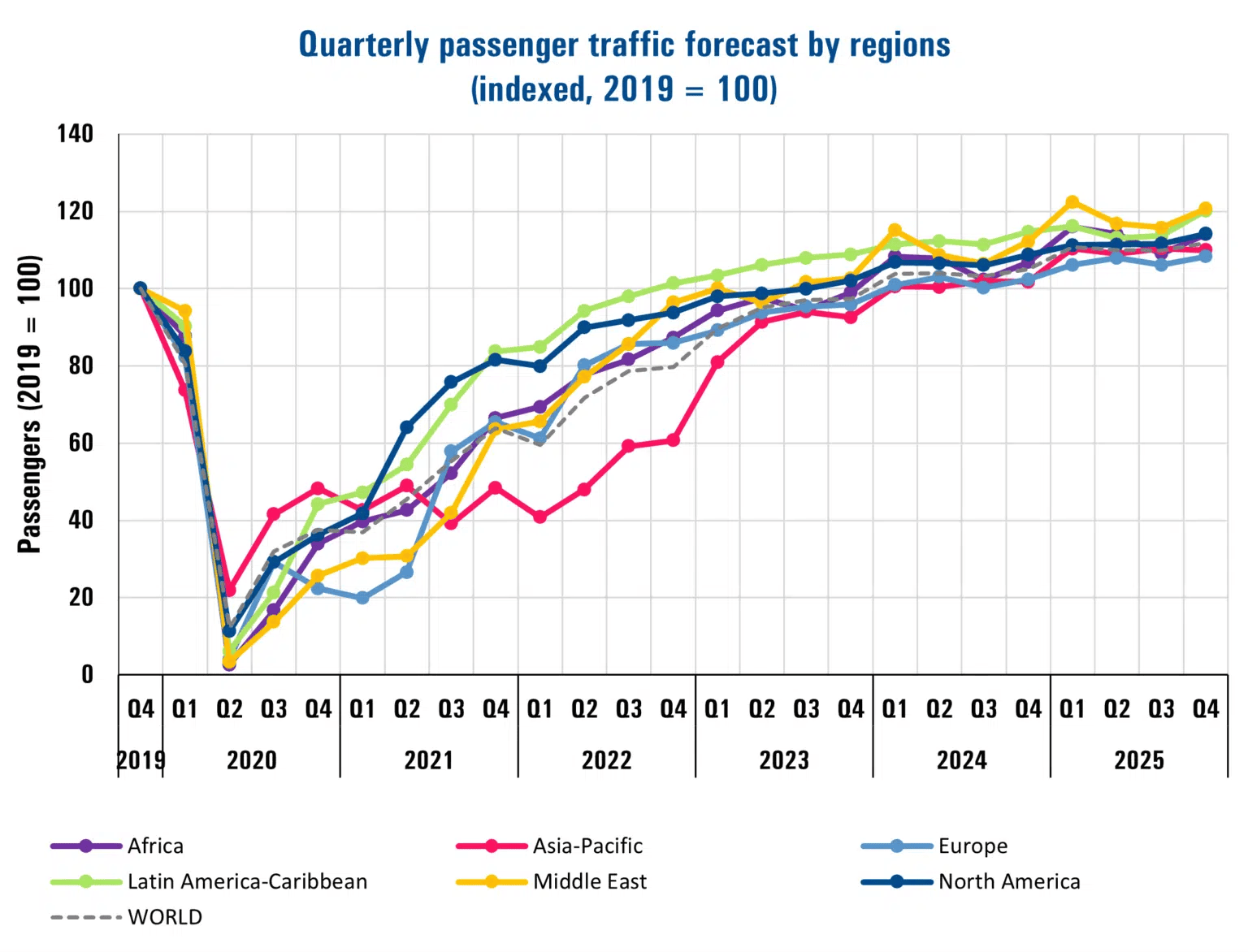

Regionally, Asia-Pacific is expected to lead air travel growth, with 13% YoY growth in passenger numbers in 2024, while North America and Europe are expected to recover to 107% and 102% of their 2019 traffic levels, respectively. However, recovery in business travel remains slow, dampening airlines’ revenue streams from premium services, which previously accounted for a significant portion of profitability.

Source: aci.aero

Future trends include sustainable aviation, with airlines focusing on fuel-efficient aircraft and alternative fuels to meet carbon reduction goals. Digital transformation is accelerating, with airlines implementing AI-powered customer service and dynamic pricing algorithms to optimize operations and enhance customer experience. Efficiency gains will come from automated check-ins and real-time data analytics to streamline logistics and reduce delays.

Challenges persist, notably fuel price volatility, with jet fuel prices spiking over 50% in 2022, significantly affecting profitability. Additionally, labor shortages and increased labor costs due to union negotiations add pressure. Overall, the long-term outlook is positive, with growing demand for domestic and international travel, although airlines must navigate operational challenges and external risks to capitalize on this recovery.