- Biotech stocks are characterized by their potential for high returns due to groundbreaking innovations, which can lead to significant profits if a product successfully reaches the market.

- However, biotech stocks are also marked by extreme volatility, as stock prices can fluctuate dramatically based on clinical trial results or regulatory decisions.

- Additionally, biotech stocks are heavily influenced by the lengthy and uncertain approval processes, making them riskier compared to other sectors.

Source: baltana.com

I. What Are Biotech Stocks?

Biotech stocks represent shares of companies that focus on the research, development, and commercialization of products based on biological processes. These companies are typically involved in the production of drugs, therapies, and diagnostic tools that rely on the manipulation of living organisms or their derivatives. The biotech industry encompasses various subsectors, including healthcare stocks, pharmaceutical stocks, and regenerative medicine stocks.

- Healthcare stocks are companies that provide medical services, manufacture medical equipment, or develop pharmaceuticals. Biotech companies within this category often focus on creating innovative treatments for complex diseases, utilizing cutting-edge biological research.

- Pharmaceutical stocks specifically refer to companies that develop and produce drugs. Biotech pharmaceutical companies leverage biological processes, such as gene editing or monoclonal antibodies, to create therapies that traditional chemical-based pharmaceuticals cannot achieve.

- Regenerative medicine stocks involve companies that specialize in repairing or replacing damaged tissues and organs. These companies often focus on stem cell therapy, tissue engineering, and gene therapy, aiming to provide long-term solutions to previously incurable conditions.

Why Invest in Biotech Stocks?

Investing in biotech stocks offers unique opportunities due to the innovative potential of the industry and the technological integration that drives its growth. The following key factors highlight the attractiveness of biotech stocks:

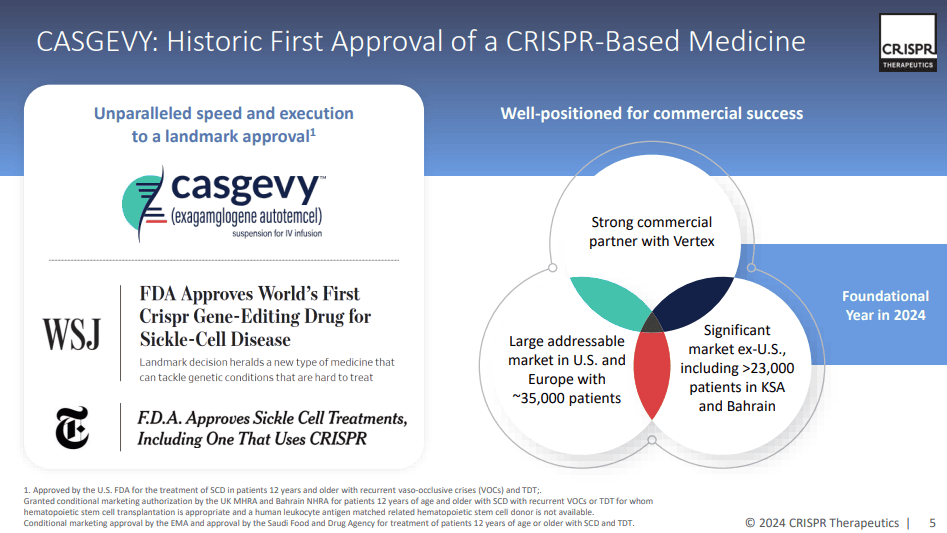

Innovative Potential & Technological Integration

Biotech companies are at the forefront of innovation, continuously exploring new frontiers in medicine and technology. Their ability to develop groundbreaking treatments for diseases like cancer, Alzheimer's, and rare genetic disorders makes them highly appealing to investors seeking significant returns. The integration of advanced technologies such as CRISPR gene editing, AI, and bioinformatics has revolutionized the industry, allowing for more precise and effective therapies. This technological convergence enhances the value proposition of biotech stocks, as these innovations have the potential to disrupt traditional healthcare and pharmaceutical markets.

Source: ir.crisprtx.com

For example, companies like Moderna and BioNTech have demonstrated the transformative power of biotech innovation through their rapid development of mRNA-based vaccines during the COVID-19 pandemic. This success not only underscores the potential for substantial financial gains but also highlights the critical role biotech plays in addressing global health challenges.

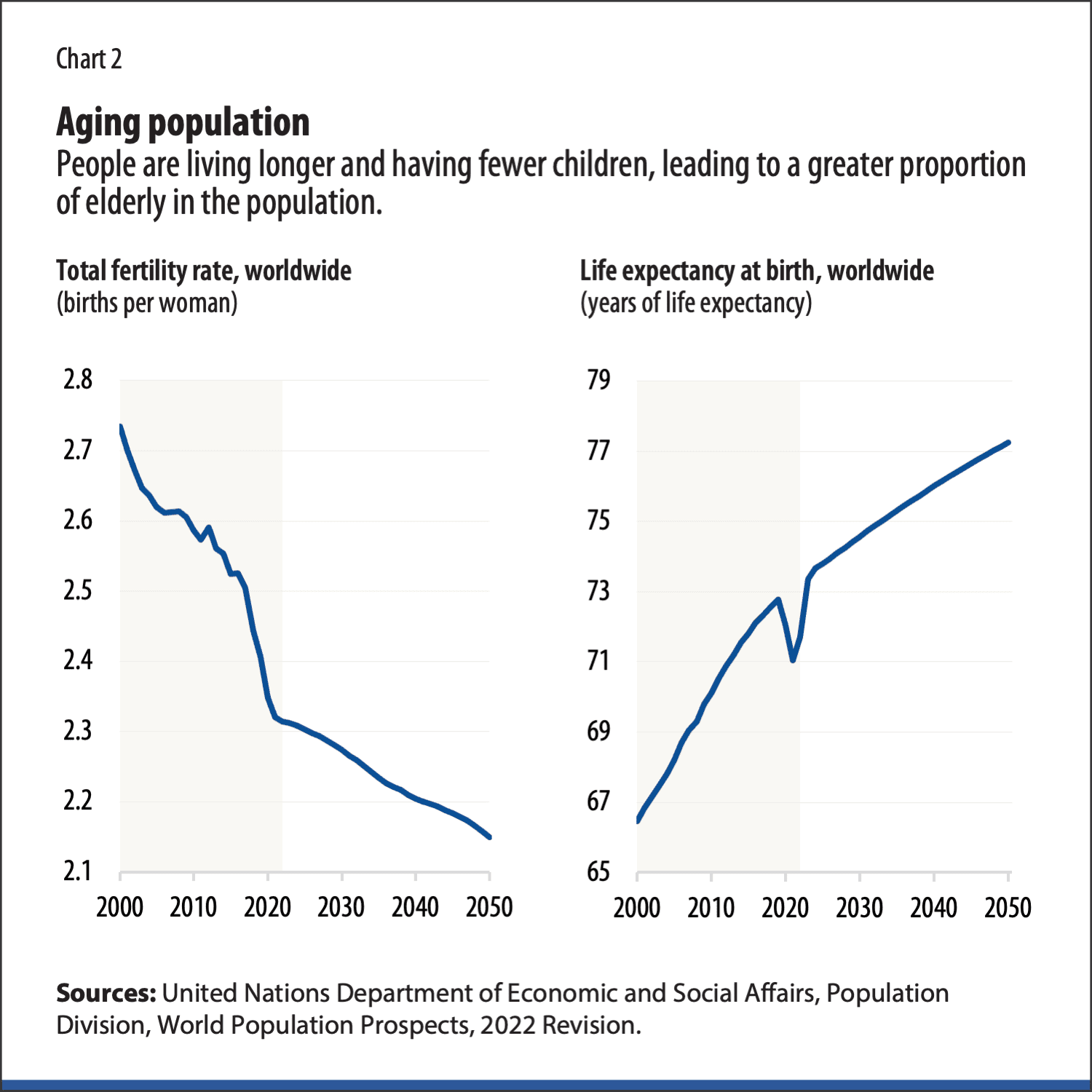

Market Growth: Aging Population and Rising Healthcare Expenditure

The biotech sector is poised for continued growth, driven by demographic trends and increasing healthcare expenditures. The aging global population is a significant factor contributing to the rising demand for innovative medical treatments. As the population ages, the prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions increases, necessitating the development of new and more effective therapies. Biotech companies are well-positioned to address these challenges by leveraging their expertise in biological research and drug development.

Source: imf.org

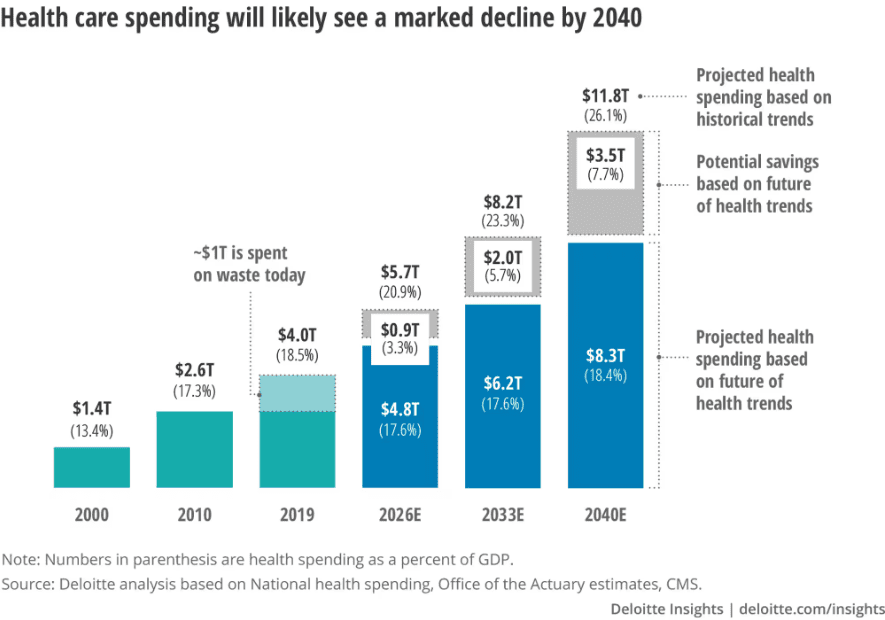

Additionally, rising healthcare expenditure globally supports the growth of the biotech industry. Governments and private sectors are investing heavily in healthcare to improve access to advanced medical treatments and enhance the quality of life. This trend is particularly evident in regions like North America, Europe, and Asia, where healthcare spending is expected to rise significantly over the next decade. As a result, biotech companies are likely to benefit from increased funding for research and development, as well as greater market opportunities for their products.

Source: deloitte.com

Moreover, the industry's focus on personalized medicine—tailoring treatments to individual patients based on their genetic makeup—further strengthens its growth prospects. Personalized medicine not only improves treatment efficacy but also reduces the risk of adverse side effects, making it an attractive area for investment.

II. Best Biotech Stocks

Biotech Stocks (US Stocks)

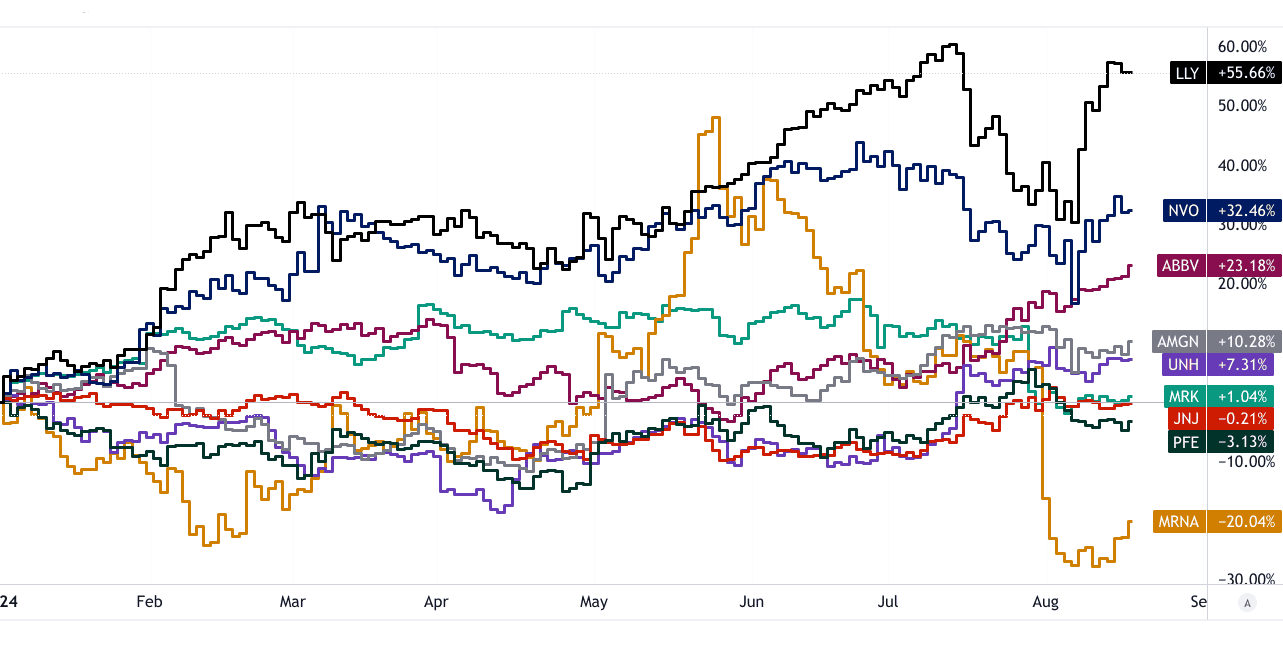

Eli Lilly (LLY):

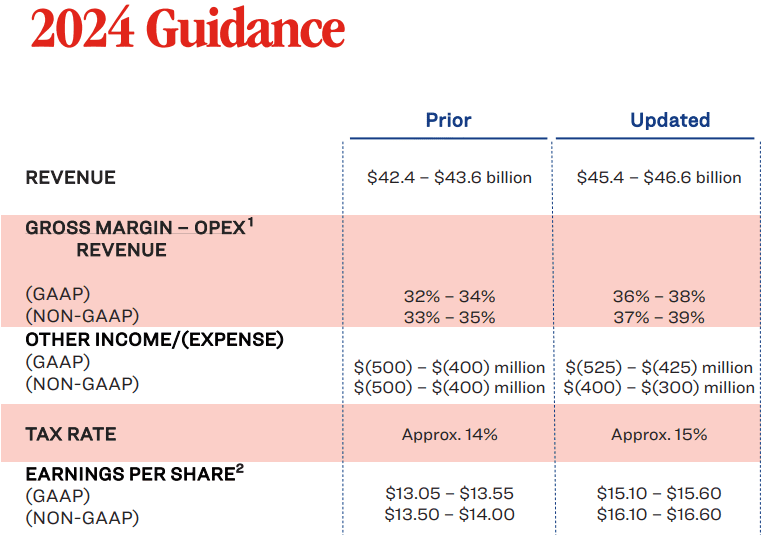

Eli Lilly is renowned for its strong pipeline in diabetes care, particularly its blockbuster drug Trulicity and obesity drug, Mounjaro. Lilly holds a dominant market position in diabetes and is expanding into obesity, with Mounjaro expected to be a major revenue driver. Recent stock performance reflects optimism around its new drug pipeline, with a 25% increase in 2023. Future outlook is robust, driven by continuous innovation in metabolic diseases.

Source: investor.lilly.com

Pfizer (PFE):

Pfizer, best known for its COVID-19 vaccine Comirnaty, remains a powerhouse in pharmaceuticals, with a diverse portfolio including oncology, immunology, and rare diseases. While its COVID-19 revenues are stabilizing, its stock price has been under pressure, down 15% in 2023. However, Pfizer's future outlook remains positive, supported by a strong pipeline of vaccines and oncology drugs.

Johnson & Johnson (JNJ):

Johnson & Johnson, with a market-leading position in pharmaceuticals, medical devices, and consumer health products, maintains a diversified portfolio. Key products include cancer drugs like Darzalex and medical devices for orthopedics. Despite legal challenges affecting its stock, JNJ's future outlook remains stable, with a focus on innovation in immunology and oncology.

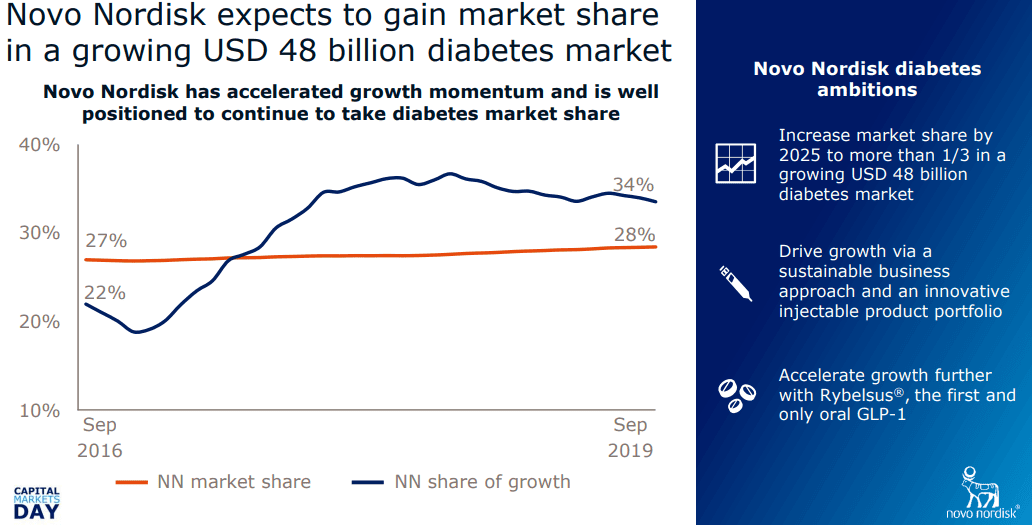

Novo Nordisk (NVO):

Novo Nordisk is a global leader in diabetes care and obesity treatments. Its key product, Ozempic, has revolutionized diabetes management and is driving strong market share gains. The stock has surged by over 30% in 2023, reflecting investor confidence in its future growth, particularly in obesity treatments.

Source: novonordisk.com

Amgen (AMGN):

Amgen specializes in oncology and cardiovascular treatments, with flagship drugs like Repatha and Otezla. The company has a strong market position in biologics and biosimilars. Despite flat stock performance in 2023, Amgen’s future outlook is promising, with a solid pipeline in oncology and new drug launches expected to drive growth.

UnitedHealth Group (UNH):

UnitedHealth, though primarily a healthcare provider, is heavily invested in biotech through its Optum segment, which focuses on healthcare services and technology. The stock has been a steady performer, up 10% in 2023. UnitedHealth’s integration of AI and data analytics in healthcare gives it a competitive edge, with a positive future outlook in managed care and biotech-driven healthcare solutions.

AbbVie (ABBV):

AbbVie is a leader in immunology and oncology, with blockbuster drugs like Humira and Imbruvica. Despite challenges from biosimilar competition, AbbVie’s stock has shown resilience, with a 5% gain in 2023. The future outlook is strong, bolstered by its pipeline in immunology and recent acquisition of Allergan.

Moderna (MRNA):

Moderna, a pioneer in mRNA technology, gained global recognition with its COVID-19 vaccine. While the stock has been volatile, with a 15% decline in 2023, Moderna’s pipeline in mRNA vaccines and therapeutics offers significant long-term potential. The company’s future outlook depends on its ability to diversify beyond COVID-19.

Merck (MRK):

Merck is a major player in oncology and vaccines, with its cancer drug Keytruda leading the market. Merck’s stock has performed well, up 10% in 2023, driven by strong sales of Keytruda and vaccines. The future outlook is positive, with ongoing expansion in oncology and vaccine development.

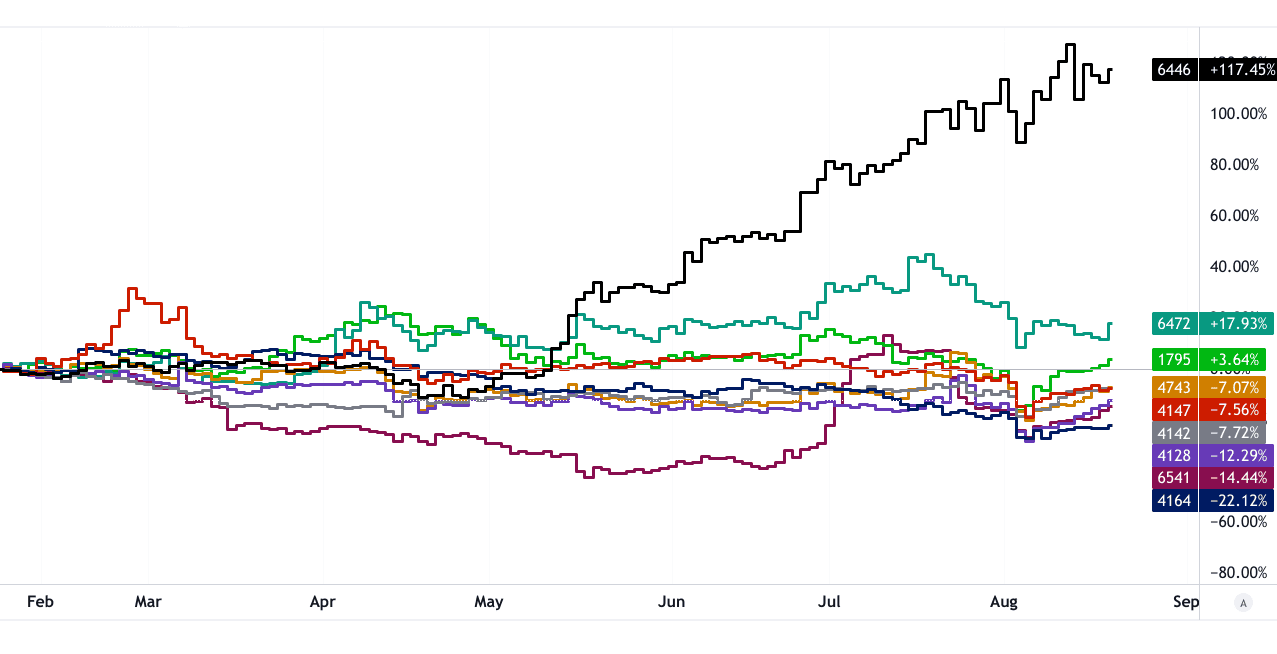

[YTD Price Return 2024]

Source: tradingview.com

Other Notables:

- Regeneron (REGN): Known for its eye drug Eylea, expanding into immunology.

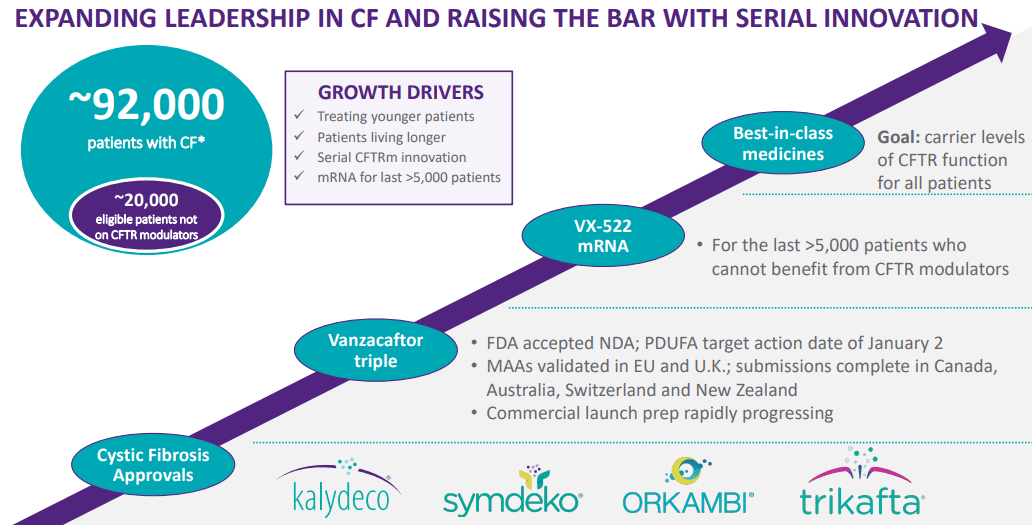

- Vertex (VRTX): Dominant in cystic fibrosis treatment, expanding pipeline.

- Gilead (GILD): Leader in HIV treatment, expanding into oncology.

- Novavax (NVAX): Focus on vaccine development, volatile stock performance.

- Biogen (BIIB): Known for its Alzheimer’s drug, facing competition.

- Pacific Biosciences (PACB): Leading in DNA sequencing, growing in genomics.

Source: investors.vrtx.com

Biotech Stocks to Buy (Taiwan Stocks)

Regenerative Medicine Stocks

- Bionet Corp (1784): Focused on stem cell therapies, strong market presence in Taiwan.

- UnicoCell BIOMED (6794): Specializes in cell-based therapies, growing pipeline.

- Ever Supreme (6712): Developing regenerative products for tissue repair.

- Intech Biopharm (6461): Known for respiratory treatments, expanding into regenerative medicine.

Regenerative Medicine focuses on repairing, replacing, or regenerating damaged tissues and organs. Taiwan's “Regenerative Medicine Dual Acts” legislation supports the industry’s growth by streamlining regulations and encouraging innovation in cell therapy and tissue engineering.

Healthcare Stocks Using AI

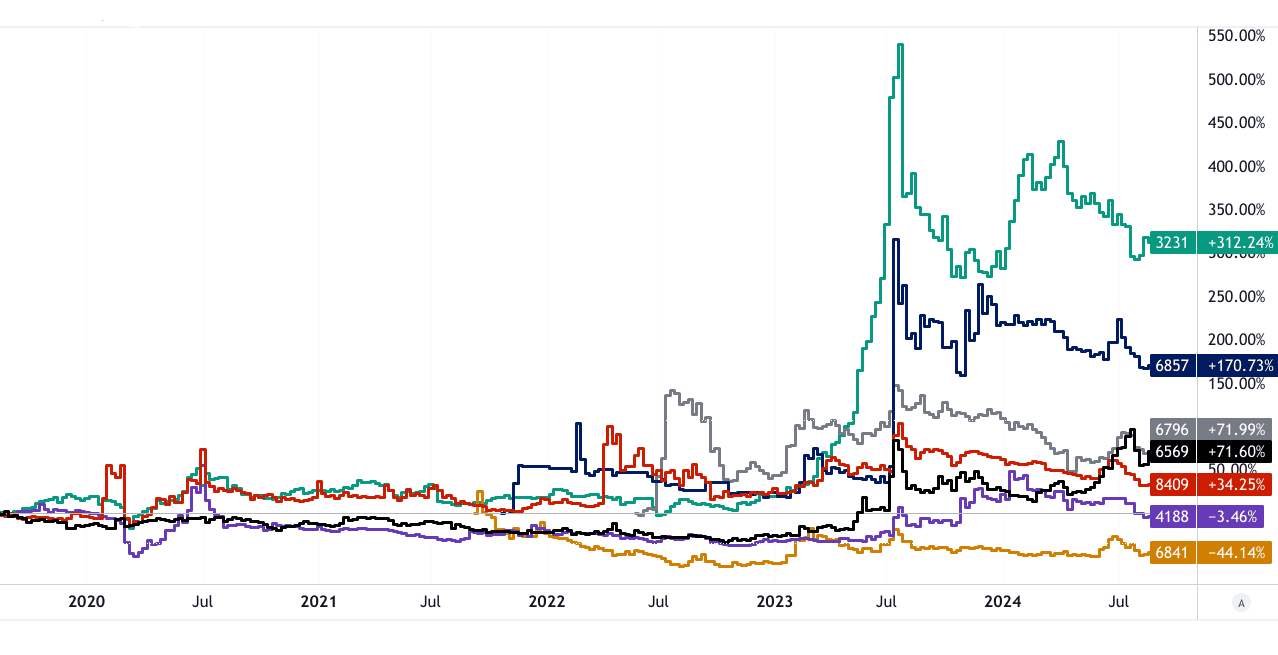

- Onyx Healthcare (6569): AI-powered medical devices, strong market position in Asia.

- EverFortune AI (6841): Specializes in AI-driven diagnostics, growing presence in Taiwan.

- Acer Medical (6857): Focuses on AI in medical imaging, leading market share.

- Wistron Corporation (3231): Broad AI healthcare applications, significant R&D investment.

- Medimaging Integrated Solution (6796): AI-based imaging solutions, expanding globally.

- AmCad (4188): Known for AI in cancer detection, strong R&D pipeline.

- EBM Technologies (8409): AI-driven healthcare software, leading position in Taiwan.

Source: tradingview.com [5Y Price Return 2024]

Source: tradingview.com [5Y Price Return 2024]

Applications of AI in Healthcare

AI in healthcare enhances diagnostics, personalizes treatment plans, and improves patient outcomes. Medical imaging and diagnostics leverage AI for early disease detection. Personalized medicine uses AI to tailor treatments based on individual genetic profiles. Virtual health assistants provide AI-driven support for patient monitoring and care management.

Best Pharmaceutical Stocks

- PharmaEssentia Corp (6446): Leader in blood disorder treatments.

- EirGenix (6589): Known for biosimilar development, growing global presence.

- Oneness Biotech (4743): Focuses on oncology, expanding pipeline.

- TaiMed Biologics (4147): HIV treatments, strong R&D capabilities.

- Microbio Co., Ltd. (4128): Specializes in cancer immunotherapy.

- Adimmune Corporation (4142): Leader in vaccine development, strong market position.

- CHC Healthcare (4164): Known for oncology and cardiovascular drugs.

- Bora Pharmaceuticals (6472): Leading contract manufacturer, expanding globally.

- Lotus Pharmaceutical (1795): Focus on CNS disorders, growing pipeline.

- Tanvex BioPharma (6541): Biosimilar development, expanding into global markets.

[YTD Price Return 2024]

Source: tradingview.com

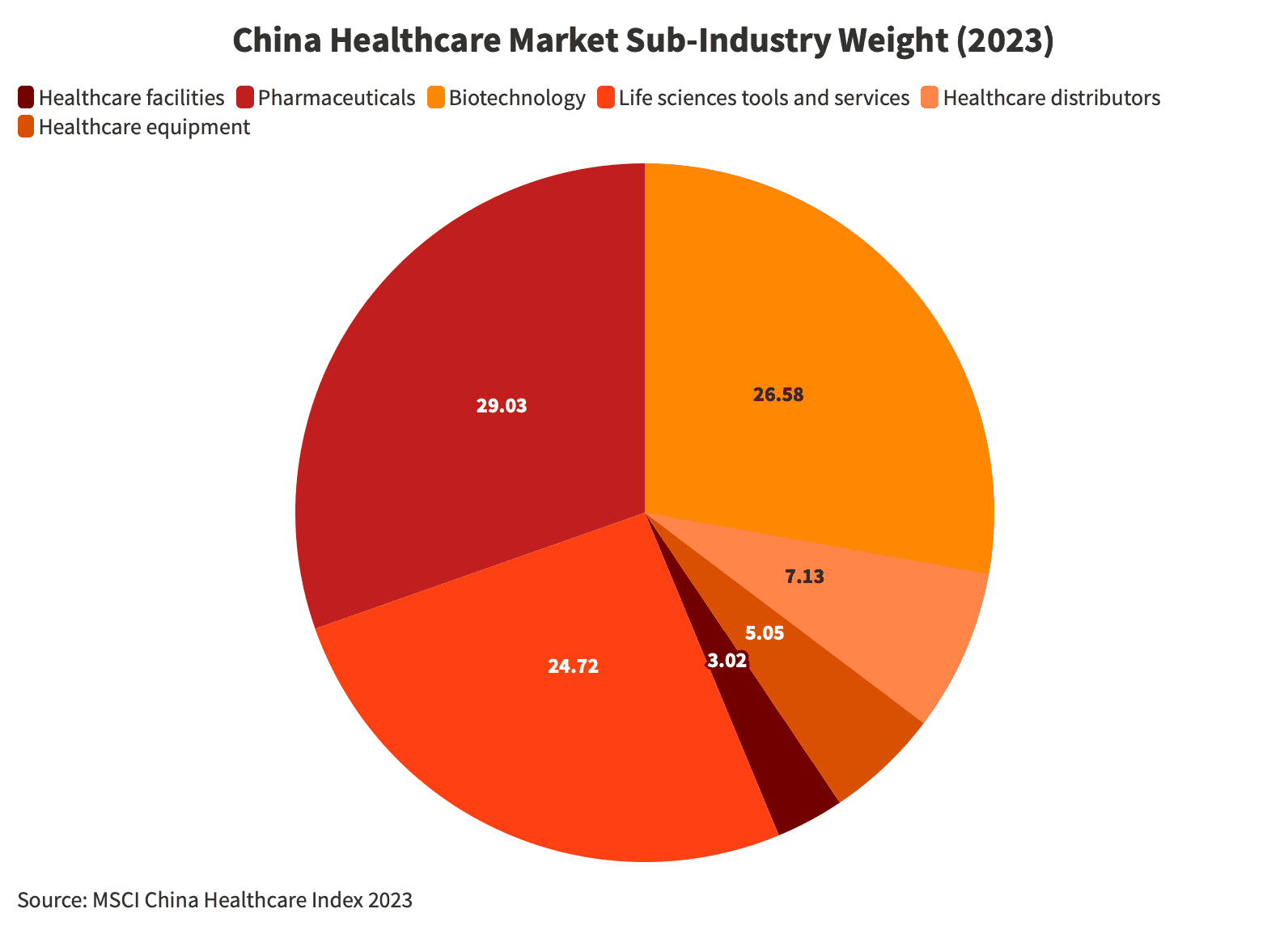

Best Healthcare Stocks & Biotech Stocks (HK Stocks)

WuXi Biologics (Cayman) Inc (2269.HK):

WuXi Biologics is a leading global open-access biologics technology platform, offering end-to-end solutions. It holds a strong market position in biologics manufacturing and is rapidly expanding its global footprint. Stock performance has been robust, reflecting strong revenue growth driven by increased demand for biologics.

JD Health (6618.HK):

JD Health is a leader in online healthcare services in China, leveraging its e-commerce platform to provide telemedicine, online pharmacy, and health management services. The company’s stock has shown resilience, supported by growing revenues from its online pharmacy segment and expanding user base.

Alibaba Health (0241.HK):

Alibaba Health is the healthcare arm of Alibaba Group, focusing on digital health solutions. It has a strong market position in China’s online pharmacy and telemedicine sectors. The stock has been volatile but shows potential for growth as the digital health market in China expands.

Source: china-briefing.com

These companies represent some of the best biotech and healthcare stocks globally, offering strong growth potential through innovative products, market leadership, and strategic developments.

III. Factors to Consider When Investing in Biotech Stocks

Investing in biotech stocks presents unique opportunities, but it also requires careful consideration of several critical factors. The biotech sector is characterized by its innovation-driven nature, long development cycles, and a high level of regulatory scrutiny. Understanding these factors can help investors navigate the complexities of the market.

Market Trends

One of the primary factors to consider is market trends, which are often driven by the demand for new and innovative treatments. As populations age and healthcare needs evolve, there is an increasing demand for novel therapies, particularly in areas such as oncology, immunology, and rare diseases. Investors should closely monitor the therapeutic areas where a company is focusing its efforts. Companies that align their research with growing medical needs, such as treatments for chronic diseases or personalized medicine, are more likely to succeed. Additionally, the rise of technologies like gene editing, mRNA therapies, and regenerative medicine are reshaping the biotech landscape, offering significant growth potential. Understanding these trends can help investors identify companies that are well-positioned to benefit from emerging opportunities.

Source: nvidia.com

Company Financial Health and Profitability

The financial health of a biotech company is another crucial factor. Many biotech companies, especially early-stage ones, may not be profitable yet, making it essential to evaluate their financial stability. Investors should examine a company's cash flow, burn rate, and funding sources. A healthy balance sheet with sufficient cash reserves is vital, as biotech companies often require substantial capital to fund research and development (R&D) activities, including clinical trials. Profitability, while not always present in early stages, becomes critical as companies advance their products through the pipeline. Companies with a diversified revenue stream, perhaps from already approved products or strategic partnerships, are generally in a stronger position to sustain long-term growth.

Research and Development Capabilities

In the biotech industry, a company's research and development (R&D) capabilities are central to its success. The biotech sector thrives on innovation, and companies with robust R&D pipelines are better equipped to bring new treatments to market. Key indicators of strong R&D capabilities include the number of drugs in development, the stages of these drugs (preclinical, Phase I, II, III, or awaiting approval), and the success rate of their clinical trials. Positive clinical trial results are often a catalyst for stock price increases, as they indicate the potential for future revenue. Investors should also consider the company’s intellectual property (IP) portfolio, which can protect its innovations from competitors, offering a competitive advantage. A strong R&D team with experienced scientists and strategic collaborations with research institutions or larger pharmaceutical companies can also enhance a biotech company's prospects.

Regulatory Environment and Approval Processes

The regulatory environment is perhaps the most critical factor in biotech investing. Biotech companies operate under stringent regulations, with the U.S. Food and Drug Administration (FDA) playing a pivotal role in the approval of new drugs. The FDA’s approval process is rigorous, involving multiple stages of clinical trials to ensure the safety and efficacy of new treatments. Investors must understand that delays or failures in obtaining FDA approval can significantly impact a company’s stock price and future prospects. Companies that have a clear regulatory strategy and a history of successful approvals are typically safer bets. Additionally, the global regulatory landscape is complex, with different countries requiring separate approvals. Companies that can navigate these challenges and achieve approvals in multiple markets stand to gain substantial competitive advantages.

IV. Biotech Industry Trends & Biotech Stocks Outlook

The biotech industry stands at the intersection of innovation and healthcare, poised for significant growth in the coming years. The sector's evolution is driven by breakthroughs in medical science, technological advancements, and an increasing demand for personalized healthcare solutions. Understanding current market dynamics and future trends is essential for assessing the long-term outlook of biotech stocks.

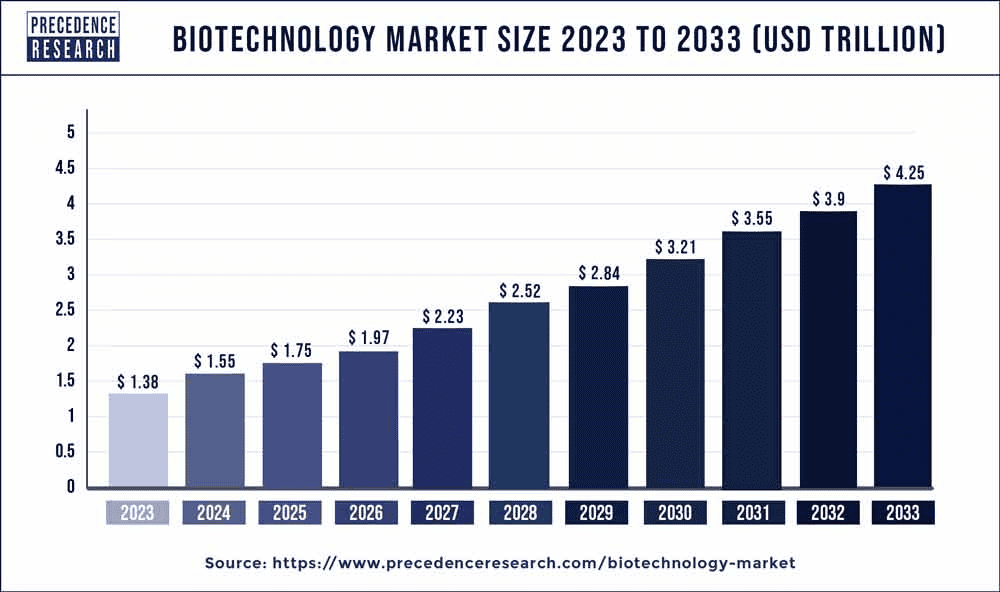

The global biotech market has experienced robust growth in recent years, driven by increased healthcare spending and advancements in medical technologies. As of 2023, the biotech industry is valued at approximately $1.38 trillion and is projected to reach $3.21 trillion by 2030, growing at a compound annual growth rate (CAGR) of around 11.8% (from 2024 to 2033). North America remains the largest market, owing to its strong R&D infrastructure, supportive regulatory environment, and high healthcare expenditure. However, Asia-Pacific is emerging as a critical growth region due to rising investments in healthcare infrastructure, increasing prevalence of chronic diseases, and favorable government initiatives.

Source: precedenceresearch.com

The biotech industry’s growth varies significantly by region. In North America, particularly the U.S., the market benefits from a well-established ecosystem of biotech companies, research institutions, and a supportive regulatory framework. Europe follows closely, with countries like Germany, France, and the UK leading in biotech innovation, especially in areas such as gene therapy and biopharmaceuticals. Asia-Pacific is rapidly catching up, with countries like China, Japan, and India investing heavily in biotech R&D. The Chinese biotech market, for instance, is expanding due to government support, increasing clinical trials, and a growing talent pool.

Future Trends in the Biotech Industry

The future of the biotech industry will be shaped by several key trends that promise to revolutionize healthcare.

- AI Integration: Artificial Intelligence (AI) is increasingly being used in drug discovery, patient diagnosis, and personalized medicine. AI can accelerate the drug development process by predicting molecular behavior and identifying potential drug candidates more efficiently. The integration of AI is expected to reduce the time and cost associated with bringing new therapies to market.

Source: nvidia.com

- Telemedicine: The COVID-19 pandemic has accelerated the adoption of telemedicine, and this trend is likely to continue. Biotech companies are exploring ways to integrate telemedicine with ongoing patient care, particularly in monitoring chronic conditions and administering treatments remotely. This trend will enhance patient access to healthcare and streamline treatment protocols.

- RNA Technologies: The success of mRNA vaccines during the pandemic has brought RNA technologies to the forefront of biotech innovation. Companies are now exploring mRNA for various therapeutic applications, including cancer treatment and rare genetic disorders. This technology has the potential to revolutionize how we approach disease treatment and prevention.

- Gene Editing: CRISPR and other gene-editing technologies are leading the way in treating genetic disorders, cancers, and other conditions. The precision and potential of gene editing to alter DNA make it one of the most promising areas in biotech. The ethical and regulatory landscape surrounding gene editing is still evolving, but its potential is undeniable.

- Stem Cell Research: Stem cells offer the potential to regenerate damaged tissues and organs, making them a focal point in regenerative medicine. Advances in stem cell research could lead to treatments for conditions that are currently incurable, such as spinal cord injuries and neurodegenerative diseases.

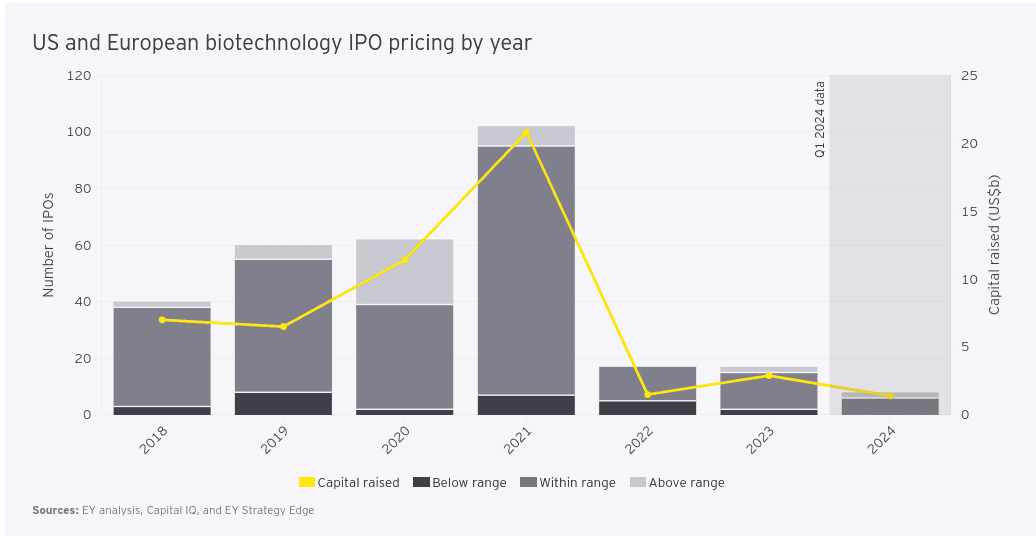

- Increased M&A Activity: The biotech sector is witnessing a surge in mergers and acquisitions (M&A), driven by larger pharmaceutical companies looking to bolster their pipelines and leverage new technologies. This trend is expected to continue as big pharma seeks to diversify its portfolio and gain access to innovative therapies.

Long-Term Outlook for Biotech Stocks & Health Care Stocks

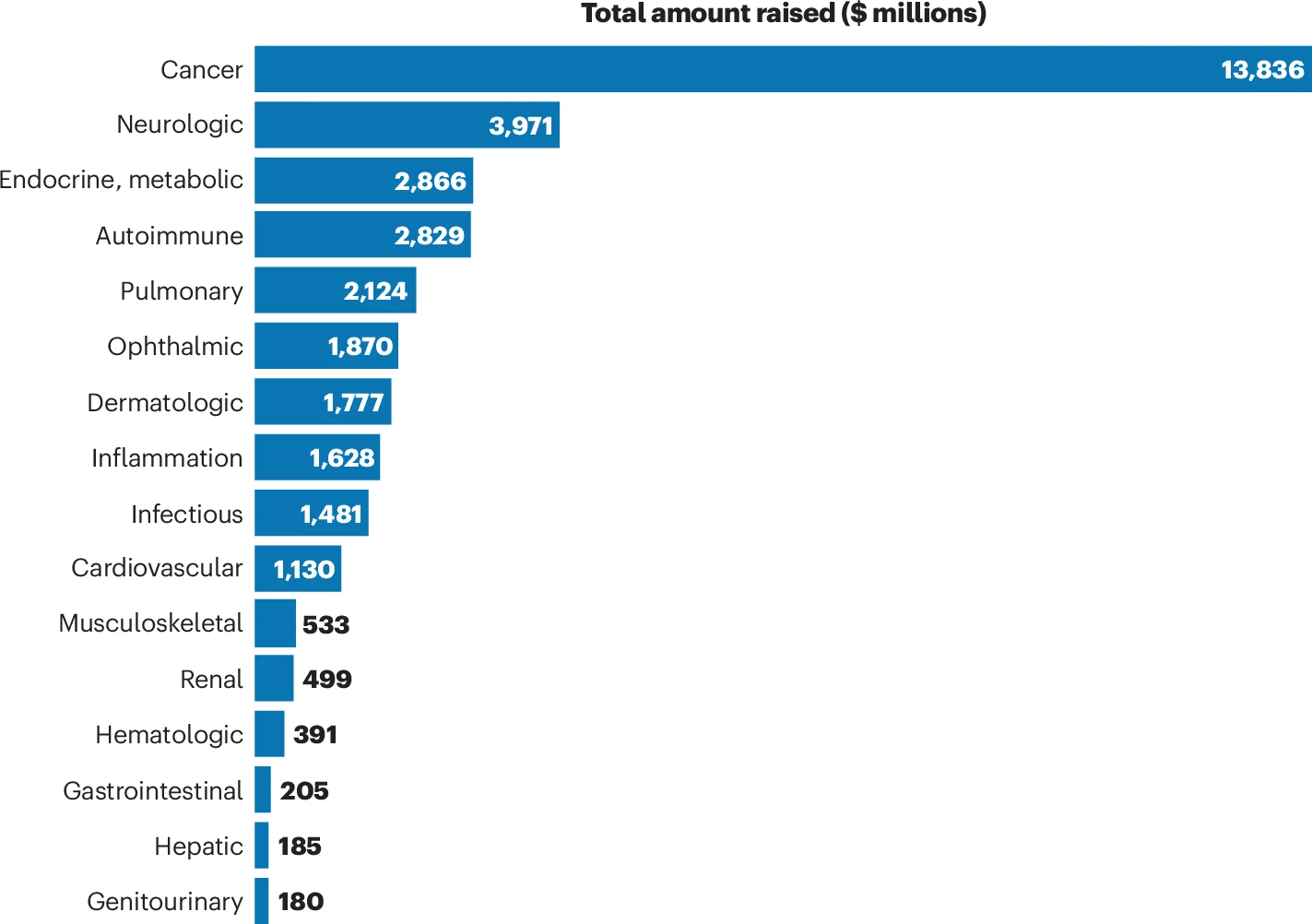

The long-term outlook for biotech stocks is optimistic, driven by several key factors. Market recovery is anticipated as the global economy stabilizes, with biotech companies poised to benefit from renewed investor confidence. Key areas like cancer and immunology are expected to drive growth due to ongoing innovations and increasing demand for advanced therapies. These sectors remain at the forefront of biotech research, offering substantial market potential as new treatments emerge.

[Top therapeutic areas for venture 2024]

Source: nature.com

Additionally, the biotech sector is likely to benefit from a favorable interest-rate environment, which lowers borrowing costs and encourages investment in R&D. This, combined with increased mergers and acquisitions (M&A) activity, will support the growth and expansion of biotech companies. Larger pharmaceutical firms are likely to continue acquiring smaller biotech companies to strengthen their pipelines and leverage new technologies. Overall, while the biotech sector is inherently volatile, its long-term growth prospects remain strong, underpinned by continued innovation, strategic dealmaking, and a favorable economic backdrop.

Source: ey.com