- Bitcoin mining stocks are known for their high return potential, as demonstrated by Riot Platforms’ 300% YTD gain in 2021 during Bitcoin’s price surge.

- Bitcoin stocks exhibit extreme volatility, with Marathon Digital’s price fluctuating between $5 and $83 in the same year.

- Liquidity of bitcoin mining stocks can vary, as smaller miners face thin trading volumes compared to larger peers like Marathon.

Source: cryptoslate.com

I. What Are Bitcoin Mining Stocks

Bitcoin mining stocks represent publicly traded companies involved in Bitcoin mining, the process by which new bitcoins are created and transactions are verified on the Bitcoin network. Bitcoin itself is a decentralized digital currency, functioning without a central authority like a government or bank. Bitcoin mining involves solving complex cryptographic puzzles to validate transactions, with miners rewarded in bitcoin. This requires significant computational power and energy, driving the emergence of companies that provide this service at scale.

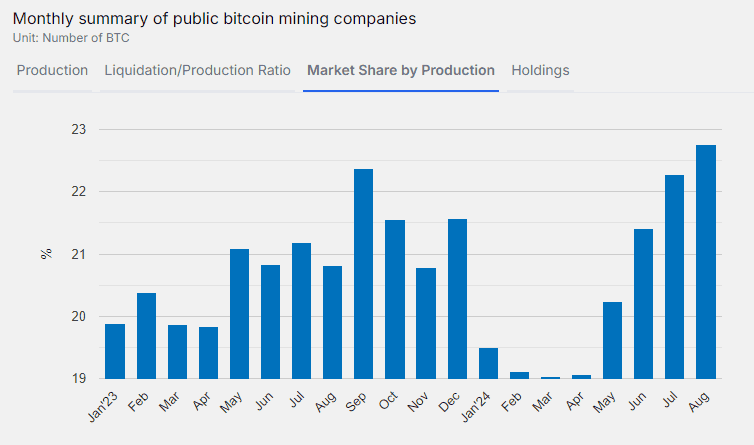

Examples of major bitcoin mining companies include Riot Platforms Inc. (RIOT), Marathon Digital Holdings (MARA), and Hut 8 Mining (HUT). As of mid-2024, these companies are responsible for a substantial portion of Bitcoin’s global hash rate, the total computational power dedicated to mining, with Riot contributing 22 EH/s (exahashes per second) in Q2 2024.

Source: cryptoslate.com

Why Invest in Bitcoin Mining Stocks?

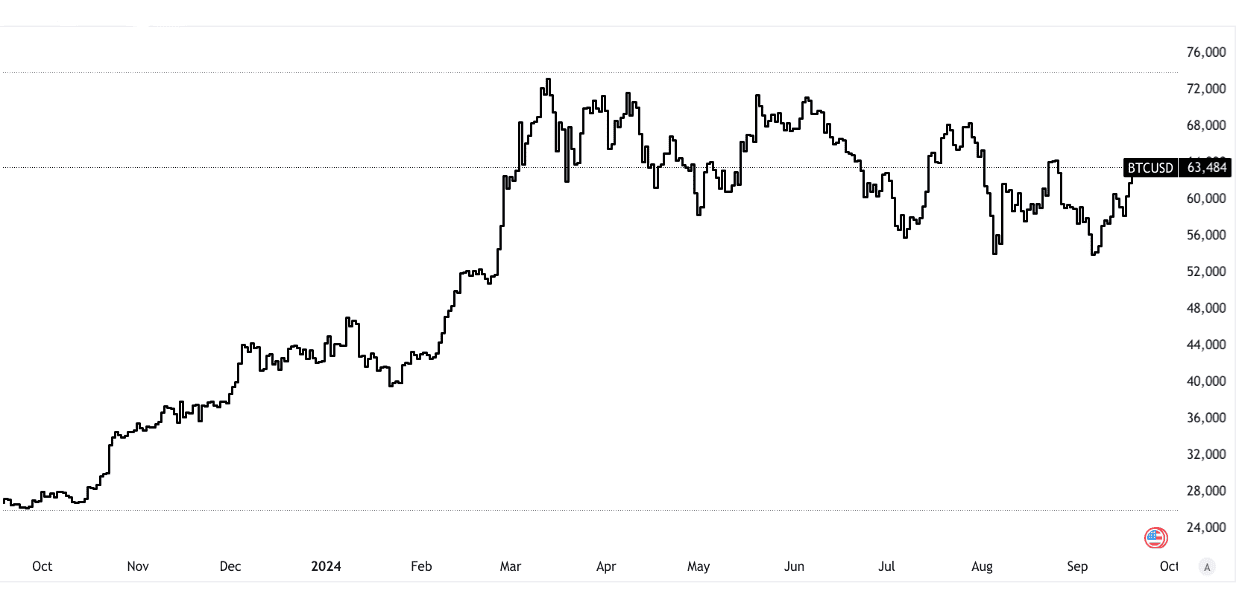

- Exposure to the Cryptocurrency Market: Mining stocks offer investors a less direct but highly correlated exposure to Bitcoin’s price. For instance, when Bitcoin surged from $26,583 on September 23, 2023 to over $63,550 in on September 24, 2023, leading mining stocks like MARA rose by 67% during the same period based on outperforming Bitcoin price gains.

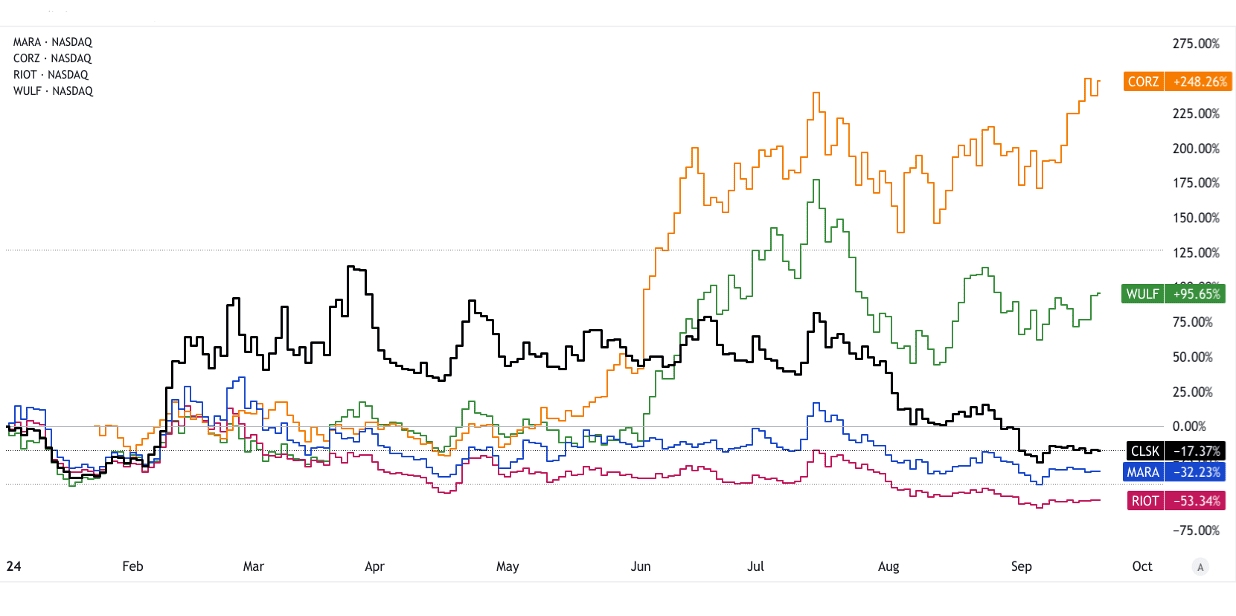

Source: tradingview.com [1Y_Price_Return]

Source: tradingview.com [1Y_Price_Return]

- Strong Growth Potential: Mining stocks have historically benefited from Bitcoin’s long-term growth. For example, Marathon Digital increased its mining capacity by 70% in 2023, positioning itself to capitalize on future Bitcoin price increases.

- Increased Bitcoin Adoption: As Bitcoin adoption increases, so does the demand for transaction validation. In turn, this drives the profitability of mining companies. For example, the global cryptocurrency market is expected to grow at a CAGR of 12.5% from 2023 to 2030, further benefiting miners.

II. Best Bitcoin Mining Stocks

Bitcoin Mining Stocks (US Stocks)

CleanSpark (CLSK)

CleanSpark focuses on sustainable bitcoin mining using renewable energy sources. As of August 31, 2024, it operates with a hash rate of 22.6 EH/s, and it plans to increase this capacity in 2024. CleanSpark is recognized for its eco-friendly approach, capitalizing on the trend toward sustainability in crypto mining. It is considered a mid-tier player in the mining industry.

Investment Case: Revenue for Q2 2024 reflecting a 163% YoY increase. CleanSpark is expanding its operations, acquiring mining infrastructure, and remains a strong contender for investors focused on green energy and scalability in the crypto space.

Marathon Digital Holdings (MARA)

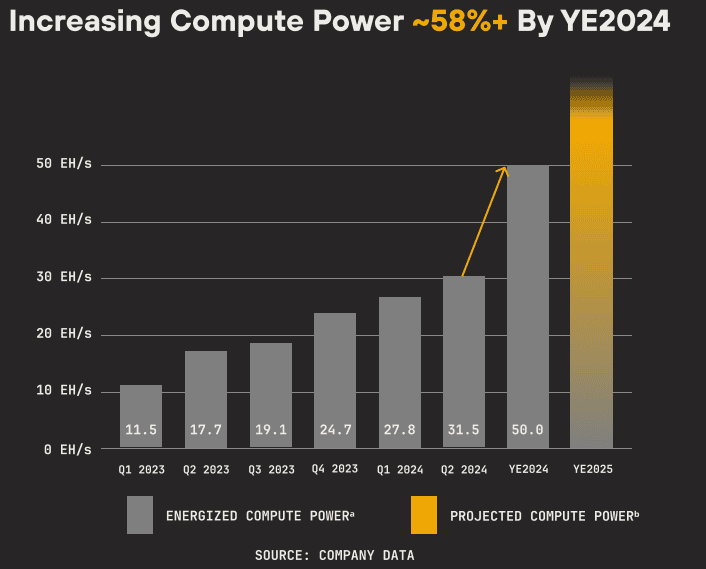

Marathon has one of the largest hash rates among U.S. miners, operating at 37 EH/s as of mid-2024. The company is aggressively expanding, targeting 50 EH/s by 2024 end. Marathon is a leading name in the U.S. bitcoin mining space, accounting for around 8% of the global hash rate.

Investment Case: In Q2 2024, Marathon reported revenue had a 78% YoY increase, mainly due to its growing mining capacity. Its future potential lies in scaling operations and navigating regulatory landscapes, positioning it as a growth stock.

Source: MARA 2024 Q2-Investor-Presentation

Core Scientific (CORZ)

Core Scientific operates a large fleet of ASIC miners, contributing significantly to the global Bitcoin hash rate (20.5 EH/s). It offers hosting services to other miners, which provides an additional revenue stream. Despite recent financial challenges and filing for bankruptcy in late 2022, Core Scientific remains a key player in terms of mining capacity and infrastructure.

Investment Case: Core Scientific's restructuring efforts could restore investor confidence. Its hosting services and mining activities provide diverse revenue streams. The company’s revenue growth stood at 11% in Q2 2024, down from its previous high, but ongoing restructuring could turn it around.

Riot Platforms (RIOT)

Riot operates with a hash rate of 31.5 EH/s as of Q2 2024, with expansion plans for 2024. Riot uses immersion-cooling technologies to maximize mining efficiency. Riot is a dominant U.S. mining company, accounting for 3% of global Bitcoin production.

Investment Case: Riot generated revenue in Q2 2024 with a -9% YoY increase. The company’s focus on increasing energy efficiency and expanding capacity positions it for long-term growth as the Bitcoin market matures.

TeraWulf (WULF)

TeraWulf uses nuclear and hydroelectric power sources, positioning itself as one of the most environmentally friendly mining companies. It operates at 10 EH/s and plans to scale in 2024. TeraWulf’s focus on clean energy gives it a niche advantage in the mining sector, appealing to ESG-conscious investors.

Investment Case: TeraWulf's focus on sustainability and potential for rapid expansion make it an intriguing stock. Revenue grew by 130% YoY in Q2 2024, and its strategic partnerships should enable further growth.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

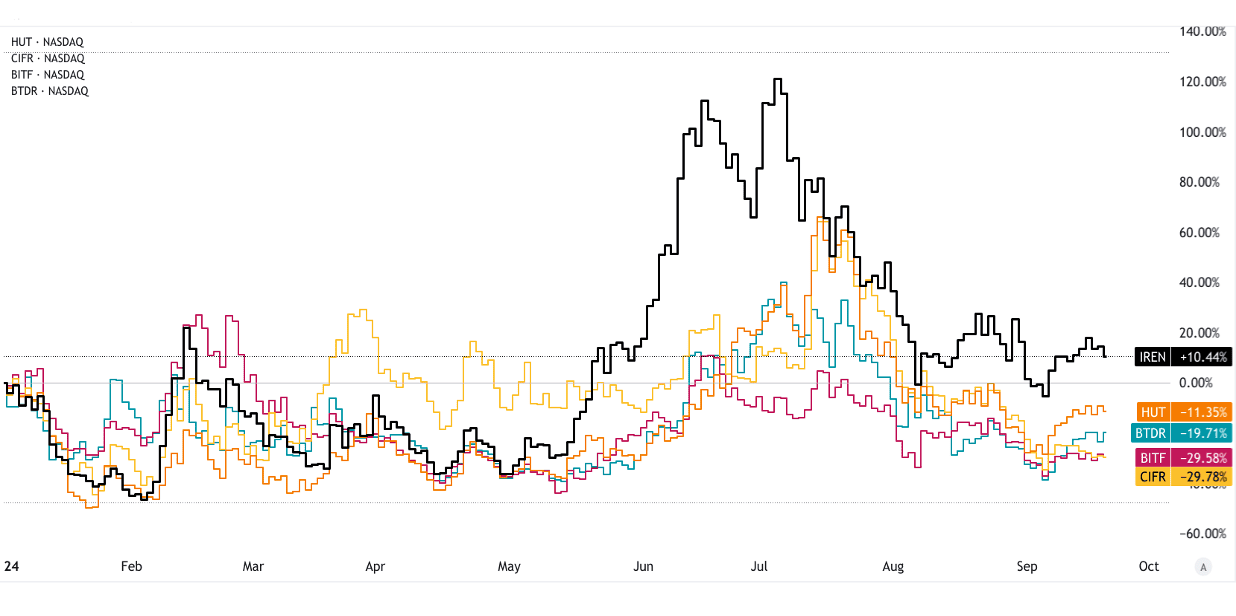

Iris Energy (IREN)

Iris Energy runs its mining operations using 100% renewable energy, with a current hash rate of 18.8 EH/s, aiming to expand to 30 EH/s by 2024. Iris Energy’s green energy focus has positioned it as a leader in sustainable mining.

Investment Case: Iris Energy reported in revenue in Q2 2024 with a 68% YoY increase. Its commitment to scaling operations and maintaining a low carbon footprint is key to its future growth.

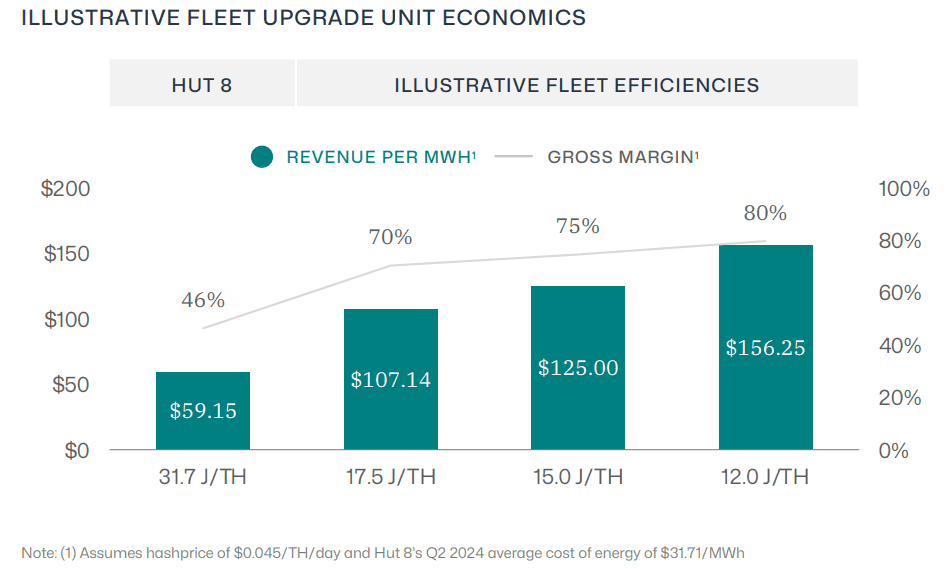

Hut 8 Corp (HUT)

Hut 8 currently operates with a hash rate of 18.5 EH/s, with plans to double (33.5) that by late 2024. It also provides hosting services for institutional clients. Hut 8 is one of Canada’s leading miners and has a strong presence in the North American market.

Investment Case: Hut 8 reported in Q2 2024 revenue with a 46% YoY increase. Its dual business model of self-mining and hosting services adds diversification to its revenue streams, offering a balanced growth trajectory.

Source: Hut-8-Investor-Presentation-September-2024

Cipher Mining Inc (CIFR)

Cipher Mining operates with a hash rate of 8.7 EH/s and plans to expand to 13.5 EH/s by 2024. As a newer player, Cipher Mining is rapidly growing its market share in the U.S. mining landscape.

Investment Case: Cipher Mining posted revenue for Q2 2024 with 18% YoY growth. Its rapid scaling and investment in energy-efficient infrastructure make it a high-growth prospect.

Bitfarms (BITF)

Bitfarms operates with a hash rate of 11.3 EH/s, focused on reducing its energy costs by leveraging hydropower in Canada. Bitfarms holds a strong position in the Canadian market and is known for its low-cost mining operations.

Investment Case: Bitfarms generated Q2 2024 revenue with a 17% YoY increase. The company's focus on cost-efficient energy sources positions it for sustained profitability.

Bitdeer Technologies Group (BTDR)

Bitdeer focuses on providing cloud mining services, allowing users to rent mining capacity. It operates a hash rate of 16.8 EH/s. Bitdeer’s cloud mining model gives it a unique advantage in diversifying its revenue streams and reducing operational risk.

Investment Case: Bitdeer posted Q2 2024 revenue with 6% YoY growth. Its cloud-based mining model allows it to scale rapidly without the capital expenditures required for hardware ownership.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

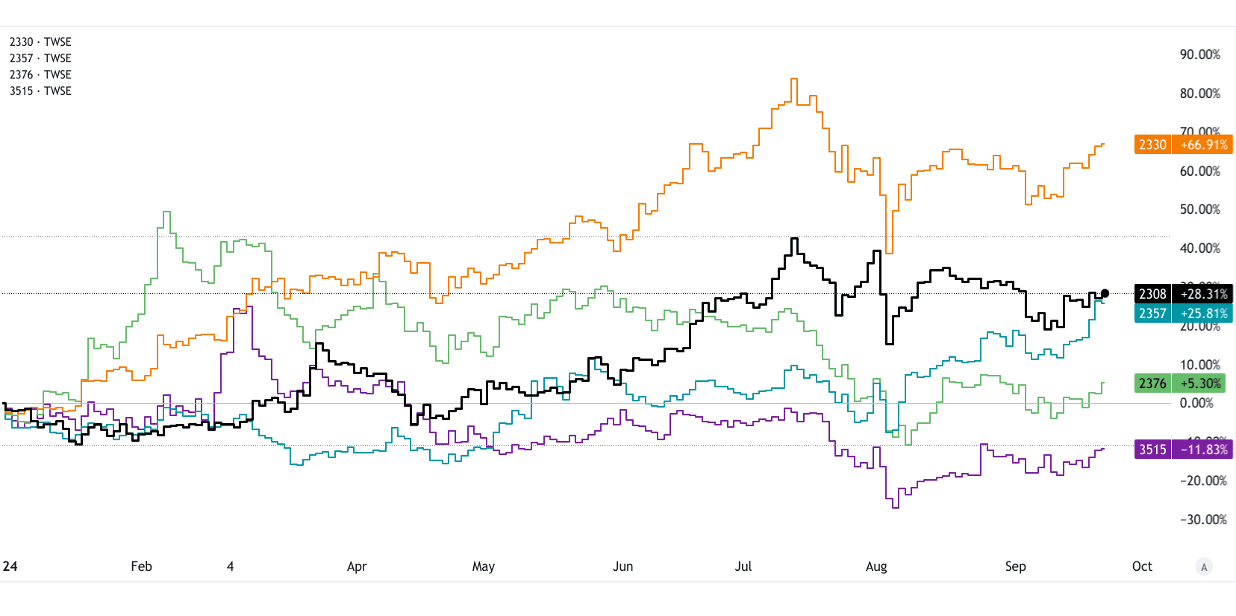

Bitcoin Mining Stocks (Taiwan Stocks)

Delta Electronics (2308)

Delta Electronics provides power supplies and cooling systems for Bitcoin mining equipment, critical components for data centers.

Investment Case: Delta Electronics has a significant market share in the global power supply industry. Its role in the supply chain of Bitcoin mining equipment positions it well for future growth.

TSMC (2330)

TSMC manufactures the advanced chips used in mining rigs. It dominates the global semiconductor market, holding a 54% market share.

Investment Case: TSMC’s revenue growth driven by demand for high-performance computing chips used in Bitcoin mining. Its leading position in the semiconductor market makes it a core stock for crypto infrastructure.

AsusTek Computer (2357)

Asus produces mining GPUs, critical for smaller-scale operations.

Investment Case: Asus holds strong brand and ongoing innovations in gaming and mining hardware make it a solid bet for exposure to the broader crypto market.

Giga-Byte Technology (2376)

Giga-Byte Technology is a leading manufacturer of computer hardware components, including GPUs (Graphics Processing Units) and motherboards that are crucial for Bitcoin mining. Their high-performance GPUs are often used in smaller-scale mining operations or altcoin mining. Giga-Byte has a strong market presence in the gaming and cryptocurrency mining hardware sector. Its market share in the motherboard and GPU market positions it as a key player in Bitcoin infrastructure.

Investment Case: Giga-Byte revenue growth, partly driven by the increasing demand for GPUs used in crypto mining. The company is well-positioned to benefit from future GPU demand as Bitcoin and cryptocurrency mining grow in complexity, requiring more advanced hardware.

ASRock (3515)

ASRock is a prominent manufacturer of motherboards, industrial PCs, and servers used in crypto mining. They are especially known for producing mining-specific motherboards capable of supporting multiple GPUs, crucial for efficient mining setups. ASRock holds a notable share of the global mining motherboard market. Its expertise in creating mining-focused hardware gives it a niche position within the broader computing hardware market.

Investment Case: With continued demand for mining hardware, particularly for altcoins and smaller Bitcoin mining setups, ASRock is expected to maintain stable growth.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

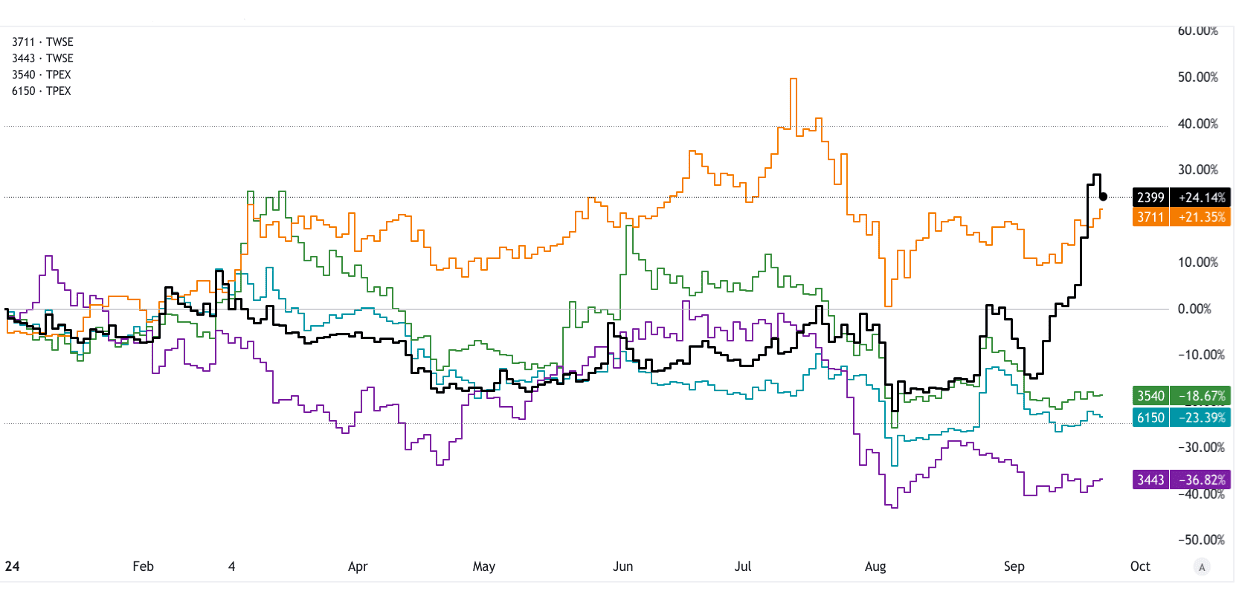

Biostar (2399)

Biostar produces motherboards and GPUs, with a focus on the cryptocurrency mining sector. Their motherboards are optimized for multi-GPU setups, making them attractive for mining operators. Though smaller in scale compared to peers like Asus or Giga-Byte, Biostar is well-respected for its mining-specific hardware.

Investment Case: Biostar’s focused product line for cryptocurrency mining positions it well to capitalize on the growing demand for high-efficiency hardware in the mining sector.

ASE Technology (3711)

ASE Technology is a global leader in semiconductor packaging and testing services. Their advanced semiconductor solutions are essential in the production of ASIC chips used in Bitcoin mining rigs. ASE Technology holds a dominant market share in the semiconductor packaging industry, making it a critical supplier for cryptocurrency mining hardware manufacturers.

Investment Case: ASE Technology’s role in the semiconductor supply chain ensures steady demand as Bitcoin mining becomes more specialized and requires advanced chip designs.

Global Unichip (3443)

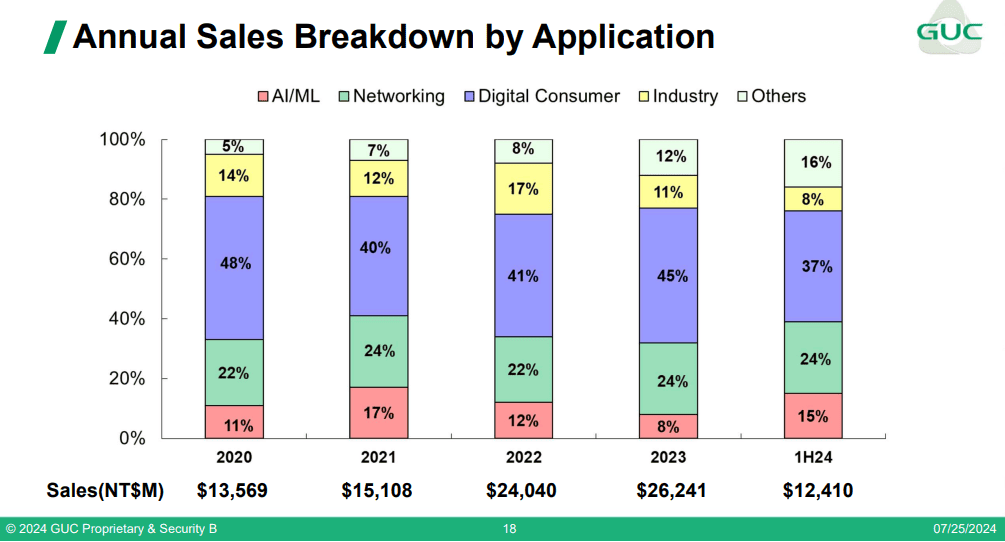

Global Unichip specializes in custom chip design, focusing on ASICs (Application-Specific Integrated Circuits), which are pivotal in Bitcoin mining. Their custom solutions optimize mining efficiency, allowing miners to produce more bitcoins with lower energy costs. As a key player in the ASIC development market, Global Unichip benefits from the growing trend toward more efficient and powerful mining rigs.

Investment Case: Global Unichip driven by the demand for custom ASICs. With Bitcoin mining moving toward more specialized equipment, the company is poised for significant future growth.

Source: GUC 2Q24 investor results

Thermaltake (3540)

Thermaltake is a global supplier of cooling solutions and power supplies, both essential for the hardware used in cryptocurrency mining. Effective cooling systems are critical to maintain the efficiency and lifespan of Bitcoin mining hardware, which tends to generate large amounts of heat. Thermaltake has a strong reputation in the gaming and cryptocurrency hardware markets, with a notable share of the global cooling solutions market.

Investment Case: As mining rigs evolve and demand better cooling solutions, Thermaltake’s high-performance products are set to remain in demand, particularly as more powerful ASICs and GPUs require robust cooling systems.

TUL Corporation (6150)

TUL Corporation is a supplier of AMD-based GPUs under its PowerColor brand, a key component in smaller-scale and alternative cryptocurrency mining operations. GPUs are often used in Ethereum and other altcoin mining, although they can also be adapted for Bitcoin mining in certain cases.

TUL is a well-known player in the high-performance GPU market, with a growing share in the crypto-mining sector, especially for altcoins.

Investment Case: TUL Corporation’s revenue growth, largely driven by the increased demand for GPUs. The company’s growth potential is linked to the continued rise of GPU-based mining for both Bitcoin and other cryptocurrencies, positioning TUL for long-term success.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

Crypto Mining Stocks ETFs

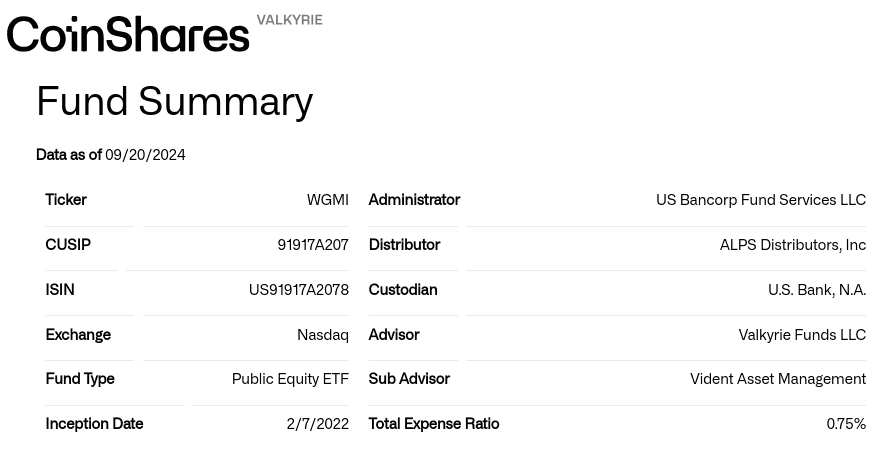

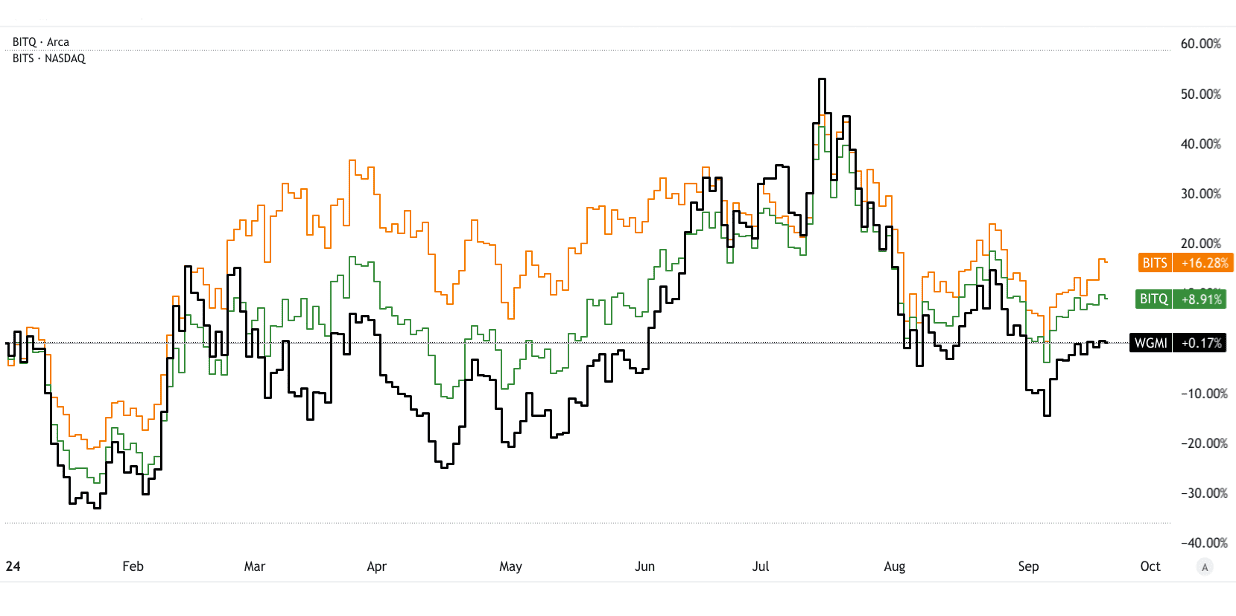

WGMI (Valkyrie Bitcoin Miners ETF)

WGMI focuses on Bitcoin mining companies, with top holdings like Riot Platforms (RIOT), Marathon Digital (MARA), and Cipher Mining (CIFR). These companies drive at least 50% of their revenue from mining Bitcoin, giving WGMI strong exposure to the sector. Riot and Marathon made up considerable fraction of the ETF, respectively. WGMI has an expense ratio of 0.75% and delivered a flat YTD return in 2024, benefiting from Bitcoin’s price resurgence and increased mining activity. While it lacks a significant dividend yield, it offers high growth potential tied to Bitcoin prices and operational improvements.

Source: valkyrie-funds.com

BITQ (Bitwise Crypto Industry Innovators ETF)

BITQ invests more broadly in the crypto sector, including exchanges, asset managers, and hardware providers. Key holdings include Coinbase (COIN), MicroStrategy (MSTR), and Riot Platforms. Coinbase high portion of the ETF, with MicroStrategy and Riot. BITQ has a 0.85% expense ratio and posted a 9% YTD return in 2024. Though dividend yield is minimal, BITQ offers diversified exposure to the cryptocurrency industry, reducing risk from Bitcoin mining alone.

BITS (Global X Blockchain & Bitcoin Strategy ETF)

BITS combines investments in blockchain companies, Bitcoin mining, and Bitcoin futures, offering a diverse approach. Key holdings include Marathon, Riot, and blockchain infrastructure firms. With an expense ratio of 0.68% and a 26% YTD return, BITS provides a unique blend of blockchain exposure and direct Bitcoin price correlation via futures, balancing risk and reward.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

III. Factors to Consider When Investing in Bitcoin Mining Stocks

- Bitcoin Price Volatility: Bitcoin mining stocks are highly sensitive to Bitcoin price fluctuations. Miners' profitability directly depends on Bitcoin’s market value, as revenues come from mining rewards and transaction fees. A 10% decline in Bitcoin’s price could significantly reduce miners' earnings, impacting stock valuations. In 2021, for example, Bitcoin’s price dropped from $63,000 in April to $30,000 by July, halving the profitability of most miners.

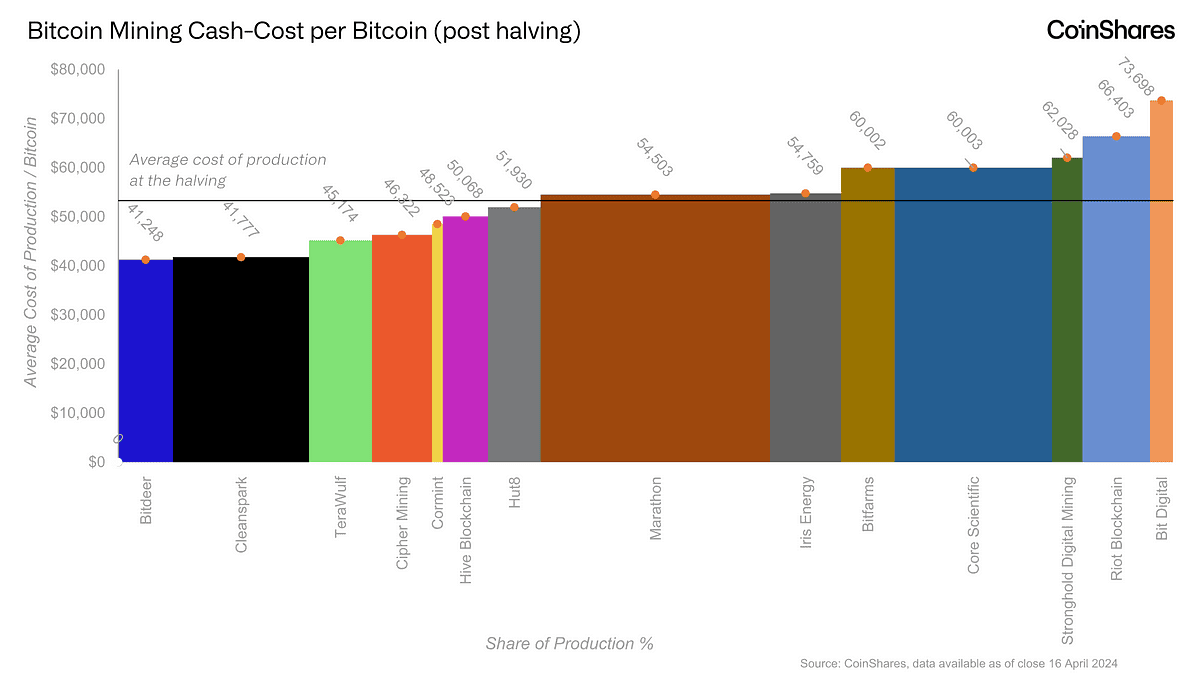

- Mining Profitability and Costs: Profitability is shaped by Bitcoin’s hashrate (total computational power) and mining difficulty, which adjusts roughly every two weeks. Rising hashrate intensifies competition, making it harder for individual miners to earn rewards. For example, in Q3 2023, the global hashrate hit a record 400 EH/s, raising difficulty and operational costs. Energy costs, often the largest expense, can vary significantly by location. Riot Platforms reported energy costs of $0.03/kWh in Texas, while other miners pay as high as $0.08/kWh.

Source: coinshares.com

- Company Fundamentals: Strong financial health, low debt, and sizable Bitcoin reserves improve resilience during bear markets. Marathon Digital held over 12,000 BTC on its balance sheet in 2023, bolstering liquidity. Operational efficiency, reflected in metrics like mining costs per Bitcoin mined, is critical for profitability; Riot's Q2 2023 report highlighted a cost of $8,389 per BTC mined.

- Technological Advancements: Innovations in mining hardware (e.g., Bitmain’s Antminer S21 Pro) can significantly enhance efficiency, reducing electricity consumption per hash. Miners adopting energy-efficient solutions may achieve higher margins.

- Regulatory Trends: Government crackdowns, carbon regulations, and taxation pose risks. China’s 2021 mining ban cut global hashrate by 50%, while rising scrutiny over carbon emissions, such as from the EU’s 2023 Green Deal, adds cost pressure on miners using non-renewable energy.

IV. Bitcoin Mining Industry Trends and Bitcoin Mining Stocks Outlook

The Bitcoin mining industry was valued at $2.2 billion in 2023, with estimates suggesting a CAGR of 13% from 2023 to 2030. Key mining regions like the U.S., which hosts 35% of the global hashrate, and Kazakhstan are central to growth. The U.S. market continues to expand due to regulatory clarity and access to cheap energy sources, while concerns over geopolitical instability threaten Kazakhstan’s future contributions.

Future Trends

Integration with AI and High-Performance Computing (HPC) is emerging, with miners leveraging AI for predictive analytics to enhance mining efficiency. Companies are also integrating HPC tasks into data centers, reducing downtime. Sustainability is another key trend. Green mining initiatives are gaining momentum, with firms like Iris Energy and CleanSpark utilizing renewable energy sources to power operations. Next-generation ASICs, such as Bitmain’s Antminer S21 Pro, and immersion cooling solutions aim to reduce energy consumption and boost operational efficiency, critical given the rising hashrate.

M&A Activity: Mergers and acquisitions are on the rise as smaller mining firms struggle with operational costs and regulatory hurdles. Riot Platforms’ acquisition of Whinstone U.S. in 2021, for $650 million, is a prime example, consolidating market power and scale.

Bitcoin Stocks Long-Term Outlook

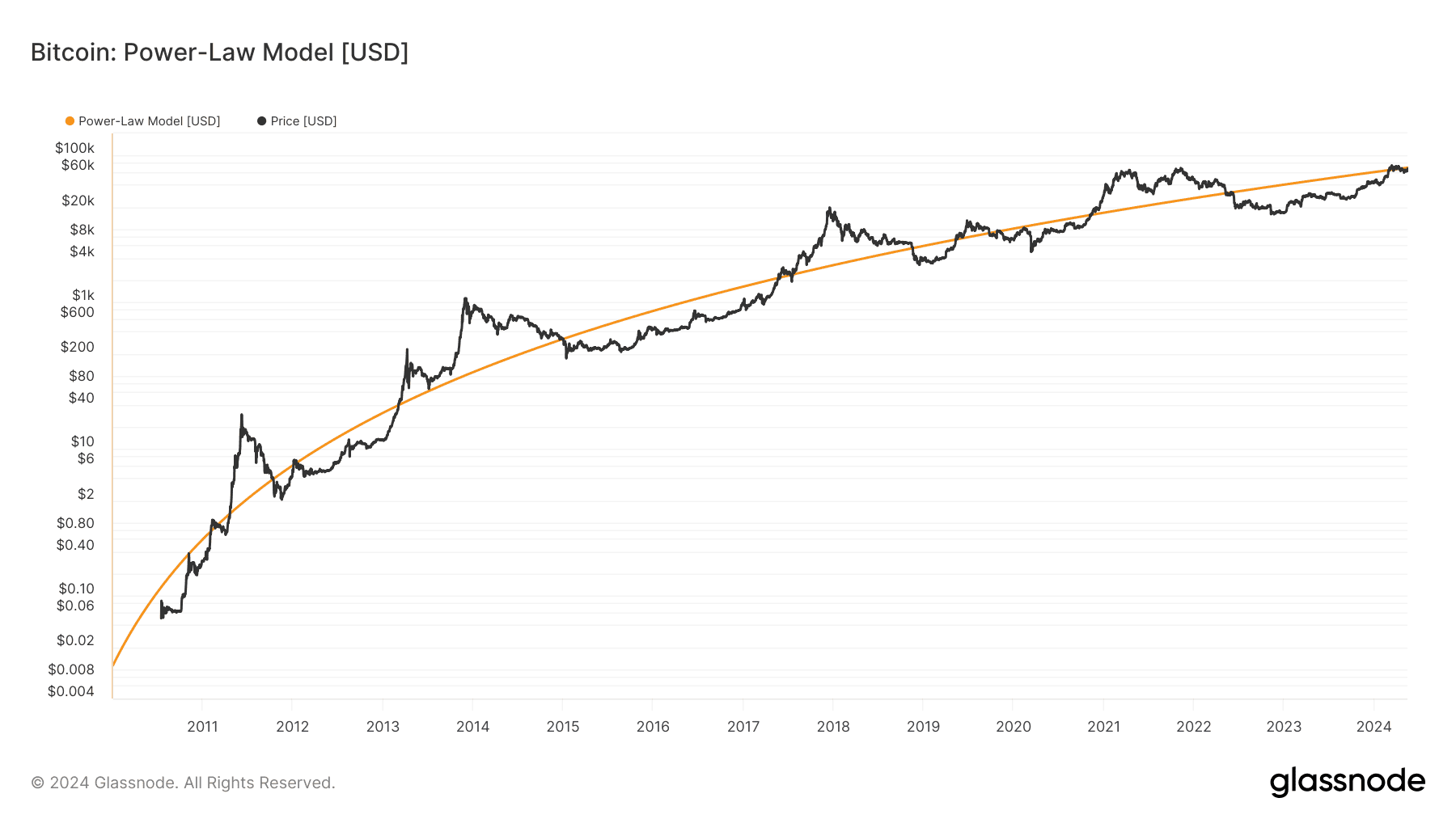

Institutional investments are increasing, with firms like BlackRock showing interest in Bitcoin miners, signaling growing market maturity. Bitcoin halving in 2024 will halve mining rewards, reducing revenue by 50% per block mined, likely driving consolidation in the industry. However, the halving is often bullish for Bitcoin's price, which many analysts predict could reach $100K by 2025 (like Power-Law Model), thus supporting long-term stock valuations. Maturation of the sector and innovation should improve operational margins and resilience to volatility.

Source: cryptoslate.com