● Communication services stocks generally offer moderate returns, with an average annual return of around 8% over the past decade.

● Communications stocks often exhibit higher volatility, typically reflecting beta values around 1.2, indicating greater price swings compared to the market.

● Liquidity remains strong, as major firms in this sector, like Google and Facebook, frequently trade in volumes exceeding millions of shares daily.

Source: peakpx.com

I. What Are Communication Services Stocks

Communication Services Stocks represent companies that provide essential communication and entertainment services. The sector encompasses a broad range of industries, including wired and wireless telecommunications, satellite communications, cable and internet services, media companies, and entertainment firms.

Scope of Communication Services Stocks:

● Telecommunications includes companies like AT&T (NYSE: T) and Verizon (NYSE: VZ), offering wired and wireless connectivity. In 2023, AT&T generated over $121 billion in revenue, with wireless services contributing approximately 43%.

● Satellite firms like Dish Network (NASDAQ: DISH) offer direct-broadcast satellite services, while providers like SpaceX’s Starlink are expanding into global broadband.

● Cable & Internet services, such as Comcast (NASDAQ: CMCSA), generated $121.5 billion in revenue in 2023, driven by increasing broadband subscribers.

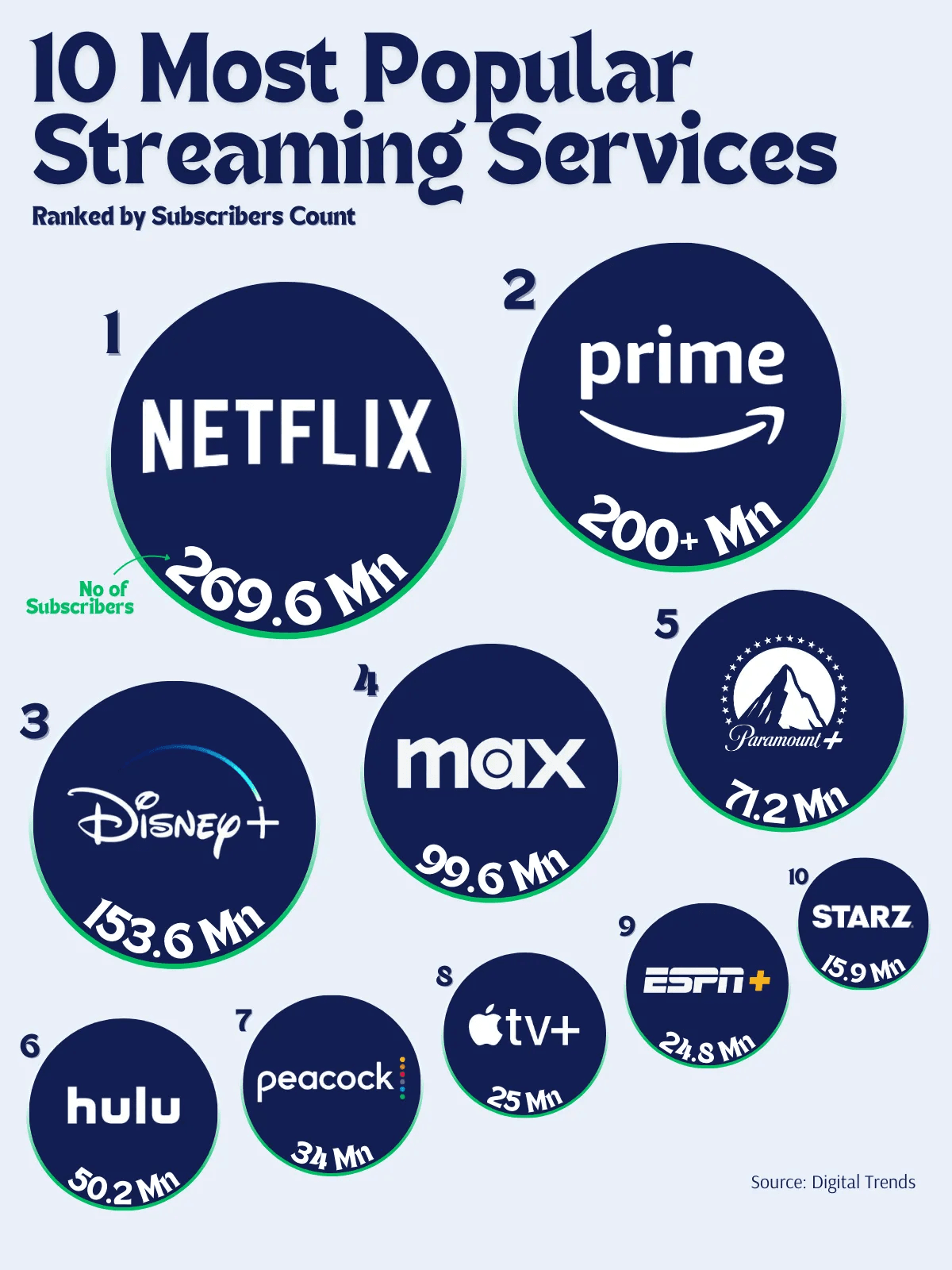

● Media & Entertainment companies include streaming giants like Netflix (NASDAQ: NFLX) and traditional broadcasters like Disney (NYSE: DIS), which reported $88.9 billion in annual revenue in fiscal 2023.

Source: bloomberg.com

Why Invest in Communication Services Stocks?

● Stable Demand & Revenue Streams: Communication services are essential, generating predictable income even during economic downturns. For example, Verizon had $33.8 billion in revenue in Q2 2024.

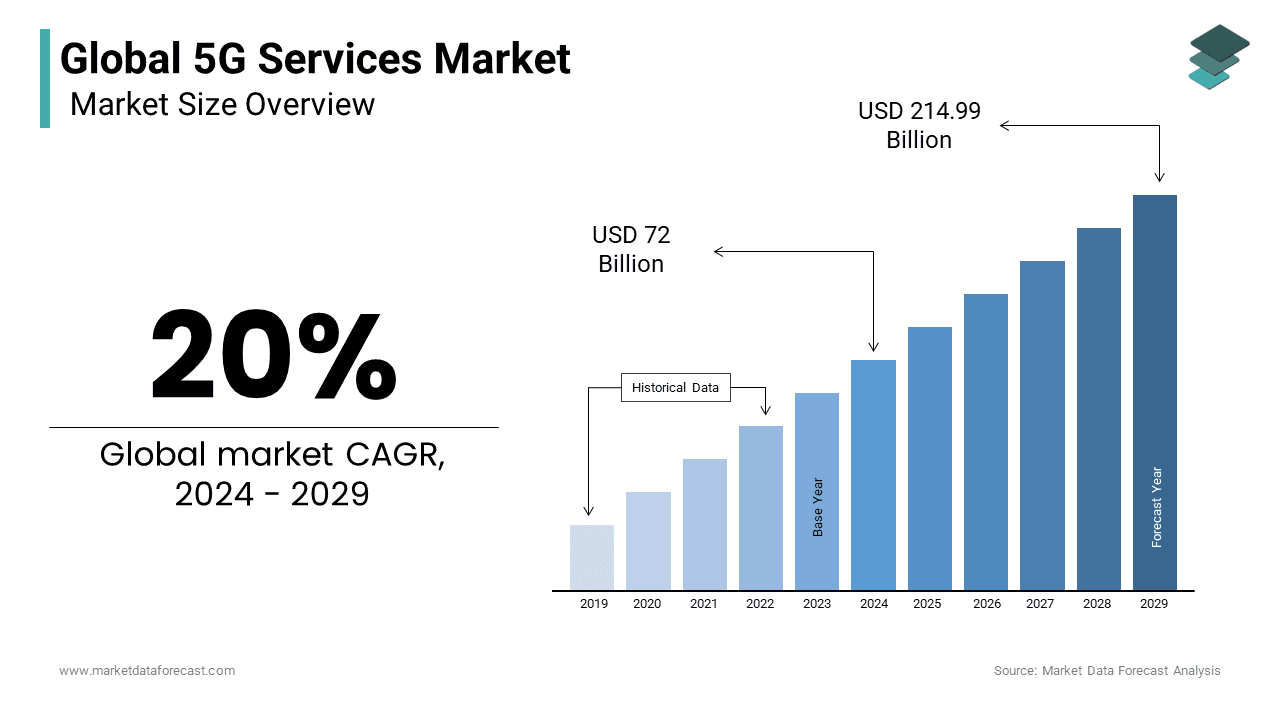

● High Growth Potential: Streaming and 5G innovations promise significant long-term growth. The global 5G market is expected to reach trillions by 2030.

● Technological Innovation: Companies in this sector invest heavily in R&D, driving innovation in wireless networks and digital content distribution.

● Global Reach & Economic Resilience: Communication services companies operate globally, insulating them from regional economic crises, as seen in the pandemic, where demand for internet and digital services surged.

II. Best Communication Services Stocks

Communication Services Stocks (US Stocks)

T-Mobile US (TMUS)

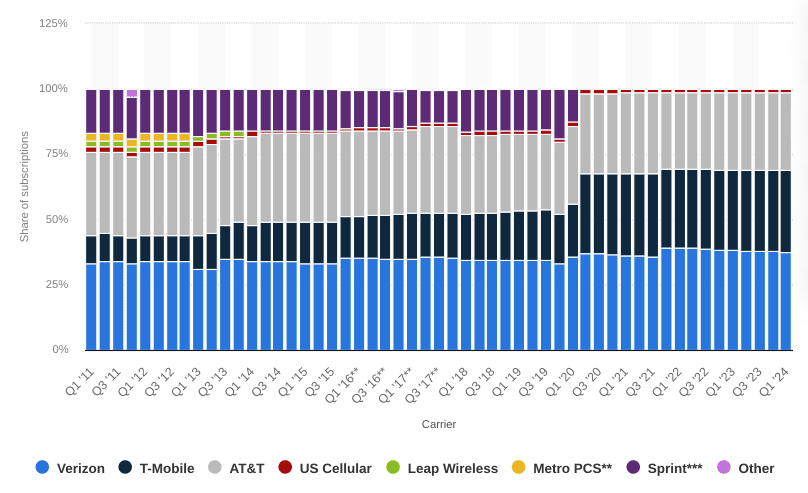

T-Mobile provides wireless telecommunications services, specializing in 5G networks. As of 2023, T-Mobile holds approximately 30% of the U.S. wireless market.

T-Mobile has aggressively expanded its 5G network, covering over 260 million people. Its revenue in 2023 was $78.6 billion. Future growth lies in increased 5G adoption, where T-Mobile is a leader, and continued expansion of its customer base, which grew over 100 million subscribers in Q2 2024.

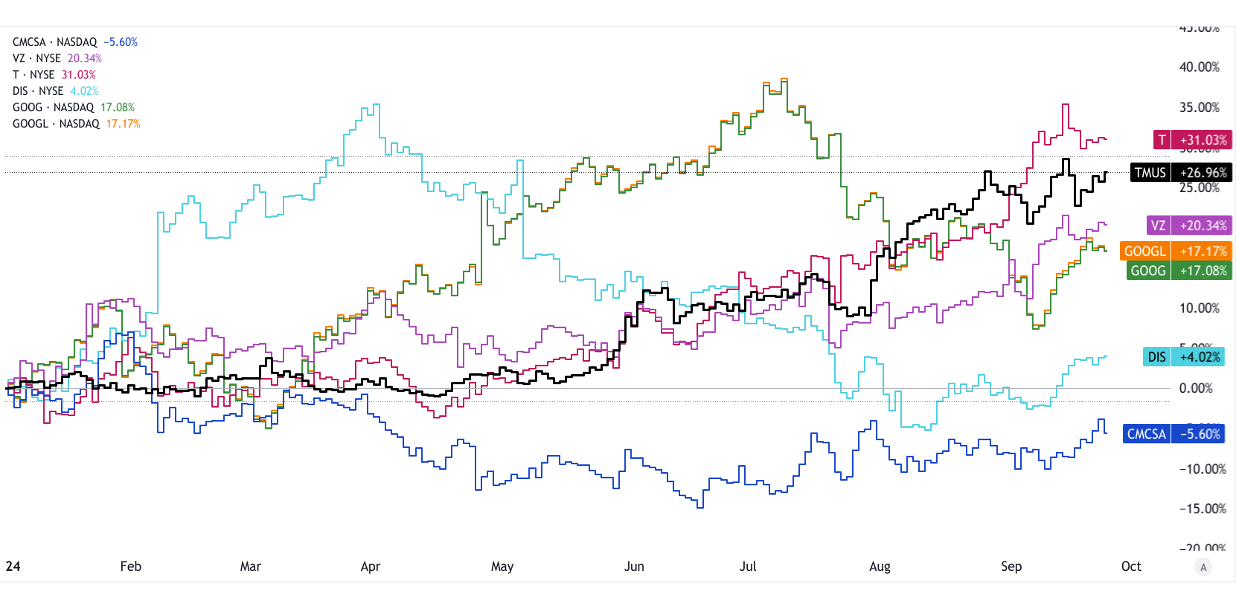

Comcast (CMCSA)

Comcast offers cable, broadband, and streaming services. The company is the largest cable TV provider in the U.S. and a significant player in internet services, with 32 million broadband subscribers.

In 2023, Comcast generated $121.57 billion in revenue, with broadband driving most of the growth. Its Peacock streaming service has seen a 38% increase in subscribers to 33 million. Future growth is expected from its broadband and streaming businesses.

Verizon (VZ)

Verizon is one of the largest U.S. telecom providers, serving 143 million wireless customers and holding over 30% of the U.S. wireless market.

Verizon's 5G infrastructure offers significant growth potential, particularly with expanding IoT services. Verizon's 2023 revenue was $133.97 billion, although challenges remain with competitive pricing pressures. The company’s strong dividend yield of 6.07% makes it attractive for income investors.

Source: statista.com [Wireless network operator subscriptions market share in the US]

AT&T (T)

AT&T is a major telecommunications provider, offering wireless and broadband services. Its 2023 revenue was $122.4 billion, with a significant portion from wireless services.

AT&T is focusing on its 5G expansion and fiber-optic broadband services. While its past debt issues have hurt investor confidence, the company's shift toward essential telecommunications infrastructure positions it for stable growth. Future growth is expected from 5G expansion and increasing demand for fiber broadband services.

Walt Disney (DIS)

Disney operates in media, entertainment, and streaming. Its Disney+ platform, with over 150 million subscribers, positions it as a leader in streaming.

Despite short-term challenges, Disney is focused on transitioning to a direct-to-consumer model. The company reported $88.9 billion in revenue in fiscal 2023, and long-term growth is driven by Disney+ and its content pipeline.

Alphabet (GOOG/GOOGL)

Alphabet dominates the global search engine market, with Google holding over 92% of the market share. It also operates YouTube and Google Cloud.

Alphabet’s revenue in 2023 was $307.4 billion, a 9% year-over-year increase. The company’s focus on AI, cloud computing, and advertising growth, combined with its +$2 trillion market cap, makes it a compelling long-term play.

Source: tradingview.com [YTD_Price_Return]

Meta Platforms (META)

Meta owns Facebook, Instagram, and WhatsApp, with a user base of nearly 3 billion across its platforms.

In 2023, Meta generated $134.9 billion in revenue. The company is aggressively investing in AI and virtual reality (Metaverse), while also expanding its ad business. Though facing challenges from regulatory scrutiny, its dominant position in social media provides significant revenue potential.

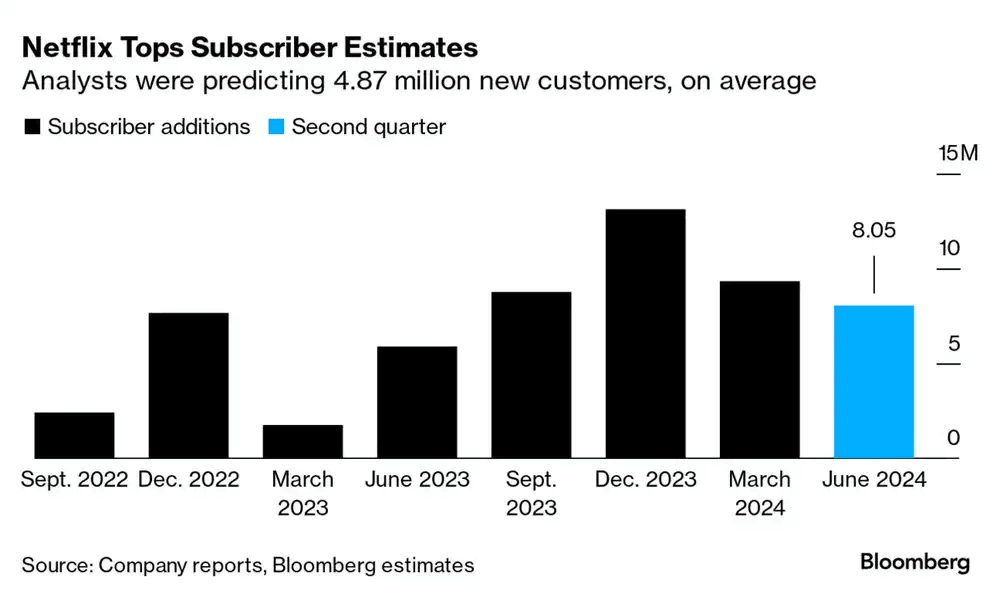

Netflix (NFLX)

Netflix is the largest streaming service worldwide, with over 270 million subscribers.

Netflix’s 2023 revenue is expected to hit $33.7 billion, driven by global expansion and a growing content library. Its advertising tier and password-sharing crackdown are expected to fuel future growth.

Source: voronoiapp.com

Broadcom (AVGO)

Broadcom provides semiconductors and infrastructure software for communication networks.

In fiscal 2023, Broadcom reported $35.8 billion in revenue, an 8% year-over-year increase. With its focus on network infrastructure and 5G-related technologies, it’s well-positioned for growth.

Cisco Systems (CSCO)

Cisco provides networking hardware, software, and telecommunications equipment.

Cisco reported $53.8 billion in revenue in fiscal 2024, with its focus on cybersecurity and 5G networks driving growth. The company’s strategic investments in cloud services also make it a strong long-term pick.

Qualcomm (QCOM)

Qualcomm is a leader in wireless technology, providing essential components for smartphones and 5G networks.

Qualcomm’s fiscal 2023 revenue was $35.8 billion. Its leadership in 5G and IoT technologies positions it for future growth as global demand for connectivity continues to rise.

Source: tradingview.com [YTD_Price_Return]

Communication Services Stocks (Taiwan Stocks)

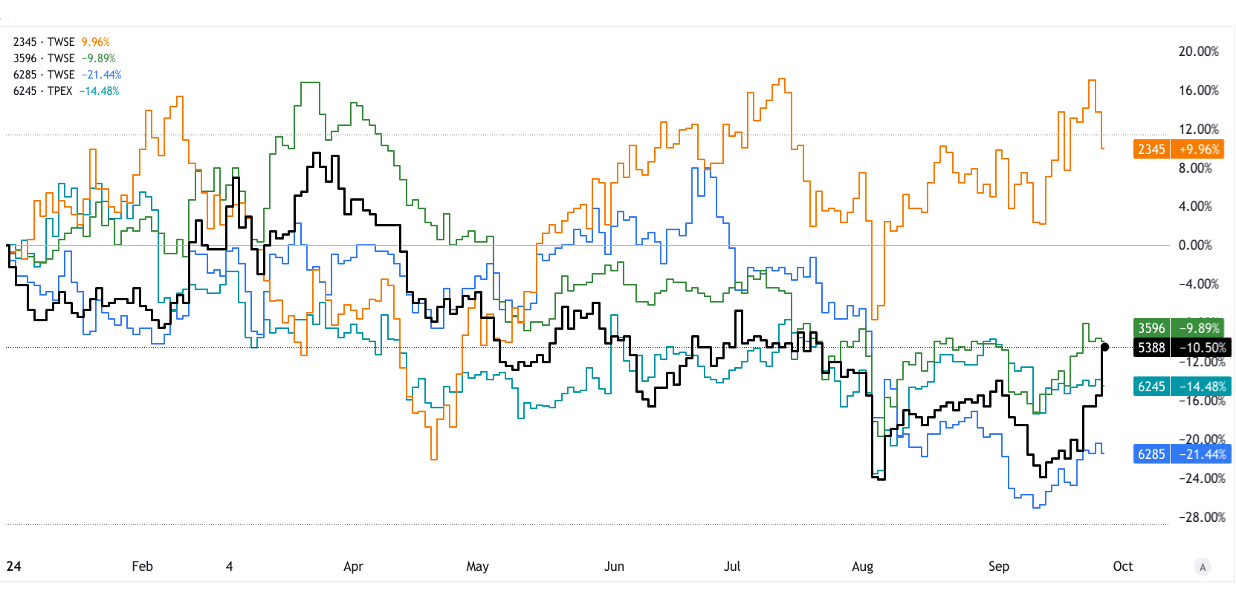

Sercomm Corp (5388)

Sercomm specializes in broadband networking equipment. The company holds a 5% share in global broadband equipment production.

Sercomm's 2023 revenue was NT$62.58 billion, reflecting solid demand for broadband infrastructure. With the global shift toward 5G and fiber optics, its equipment will remain essential for future network upgrades.

Accton Technology (2345)

Accton is a key player in cloud computing and data center infrastructure, with a market-leading position in network equipment manufacturing.

The company reported NT$84.19 billion in revenue in 2023, up from the previous year, driven by rising cloud demand. With its strong presence in data centers, Accton is poised for continued growth.

Arcadyan Technology (3596)

Arcadyan manufactures wireless networking products, including routers and modems, for major global brands.

The company’s 2023 revenue was NT$46.544 Billion, up from the previous year. With the ongoing shift to smart home devices and 5G, Arcadyan is expected to see significant demand growth.

Wistron NeWeb Corp (6285)

Wistron NeWeb specializes in the development of advanced wireless communication products and IoT solutions. Its product portfolio includes wireless routers, cellular modules, satellite communication devices, and connected car systems. It holds a strong position in the global wireless and telecommunications equipment market, catering to major international telecom companies.

In 2023, Wistron NeWeb reported annual revenues of approximately $3.50 billion with a year-over-year increase driven by the rising demand for 5G-related products and IoT infrastructure. The company’s future growth potential lies in the global adoption of 5G, connected vehicles, and IoT expansion. With partnerships with global leaders like Qualcomm and AT&T, it is well-positioned to capitalize on these trends.

Lanner Electronics (6245)

Lanner Electronics is a leader in network communication platforms, with a focus on cybersecurity, network appliances, and edge computing solutions for 5G networks. The company serves a broad range of sectors, including telecommunications, industrial automation, and transportation.

Lanner Electronics reported a revenue of $8.371 billion in 2023 based on rising demand for its edge computing solutions. Lanner is poised to benefit from the expansion of 5G networks and the growing importance of cybersecurity infrastructure. Future growth is expected to be driven by its investments in AI-based edge solutions and its expansion into autonomous vehicle technologies.

Source: tradingview.com [YTD_Price_Return]

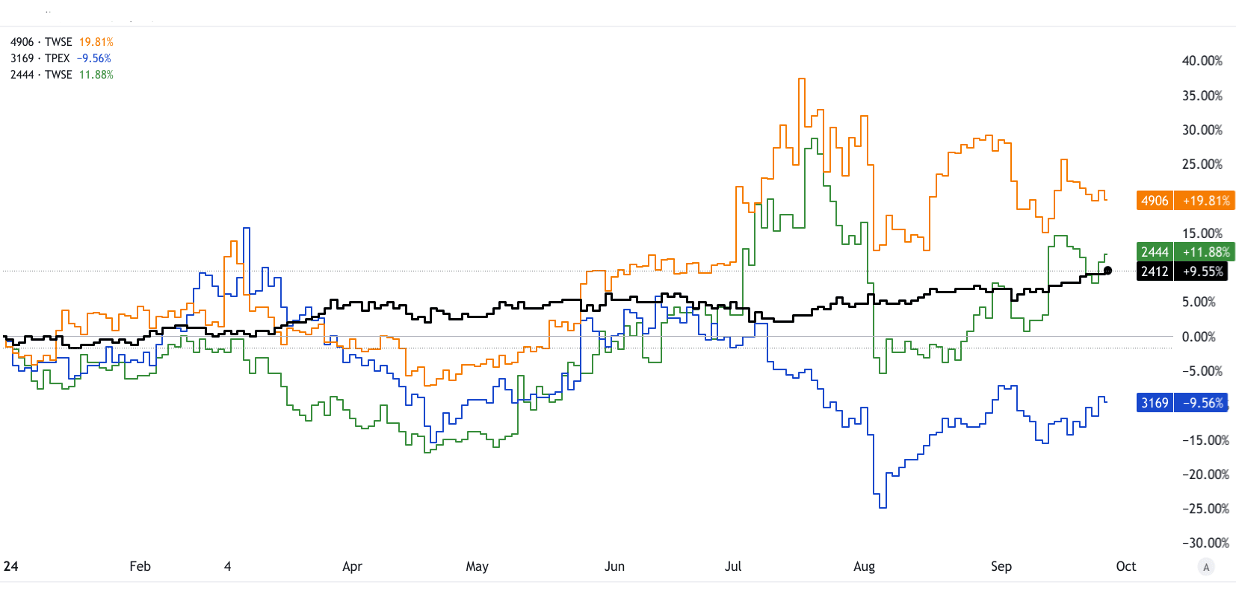

Chunghwa Telecom (2412)

Chunghwa Telecom dominates Taiwan's telecom industry, providing fixed-line, mobile, and broadband internet services. With over 12 million mobile users and 4.4 million broadband subscribers, it commands 80% of Taiwan’s broadband market. This strong market position makes it a leader in Taiwan’s telecommunications sector.

Chunghwa generated $7.02 Billion in 2024 TTM and is expanding its 5G and fiber-optic infrastructure. Its leadership in broadband ensures stable revenues. Future growth lies in smart city solutions and IoT integration. Offering a 4.2% dividend yield, it's attractive for income-seeking investors.

Gemtek Technology (4906)

Gemtek specializes in wireless broadband products, producing Wi-Fi routers, LTE/5G modems, and IoT devices for telecom operators and global manufacturers. This makes it a key player in the wireless communication industry, with a strong market position.

In 2023, Gemtek generated TWD 26.14 billion in revenue, benefiting from demand for 5G-ready devices. Positioned for growth through 5G expansion and smart home adoption, Gemtek’s diversification into IoT and partnerships with major brands offer significant long-term potential.

ASIX Electronics (3169)

ASIX Electronics provides networking IC solutions, including Ethernet controllers and USB-to-LAN adapters for industrial, automotive, and consumer markets. Its products are widely used in critical connectivity applications across industries, enhancing its market presence.

ASIX reported TWD 887.6 million in 2023 revenue with a rise driven by industrial Ethernet demand. Positioned to capitalize on global IoT and Industry 4.0 trends, ASIX’s focus on critical networking solutions, such as for autonomous driving, suggests strong future growth prospects.

AboCom Systems (2444)

AboCom Systems develops wireless networking products, like Wi-Fi modules and broadband routers, serving industries ranging from consumer electronics to industrial IoT. It plays a significant role in wireless technology, particularly for IoT applications.

AboCom earned $1.82 billion in 2023 revenue, driven by IoT demand, particularly in industrial and smart city applications. The company's strategy includes expanding its portfolio and growing its market presence in Asia, with plans to enter U.S. and European markets through strategic partnerships.

Source: tradingview.com [YTD_Price_Return]

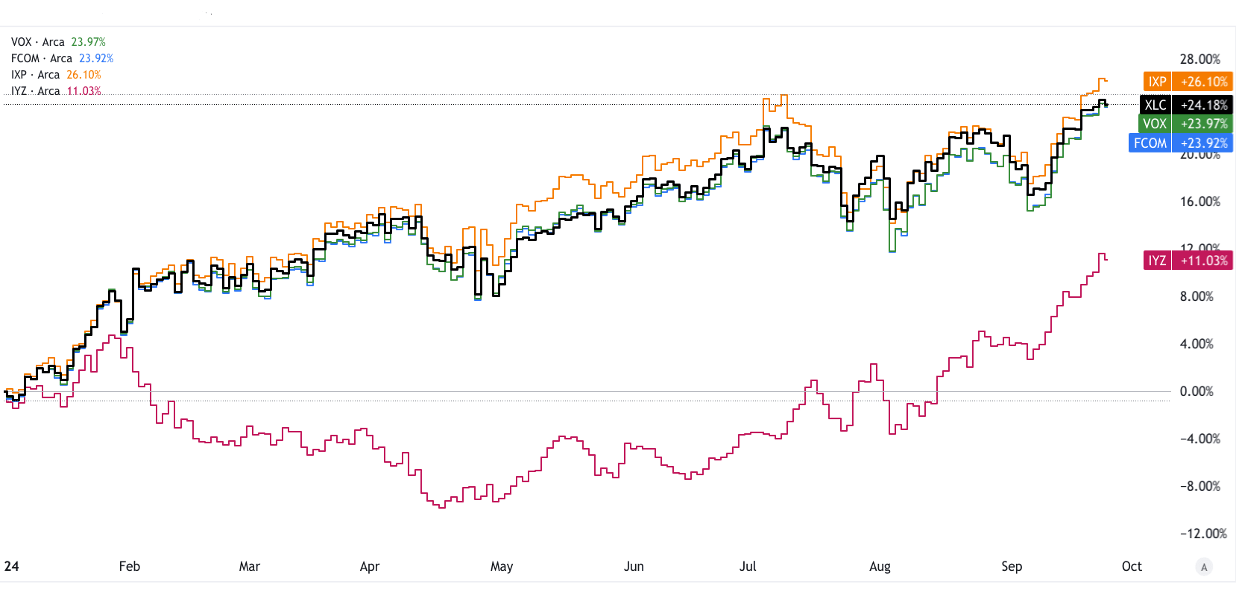

Communication Services Stocks ETFs

Communication Services Select Sector SPDR Fund (XLC)

● Holdings & Exposure: XLC has significant exposure to major players like Alphabet, Meta, and Netflix. It holds 26 stocks, with Alphabet and Meta comprising over 40% of the fund.

● Expense Ratio: 0.10%

● Price Return & Yield: XLC has returned 8.25% annually over the last five years, with a yield of 1%.

● Reasons to Invest: XLC offers diversified exposure to U.S. communication giants with high growth potential in streaming, social media, and 5G technologies.

Vanguard Communication Services ETF (VOX)

● Holdings & Exposure: VOX holds 113 stocks, including Alphabet, Meta, and Disney. Its top five holdings make up about 50% of the fund.

● Expense Ratio: 0.10%

● Price Return & Yield: VOX has returned 8.6% annually over the last five years, with a 0.90% yield.

● Reasons to Invest: VOX provides broad exposure to the U.S. communication sector, with a focus on internet services and digital media.

Fidelity MSCI Communication Services Index ETF (FCOM)

● Holdings & Exposure: FCOM holds 112 stocks, with large weightings in Alphabet, Meta, and Disney.

● Expense Ratio: 0.08%

● Price Return & Yield: FCOM has a five-year annualized return of 8.1%, with a 0.90% yield.

● Reasons to Invest: FCOM is a low-cost option for diversified exposure to the U.S. communication services sector, particularly tech-driven companies.

iShares Global Communication Services ETF (IXP)

The iShares Global Communication Services ETF (IXP) provides exposure to 71 communication companies, with top holdings in Alphabet (23.4%), Meta Platforms (15.3%), and Disney (4.9%). It has a 0.40% expense ratio and offers a 1% yield. IXP's 9% annualized return is driven by global demand for digital services, online advertising, and 5G growth.

iShares U.S. Telecommunications ETF (IYZ)

The iShares U.S. Telecommunications ETF (IYZ) targets U.S. telecom firms, holding 22 stocks with a focus on major players like Verizon (23.6%), AT&T (22.5%), and T-Mobile (10.1%). It offers a 2.04% dividend yield, making it appealing for income-focused investors. While IYZ emphasizes stability over high growth, the rise of 5G networks provides long-term sector growth potential. Expense ratio: 0.39%.

Source: tradingview.com [YTD_Price_Return]

III. Factors to Consider When Investing in Communication Services Stocks

Economic Conditions & Market Trends

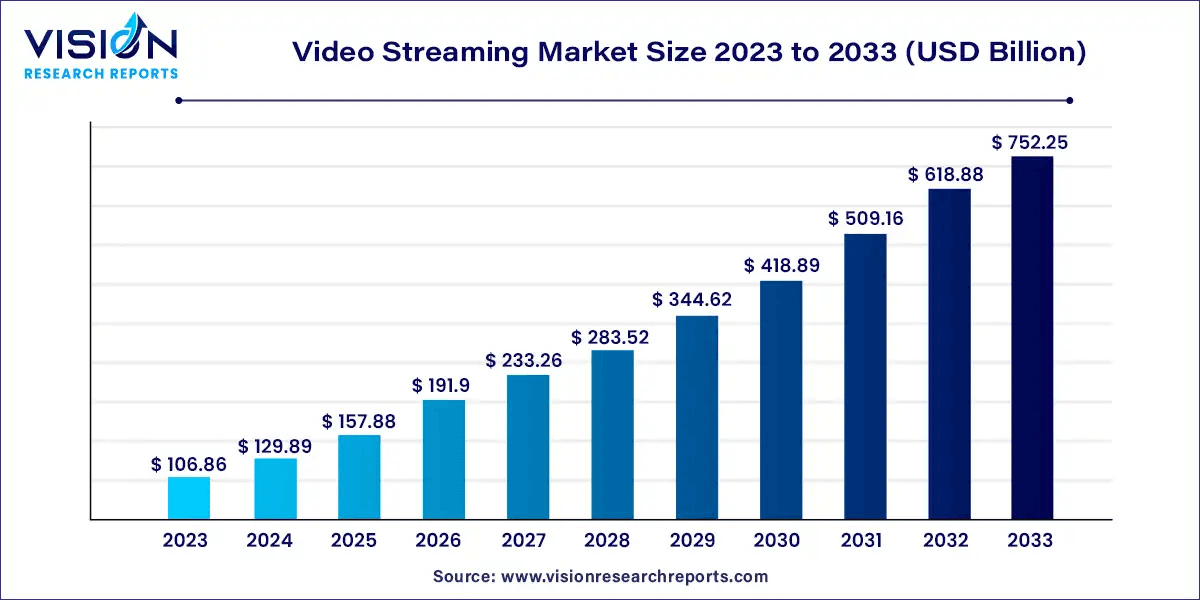

● Consumer Behavior: Shifts in consumer habits, such as the growing preference for digital media, streaming, and mobile usage, impact revenue sources. For example, the global streaming market is projected to grow rapidly, driving growth for companies like Netflix.

● Economic Sensitivity: During economic downturns, advertising revenues decline, impacting media companies. In contrast, telecom companies, with stable demand for mobile and broadband services, are more resilient.

Company Financial Health

● Revenue per User (ARPU): Higher ARPU reflects stronger profitability. For instance, Verizon's ARPU of $54.77 demonstrates pricing power in the competitive U.S. telecom market.

● Customer Base & Retention: Strong customer loyalty and low churn rates support stable revenues. T-Mobile's churn rate of 0.88% reflects its effective customer retention.

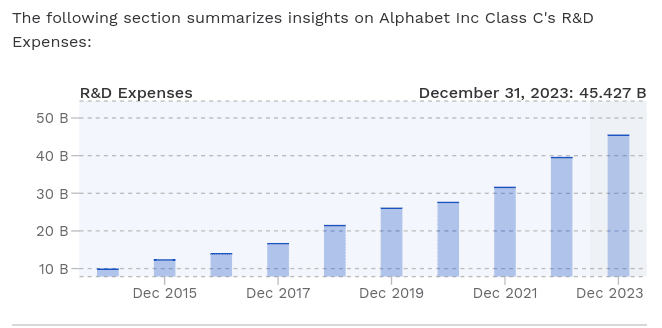

● Innovation and R&D: Companies heavily investing in 5G and internet services are better positioned for future growth. For example, Alphabet’s $45 billion R&D budget focuses on AI and digital services expansion.

Source: finbox.com

Regulations and Policies

● Spectrum Allocation: Limited availability and high costs of spectrum licenses impact telecom profits. The U.S. 5G spectrum auction raised $81 billion in 2021, raising costs for companies like AT&T.

● Data Privacy & Net Neutrality: Increasing regulatory scrutiny affects tech giants like Meta and Google, adding compliance costs and limiting data-driven advertising revenues.

IV. Communication Services Sector Trends and Communications Stocks Outlook

The communication services sector is undergoing rapid transformation, driven by technological innovation and evolving consumer behaviors. In 2023, the global communication services market was valued at $2.4 trillion and is projected to grow at a 6.1% CAGR through 2030. Key drivers include 5G adoption, increasing video streaming, and expanding digital advertising.

Regional Market Analysis

The U.S. leads with the highest revenue share, driven by companies like Alphabet (GOOG/GOOGL) and Meta Platforms (META). Asia-Pacific is the fastest-growing region, with nations like China and India adopting 5G at scale, supporting the growth of Chunghwa Telecom (2412) and other regional telecom players.

Source: marketdataforecast.com

Key Trends Shaping the Sector

● 5G: By 2025, global 5G connections are expected to reach 2.6 billion, with heavy investment from companies like T-Mobile (TMUS) and Verizon (VZ). This will fuel growth in areas like edge computing and autonomous vehicles, benefiting Lanner Electronics (6245).

● AI Integration: AI-driven services like automated customer support and content curation will drive digital ad revenue, with Alphabet and Meta leading innovation in this space.

● IoT and Remote Work: The increasing demand for IoT devices and remote connectivity is expanding, with Wistron NeWeb (6285) and Gemtek (4906) poised to benefit from manufacturing wireless communication products.

● Sustainability Initiatives: Telecoms are under pressure to reduce their carbon footprint, with companies like AT&T (T) committing to net-zero emissions by 2035.

Long-Term Outlook

The sector’s future is bright, with streaming services expected to grow at 21.55% CAGR through 2033, benefitting companies like Netflix (NFLX) and Walt Disney (DIS). Digital advertising, driven by increased mobile consumption, is projected to grow to $1,782 billion over the next ten years (2033). Overall, communication stocks will see sustained growth, especially those investing in 5G, streaming, and AI-driven services.

Source: visionresearchreports.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.