● Copper stocks offer strong long-term growth potential, driven by rising global demand, particularly in renewable energy and infrastructure sectors.

● Copper stocks are highly sensitive to copper price fluctuations, influenced by economic cycles and global supply-demand dynamics.

● Many major copper stocks, like Freeport-McMoRan and Southern Copper, are highly liquid, allowing for easier trading.

Source: maltemoney.com.br

I. What Are Copper Stocks

Copper stocks refer to companies involved in the exploration, extraction, and processing of copper, a key industrial metal with diverse applications. Copper’s conductivity makes it indispensable in electrical wiring and electronics, while its durability supports the construction sector, where it’s used in plumbing, roofing, and industrial machinery. Copper is also crucial to the renewable energy sector, with applications in solar panels, wind turbines, and electric vehicles. For example, an electric vehicle contains approximately 180 pounds of copper, three times that of a gasoline-powered car, underscoring copper’s growing demand.

Investing in copper stocks offers strong market fundamentals, supported by rising demand in the electrification and renewable energy transition. Copper is often viewed as a barometer for the global economy due to its widespread industrial use—its price typically rises during periods of economic expansion. For instance, global copper demand is projected to reach 35.1 million tonnes by 2034, a significant increase from 26.5 million tonnes in 2023. Copper stocks also present opportunities for high returns due to supply constraints; mining projects can take over a decade to come online.

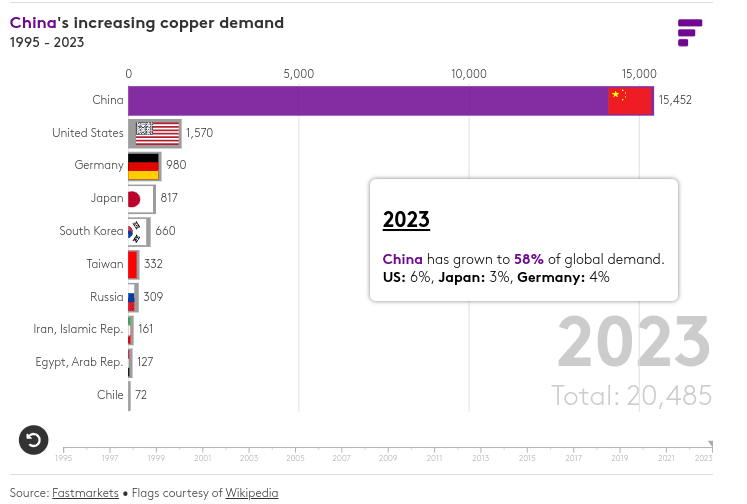

Source: fastmarkets.com

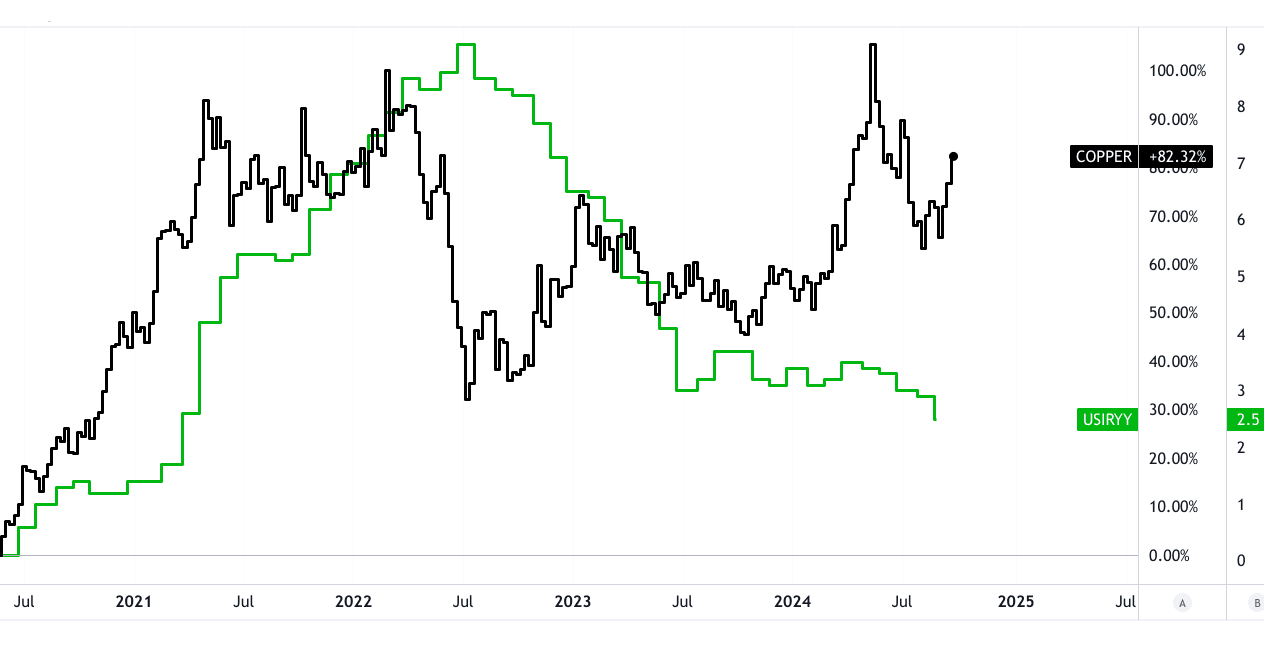

Additionally, copper is a hedge against inflation, with copper prices rising +80% since June 2020 amid inflationary pressures. Finally, copper has aligned with Environmental, Social, and Governance (ESG) investing trends, given its essential role in reducing carbon emissions through clean energy technologies.

Source: tradingview.com

II. Best Copper Stocks

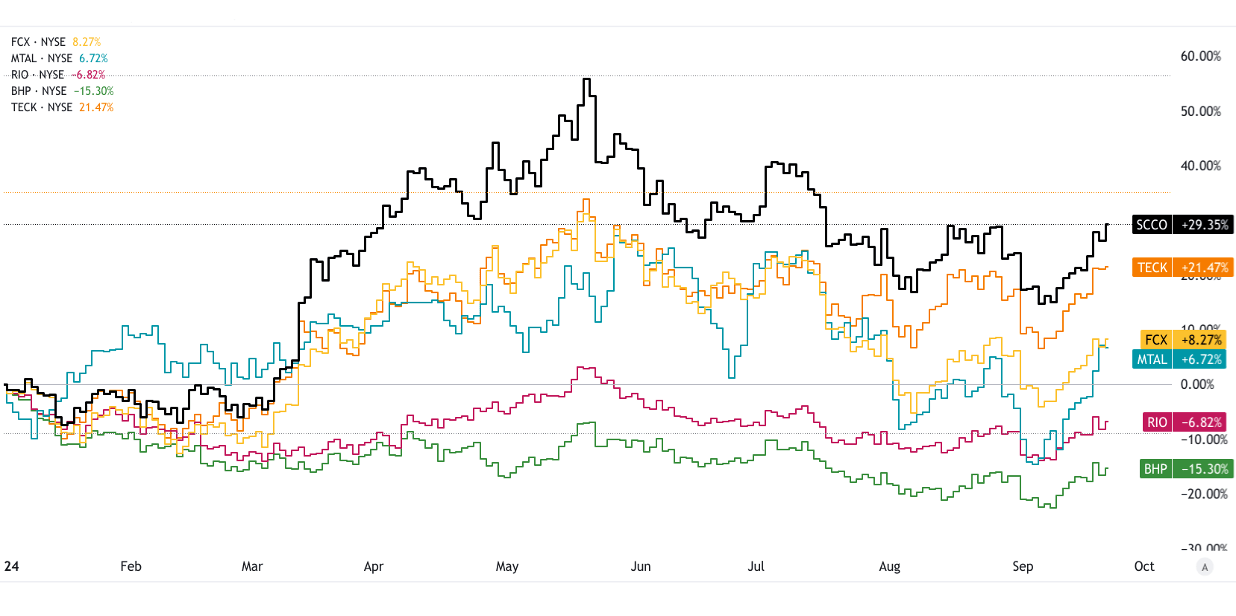

Copper Stocks & Copper Mining Stocks (US Stocks)

Southern Copper Corporation (SCCO)

Southern Copper Corporation is one of the largest copper mining companies globally, with significant operations in Mexico and Peru. As of 2023, it controls over 13% of the world’s copper reserves. Southern Copper is vertically integrated, managing all aspects of mining, smelting, and refining. In 2023, SCCO generated $9.9 billion in revenue, primarily from copper sales, and continues to benefit from elevated copper prices. With global copper demand set to rise, particularly in renewable energy and electric vehicle sectors, SCCO is well-positioned for future growth. The company also offers an attractive dividend yield of around 2.25%.

Investment Rationale: SCCO is a key player with extensive reserves and cost-efficient operations. Its stable dividend policy and focus on expanding production capacity in Peru make it a solid long-term investment.

Freeport-McMoRan Inc. (FCX)

Freeport-McMoRan is a leading copper producer, accounting for approximately 7% of global copper production. It operates large-scale mining operations in North and South America and Indonesia. FCX reported $22.85 billion in revenue for 2023, with the majority coming from copper production. Freeport is highly leveraged to copper prices, and its Grasberg mine in Indonesia is one of the largest copper and gold deposits globally. With a focus on sustainable production and reducing carbon emissions, FCX is appealing to ESG-conscious investors.

Investment Rationale: FCX’s strategic positioning in global markets, strong revenue growth of 12% in 2024 (YTD, TTM), and exposure to both copper and gold make it a compelling choice for investors seeking growth and diversification. Its robust free cash flow generation supports future dividend increases and share buybacks.

Metals Acquisition Limited (MTAL)

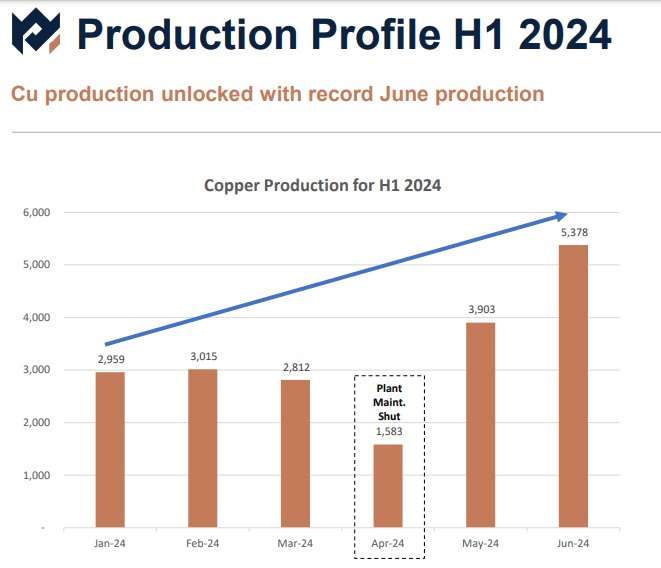

MTAL is a newer player in the copper mining space, focusing on acquiring copper and base metal assets. Its strategy revolves around exploiting undervalued assets in regions with favorable regulatory and environmental policies. The company’s recent acquisition of the CSA Copper Mine in Australia is expected to boost its production capabilities.

Investment Rationale: MTAL’s focus on acquisition-led growth and strategic copper assets offers potential upside as it expands its portfolio. Although smaller than SCCO or FCX, it targets opportunities in high-grade copper mining areas with substantial growth potential.

Source: metalsacquisition.com [H1 2024 Presentation]

Rio Tinto Group (RIO)

Rio Tinto is a diversified mining giant with substantial copper assets, including the Oyu Tolgoi mine in Mongolia, one of the world's largest known copper and gold deposits. The company generated $54 billion in revenue in 2023, with a significant portion coming from copper operations. Rio Tinto’s scale allows it to operate at lower costs, and its copper production is expected to grow as Oyu Tolgoi ramps up to full capacity.

Investment Rationale: Rio Tinto offers stability and growth potential, driven by its diversified portfolio and focus on expanding high-quality copper assets. Its commitment to sustainability also aligns well with ESG trends, and its dividend yield stands at 6.74%.

BHP Group Limited (BHP)

BHP is one of the world’s largest resource companies and a key player in copper production. Its Escondida mine in Chile is the world’s largest copper mine, producing over 1 million tons annually. In fiscal 2024, BHP generated $55.7 billion in revenue, with ~30% of that from copper. BHP's focus on expanding its copper portfolio, including projects like Spence Growth Option and South American ventures, indicates continued revenue growth potential.

Investment Rationale: BHP’s sheer scale, diversified resource base, and operational excellence make it a cornerstone stock for copper exposure. Its large-scale projects and strong free cash flow generation support its ability to weather commodity price volatility.

Teck Resources Limited (TECK)

Teck Resources is a major diversified miner based in Canada, with significant copper operations in the Americas. The company generated $11.3 billion in 2023, with copper accounting for ~30% of revenue. TECK's copper production is set to grow with its QB2 project in Chile, a massive copper mine expansion begin production in 2024.

Investment Rationale: TECK offers exposure to growing copper demand, driven by large-scale projects and an expanding portfolio. Its strong balance sheet and low-cost production make it a long-term growth story.

Source: tradingview.com [YTD_Price_Return]

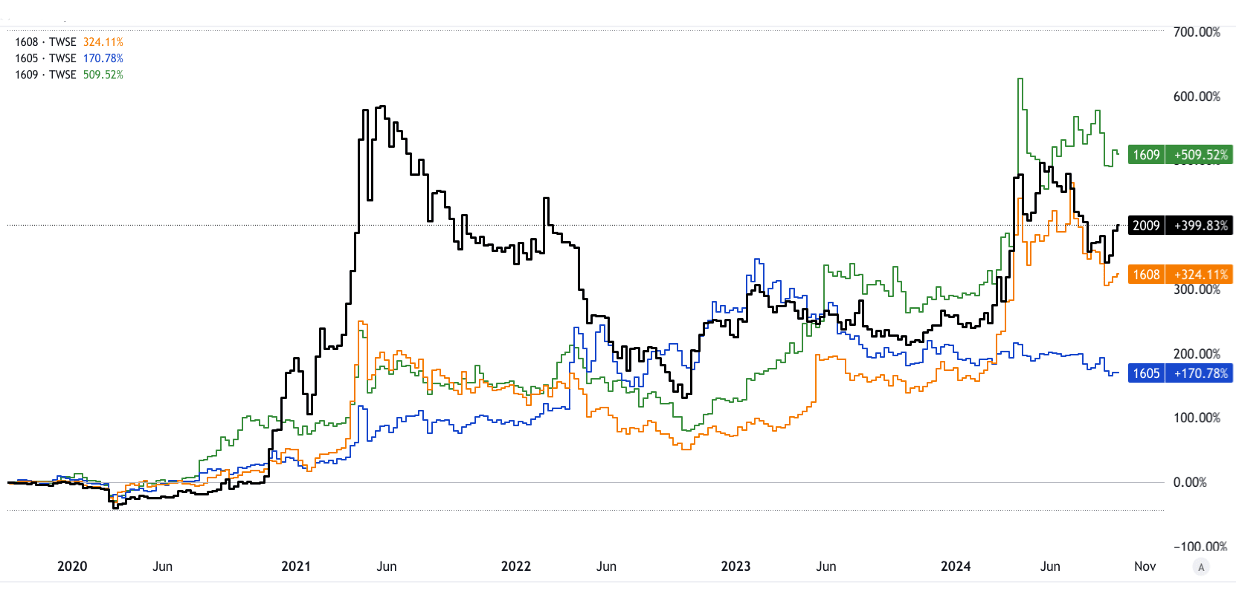

Copper Stocks (Taiwan Stocks)

First Copper Technology (2009)

First Copper Technology focuses on copper wire manufacturing and processing. It holds a significant market share in Taiwan’s copper products sector. The company reported TWD2.65 billion in revenue in 2023, driven by strong demand from the electronics and telecommunications sectors.

Investment Rationale: First Copper’s strategic market position and steady revenue growth from Taiwan’s burgeoning tech industry make it a strong investment for those seeking exposure to Asia’s copper market.

Hua Eng Wire & Cable (1608)

Hua Eng specializes in the production of copper wire and cable products used in power transmission and telecommunications. The company reported TWD9.76 billion in revenue in 2023. Its key advantage lies in its extensive distribution network across Taiwan and Southeast Asia.

Investment Rationale: Hua Eng’s stable market position and growing demand for infrastructure and 5G technology provide robust long-term growth potential.

Walsin Lihwa Corporation (1605)

Walsin Lihwa is a major player in the copper and specialty materials market, focusing on electrical wire, cable, and copper rod products. The company generated TWD190 billion in revenue in 2023. Walsin’s expansion into the semiconductor and renewable energy markets provides a strong growth trajectory.

Investment Rationale: Walsin’s broad exposure to high-growth industries, including semiconductors and clean energy, makes it an attractive long-term investment.

Ta Ya Electric Wire & Cable (1609)

Ta Ya focuses on manufacturing copper wire and cable for industrial applications, including power generation and distribution. The company earned TWD26.44 billion in revenue in 2023, benefiting from Taiwan’s growing renewable energy projects.

Investment Rationale: Ta Ya’s key position in Taiwan’s renewable energy sector and consistent revenue growth offer a promising investment thesis.

Source: tradingview.com [5Y_Price_Return]

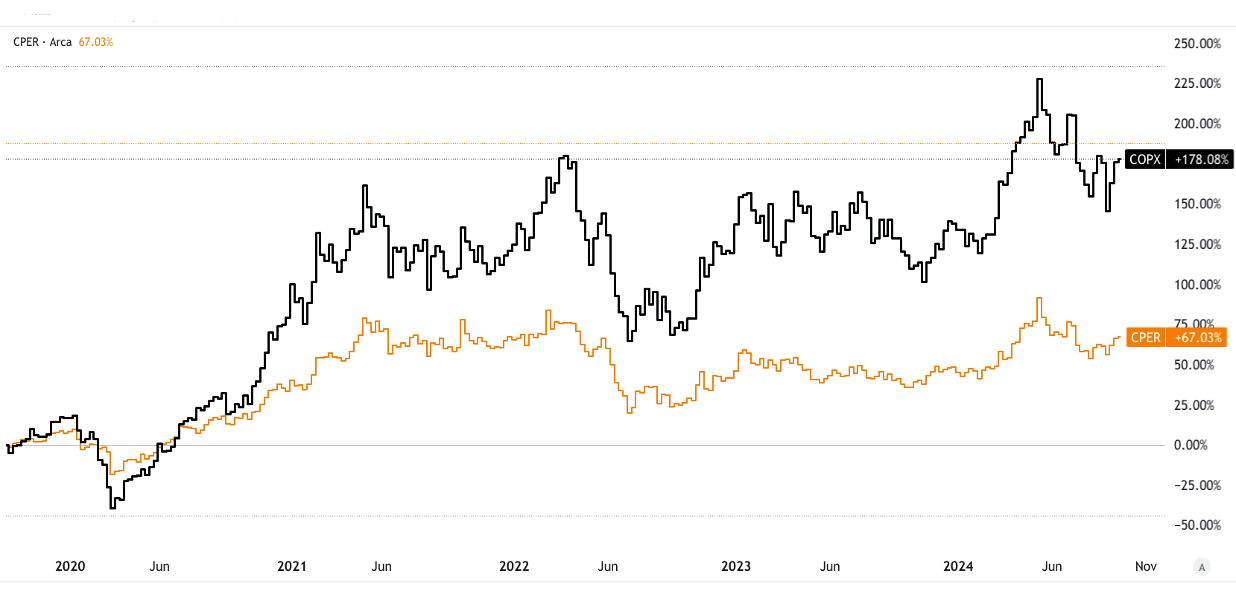

Best Copper Stocks ETFs

Global X Copper Miners ETF (COPX)

COPX offers exposure to a diversified basket of global copper mining stocks, including SCCO, FCX, and TECK. The ETF has an expense ratio of 0.65%, a total return of 25.23% YTD in 2024, and a dividend yield of 1.26%. It capitalizes on rising copper demand, driven by electrification and renewable energy investments.

Investment Rationale: COPX provides broad exposure to the copper sector with reduced individual stock risk. Its focus on top-tier miners with substantial production capacity makes it a compelling option for those seeking copper exposure without single-stock volatility.

United States Copper Index Fund (CPER)

CPER is designed to track the performance of the SummerHaven Copper Index. With an expense ratio of 1.04% and a total return of 17.23% YTD in 2024, CPER provides a pure play on copper prices. This ETF benefits directly from rising copper prices, offering a simple way to gain copper exposure.

Investment Rationale: CPER is suitable for investors seeking direct exposure to copper price movements, especially during periods of rising inflation or supply constraints.

Both COPX and CPER offer unique ways to gain exposure to copper, but COPX provides more diversified stock exposure, while CPER is more sensitive to commodity price movements.

Source: tradingview.com [5Y_Price_Return]

III. Factors to Consider When Investing in Copper Stocks

When investing in copper stocks, several factors must be considered due to the commodity's cyclical nature and its reliance on broader economic conditions:

Copper Price Volatility: Copper prices are highly volatile, influenced by global demand, particularly from industrial powerhouses like China, and macroeconomic trends. For example, copper prices surged 26% in 2021 but experienced significant fluctuations in subsequent years.

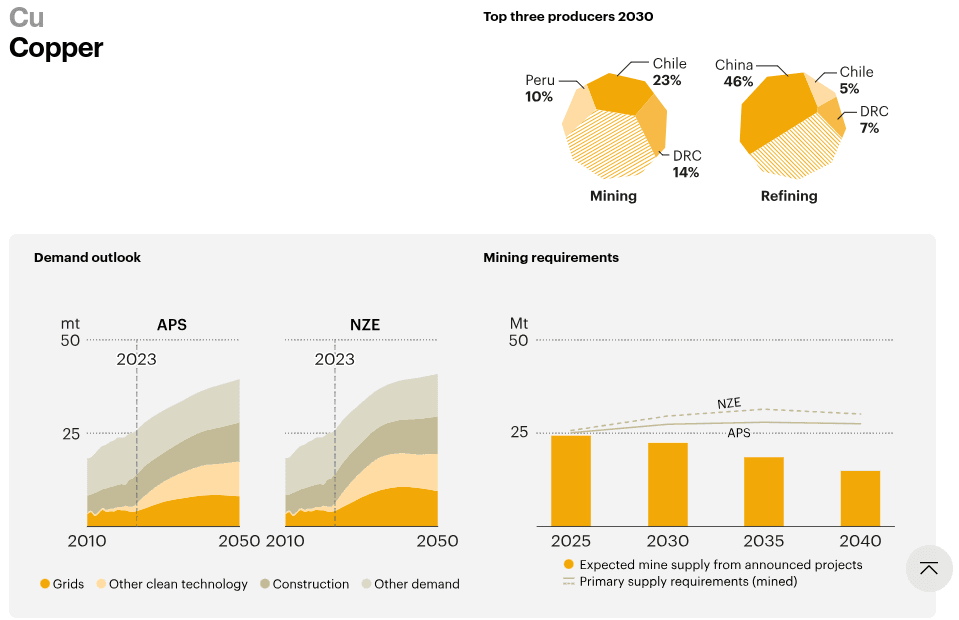

Economic Indicators: Copper demand correlates with economic growth. Indicators like GDP growth, industrial production, and construction activity directly impact copper prices. For instance, global copper consumption is projected to grow from 25.855 million tons in 2023 to 31.128 million tons by 2030, driven by infrastructure and renewable energy projects.

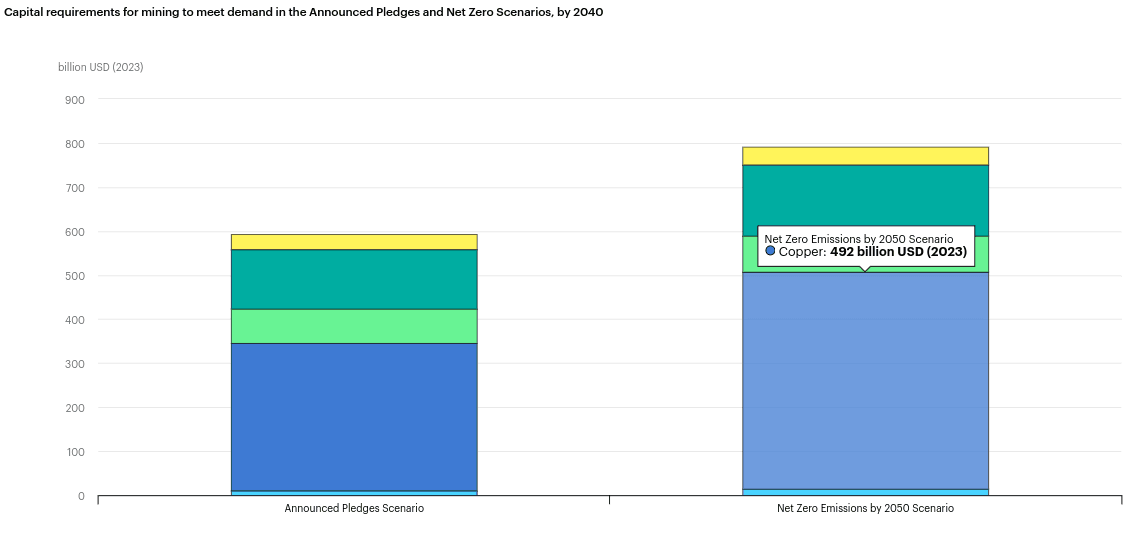

Source: iea.org

Market Demand and Supply Dynamics: Supply constraints, such as labor strikes or low-grade ores, can tighten the market. Conversely, an oversupply, driven by increased production, can depress prices.

Company Financial Health: Evaluating a company's balance sheet, production costs, and cash flow is critical. Southern Copper’s 2023 net income of $2.4 billion shows the importance of profitability amid price swings.

Regulations and Geopolitics: Mining companies face strict environmental regulations and geopolitical risks. For example, Chile and Peru, major copper producers, have been tightening mining regulations, impacting operational costs.

Supply Chain and Trade Policies: Global trade disruptions, such as U.S.-China tensions, could affect copper exports, adding uncertainty to stock performance.

Source: scmp.com

IV. Copper Industry Trends and Copper Stocks Outlook

The global copper market, valued at approximately $333.15 billion in 2024, is projected to grow at a CAGR of 5.11%, reaching $548.2 billion by 2034. Key drivers include increasing demand from Asia-Pacific, particularly China, the world’s largest copper consumer, and the transition to green energy technologies such as electric vehicles and renewable energy infrastructure. Electric vehicles alone are expected to increase copper demand by 1.7 million tons annually by 2030.

Source: iea.org

Future Trends: The shift to green energy will boost demand for copper, as renewable energy projects like solar and wind power require significantly more copper than conventional energy sources. Innovations in exploration and extraction, such as deeper mining techniques and automation, are expected to lower production costs. Additionally, copper recycling is gaining prominence as part of global sustainability efforts, offering a secondary supply source, which accounted for 35% of copper production in 2022.

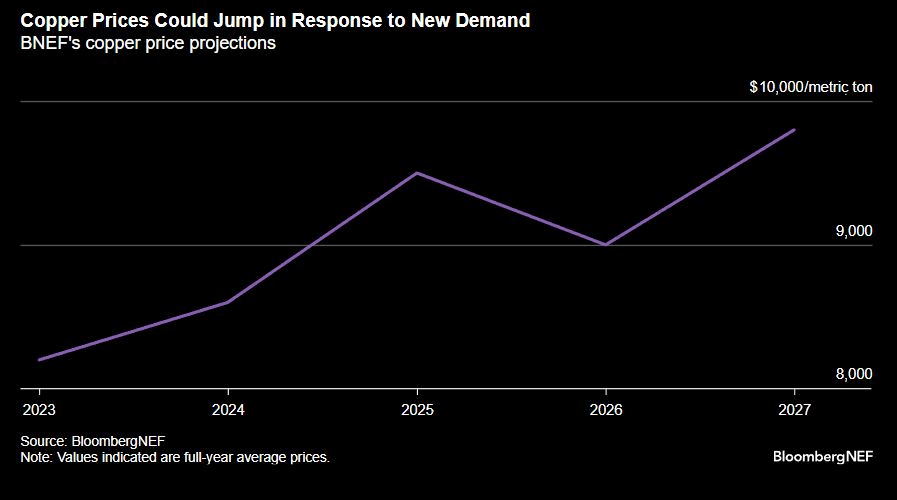

Outlook for Copper Stocks: The long-term outlook for copper stocks remains bullish due to rising demand across industries like infrastructure, electronics, and electric vehicles. Companies like Southern Copper (SCCO) and Freeport-McMoRan (FCX), which are heavily investing in expansion projects like Peru’s Tia Maria and Indonesia’s Grasberg mine, are well-positioned to benefit from this demand. Copper prices, which are forecast to stabilize at over $9,000 per ton by 2025, will support profitability for well-capitalized producers. As global supply struggles to keep pace with demand, copper stocks stand to gain from tight market conditions and favorable long-term fundamentals.

Source: bnef.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.