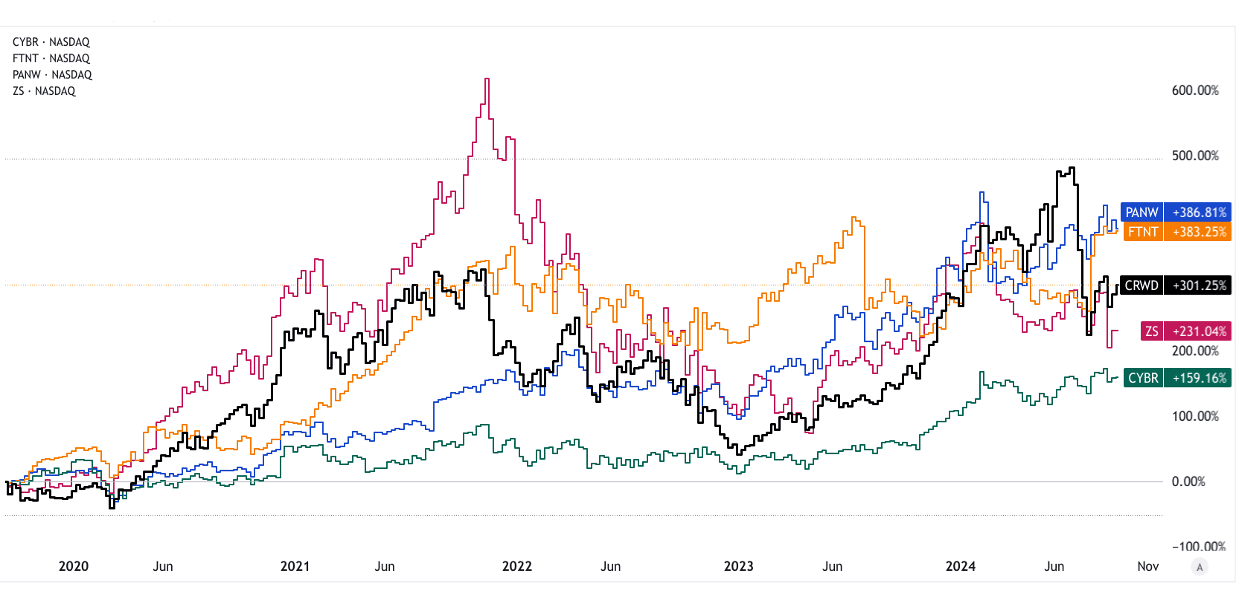

- Cybersecurity stocks are characterized by high return potential, as evidenced by CrowdStrike's 60% revenue growth year-over-year, driven by rising cyber threats.

- Cyber security stocks exhibit moderate to high volatility, with stock prices fluctuating significantly due to market reactions to cyber incidents and regulatory changes; for example, Fortinet's stock price has seen swings of up to 25% within a year.

- Lastly, cybersecurity stocks offer relatively high liquidity, with major companies like Palo Alto Networks and Cisco Systems frequently trading millions of shares daily, ensuring ease of entry and exit in the market.

Source: unsplash.com

I. What Are Cybersecurity Stocks?

Cybersecurity stocks represent shares in companies that develop, implement, or provide cybersecurity solutions. These solutions are designed to protect digital assets, including networks, endpoints, and cloud environments, from unauthorized access, cyber-attacks, and data breaches.

Types of Cybersecurity Stocks

- Network Security: These companies focus on securing the infrastructure of networks against breaches and attacks. Products may include firewalls, intrusion detection systems (IDS), and intrusion prevention systems (IPS). For instance, Cisco Systems (CSCO) and Palo Alto Networks (PANW) are notable players in this segment. Cisco’s Firepower Next-Generation Firewall and Palo Alto’s Next-Generation Firewall represent critical solutions in this space.

Source: companiesmarketcap.com

- Endpoint Security: Companies in this category provide solutions to protect individual devices such as laptops, smartphones, and tablets from threats. Products include antivirus software, anti-malware, and endpoint detection and response (EDR) tools. Examples include CrowdStrike Holdings (CRWD) and Symantec (now part of Broadcom Inc. [AVGO]). CrowdStrike’s Falcon platform is widely recognized for its advanced endpoint protection capabilities.

- Cloud Security: This sector deals with securing cloud-based infrastructures, applications, and data. Cloud security solutions are vital as organizations increasingly move their operations to the cloud. Companies like Zscaler (ZS) and Okta (OKTA) operate in this area. Zscaler’s cloud-native security platform and Okta’s identity and access management services are key offerings in this segment.

Why Invest in Cybersecurity Stocks?

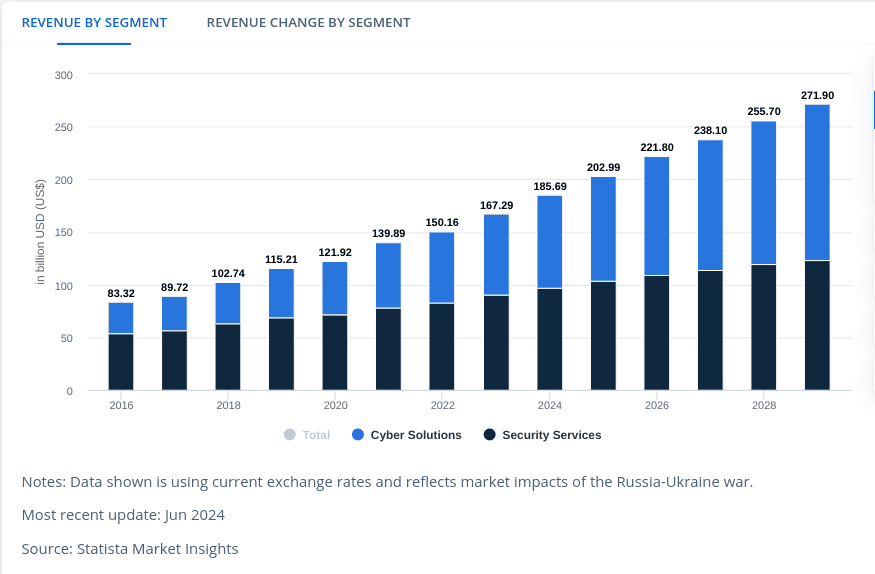

- Growing Demand for Cybersecurity Solutions: The surge in cyber threats, data breaches, and the rise of remote work has increased the need for robust cybersecurity measures. According to a report by Statista, global cybersecurity revenue may reach $272 billion by 2029, up from $186 billion in 2024. This rising demand is driven by the increasing frequency and sophistication of cyber-attacks, exemplified by the 2023 ransomware attack on the Colonial Pipeline, which highlighted the vulnerabilities in critical infrastructure.

[Cybersecurity Revenue - Worldwide]

Source: statista.com

- Technological Advancements: The integration of artificial intelligence (AI), machine learning (ML), and cloud computing into cybersecurity solutions enhances their effectiveness. AI and ML can predict and identify threats with greater accuracy, while cloud computing facilitates scalable and flexible security solutions. For instance, IBM’s QRadar Security Information and Event Management (SIEM) system leverages AI to analyze vast amounts of security data for anomalies.

- Resilience in Economic Downturns: Cybersecurity investments are often considered essential and non-discretionary, which contributes to their resilience during economic downturns. Unlike other sectors, cybersecurity tends to experience steady demand regardless of economic conditions. During the COVID-19 pandemic, for example, cybersecurity firms reported stable or even increased revenues due to the heightened focus on securing remote work environments.

II. Best Cybersecurity Stocks

Cybersecurity Stocks (US Stocks)

CrowdStrike (CRWD)

CrowdStrike Holdings leads in cloud-native endpoint security with a 13% market share in 2023. Strong growth is fueled by rising demand for advanced protection, a partnership with AWS, and new AI-driven features. The expanding market, projected to reach $40 billion by 2027, and CrowdStrike's consistent innovation and revenue growth make it a compelling investment choice.

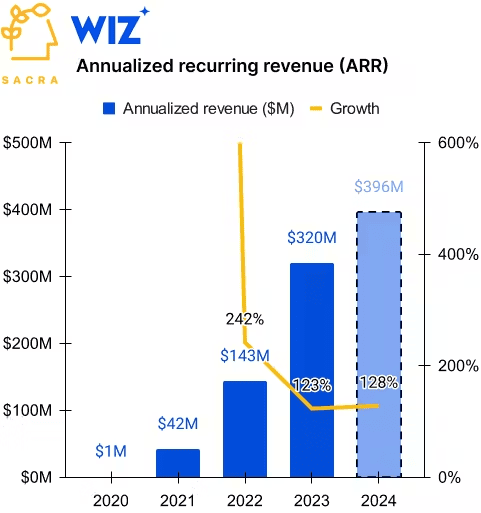

Wiz (Private)

Wiz is a fast-growing cloud security leader, competing with giants like Palo Alto Networks. It secured $300 million in Series D funding, valuing it at $10 billion. With strong market presence, integration with major cloud providers, and a booming cloud security market set to reach $60 billion by 2025, Wiz is well-positioned for growth.

Source: sacra.com

CyberArk Software (CYBR)

CyberArk is a leader in privileged access management (PAM) with a 20% market share. Its acquisition of Idaptive strengthens identity management capabilities. With consistent revenue growth and increasing regulatory demands, CyberArk is well-positioned for future expansion as the PAM market grows from $3.5 billion in 2021 to $7 billion by 2027.

Fortinet (FTNT)

Fortinet leads in network security, with a 20% firewall market share in 2023. Its innovations, such as the FortiGate 3000F series and Security Fabric architecture, have fueled growth. In 2023, revenue rose 23% to $4.4 billion, driven by increasing demand for advanced security solutions.

Palo Alto Networks (PANW)

Palo Alto Networks, holding 18% of the network security market, leads in next-gen firewalls and threat prevention. Its acquisition of Lacework boosts cloud security. With a 22% revenue rise in 2023 and an expanding cybersecurity market, Palo Alto is positioned for future growth.

Zscaler (ZS)

Zscaler, a cloud security leader, holds a significant market position with a projected 10% share by 2024. Its Zero Trust Exchange platform differentiates it in the industry. Strong financials, including 30% revenue growth in Q2 2024, and increasing cloud adoption make it a compelling investment.

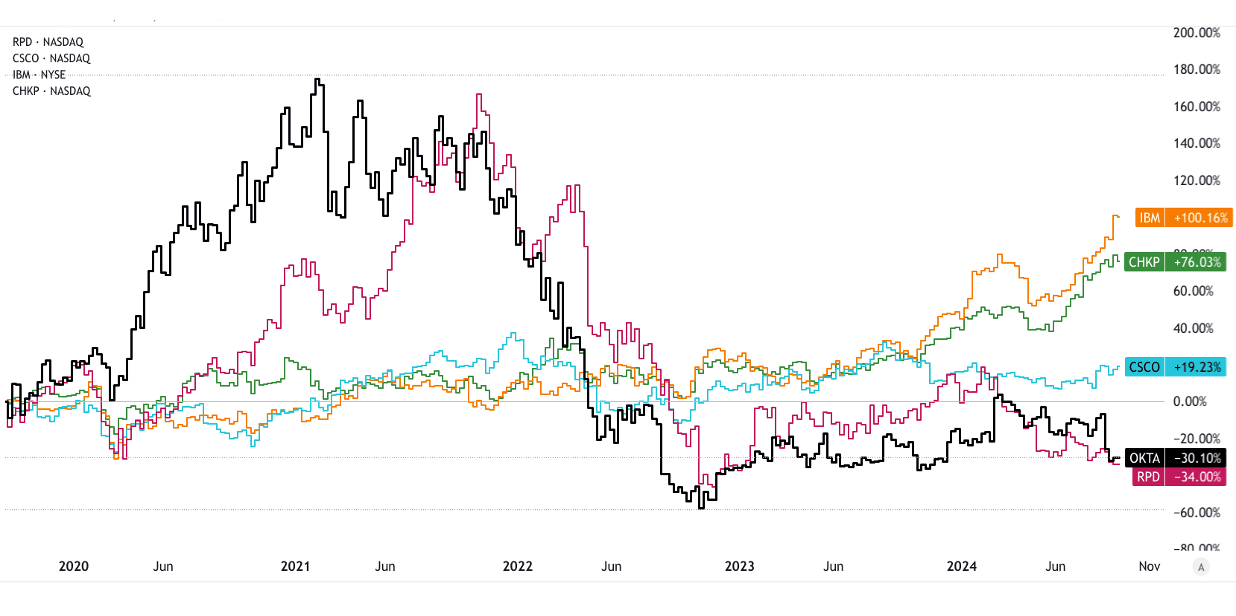

Source : tradingview.com [5Y_price_return]

Source : tradingview.com [5Y_price_return]

Okta (OKTA)

Okta, holding 15% of the IAM market in 2023, specializes in secure user authentication. Its acquisition of Auth0 strengthens its platform and expands market reach. With 28% YoY revenue growth in Q1 2024, Okta is poised for continued success.

Rapid7 (RPD)

Rapid7 provides security solutions like vulnerability management and incident detection, with a strong SIEM market presence. Its 9% revenue growth in Q2 2024 and innovative Insight Platform highlight strong financial performance and growth potential in the expanding cybersecurity market.

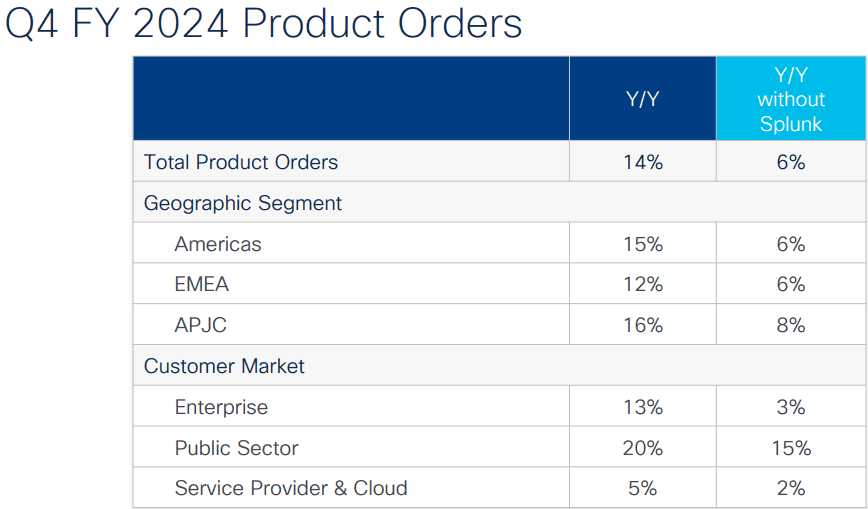

Cisco Systems (CSCO)

Cisco is a key player in network security, holding 15% market share in 2023. Its innovations like the Cisco Secure Firewall and AI integration, along with strategic acquisitions, bolster its growth. Rising demand for integrated security solutions strengthens its long-term investment potential.

Source: Q4 FY 2024 Presentation

IBM (International Business Machines) (IBM)

IBM, with a 12% market share in 2023, excels in cybersecurity through QRadar SIEM and identity management. Recent AI-driven upgrades and the Red Hat acquisition highlight its innovation. IBM’s strong performance and AI integration position it well for future growth amid rising cyber threats.

Check Point Software Technologies (CHKP)

Check Point Software Technologies, a network security leader with a 16% market share, offers a strong investment opportunity. Its recent innovations like Quantum Security Gateways and consistent revenue growth highlight its market strength and commitment to advanced threat prevention.

Source : tradingview.com [5Y_price_return]

Source : tradingview.com [5Y_price_return]

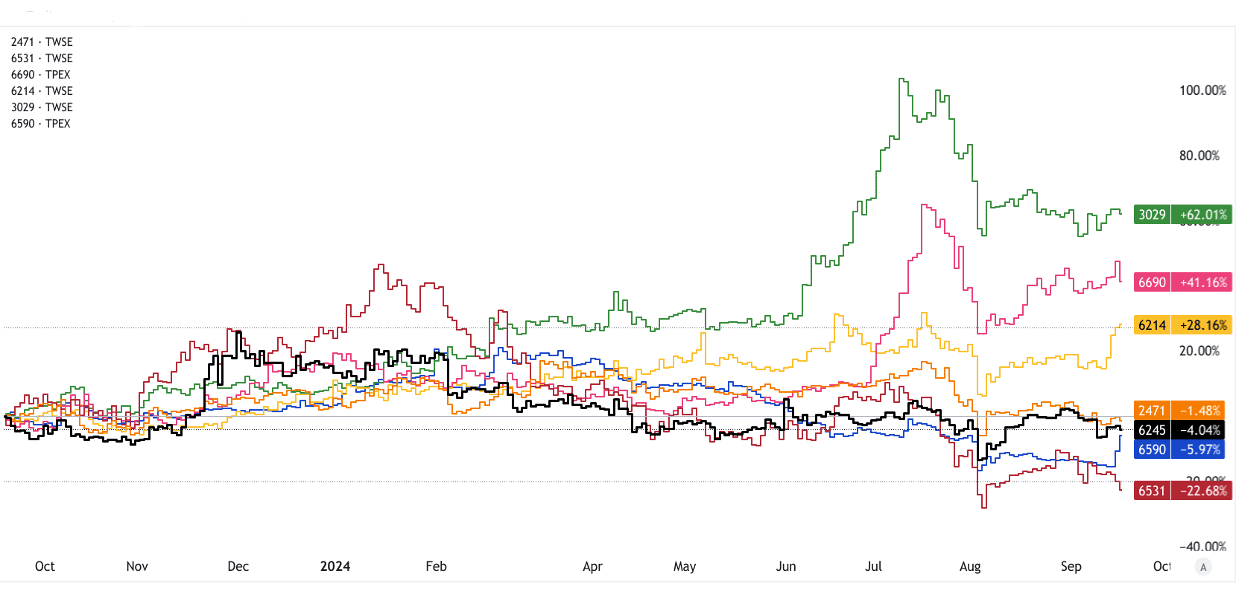

Cybersecurity Stocks (Taiwan Stocks)

Lanner Electronics (6245)

Lanner Electronics excels in network security hardware, with advancements and partnerships boosting growth. Its niche position and rising demand for robust security solutions enhance its investment appeal.

Ares International (2471)

Ares International, a modest player in Taiwan's enterprise security market, is poised for growth due to expanding services and international partnerships, driven by rising global demand for enterprise security solutions.

AP Memory Technology (6531)

AP Memory Technology, specializing in secure memory solutions, is well-positioned for growth due to its recent innovations and rising demand for secure storage, making it a promising investment opportunity.

Acer Cyber Security (6690)

Acer Cyber Security, part of Acer’s IT portfolio, is expanding in the cybersecurity market. Investing is promising due to Acer’s innovation focus and growing market demand for security solutions.

Systex Corporation (6214)

Systex Corporation, a key player in Taiwan's cybersecurity market, offers diverse IT services. Its expansion efforts and strategic partnerships, alongside rising local demand, make it a strong investment prospect.

Zero One Technology (3029)

Zero One Technology excels in IT security with a niche in cybersecurity. Its innovative solutions and recent service growth, coupled with a booming cybersecurity market, enhance its investment potential.

Provision (6590)

Provision specializes in cybersecurity hardware and software, with a niche in Taiwan’s financial and government sectors. Recent advancements and growing demand for specialized security solutions boost its growth potential. Increasing cyber threats further strengthen the investment case for Provision.

Source : tradingview.com [1Y_price_return]

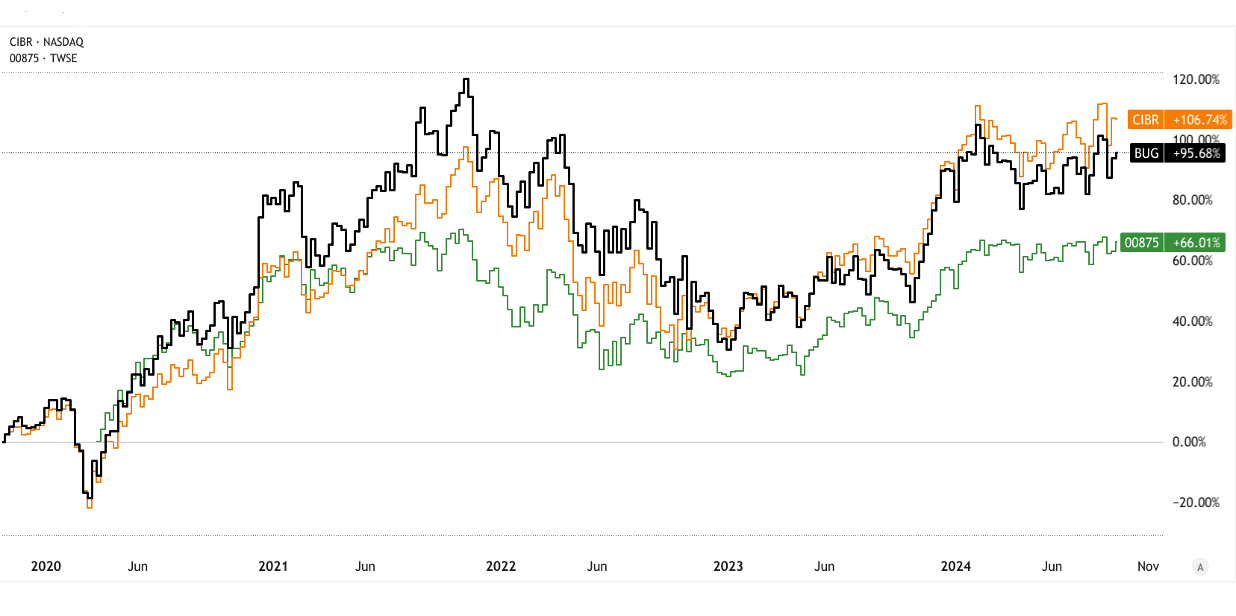

Best Cybersecurity ETFs

BUG (Global X Cybersecurity ETF)

The BUG ETF offers exposure to a diversified range of cybersecurity companies, aiming to capitalize on the sector's expected growth. Its broad portfolio mitigates individual stock risk, leveraging the rising global focus on cybersecurity. Key holdings include industry leaders like CrowdStrike and Palo Alto Networks, enhancing its growth potential.

CIBR (First Trust NASDAQ Cybersecurity ETF)

The CIBR ETF targets cybersecurity firms, tracking the NASDAQ CTA Cybersecurity Index. It blends established and emerging players, offering diversified exposure and reduced stock volatility. With strong performance and sector growth, it's positioned to benefit from the expanding cybersecurity market. Recent highlights include top holdings’ robust gains and broad sector capture.

Cathay Cyber Security ETF (00875)

The Cathay Cyber Security ETF targets global and Taiwanese cybersecurity stocks, reflecting the rising demand for digital security. It provides investors with exposure to both local and international firms, capitalizing on the increasing need for advanced security solutions, which enhances its growth potential and investment attractiveness.

Source : tradingview.com [5Y_price_return]

Source : tradingview.com [5Y_price_return]

III. Factors to Consider When Investing in Cybersecurity Stocks

Market Trends and Growth Potential

Investing in cybersecurity stocks requires an understanding of key market trends and growth drivers:

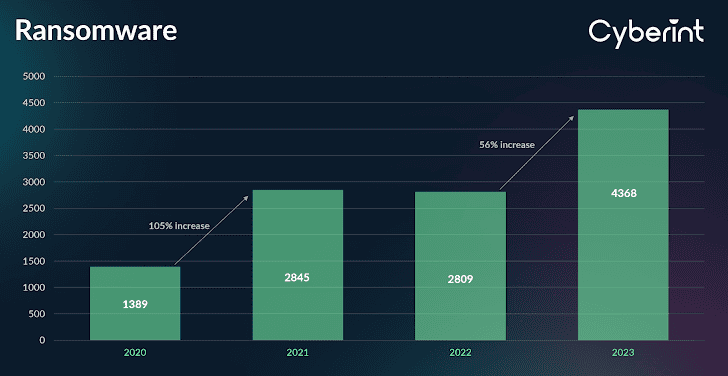

- Rising Ransomware Attacks: Ransomware attacks have surged, with a 14% increase in reported incidents from 2022 to 2023, according to Cybersecurity Ventures. This growing threat drives demand for advanced security solutions, presenting investment opportunities in companies specializing in threat prevention and response.

Source: thehackernews.com

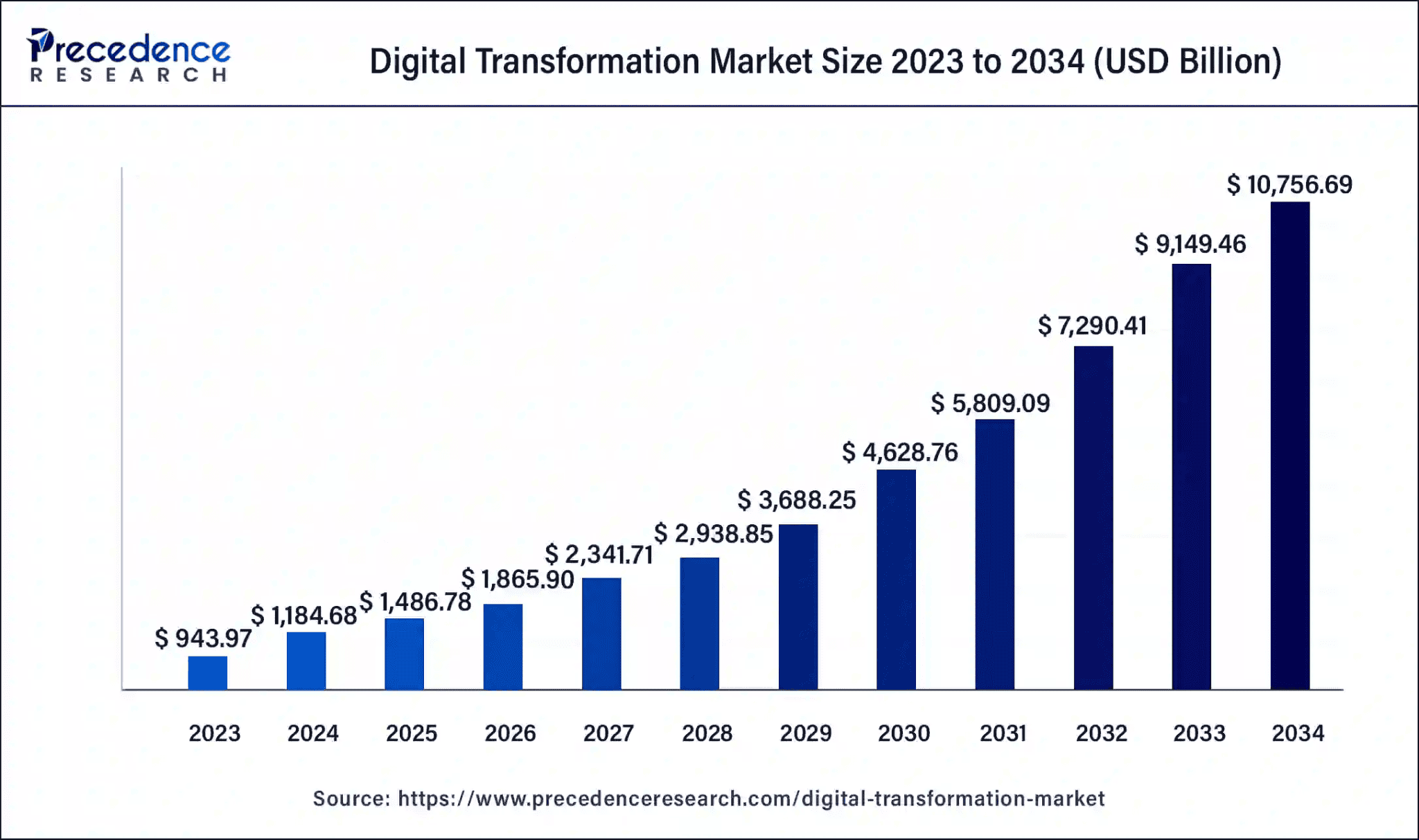

- Enterprise Digital Transformation: As businesses increasingly adopt digital technologies, the need for cybersecurity solutions has expanded. The global digital transformation market is projected to grow from $1.2 trillion in 2024 to $10.8 trillion by 2034, according to IDC. This trend creates opportunities for companies offering robust security measures for cloud environments, remote work, and IoT devices.

Source: precedenceresearch.com

- Increased Regulatory Pressure: Stricter regulations, such as the GDPR in Europe and CCPA in California, impose significant compliance requirements on organizations. The global market for compliance software, including cybersecurity solutions, is expected to grow from $15 billion in 2022 to $30 billion by 2026, according to Market Research Future. This regulatory environment bolsters demand for cybersecurity investments.

Company Fundamentals

Evaluating a cybersecurity company's fundamentals is crucial:

- Revenue Growth & Profitability: Strong revenue growth and profitability are indicators of a company’s market strength. For instance, CrowdStrike reported a 32% year-over-year increase in revenue in Q2 fiscal 2025, showcasing its rapid growth. Similarly, Palo Alto Networks saw a 12% YoY revenue increase in Q4 fiscal 2024, reflecting robust financial health.

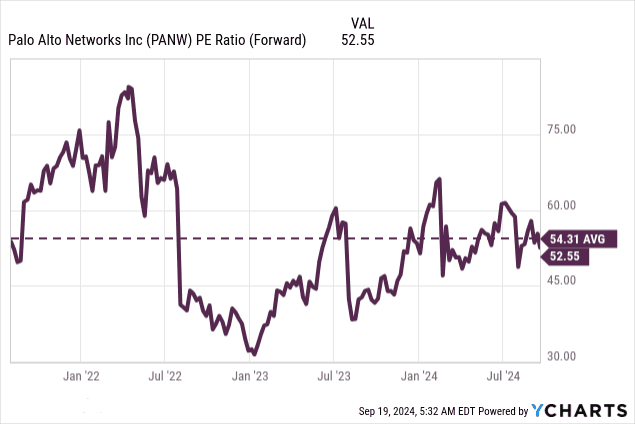

- Valuation: Assessing valuation is critical to ensure a fair investment. The Price-to-Earnings (P/E) ratio provides insight into a company's valuation relative to its earnings. For example, as of September 2024, Palo Alto Networks trades at a P/E ratio of 53, indicating high growth expectations.

Source: Ycharts.com

- Innovation and Technological Leadership: Companies leading in innovation are better positioned for long-term success. Zscaler's advancements in its Zero Trust Exchange platform and CrowdStrike's AI-driven Falcon platform exemplify technological leadership that enhances their competitive edge.

- Customer Base and Partnerships: A diverse and high-profile customer base, along with strategic partnerships, can indicate a company’s market strength. For instance, Okta’s partnerships with major tech firms like Microsoft and its broad enterprise customer base underscore its strong market position.

Market Volatility and Technological Obsolescence

- Market Volatility: The cybersecurity sector can be subject to market volatility driven by broader economic conditions or sector-specific news. For example, stock prices of cybersecurity firms may fluctuate with changes in regulatory policies or major cyber incidents.

- Technological Obsolescence: Rapid technological advancements pose a risk of obsolescence. Companies must continually innovate to stay ahead of emerging threats. Investing in firms with a strong track record of adapting to new technologies and threats, like Fortinet with its latest FortiGate series, can mitigate this risk.

IV. Cybersecurity Industry Trends and Cybersecurity Stocks Outlook

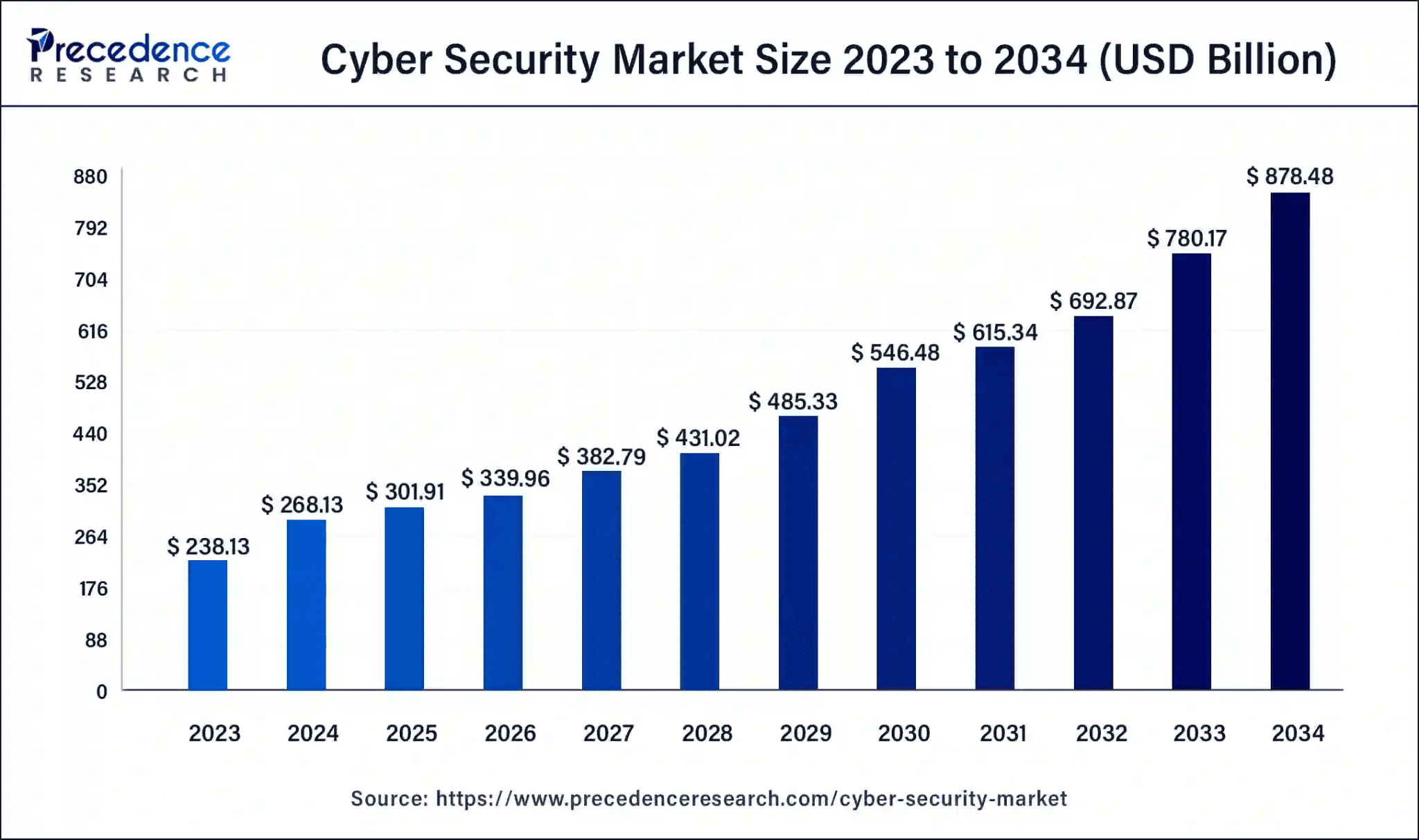

As per precedenceresearch.com, the global cybersecurity market is valued at approximately $238 billion. This market is projected to grow at a compound annual growth rate (CAGR) of about 13% from 2024, reaching an estimated $878 billion by 2034.

Source: precedenceresearch.com

Regional Market Analysis

- North America: Dominates the cybersecurity market, accounting for nearly 40% of the global market share. The U.S. is a major driver due to its large number of enterprises and high rate of cyber incidents. The market in North America is expected to grow at a CAGR of 11% through 2028.

- Europe: Holds around 25% of the market share, with significant growth driven by increasing regulatory requirements like GDPR. The European market is projected to grow at a CAGR of 13% from 2024 to 2028.

- Asia-Pacific: Represents a rapidly growing market, driven by rising digital transformation and increasing cyber threats in countries like China and India. The region’s market is expected to grow at a robust CAGR of 14% during the forecast period.

Future Trends

- AI-Driven Cybersecurity: Artificial Intelligence (AI) is increasingly being integrated into cybersecurity solutions to enhance threat detection and response. AI can analyze vast amounts of data to identify anomalies and predict potential threats more accurately. Companies like CrowdStrike are leveraging AI to enhance their endpoint protection capabilities, positioning themselves at the forefront of this trend.

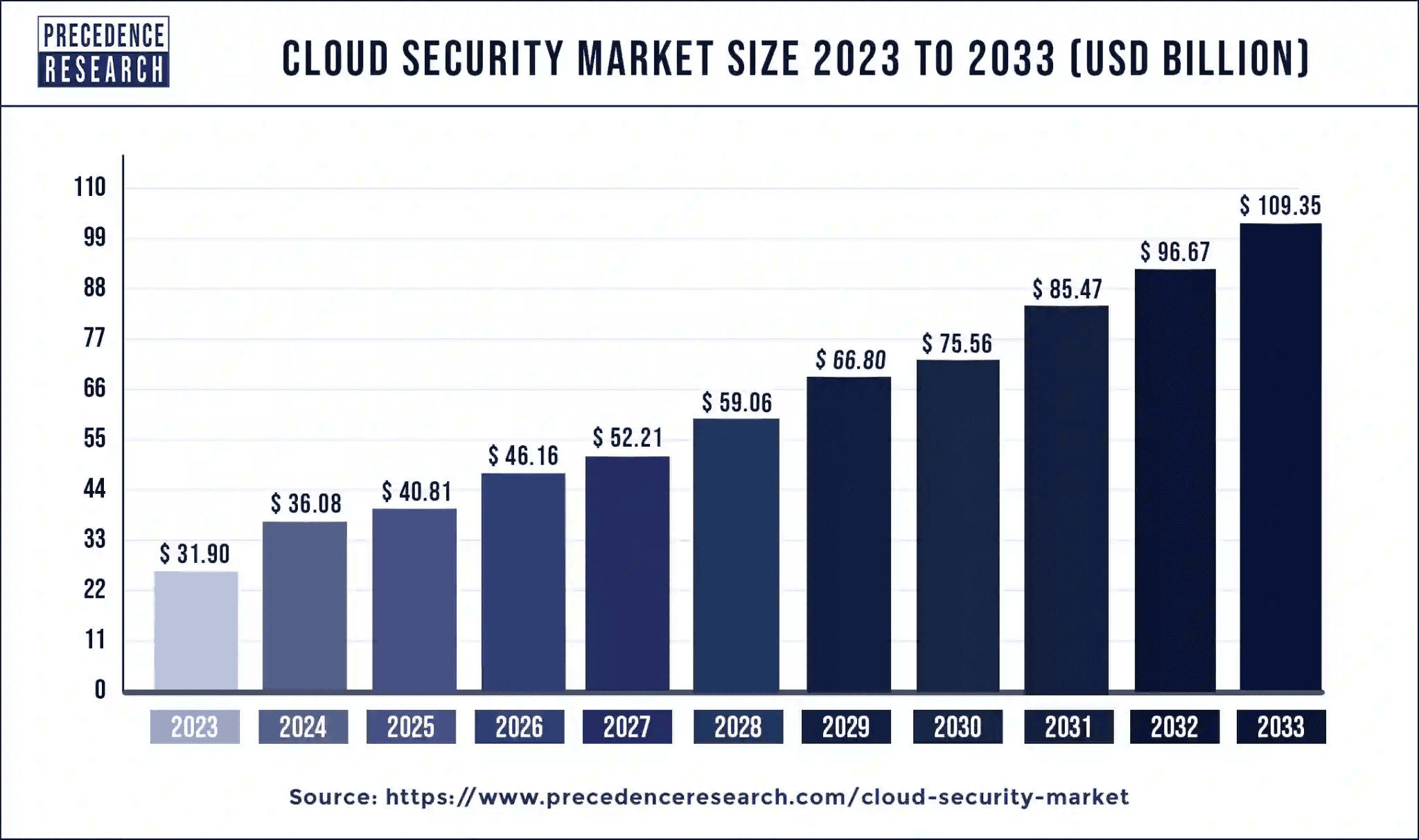

- Cloud Adoption and Digital Ecosystems: As organizations continue to migrate to cloud environments, the need for cloud-specific security solutions grows. Cloud security is anticipated to be a major growth area, with the cloud security market expected to reach over $100 billion by 2033. Companies such as Zscaler and Palo Alto Networks are capitalizing on this trend by offering comprehensive cloud security solutions.

Source: precedenceresearch.com

- Zero-Trust Architecture: Zero-Trust models, which operate on the principle of never trust, always verify, are gaining traction. This approach is becoming crucial in protecting against sophisticated cyber threats. Palo Alto Networks and Okta are investing heavily in Zero-Trust solutions to address the evolving threat landscape.

Long-Term Outlook for Cybersecurity Stocks

- Strong Market Performance: Cybersecurity stocks are expected to maintain strong performance due to the continuous rise in cyber threats and the increasing need for sophisticated security solutions. Stocks such as Fortinet, CrowdStrike, and Palo Alto Networks have demonstrated strong revenue growth and technological leadership, indicating a favorable outlook.

- Talent Gap: The industry faces a significant talent shortage, with an estimated 3.5 million unfilled cybersecurity positions globally as of 2024, according to (ISC). This talent gap could drive demand for more advanced and automated solutions, benefitting leading cybersecurity companies that can adapt and scale their offerings efficiently.