● Defense stocks offer stable returns, often fueled by long-term government contracts.

● Defense stocks typically experience lower volatility due to consistent government spending, even during economic downturns.

● However, defense stocks may have limited explosive growth potential, as their profitability is tied to government budgets and contract cycles.

Source: wikimedia.org

I. What Are Defense Stocks?

Defense stocks represent shares in companies that provide products and services to the defense and security sectors. These firms develop technologies, manufacture equipment, and offer services essential for military operations and national security. Defense stocks can be categorized into several key areas:

● Aerospace and Aviation: This includes companies that manufacture military aircraft, drones, and helicopters.

● Shipbuilding and Naval Systems: Firms that build warships, submarines, and naval defense systems.

● Defense Electronics and IT: Companies providing communication systems, radars, and cybersecurity solutions.

● Missiles and Munitions: These companies specialize in weapons, from small arms to advanced missile systems.

● Space and Satellite Systems: Firms developing military-grade satellites for surveillance and communication.

● Autonomous Systems and Robotics: Companies involved in creating unmanned vehicles, robots, and AI-driven defense solutions.

Why Invest in Defense Stocks?

Government Contracts

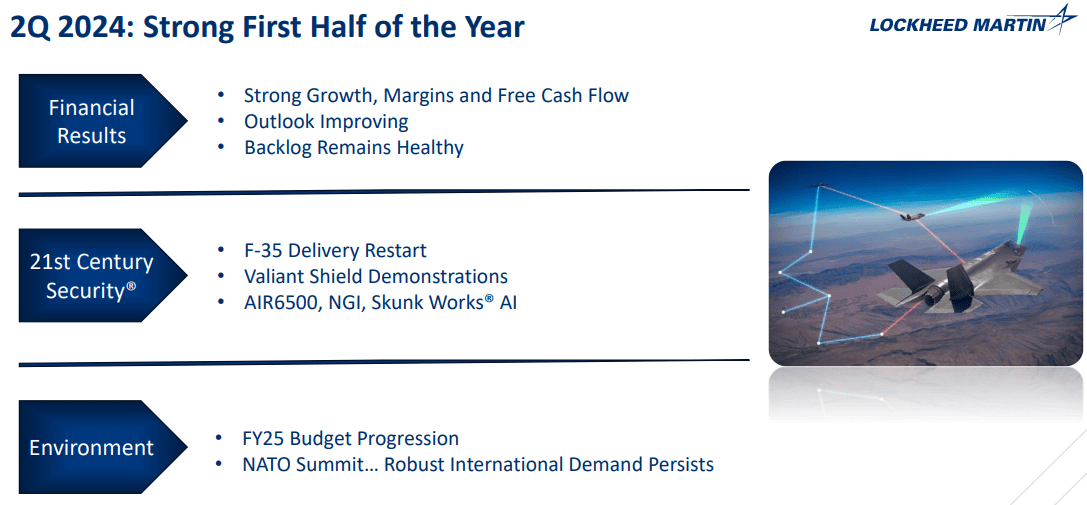

One of the primary reasons to invest in defense stocks is their reliable revenue streams due to long-term government contracts. Governments are the largest clients for defense companies, with contracts often lasting several years. This ensures predictable cash flows and less volatility in earnings compared to other industries. For example, Lockheed Martin benefits from U.S. military contracts for F-35 fighter jets, providing steady revenue.

Additionally, the defense sector has high barriers to entry due to stringent government regulations, complex technology requirements, and significant capital investments. This limits competition, allowing established defense companies to dominate the market. Government spending priorities also favor consistent funding, especially during periods of geopolitical uncertainty, ensuring defense budgets remain a priority.

Source: LMT Q2 Presentation

Technological Innovation

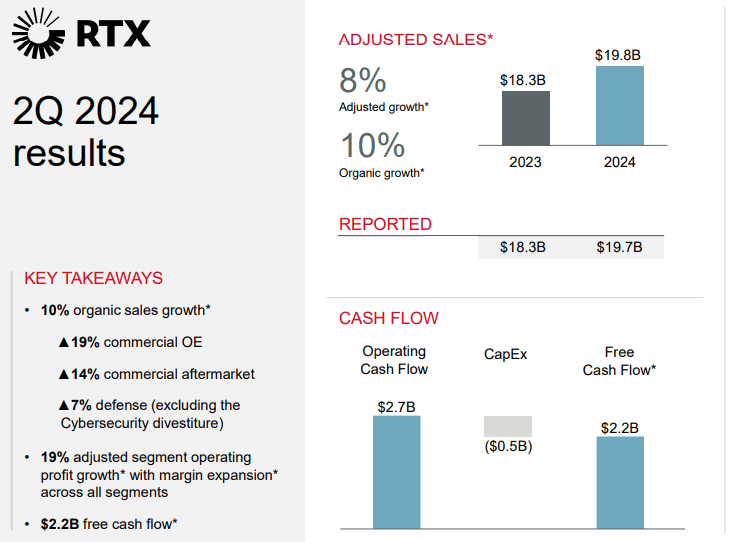

Defense companies are at the forefront of technological advancements, particularly in aerospace, cybersecurity, artificial intelligence, and unmanned systems. These firms invest heavily in research and development (R&D) to create cutting-edge technologies. For instance, Raytheon Technologies is a leader in missile defense and cyber solutions, contributing to its long-term growth prospects. As these technologies often have dual-use applications, they expand into commercial sectors, enhancing profitability.

Source: RTX Q2 Presentation

Moreover, technological innovation in the defense industry is driven by national security needs. Countries invest in advanced defense systems to maintain military superiority. Northrop Grumman, for instance, is heavily involved in developing autonomous systems and space technology, ensuring it remains competitive in future defense initiatives.

Geopolitical Tensions and Defense Spending

Global conflicts and rising geopolitical tensions lead to increased defense spending, making defense stocks appealing in uncertain times. For example, the ongoing conflict between Russia and Ukraine has pushed NATO countries to boost defense budgets. Germany recently committed to significantly increasing military expenditures, benefiting European defense contractors such as BAE Systems.

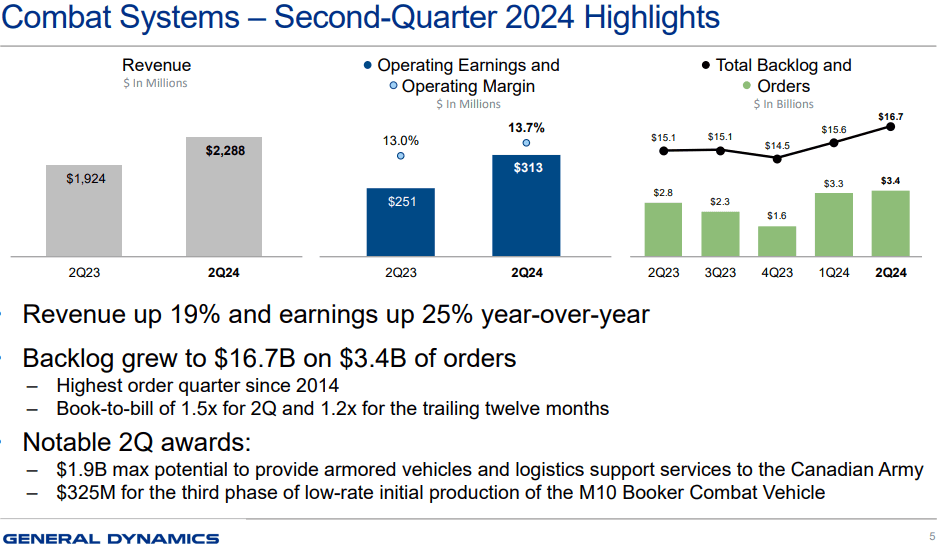

Defense spending trends also play a crucial role in the profitability of defense companies. Global military spending reached over $2.44 trillion in 2023, with the United States, China, and Russia being the largest contributors. Defense companies like General Dynamics benefit from this upward trend, as governments prioritize defense capabilities in light of evolving global threats.

Source: General Dynamics Q2 Presentation

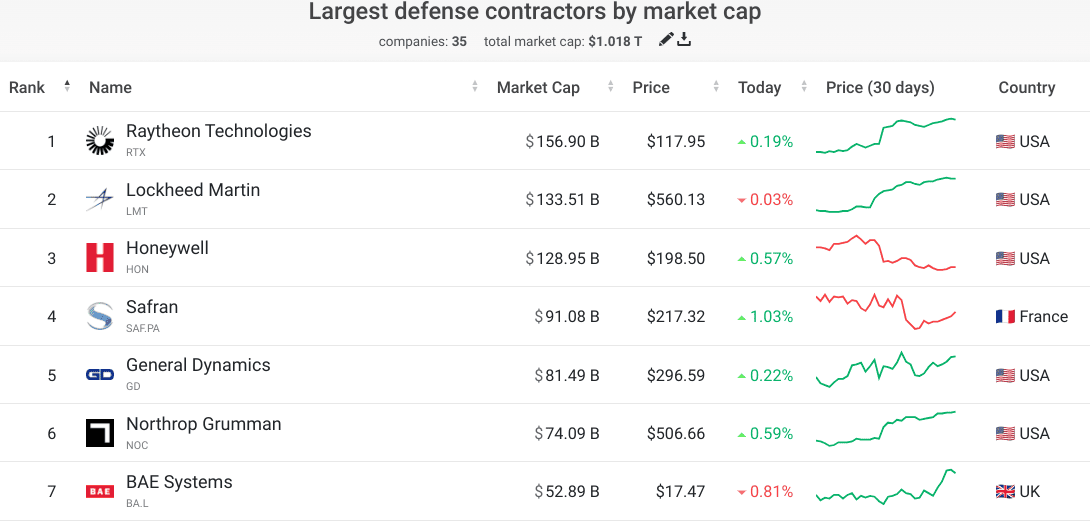

II. Best Defense Stocks

Defense Stocks (US Stocks)

Lockheed Martin (LMT)

Lockheed Martin is renowned for the F-35 Lightning II fighter jet, missile defense systems like THAAD, and space exploration projects. It holds significant contracts with the U.S. Department of Defense (DoD) and NASA. Lockheed Martin is a leader in the aerospace and defense industry, holding a dominant position with the largest share of the U.S. defense budget.

Source: companiesmarketcap.com

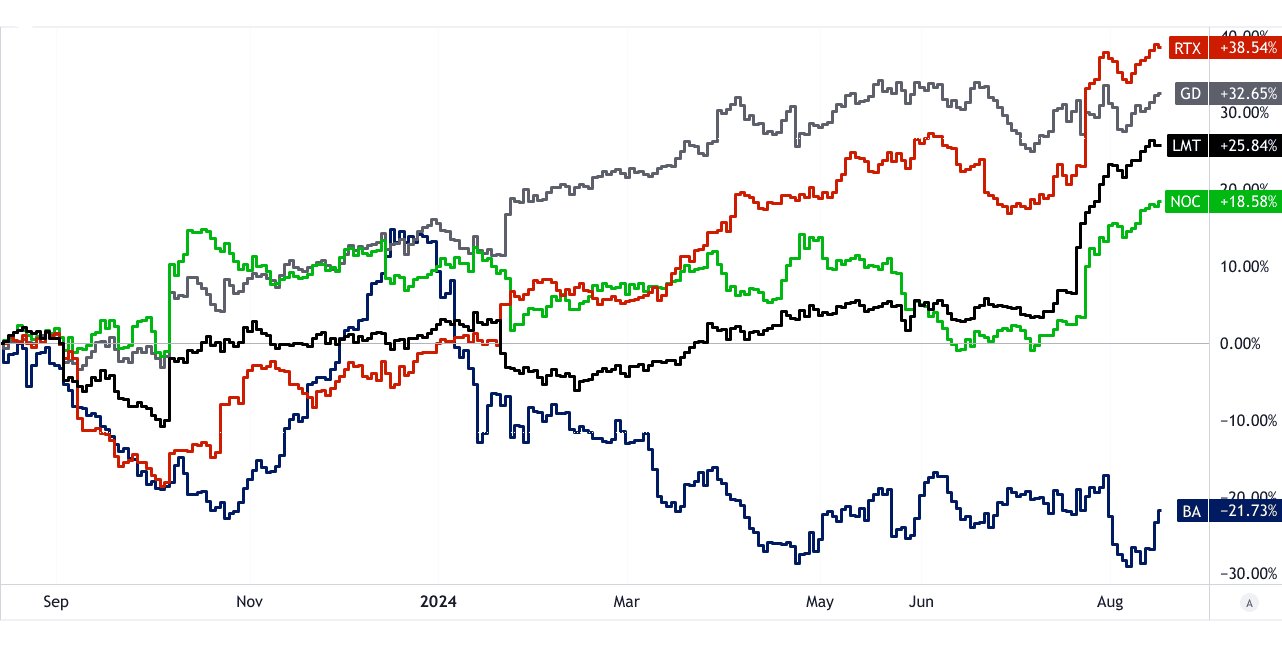

The company has seen stable stock performance, reflecting its steady earnings from government contracts. In 2023, LMT focused on expanding its space division. The company’s stock has delivered a price return of 26% in the last 12 months. With rising global tensions and increased defense spending, Lockheed Martin is poised for sustained growth, particularly in space and cybersecurity.

Raytheon Technologies (RTX)

Raytheon is a leader in missile systems (e.g., Patriot), radar technologies, and cybersecurity. It also supplies aircraft engines through its Pratt & Whitney division. RTX is a top contender in defense electronics and missiles, holding a significant market share globally.

RTX has seen moderate stock gains, driven by new contracts in missile defense and air traffic management systems. The merger with United Technologies in 2020 bolstered its market position. Its stock has yielded a price return of 39% in the last 12 months. Raytheon’s focus on cybersecurity and advanced defense technologies should drive future growth, supported by robust global demand for missile systems.

[1Y Price Return]

Source: tradingview.com

Northrop Grumman (NOC)

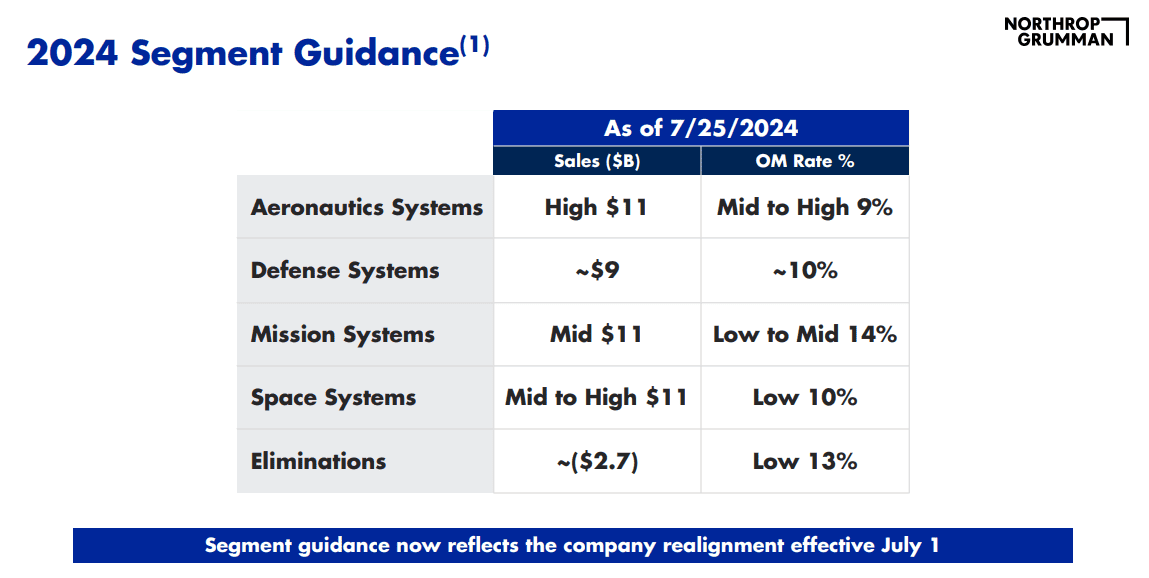

Northrop Grumman specializes in autonomous systems, cybersecurity, and space systems, notably the B-21 Raider bomber and missile defense systems. NOC is a leader in aerospace and defense, particularly in autonomous systems and cyber solutions.

NOC stock has performed well, reflecting strong contract wins and growth in space and missile defense sectors. The company’s stock has provided 19% price return in the last 12 months. Northrop Grumman is well-positioned for long-term growth with increased investment in space technology and autonomous systems.

Source: Northrop Grumman Q2 Presentation

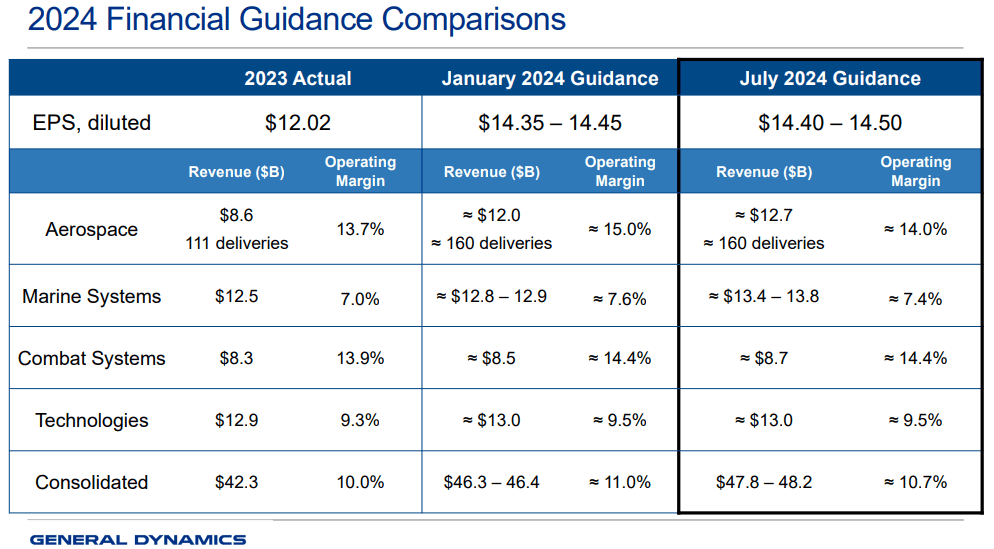

General Dynamics (GD)

General Dynamics produces submarines, combat vehicles, and IT solutions. Its key contracts include U.S. Navy submarines and Army combat vehicles. GD holds a strong position in naval systems and land combat vehicles.

GD stock has seen steady growth, driven by contracts for Virginia-class submarines and IT services. The company’s stock has yielded a price return of 33% in the last 12 months. The focus on advanced naval platforms and cybersecurity offers GD a stable growth trajectory.

Source: General Dynamics Q2 Presentation

Boeing (BA)

Boeing is a major player in military aircraft, satellites, and defense electronics, with key products including the KC-46 tanker and various fighter jets. Boeing is a global leader in aerospace, with significant defense sector involvement.

Boeing has faced challenges in commercial aviation, but its defense sector remains robust, with stable stock performance in recent months. Its stock has provided a negative price return of 22% in the last 12 months. Continued demand for military aircraft and space exploration supports Boeing's defense outlook, despite commercial aviation setbacks.

Defense Stocks (Taiwan Stocks)

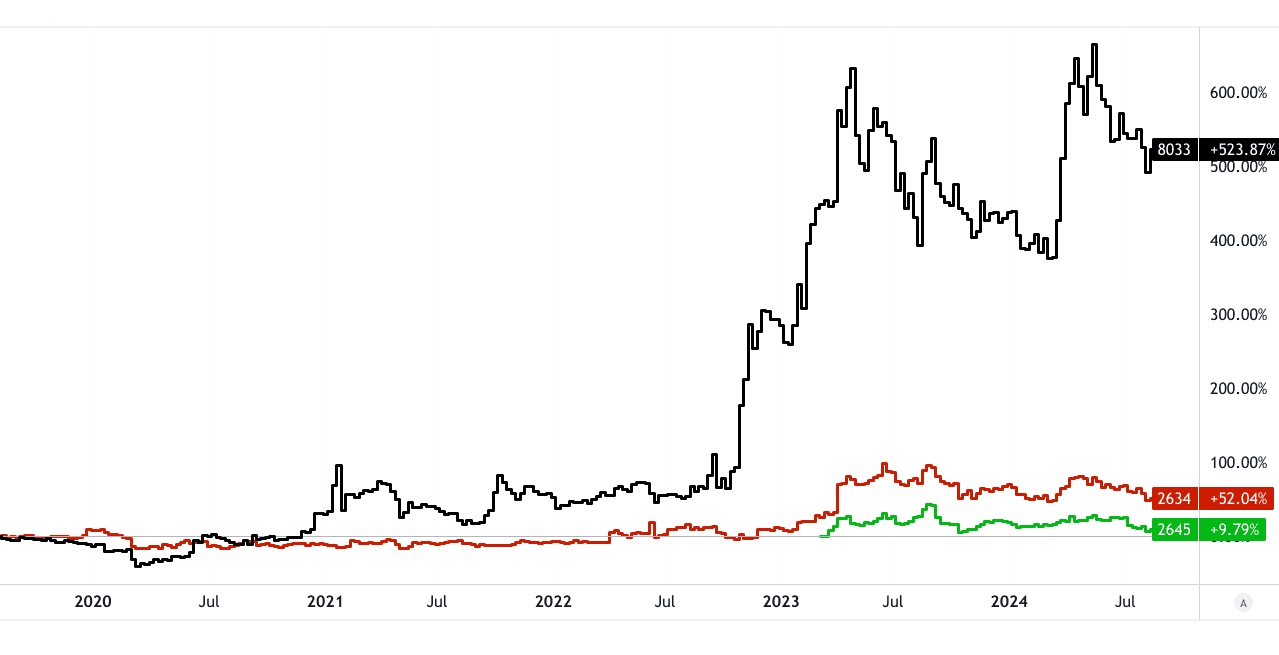

Thunder Tiger (8033)

Specializing in unmanned aerial vehicles (UAVs) for defense and commercial use, Thunder Tiger is a leading UAV manufacturer in Taiwan with a growing international footprint.

Thunder Tiger has expanded its UAV offerings, leading to stock price appreciation. The company’s stock has delivered a price return of 524% in the last 60 months. Growing defense budgets and UAV adoption globally support its long-term growth.

Aerospace Industrial Development Corporation (AIDC) (2634)

Producing military aircraft and provides maintenance, repair, and overhaul (MRO) services, AIDC is a major aerospace manufacturer in Taiwan, with strong government ties.

The company has seen stable growth due to new military contracts and MRO services expansion. Its stock has yielded a price return of 52% in the last 60 months. AIDC may benefit from increased defense spending and regional security concerns.

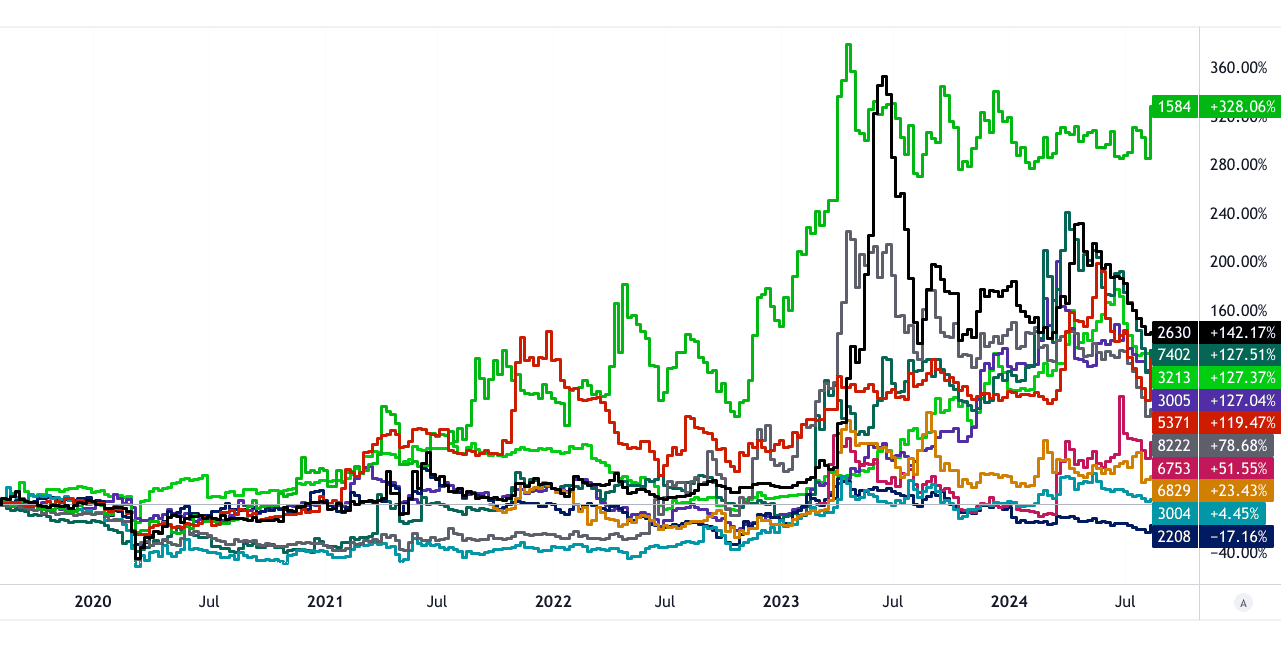

[5Y Price Return]

Source: tradingview.com

EGAT (2645)

Specializing in power generation equipment and defense electronics, EGAT is a niche player in defense electronics with growing influence in Taiwan’s defense industry.

EGAT has diversified its product offerings, positively impacting its stock performance. The company’s stock has provided a price return of 10% in the last 60 months. Increased focus on defense electronics and energy security should drive future growth.

Other Taiwanese Military Stocks to Buy

● Air Asia (2630): A key MRO service provider for military and commercial aircraft, with stable growth prospects due to increasing defense aviation needs.

[5Y Price Return]

Source: tradingview.com

● Coretronic (5371): Provides optical and display systems, with potential growth driven by defense applications.

● S-Tech (1584): A leader in precision manufacturing for defense components, with growth tied to regional security concerns.

● Chenfull Precision (6829): Focuses on precision machining for aerospace and defense, benefiting from Taiwan's defense industry expansion.

● Aero Win Technology (8222): Specializes in aviation components, with stable growth supported by Taiwan’s defense needs.

● NAFCO (3004): Manufactures aerospace components, with growth driven by increased defense spending in Taiwan.

● Lungteh Shipbuilding (6753): A leading shipbuilder for naval vessels, with robust growth prospects due to Taiwan’s naval expansion.

● CSBC Corporation (2208): Taiwan’s largest shipbuilder, with key contracts for naval vessels and potential growth from increased defense budgets.

● Brinno (7402): Produces rugged computing solutions for defense, with steady growth tied to technological advancements.

● Getac (3005): Specializes in rugged computers for military use, with a positive outlook due to rising demand for durable defense electronics.

● Mildef Crete (3213): Provides ruggedized IT solutions, benefiting from increasing digitization and cybersecurity needs in defense.

These companies are critical players in Taiwan's growing defense sector, supported by government initiatives and rising regional tensions.

III. How to Invest in Defense Stocks

Ways to Invest in Defense Stocks & Weapon Stocks

● Direct Stock Purchases: Investors can buy shares of individual defense companies like Lockheed Martin, Raytheon, or Northrop Grumman. This provides direct exposure to the financial performance of these companies and allows investors to target specific segments, such as aerospace or cybersecurity.

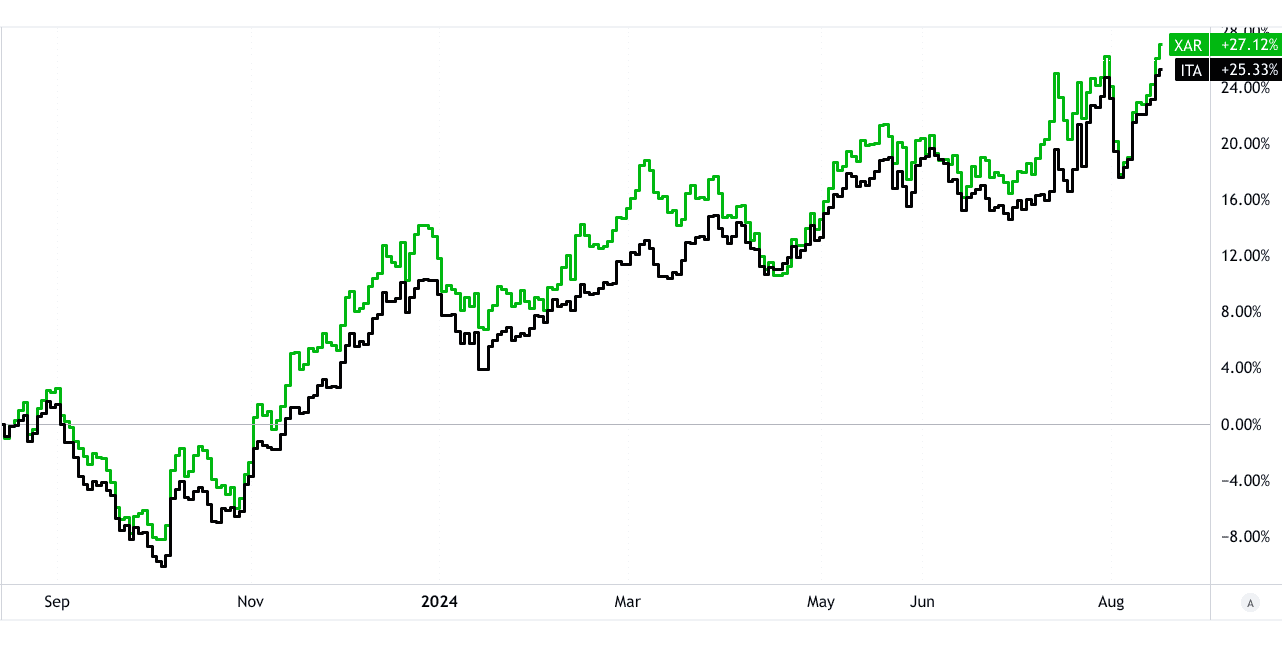

● Exchange-Traded Funds (ETFs): ETFs offer a diversified portfolio of defense stocks. Popular defense stocks ETFs include the iShares U.S. Aerospace & Defense ETF (ITA) or the SPDR S&P Aerospace & Defense ETF (XAR), which spread risk across multiple defense companies, making them an efficient way to gain industry-wide exposure.

[1Y Price Return]

Source: tradingview.com

● Mutual Funds and Index Funds: These funds also provide diversification by investing in a range of defense companies. Some may focus on sectors like defense technology or aerospace. While similar to ETFs, they are often actively managed and come with higher fees.

Factors to Consider When Investing in Defense Stocks & Military Stocks

● Government Contracts and Budgets: Defense companies heavily rely on contracts from governments, particularly in countries like the U.S. A company’s ability to secure large government contracts directly impacts its revenue stability. For example, a company like Lockheed Martin, with long-term contracts for the F-35 fighter jet program, offers more predictable returns compared to those with shorter-term contracts.

● Geopolitical Climate: Global conflicts and rising tensions can lead to increased defense spending, making defense stocks more attractive. Events like Russia’s invasion of Ukraine or rising tensions in the South China Sea often push governments to boost defense budgets, directly benefiting defense companies.

Source: tradingview.com

● Technological Innovations: Defense companies must stay at the forefront of innovation in areas like cybersecurity, unmanned systems, and artificial intelligence. Companies investing heavily in R&D, such as Northrop Grumman with its autonomous systems, often have stronger future growth prospects.

● Financial Health and Valuation: Evaluating a defense company’s financials—such as its debt levels, revenue growth, and profitability—is crucial. A company with a strong balance sheet and healthy cash flow, like Raytheon Technologies, is better positioned to weather economic downturns or delays in government contracts.

● Ethical and ESG Considerations: Defense companies often face scrutiny over their involvement in weapons production and military contracts. Ethical and ESG (Environmental, Social, and Governance) considerations have gained importance, influencing investor decisions, particularly for those focused on socially responsible investing.

Risks for Defense Stocks & Military Stocks

● Government Policy and Regulations: Changes in government policies or defense spending priorities can significantly impact defense companies. A shift towards diplomatic solutions or cuts in defense budgets could reduce revenues.

● Political Risks: Defense companies operate in a highly regulated sector and are vulnerable to political risks, such as changes in administration or trade restrictions. For instance, export restrictions or international sanctions can reduce global demand for defense equipment.

● Economic Downturns: In times of economic uncertainty, defense companies may face reduced government spending or delays in procurement, which can negatively affect their cash flow and stock prices.

● Project Delays: Defense projects are often large and complex, with long timelines. Delays or cost overruns in high-profile projects, like Boeing’s KC-46 tanker, can harm profitability and erode investor confidence.

IV. Defense Industry Trends & Defense Stocks Outlook

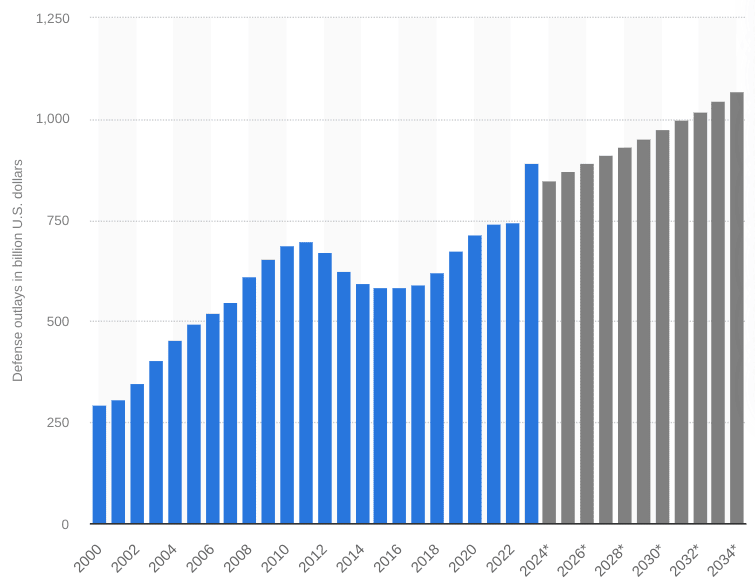

The global defense market is currently valued at approximately $2 trillion and is expected to grow at a compound annual growth rate (CAGR) of 3-4% over the next decade. Key drivers include increased defense budgets in response to rising geopolitical tensions, with significant growth in regions like the United States, China, and Europe. The U.S. remains the largest defense spender, allocating over $800 billion annually, while countries like India and Japan are ramping up military spending amid regional security concerns. Defense spending in the US will hit $1.07 trillion annually in 2034.

[Defense outlays and forecast in the United States from 2000 to 2034]

Source: statista.com

Regional Market Analysis

● North America: The U.S. defense sector continues to dominate, driven by extensive budgets and a focus on technological superiority. Lockheed Martin, Raytheon, and Northrop Grumman benefit from large contracts, such as those related to the F-35 program and missile defense systems.

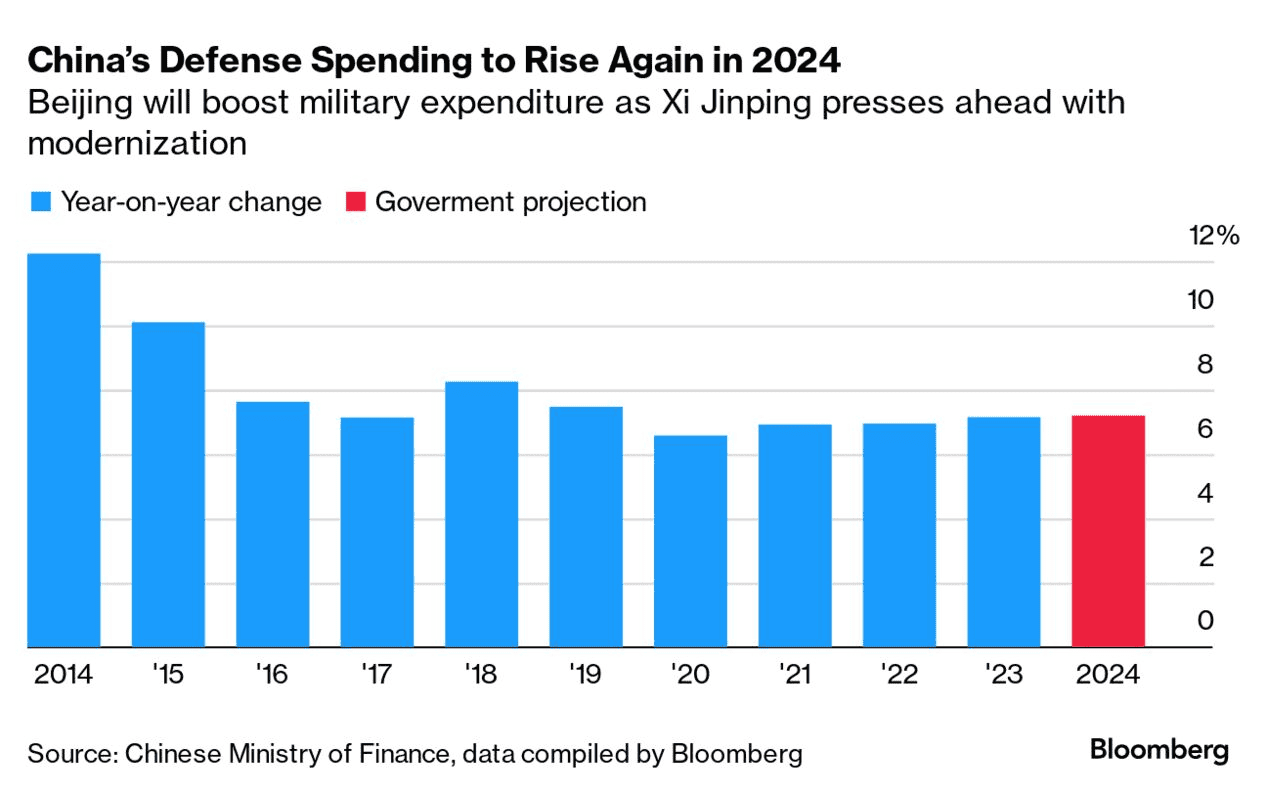

● Asia-Pacific: Rising tensions in the South China Sea and increasing military investments by China, India, and Japan have led to substantial market growth. Defense companies in Taiwan, such as Thunder Tiger and AIDC, are positioned to capitalize on regional defense needs.

Source: bloomberg.com

● Europe: NATO members are bolstering their military capabilities, particularly after the Russian invasion of Ukraine. Germany, France, and the U.K. are leading defense investments, boosting demand for missile systems, fighter jets, and naval assets.

Future Trends of Defense Stocks & War Stocks

● AI, Robotics, and Autonomous Systems: The integration of artificial intelligence (AI) in defense is rapidly transforming warfare, with autonomous systems like drones and unmanned ground vehicles becoming more prevalent. Northrop Grumman, for example, has made significant strides in autonomous defense systems. Future military operations will rely heavily on robotic solutions for reconnaissance, logistics, and combat.

● Cybersecurity: With the increasing digitization of defense systems, cybersecurity has become a top priority. Defense companies are now focusing on securing critical infrastructure, networks, and classified information. Companies like Raytheon and General Dynamics are leaders in defense cybersecurity solutions, providing services to government agencies and militaries worldwide.

● UAVs and Drones: Unmanned aerial vehicles (UAVs) and drones are playing an increasingly critical role in modern warfare, from intelligence gathering to precision strikes. Companies like Thunder Tiger and Lockheed Martin are advancing drone technology for military use, contributing to the rapid expansion of this segment.

● Space Warfare: Space has become a critical domain for defense, with investments in satellite systems and anti-satellite technologies. Space warfare capabilities, such as those developed by Lockheed Martin and Boeing, are expected to grow as nations focus on space-based defense systems.

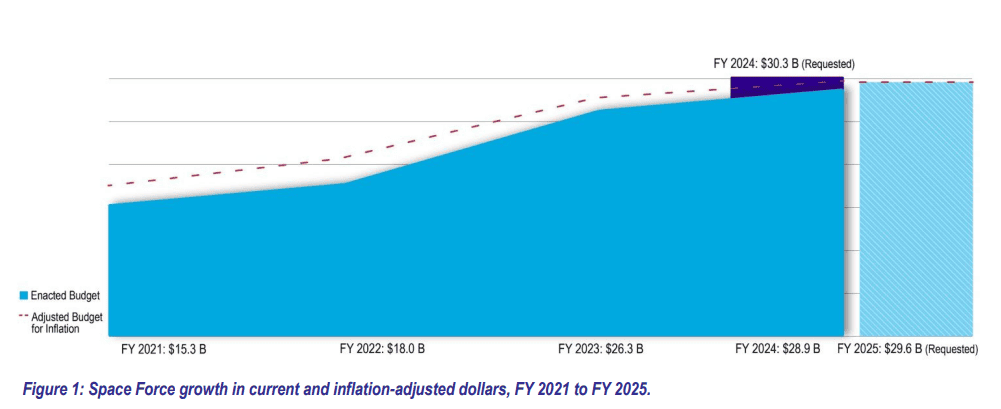

[US Space Force budget growth]

Source: csps.aerospace.org

● Electronic Warfare: The use of electronic systems to disrupt enemy communications and radar systems is gaining importance. Northrop Grumman and Raytheon are key players in this area, developing systems designed to neutralize enemy technology.

Long-Term Outlook for Defense Stocks & Weapons Stocks

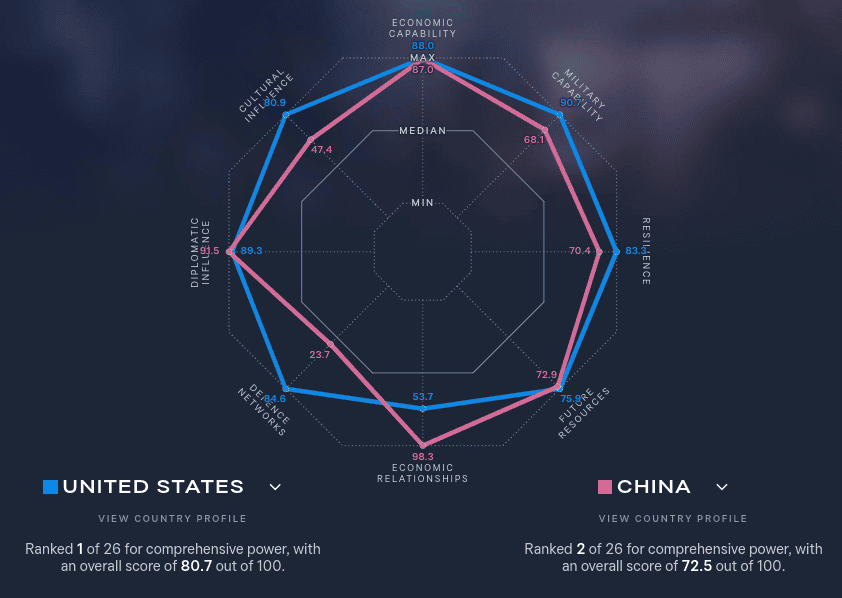

The long-term outlook for defense stocks is optimistic due to the indispensable nature of defense spending. Defense budgets are relatively insulated from economic downturns, ensuring a steady revenue stream for companies in the sector. Rising geopolitical tensions, such as the U.S.-China rivalry and the conflict in Ukraine, have increased the urgency for nations to modernize their military capabilities. Technological advancements in AI, cybersecurity, and space warfare are expected to further drive growth in the defense industry.

Source: power.lowyinstitute.org

Companies like Lockheed Martin, Raytheon, and Northrop Grumman may lead due to their established government contracts, technological prowess, and ability to innovate. Furthermore, emerging markets in Asia-Pacific and increased defense collaboration among NATO allies will contribute to sustained demand for defense products and services.