- Dividend stocks typically offer steady returns through regular dividend payments, yield, which provides predictable income.

- Dividend stocks often exhibit lower volatility compared to growth stocks, with established companies like Procter & Gamble showing less price fluctuation.

- Liquidity of dividend stocks is generally high, as large-cap dividend stocks like Johnson & Johnson are frequently traded, allowing investors to buy or sell shares with ease.

Source: unsplash.com

I. What Are Dividend Stocks

Dividend stocks are shares of companies that regularly distribute a portion of their earnings to shareholders in the form of dividends. Dividends are typically paid in cash on a quarterly basis, though some companies may issue them monthly or annually. The payment amount is determined by the company’s board of directors and is often based on profitability. Dividends can be a fixed amount or a percentage of earnings, providing investors with a direct way to earn income without selling shares.

When a company earns a profit, it can choose to reinvest the funds into the business (e.g., for expansion or R&D) or distribute a portion of these earnings to shareholders as dividends. Companies like Johnson & Johnson and Procter & Gamble, for instance, pay consistent dividends to reward long-term investors and signal financial strength.

Why Do Companies Pay Dividends? Companies distribute dividends to reward shareholders, attract income-seeking investors, and project stability. Mature companies with stable earnings—such as utilities or consumer staples—are more likely to pay dividends. Firms with consistent cash flows like AT&T and Verizon regularly pay dividends, as growth opportunities are often limited, and returning value to shareholders is prioritized.

Why Invest in Dividend Stocks?

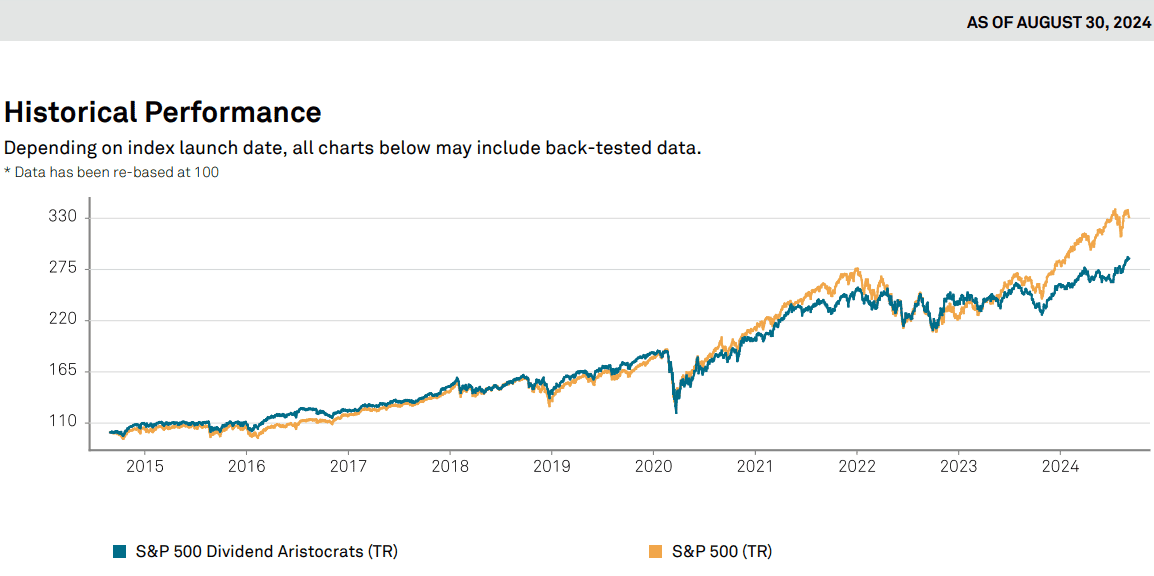

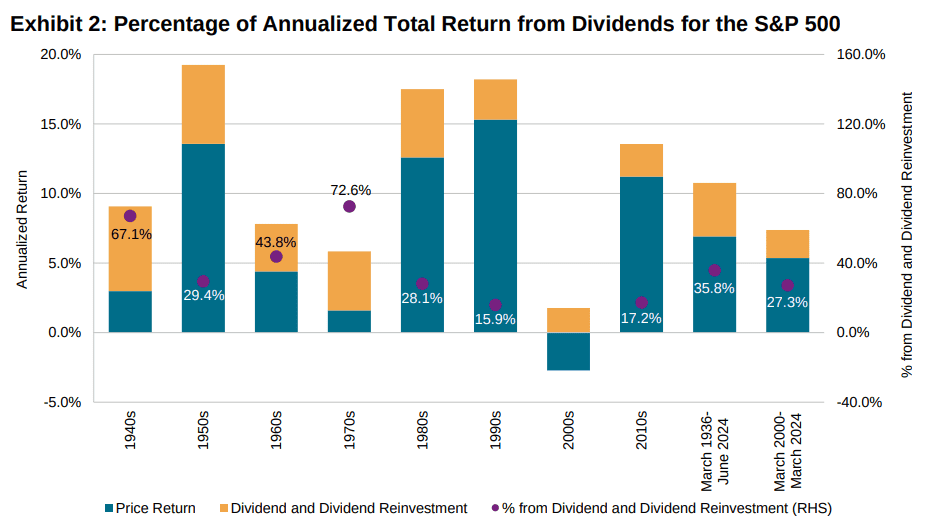

- Steady Income: Dividend stocks provide a reliable income stream, making them attractive to retirees and conservative investors. The S&P 500 Dividend Aristocrats, companies that have increased dividends for 25 consecutive years, offer stable yields, with an average yield of around 2.5% in 2023.

- Potential for Capital Appreciation: In addition to dividends, these stocks can increase in value over time. For example, Microsoft, which pays a modest dividend of 0.72%, saw its stock price rise by over 200% in the past five years.

Source: factsheet-sp-500-dividend-aristocrats

- Dividend Reinvestment: Many companies offer Dividend Reinvestment Plans (DRIPs), allowing investors to reinvest dividends to buy more shares. This can increase holdings over time, leveraging compounding growth.

- Compounding Growth: Reinvested dividends allow investors to earn dividends on previously reinvested shares, creating a snowball effect. Over decades, this can result in significant portfolio growth.

- Inflation Hedge: Dividend stocks, particularly those with growing dividends, provide some protection against inflation. Companies that increase dividends, like PepsiCo, often match or exceed inflation rates, preserving purchasing power.

II. Best Dividend Stocks

Dividend stocks are an attractive option for long-term investors seeking a combination of steady income and capital growth. Dividend Aristocrats and Dividend Kings are two key groups of dividend-paying stocks, while high-dividend stocks and dividend-focused ETFs offer other ways to capture yield.

Dividend Aristocrats & Dividend Kings

Dividend Aristocrats are companies within the S&P 500 that have increased their dividends annually for at least 25 consecutive years. These firms are often large, well-established companies with stable earnings and strong market positions.

Dividend Kings go a step further by maintaining a record of at least 50 consecutive years of dividend increases. These are usually blue-chip companies that have demonstrated exceptional longevity and stability in both good and bad economic times.

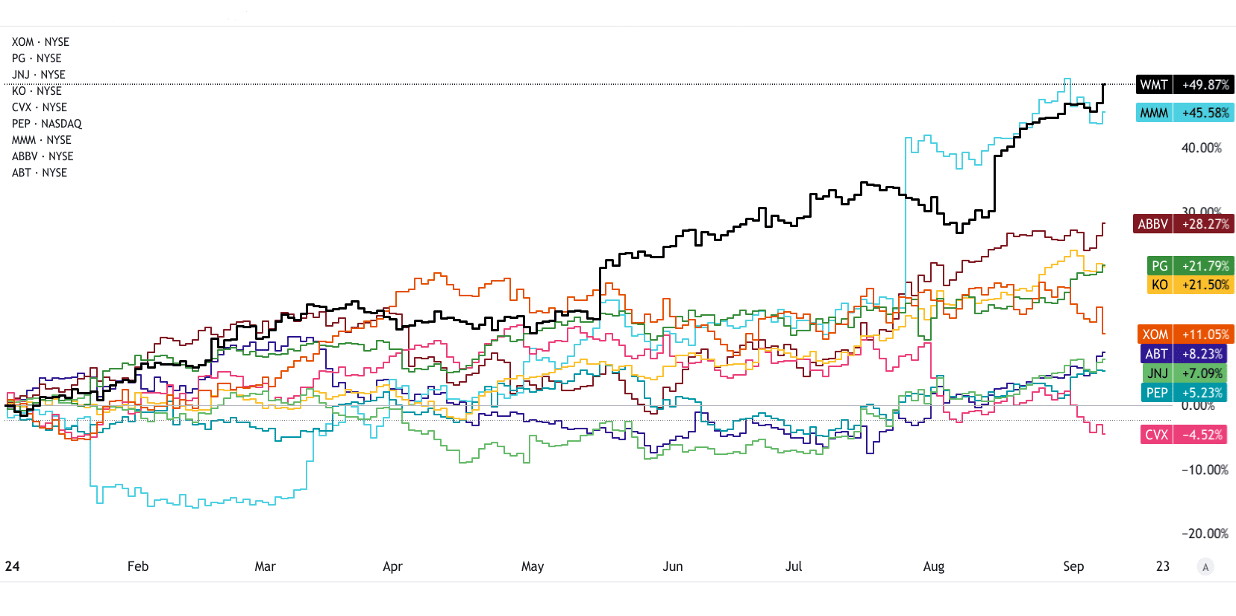

Dividend Aristocrats: Top 10 Stocks

- Walmart (WMT) – Retail giant Walmart commands a significant share of the global retail market, with a 1.1% dividend yield. Despite recent inflationary pressures and supply chain disruptions, Walmart’s e-commerce growth has remained robust, supporting future expansion. Its stock has grown around 44% over the past year.

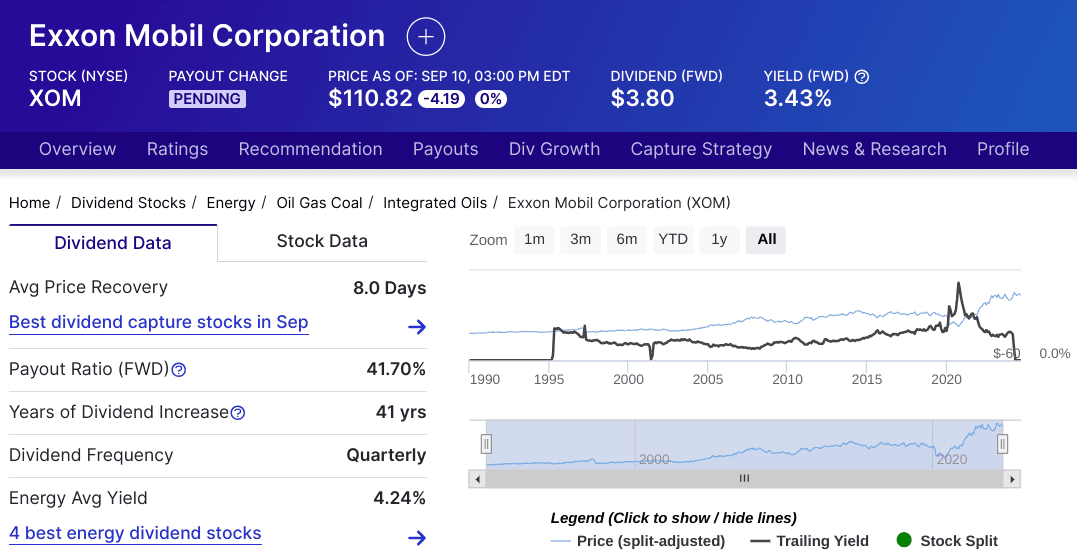

- ExxonMobil (XOM) – A leading player in the oil and gas industry, ExxonMobil benefits from rising oil prices. Its dividend yield is around 3.4%, but the stock faces volatility from fluctuating energy markets. Over the past 5 years, the stock rose 55%, driven by increasing global energy demand.

Source: Dividend.com

- Procter & Gamble (PG) – A dominant consumer goods company with a 2.3% yield, PG’s portfolio includes brands like Tide and Gillette. Recent cost inflation challenges have pressured margins, but its strong pricing power enables continued dividend growth. Its stock has appreciated by 16% in the past 12 months.

- Johnson & Johnson (JNJ) – A healthcare giant, JNJ offers a 3% yield. The company's strength lies in its diversified operations, spanning pharmaceuticals, medical devices, and consumer health. Recent legal challenges related to talc lawsuits have weighed on the stock, which is up 4.25% over the past 12 months.

- Coca-Cola (KO) – As a beverage leader with a 2.7% yield, Coca-Cola benefits from strong brand recognition and global distribution. However, increased costs of raw materials have put pressure on margins. The stock has seen modest growth of 23% over the past 12 months.

- Chevron (CVX) – Another energy titan, Chevron has a 4.7% yield and strong cash flow driven by high oil prices. Its stock has climbed 44% in the past 3 years, but it remains sensitive to energy market fluctuations and regulatory pressures.

- PepsiCo (PEP) – PepsiCo offers a 3.1% dividend yield and operates in both the beverage and snack food markets. Its strong brand portfolio includes Frito-Lay and Gatorade. Despite cost pressures, PepsiCo’s revenue growth has remained stable, with its stock rising 14% over the past 3 years.

- 3M (MMM) – With a 2.2% dividend yield, 3M is a diversified manufacturer in industries like healthcare, consumer products, and electronics. However, it has faced legal challenges related to PFAS chemicals, which have hurt stock performance (+22% in the past 12 months).

- AbbVie (ABBV) – A major player in the pharmaceutical sector, AbbVie has a high yield of 3.1%. Its growth is driven by immunology drugs, though it faces a patent cliff for its blockbuster drug Humira. The stock has performed well, up 34% in the past 12 months.

- Abbott Laboratories (ABT) – Abbott operates in medical devices and diagnostics, offering a 1.9% yield. Despite challenges in its infant formula division, Abbott's future growth looks solid due to its advancements in diagnostics technology. The stock is up 16% in the past 12 months.

[YTD Price Return, September 10, 2024]

Source: tradingview.com

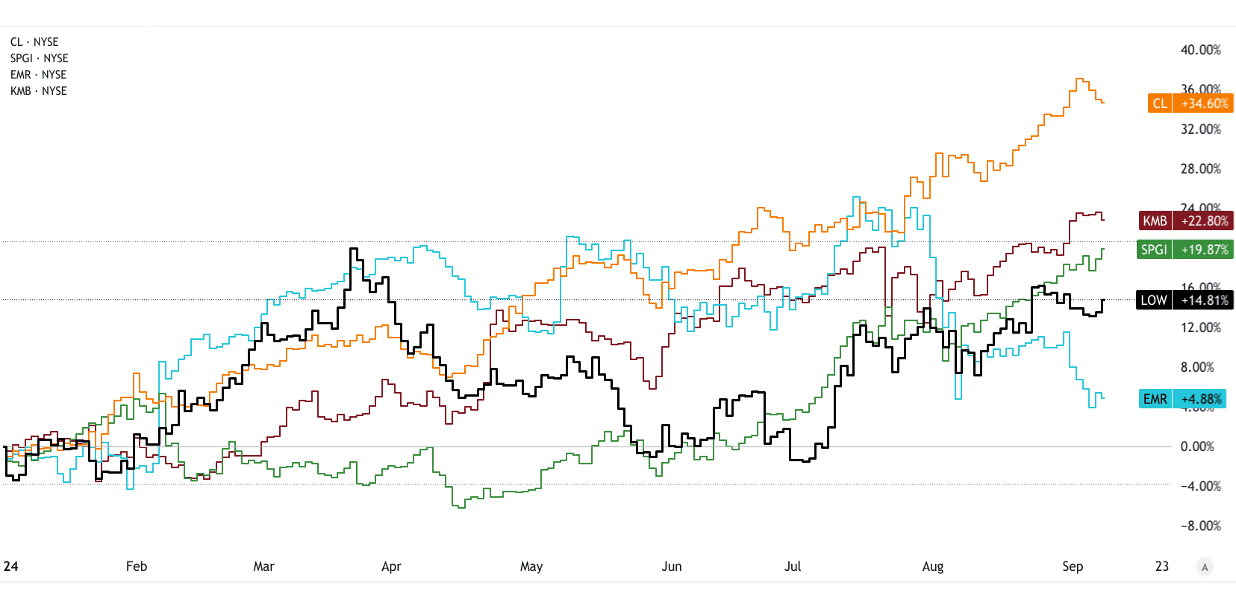

Dividend Kings: Top 5 Stocks

- Lowe’s (LOW) – A home improvement giant, Lowe's benefits from housing market strength, with a 1.9% dividend yield. Despite a cooling in pandemic-driven home improvement demand, Lowe’s continues to grow, with its stock rising 21% over the past 3 years.

- Colgate-Palmolive (CL) – A consumer staples leader in oral and personal care, Colgate-Palmolive offers a 1.9% yield. The company has maintained market share through innovation and global expansion, though it faces rising input costs. The stock has remained robust with over 46% price return over the past 12 months.

- S&P Global (SPGI) – A leader in financial analytics and ratings, S&P Global offers a 0.7% yield. Despite regulatory risks and fluctuations in demand for credit ratings, SPGI’s data and analytics businesses support strong future growth. The stock is up 33% in the past 12 months.

- Emerson Electric (EMR) – A diversified manufacturer with operations in industrial automation, Emerson offers a 2.1% yield. Its stock is up 53% over the past 5 years, supported by strong demand for automation technologies, though it faces supply chain challenges.

- Kimberly-Clark (KMB) – Known for personal care products like Huggies, Kimberly-Clark offers a 3.3% yield. Despite a slowdown in its baby care segment, KMB is investing in innovation to regain market share. The stock is up 15% over the past year.

Source: tradingview.com [YTD Price Return, September 10, 2024]

Source: tradingview.com [YTD Price Return, September 10, 2024]

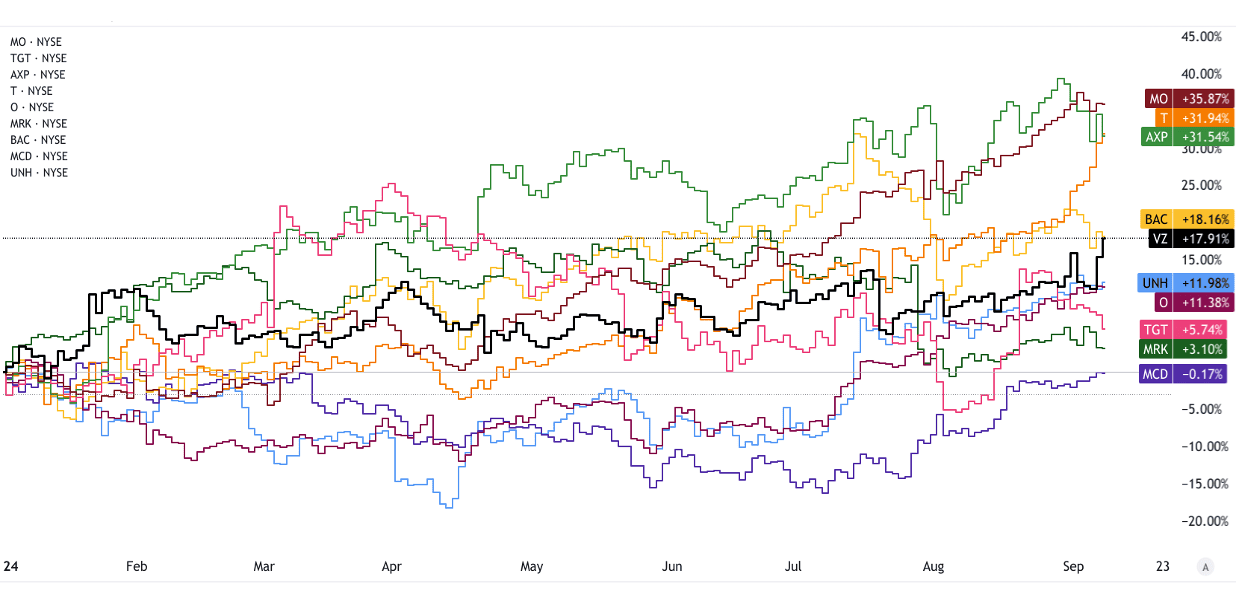

High Dividend Stocks: Top 10 Stocks

- Verizon (VZ) – Telecom giant Verizon offers a high 6.2% yield. Despite intense competition, Verizon maintains a strong market position in the U.S., though it faces challenges with 5G infrastructure investments. The stock is up 30% in the past year.

- Altria (MO) – Tobacco company Altria offers a 7.6% yield. Despite regulatory risks and declining cigarette consumption, Altria’s investments in smokeless products offer future growth potential. The stock is up 23% over the past year.

- Target (TGT) – A major U.S. retailer, Target offers a 3% yield. It has faced headwinds from reduced consumer spending, with the stock up 20% in the past year. However, long-term growth is supported by e-commerce initiatives.

- American Express (AXP) – A leading financial services company, AXP has a 1.1% yield. The stock is up 56% over the past 12 months, driven by increased consumer spending and travel.

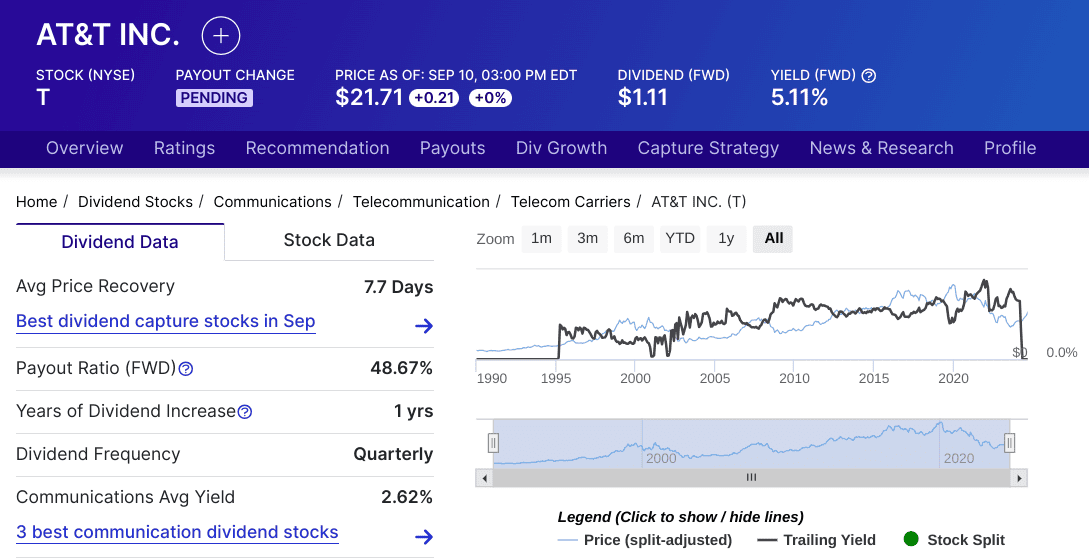

- AT&T (T) – Telecom firm AT&T offers a 5.1% yield. It faces challenges in balancing debt and investing in 5G, but remains a key player in U.S. wireless services. The stock is up 51% over the past year (12 months).

Source: dividend.com

Source: dividend.com

- Realty Income (O) – A real estate investment trust (REIT) specializing in commercial properties with a stock price return of 14% over the past 12 months, offering monthly dividends with a current yield of around 5%, focusing on long-term, stable income generation.

- Merck (MRK) – A pharmaceutical giant, Merck offers a 2.7% yield, driven by strong performance from cancer drug Keytruda. The stock is up 57% in the past 3 years.

- Bank of America (BAC) – BAC offers a 2.7% yield and remains a leading US bank. Despite higher interest rates boosting profits, the stock is up 39% against recession fears.

- McDonald’s (MCD) – Fast-food leader McDonald’s offers a 2.3% yield. It has outperformed peers, with the stock up 22% over the past 3 years, due to global expansion and digital innovations.

- UnitedHealth Group (UNH) – A leader in health insurance, UNH offers a 1.4% yield. Despite facing regulatory challenges, it continues to benefit from an aging population, with the stock up 25% in the past year.

Source: tradingview.com [YTD Price Return, September 10, 2024]

Source: tradingview.com [YTD Price Return, September 10, 2024]

Best Dividend ETFs

Why Choose Dividend ETFs? Dividend ETFs provide diversification, lower risk, and broad exposure to dividend-paying stocks, making them ideal for investors seeking stable income without picking individual stocks.

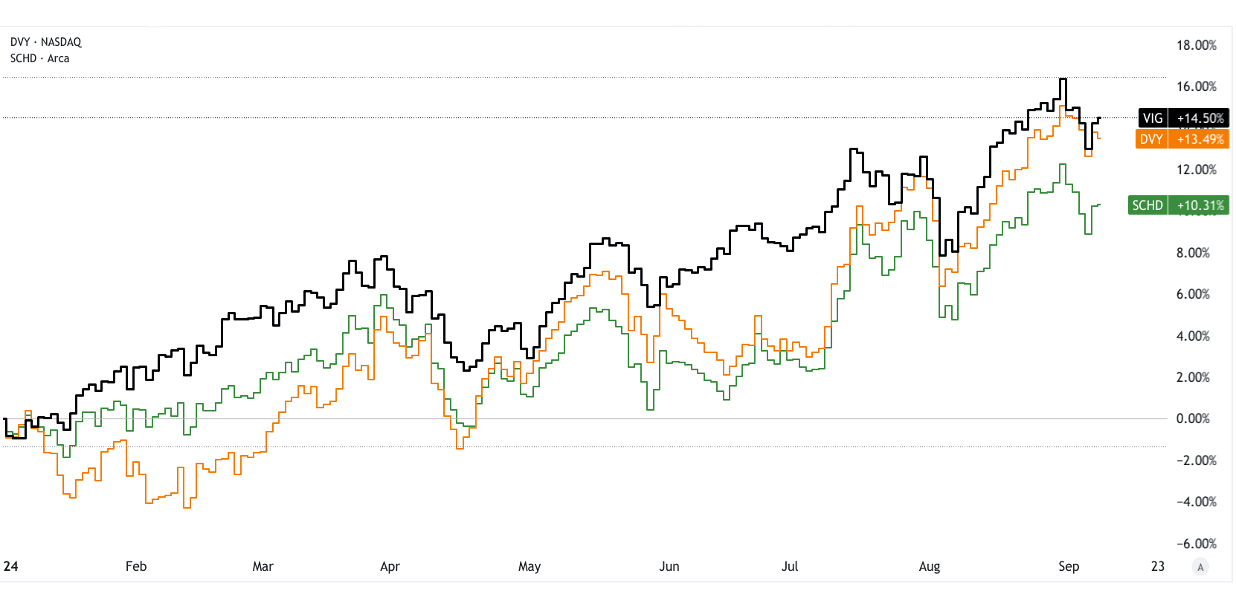

- Vanguard Dividend Appreciation ETF (VIG) – VIG focuses on U.S. companies that have increased dividends for at least 10 years. With a yield of around 1.9%, it holds top stocks like Microsoft and Visa. The ETF is up 20% in the past year, offering stability.

- iShares Select Dividend ETF (DVY) – DVY offers a high dividend yield of around 2.8% by focusing on high-yielding U.S. stocks like utilities and financials. Despite recession fears, the ETF is up 18% in the past year.

- Schwab U.S. Dividend Equity ETF (SCHD) – SCHD targets high-quality U.S. dividend stocks, offering a 4.2% yield. Its holdings include companies like Home Depot and Broadcom. The ETF has gained 13% over the past year, with future growth supported by strong cash-flow-generating businesses.

Source: tradingview.com [YTD Price Return, September 10, 2024]

Source: tradingview.com [YTD Price Return, September 10, 2024]

III. Factors to Consider When Investing in Dividend Stocks

When investing in dividend stocks, it's crucial to evaluate several factors to ensure you're selecting stable, growth-oriented investments.

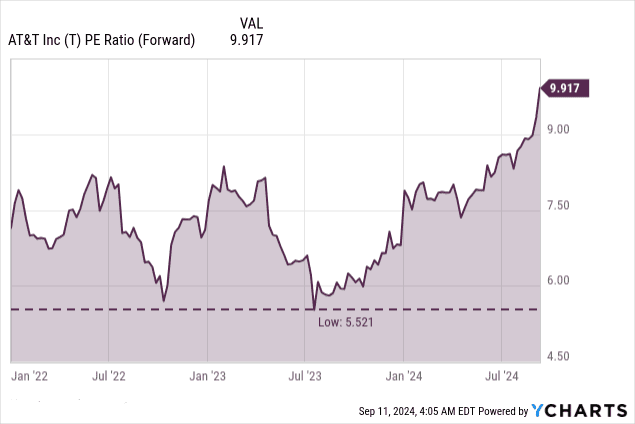

- Dividend Yield: This metric shows how much a company pays out in dividends relative to its stock price. A high yield, such as AT&T's, may seem attractive, but excessively high yields can indicate financial trouble. Typically, a yield between 2% and 5%, like Johnson & Johnson, suggests sustainability without sacrificing growth.

- Payout Ratio: The payout ratio measures the percentage of earnings paid out as dividends. A lower payout ratio, like Microsoft's 23%, indicates a company retains ample earnings for reinvestment and future growth. A high payout ratio, above 80%, may signal limited reinvestment potential and a higher risk of dividend cuts if earnings fall.

- Dividend Growth Rate: Consistent dividend growth reflects a company's ability to increase shareholder value. Companies like Microsoft, with a 5-year dividend growth rate of 9.4%, are ideal for long-term investors seeking compounding income.

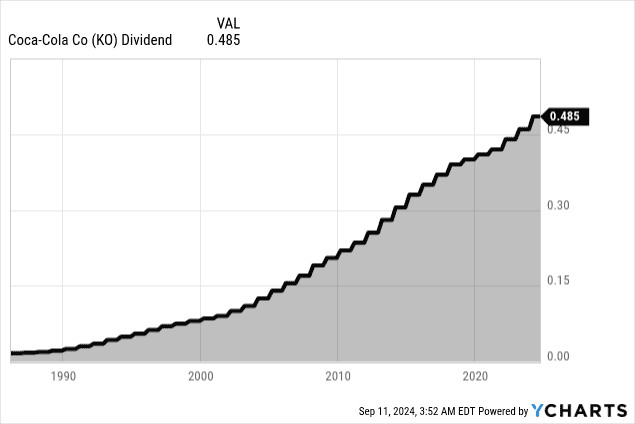

- Dividend Durability: Stability in paying dividends over time is critical. Dividend Aristocrats like Coca-Cola, which has raised dividends for over 63 consecutive years, exemplify dividend durability, offering investors confidence in the company’s long-term financial health.

Source: Ycharts.com

- Financial Health and Earnings Growth: A company’s ability to generate and grow earnings directly impacts its capacity to maintain or increase dividends. For instance, Merck’s consistent growth in pharmaceuticals, driven by cancer drug Keytruda, supports both earnings and a stable dividend yield.

- Competitive Advantages or Economic Moats: Companies with strong competitive advantages, such as Procter & Gamble’s brand power, can protect their market share and sustain dividend payments. These moats help firms maintain pricing power, revenue growth, and profitability.

- Valuation: Assessing a stock’s valuation using metrics like the price-to-earnings (P/E) ratio helps avoid overpaying. A lower P/E ratio, compared to historical averages or peers, may indicate a good buying opportunity, as with AT&T's P/E of 5.5 in mid-2023, which suggests high undervaluation.

Source: Ycharts.com

- Dividend Traps and Cuts: Companies with unsustainable yields can lead to dividend traps. For example, Intel (INTC) suspended its dividend starting Q4 2024 due to poor financial health. Investors should scrutinize dividend histories and payout ratios to avoid such risks.

- Federal Reserve Interest Rate Cuts: Lower interest rates can boost high-yielding dividend stocks, as fixed-income alternatives become less attractive. Stocks like Verizon often gain appeal when rates fall.

- How to Buy Dividend Stocks: Investors can purchase dividend stocks through brokerage accounts, using strategies like dollar-cost averaging to reduce risk. Alternatively, Dividend Reinvestment Plans (DRIPs) allow for automatic reinvestment of dividends, leveraging compounding growth.

IV. Dividend Stocks Outlook

Global Dividend Trends: Dividend trends vary regionally. In the U.S., companies are increasingly focusing on returning capital to shareholders, with the S&P 500 offering an average yield of around 1.8%. European markets, historically higher in dividends, have seen yields of 3-4% as firms distribute a higher share of profits. Emerging markets offer varied yields, with some countries like Russia and Brazil providing higher dividends due to less developed capital markets and higher risk premiums.

Source: spglobal.com

Sector-Specific Trends:

- Energy: Energy stocks, such as ExxonMobil and Chevron, benefit from elevated commodity prices, leading to robust dividend payouts. The sector's average yield is around 3.5%, bolstered by strong cash flows from high oil prices. However, volatility in energy prices and regulatory pressures on carbon emissions can affect future stability.

- Technology: Tech stocks have traditionally paid lower dividends, but companies like Apple and Microsoft are changing this trend. The technology sector’s average yield is about 1.5%, with a focus on growth over income. However, the sector’s strong cash flow and profitability provide a solid foundation for sustainable dividends.

- Real Estate and REITs: Real Estate Investment Trusts (REITs) like Realty Income offer high yields around 5%, driven by long-term lease agreements and stable rental income. REITs are particularly appealing in a low-interest-rate environment, offering attractive income compared to fixed-income investments.

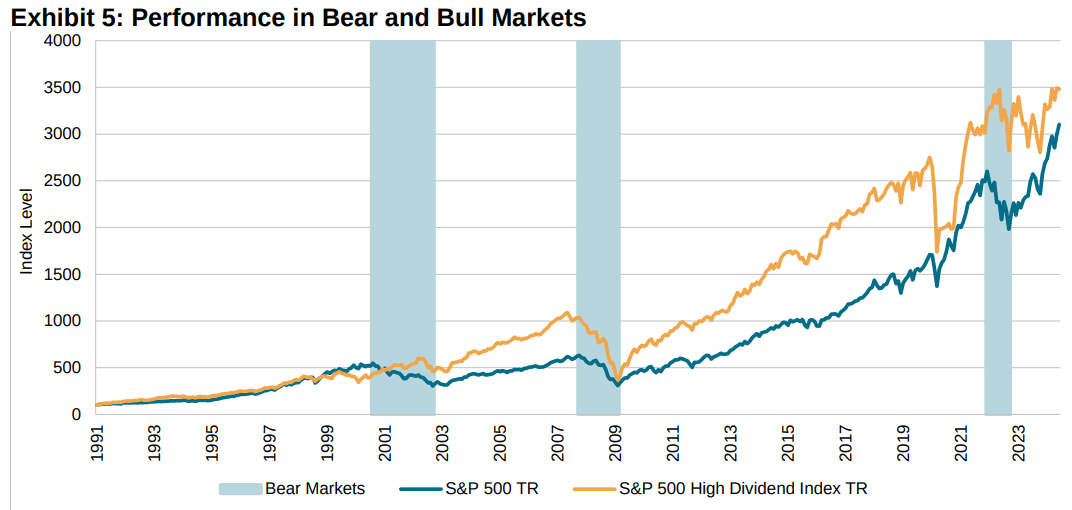

Safe Havens in Volatile Markets: Dividend stocks are often viewed as safe havens during market volatility. Companies with stable dividends, like Procter & Gamble and Johnson & Johnson, provide consistent income regardless of market swings, appealing to risk-averse investors.

Source: spglobal.com

Role in Retirement Portfolios: Dividend stocks are crucial in retirement portfolios for generating regular income and preserving capital. Stocks with a history of consistent and growing dividends, such as Dividend Aristocrats, can provide retirees with a reliable income stream and protect against inflation, supporting financial stability throughout retirement.