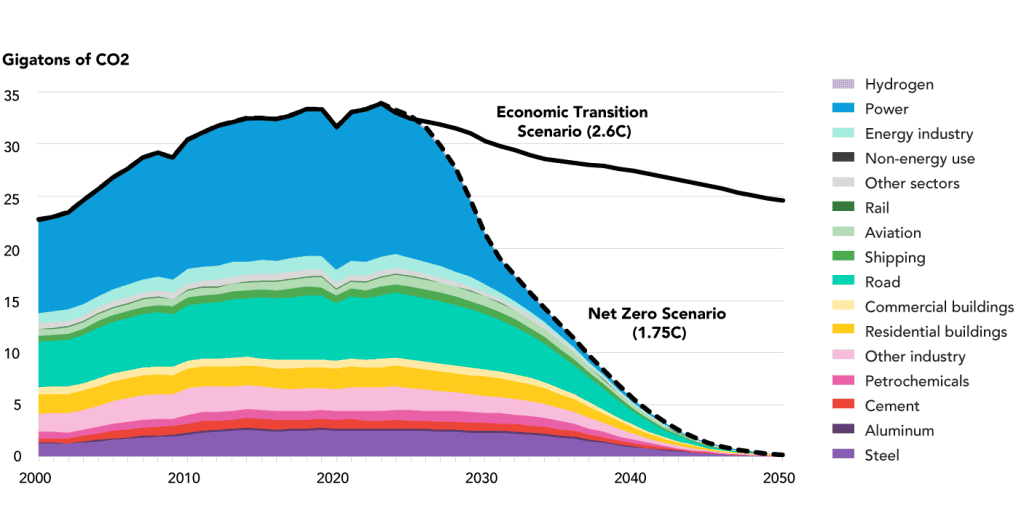

The energy industry plays a pivotal role in powering global economies, but it is undergoing significant transformations. Traditionally dominated by fossil fuels, it is now shifting towards sustainable and renewable energy sources. Climate change, regulatory pressures, and technological advancements have fueled this transition. Solar, wind, and hydropower are key players in the renewable energy space, while nuclear power is also gaining attention as a low-emission option. This shift aligns with the growing trend in ESG (Environmental, Social, Governance) investing, which emphasizes sustainability and corporate responsibility. Investors are increasingly focusing on companies that adhere to ESG principles, boosting demand for clean energy stocks.

Source: BloombergNEF

Energy stocks are crucial to the global market as they provide consistent returns and influence multiple sectors. Energy drives industrial production, transportation, and even technology. Broadly, energy stocks fall into several categories, each offering distinct investment opportunities. Oil and gas stocks remain prominent despite the global push for greener alternatives. These stocks focus on exploration, production, and refining of fossil fuels. However, their future is closely tied to fluctuations in commodity prices and regulatory developments around emissions.

Utility stocks, often considered stable and dividend-paying investments, include companies that generate and distribute electricity, water, and natural gas. Recently, many utility firms are pivoting toward green energy solutions, adding renewable energy production to their portfolios. This shift has given rise to Green Energy Stocks, which are tied to companies producing renewable energy like solar and wind. These stocks are appealing to investors seeking exposure to clean technologies.

Heavy Electrical Equipment Stocks are tied to companies that manufacture equipment used in energy production, such as turbines and transmission systems. These companies are essential for both conventional and renewable energy projects. As renewable energy infrastructure expands globally, demand for heavy electrical equipment continues to rise.

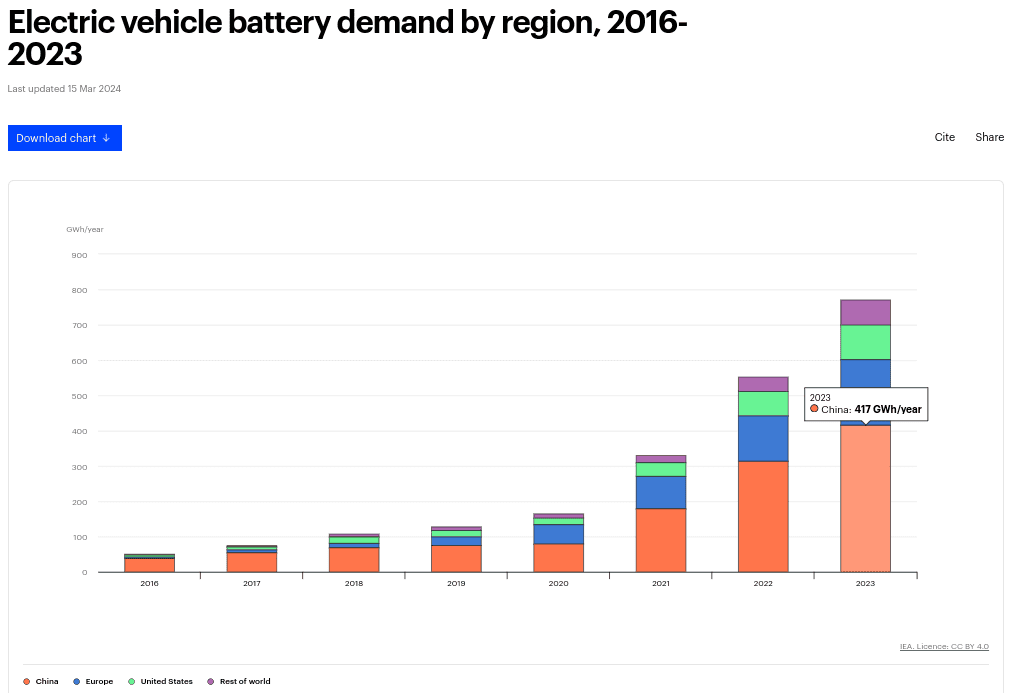

Source: iea.org

Energy Storage Stocks focus on technologies that store energy, including batteries for electric vehicles and grid storage solutions. As renewable energy sources, such as wind and solar, often produce power intermittently, energy storage is vital for balancing supply and demand. Investors are paying close attention to this sector, particularly with innovations in battery technology, which promises to improve efficiency and scalability.

I. Best Energy Stocks: Green Energy Stocks or Clean Energy Stocks

What is Green Energy?

Green energy refers to energy produced from natural, renewable resources that have a minimal environmental impact compared to traditional fossil fuels. It encompasses sources like solar, wind, hydropower, and hydrogen energy. The push towards green energy is driven by global concerns over climate change and global warming. Carbon emissions from burning fossil fuels are a major contributor to these issues, leading to rising temperatures, melting ice caps, and more extreme weather events.

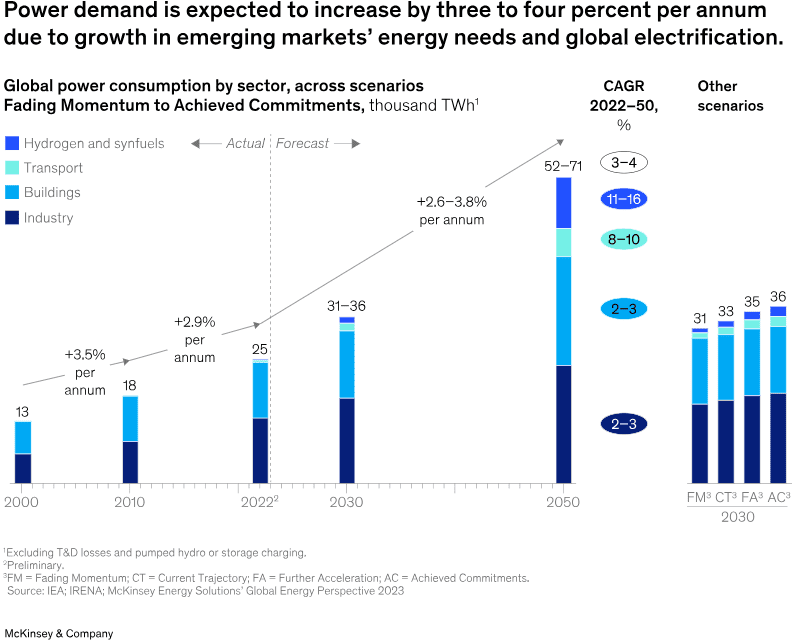

Governments and corporations worldwide are adopting carbon reduction policies to address this crisis, with many committing to achieving net-zero carbon emissions by 2050. This involves offsetting all greenhouse gas emissions produced by human activities through various methods, including the adoption of renewable energy. The global demand for green energy is increasing rapidly as a result, spurred by technological advancements and growing public awareness of environmental issues.

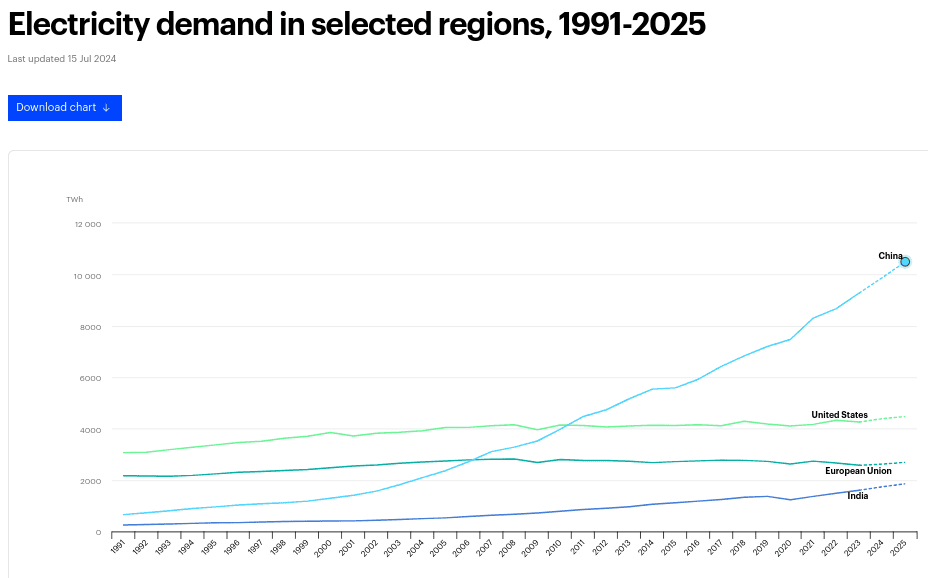

Source: iea.org

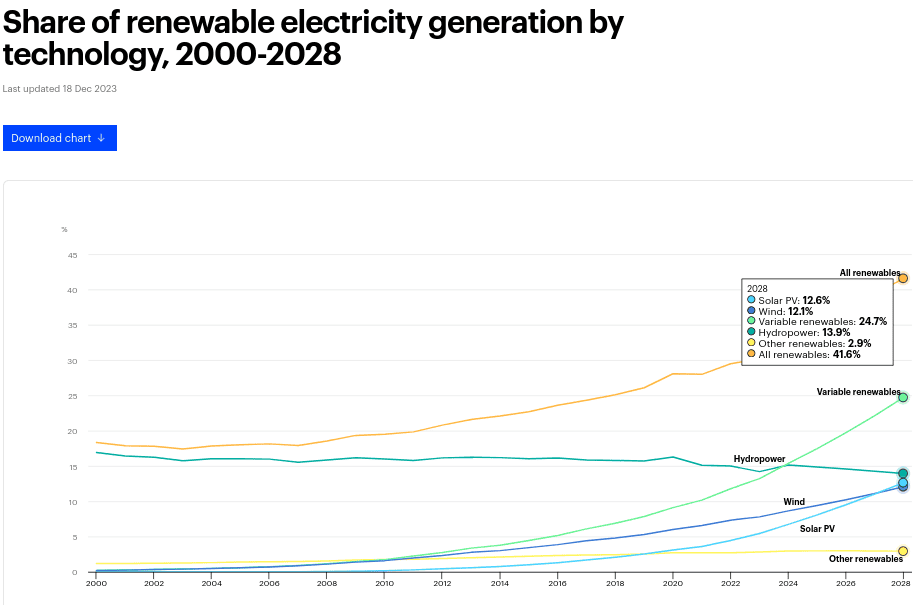

Renewable energy stocks represent companies that produce energy from these green sources, such as solar, wind, hydropower, and hydrogen. These stocks have gained popularity due to the massive growth potential in the renewable energy sector, especially as nations work to meet their climate goals. Green energy adoption is expected to expand exponentially as global carbon policies tighten.

Key Trends

Government Policies and Incentives

Governments worldwide are implementing policies to accelerate the transition to green energy. The Inflation Reduction Act in the United States, passed in 2022, offers billions in tax credits and subsidies to clean energy projects. This legislation aims to reduce U.S. carbon emissions by 40% by 2030. Similarly, the European Union has been pushing forward its Green Deal, focusing on cutting emissions and increasing renewable energy production.

Countries like China, Japan, and India have also introduced aggressive climate action plans and policies supporting green energy production. These policies create favorable conditions for renewable energy companies, leading to strong market growth and increased investment in green energy stocks.

Technological Advancements in Renewable Energy

Technological innovation is central to the energy transition. Solar and wind energy technologies have seen significant advancements, reducing costs and improving efficiency. The development of green power technologies includes floating solar farms, offshore wind energy, and advanced battery storage systems that allow energy to be stored and used when needed.

Emerging technologies, such as green hydrogen (produced by electrolysis powered by renewable energy), offer new solutions for industries looking to decarbonize. Hydrogen has become a key focus in areas where electrification is difficult, such as heavy transport and industrial applications. These advancements enable energy companies to meet the growing global demand for renewable energy, opening new investment opportunities in green energy stocks.

Source: mckinsey.com

Increasing Corporate Commitments to Sustainability

Corporations are under increasing pressure to reduce their carbon footprints. Many large companies have committed to using 100% renewable energy within the next few decades. For example, Google and Apple are pushing forward renewable energy initiatives, influencing demand for solar and wind power.

This corporate shift towards sustainability boosts the long-term demand for green energy, further supporting the growth of companies within the sector. Investors have taken note of these trends, driving up the value of green energy stocks.

Best Green Energy Stocks

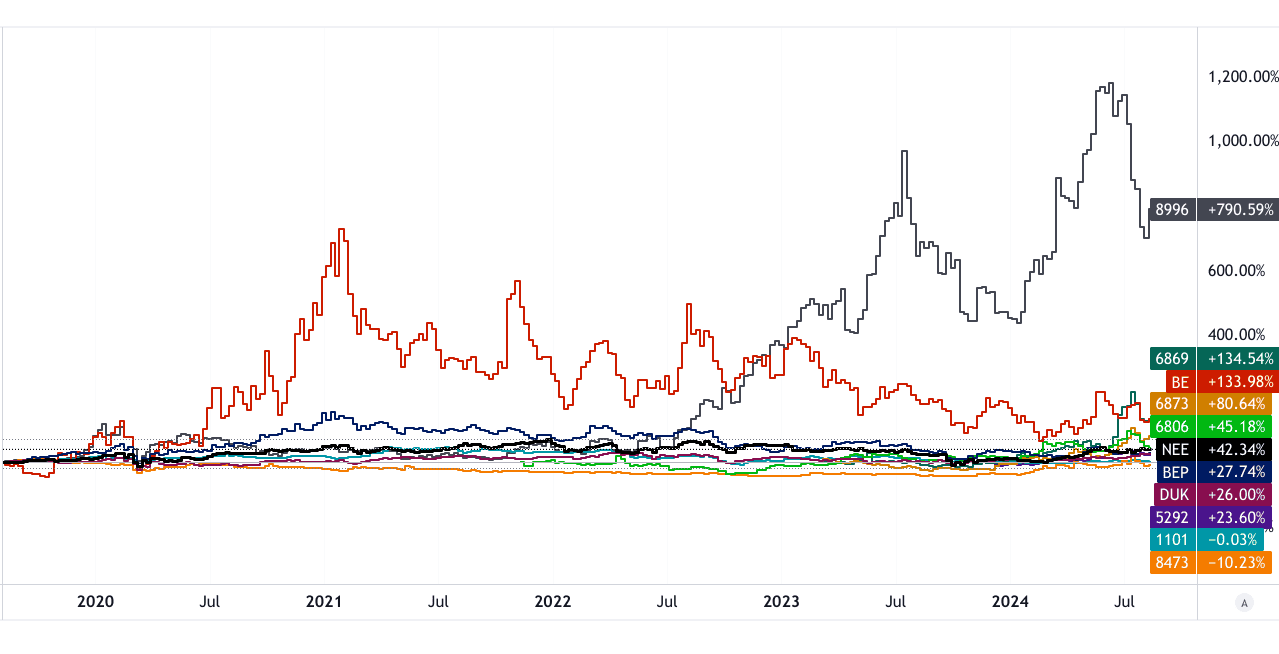

● NextEra Energy (NEE): One of the largest renewable energy companies globally, with a strong presence in solar and wind energy. It dominates the U.S. renewable energy market.

● Brookfield Renewable Partners (BEP): A global leader in hydroelectric power, expanding into solar and wind energy, with operations in North America, Europe, and Asia.

● Bloom Energy (BE): Specializes in clean hydrogen and fuel cell technology, enabling the production of zero-emission energy.

● Duke Energy (DUK): A major U.S. utility company investing heavily in solar and wind energy projects.

● Shinfox Energy (6806), HD Renewable Energy (6873), J&V Energy (6869): Asian green energy companies focused on solar and wind power solutions.

● Forest Water Environmental Engineering (8473), TCC (1101), Kaori (8996): Taiwanese companies working in environmental sustainability, energy storage, and renewable technologies.

● Desiccant Technology (5292): Develops energy-saving equipment, critical for green energy infrastructure.

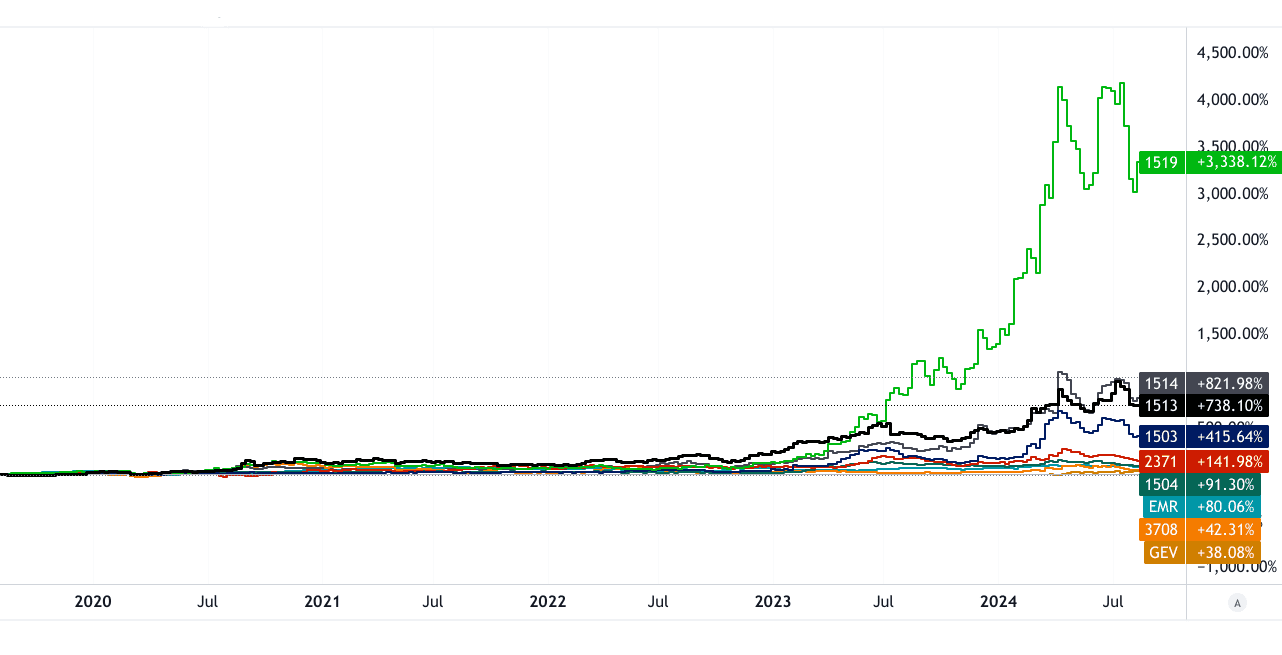

[5Y Price Return-Weekly Chart]

Source: tradingview.com

Best Renewable Energy Stocks: Solar Energy Stocks

Solar energy is one of the fastest-growing segments in green energy. Key players include:

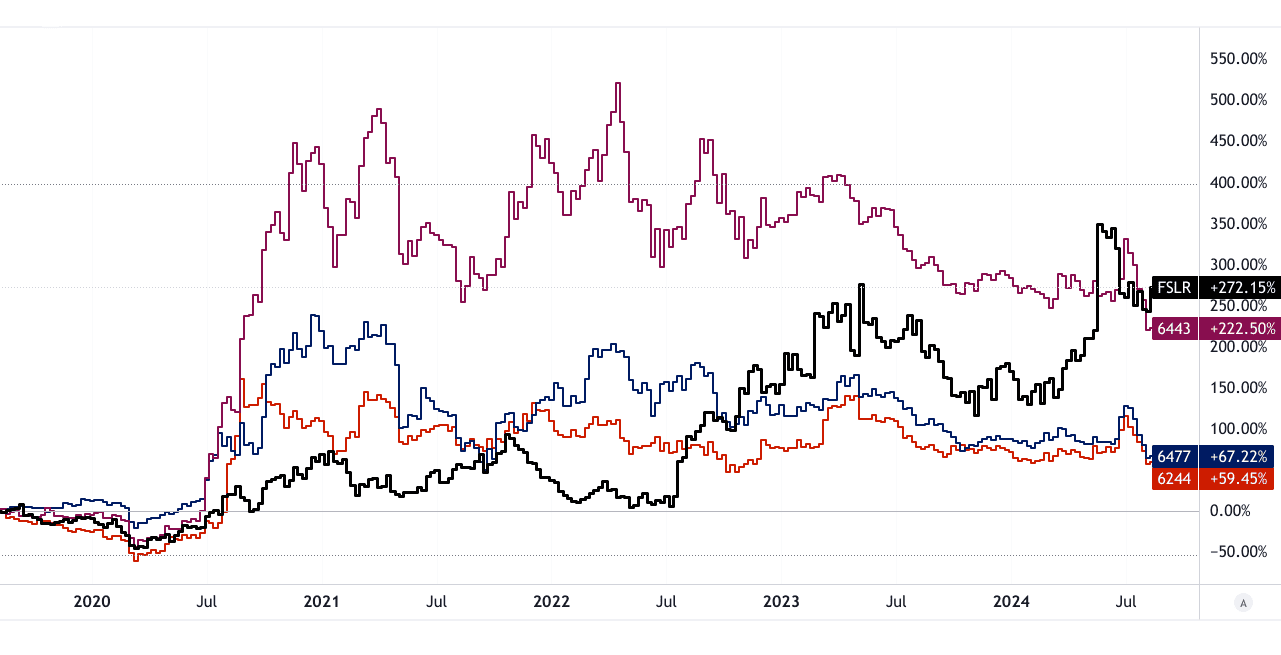

● First Solar (FSLR): A U.S.-based solar panel manufacturer known for its efficient, thin-film technology.

● SunPower (SPWR): A leading solar technology provider offering high-efficiency solar panels.

● LONGi Green Energy: A Chinese giant in the solar manufacturing sector, focusing on monocrystalline silicon solar panels.

● TSEC (6443), ANJI Technology (6477), Motech Industries (6244): Asian solar energy players producing components like solar cells and modules.

[5Y Price Return-Weekly Chart]

Source: tradingview.com

Best Clean Energy Stocks: Wind Energy Stocks

Wind energy stocks represent companies that produce energy through wind turbines. Key players include:

● Vestas: The global leader in wind turbine manufacturing, with a strong presence in Europe and North America.

● Siemens Gamesa: A major player in offshore wind energy production, providing innovative wind power solutions.

● Swancor Holding (3708), Tatung (2371): Taiwanese companies involved in wind energy infrastructure and development.

Hydrogen Energy Stocks

Hydrogen is emerging as a key green energy technology, particularly for heavy industry and transportation. Key stocks include:

● Plug Power (PLUG): A leader in green hydrogen fuel cell technology for transportation and industrial applications.

● Chem (1513), Allis Electric (1514), Coremax (4739): Asian companies engaged in hydrogen energy production and storage solutions.

Nuclear Energy Stocks & Nuclear Fusion Stocks

Nuclear energy is gaining traction as a low-carbon energy source, with developments in nuclear fusion offering long-term potential. Best nuclear energy stocks include:

● Chevron (CVX): Expanding into nuclear energy to diversify its energy portfolio.

● NuScale Power (SMR): A leader in small modular reactor (SMR) technology, providing efficient and scalable nuclear power solutions.

II. Best Energy Stocks: Heavy Electrical Equipment Stocks

What is Heavy Electrical Equipment?

Heavy electrical equipment refers to machinery and components used in the production, transmission, and distribution of electrical power. These include transformers, generators, switchgear, circuit breakers, and other systems critical to energy infrastructure. Heavy electrical stocks represent companies that manufacture and provide these solutions to industries such as power generation, renewable energy, and utilities.

These stocks are crucial to the energy sector as they provide the backbone for energy generation and transmission systems worldwide. The shift toward more efficient and eco-friendly solutions is transforming the heavy electrical equipment industry. Companies are focusing on developing technology that enhances energy efficiency, reduces losses, and integrates renewable energy into the grid. This shift is driven by increasing environmental regulations and a growing demand for sustainable energy systems.

Key Trends

Infrastructure Development and Modernization

As economies grow, the demand for reliable and efficient electrical infrastructure is increasing. Governments and private companies are investing in upgrading outdated electrical grids to meet the needs of modern industries. One example is Taipower’s “Grid Resilience Strengthening Construction Plan”, which aims to upgrade Taiwan’s power grid by enhancing its resilience to natural disasters and integrating renewable energy. This initiative involves investments in high-voltage transformers, advanced circuit breakers, and other heavy electrical equipment to modernize the grid and ensure a stable power supply.

The global push toward energy efficiency and reducing transmission losses is also a key factor. This requires modern heavy electrical equipment that supports high-voltage, high-efficiency power transmission, which is crucial for long-distance energy distribution, especially for renewable sources like solar and wind.

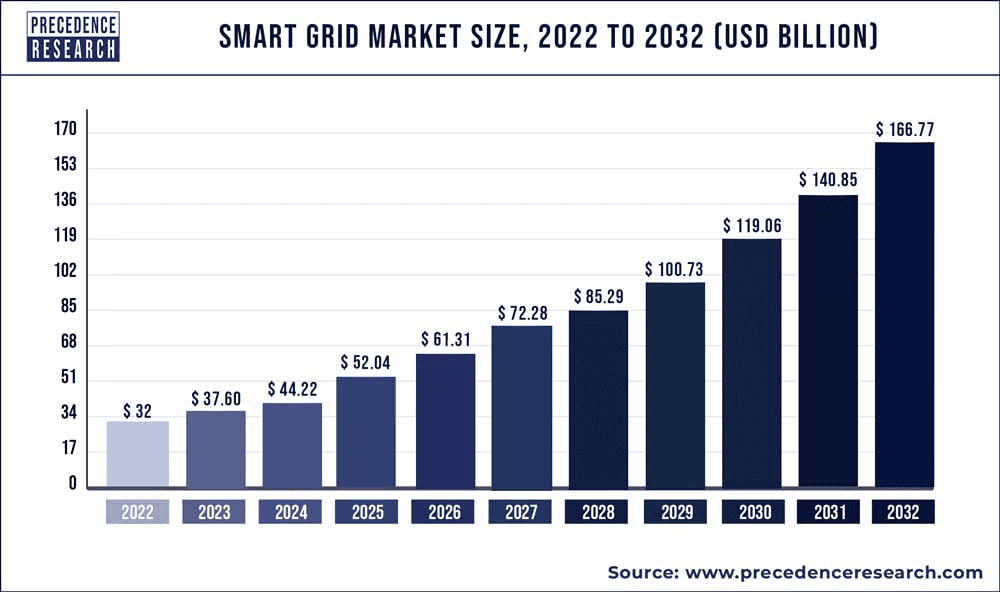

Integration of Smart Grid Technologies

The integration of smart grid technologies is revolutionizing how electrical grids operate. Smart grids use digital technologies, such as the Internet of Things (IoT) and Artificial Intelligence (AI), to optimize the production, distribution, and consumption of electricity. By employing smart meters, sensors, and advanced software, these technologies allow for real-time monitoring of energy use, more efficient load management, and quick responses to power outages.

Companies manufacturing heavy electrical equipment are at the forefront of this transformation. They are producing equipment embedded with IoT and AI capabilities, allowing grid operators to manage energy flows more efficiently, reduce downtime, and improve reliability. This trend is expected to grow as more countries adopt smart grid solutions to meet their energy demands.

Source: precedenceresearch.com

Growth in Industrial and Commercial Energy Demand

The global demand for energy in industrial and commercial sectors continues to rise. With the growing adoption of electric vehicles, automation in manufacturing, and the expansion of data centers, the need for efficient power generation and distribution systems has never been higher. This has led to increased investments in heavy electrical equipment to support these industries.

For example, companies in sectors like manufacturing, telecommunications, and e-commerce are driving demand for large-scale transformers, generators, and switchgear. As these sectors grow, they require reliable power systems to meet their high energy demands, presenting significant growth opportunities for heavy electrical equipment manufacturers.

Top Energy Stocks: Heavy Electrical Equipment Stocks

● CHEM (1513): CHEM specializes in power transformers, switchgear, and distribution systems, serving both industrial and utility sectors. The company is a significant player in Asia and has a strong presence in Taiwan’s electrical grid modernization efforts.

● Allis Electric (1514): A key player in the heavy electrical sector, Allis Electric provides transformers, switchgear, and other electrical equipment. The company focuses on integrating smart grid technology into its products, allowing for enhanced energy management and efficiency.

● Tatung (2371): A major electrical equipment provider, Tatung manufactures transformers, motors, and generators. The company is involved in Taiwan’s energy infrastructure upgrades and is working on expanding its renewable energy offerings.

● Shihlin Electric (1503): Known for producing transformers, switchgear, and other high-voltage equipment, Shihlin Electric is another key player in Taiwan’s power sector. The company is investing in green technologies to improve the efficiency of its products.

[5Y Price Return-Weekly Chart]

Source: tradingview.com

● Fortune Electric (1519): This company manufactures high-voltage transformers and switchgear, with a focus on energy efficiency and eco-friendly solutions. Fortune Electric plays a key role in supporting Taiwan’s and other Asian countries’ energy infrastructure development.

● Swancor Holding (3708): A leader in wind energy solutions, Swancor Holding is expanding into heavy electrical equipment manufacturing for renewable energy projects. The company produces components used in wind turbines and energy storage systems.

● TECO (1504): A global leader in electrical motors and industrial systems, TECO also manufactures generators and transformers. The company is heavily involved in infrastructure projects in Asia and North America, focusing on energy efficiency.

● GE Vernova (GEV): A global heavyweight in the heavy electrical equipment market, GE produces transformers, generators, and smart grid solutions. GE is a key player in renewable energy technologies, particularly in wind and hydroelectric power generation.

● ABB: A Swiss-based multinational, ABB is a leader in automation and electrical equipment for utilities and industries. ABB has a significant market share in smart grid technologies and energy-efficient solutions for power transmission.

● Siemens USA: A global leader in heavy electrical equipment, Siemens produces transformers, switchgear, and energy automation systems. The company is heavily invested in smart grid technologies, focusing on integrating renewable energy sources into the grid.

● Emerson Electric (EMR): Emerson provides advanced energy management solutions and electrical equipment for the power generation industry. The company is known for its innovative solutions in energy efficiency and smart grid technology.

III. Best Energy Stocks: Energy Storage Stocks

Energy storage stocks represent companies involved in the production, development, or sale of energy storage systems, which are essential for managing energy supply and demand. Energy storage is critical for stabilizing the grid, improving the efficiency of renewable energy sources, and ensuring reliable energy delivery. These technologies store energy when it is abundant and release it when needed, making them key to achieving a sustainable energy future.

There are various types of energy storage technologies, including:

● Batteries: The most common form of energy storage, particularly lithium-ion batteries, used in electric vehicles (EVs) and grid storage.

● Thermal Storage: Stores excess heat energy, typically for heating or cooling purposes.

● Pumped Hydro Storage: Uses water reservoirs to store and generate electricity.

● Compressed Air Energy Storage (CAES): Stores energy by compressing air and later releasing it to generate power.

These energy storage systems enable the effective integration of renewable energy into the grid, as renewable sources like solar and wind are intermittent. By ensuring a consistent energy supply, storage systems are vital to decarbonizing the global energy landscape.

Key Trends

Increasing Demand for Grid Stability and Renewable Integration

As countries transition toward renewable energy sources, energy storage plays a critical role in maintaining grid stability. Renewable energy is inherently variable – the sun doesn’t always shine, and the wind doesn’t always blow – so energy storage systems smooth out fluctuations by storing excess energy when production is high and releasing it when demand exceeds supply. For instance, during peak solar energy production, battery storage systems capture surplus power, releasing it during periods of low sunlight. This helps avoid blackouts and ensures a continuous energy supply.

Advancements in Battery Technology

Battery technology is evolving rapidly, with innovations in lithium-ion and other battery chemistries like solid-state batteries leading to increased energy density, longer lifespans, and reduced costs. These advancements are crucial for scaling up renewable energy storage and improving the efficiency of electric vehicles (EVs).

Source: iea.org

For example, Tesla (TSLA) is investing heavily in its battery production through its Gigafactories, aiming to produce more cost-effective and high-capacity batteries. CATL, another major battery producer, is a global leader in lithium-ion battery technology, supplying batteries to both EV manufacturers and grid-scale energy storage projects.

Increasing Adoption of Renewable Energy Sources

The rise of renewable energy sources like solar and wind power is driving the demand for energy storage. As the world shifts toward net-zero carbon emissions, governments and corporations are increasingly integrating renewable energy into their operations. For example, Delta Electronics (2308) has developed advanced energy storage systems designed to store solar energy for later use, reducing reliance on fossil fuels.

Government Incentives and Policies

Government policies and incentives are fueling the growth of energy storage systems. In the United States, the Inflation Reduction Act and various state-level initiatives offer tax credits and incentives for energy storage projects. These policies are aimed at reducing the costs of installing energy storage systems and encouraging investment in clean energy technologies. Similar incentives are seen in the European Union’s Green Deal, which promotes energy storage as part of the overall strategy to decarbonize the energy system.

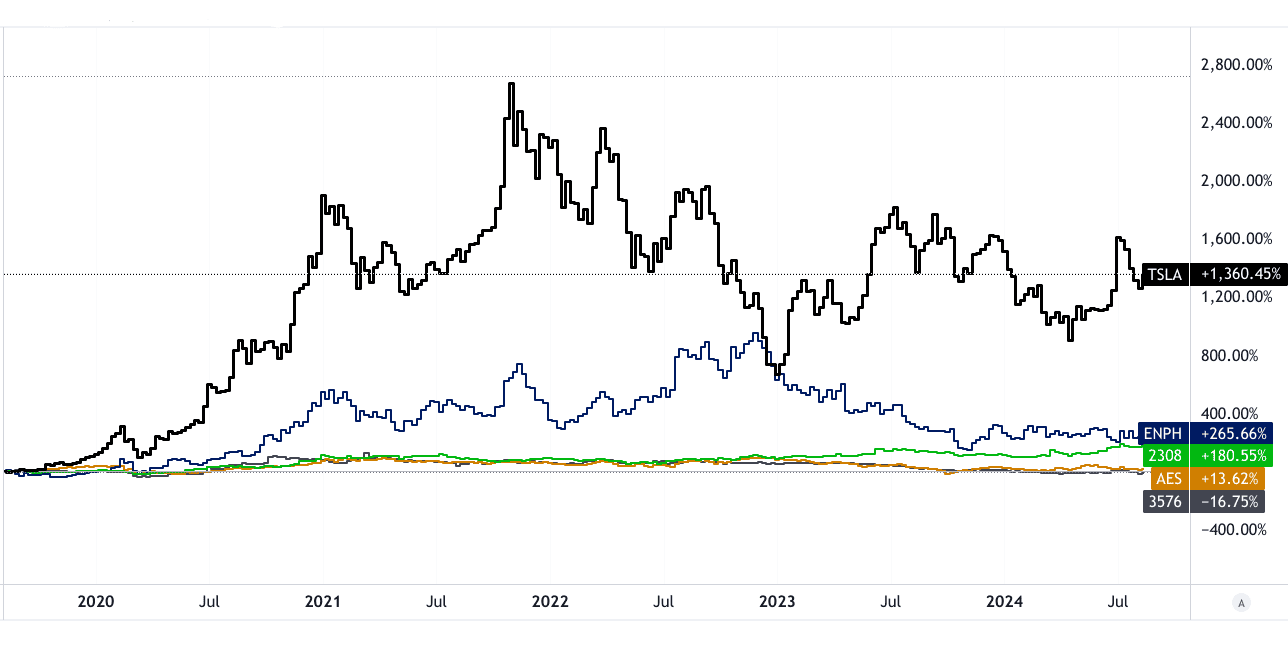

Best Energy Stocks to Buy Now: Energy Storage Stocks

● Tesla (TSLA): Tesla is a leader in both electric vehicles and energy storage solutions. The company’s Powerwall and Megapack systems are designed for home and utility-scale energy storage, respectively. Tesla’s Gigafactories produce large volumes of lithium-ion batteries, positioning it as a major player in the global energy storage market.

● CATL: Contemporary Amperex Technology Co., Limited (CATL) is a Chinese battery manufacturer and a key supplier for electric vehicle manufacturers like Tesla and BMW. The company is also expanding into grid-scale energy storage projects, solidifying its position as a global leader in battery technology.

● Delta Electronics (2308): Delta is a Taiwan-based company known for its energy storage systems, which are primarily used to store renewable energy for later use. The company is heavily involved in producing energy-efficient storage solutions, and its products are widely adopted across Asia.

● United Renewable Energy (3576): Specializing in solar energy and energy storage solutions, United Renewable Energy is a Taiwanese company that is focused on integrating storage with renewable energy projects. Their systems allow for efficient storage of solar energy, enabling a stable supply even when solar generation is low.

● Fortune Electric (1519): A key player in the heavy electrical equipment sector, Fortune Electric is also involved in producing energy storage solutions that are integrated with renewable energy projects. The company’s focus on high-voltage energy storage systems helps stabilize the grid and ensure reliable power delivery.

[5Y Price Return-Weekly Chart]

Source: tradingview.com

● AcBel Polytech (6282): AcBel Polytech produces a range of energy storage solutions, including advanced battery systems for renewable energy and grid stabilization. The company is focusing on improving battery efficiency and scalability, contributing to the broader adoption of energy storage technologies.

● Enphase Energy (ENPH): Enphase Energy is a leader in the production of solar energy storage systems, particularly through its Enphase Energy System, which integrates solar panels and storage units for home and commercial use. Enphase’s storage solutions help balance energy supply and demand, making them popular in regions with high solar adoption.

● AES Corporation (AES): AES is a global energy company involved in renewable energy and energy storage projects. The company’s Fluence energy storage platform is widely used in utility-scale projects, and AES is at the forefront of integrating storage into the grid to support renewable energy.

● Formosa Energy & Material Technology (6832): This Taiwanese company is involved in the production of advanced materials used in energy storage systems. Formosa’s focus on improving battery materials contributes to the efficiency and longevity of energy storage systems.

IV. Energy Industry Trends & Energy Sector Stocks Outlook

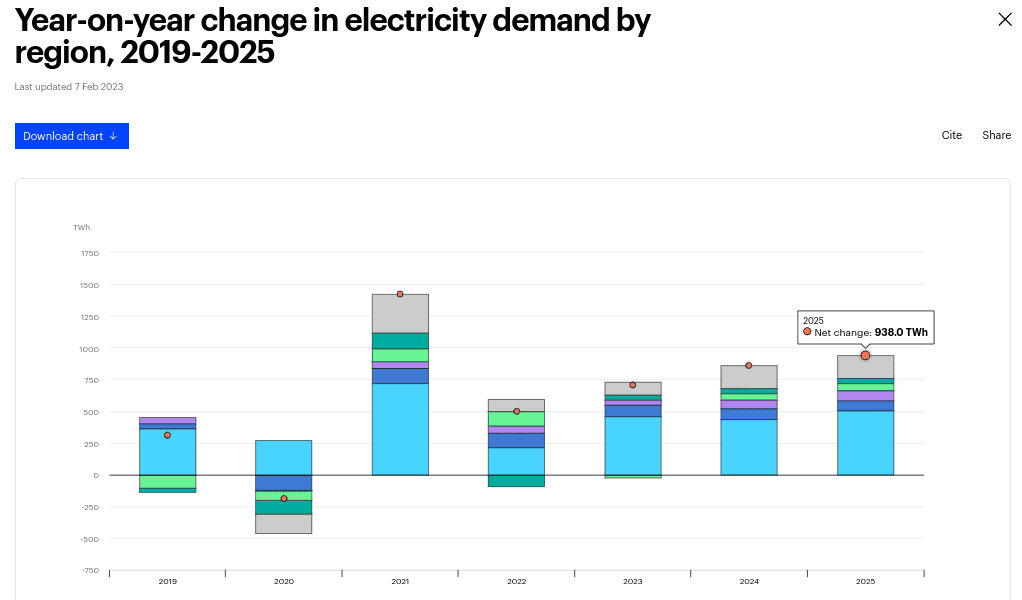

The global energy market is vast and diverse, covering conventional energy sources such as oil, gas, coal, and emerging renewable energy sectors like wind, solar, and hydropower. According to IEA (International Energy Agency) data, the global energy market was valued at approximately $10 trillion (consumption) in 2022, with projections of continued growth, largely driven by the shift towards renewable energy and increasing energy demands in developing regions.

Despite a significant decline in oil and gas demand during the COVID-19 pandemic, energy consumption rebounded in 2021-2022, supported by economic recovery and industrial activity. In 2023, oil and gas still accounted for a dominant share of the market, but the renewable energy sector saw an annual growth rate of 6%, with expectations of reaching $1.9 trillion by 2030.

Regional Market Analysis

The energy sector varies significantly across regions, shaped by local energy needs, resource availability, and government policies.

● North America: The U.S. remains a major player in both fossil fuels and renewable energy. Natural gas dominates, but significant growth in solar and wind projects, supported by policies such as the Inflation Reduction Act (IRA), signals a shift. The IRA, with its generous tax incentives for clean energy investment, is expected to further boost the U.S. renewable energy sector in the coming decade.

● Europe: Europe is at the forefront of the global energy transition, with strong government support for renewables and ambitious climate targets like net-zero emissions by 2050. Countries like Germany and Spain lead in wind and solar capacity, while Norway and France focus on hydropower and nuclear energy. Europe’s dependence on Russian gas has pushed the region to accelerate the development of green energy.

● Asia-Pacific: Rapid industrialization in China, India, and Southeast Asia is driving massive demand for energy. China is the world’s largest renewable energy producer, with strong government support for wind, solar, and hydropower projects. However, coal remains a dominant source, particularly in India. Regional governments are investing in renewables to meet rising demand and environmental goals.

Source: iea.org

Long-Term Outlook for Energy Stocks

Continued Growth of Renewable Energy Stocks

Renewable energy stocks, encompassing solar, wind, and hydropower companies, are expected to maintain strong growth trajectories. This growth is largely fueled by the global commitment to reducing carbon emissions and meeting net-zero targets by 2050. Companies like NextEra Energy (NEE) and Brookfield Renewable Partners (BEP) are likely to benefit from government incentives and increased corporate demand for clean energy.

Moreover, technological advancements in solar panel efficiency and offshore wind energy will continue to drive down costs, making renewable energy more competitive with traditional fossil fuels. Emerging technologies such as green hydrogen and energy storage are also critical drivers of growth, as they allow for more reliable integration of renewables into the energy grid. As governments increase investment in grid resilience and storage solutions, companies that offer innovative clean energy products, such as Tesla (TSLA) with its battery storage systems, will likely see significant growth.

Shift in Fossil Fuel Stocks

While renewable energy stocks are on the rise, fossil fuel stocks, particularly oil and gas, still hold a significant place in global energy portfolios. Oil and gas companies like ExxonMobil (XOM) and Chevron (CVX) have remained profitable, particularly as global oil demand recovers post-pandemic. However, long-term projections indicate a gradual decline in demand for fossil fuels, driven by climate policies and the shift to electric vehicles (EVs).

That said, traditional energy companies are adapting to the changing landscape by diversifying into clean energy. For instance, BP (BP) and Royal Dutch Shell (RDS.A) have announced plans to invest in renewable energy projects and carbon capture technologies. As fossil fuel giants transition to more sustainable business models, their stocks may offer growth potential alongside higher dividends from their traditional energy operations.

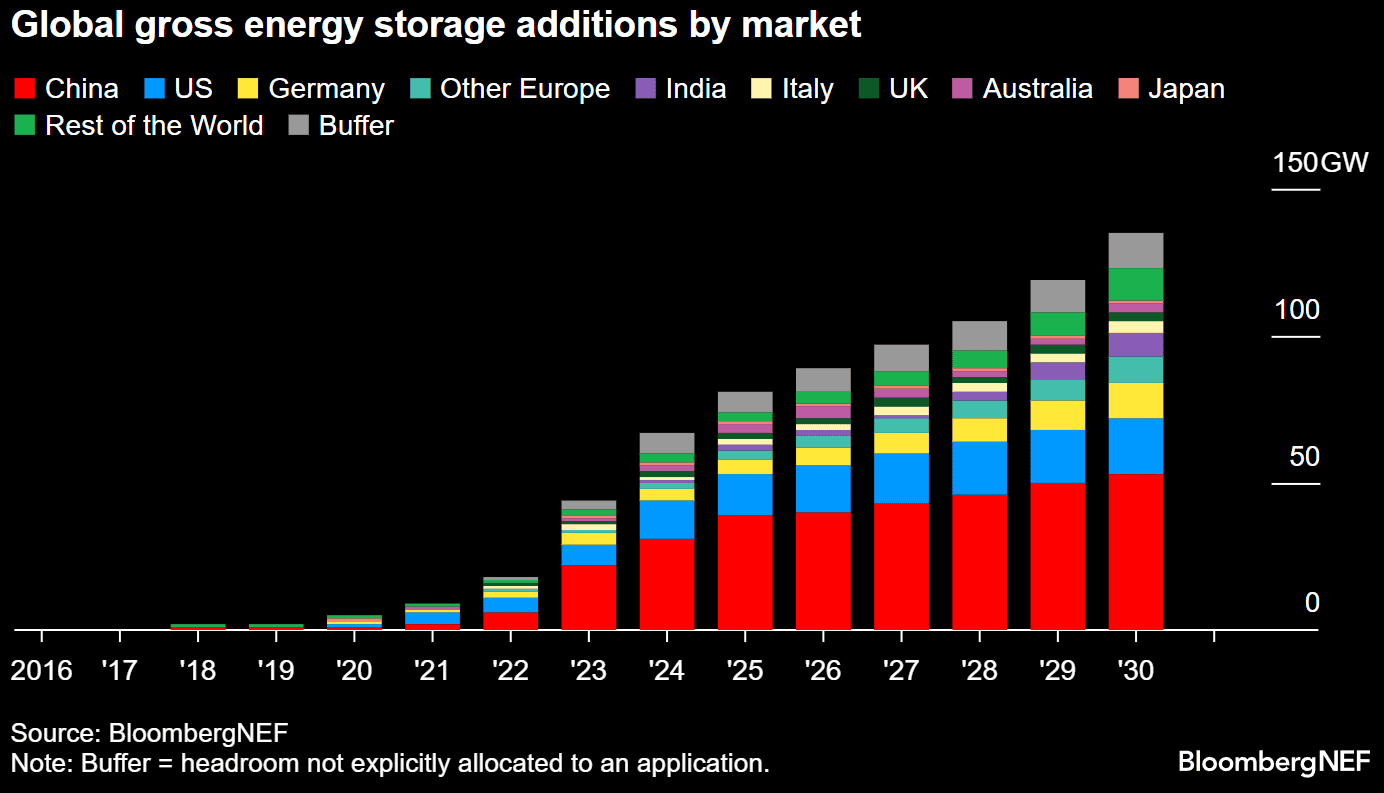

Energy Storage Stocks on the Rise

The energy storage sector will see accelerated growth, with companies involved in battery technology and grid integration becoming essential to the renewable energy industry. As solar and wind energy expand, the need for efficient storage solutions, like those developed by Tesla (TSLA) and Enphase Energy (ENPH), will grow. Battery manufacturers such as Contemporary Amperex Technology Co., Limited (CATL) and LG Chem will be central to the success of energy storage technologies.

Long-term, energy storage is expected to become a $600 billion industry by 2030, providing significant growth opportunities for investors. Innovations in lithium-ion batteries, solid-state batteries, and grid-scale storage solutions will drive this growth as the world seeks to stabilize energy production from renewable sources.

Source: BloombergNEF (BNEF)

Emerging Role of Nuclear and Hydrogen Energy

Nuclear energy, particularly nuclear fusion, is gaining attention as a potential long-term clean energy solution. While it remains in the experimental stages, nuclear fusion promises limitless, carbon-free power. Companies like Commonwealth Fusion Systems and General Fusion are at the forefront of developing commercially viable fusion energy technologies. For now, nuclear fission remains a crucial part of the energy mix, with companies like Southern Company (SO) and Exelon (EXC) leading nuclear power production in the US.

[5Y Price Return-Weekly Chart]

Source: tradingview.com

Hydrogen energy is another emerging sector, with applications ranging from industrial use to fuel cell vehicles. Green hydrogen, produced using renewable energy, is expected to play a significant role in decarbonizing heavy industries such as steel and chemicals. Plug Power (PLUG) and Ballard Power Systems (BLDP) are key players in this space.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.