- Gold stocks offer the potential for high returns, with significant gains realized during gold price surges; for example, Barrick Gold’s stock surged over ~30% in the last 12 months as gold prices hit record highs.

- Gold stocks exhibit greater volatility compared to physical gold, with price swings influenced by operational risks and market sentiment; for instance, Kinross Gold's stock experienced a +100% price return in the last 12 months.

- Unlike physical gold investments, gold mining stocks are more liquid, providing easier buying and selling opportunities through stock exchanges, and offering an advantage over the physical storage and transaction complexities of gold bullion.

Source: freepik.com

I. What Are Gold Stocks

Gold stocks represent equity investments in companies involved in the gold industry, ranging from exploration to production. They primarily fall into two categories: gold mining stocks and gold royalty and streaming companies.

Gold Mining Stocks: These are shares in companies directly engaged in the extraction of gold. They can be further categorized into:

Major Miners: Large, well-established companies with significant gold reserves and diversified operations. Examples include Newmont Corporation (NEM) and Barrick Gold Corporation (GOLD). For instance, Newmont reported gold reserves of approximately 128 million ounces as of its latest update, underscoring its extensive production capacity.

Source: Newmont Corporation investor presentation_Q3 2024

Source: Newmont Corporation investor presentation_Q3 2024

Intermediate and Junior Miners: Smaller firms with less diversified operations. Junior miners are often in exploration or early production stages, such as Endeavour Mining Corporation (EDV). Endeavour has shown substantial growth in production, with a reported 470K ounces of gold production in H1 2024.

Gold Royalty and Streaming Companies: These companies provide upfront capital to gold mining firms in exchange for a percentage of future production or a fixed amount of gold. This model mitigates operational risks and capital requirements for the company. Notable examples include Franco-Nevada Corporation (FNV) and Royal Gold, Inc. (RGLD). Franco-Nevada, for instance, holds royalties on over 400 assets globally and reported a revenue of $835 million in 2023 from these royalties.

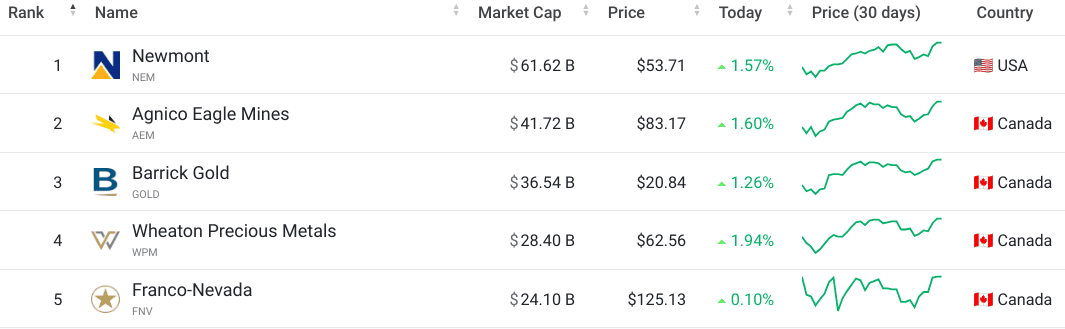

Source: companiesmarketcap.com

Why Invest in Gold Stocks?

- Potential for High Returns: Gold stocks can offer substantial returns due to their leverage on gold prices. For instance, when gold prices rise, gold mining companies can see their profits increase disproportionately because their production costs are relatively fixed. During the gold price rally of 2020, many gold mining stocks surged by over 100% as gold prices reached record highs of $2,067 per ounce.

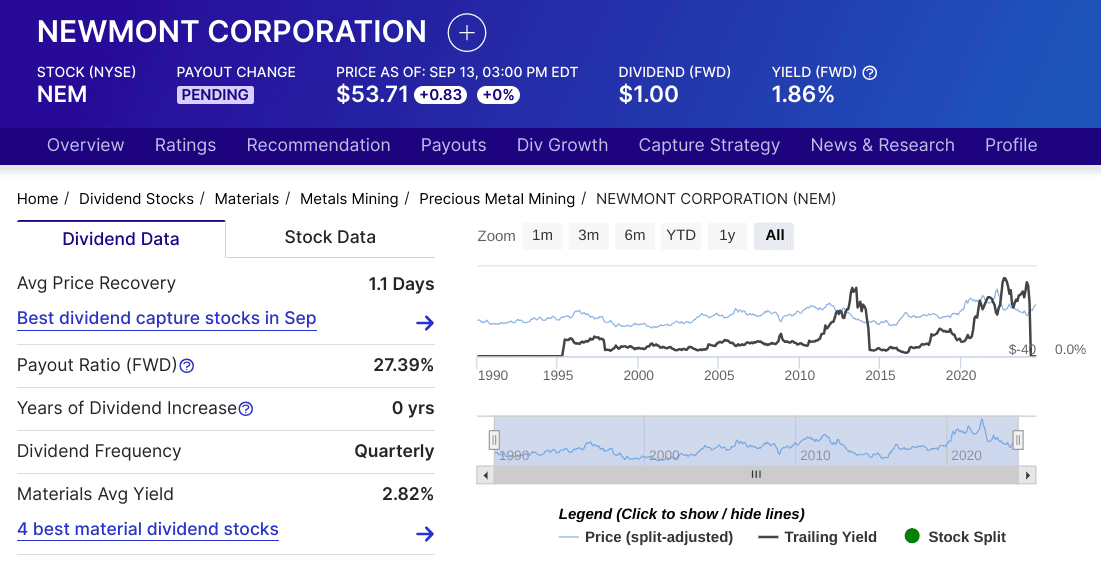

- Dividend Income Potential: Some gold stocks provide dividend income, which can be an attractive feature for investors seeking regular cash flow. For example, Newmont Corporation has a dividend yield of approximately 1.9%, reflecting its stable cash flow and commitment to returning value to shareholders.

Source:Dividend.com

Source:Dividend.com

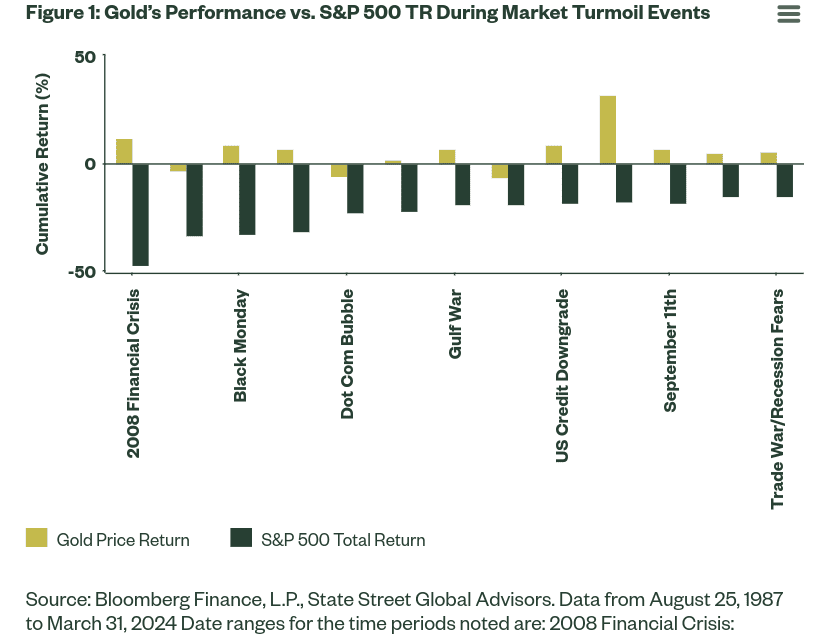

- Safe Haven Investment: Gold is traditionally viewed as a safe haven asset, providing protection against currency devaluation and inflation. For instance, during the 2008 financial crisis, gold prices increased by 25% as investors sought safety amidst market turmoil.

- Exposure to Global Markets: Investing in gold stocks provides indirect exposure to global gold markets without the need for physical storage. Gold mining companies operate in various countries, offering geographical diversification and access to different regional gold deposits.

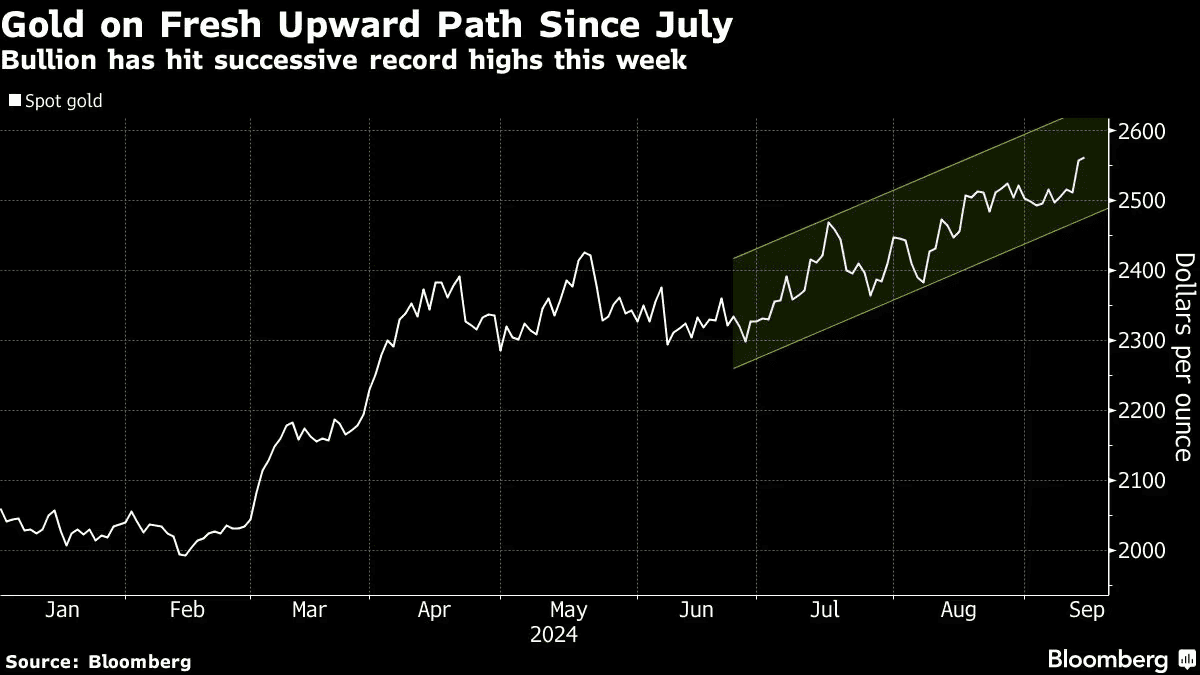

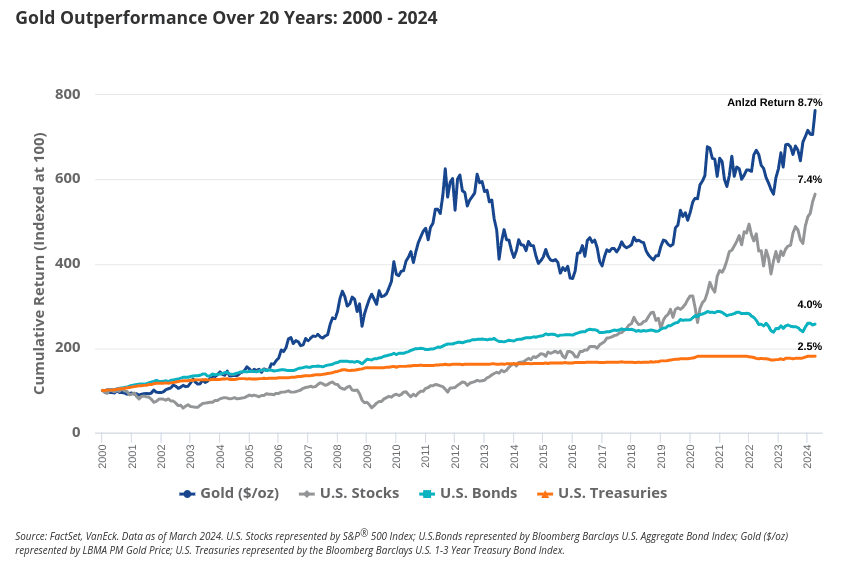

- Long-Term Value: Gold has historically maintained its value over the long term, often outperforming other assets during economic downturns. For example, gold’s price has risen consistently from $300 per ounce in 2001 to over $2,588 per ounce by mid-September 2024, highlighting its enduring value.

Source: bnnbloomberg.ca

II. Best Gold Stocks

Gold Stocks & Gold Mining Stocks (US Stocks)

Seabridge Gold Inc. (SA): Seabridge Gold focuses on exploring and developing gold projects in North America. Its flagship asset, the KSM Project in British Columbia, is one of the largest undeveloped gold-copper-silver resources in the world. Seabridge's market position is bolstered by its substantial resource base, with a measured and indicated gold resource of over 40 million ounces. Recent highlights include the completion of a positive feasibility study in 2023, which outlines a robust economic model with a projected internal rate of return (IRR) of 15%. However, it does not currently offer a dividend.

AngloGold Ashanti plc (AU): AngloGold Ashanti is a global gold mining company headquartered in South Africa, with operations in several countries, including the Americas and Africa. It holds a strong market position due to its diversified portfolio and significant production base. In 2023, AngloGold produced 3.3 million ounces of gold and generated revenues of $6.2 billion. The company is investing in growth projects, including the Tropicana and Obuasi mines, aiming to increase production by 10% over the next five years. The dividend yield stands at approximately 1.5%.

Newmont Corporation (NEM): As the world's largest gold producer, Newmont has a dominant market share and a diversified portfolio of operations across North and South America, Australia, and Africa. Newmont’s 2023 gold production totaled 6 million ounces, with revenues exceeding $10 billion. The company has a solid track record of dividends, currently offering a yield of about 1.9%. Newmont's future growth is supported by its expansion projects and strong pipeline of development opportunities, including the Tanami Expansion 2 project in Australia.

Barrick Gold Corporation (GOLD): Barrick Gold is a leading gold producer with a global footprint. It operates several large mines, including the Pueblo Viejo in the Dominican Republic and the Veladero in Argentina. In 2023, Barrick produced 4.4 million ounces of gold and achieved revenues of $8.3 billion. The company’s focus on cost control and strategic acquisitions, such as the merger with Randgold Resources, has strengthened its market position. Barrick’s dividend yield is around 1.9%, and it has a strong focus on generating shareholder value through disciplined capital allocation.

Perpetua Resources Corp (PPTA): Perpetua Resources is a U.S.-based gold mining company developing the Stibnite Gold Project in Idaho. The project boasts a substantial resource base with over 4 million ounces of measured and indicated gold. Perpetua's recent highlight includes the completion of a feasibility study demonstrating robust project economics, with an IRR of 20%. The company does not currently offer a dividend, but its growth potential is significant due to the project’s high-grade ore and environmental benefits.

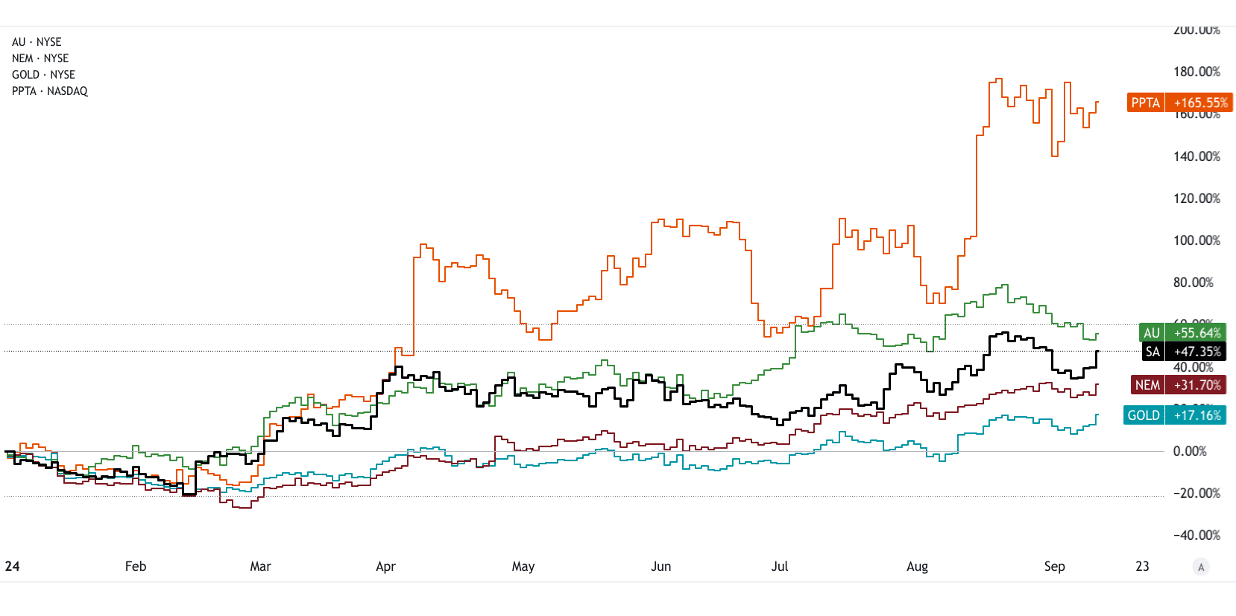

Source: tradingview.com [YTD_Price return]

Source: tradingview.com [YTD_Price return]

Kinross Gold Corporation (KGC): Kinross Gold operates a diverse portfolio of mines in North and South America, West Africa, and Russia. The company produced 2.3 million ounces of gold in 2023, with revenues of $4.5 billion. Kinross is focusing on growth through exploration and optimization of existing assets. The company’s dividend yield is approximately 1.2%. Recent highlights include successful expansions at the Tasiast mine in Mauritania, which are expected to enhance production and profitability.

Alamos Gold Inc. (AGI): Alamos Gold is known for its operations in North America, particularly its Young-Davidson and Island Gold mines in Canada. In 2023, Alamos produced 495,000 ounces of gold with revenues of $945 million. The company’s growth strategy involves expanding its existing mines and exploring new opportunities. Alamos offers a dividend yield of around 0.5%. Recent developments include the ongoing expansion of Island Gold, which is expected to significantly increase production over the next few years.

Franco-Nevada Corporation (FNV): Franco-Nevada is a leading gold royalty and streaming company with a diverse portfolio of assets. It does not directly mine gold but earns revenue through royalties and streaming agreements. Franco-Nevada reported revenue of $835 million in 2023, with a portfolio that includes over 400 royalties and streams globally. The company's strong financial position and diverse asset base provide stability and growth potential. Its dividend yield is approximately 1.2%, reflecting its commitment to returning capital to shareholders.

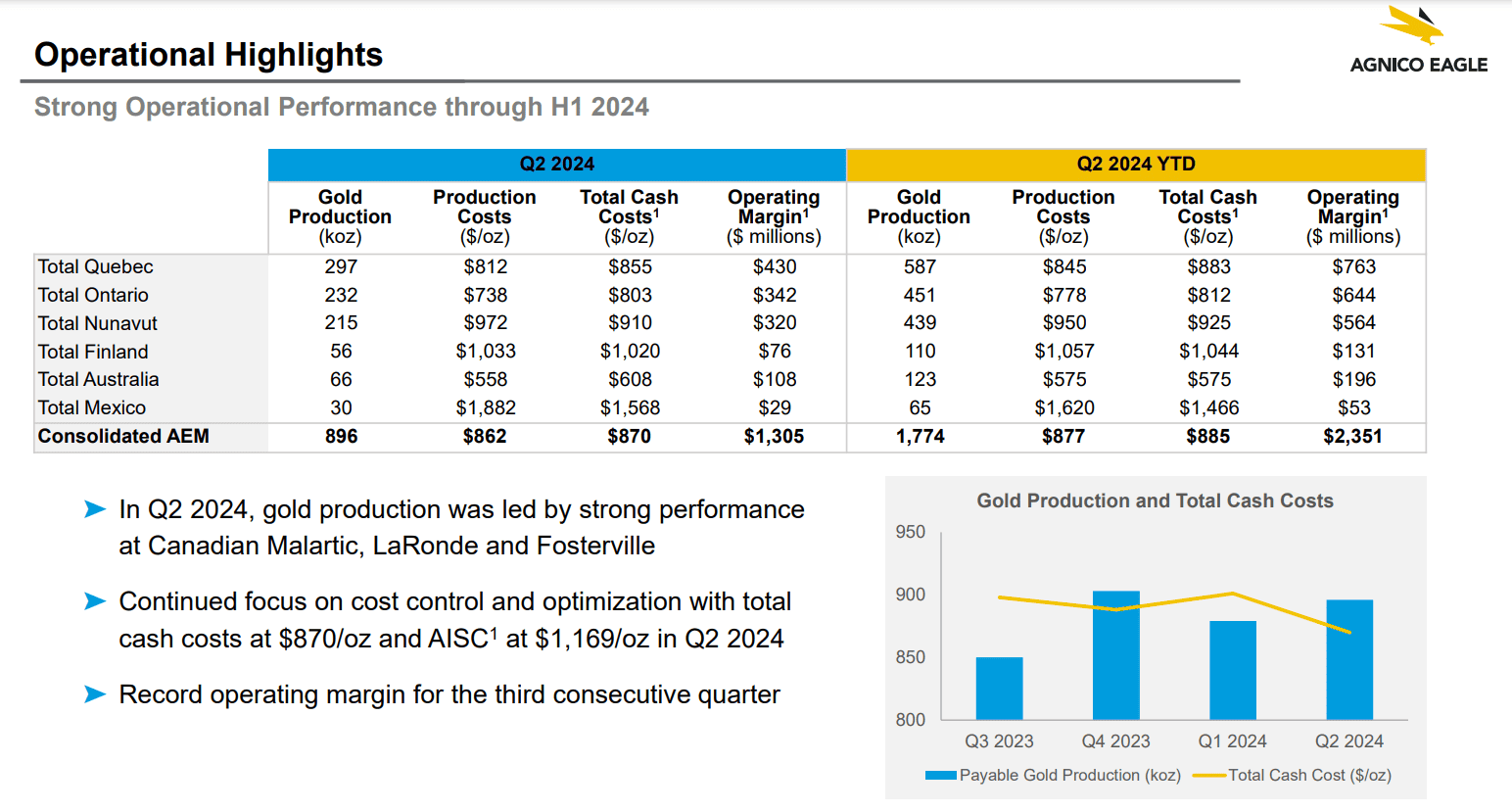

Agnico Eagle Mines Limited (AEM): Agnico Eagle operates several mines across Canada, Finland, and Mexico. The company produced 1.7 million ounces of gold in 2023, generating revenues of $3.4 billion. Agnico Eagle’s market position is strengthened by its focus on high-quality assets and efficient operations. The company’s dividend yield is around 1.9%. Recent highlights include the integration of the Kirkland Lake Gold assets, which are expected to enhance production and operational synergies.

Eldorado Gold Corporation (EGO): Eldorado Gold is involved in mining and exploration with operations primarily in Turkey and Canada. In 2023, Eldorado produced 402,000 ounces of gold, with revenues of $785 million. The company is focused on expanding its production capacity and optimizing its existing operations. Recent advancements include progress on the Skouries project in Greece, which is set to significantly boost future production.

Coeur Mining (CDE): Coeur Mining is a U.S.-based precious metals mining company with operations in Nevada, Alaska, and Mexico. It produced 175,000 ounces of gold in 2023, with revenues of $473 million. Coeur’s market position is supported by its diverse asset base and ongoing exploration efforts. The company does not currently offer a dividend but has potential growth from its expansion projects, such as the Rochester silver-gold mine.

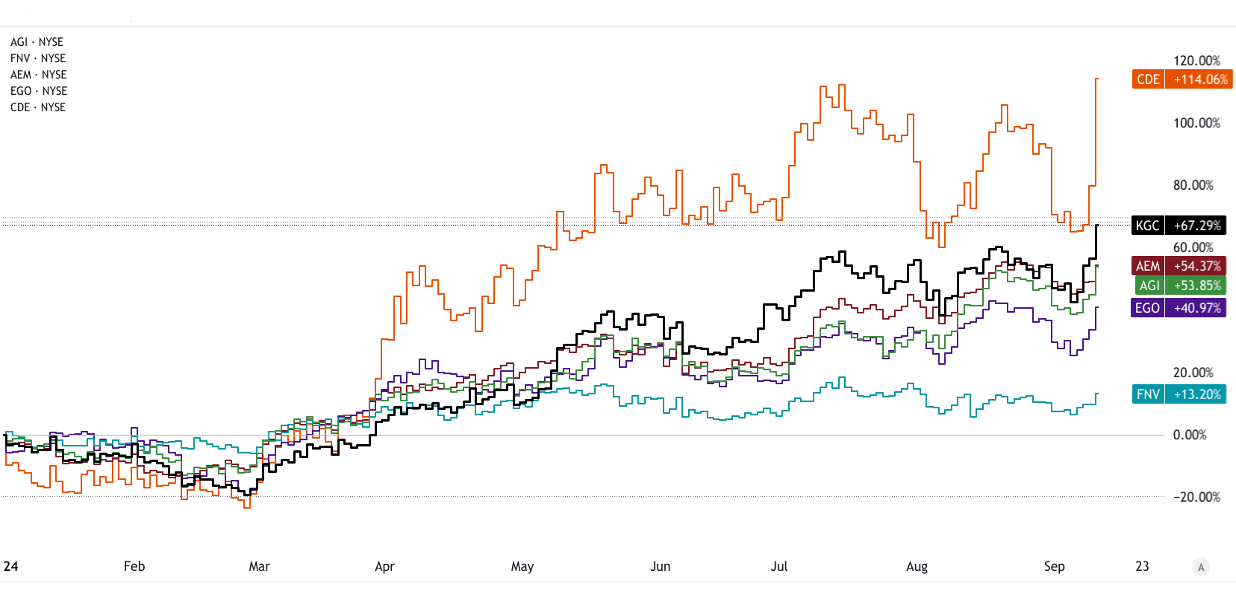

Source: tradingview.com [YTD_Price return]

Source: tradingview.com [YTD_Price return]

Gold Stocks List (Taiwan Stocks)

Jiin Yeeh Ding Enterprise (8390): Jiin Yeeh Ding Enterprise is a Taiwanese company involved in the production and sale of gold jewelry and related products. It has a niche market position in Taiwan’s jewelry industry. The company's recent highlights include an expansion into international markets, which is expected to boost revenue. However, it does not offer a dividend.

Super Dragon Technology (9955): Super Dragon Technology engages in the manufacture of gold and precious metal components for electronic applications. The company holds a specialized position in Taiwan’s electronics sector. Recent growth is driven by increased demand for high-precision components in technology. Super Dragon Technology does not provide a dividend.

Solar Applied Materials Technology (1785): This company produces advanced materials for solar energy applications, including gold-based components for photovoltaic cells. Its market position benefits from the increasing adoption of solar technology. Recent advancements in technology and expansion into new markets highlight its growth potential. Solar Applied Materials does not currently offer a dividend.

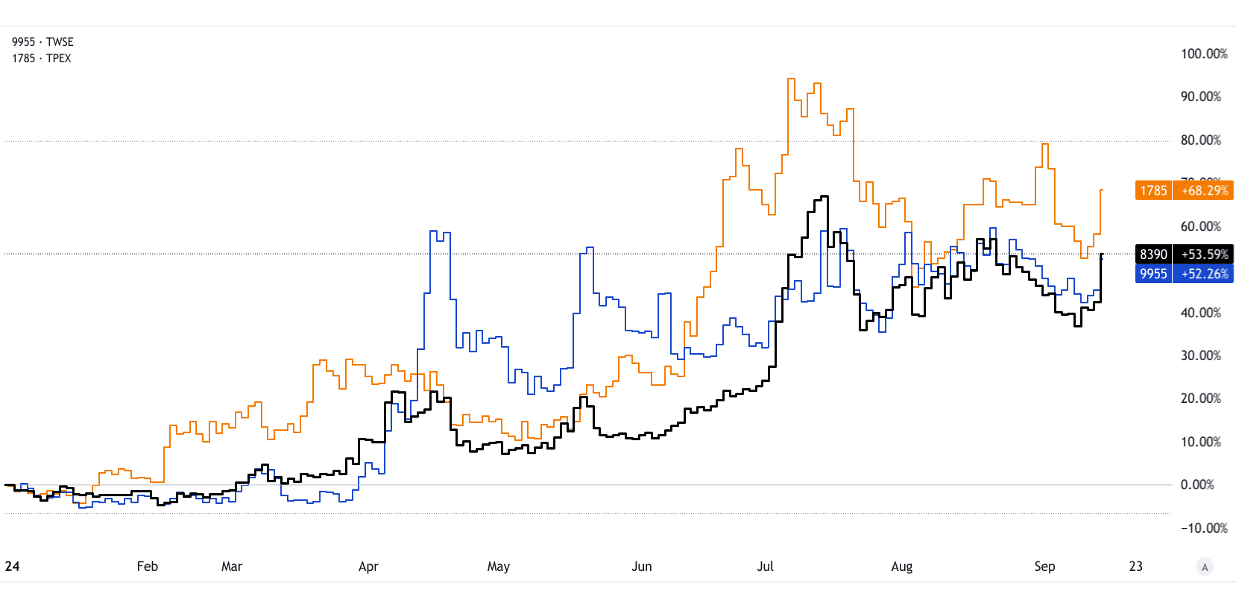

Source: tradingview.com [YTD_Price return]

Source: tradingview.com [YTD_Price return]

Top Gold Stocks ETFs

VanEck Gold Miners ETF (GDX): GDX is a leading ETF that tracks the performance of large and mid-cap gold mining companies. It holds a diverse portfolio, including major producers like Newmont and Barrick Gold. The ETF provides exposure to the broader gold mining sector without requiring physical storage of gold. GDX offers a dividend yield of approximately 1.3%. It is a popular choice for investors seeking broad exposure to gold mining equities.

SPDR Gold Shares (GLD): GLD is designed to track the price of gold bullion. It holds physical gold bars and offers a direct investment in gold without the complexities of storing physical gold. GLD provides a simple way to gain exposure to gold prices with an annual expense ratio of 0.40%. This ETF does not offer a dividend, as its primary aim is to reflect gold’s price movement.

VanEck Vectors Junior Gold Miners ETF (GDXJ): GDXJ focuses on smaller, junior gold mining companies with high growth potential. It includes a diversified mix of emerging producers and exploration companies. GDXJ offers higher risk and reward compared to GDX due to its focus on smaller, less established companies. The ETF has a dividend yield of around 0.6%, reflecting its focus on growth stocks rather than high dividend payouts.

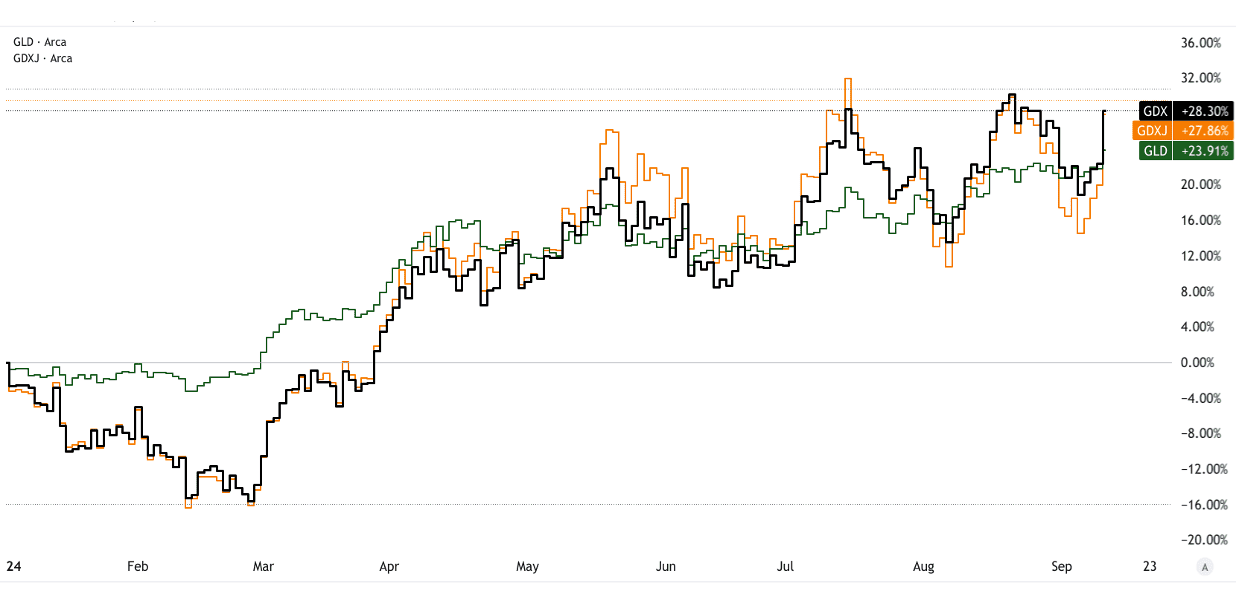

[YTD_Price return]

Source: tradingview.com

III. Factors to Consider When Investing in Gold Stocks

Gold Prices: The price of gold is a primary driver of gold stock performance. Gold prices are influenced by global economic conditions, investor sentiment, and currency fluctuations. For example, gold prices surged from around $1,200 per ounce in early 2018 to over $2,000 per ounce in August 2020 amid economic uncertainty and inflation concerns. Higher gold prices generally boost the profitability of gold mining companies, potentially leading to higher stock values.

Macroeconomic Factors:

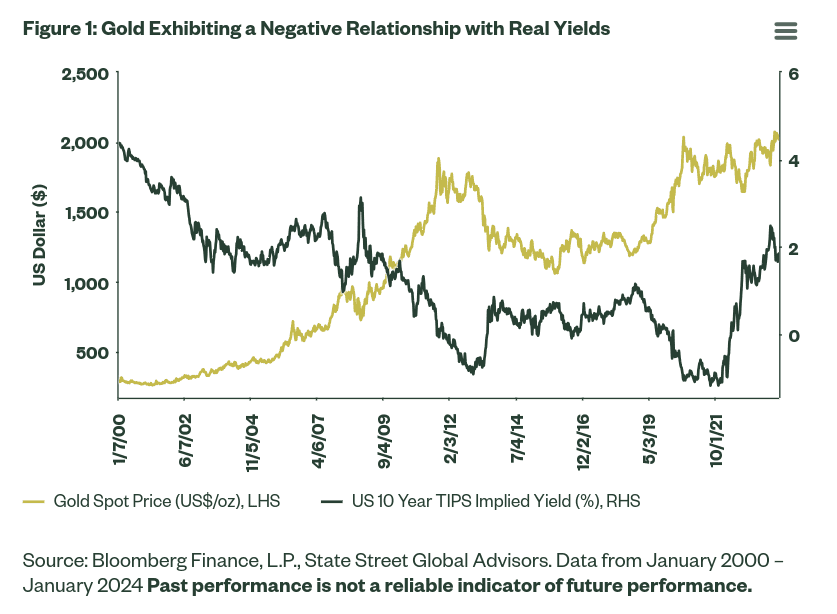

Inflation and Interest Rates: Gold is often seen as a hedge against inflation. As inflation rises, the real value of currency declines, increasing gold's appeal. Conversely, higher interest rates can negatively impact gold stocks since they raise the opportunity cost of holding non-yielding assets like gold. For instance, the Federal Reserve's interest rate hikes in 2022-2023 led to a decrease in gold prices as investors preferred higher-yielding investments.

Source: ssga.com

Global Economic Conditions: Economic instability or downturns can drive investors to gold as a safe haven. The 2008 financial crisis and the COVID-19 pandemic saw gold prices rise significantly due to increased demand for safe-haven assets.

Supply and Demand: The balance between gold supply (from mining and recycling) and demand (for jewelry, technology, and investment) affects gold prices. Supply disruptions, such as those caused by mining strikes or geopolitical issues, can push prices higher, benefiting gold stocks.

Company Performance:

Financial Health: A company's financial stability, including its cash flow, debt levels, and profitability, impacts its ability to invest in growth and weather market downturns. For example, Newmont Corporation's strong financial position allows it to fund exploration and development while maintaining a healthy dividend.

Operational Efficiency: Efficient operations reduce costs and increase profitability. Companies with low all-in sustaining costs (AISC) have a competitive advantage. For instance, Barrick Gold's focus on cost management has enabled it to maintain robust profit margins even during periods of lower gold prices.

Source: Barrick Gold_Q2_2024_Results_Presentation

Source: Barrick Gold_Q2_2024_Results_Presentation

Exploration and Reserve Growth: Companies investing in exploration and successfully expanding their reserves can ensure long-term growth. Kinross Gold's exploration successes and reserve increases enhance its future production potential.

Geopolitical and Regulatory Risks:

Global Events: Geopolitical events, such as trade wars or conflicts in mining regions, can impact gold production and prices. For example, geopolitical instability in the Middle East, and Ukraine can disrupt mining operations and affect global gold supply.

Source: ssga.com

Mining Regulations and Policies: Regulatory changes and environmental policies can impact mining operations. Stricter regulations or increased taxation in mining jurisdictions can raise costs or limit production. For instance, increased environmental regulations in Canada have led to higher compliance costs for mining companies.

Mining Costs and Production Efficiency:

All-in Sustaining Costs (AISC): AISC measures the total cost of producing gold, including mining, processing, and sustaining capital costs. Lower AISC indicates better operational efficiency and higher profit margins. For example, Agnico Eagle Mines aims to keep its AISC below $1,000 per ounce, which enhances its profitability and competitive position in the market.

Source: AEM-Earnings-Presentation-Q2-2024

Source: AEM-Earnings-Presentation-Q2-2024

IV. Gold Industry Trends and Gold Stocks Outlook

As of 2024, the global gold market is valued at approximately $12 trillion, driven by investment demand, jewelry consumption, and central bank purchases. The market is projected to grow at a compound annual growth rate (CAGR) of about 4% through 2028, supported by rising inflationary pressures and geopolitical uncertainties.

Regional Market Analysis

- North America: The U.S. and Canada are major gold producers, with significant mining operations and exploration activities. North America remains a stable region due to its robust regulatory framework and advanced mining technologies.

- Africa: Africa holds a substantial share of global gold production and reserves. However, political instability and regulatory changes pose risks. Despite these challenges, the region’s potential for exploration remains high.

- Asia: Countries like China and India are key markets for gold jewelry, driving demand. China’s growing middle class and India’s cultural affinity for gold support long-term consumption trends.

Source: gold.org (Global mine production)

Future Trends

- Sustainable Mining Practices: There is a growing emphasis on reducing environmental impact. Companies like Newmont are investing in sustainable practices, including lower-carbon technologies and water conservation. The transition to more sustainable mining is expected to improve regulatory compliance and operational efficiency.

- Automation and AI: Automation and AI are transforming gold mining by enhancing exploration accuracy and operational efficiency. AI-driven technologies are improving ore discovery and reducing operational costs. For example, Barrick Gold has integrated AI to optimize its mining processes and predictive maintenance.

- Digital Gold and Blockchain: Digital gold and blockchain technologies are gaining traction. Blockchain can enhance transparency and traceability in gold trading, while digital gold platforms offer new investment opportunities. This innovation is likely to attract tech-savvy investors and increase market liquidity.

- Exploration Investment & Emerging Markets: Investment in exploration is shifting towards emerging markets with untapped potential. Countries like Peru and Mongolia are becoming focal points due to their rich mineral deposits. Increased investment in these regions could offset supply constraints.

- Gold Supply Constraints: Decreasing ore grades and high mining costs are pressing issues. Major producers are addressing these through mergers and acquisitions (M&A) to consolidate resources and reduce operational costs. For instance, Agnico Eagle’s acquisition of Kirkland Lake Gold is aimed at enhancing its resource base and operational efficiency.

- Mining Nationalization: There is a risk of increased mining nationalization, particularly in resource-rich but politically unstable countries. Nationalization policies can impact foreign investment and operational stability.

Long-Term Outlook for Gold Stocks

- Gold Price Prediction: Analysts forecast gold prices will remain volatile but trend upwards due to persistent inflationary pressures and economic uncertainties. Prices are expected to average around ~$3,000 per ounce in the next five years.

Source: vaneck.com

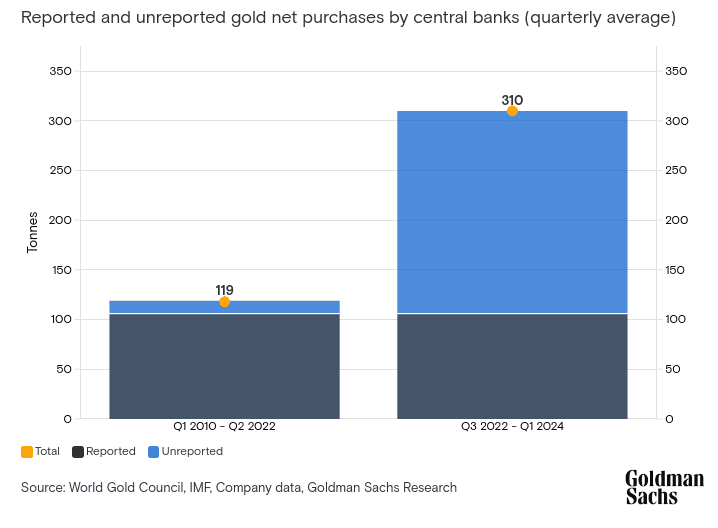

- Central Bank Purchases: Central banks, particularly in emerging markets, are expected to continue increasing their gold reserves as a hedge against economic instability and currency devaluation. This demand will support gold prices and market stability.

Source: goldmansachs.com

- Investment, Technological, and Jewelry Demand: Investment demand, driven by uncertainty and inflation, will likely continue to support gold prices. Technological advancements and increased gold usage in electronics could further boost demand. Additionally, cultural factors in markets like India will sustain high jewelry demand.

- Inflationary Pressures: Persistent inflation will keep gold attractive as a hedge. Historical patterns suggest that gold often performs well during inflationary periods, supporting long-term investment in gold stocks.

- Geopolitical Risks: Geopolitical tensions and conflicts will continue to drive gold’s safe-haven appeal. Events such as trade disputes, regional conflicts, and economic sanctions can influence gold prices and investment flows, affecting gold stock performance.

Overall, while challenges like supply constraints and regulatory risks persist, the outlook for gold stocks remains positive due to strong investment demand, technological advancements, and ongoing geopolitical uncertainties.