- Construction and infrastructure stocks typically offer stable returns due to long-term contracts and essential services, with dividend yields like Enbridge’s 6.7% in 2024 reflecting this stability.

- Infrastructure and construction stocks, however, can exhibit moderate volatility, driven by economic cycles and factors like interest rates, as seen with Caterpillar’s 30% price fluctuations in 2022.

- Lastly, liquidity varies; larger stocks like United Rentals (market cap of $29 billion in 2023) tend to have higher trading volumes, while smaller, region-specific stocks like Huaku Development in Taiwan may be less liquid.

Source: unsplash.com

I. What Are Construction & Infrastructure Stocks

Construction and infrastructure stocks represent companies involved in building, maintaining, and operating physical structures essential for societal functioning. These assets include transportation networks (roads, bridges, railways), utilities (water, energy), and communication systems. Broadly, infrastructure stocks can be classified into several categories:

- Transportation Infrastructure: Companies involved in road, rail, and port construction and management (e.g., Vinci, Union Pacific).

- Utilities: These firms provide essential services such as electricity, gas, and water (e.g., NextEra Energy, National Grid).

- Energy Infrastructure: Firms managing pipelines, storage facilities, and refineries (e.g., Kinder Morgan, Enbridge).

- Telecommunications: Companies building and maintaining communication networks (e.g., American Tower, Crown Castle).

[See, American Tower, Crown Castle]

Source: Largest Real-Estate-Investment-Trusts

- Construction: This category includes firms engaged in building large-scale infrastructure projects, housing, and commercial developments (e.g., Fluor Corporation, Caterpillar).

Why Invest in Infrastructure & Construction Stocks?

Stable and Predictable Cash Flows

Infrastructure projects, such as toll roads or utility grids, often operate under long-term contracts, providing consistent revenue streams. For instance, toll road operators like Abertis generate stable cash flows by securing multi-decade government contracts. Similarly, utility companies have regulated revenue structures, ensuring steady returns. The long-term nature of these assets, typically 10 to 30 years, provides income predictability.

Inflation Protection & Asset Appreciation

Many infrastructure investments include inflation-linked contracts. For example, utilities and toll road operators often have pricing mechanisms tied to inflation indices. American Tower, a major telecom infrastructure company, adjusts rents on cell towers annually based on inflation metrics. As inflation rises, infrastructure assets tend to appreciate due to higher replacement costs, making these stocks a hedge against inflation.

High Dividend Yields & Reliable Payouts

Infrastructure stocks often pay high dividends due to their stable cash flows. In 2024, for example, Enbridge yielded around 6.7%, while Duke Energy offered a 5.7% dividend. These companies often aim for consistent payouts, as their essential services make earnings more predictable. Long-term infrastructure projects, typically financed through debt, focus on generating reliable returns to shareholders through steady dividends.

Source: dividend.com

Source: dividend.com

II. Best Construction & Infrastructure Stocks

Construction & Infrastructure Stocks (US Stocks)

Caterpillar (CAT)

Caterpillar is a global leader in construction and mining equipment, with approximately 16% market share in the construction machinery sector. It serves diverse industries including construction, mining, and energy.

Caterpillar has a strong global footprint, benefiting from increased demand for infrastructure projects due to government stimulus plans, like the U.S. Infrastructure Investment and Jobs Act (IIJA), which allocated $1.2 trillion to infrastructure. The company reported a 13% year-over-year increase in revenue in 2023, driven by robust demand for construction machinery. With a dividend yield of 1.7% and solid earnings growth, Caterpillar remains a reliable investment for those seeking exposure to global construction trends and equipment demand.

Eaton (ETN)

Eaton is a leader in power management solutions with a focus on electrical infrastructure and energy-efficient solutions. It has a strong presence in the industrial sector, holding around 12% of the global power management market.

Eaton benefits from the increasing demand for energy efficiency and renewable energy solutions. In 2023, it posted a 12% increase in revenue driven by growth in its electrical systems segment. Eaton’s focus on sustainability and the electrification trend positions it well for future growth. The company offers a dividend yield of 1.3%, appealing to investors looking for a stable growth stock with long-term potential.

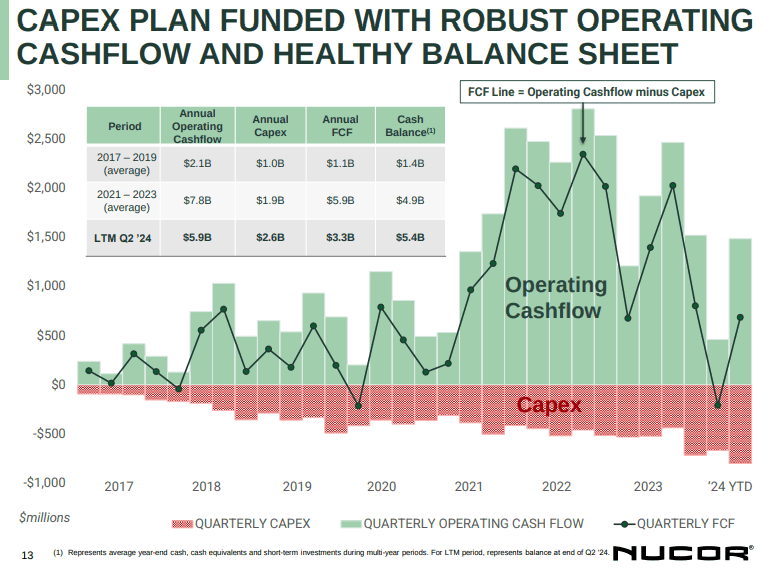

Nucor (NUE)

Nucor is the largest steel producer in the U.S., with about a 28% share of the domestic market. It is a leader in sustainable steel production, utilizing electric arc furnaces (EAFs) for more eco-friendly manufacturing.

Nucor benefits from strong demand for steel in construction and manufacturing. It reported $34.7 billion in revenue in 2023, with a focus on expanding its downstream product offerings to increase profitability. Nucor's 1.6% dividend yield and commitment to share buybacks provide value to shareholders, and its focus on sustainability aligns with long-term industry trends.

Source: Nucor Q2 2024 Earnings

United Rentals (URI)

United Rentals is the largest equipment rental company in the world, controlling about 13% of the U.S. equipment rental market. Its fleet includes construction equipment, industrial machinery, and aerial platforms.

The company benefits from growing demand for rental equipment in the U.S. construction sector, particularly in large infrastructure projects. United Rentals posted a 23% year-over-year revenue increase in 2023, underpinned by high demand for its rental fleet. With significant pricing power and a flexible cost structure, URI is well-positioned for continued growth. While its dividend yield (0.9%)is lower than peers, the company focuses heavily on growth, with strong cash flow generation for reinvestment.

Fluor (FLR)

Fluor is a global engineering and construction firm that serves industries like energy, chemicals, and government services. It holds a significant position in the EPC (Engineering, Procurement, and Construction) space, focusing on large-scale infrastructure projects.

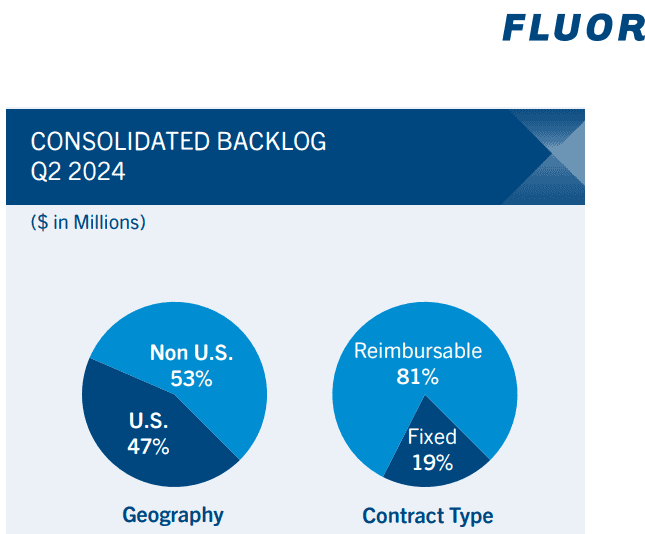

Fluor’s diversified business portfolio allows it to capitalize on opportunities in sectors like renewable energy, oil and gas, and infrastructure. In Q2 2024, the company reported a backlog of $32 billion, highlighting its strong pipeline of future projects. The company’s strong backlog and future growth potential in infrastructure projects make it an attractive investment.

Brookfield Infrastructure Partners (BIP)

BIP is one of the largest infrastructure investors globally, with a portfolio that includes utilities, transportation, energy, and data infrastructure. It operates in North America, South America, Asia, and Europe.

BIP offers exposure to a diversified portfolio of essential infrastructure assets with stable cash flows. In Q2 2024, BIP posted a 10% year-over-year increase in funds from operations (FFO), driven by acquisitions in the utility sector and growth in its data infrastructure business. With a dividend yield of 5.1%, BIP is attractive for income-oriented investors seeking steady returns from essential services.

Enbridge (ENB)

Enbridge is a leader in energy infrastructure, particularly in the transportation of crude oil, natural gas, and natural gas liquids across North America. It operates the largest pipeline network on the continent.

Enbridge benefits from the critical role its pipelines play in North American energy security. The company posted $8.2 billion in Q2 2024 revenue and continues to expand its renewable energy footprint. Enbridge’s 6.7% dividend yield is one of the highest in the industry, making it highly attractive for income-focused investors, with stable long-term growth prospects tied to energy demand and infrastructure expansion.

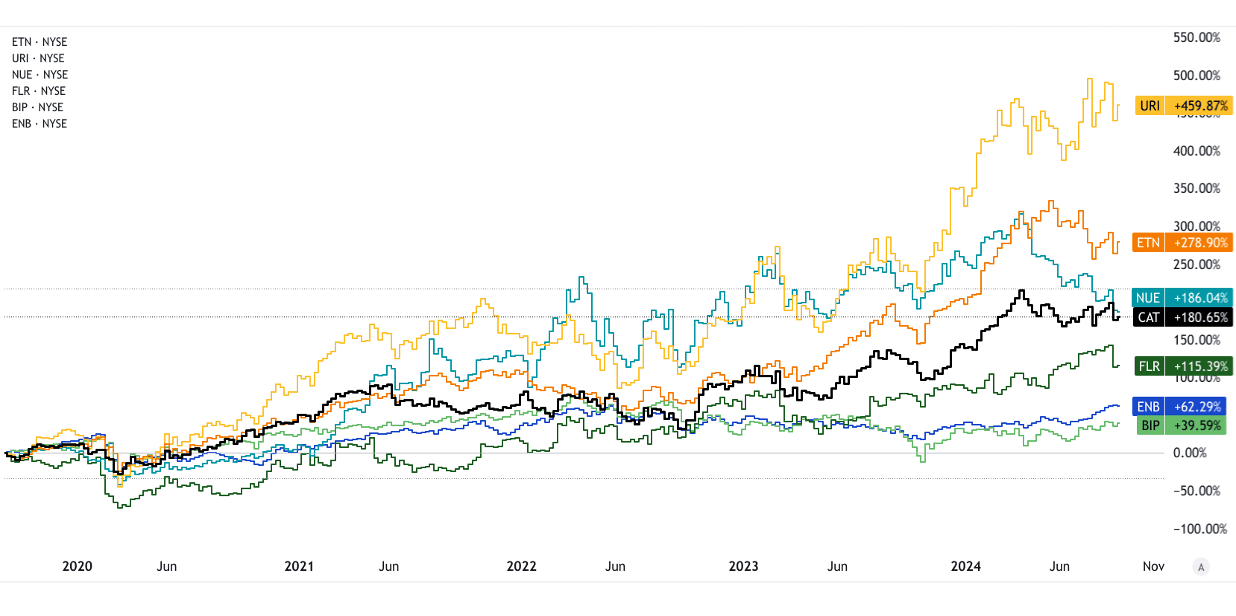

Source: tradingview.com [5Y Price Return]

Source: tradingview.com [5Y Price Return]

Construction Stocks (Taiwan Stocks)

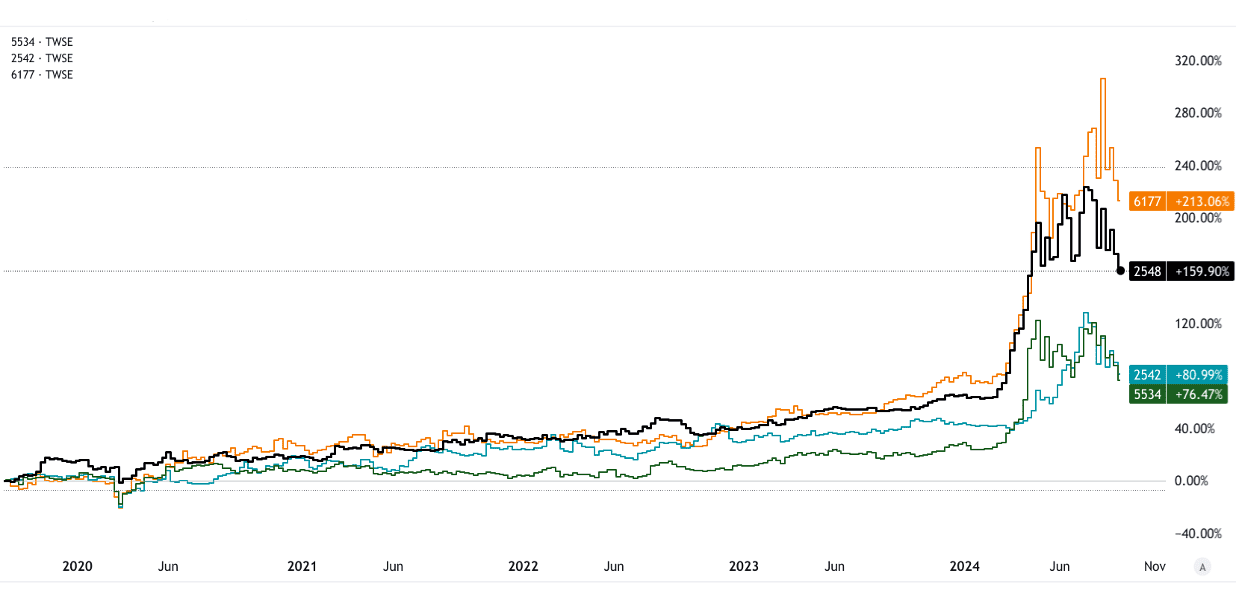

Huaku Development (2548)

Huaku Development is a leading real estate developer in Taiwan, specializing in residential and commercial construction projects. It has a strong presence in the Taipei metropolitan area.

Huaku benefits from robust demand for residential housing in Taiwan's urban centers, particularly in Taipei. In 2023, the company focused on high-end residential projects, catering to growing demand among high-income buyers. The company’s dividend yield is around 5.3%, providing steady returns for investors seeking exposure to Taiwan's real estate market.

Chong Hong Construction (5534)

Chong Hong Construction is a major Taiwanese construction firm focused on residential, commercial, and public sector projects. It holds a significant share in the luxury real estate market.

Chong Hong benefits from increasing urbanization and government-backed infrastructure projects. In 2023, it launched several high-end residential projects in Taipei, positioning itself for future growth. Its dividend yield of 4.8% makes it a solid choice for investors looking for exposure to Taiwan's real estate and construction boom.

Highwealth Construction (2542)

Highwealth is a key player in Taiwan’s construction sector, specializing in high-rise residential buildings and mixed-use commercial projects. It has a strong market share in central and northern Taiwan.

Highwealth’s focus on premium residential projects, particularly in Taipei and New Taipei City, positions it for continued growth. With a dividend yield of 4.5%, the company provides a reliable income stream for investors seeking exposure to Taiwan’s thriving real estate market.

Source: tradingview.com [5Y Price Return]

Da-Li Development (6177)

Da-Li is a leading Taiwanese construction and real estate development company, specializing in high-rise residential and commercial developments. It holds a prominent position in the luxury housing market.

Da-Li benefits from strong demand for luxury properties in Taipei, where housing prices remain elevated. The company reported solid financial results in 2023, driven by its premium residential projects. Da-Li’s dividend yield of 3.9% is slightly lower than peers, but its growth potential in Taiwan’s high-end real estate market remains strong.

Best Infrastructure Stocks ETFs

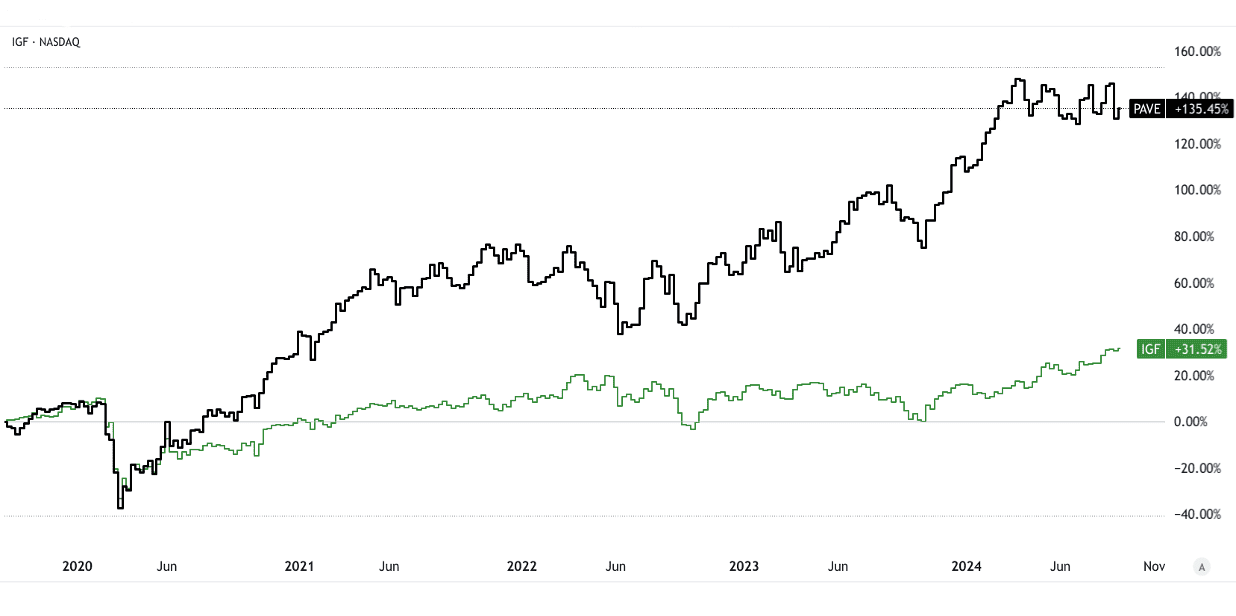

PAVE (Global X U.S. Infrastructure Development ETF)

PAVE is one of the largest U.S.-focused infrastructure ETFs, with over $5 billion in assets under management (AUM). It holds a diversified portfolio of construction and infrastructure-related stocks.

PAVE offers exposure to key U.S. infrastructure stocks like Caterpillar, Nucor, and United Rentals, benefiting from the U.S. government’s infrastructure investments. In 2023, the ETF gained 15%, driven by increased construction activity. With a dividend yield of around 0.6%, it offers a balance between growth and income.

IGF (iShares Global Infrastructure ETF)

IGF is a globally diversified infrastructure ETF, holding over $3 billion in AUM and including stocks from various sectors like utilities, transportation, and energy.

IGF provides exposure to global infrastructure leaders like Enbridge, Transurban, and National Grid. The ETF gained approximately 10% in 2023, driven by increasing global infrastructure investments. Its dividend yield is around 3.3%, making it an attractive option for income-oriented investors looking for global diversification.

Source: tradingview.com [5Y Price Return]

Source: tradingview.com [5Y Price Return]

III. Factors to Consider When Investing in Construction & Infrastructure Stocks

Economic Cycles and Market Conditions

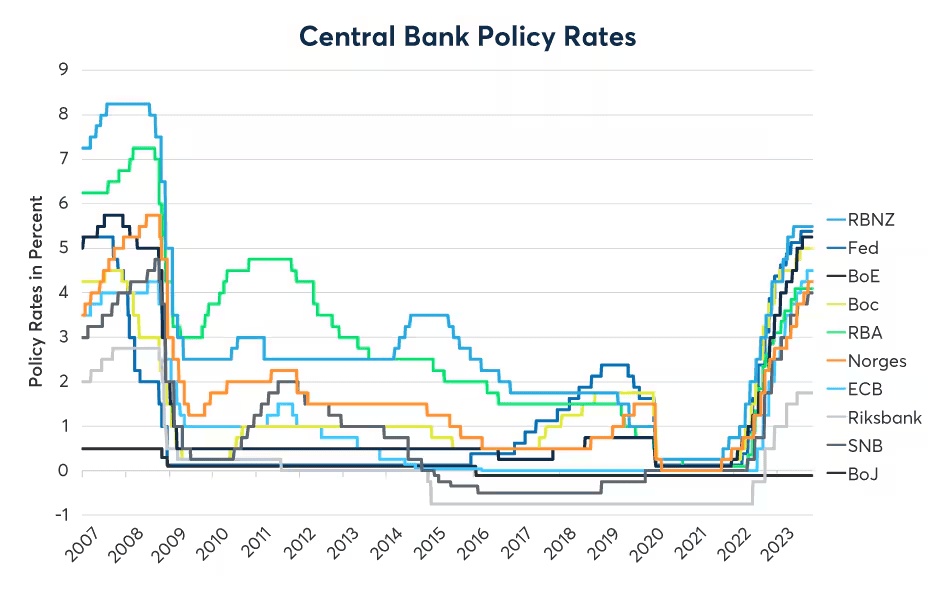

The construction sector is highly cyclical, influenced by economic expansion and contraction. During periods of economic growth, construction projects flourish, driving demand for infrastructure stocks. For example, during the 2009-2019 economic expansion, Caterpillar (CAT) saw its revenue grow by 52%, reflecting broader economic conditions. However, downturns, such as the 2020 COVID-19 recession, saw reduced activity, causing construction-related stocks to fall. Additionally, interest rates directly impact infrastructure projects, as high rates increase borrowing costs, slowing project initiation. In 2023, with the U.S. Federal Reserve raising interest rates to over 5%, construction firms faced pressure, delaying new developments. Inflation, which peaked at 9.1% in the U.S. in 2022, also raises material and labor costs, squeezing margins for construction companies like Fluor (FLR), where labor cost overruns have impacted project profitability.

Source: cmegroup.com

Government Policies and Spending

Government infrastructure spending is a critical driver of growth for this sector. Policies like the U.S. Infrastructure Investment and Jobs Act (IIJA), which earmarked $1.2 trillion for infrastructure over 10 years, create substantial demand for construction and infrastructure companies. Companies like Brookfield Infrastructure Partners (BIP) and Nucor (NUE) benefit from these public sector investments. The focus on clean energy and sustainable infrastructure globally, such as the European Green Deal, also creates growth opportunities for infrastructure firms involved in energy-efficient and renewable projects.

Company Fundamentals

Evaluating company-specific fundamentals is crucial. A strong balance sheet allows a company to weather economic downturns and pursue new projects. For instance, United Rentals (URI), which had over $1.5 billion in free cash flow in 2023, is well-positioned to invest in new equipment and growth. Additionally, the size of a company’s project backlog is a good indicator of future revenue potential. Fluor (FLR) offers strong visibility into future earnings and its diversity, reducing uncertainty.

Source: Fluor Q2 2024 Presentation

Geopolitical Risks

Geopolitical instability can disrupt international projects and supply chains. For example, in 2022, Russia’s invasion of Ukraine led to significant delays in European energy projects, affecting companies like Enbridge (ENB). Furthermore, supply chain disruptions caused by COVID-19 led to increased material costs and project delays globally, with construction firms facing an average cost increase of 25% for critical materials like steel and timber. This is why careful consideration of geopolitical and logistical risks is crucial for infrastructure investors.

IV. Construction Industry Trends and Construction Stocks Outlook

The global construction market was valued at $13.6 trillion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.3%, reaching $17.5 trillion by 2027. The U.S. construction market alone is forecasted to grow from $1.6 trillion in 2023 to $2.2 trillion by 2027, fueled by government spending, urbanization, and technological advancements. Emerging markets, particularly in Asia-Pacific and Latin America, are expected to see rapid growth, with China and India driving infrastructure investment due to urbanization and industrialization. In contrast, mature markets in North America and Europe are focusing on modernizing aging infrastructure.

Construction Industry Future Trends

Automation and Robotics

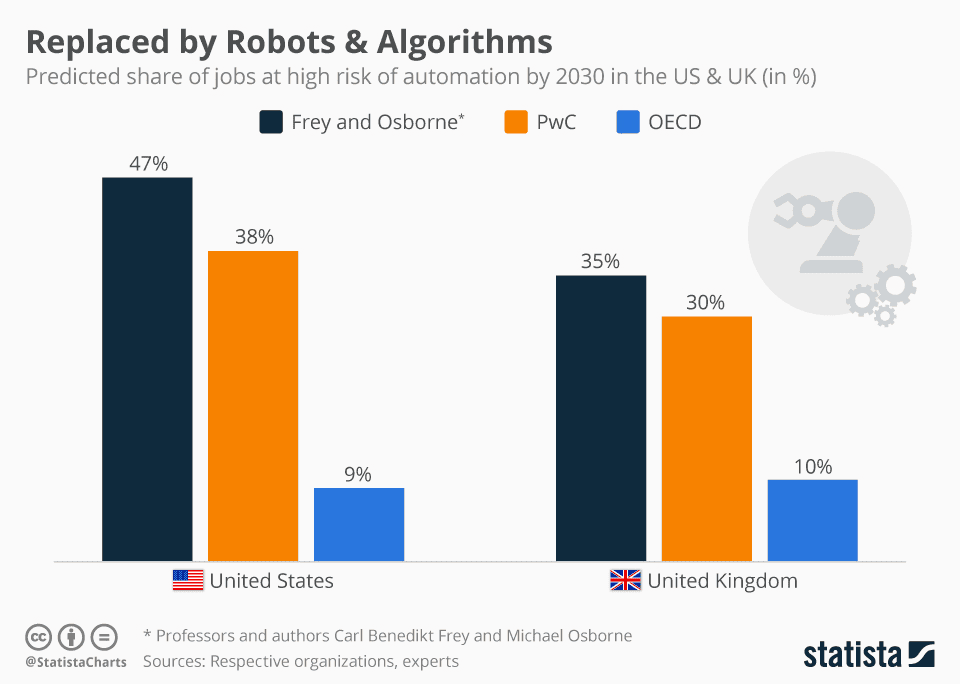

The adoption of automation and robotics is transforming the construction sector. Companies like Caterpillar (CAT) are investing in autonomous machinery to reduce labor dependency and improve efficiency. For example, CAT's autonomous trucks have been deployed in mining operations, cutting operating costs by 20%. Automation will enhance productivity, especially amid labor shortages, which are projected to impact 200,000 construction jobs annually in the U.S. by 2025.

Source: statista.com

Modular Construction

Modular construction, projected to grow at a CAGR of 6.5% by 2030, allows for faster project completion and cost reduction. United Rentals (URI) benefits from this trend, as modular construction requires specialized equipment for transportation and installation.

Sustainability and Green Infrastructure

The global push for sustainability is reshaping construction. Companies like Nucor (NUE) focus on green steel production, a low-carbon alternative, which positions them well as demand for eco-friendly building materials rises. Green building materials are expected to grow at a 10.7% CAGR, reaching $610 billion by 2029. Energy-efficient buildings and renewable infrastructure are top priorities for governments and developers worldwide.

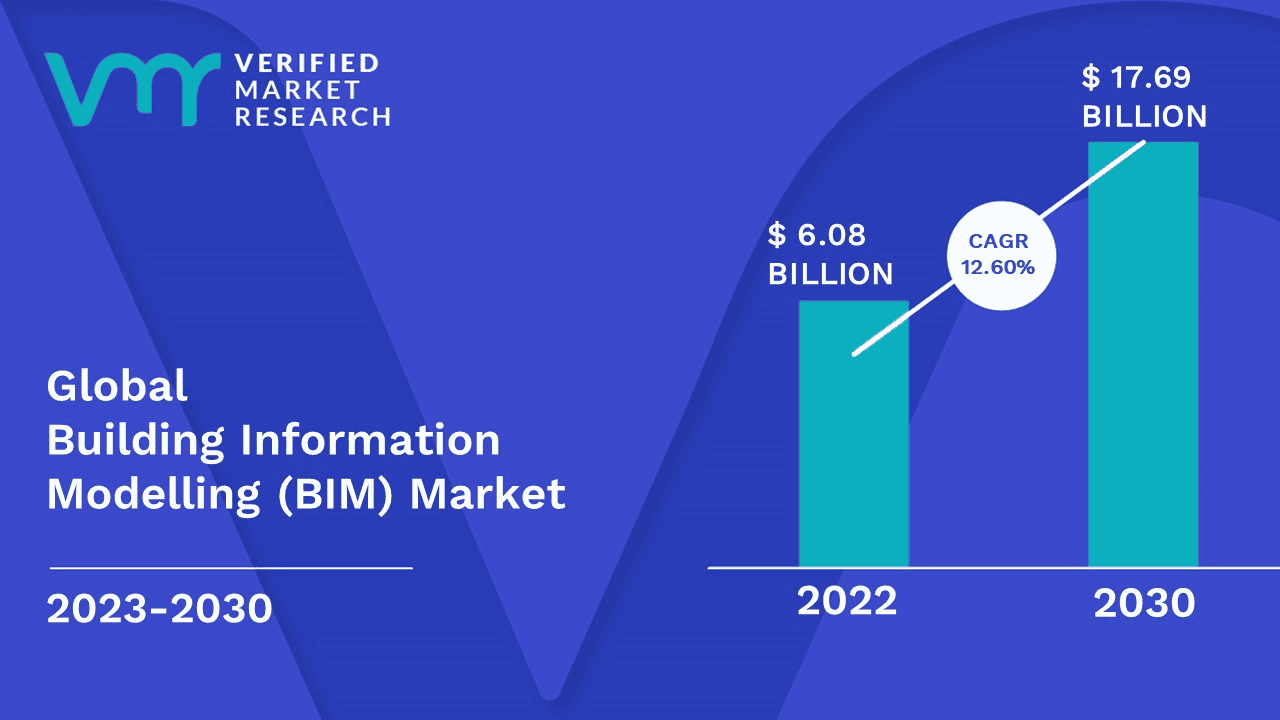

Digital Transformation

Tools like Building Information Modeling (BIM) and Virtual Design and Construction (VDC) are revolutionizing the construction process. By 2030, the BIM market is expected to surpass $17 billion. Smart construction practices enable firms like Fluor (FLR) to optimize design processes, reducing project timelines by up to 30%.

Source: verifiedmarketresearch.com

Rising Material Costs & Labor Shortages

Supply chain disruptions and inflation have driven material costs higher, with steel prices rising 25% in 2022. Nucor and other material suppliers will benefit from price increases but face pressure from rising labor costs, which are expected to increase 4.5% annually through 2026.

Long-Term Outlook for Construction & Infrastructure Stocks

Increased Government Infrastructure Spending

Government spending on infrastructure projects, particularly in the U.S. and Europe, will drive long-term demand for construction firms. The U.S. Infrastructure Investment and Jobs Act (IIJA), which allocates $1.2 trillion, will benefit companies like Brookfield Infrastructure Partners (BIP) and Caterpillar through 2030. In Europe, the European Green Deal aims to funnel over €1 trillion into sustainable infrastructure by 2030.

Urbanization and Housing Demand

Urbanization continues to push real estate development in emerging markets. By 2050, over 68% of the world’s population is expected to live in urban areas, increasing demand for housing, transportation, and utilities. Taiwan’s construction stocks like Huaku Development (2548) and Da-Li Development (6177) are poised to benefit from rising real estate demand in urban centers.

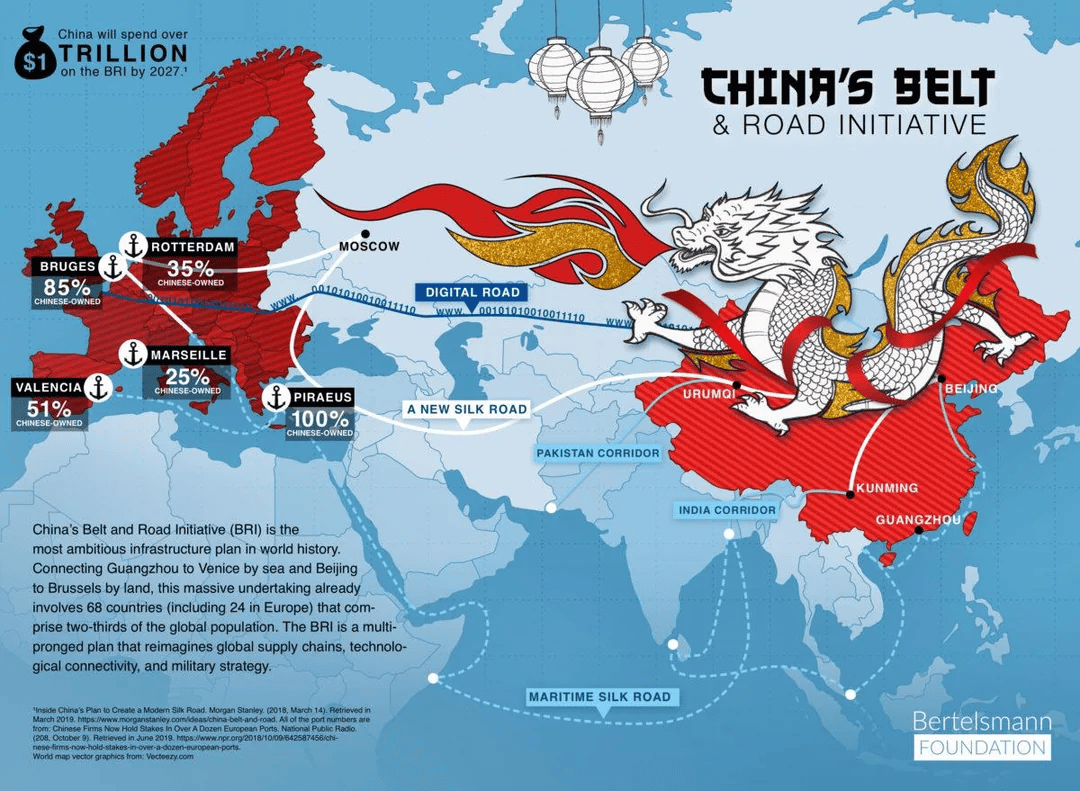

Global Expansion in Emerging Markets

Emerging markets in Africa, Asia, and Latin America are investing heavily in infrastructure. For instance, China’s Belt and Road Initiative has committed over $1 trillion to global infrastructure projects. Enbridge (ENB) and Fluor will likely capitalize on these global opportunities, as infrastructure needs in these regions expand rapidly.

Source: reddit.com

Megaprojects & Aging Infrastructure

The rise of megaprojects, such as smart cities, 5G networks, and renewable energy, will support long-term growth. For example, Brookfield Infrastructure Partners is involved in the development of renewable energy projects, which are crucial as global energy transitions away from fossil fuels. Additionally, aging infrastructure in developed markets—such as bridges, roads, and power grids—requires modernization, supporting companies like Eaton (ETN), which specializes in power management solutions.