- Penny stocks have high return potential, as small-cap companies can experience significant price appreciation.

- However, penny stocks also exhibit extreme volatility, with price swings driven by low market capitalization and limited trading volume.

- Additionally, penny stocks often suffer from low liquidity, making it difficult to execute large trades without affecting market prices.

Source: unsplash.com

I. What Are Penny Stocks

Penny stocks are shares of small companies typically trading for less than $5 per share. These stocks are often found in the Over-The-Counter (OTC) markets, such as the OTC Bulletin Board (OTCBB) or Pink Sheets, rather than major exchanges like the NYSE or NASDAQ due to lower regulatory requirements. However, some penny stocks do trade on larger exchanges. For example, small-cap AI companies offering innovative tech solutions can be classified as penny stocks if their stock prices fall below the $5 threshold.

Trading penny stocks involves high volatility and liquidity risks, as these stocks are often subject to less stringent financial reporting. OTC markets play a significant role by listing these companies, enabling trades through less formal networks than major exchanges, which demand more transparency and financial stability.

Investing in penny stocks can be appealing due to their potential for high returns on small investments, especially for those with limited capital. Many investors are drawn to the possibility of discovering undervalued companies, particularly in emerging industries like AI or biotechnology, offering early exposure to potential future giants. However, the speculative nature of penny stocks means high risk, as many of these companies have uncertain prospects and face limited access to capital.

Source: investopedia.com

II. Best Penny Stocks

Penny stocks, known for their potential to generate substantial returns, typically represent smaller companies with lower market capitalization. Below is a detailed analysis of some of the best penny stocks, including those in emerging sectors like AI, renewable energy, and biotechnology.

Top Penny Stocks

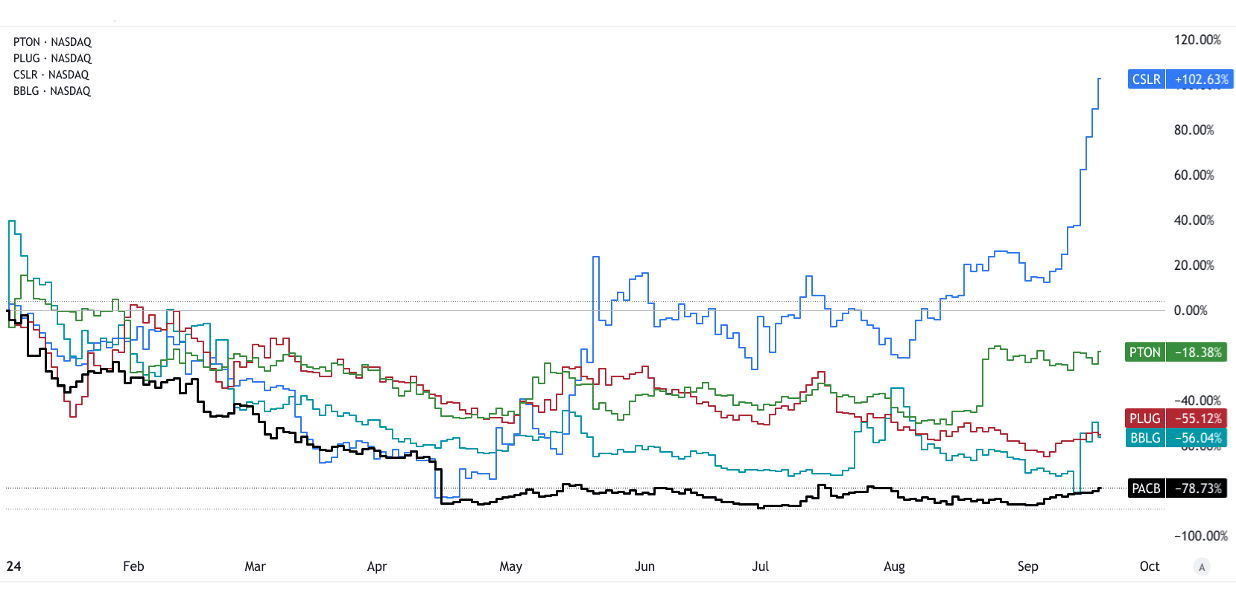

Pacific Biosciences (PACB)

PACB operates in the biotechnology and genomics industry, specializing in DNA sequencing technologies. Despite being a smaller player, it has carved out a niche in the long-read sequencing market, competing with major players like Illumina.

PACB has a market capitalization of $1.4 billion and is positioned to capitalize on the growing genomics market, projected to expand at a CAGR of 15.3% by 2027. The company’s collaboration with Google Cloud and advancements in sequencing technology, vital for personalized medicine, indicate strong future growth potential.

Peloton Interactive (PTON)

PTON is a leader in the connected fitness industry, offering exercise equipment paired with subscription-based workout content. Despite losing significant market share post-pandemic, it remains a household name in home fitness.

Peloton has seen a drastic decrease in stock price but has begun restructuring efforts, including cutting costs and partnerships like the one with Lululemon. With a market cap of $1.5 billion, it offers potential for recovery if the restructuring succeeds and consumer demand rebounds.

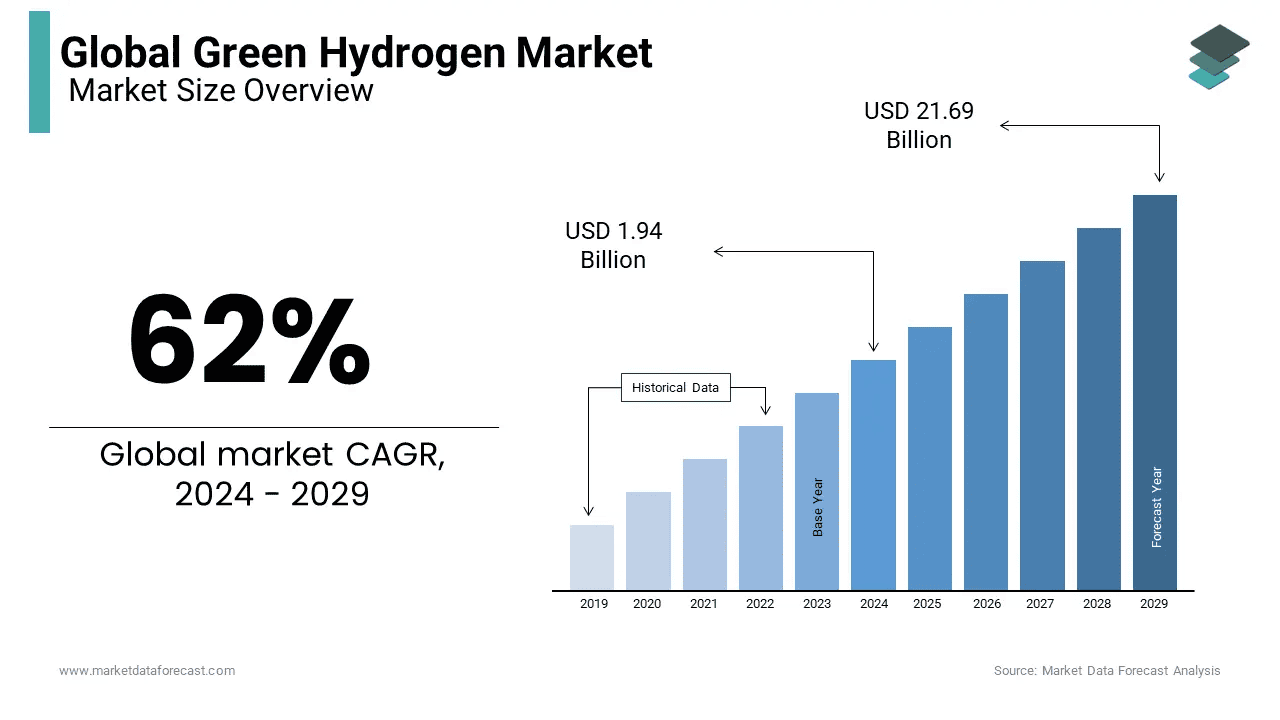

Plug Power (PLUG)

Plug Power is a leader in hydrogen fuel cell technology, particularly in logistics and material handling, serving large clients like Amazon and Walmart. It is one of the frontrunners in the green hydrogen space.

Hydrogen fuel cells are crucial in the global energy transition, with the hydrogen market projected to grow at a 9.2% CAGR through 2030. Plug Power’s market cap of $4 billion, recent strategic partnerships, and expansion into green hydrogen production provide significant long-term growth potential.

Source: marketdataforecast.com

Complete Solaria (CSLR)

Complete Solaria is focused on residential solar energy solutions, combining solar panels with energy storage systems. Though a smaller player in the industry, its integrated offerings have the potential to carve out a unique market position.

The global solar market is projected to grow by 20% annually through 2026. CSLR, with its strategic mergers and acquisitions, is well-positioned to benefit from the expanding demand for clean energy, making it a speculative but potentially rewarding investment.

Bone Biologics Corporation (BBLG)

BBLG operates in the orthobiologics space, focusing on bone regeneration treatments. It is a small player with a niche focus on spinal fusion surgeries.

The spinal fusion market is expected to reach $10 billion by 2028. BBLG’s lead product, Nell-1, could potentially capture a share of this market, especially if it receives FDA approval. The speculative nature of this investment comes with high potential rewards.

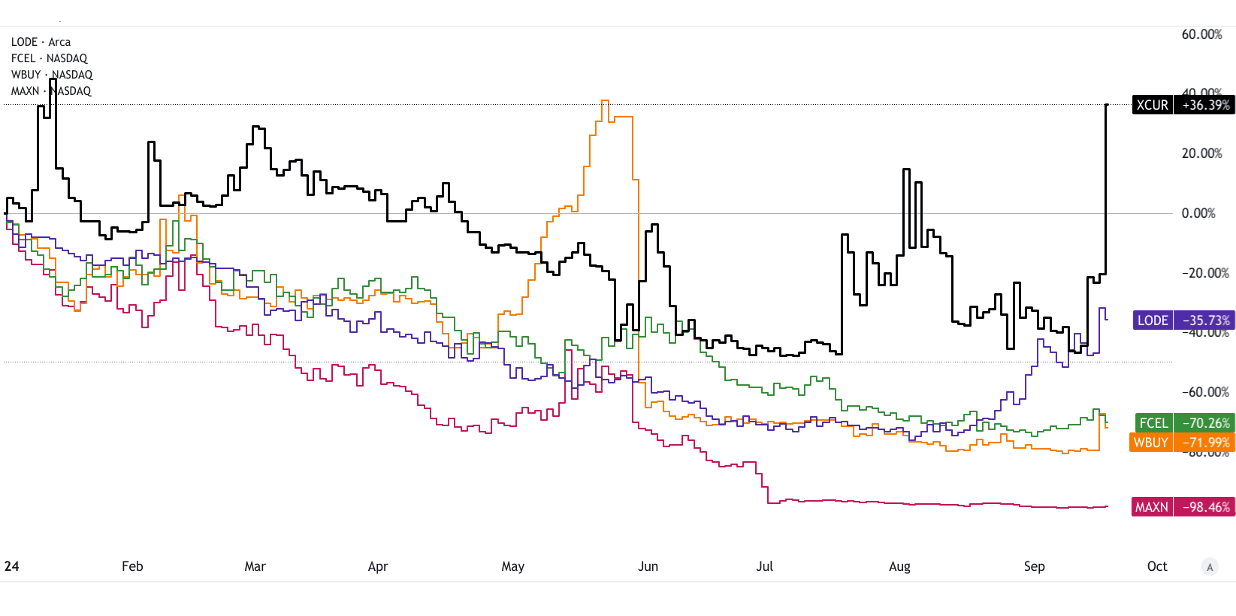

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

Exicure, Inc. (XCUR)

Exicure is a biotechnology company developing therapies based on gene-silencing RNA technology. It operates in a highly competitive but promising area of biotech.

Despite setbacks, including restructuring and management changes, RNA-based therapies represent a growing sector, with a projected 17% CAGR through 2028. XCUR’s restructured pipeline could see positive results, making it a high-risk, high-reward investment.

Comstock Mining (LODE)

Comstock Mining is transitioning from traditional mining to focusing on clean technologies like recycling metals from e-waste. This pivot reflects broader trends in environmental sustainability.

Comstock is capitalizing on the growing demand for recycled metals, with the e-waste recycling market expected to grow at a 6.1% CAGR through 2026. Its shift toward green technologies positions it for future growth, though with considerable risk.

FuelCell Energy (FCEL)

FuelCell Energy is a key player in the fuel cell power industry, providing clean energy solutions for power generation and carbon capture.

With a market cap of around $1.1 billion, FCEL stands to benefit from increasing global investment in clean energy. The fuel cell market is expected to grow at a CAGR of 14% through 2027. FCEL’s focus on green hydrogen and carbon capture makes it a potentially lucrative long-term investment, despite near-term financial instability.

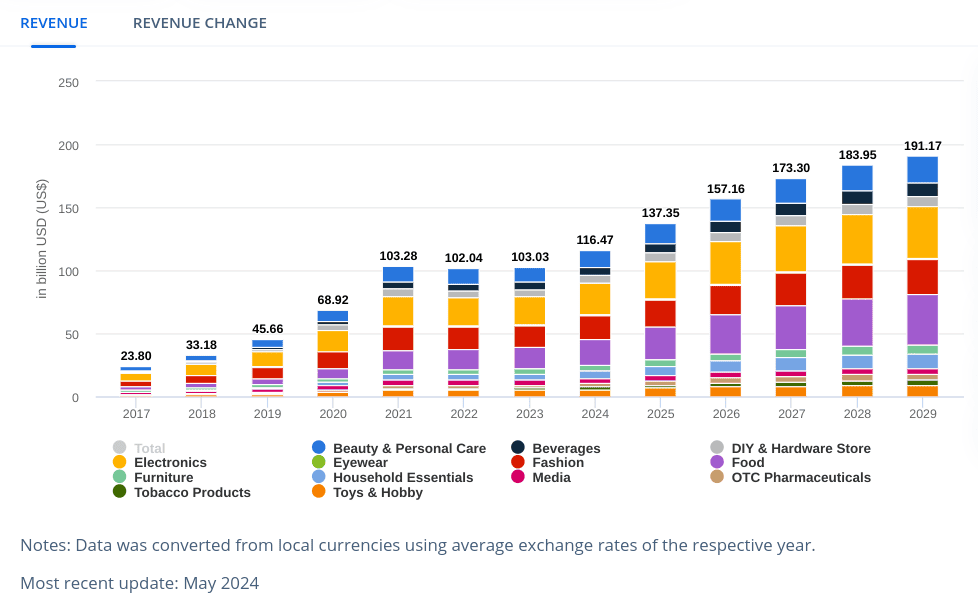

Webuy Global (WBUY)

WBUY operates in the e-commerce and group-buying sector, targeting consumers in emerging markets. Its unique model allows customers to leverage collective buying power.

The e-commerce market in Southeast Asia, where WBUY is expanding, is projected to grow by 10.4% annually through 2029 with user penetration of 29.2% in 2024. If WBUY continues to gain traction, it could capitalize on this explosive growth, though it remains a speculative play.

[eCommerce - Southeast Asia]

Source: statista.com

Maxeon Solar Technologies (MAXN)

Maxeon manufactures high-efficiency solar panels and holds a strong position in the premium solar panel market, operating globally in over 100 countries.

With a market cap of around $900 million, MAXN is poised to benefit from the growing solar energy market, which is expected to grow at a 6.9% CAGR through 2027. Recent investments in next-generation solar technology and production expansion highlight future growth potential.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

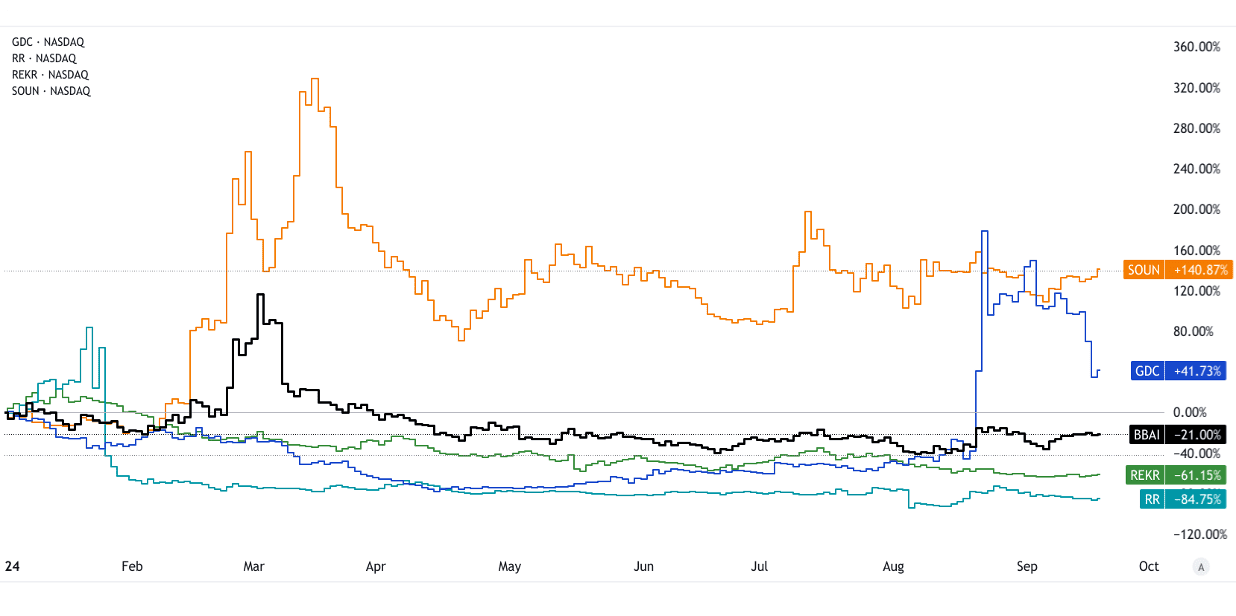

AI Penny Stocks

BigBear.ai Holdings (BBAI)

BigBear.ai specializes in AI-driven analytics and decision-making tools for government and commercial sectors. It is a small but growing player in the defense and national security markets.

Recent government contracts and increasing demand for AI in national security, expected to grow at a 15.3% CAGR, offer growth potential. BBAI is positioned to capitalize on AI-driven defense spending, making it a high-risk but promising stock.

GD Culture Group (GDC)

GDC operates in AI and blockchain sectors, primarily focusing on applications in logistics and e-commerce.

The global AI logistics market is projected to grow by 37.4% CAGR by 2030. While GDC is speculative, its focus on blockchain integration into logistics offers potential upside, particularly if the company secures strategic partnerships.

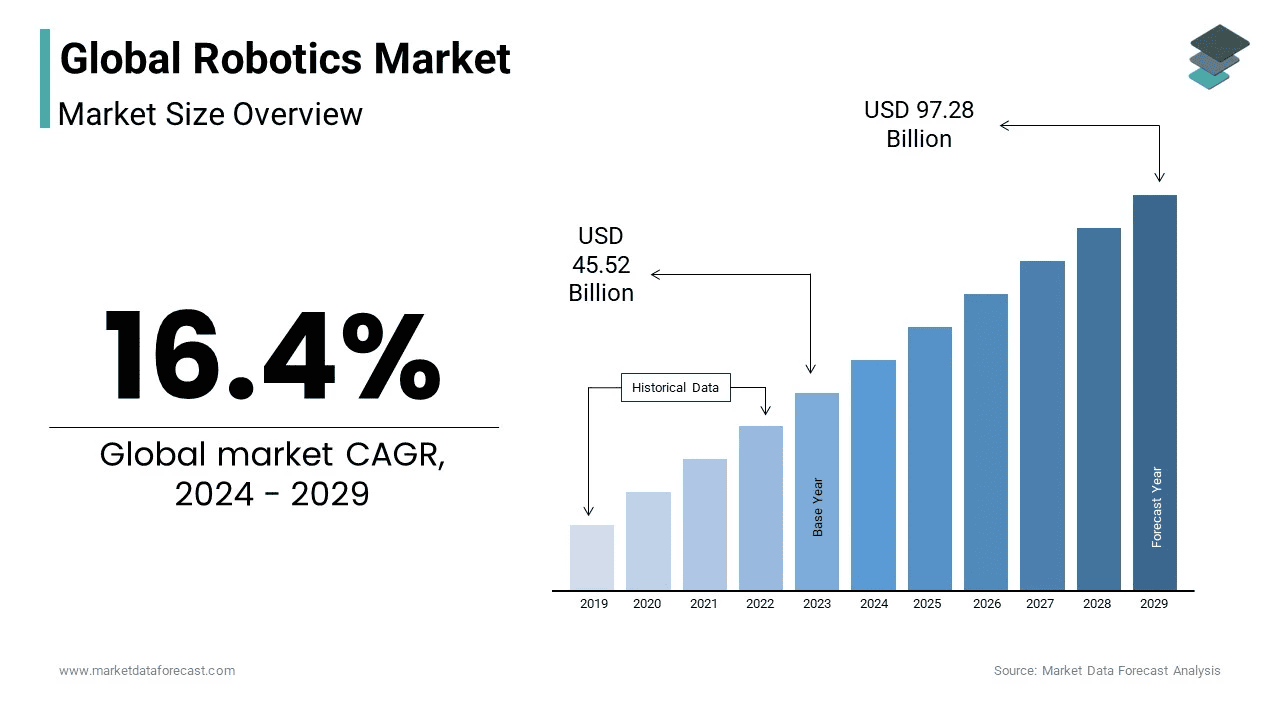

Richtech Robotics (RR)

Richtech Robotics provides AI-driven robotics solutions for industries like hospitality and manufacturing, focusing on automation and efficiency.

The global robotics market is expected to grow at a CAGR of 16.4% through 2029. Richtech’s innovative AI-powered robots could capture a portion of this expanding market, particularly as industries look to automate processes for cost savings and efficiency.

Source: marketdataforecast.com

Rekor Systems (REKR)

Rekor offers AI-powered vehicle recognition and traffic management systems, focusing on smart city solutions.

The smart city market, expected to grow at a 20% CAGR through 2027, presents significant opportunities for Rekor. With existing contracts in North America and expansions planned globally, REKR could see considerable growth as cities invest more in smart infrastructure.

SoundHound AI (SOUN)

SoundHound AI specializes in voice-enabled AI solutions, providing conversational AI to businesses and automakers.

The voice AI market is projected to grow at a CAGR of 17.2% through 2028. SoundHound’s partnerships with major automotive manufacturers position it to benefit from the growing adoption of voice technology in vehicles and smart devices, giving it strong growth potential in the coming years.

Source: tradingview.com [YTD_Price_Return]

Source: tradingview.com [YTD_Price_Return]

III. How to Buy Penny Stocks

Factors to Consider When Investing in Penny Stocks

When evaluating penny stocks, it’s essential to examine the company’s fundamentals, such as earnings, revenue growth, and balance sheet strength. Industry potential and broader macroeconomic factors, like market trends or regulatory changes, can significantly impact a company’s future prospects. Additionally, check where the stock is listed—stocks on major exchanges like NASDAQ have stricter regulatory oversight compared to Over-The-Counter (OTC) markets, which may have limited reporting requirements.

Investors must also be aware of the risks. Penny stocks often lack transparency, with limited financial data, making it harder to assess their true value. The potential for significant losses is high, given the volatility and low liquidity in these markets.

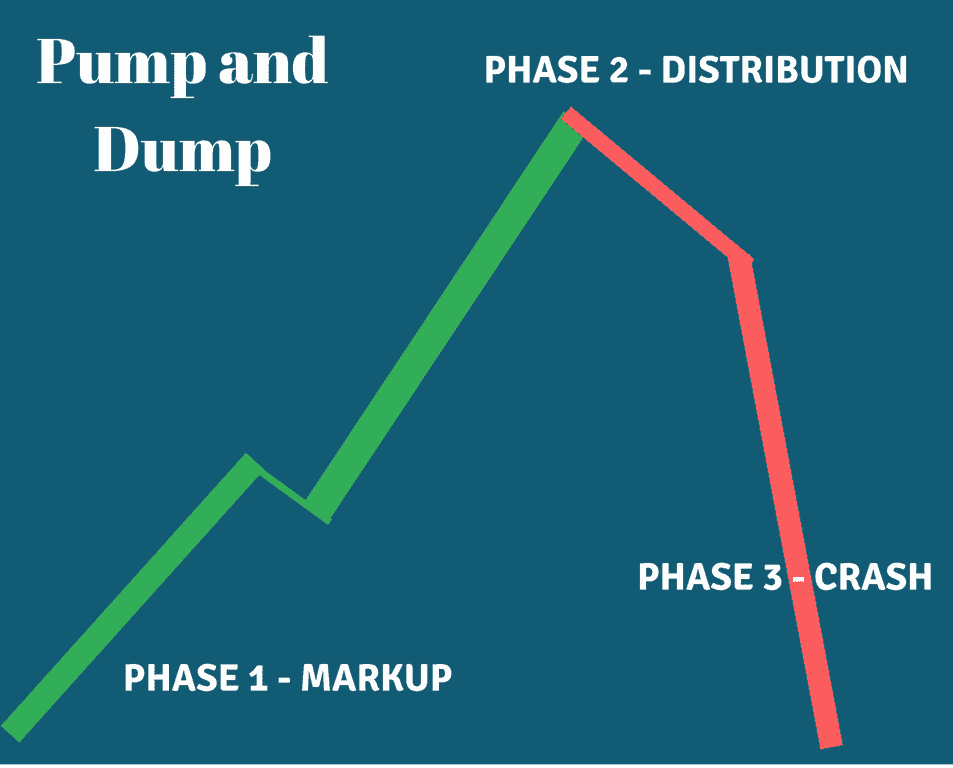

Common Penny Stock Scams

Pump-and-dump schemes, where a stock’s price is artificially inflated by false information, are rampant in penny stocks. Scammers use misleading news to drive hype, luring investors in before dumping their shares, causing prices to crash. To avoid these scams, verify company information through official filings like SEC reports and avoid stocks driven by social media or promotional emails.

Source: tradingsim.com

How to Invest in Penny Stocks

Due diligence is crucial: research the company’s history, leadership, and financial reports thoroughly. Understand the company’s product pipeline, competitive position, and cash flow. Buy penny stocks through reputable brokers like TD Ameritrade, Fidelity, or E*TRADE, which offer access to both major exchanges and OTC markets.

How to Trade Penny Stocks

Penny stocks are often traded through day trading or after-hours trading to capitalize on short-term price movements. Diversification and risk management are key—never allocate more than a small portion of your portfolio to these highly speculative investments.

IV. Penny Stocks Outlook

The outlook for penny stocks is shaped by the rise of emerging technologies, increased retail investor participation, and the globalization of markets. Innovations in AI, renewable energy, and biotechnology are driving new opportunities in penny stocks. Companies developing cutting-edge solutions in AI, such as voice recognition or autonomous driving, or renewable energy firms focused on hydrogen or solar technologies, are attracting investor interest. The renewable energy market is expected to grow at a 6.9% CAGR through 2027, while AI is projected to expand by 19.6% annually by 2030.

Increased retail investor participation, fueled by zero-commission platforms like Robinhood and Webull, has heightened interest in penny stocks. This surge in participation has coincided with tighter regulations from entities like the SEC, aimed at curbing fraudulent practices like pump-and-dump schemes.

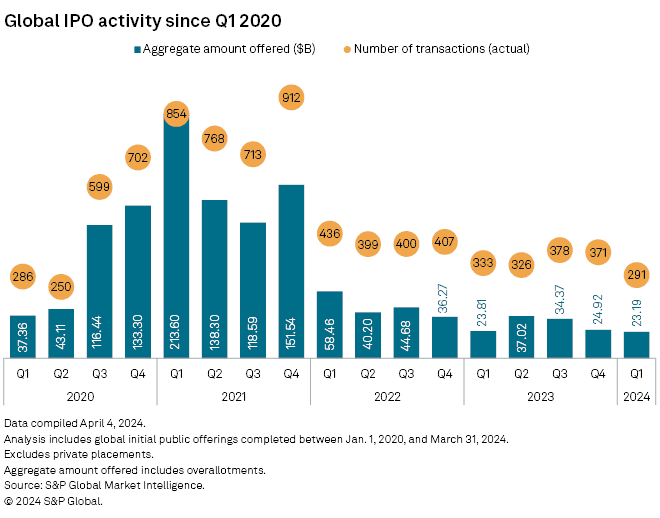

Technological advancements in trading, particularly the use of AI and algorithmic trading, enable faster, more precise decision-making, which can amplify price volatility in penny stocks. Globalization also plays a role, as companies in emerging markets can tap into broader investor pools and potentially pursue IPOs. For example, the IPO market in Q1 2024 raised $23 billion globally, offering a path for successful penny stock companies to transition to larger exchanges.

Source: capitaliq.spglobal.com