- Robotics stocks often exhibit high return potential due to the sector’s rapid technological advancements and growing demand.

- Robotics stocks generally face significant volatility because of the fluctuating nature of technological innovation and market competition.

- Additionally, the capital-intensive nature of robotics development can lead to inconsistent financial performance, impacting stock stability.

Source: X.com

I. What Are Robotics Stocks?

Robotics stocks represent shares in companies that are involved in the development, manufacturing, and application of robotic technologies. These companies range from those directly producing robots and automation systems to those supplying essential components such as sensors, software, and artificial intelligence (AI) algorithms. Robotics stocks can be broadly categorized into three types:

- Pure-Play Robotics Companies: These companies are primarily focused on robotics and automation, such as manufacturers of industrial robots, autonomous systems, and AI-driven robotics software.

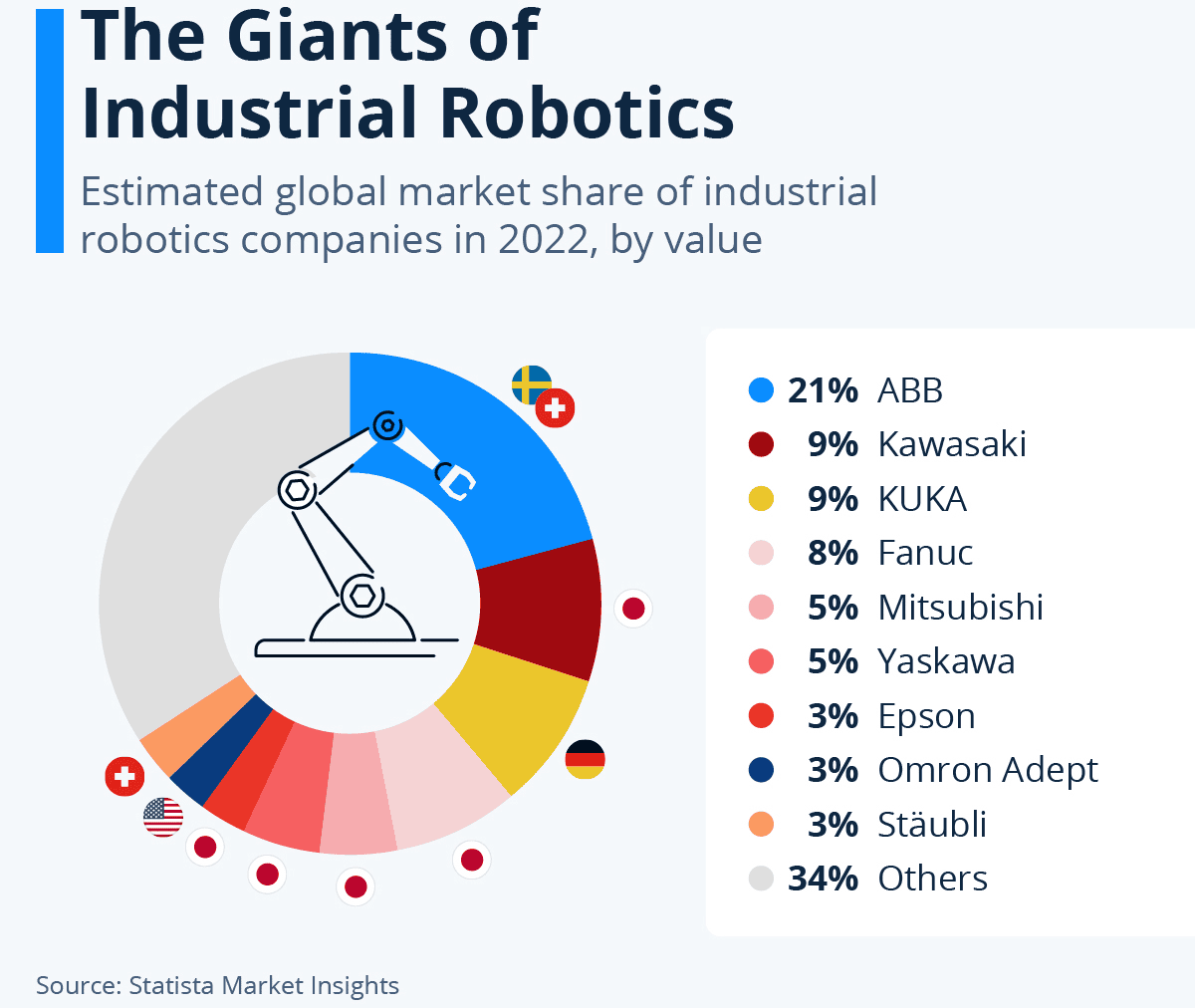

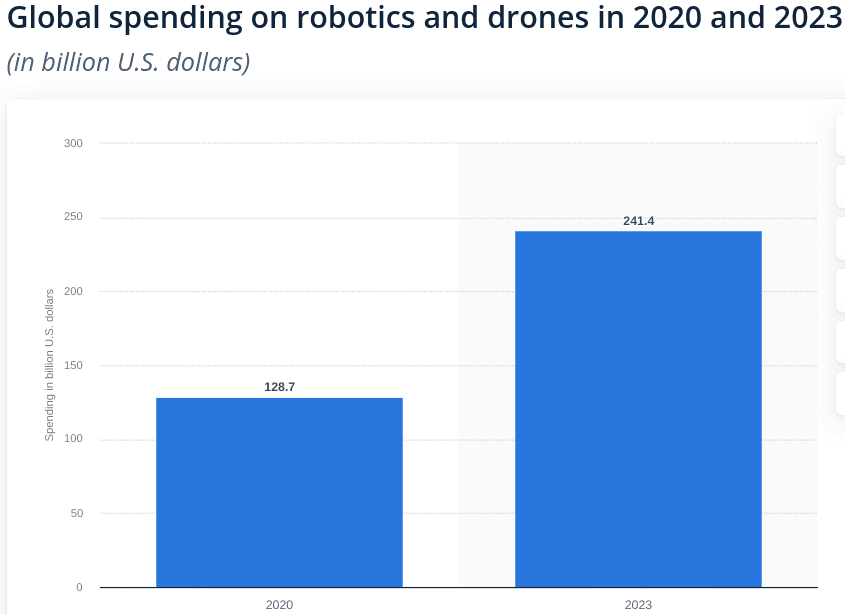

Source: statista.com

- Diversified Technology Companies: These firms have significant robotics and automation divisions but also operate in other technology sectors. Examples include large tech conglomerates that invest in robotics as part of their broader innovation strategies.

- Robotics Component Suppliers: These companies produce key components used in robotic systems, such as sensors, microchips, AI software, and machine learning algorithms.

Why Invest in Robotics Stocks?

Exposure to High-Growth Industry

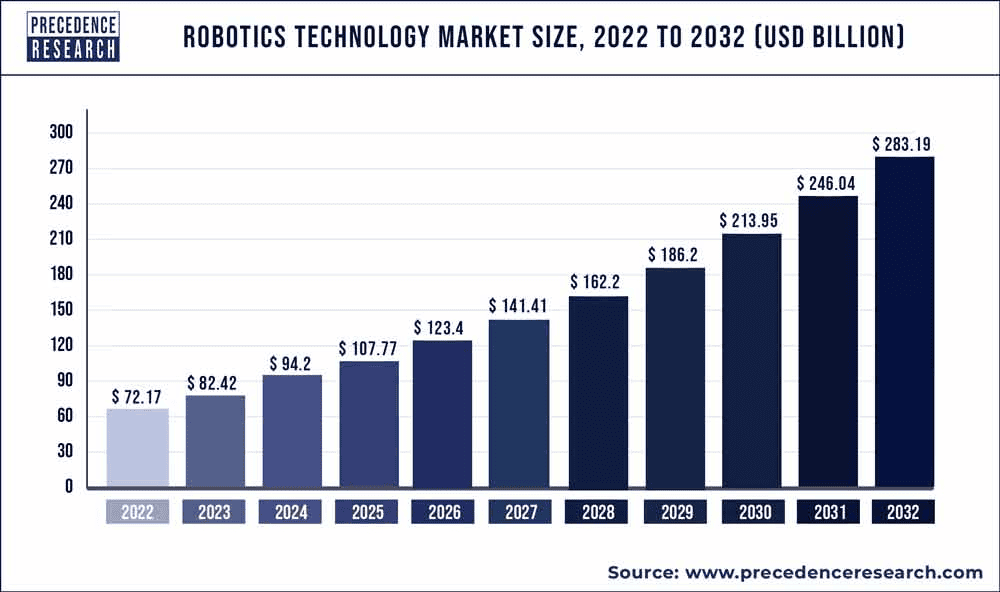

Investing in robotics stocks provides exposure to a rapidly growing industry that is at the forefront of technological innovation. The integration of AI, machine learning, and the Internet of Things (IoT) into robotics has revolutionized the way industries operate. For example, AI and machine learning enable robots to perform complex tasks with precision, while IoT allows for real-time data exchange between machines and central systems, enhancing efficiency. As per precedenceresearch.com, the robotics tech market size hit 72.17 billion in 2022 and may go above 283.19 billion by 2032 with a CAGR of 14.7%.

Source: precedenceresearch.com

The applications of robotics are diverse and span across various sectors:

- Manufacturing: Robotics is critical in automating production lines, improving productivity, and reducing human error. Advanced robots are now capable of performing delicate tasks, such as assembling microelectronics or working alongside humans in collaborative environments (cobots).

- Healthcare: Robots are increasingly used in surgery, rehabilitation, and patient care. Robotic surgery systems offer greater precision, leading to better patient outcomes, while robotic assistants help in elderly care and rehabilitation.

- Retail and Logistics: Robotics enhances supply chain efficiency through automation of warehouses, inventory management, and last-mile delivery solutions. The rise of e-commerce has accelerated the adoption of automated systems in logistics.

- Agriculture: Robotics is revolutionizing agriculture through precision farming, automated harvesting, and pest control, leading to higher yields and reduced labor costs.

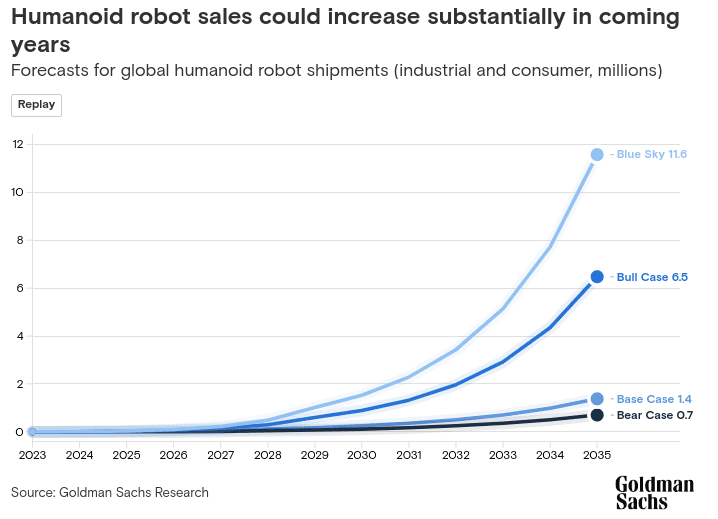

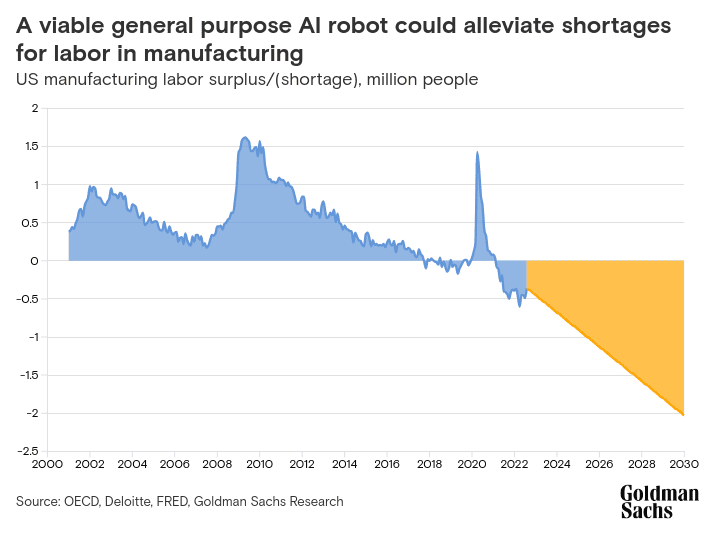

Source: goldmansachs.com

Resilience in Economic Downturns

Robotics companies often demonstrate resilience during economic downturns due to the essential nature of their technologies in maintaining business operations. Automation can reduce costs and increase efficiency, making robotic solutions attractive to businesses looking to optimize their operations during tough economic conditions.

During the COVID-19 pandemic, for instance, companies that had invested in robotics and automation were better equipped to handle disruptions in the workforce and supply chains. The ability to maintain production with minimal human intervention proved to be a significant advantage, reinforcing the value of robotics in maintaining business continuity.

Ethical and Sustainable Investing

Investing in robotics stocks can align with ethical and sustainable investing principles, as many robotics technologies contribute to solving global challenges. For instance, robotics can play a crucial role in reducing the environmental impact of industrial activities by optimizing energy use and minimizing waste. Autonomous robots in agriculture can precisely apply fertilizers and pesticides, reducing chemical runoff and improving sustainability.

Furthermore, robots in healthcare and eldercare can improve the quality of life for aging populations, addressing the growing need for healthcare services without overburdening the workforce. By investing in robotics companies that focus on sustainable and ethical innovations, investors can contribute to a more sustainable future while potentially realizing financial gains.

II. Best Robotics Stocks

Top Robotics Companies

NVIDIA (NVDA)

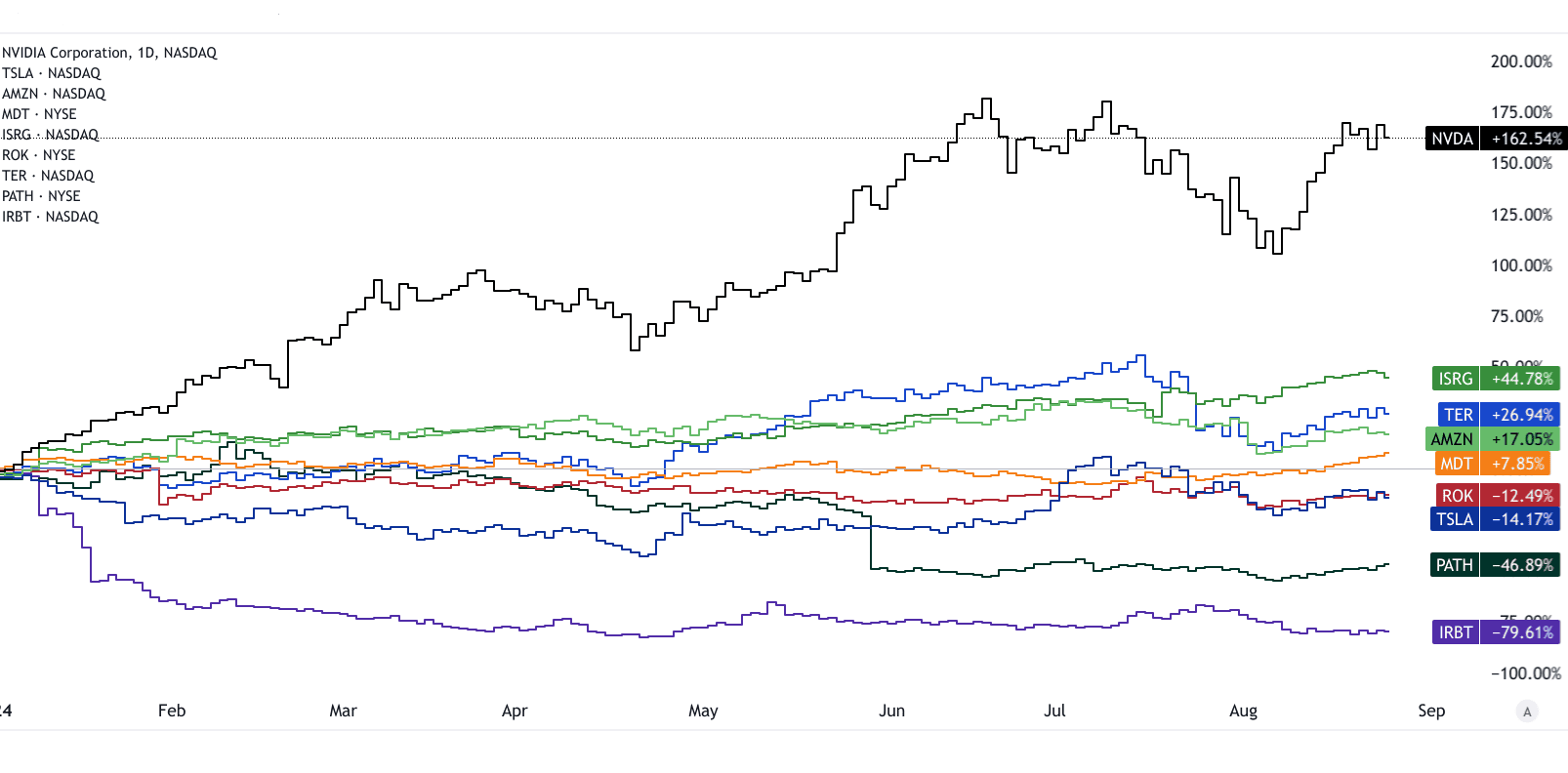

NVIDIA is a leader in AI and robotics, with Project GR00T and ISAAC being a notable robotics project that focuses on creating advanced AI-driven robots for a range of industries. NVIDIA’s GPUs and AI platforms are integral to many robotics systems globally, giving it a dominant market position in the robotics space. Recent developments include the growth in AI demand, driving stock prices significantly upward. The company has a forward P/E ratio of 47, reflecting high growth expectations. With strong cash flow, NVIDIA is well-positioned for future growth, particularly as AI and robotics continue to converge.

Source: Nvidia.com

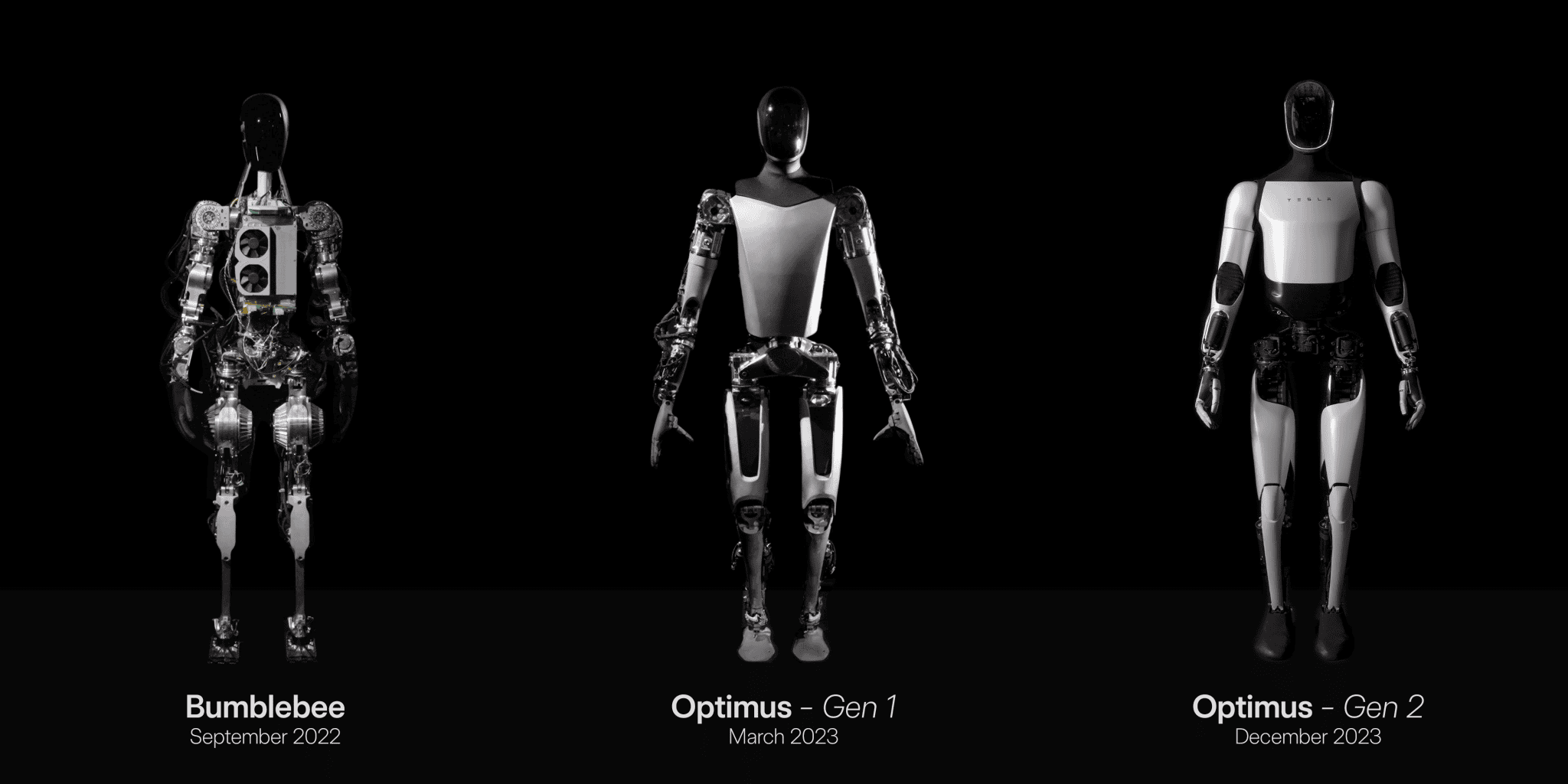

Tesla (TSLA)

Tesla's robotics efforts are highlighted by the Optimus project, a humanoid robot aimed at performing tasks that are unsafe, repetitive, or boring for humans. Tesla's integration of robotics within its manufacturing processes and vehicles gives it a unique market position. Despite recent stock price fluctuations, Tesla's forward P/E ratio of around 93 suggests optimism about its growth prospects. With strong cash flow from its EV business, Tesla is likely to continue investing heavily in robotics, making it a key player in the sector.

Source: reddit.com

Amazon (AMZN)

Amazon has heavily invested in robotics, especially within its logistics operations, with over 200,000 robots in its warehouses. These innovations have helped maintain Amazon's dominance in e-commerce. Despite challenges, AMZN's stock has shown resilience, with a P/E ratio around 38 (forward), reflecting investor confidence in its long-term strategy. Amazon’s cash flow remains robust, and its continuous innovation in robotics bodes well for future market leadership.

Medtronic (MDT)

Medtronic is a leader in medical robotics, particularly with its Hugo robotic-assisted surgery system, positioning it strongly in the healthcare robotics market. The stock has been under pressure, but with a forward P/E ratio of around 17, it remains attractive for long-term investors. Strong cash flow supports ongoing R&D, which is crucial for maintaining its competitive edge in the evolving medical robotics field.

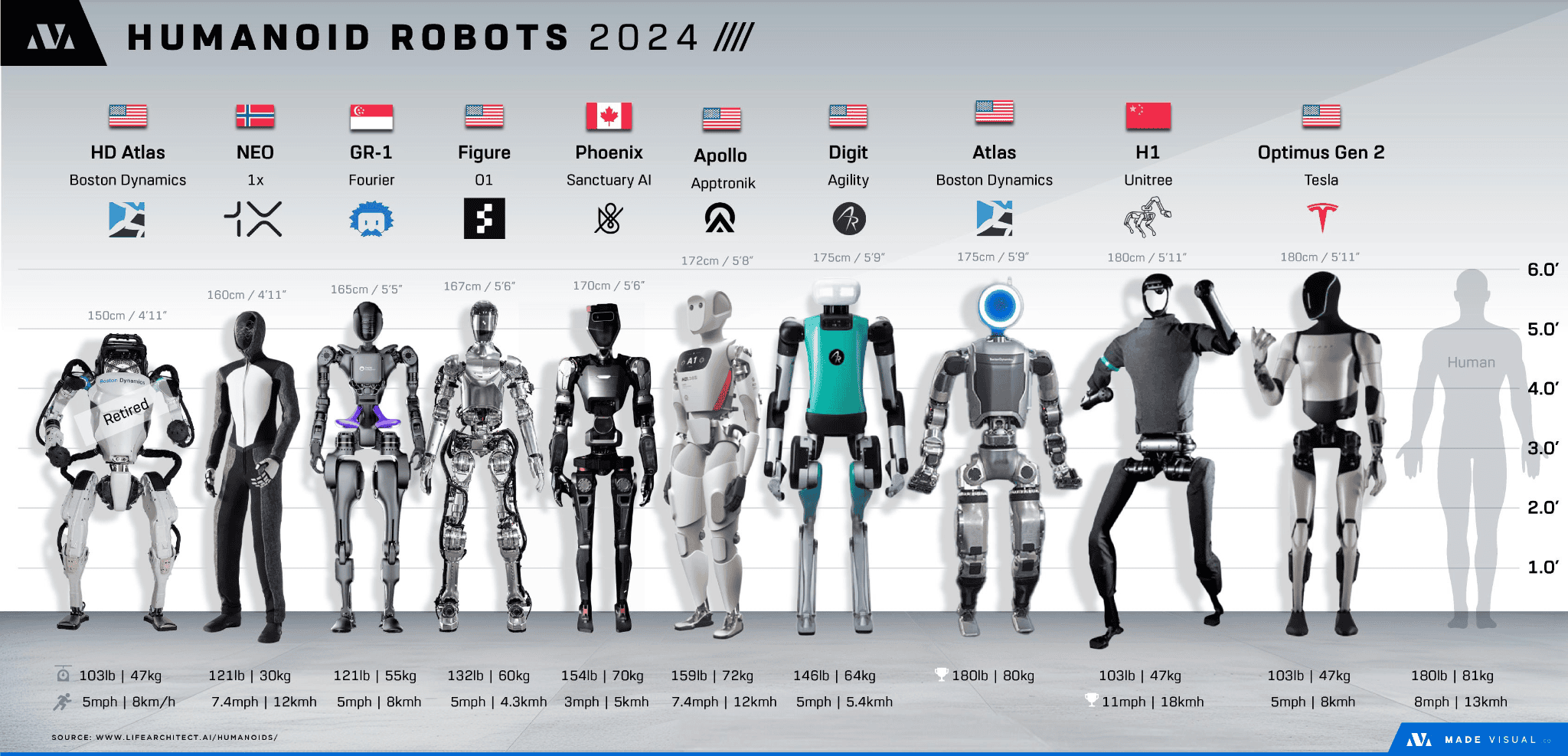

Boston Dynamics

Boston Dynamics is renowned for its advanced robotics, including robots like Spot and Atlas. Although privately held, it has a significant market presence and continues to innovate in mobile and humanoid robotics. Recent developments involve expanding commercial applications, particularly in logistics and inspection. As it scales operations, Boston Dynamics is poised to capture a larger market share, especially with potential public offerings on the horizon.

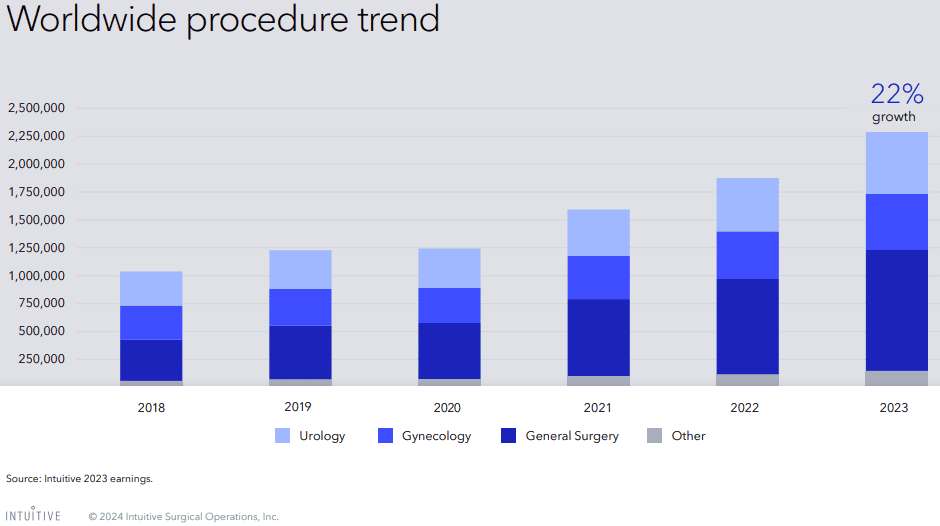

Intuitive Surgical (ISRG)

Intuitive Surgical is a leader in robotic-assisted surgery, with its da Vinci system being widely used worldwide. ISRG has a solid market share in the medical robotics sector. Despite stock volatility, its forward P/E ratio around 73 reflects strong growth expectations. The company’s cash flow is robust, supporting continuous innovation and market expansion.

Source: ISRG Q2 2024 Presentation

Miso Robotics

Miso Robotics specializes in robotic kitchen assistants like Flippy, which is gaining traction in the fast-food industry. While still in the early stages, Miso Robotics is expanding its market presence. Its recent funding rounds suggest strong investor confidence in its growth potential.

Rockwell Automation (ROK)

Rockwell Automation focuses on industrial automation and has a strong position in the market. Its recent developments include expanding its AI-driven automation solutions. With a forward P/E ratio around 28, Rockwell’s stock performance reflects steady growth. The company’s cash flow supports ongoing investments in robotics, ensuring its competitive edge.

Teradyne (TER)

Teradyne is a leader in industrial robotics and testing equipment. It has a strong market position, particularly in semiconductor testing and collaborative robots (cobots). The stock has shown steady growth, with a P/E ratio around 45 (forward). Teradyne’s robust cash flow enables continued investment in R&D, ensuring it remains at the forefront of industrial automation.

ABB Ltd (ABB)

ABB is a global leader in industrial robotics and automation. Its strong market position is bolstered by a diverse portfolio of robotics solutions. The stock has performed steadily, with a P/E ratio around 23. ABB’s cash flow supports its global expansion and R&D efforts, positioning it for sustained growth.

UiPath (PATH)

UiPath is a leader in robotic process automation (RPA), with a strong market position in software-based automation. The stock has been volatile, but its long-term growth prospects remain strong, with a forward P/E ratio of 33 reflecting optimism. UiPath’s cash flow supports its expansion in the growing RPA market.

iRobot (IRBT)

iRobot, known for its Roomba vacuum cleaners, has a strong consumer market presence. Despite challenges, it remains a key player in consumer robotics. The stock has been under pressure, but long-term growth prospects remain, supported by steady cash flow.

[YTD Price Return]

Source: tradingview.com

Companies like Agility Robotics, NextGen Food Robotics, and Figure Robotics are emerging players with specialized robotics solutions. These companies are still growing but show significant potential in their respective niches.

Best Robotics ETFs

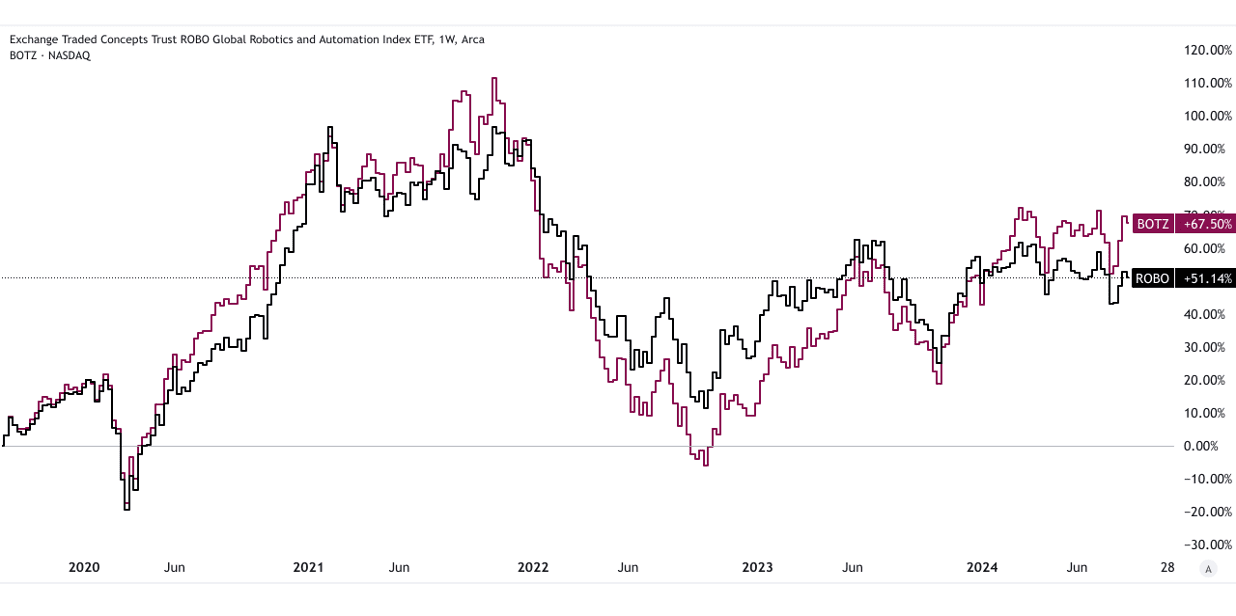

ROBO Global Robotics and Automation Index ETF (ROBO) ROBO offers exposure to a diversified portfolio of leading robotics companies. It has performed well, reflecting the growth in the robotics sector.

Global X Robotics & Artificial Intelligence ETF (BOTZ) BOTZ focuses on AI and robotics companies, providing investors with broad exposure to the sector. Its performance has been strong, driven by the rise in AI and automation.

[5Y Price Return]

Source: tradingview.com

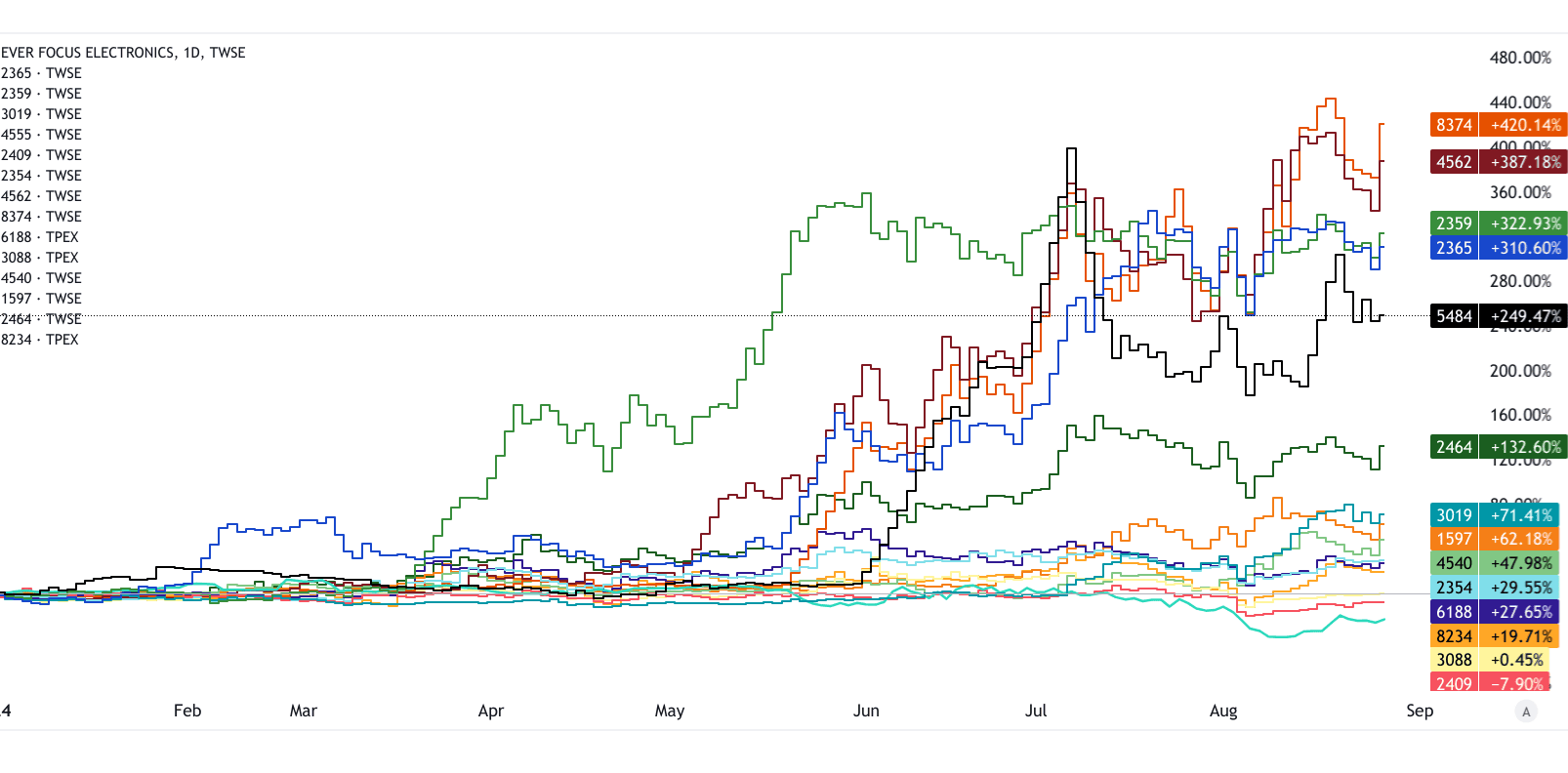

Robotics Stocks & AI Robot Stocks (Taiwan Stocks)

EverFocus (5484) EverFocus is known for its advanced surveillance systems and AI-driven security robots, with a growing market share in Taiwan and beyond.

KYE Systems (2365) KYE Systems focuses on AI and automation technologies, with strong growth potential in the global robotics market.

Solomon Technology (2359) Solomon Technology is a leader in industrial automation in Taiwan, with significant market share and a strong outlook.

Asia Optical (3019) Asia Optical focuses on optical components for robotics, with a strong market position in Taiwan.

Taiwan Chelic (4555) Taiwan Chelic specializes in pneumatic components, crucial for industrial robotics, with a growing market share.

AUO Corp (2409) AUO Corp is a leader in display technologies and is expanding into robotics applications, with strong growth prospects.

Foxconn Technology (2354) Foxconn is a global leader in electronics manufacturing and is increasingly investing in robotics to enhance its production capabilities.

Ying Han Technology (4562):

Specializes in automation components and systems, with a growing market presence in Taiwan's industrial automation sector.

Ace Pillar (8374):

Focused on industrial automation equipment, particularly in motion control, serving various manufacturing industries in Taiwan.

Quanta Storage (6188):

Manufactures storage devices and components, expanding into robotics and automation technologies for broader industrial applications.

[YTD price returns]

Source: tradingview.com

Axiomtek (3088):

Produces embedded systems and industrial computers, integral to robotics and automation, with a strong market position.

Tbi Motion (4540):

Specializes in linear motion components, crucial for precision robotics and automation in various industries.

Chieftek Precision (1597):

Focused on high-precision linear guides and components, essential for advanced robotics and automation systems.

Mirle Automation (2464):

Provides automation solutions, particularly in factory automation and robotics, with a significant market presence in Taiwan.

NEXCOM International (8234):

Develops industrial computing solutions, including AI and IoT for robotics, enhancing automation capabilities in diverse sectors.

The Taipei International Industrial Automation Exhibition 2024 (Automation Taipei 2024) is a major event that showcases cutting-edge robotics and automation technologies, highlighting Taiwan's growing role in global automation.

III. Factors to Consider When Investing in Robotics Stocks

Innovation & R&D Investment

When investing in robotics stocks, one of the critical factors is the level of innovation and R&D investment within the company. Robotics is a rapidly evolving field, with advancements in artificial intelligence (AI), machine learning, and automation driving the industry forward. Therefore, companies that consistently allocate significant resources to R&D are more likely to develop cutting-edge technologies, maintain a competitive edge, and capture a larger market share.

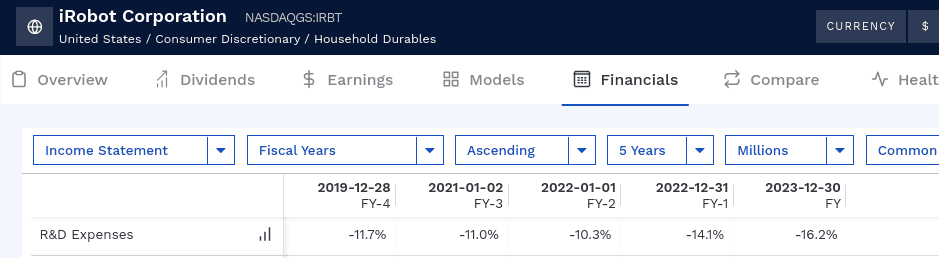

For instance, iRobot, known for its robotic vacuum cleaners, allocated 16% of its revenue to R&D in 2023, which is higher than many peers in the consumer electronics sector. This investment has allowed iRobot to innovate rapidly, incorporating advanced AI and sensor technology into its products, leading to a 10% increase in unit sales year-over-year. In contrast, companies with lower R&D spending may struggle to keep up with technological advancements, risking obsolescence in a market where innovation is key.

Source: finbox.com

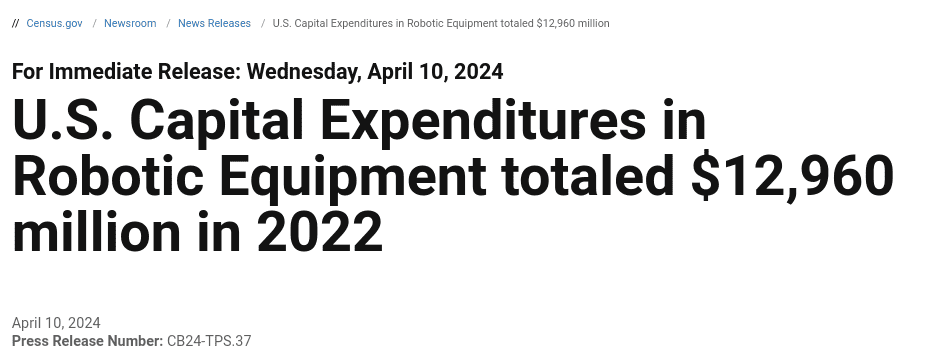

Moreover, R&D investment is closely linked to a company’s ability to enter new markets and develop new applications for robotics technology. For example, Boston Dynamics, heavily backed by Hyundai, has consistently prioritized R&D, leading to breakthroughs in robotics applications beyond manufacturing, such as logistics and healthcare. This broader focus has resulted in a heavy CapEx spending in the US in robotic equipment recently.

Source: census.gov

Investors should also consider the efficiency of R&D spending. A company like ABB, which spends approximately $1.5 billion annually on R&D, has a well-established track record of converting R&D investment into revenue-generating products, with an R&D-to-revenue ratio of about 4.6%. This efficiency is crucial as it indicates that the company is not only investing in innovation but doing so effectively, translating R&D into tangible growth.

Source: statista.com

Regulatory and Ethical Considerations

Safety Standards and Data Privacy Companies like Medtronic and Boston Dynamics must adhere to stringent safety standards and data privacy regulations due to the critical nature of their robotics applications. Ensuring compliance with these regulations is crucial for maintaining market trust and avoiding legal issues.

Job Displacement The automation of jobs through robotics, as seen in Amazon’s logistics operations and Miso Robotics' kitchen assistants, raises concerns about job displacement. Companies must address these ethical considerations by investing in workforce retraining and creating new job opportunities.

Use of Robots in Warfare Companies involved in defense robotics, such as Boston Dynamics, must navigate ethical considerations related to the use of robots in warfare. Balancing innovation with responsible use is crucial for maintaining ethical standards and public trust.

Source: bostondynamics.com

Technological Obsolescence The rapid pace of technological advancement means that companies like NVIDIA and Tesla must continuously innovate to avoid obsolescence. Investing in R&D and staying ahead of technological trends are essential for maintaining a competitive edge.

Shortage of Skilled Professionals The robotics industry faces a shortage of skilled professionals, impacting companies like Rockwell Automation and Teradyne. Addressing this issue through training programs and partnerships with educational institutions is vital for sustaining growth.

Market Volatility and Competition Companies across the robotics sector, including Intuitive Surgical and ABB, face market volatility and intense competition. Strategic investments in innovation and diversification can help mitigate these risks and ensure long-term success.

IV. Robotics Industry Trends & Robotics Stocks Outlook

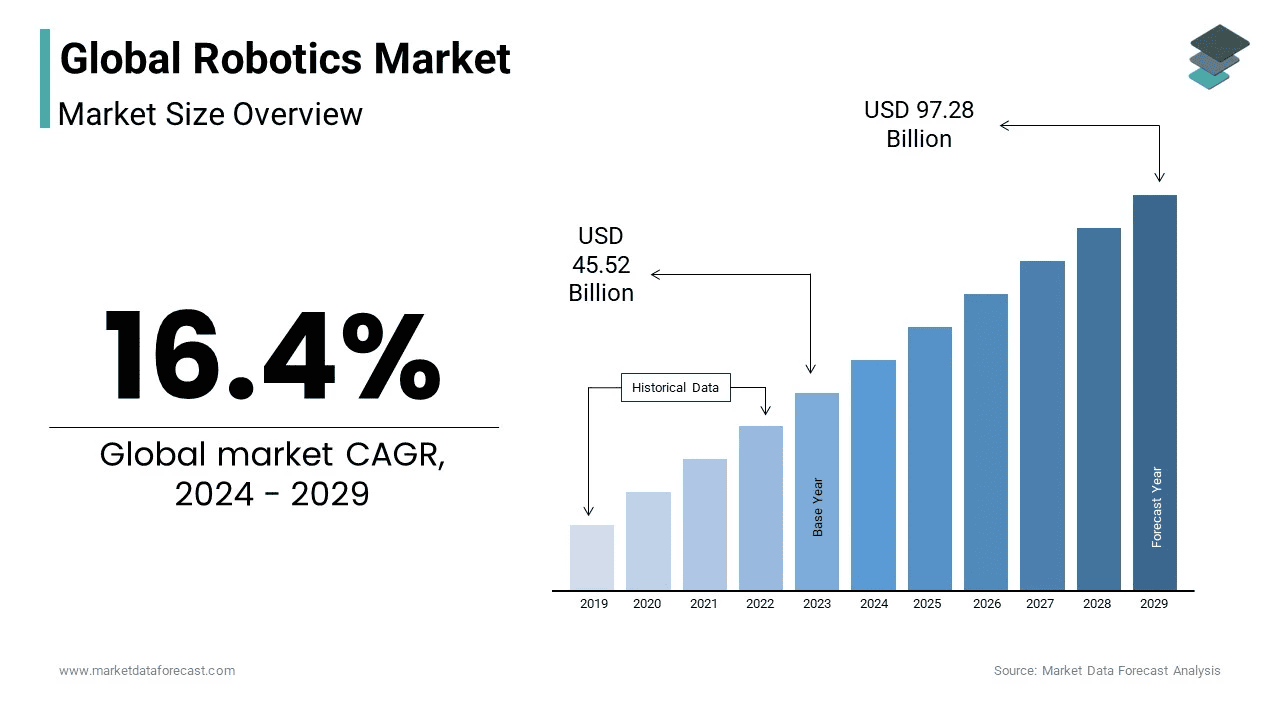

The robotics industry is rapidly expanding, driven by advancements in AI, automation, and IoT. As of 2023, the global robotics market is valued at approximately $46 billion and is projected to grow at a compound annual growth rate (CAGR) of +16% through 2029 to hit $100 billion (marketdataforecast.com). This growth is fueled by increased adoption across various sectors including manufacturing, healthcare, logistics, and consumer goods.

Source: marketdataforecast.com

Regional Market Analysis

- North America: Dominates the global robotics market due to technological advancements and a strong presence of leading robotics companies like NVIDIA and Tesla. High investments in automation and robotics research contribute to the region's leadership.

- Europe: Shows strong growth in industrial robotics and automation, with significant investments in R&D. Companies like ABB and Rockwell Automation are prominent in the European market.

- Asia-Pacific: Rapidly growing due to manufacturing expansion and increasing automation needs. Japan, South Korea, and China are major players, with companies like Miso Robotics and KYE Systems driving regional growth.

Future Trends

- AI Integration: Companies like NVIDIA are leading in integrating AI with robotics, enhancing capabilities and efficiency. AI allows for smarter decision-making and more autonomous operations.

- Robotic Process Automation (RPA): UiPath is a key player in RPA, automating repetitive tasks across various industries to improve efficiency and reduce costs.

- Collaborative Robots (Cobots): Collaborative robots, such as those from Universal Robots, work alongside humans, enhancing productivity and safety. Companies like Rockwell Automation are investing heavily in cobots.

- Humanoid Robots: Tesla's Optimus and Boston Dynamics' Atlas represent advancements in humanoid robotics, aiming to perform complex tasks in human-centric environments.

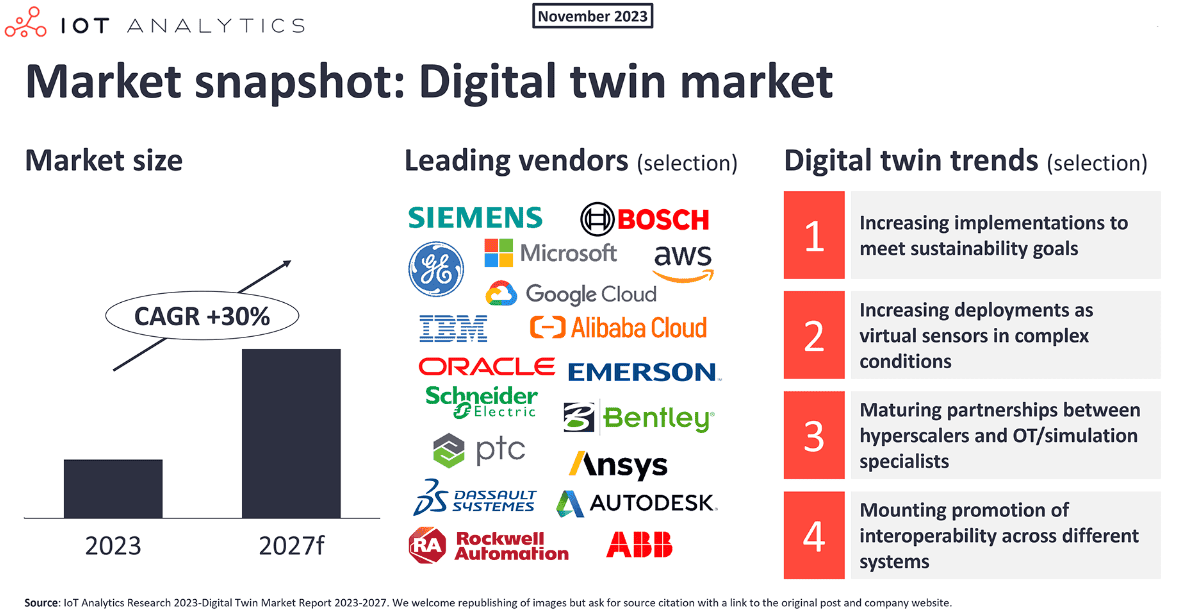

- Digital Twins and Simulation: Digital twins are virtual replicas of physical systems used for simulation and optimization. Companies like ABB are utilizing this technology to enhance the design and performance of robotic systems.

Source: iot-analytics.com

- Edge and Cloud Computing: Integration of edge and cloud computing with robotics, as seen with NVIDIA’s platforms, enhances real-time data processing and decision-making capabilities.

Long-term Outlook for Robotics Stocks

The long-term outlook for robotics stocks appears promising, driven by increasing automation across various industries, advancements in AI, and a growing need for efficiency in manufacturing, healthcare, and logistics. According to the International Federation of Robotics, global robot installations reached 517,000 units in 2023, a 15% increase from the previous year. This trend is expected to continue, with the robotics market projected to grow at a compound annual growth rate (CAGR) of 25.38% from 2023 to 2030, reaching a market size of $275.1 billion by 2030.

Source: goldmansachs.com

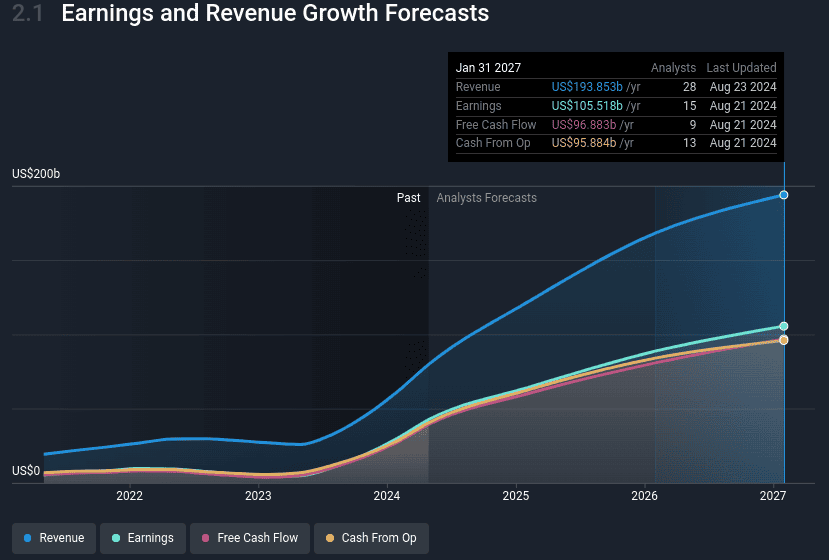

Companies that lead in technological advancements, such as NVIDIA with its AI and robotics innovations, and Tesla with its development of humanoid robots, are expected to benefit significantly. The demand for automation solutions will likely continue to rise, driven by the need for efficiency and productivity improvements in various sectors.

[Nvidia’s Earnings and Revenue Estimates]

Source: simplywall.st

Key players in the robotics sector, such as Fanuc Corporation, and Yaskawa Electric, are investing heavily in research and development (R&D) to innovate and improve their product offerings. For example, Fanuc's R&D expenditure exceeded $1 billion in 2023, reflecting the company's commitment to advancing robotics technology. Similarly, Boston Dynamics, acquired by Hyundai in 2020, is expanding its commercial robot offerings, indicating robust growth potential.

The adoption of robotics in healthcare is also a critical growth driver. The surgical robotics market alone is expected to grow from $7.2 billion in 2021 to $16.77 billion by 2030. Companies like Intuitive Surgical, the maker of the da Vinci Surgical System, dominate this segment, with its stock appreciating over 8X in the past decade, underscoring the profitability in this niche.

However, the sector faces challenges, including high initial costs and technological integration hurdles. Moreover, regulatory uncertainties, particularly concerning AI-driven robots, could impede growth. For instance, the European Union’s AI Act, expected to be enacted by 2025, may impose strict regulations on AI-based robotics, potentially influencing innovation pace.