● Travel stocks offer high return potential, with companies like Airbnb (ABNB) delivering a 32% stock price increase in 2023 driven by surging post-pandemic travel demand.

● Travel stocks are prone to volatility, as seen when Carnival (CCL) shares dropped over 60% in 2020 due to global travel restrictions.

● Travel stocks, especially large-cap names like Booking Holdings (BKNG), are highly liquid, trading with an average daily volume of 800,000 shares in 2023, allowing easy market entry and exit.

I. What Are Travel Stocks

Travel stocks refer to publicly traded companies involved in the travel and tourism industry, spanning various sectors such as Online Travel Agencies (OTAs), Cruise Lines, Hotels and Resorts, and Airlines. These businesses generate revenue from services related to travel bookings, accommodations, and transportation.

OTAs: Companies like Booking Holdings (NASDAQ: BKNG) and Expedia Group (NASDAQ: EXPE) enable users to book flights, hotels, and vacation packages through digital platforms. These companies benefit from digital disruption, with BKNG's 2024 Q2 revenue at $5.9 billion, a 7.3% YoY increase.

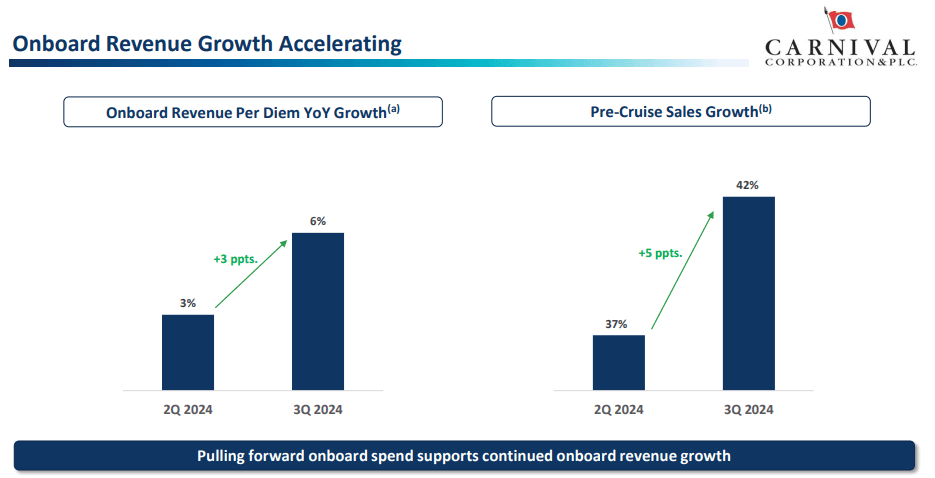

Cruise Lines: Firms like Carnival Corporation (NYSE: CCL) and Royal Caribbean (NYSE: RCL) operate luxury cruise services. In Q3 fiscal 2024, CCL reported $7.9 billion in revenue, up 15.2% from the same quarter in 2022, signaling a strong recovery in global tourism.

Source: CCLThird Quarter 2024 Earnings Presentation

Hotels and Resorts: Major players like Marriott International (NASDAQ: MAR) and Hilton Worldwide (NYSE: HLT) offer lodging services globally. For example, MAR's Q2 2024 revenue reached $6.4 billion, a 6% YoY increase from Q2 2023, driven by higher occupancy rates and average daily rates (ADR).

Airlines: Companies like Delta Air Lines (NYSE: DAL) and American Airlines (NASDAQ: AAL) provide passenger and cargo air transport. DAL’s Q3 2024 revenue hit $15.7 billion (+1.22% YoY), a record high driven by robust travel demand.

Why Invest in Travel Stocks?

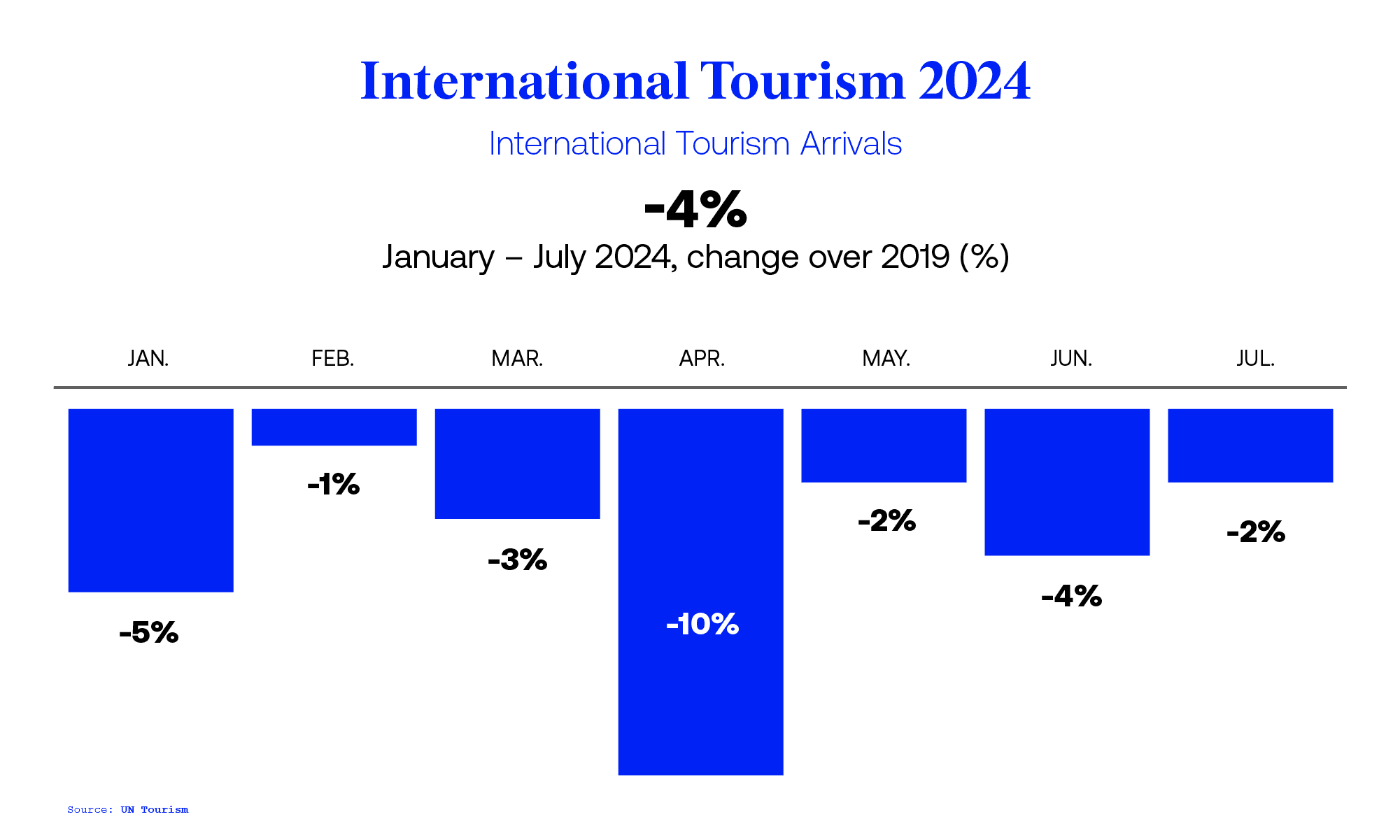

● Post-Pandemic Surge: As travel restrictions ease, global tourism spending surged, with international tourist arrivals reaching 89% of pre-pandemic levels in 2023 and 96% in January-July 2024, per UNWTO.

● Variety of Sectors: Exposure across distinct industries (lodging, transportation, experiences) offers diversification.

● Global Exposure: Companies like MAR and DAL operate globally, benefiting from international tourism growth.

Source: unwto.org

II. Best Travel Stocks

Travel Stocks (US Stocks)

Booking Holdings (BKNG)

Booking Holdings, owner of brands like Booking.com, Priceline, and Kayak, dominates the OTA sector. It had a market share of approximately 22% in global online travel bookings in 2023.

BKNG’s robust growth is evident from revenue growth driven by increased global travel demand. Additionally, its merchant Gross Booking Value (GBV) reached 51% of total GBV. The company’s exposure to Europe and Asia positions it well for continued growth as international travel rebounds.

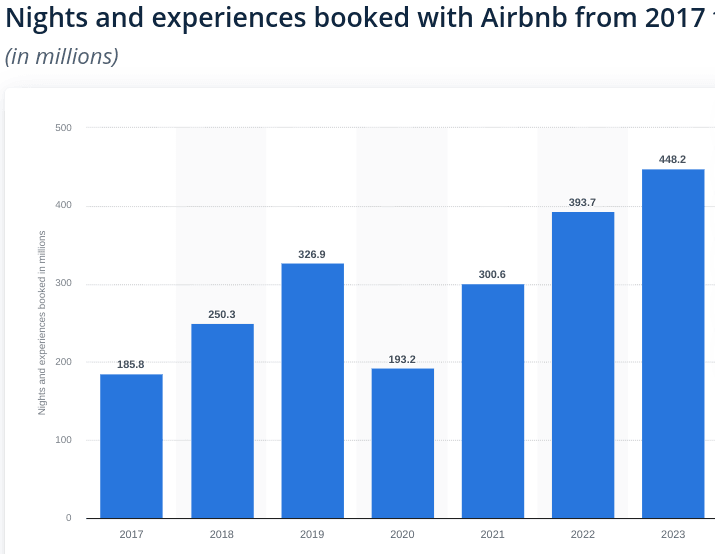

Airbnb (ABNB)

Airbnb is a global leader in short-term rental bookings, competing with hotels by offering unique travel accommodations. It holds a global market share of 20% in the vacation rental space.

ABNB reported $2.75 billion in revenue for Q2 2024, a 11% YoY increase. The company’s innovative offerings, like "Airbnb Experiences," and expansion into long-term stays (19% YoY growth nights booked in Q2 2024) provide future growth potential as travel trends evolve post-pandemic.

Source: statista.com

Carnival Corporation & plc (CCL)

Carnival is the largest cruise company globally, holding 45% of the market share. Its brands include Carnival Cruise Line, Princess Cruises, and Holland America.

Carnival’s Q3 2024 reflecting a strong rebound in cruise demand. As capacity utilization and ticket prices rise, CCL is poised for further revenue increases. The company’s focus on reducing carbon emissions also aligns with ESG investment trends.

Royal Caribbean Cruises Ltd. (RCL)

Royal Caribbean is the second-largest cruise line operator globally with a 23.6% market share in the industry. It offers luxury and mass-market cruise experiences worldwide.

In Q2 2024, RCL generated $4.11 billion in revenue, up 16.7% YoY, demonstrating a solid recovery post-pandemic. With record bookings for 2025, RCL’s innovative ship designs and new itineraries cater to high-end travelers, fueling future revenue growth.

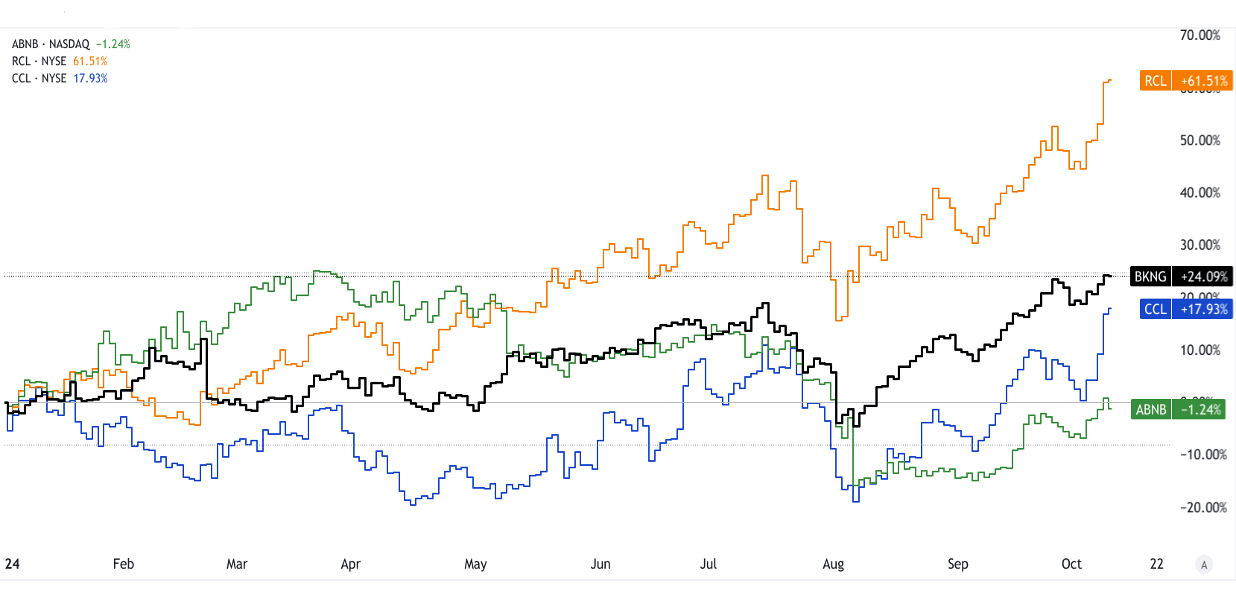

Source: tradingview.com [YTD_Price_Return]

MakeMyTrip Limited (MMYT)

MakeMyTrip is the leading OTA in India, offering services such as flight bookings, hotel reservations, and vacation packages.

In Q1 fiscal 2025, MMYT saw a 23% YoY revenue growth, totaling $243 million. With India's rapidly growing travel market and rising middle-class income, MMYT is well-positioned to capture domestic and international travel demand in Asia.

Tripadvisor (TRIP)

Tripadvisor is a prominent platform for travel reviews, restaurant recommendations, and vacation bookings. It holds a large market share in travel research but faces competition in direct bookings.

Despite challenges, TRIP reported $497 million in Q2 2024 revenue, supported by its "Experiences" segment. The company’s recent pivot toward paid subscriptions (Tripadvisor Plus) could further boost profitability.

Expedia Group (EXPE)

Expedia, which owns brands like Expedia.com, Vrbo, and Hotels.com, holds a global market share of about 16% in OTAs, competing closely with Booking.com.

EXPE posted $3.6 billion in Q2 2024 revenue, a 6% YoY increase, reflecting steady recovery in travel demand. Expedia’s strong position in the U.S. market and its growing Vrbo segment (for vacation rentals) contribute to its long-term potential.

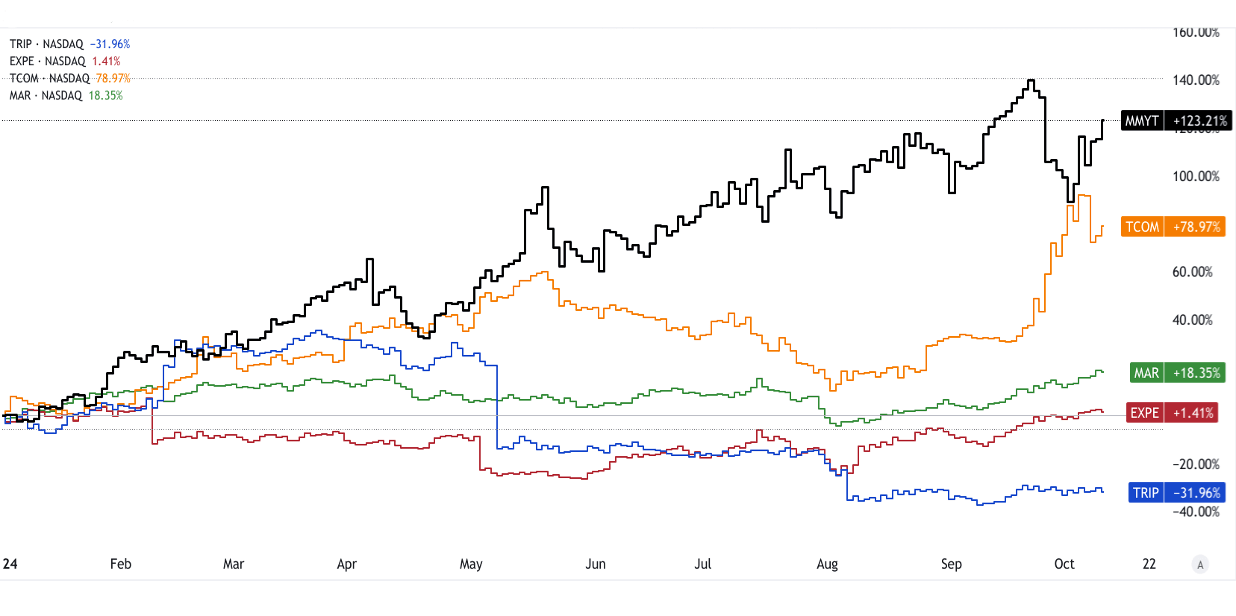

Source: tradingview.com [YTD_Price_Return]

Trip.com (TCOM)

Based in China, Trip.com offers services across flights, hotels, and package tours. It is the dominant travel service provider in Asia, with an estimated market share of 28% in online travel bookings in China.

TCOM reported a 16% YoY revenue increase to $1.8 billion in Q2 2024, driven by the resurgence of domestic and international travel in Asia. As China reopens, Trip.com is likely to benefit from growing outbound tourism and a strong rebound in travel spending.

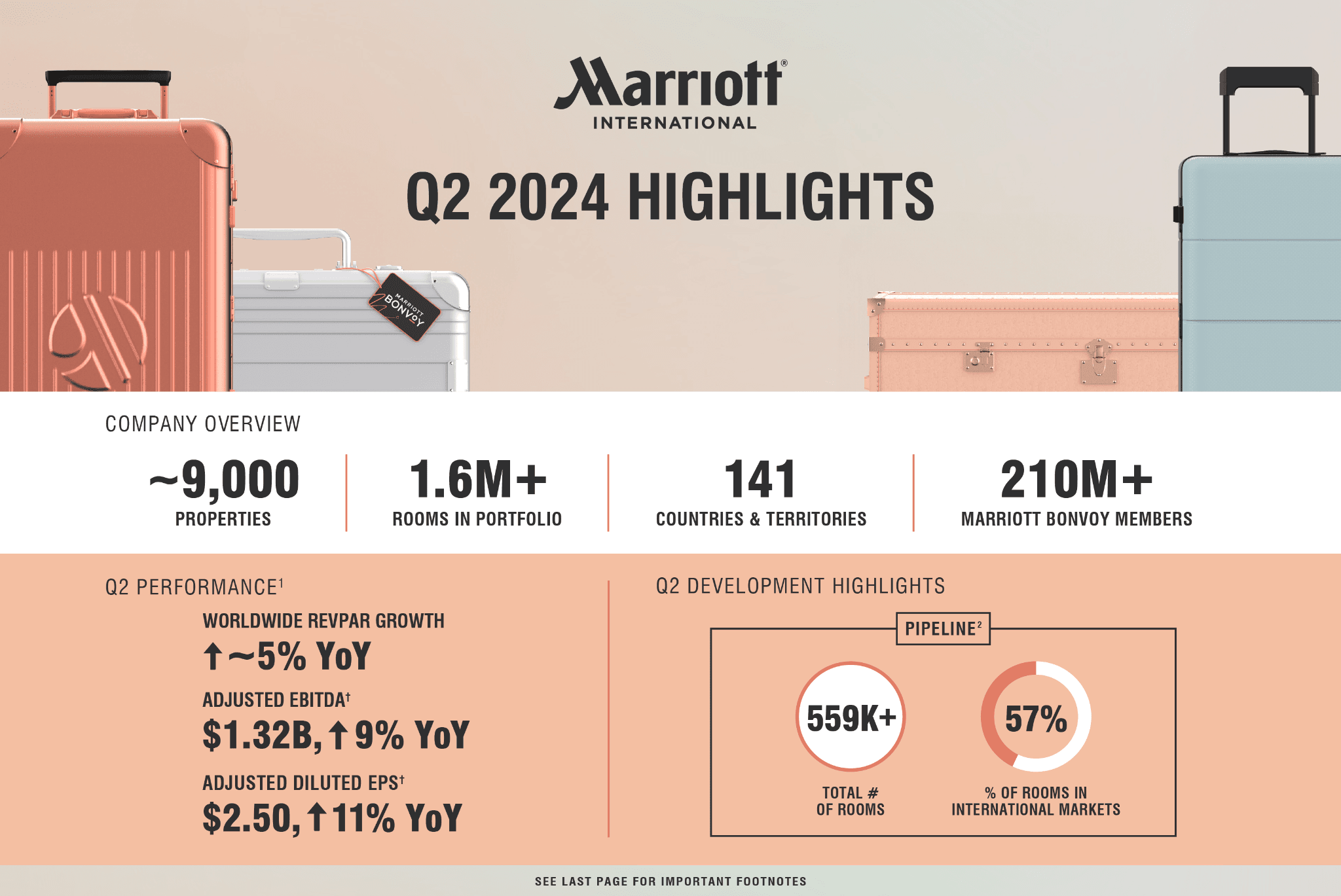

Marriott International (MAR)

Marriott operates over 8,500 properties globally across 138 countries, making it the largest hotel chain by revenue.

Marriott’s Q2 2023 revenue grew by 13.8% YoY, reaching $6.1 billion. The company’s RevPAR (Revenue per Available Room) rose by 5%, reflecting strong pricing power and higher occupancy rates. With continued expansion in luxury brands and loyalty programs (Marriott Bonvoy), Marriott is well-positioned for future growth.

Source: news.marriott.com

Travel Stocks to Buy (Taiwan Stocks)

Lion Travel Service (2731)

Lion Travel is Taiwan’s leading travel agency, specializing in group tours, individual travel, and corporate travel management.

Lion Travel had TWD 7,421.81 million in Q2 2024 revenue compared to TWD 5,504.31 million in Q2 2023 as domestic and outbound travel recovered post-pandemic. Its dominance in Taiwan’s travel industry and expansion into new markets in Asia offer solid growth potential.

Hoya Resort Hotel Group (2736)

Hoya Resort is a luxury hotel and resort operator in Taiwan, catering to domestic and international tourists.

Hoya’s revenues are projected to grow as Taiwan’s tourism industry rebounds, particularly in luxury accommodations. Q2 2024 revenue was TWD 73 million, with occupancy rates continuing to climb.

My Humble House Hospitality Management Consulting (2739)

This company focuses on hospitality management for boutique hotels and restaurants in Taiwan.

My Humble House reported a 3.82% YoY revenue growth in Q2 2024. As Taiwan continues to promote itself as a tourist destination, the company is well-positioned to capitalize on increased inbound tourism.

Source: tradingview.com [5Y_Price_Return]

Travel Stocks ETFs

PEJ (Invesco Dynamic Leisure and Entertainment ETF)

PEJ holds a diversified portfolio of travel, entertainment, and leisure stocks like BKNG, MAR, and EXPE.

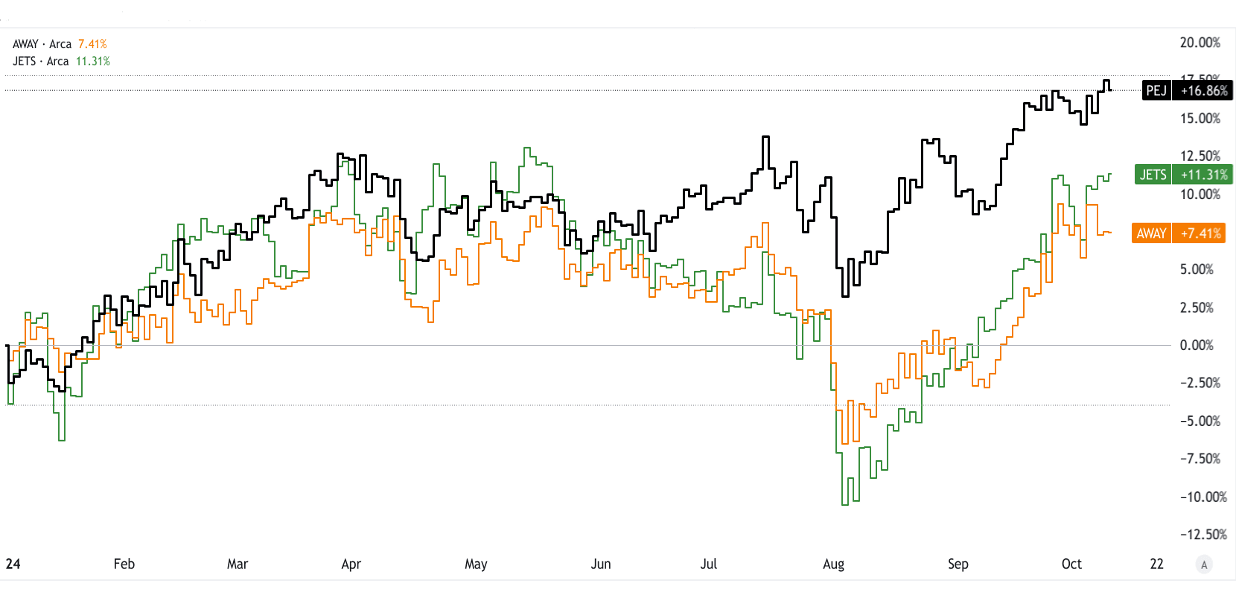

PEJ provides broad exposure to the recovering travel sector, benefiting from consumer discretionary spending. Its 2024 YTD performance is up 17%, reflecting strong sector momentum.

AWAY (Amplify Travel Tech ETF)

Invests in companies driving innovation in the travel industry through technology, including OTAs like Booking Holdings (BKNG) and Airbnb (ABNB). As digital travel bookings and tech adoption increase, AWAY offers growth potential. In 2024, it delivered a 7% YTD performance, benefiting from the resurgence of global travel demand and tech-driven disruption.

JETS (U.S. Global Jets ETF)

JETS focuses on airline stocks such as DAL, AAL, and LUV, offering exposure to the airline industry's recovery.

As airlines benefit from rising passenger numbers, JETS has seen 11% YTD growth in 2024. Its diversified holdings reduce individual airline risk while capturing the industry’s overall momentum.

Source: tradingview.com [YTD_Price_Return]

III. Factors to Consider When Investing in Travel Stocks

Economic Indicators:

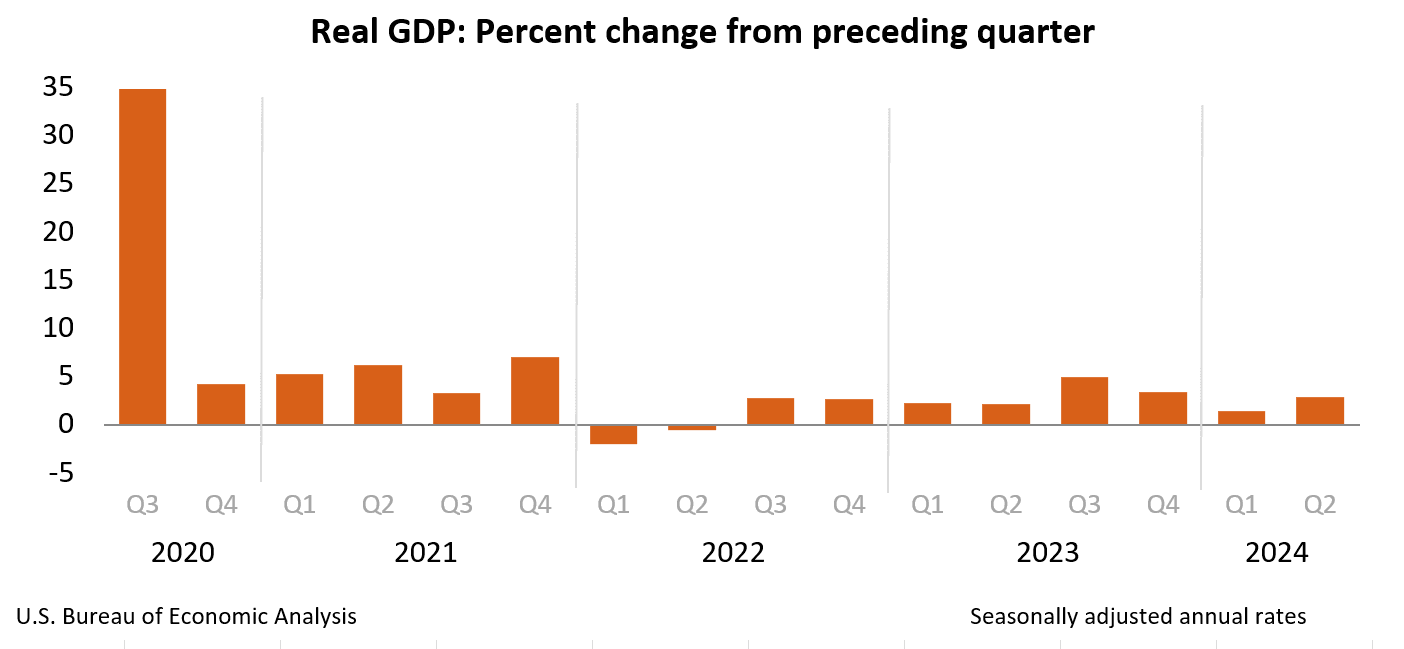

Key metrics like GDP growth, employment rates, and consumer spending are crucial. For example, when the U.S. GDP grew by 2.8% in Q2 2023, it signaled economic stability, boosting travel demand. High employment and disposable income spur spending on travel-related services, benefiting companies like Booking Holdings and Carnival.

Source: bea.gov

Company Financial Health and Unique Selling Propositions:

Investors should assess a company's balance sheet, profitability, and competitive edge. For instance, Airbnb’s debt-to-equity ratio of 0.28 (Q2 2024) indicates low leverage, while its differentiated home-sharing model offers resilience. Financially robust firms with unique offerings tend to outperform during downturns.

Fuel Prices:

Travel stocks, especially airlines and cruise lines, are sensitive to fuel costs. For example, rising crude oil prices to $74.4 per barrel in 2024 increased operating costs for Delta Air Lines, potentially squeezing margins if they can’t pass on these costs to consumers.

Inflation and Travel Costs:

High inflation can lead to higher travel costs. The 5.3% inflation rate in 2023 pushed airfare and hotel prices higher, potentially curbing demand for price-sensitive travelers, impacting firms like Expedia and Tripadvisor.

Regulations:

Travel companies must comply with stringent safety and environmental standards. Cruise lines, for example, are under pressure to reduce emissions. In 2023, Carnival invested heavily in LNG-powered ships to meet new IMO environmental regulations.

Risks:

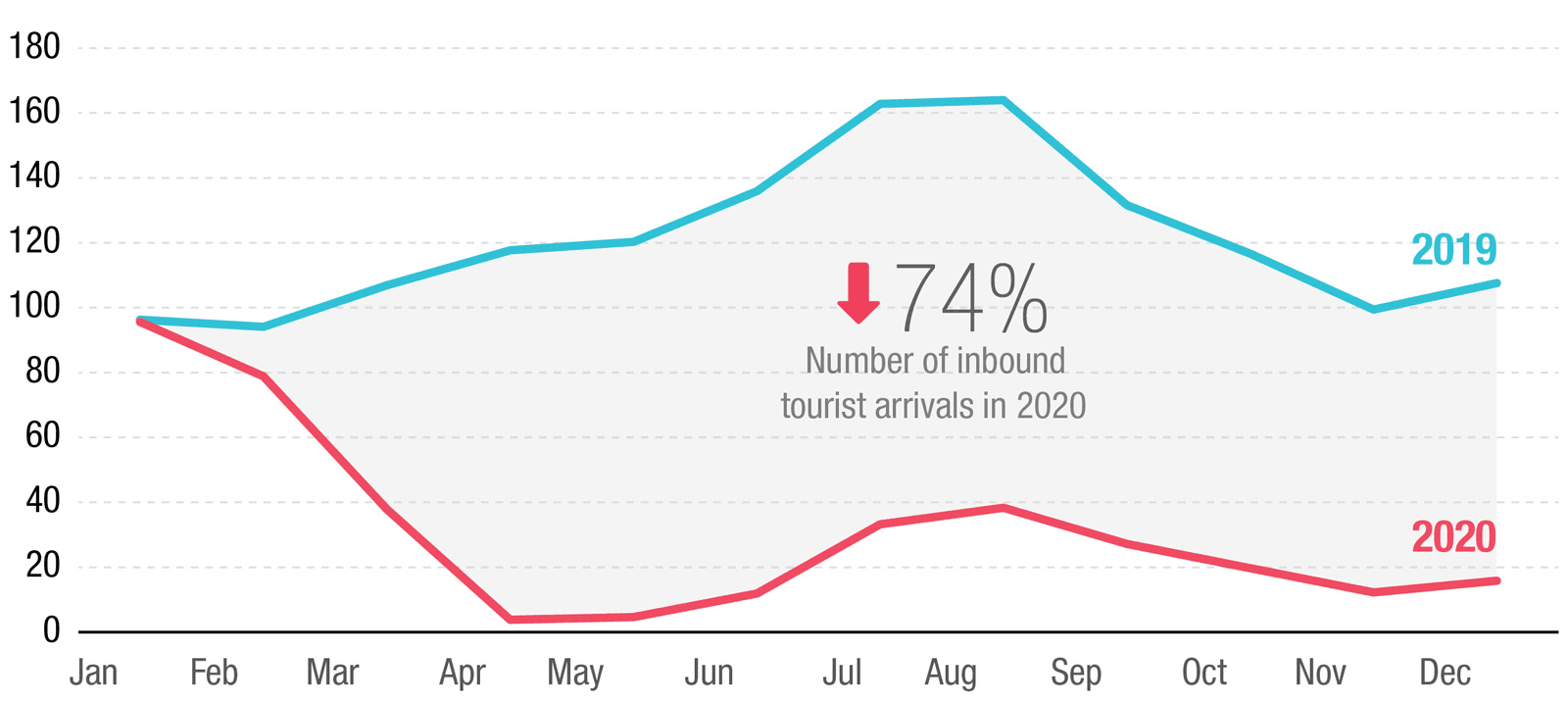

External risks like pandemics, natural disasters, or political instability can disrupt the travel industry. The 2020 pandemic wiped out $4.5 trillion in global tourism revenue, underscoring the vulnerability of travel stocks to unforeseen events.

Source: unwto.org

IV. Travel Industry Trends and Travel Stocks Outlook

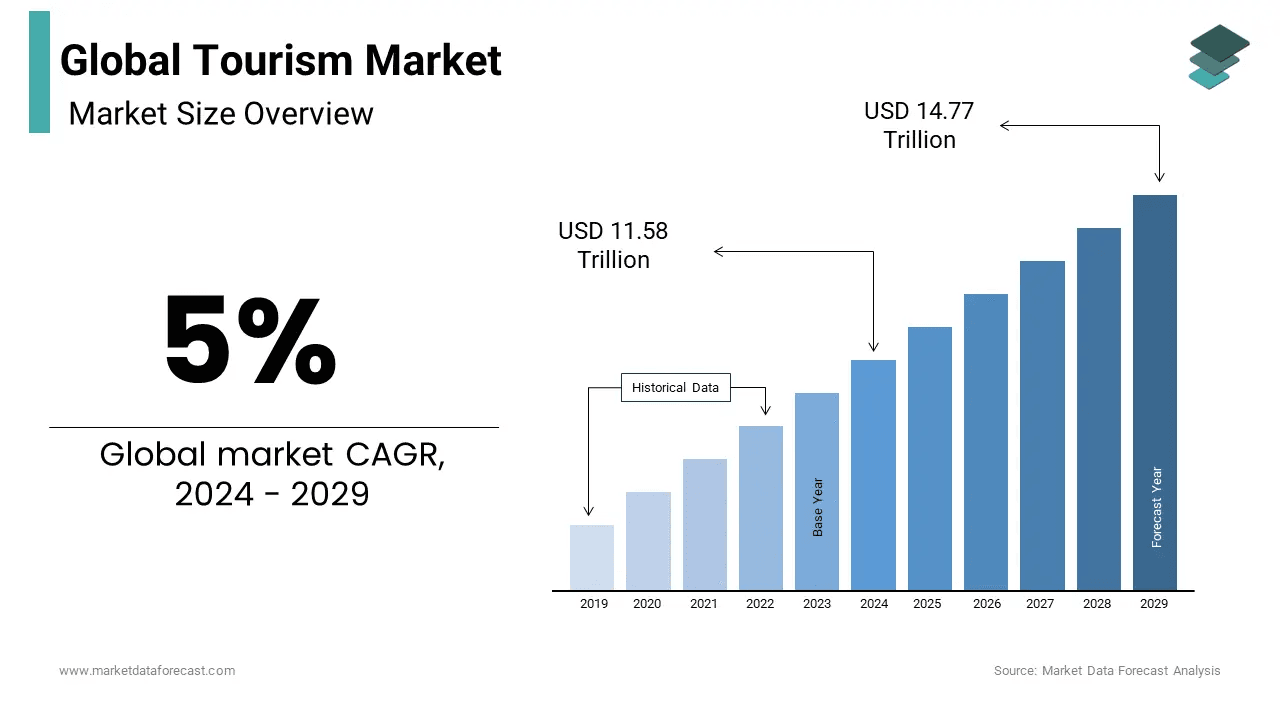

The global travel market is forecast to reach $14.77 trillion by 2029, growing at a CAGR of 5% from 2024. The rebound post-pandemic has been significant, with regions like North America and Europe driving demand. Asia-Pacific, particularly China and India, is expected to see the highest growth, boosted by a rising middle class and pent-up demand for international travel.

Source:marketdataforecast.com

Future Trends Shaping the Travel Industry

Eco-tourism and Sustainable Travel:

Increasing environmental awareness is driving demand for sustainable travel. Companies like Royal Caribbean Cruises (RCL) and Carnival (CCL) are investing in low-emission LNG-powered ships to reduce their carbon footprint. This focus on sustainability will be critical for long-term growth, with 67% of travelers in 2023 preferring environmentally friendly options.

Bleisure Travel (Business + Leisure) and Digital Nomadism:

As remote work becomes normalized, the rise of "bleisure" and digital nomads is reshaping travel patterns. Airbnb (ABNB) is well-positioned to benefit considerably from bookings for long-term stays, signaling growth in this sector. This shift expands the target demographic for travel companies, offering long-term revenue potential.

Adventure Travel, Cultural Immersion, and Local Experiences:

Travelers are seeking authentic, immersive experiences. Booking Holdings (BKNG) and Trip.com (TCOM), with platforms offering extensive local tours and activities, are poised to capitalize on this trend, reflected in their strong growth in experiential bookings (up 30% YoY in 2023).

Digital Transformation & Contactless Solutions:

The adoption of digital tools like mobile check-ins, contactless payments, and automated services has accelerated. Expedia (EXPE) and Marriott (MAR) are leading this transformation. Marriott's Bonvoy app, which offers contactless booking and check-in, has seen a 30% rise in app usage in 2023.

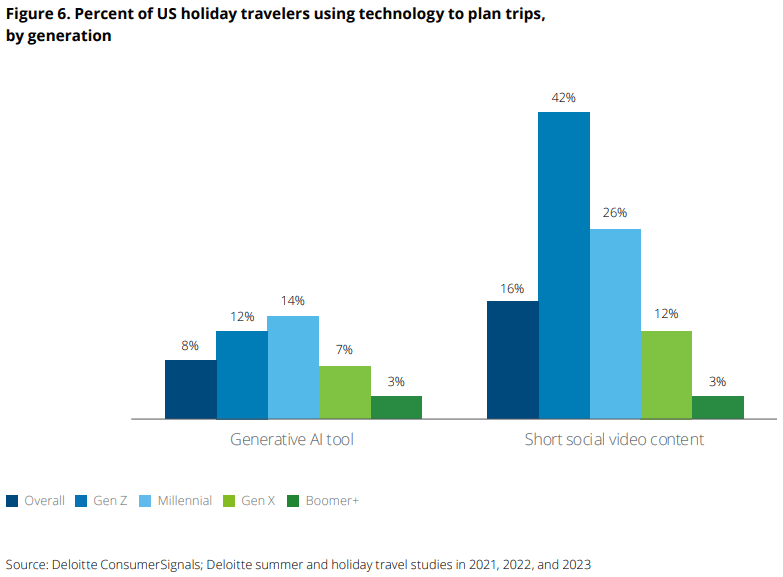

AI Technological Integration:

AI is revolutionizing travel, from AI-powered chatbots for customer service to personalized travel recommendations. Tripadvisor (TRIP) and Booking Holdings leverage AI to optimize search algorithms, improve user experiences, and increase booking conversions, driving future revenue growth.

Source: 2024 travel outlook

Long-Term Outlook for Travel Stocks

Increasing Global Wealth:

As global wealth rises, especially in emerging markets, discretionary spending on travel will increase. Marriott (MAR), with its diverse portfolio of luxury hotels, is well-placed to benefit. The growing middle class in Asia, particularly in India and China, presents an untapped market for OTAs like MakeMyTrip (MMYT) and Trip.com.

Changing Demographics:

The younger generation, including Millennials and Gen Z, prioritizes experiences over material goods, driving demand for travel. These cohorts are more likely to seek adventure travel and sustainable options, boosting demand for companies that cater to such preferences. For instance, Airbnb’s unique accommodation options and tech appeal strongly to younger travelers.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.