- Blue chip stocks are highly liquid, allowing investors to buy or sell large volumes with minimal impact on the stock price.

- Blue chip stocks typically offer consistent returns, with the S&P 500, which includes many blue chips, averaging an annual return of around 10% over the past century.

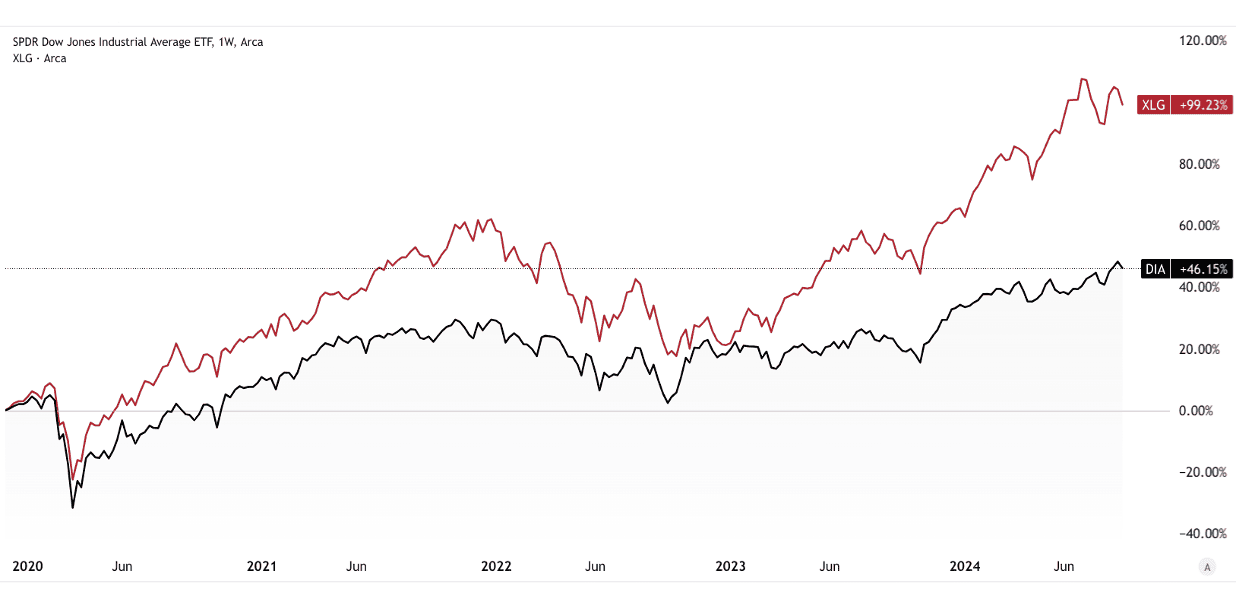

- Blue chip stocks' low volatility is evident during market downturns, as seen in the COVID-19 crash when the Dow Jones Industrial Average (DJIA) fell by 37% but quickly recovered, outperforming smaller-cap stocks.

Source: unsplash.com

I. What Are Blue Chip Stocks

Blue chip stocks refer to shares of well-established, financially sound, and historically reputable companies. The term "blue chip" originated from poker, where blue chips hold the highest value. In the stock market, this term began being used in the 1920s to describe companies that are leaders in their industries, possess large market capitalizations, and consistently perform well over time.

Source: investopedia.com

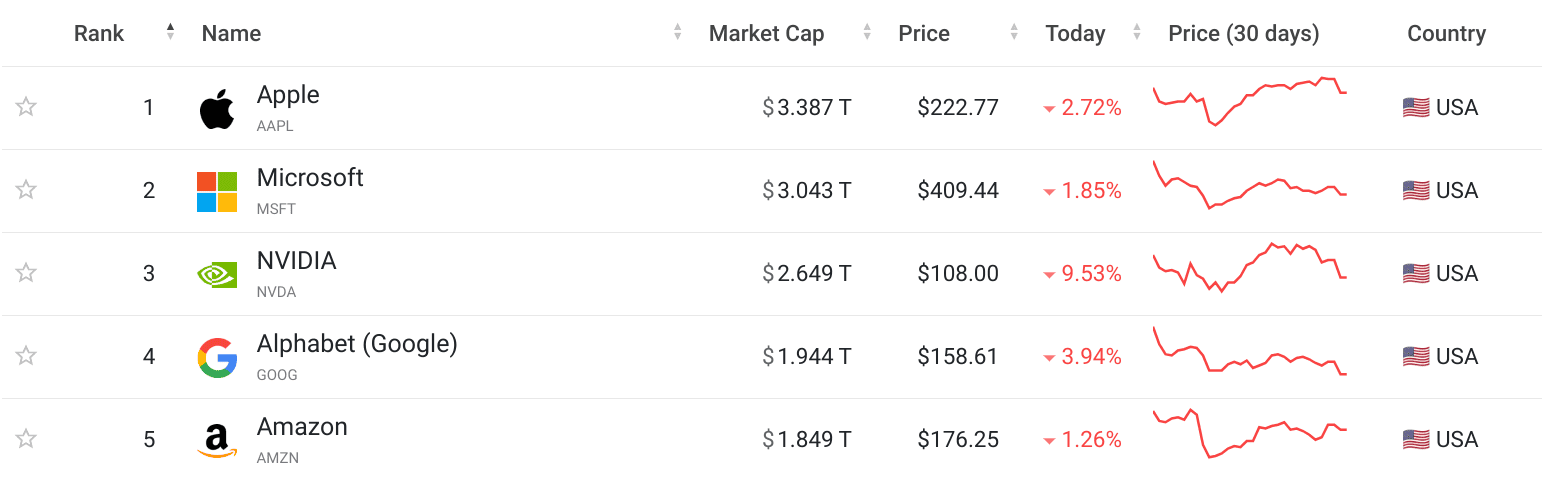

What Constitutes a Blue Chip Stock:

A blue chip stock typically belongs to a company with a market capitalization often exceeding $10 billion, though this can vary. These companies usually have a long history of stable earnings, robust balance sheets, and a strong global presence. For instance, companies like Apple, Microsoft, Nvidia, Coca-Cola, and Johnson & Johnson are considered blue chips due to their massive market caps—Apple and Microsoft hold over $3 trillion in market cap as of September 2024. Additionally, blue chip stocks are known for paying regular dividends, which appeal to income-seeking investors.

Source:companiesmarketcap.com

Source:companiesmarketcap.com

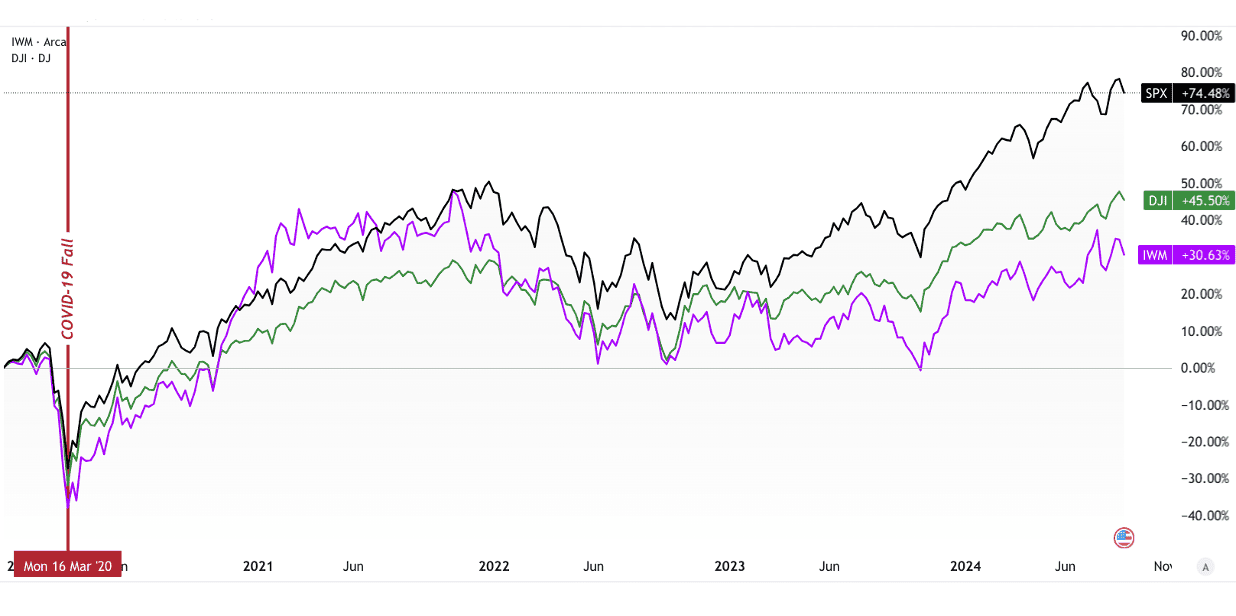

Blue Chip Stocks Performance During Market Fluctuations:

Blue chip stocks are known for their resilience during market downturns. They tend to experience less volatility compared to smaller, less established companies. During the 2008 financial crisis, the Dow Jones Industrial Average (DJIA), which includes many blue chip stocks, fell approximately 34% from its peak but eventually recovered by 2013. This demonstrates their ability to weather economic storms and eventually bounce back. Similarly, during the COVID-19 pandemic, while the DJIA dropped by about 37% in March 2020, it recovered to pre-pandemic levels by August 2020 (outperforming small caps-IWM), showcasing the stability of blue chip stocks even in unprecedented conditions.

Source:tradingview.com

Source:tradingview.com

Role in Economic Recovery Phases:

Blue chip stocks play a crucial role in economic recovery phases. Their stability and strong fundamentals often lead them to be among the first to recover following a downturn. For example, during the recovery phase post-2008, companies like Procter & Gamble and Coca-Cola, both blue chip stocks, saw substantial recovery due to their strong market positions and consistent consumer demand for their products.

Why Invest in Blue Chip Stocks?

- Stability and Reliability: Blue chip stocks offer stability and reliability, underpinned by strong financial performance and high credit ratings. For example, companies like Microsoft and Johnson & Johnson have maintained AAA credit ratings, signaling low default risk.

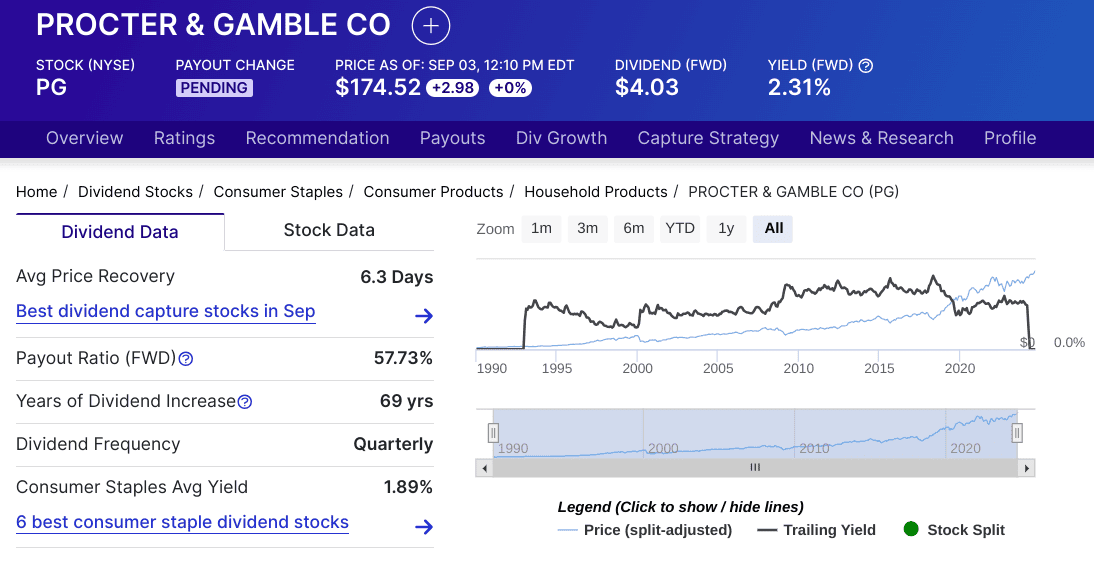

- Dividend Payments: These stocks often pay consistent dividends. For instance, Procter & Gamble has increased its dividend for 69 consecutive years as of 2024.

Source:Dividend.com

Source:Dividend.com

- Global Exposure: Blue chip companies typically have significant global operations, providing exposure to international markets.

- Safe Investment: Due to their established market positions, blue chip stocks are considered safer investments compared to smaller, more volatile companies.

- Long-Term Growth Potential: Over the long term, blue chip stocks generally exhibit steady growth. For example, the average annual return for the S&P 500, which includes many blue chip stocks, has been approximately 10% over the last century.

II. Best Blue Chip Stocks

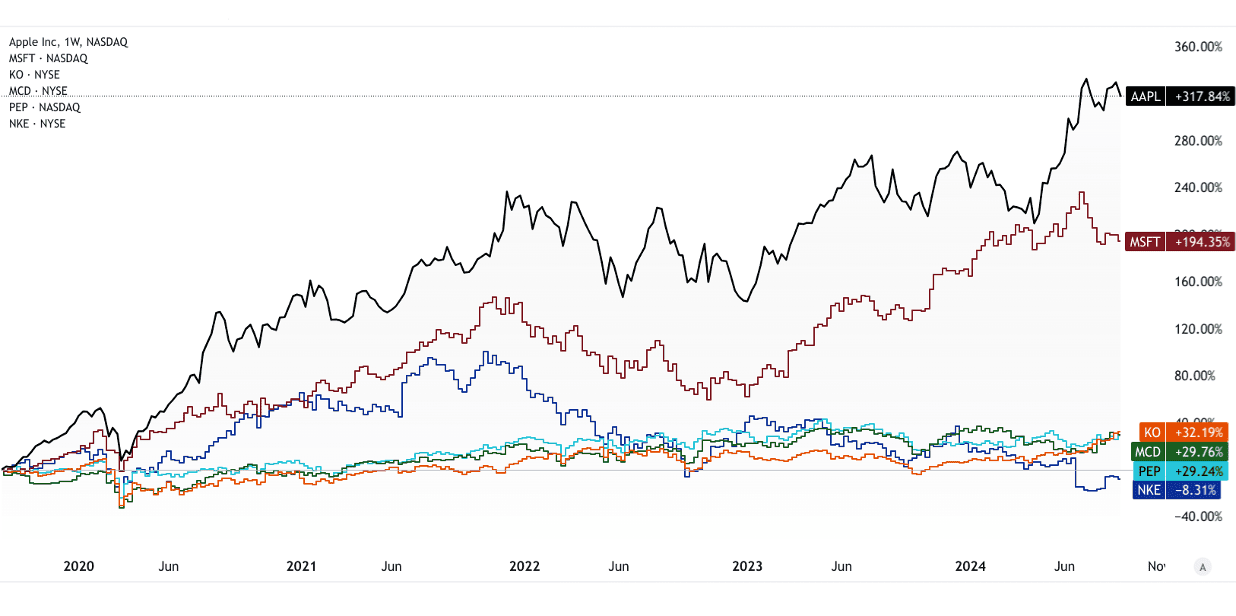

1. Apple Inc. (AAPL):

Apple Inc. designs and makes electronics like iPhones and Macs. With a $3.5 trillion market cap, it's the top public company. In 2024, its stock rose 16%, boasting $61.55 billion in cash. Future growth hinges on expanding services and AR innovations.

2. Microsoft Corp. (MSFT):

Microsoft Corp. (MSFT) is a leading software, hardware, and services company, known for Windows, Office, and Azure. With a $3.07 trillion market cap, it's the second most valuable firm. In 2023, shares rose 57%, driven by cloud revenue and dividend yield of 0.7%. Future growth hinges on cloud, AI, and Xbox.

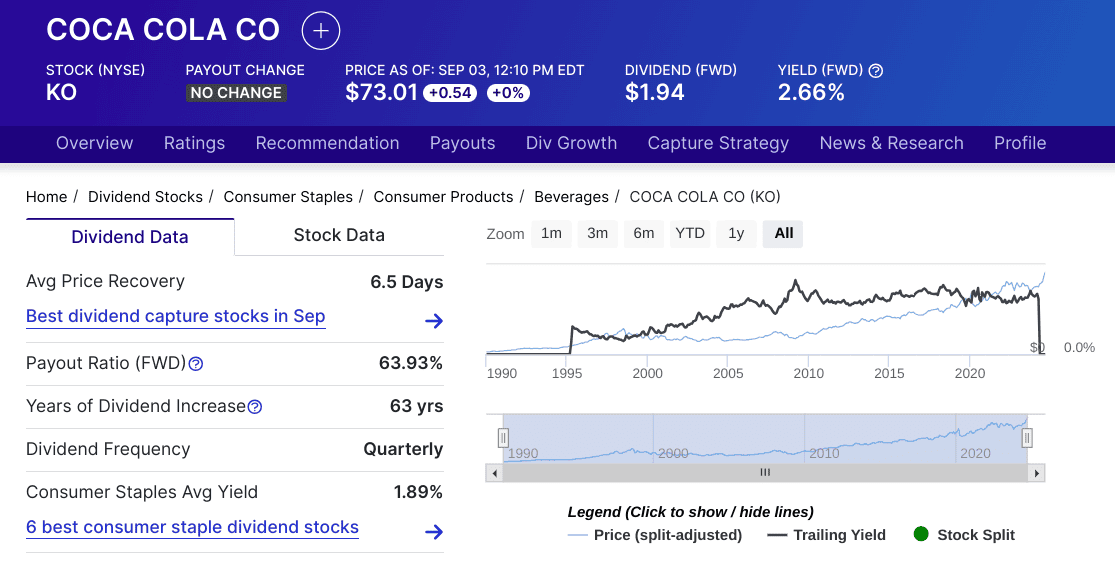

3. The Coca-Cola Company (KO):

The Coca-Cola Company (KO) is a major beverage producer with a $311 billion market cap, holding 44% of the global carbonated drink market. The stock has risen 24% YTD (2024), with $46 billion in 2023 revenue and a 2.66% dividend yield. Future growth includes healthier options and emerging markets.

Source:Dividend.com

Source:Dividend.com

4. McDonald's Corp. (MCD):

McDonald's Corp. (MCD), with a $206 billion market cap, leads the global fast-food industry. In 2023, its stock rose 13% due to strong same-store sales and offers a 2.3% dividend yield. Future growth is anticipated through menu innovation and digital advancements.

5. PepsiCo, Inc. (PEP):

PepsiCo, Inc. (PEP) is a global leader in snacks and beverages with a $236 billion market cap. YTD 2024, its stock rose 5%. It earned $91 billion in 2023, offers a 3.1% dividend yield, and is expanding into health-focused and digital markets.

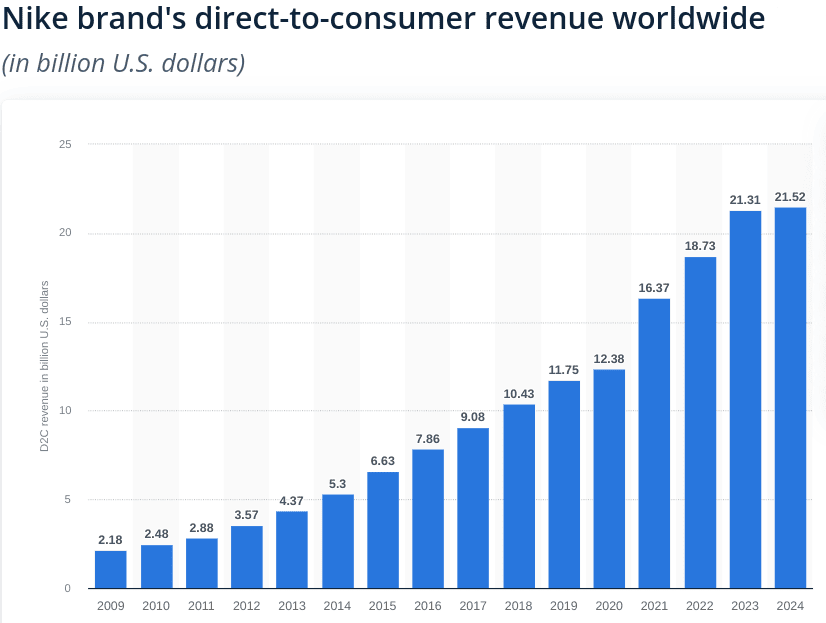

6. Nike, Inc. (NKE):

Nike, Inc. (NKE) designs and sells athletic gear, with a $125 billion market cap, making it the largest in its sector. Despite a 7% stock drop in 2023, it reported strong revenue growth and a 1.8% dividend yield, driven by direct-to-consumer sales and sustainable innovation.

Source:tradingview.com [5Y_Price return]

Source:tradingview.com [5Y_Price return]

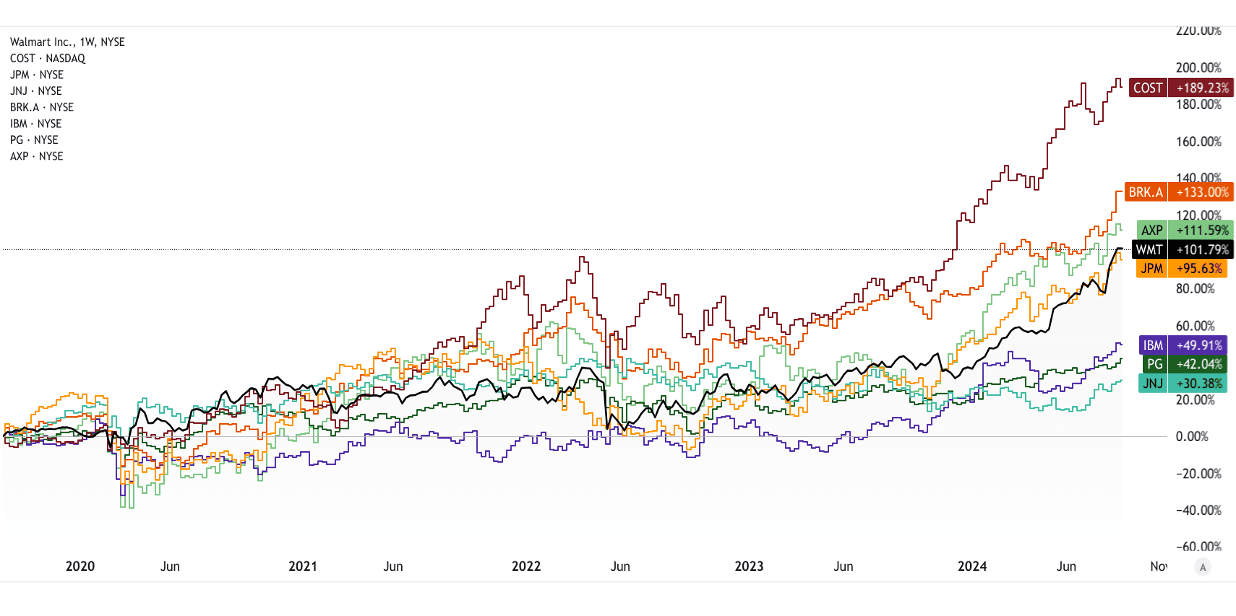

7. Walmart Inc. (WMT):

Walmart Inc. (WMT) is the world's largest retailer by revenue with a $615 billion market cap. Shares have risen 47% YTD in 2024. It focuses on e-commerce and automation for future growth and offers a 1.1% dividend yield.

8. Costco Wholesale Corp. (COST):

Costco Wholesale Corp. (COST) runs membership-only warehouse clubs and boasts a $393 billion market cap. The stock has risen 33% YTD in 2024, with $242 billion FY2023 revenue and a 0.5% dividend yield. Future growth is driven by expanding memberships and markets.

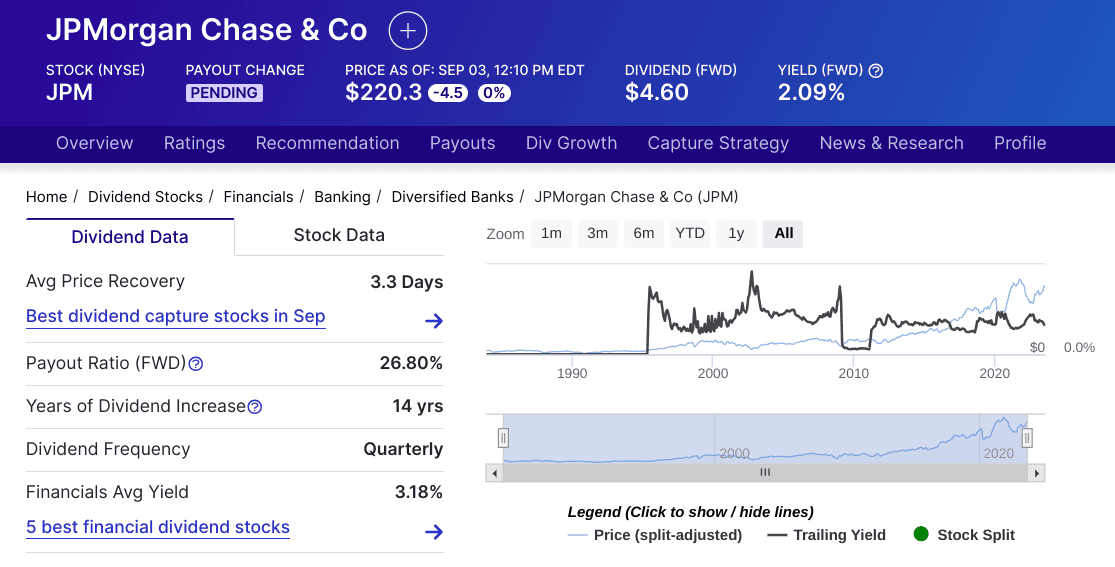

9. JPMorgan Chase & Co. (JPM):

JPMorgan Chase & Co., a top global financial firm, holds a $632 billion market cap, making it the largest U.S. bank. Its stock has risen 30% YTD in 2024, with strong earnings growth and a 2.1% dividend yield. Future growth is expected from asset management and investment banking.

10. Johnson & Johnson (JNJ):

Johnson & Johnson (JNJ) is a global leader in pharmaceuticals, medical devices, and consumer health products. With a $395 billion market cap, it had a 7% YTD price return in 2024, $85 billion in 2023 revenue, and a 3% dividend yield. Future growth hinges on innovation and global expansion.

Source:tradingview.com [5Y_Price return]

Source:tradingview.com [5Y_Price return]

11. Berkshire Hathaway Inc. (BRK.A):

Berkshire Hathaway Inc. (BRK.A), led by Warren Buffett, is a major conglomerate with a $1.01 trillion market cap. Its shares rose 32% YTD in 2024. The firm holds over $277 billion in cash and focuses on strategic

12. International Business Machines Corp. (IBM):

IBM, a major IT player with a $183 billion market cap, specializes in cloud computing and AI. Its stock rose 23% YTD in 2024. With $61 billion in FY2023 revenue and a 3.3% dividend yield, future growth hinges on cloud and AI advancements.

13. The Procter & Gamble Company (PG):

Procter & Gamble (PG) is a leading consumer goods company with a market cap of $401 billion. In 2024, PG’s shares rose 19% YTD, with $84 billion in revenue and a 2.3% dividend yield. Future growth centers on innovation and emerging markets.

14. American Express Company (AXP):

American Express (AXP), with a $185 billion market cap, excels in credit cards and travel services. Its stock surged 36% YTD in 2024, supported by strong earnings and a 1.1% dividend yield. Future growth hinges on digital payments and tech partnerships.

III. Factors to Consider When Investing in Blue Chip Stocks

Financial Performance:

When evaluating blue chip stocks, it is crucial to examine the financial performance of the company. Look for companies with consistent revenue growth, strong profit margins, and a robust balance sheet. For example, Microsoft reported a 16% year-over-year increase in revenue in fiscal 2024, with operating margins exceeding 44%. Such metrics indicate strong financial health, which is essential for long-term investment stability.

Dividend Yield and History:

Blue chip stocks are often valued for their dividend payouts. Companies like Procter & Gamble and Coca-Cola have a long history of paying and increasing dividends, with dividend yields of 2.3% and 2.7%, respectively, as of September 2024. However, investors should consider both the yield and the sustainability of these payments. A high yield might indicate a declining stock price, while a low yield could reflect high growth expectations.

Source:Dividend.com

Market Leadership & Brand Value:

Blue chip stocks typically belong to companies with significant market leadership and strong brand value. For instance, Apple holds a 55% market share in the U.S. smartphone market as of 2023, and its brand is valued over $1 trillion in 2024. Market leadership and brand strength provide a competitive edge, ensuring these companies maintain their positions even in challenging times.

Source: statista.com

Overvaluation Concerns:

One downside to blue chip stocks is the potential for overvaluation. As of mid-2024, the price-to-earnings (P/E) ratio (non-GAAP forward) for Microsoft was around 32, significantly above the S&P 500 average of 20. Overvaluation can limit future returns, making it essential for investors to consider whether they are paying too much for a stock.

Limited High Growth Potential:

While blue chip stocks offer stability, they often come with limited high growth potential compared to smaller, more volatile companies. For example, Johnson & Johnson, with a market cap of $395 billion, is unlikely to double in size quickly. Investors seeking rapid capital appreciation might find blue chips less attractive.

Market and Economic Factors:

Economic downturns and geopolitical risks can impact blue chip stocks. For instance, during the 2008 financial crisis, even stalwarts like JPMorgan Chase saw their stock prices drop by nearly 70%. Similarly, geopolitical tensions can disrupt global operations for companies like Coca-Cola, which operates in over 200 countries. Investors need to assess how external factors might affect their investments.

Blue Chip Stocks Investment Strategies:

Diversification is key when investing in blue chips. A well-diversified portfolio might include a mix of direct stock purchases, blue chip ETFs, and mutual funds. For example, the SPDR Dow Jones Industrial Average ETF (DIA) provides exposure to 30 major blue chips. Similarly, there is the Invesco S&P 500 Top 50 ETF (XLG). Dividend Reinvestment Plans (DRIPs) are another strategy, allowing investors to reinvest dividends to buy more shares, compounding returns over time.

Source:tradingview.com

Source:tradingview.com

IV. Blue Chip Stocks Outlook

Economic and Policy Factors:

The outlook for blue chip stocks is closely tied to economic recovery, central bank policies, and regulatory changes. As of mid 2024, the global economy shows signs of recovery, with GDP growth expected to stabilize around 3% in 2024. However, central banks, particularly the Federal Reserve, are expected to maintain a cautious approach to interest rate adjustments. The Federal Reserve’s rate hikes, which have brought rates to a range of 5.25-5.50%, could pressure blue chip companies with significant debt, such as AT&T, which has a debt load exceeding $150 billion. Conversely, financial firms like JPMorgan Chase could benefit from higher interest rates, which generally improve net interest margins. However the Fed may initiate interest rate cuts from the September 2024 meeting.

Source: washingtonpost.com

Changes in regulations, especially in sectors like technology and healthcare, could also impact blue chip stocks. For example, increased antitrust scrutiny on tech giants like Apple and Microsoft may constrain their growth. Healthcare reforms could affect companies like Johnson & Johnson, which faces ongoing litigation and regulatory risks.

Innovation and Adaptation:

Innovation and adaptation are key drivers of growth for blue chip stocks. Companies like Microsoft and IBM are at the forefront of AI and cloud computing, which are expected to continue growing at double-digit rates. Microsoft’s Azure cloud platform, for instance, saw revenue growth of 26% in fiscal 2024, and this trend is likely to persist as demand for cloud services remains robust. Similarly, IBM's pivot towards AI and hybrid cloud computing positions it well for future growth, despite its slower revenue growth compared to other tech giants.

Digital transformation is another critical area, with companies like Nike and Walmart investing heavily in e-commerce and digital infrastructure. Nike’s direct-to-consumer sales, which grew to 22 billion in fiscal 2024, illustrate the importance of digital channels in driving future revenue.

Source: statista.com

Environmental, Social, and Governance (ESG) trends are increasingly influencing blue chip stocks. Investors are prioritizing companies with strong ESG practices, which could benefit firms like Procter & Gamble, known for its sustainability initiatives. Conversely, companies lagging in ESG could face pressure from both investors and regulators.

Global Supply Chain Dynamics:

Global supply chain dynamics are shifting, with nearshoring and reshoring becoming more prominent due to geopolitical tensions and pandemic-related disruptions. Companies like Apple and Walmart are exploring nearshoring options to reduce dependency on Chinese manufacturing. Apple, for instance, has begun diversifying its supply chain by moving some iPhone production to India. This trend could lead to higher short-term costs but improve long-term supply chain resilience.

Source: Apple.com

Blue chip companies are also likely to benefit from the Inflation Reduction Act in the U.S., which encourages domestic manufacturing and clean energy investments. This could positively impact companies like Berkshire Hathaway, which has significant investments in renewable energy.