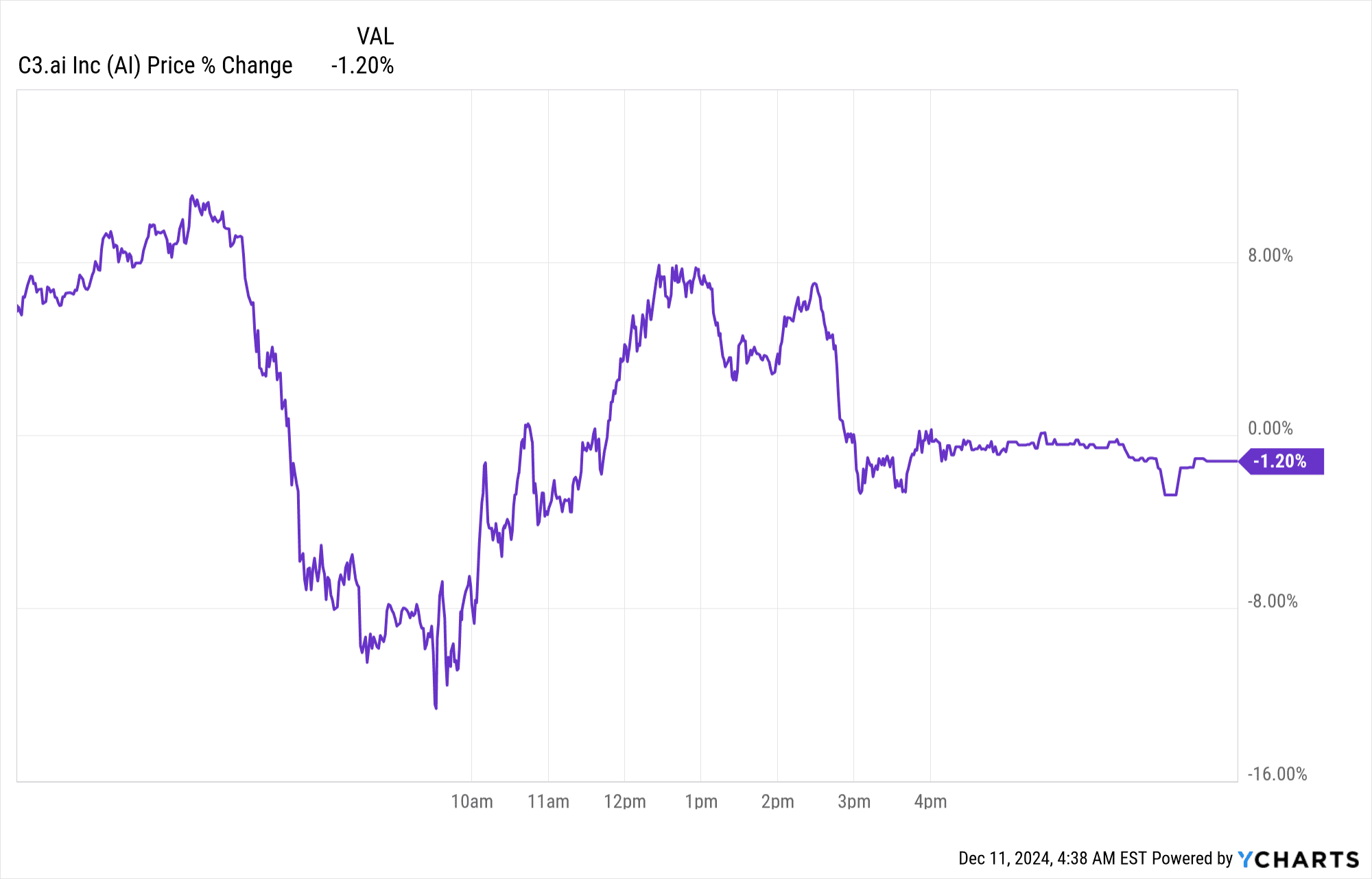

Post-earnings, C3.ai saw a modest price return of -1.2%. The company surpassed revenue expectations with $94.34M, a 29% YoY growth, while delivering better-than-expected EPS results. Despite a strong revenue outlook and strategic partnerships, margins remain under pressure. The stock’s performance is mixed with analysts projecting a range of price targets, from an optimistic $52 to a pessimistic $33 by year-end 2024.

Source: Ychart.com

I. AI Earnings Overview Q2 2025

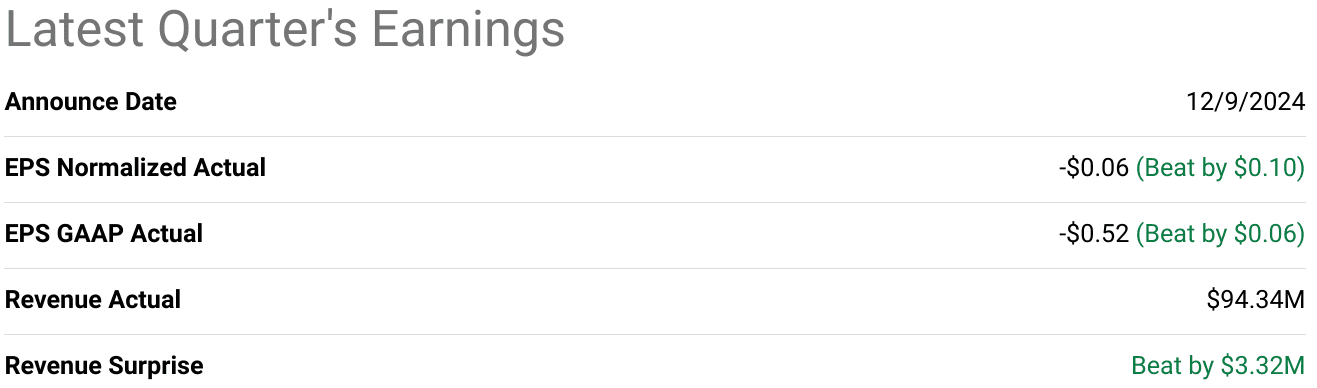

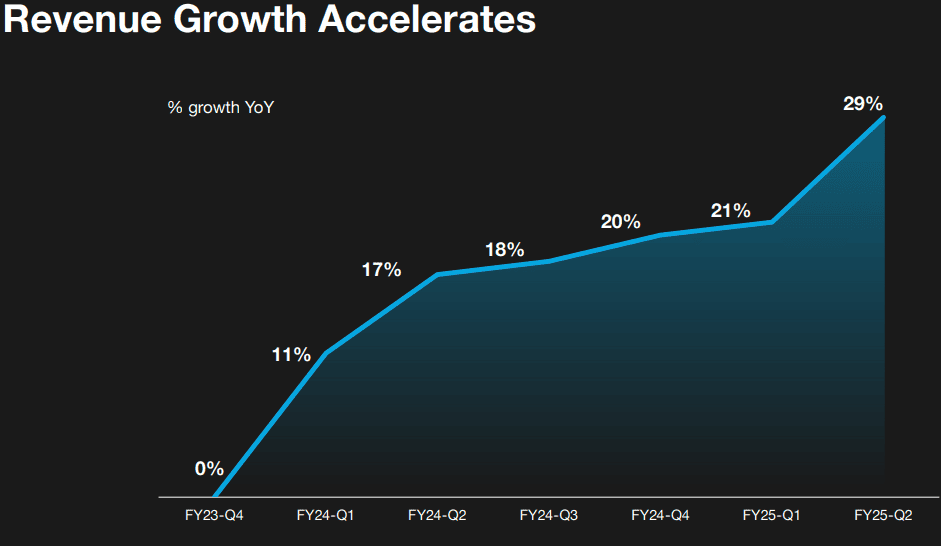

C3.ai hit $94.34M in revenue, surpassing expectations by $3.32M and reflecting a 29% YoY growth. The normalized EPS came in at -$0.06, beating projections by $0.10, while GAAP EPS hit -$0.52, exceeding estimates by $0.06. Net loss narrowed to $7.8M, compared to more substantial losses last year, showing improved expense management. Gross margin stood solid at 70%, though operating and net margins remain negative due to aggressive investment strategies.

Source: seekingalpha.com

C3 ai Earnings Q2 2025 Revenue Drivers and Market Performance

Subscription revenue reached $81.2M, a 22% YoY increase, constituting 86% of total revenue. Professional Services contributed $13.2M (14% of revenue), with gross margins exceeding 90% for this segment. Combined, Subscription and Prioritized Engineering Services revenue hit $90.8M, marking a 27% rise from $71.3M in Q2 FY24. This highlights stable demand across core offerings, underpinned by service renewals and expanding customer engagement.

Detailed Margin Analysis

Gross profit for the quarter was $66.3M. While overall gross margin held firm, margin softness in subscription revenues is projected in the near term due to the higher cost of revenue during pilot phases. Operating loss stood at $17.2M, better than guided, with delayed marketing and R&D expenses helping cushion margins. Free cash flow improved to negative $39.5M, up from negative $55.1M last year, indicating progress despite ongoing capital allocation to strategic investments.

Revenue Trends YoY and Business Expansion

The company signed 36 new pilots this quarter, contributing to a cumulative 260 pilots, with 210 active. These pilots serve as feeders into subscription contracts, which are core revenue generators. Investments in partnerships, particularly with Microsoft, are projected to lead to long-term revenue stability despite some near-term pressure on gross and operating margins.

C3.ai remains well-capitalized with $730.4M in cash, mitigating liquidity concerns even as free cash flow stays negative in the short term. Accounts receivable stood at $160M, with minimal bad debt exposure under $0.5M, underscoring healthy collections management.

Source: c3.ai

Source: c3.ai

II. Product & Market Dynamics

New Products & Innovations

C3 AI has introduced several advancements, most notably its Generative AI Accelerator program and strategic expansion into Enterprise AI applications. The program is tailored for Fortune 500 companies, offering tailored solutions and production-ready applications after immersive workshops. This effort has already converted pilots into production agreements with firms like Dow and Norfolk Iron and Metal, underlining measurable business results and secure deployment.

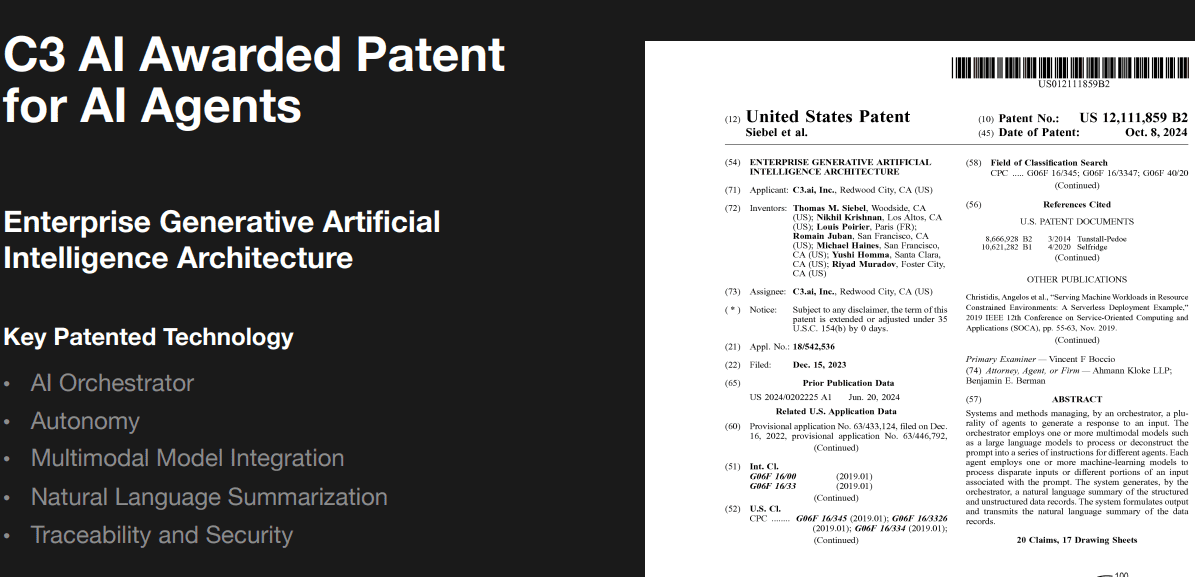

In Q2 FY25, C3 AI's new generative AI agreements included high-profile clients such as Rolls-Royce, the U.S. Navy, and Koch Industries. The company’s generative AI solutions are designed to avoid risks like data exfiltration and provide secure, traceable outputs, distinguishing it from competitors. Additionally, the recently awarded U.S. Patent #12111859 for orchestrating AI agents further cements its standing in the market by integrating sophisticated multimodal models into its architecture.

Source: c3.ai

Competitive Landscape

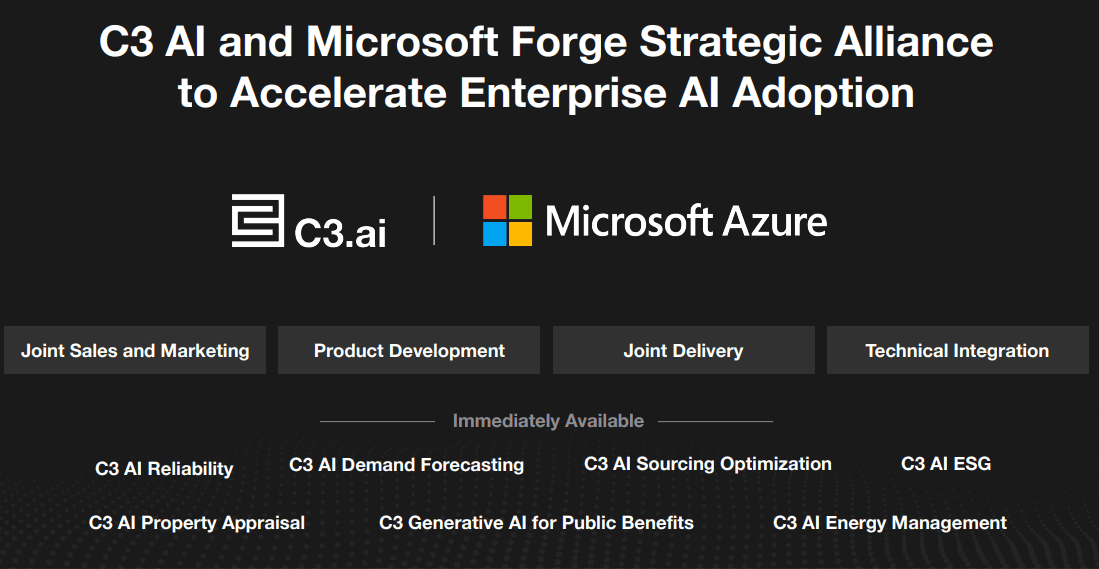

C3 AI operates in a fiercely contested market against players like Palantir Technologies, IBM Watson, Google Cloud AI, and Amazon Web Services (AWS). The competition centers around pricing, partnerships, and market penetration. The company's strategic alliances, such as with Microsoft Azure, provide a competitive edge by broadening reach and shortening sales cycles. This partnership enables C3 AI to leverage Azure’s vast network, offering its solutions as part of Microsoft's enterprise licensing agreements, which reportedly serve over 95% of Fortune 500 companies.

Market share dynamics have seen notable shifts. Google Cloud accounted for 51% of C3 AI’s customer contracts in Q2 FY25, while AWS and Azure contributed 24% and 21%, respectively. This distribution reflects a balanced reliance on multiple cloud platforms, unlike competitors who may lean heavily on a single provider.

Pricing and Partner Strategies

The expanded Microsoft alliance includes subsidized pilot projects, joint marketing funds, and commissions for Azure representatives, effectively integrating C3 AI’s solutions into Microsoft’s sales pipeline. The agreement also reduces friction by standardizing transactions on Microsoft’s “paper” and enterprise agreements, potentially increasing adoption among large-scale enterprises.

Meanwhile, competitive pricing strategies and bundled solutions by rivals like Google Cloud and AWS necessitate similar tactics. However, C3 AI’s focus on secure, scalable AI solutions positions it to retain a unique segment of the market. With 62% of agreements routed through partners and a 180% YoY increase in deals closed with Google Cloud, the company’s partner-driven model is proving effective against established competitors.

Source: c3.ai

Source: c3.ai

III. AI Stock Price Prediction

C3.ai Stock Price Prediction Technical Analysis

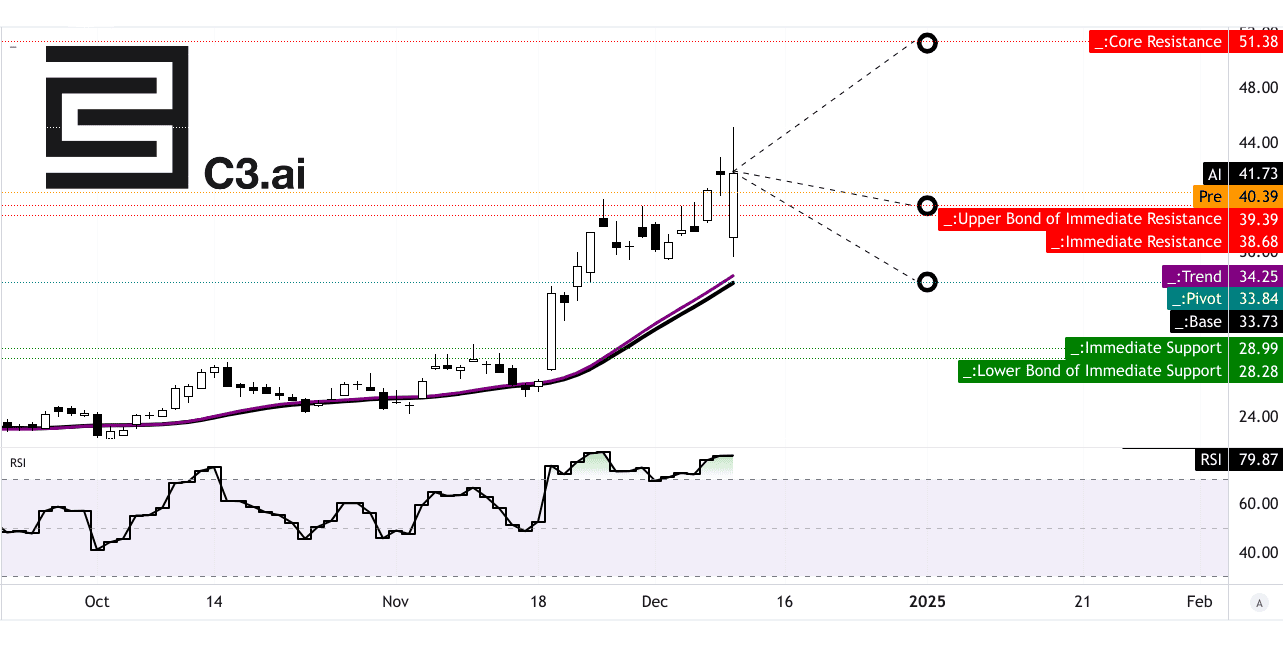

Technical analysis for C3.ai (ticker: AI) reveals mixed signals. Currently priced at $41.73, the stock hovers above its modified exponential moving average (EMA) trendline of $34.25 and baseline EMA of $33.73, suggesting a bullish momentum, albeit with potential vulnerability to reversion. The current pivot in the horizontal price channel stands at $33.84, indicating that if bearish pressure prevails, a test of this level could reset momentum.

The RSI is at a high 79.87, signaling overbought conditions and the likelihood of price cooling in the near term. The absence of bullish divergence and the presence of bearish divergence further strengthen the case for cautious optimism. The upward RSI trend might sustain positive sentiment temporarily but risks sharp corrections if external catalysts or momentum wane.

The average price target by the end of 2024 is $40, derived using momentum polarity shifts and Fibonacci levels. This projection aligns closely with the current price, reflecting a balanced expectation of neutral movement. On the upside, the optimistic target hits $52, hinging on continued bullish swings in the short to mid-term. Conversely, the pessimistic target is $33, accounting for downward corrections or market softening, also tied to Fibonacci retracement scenarios.

Source: tradingview.com

Source: tradingview.com

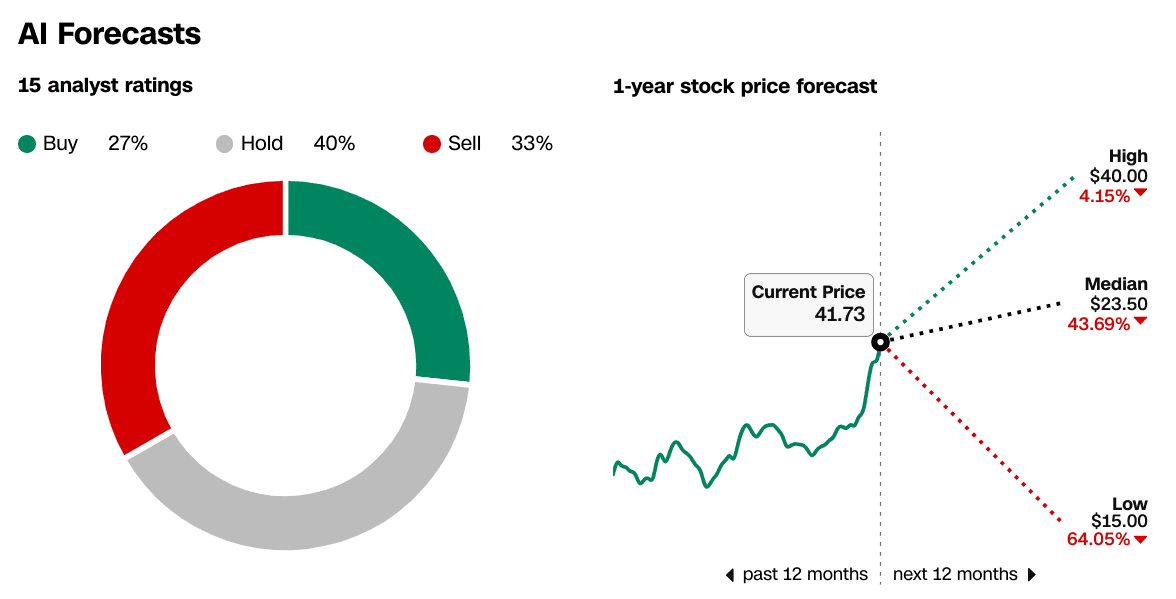

AI Stock Forecast: Market Analysts' Expectations & Ratings

Consensus ratings paint a fragmented picture. Among 15 analysts, 27% recommend buying, 40% suggest holding, and 33% lean toward selling. The one-year high forecast of $40 implies a minor 4.15% gain, while the median projection of $23.50 indicates a potential 43.69% loss. A low forecast of $15 highlights a 64.05% downside, starkly contrasting the bullish fringe. These figures demonstrate uncertainty around AI's valuation stability and trajectory.

Source: CNN.com

Source: CNN.com

IV. C3.ai Stock Forecast: Future Outlook

Management's Growth Forecasts and Strategic Initiatives

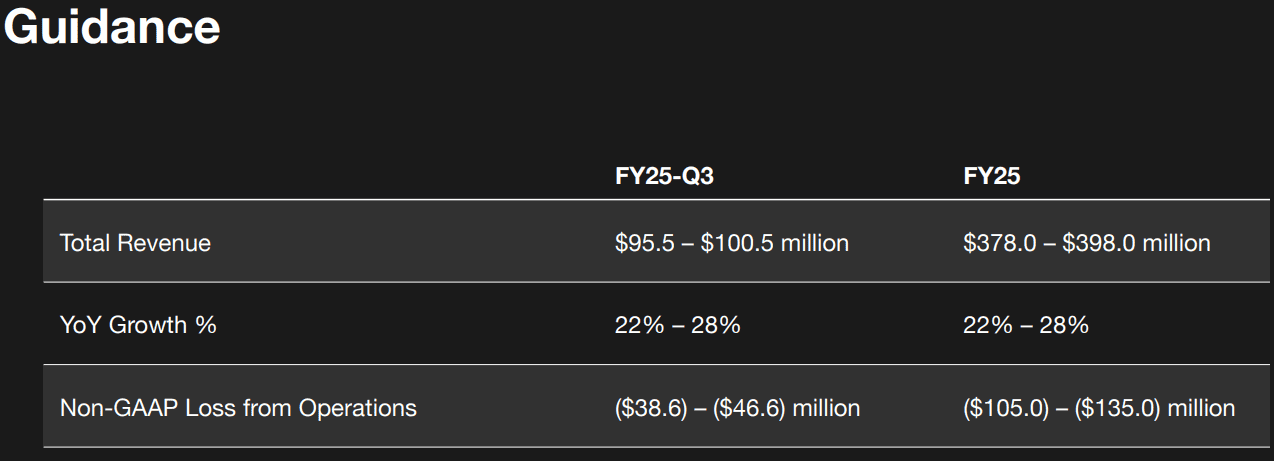

C3.ai projects revenue growth of 22%-28% YoY for Q3 FY25, translating to $95.5-$100.5 million. For FY25, revenue guidance stands at $378.0-$398.0 million. These figures reflect solid momentum, evidenced by accelerating revenue growth over consecutive quarters, from 11% in Q1 FY24 to 29% in Q2 FY25. Additionally, subscription revenue, a significant component of the revenue mix, grew by 22% YoY to $81.2 million in Q2 FY25.

The company emphasizes strategic partnerships, notably with Microsoft Azure. This alliance significantly boosts C3.ai’s sales potential by integrating its offerings into Microsoft’s ecosystem. With Azure sales personnel incentivized to sell C3.ai products, the company effectively multiplies its salesforce, potentially expanding to 10,000 professionals globally. The partnership shortens sales cycles by utilizing Microsoft's enterprise licensing agreements. These factors could critically enhance revenue generation over the medium term.

While the Baker Hughes agreement contributed 18% of Q2 revenue, its importance is decreasing as C3.ai diversifies. Non-Baker Hughes revenue surged 41% YoY in Q2 FY25, demonstrating success in broadening its customer base. The company also added 58 agreements during Q2, with notable expansions in government and enterprise sectors, highlighting the traction of its generative AI and enterprise solutions.

Source: c3.ai

Source: c3.ai

Market Trends

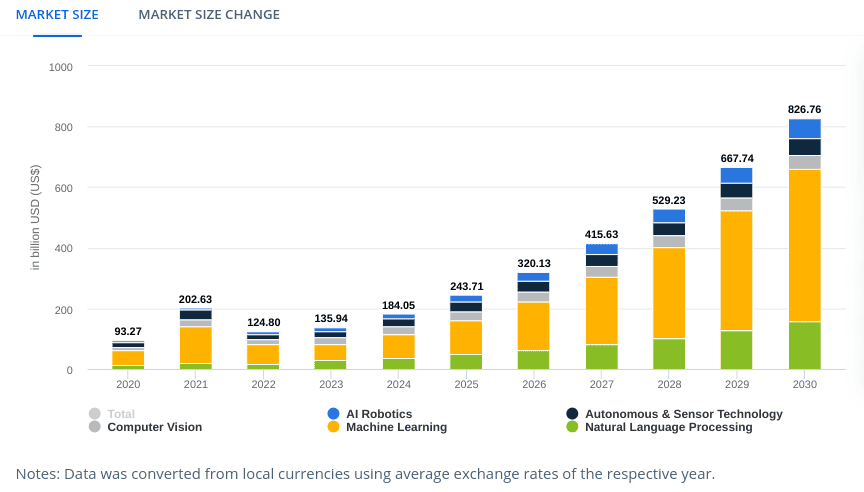

C3.ai operates within a rapidly expanding artificial intelligence sector. The AI market is projected to hit $184 billion in 2024, with a CAGR of 28.46% from 2024-2030, reaching $826.7 billion by 2030. The U.S., expected to contribute $50.16 billion in 2024, remains the largest market. These figures underscore significant growth opportunities for enterprise AI providers.

AI adoption across industries like manufacturing, defense, and healthcare is rising. C3.ai’s generative AI solutions, which avoid common pitfalls like data exfiltration, address these sectors’ specific needs. Gartner projects that by 2028, 33% of enterprise applications will feature agentic AI, compared to less than 1% today. With its proven generative AI implementations and the new Accelerator Program, C3.ai is positioned to capitalize on this evolution.

Despite 11 downward EPS revisions for the upcoming quarter, the stock's outlook is reinforced by strong partnerships, expanding markets, and substantial revenue guidance. However, achieving profitability remains a challenge, with FY25 non-GAAP operating losses expected between $105-$135 million. Long-term success hinges on sustained revenue growth and cost control.

Source: statista.com [Artificial Intelligence-Market]

Source: statista.com [Artificial Intelligence-Market]