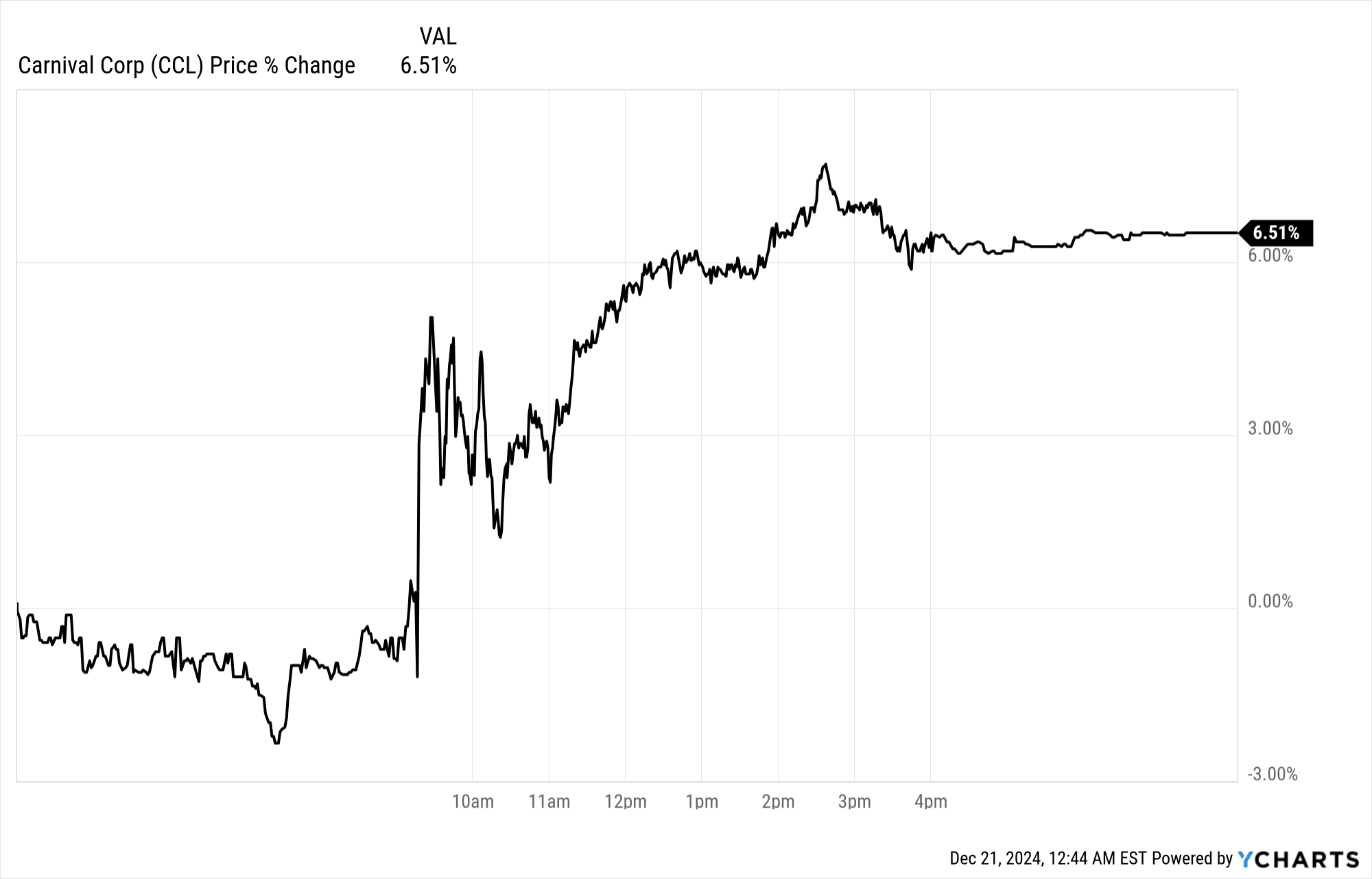

Carnival Corporation's stock gained 6.5% post-earnings, reflecting solid market sentiment following the release of its Q4 2024 results. Key metrics, such as revenue and earnings per share (EPS), aligned with expectations, while net income significantly surpassed projections. Investors responded favorably to the combination of demand-driven growth and cost discipline, boosting the share price.

Source: Ychart.com

I. CCL Earnings Overview Q4 2024

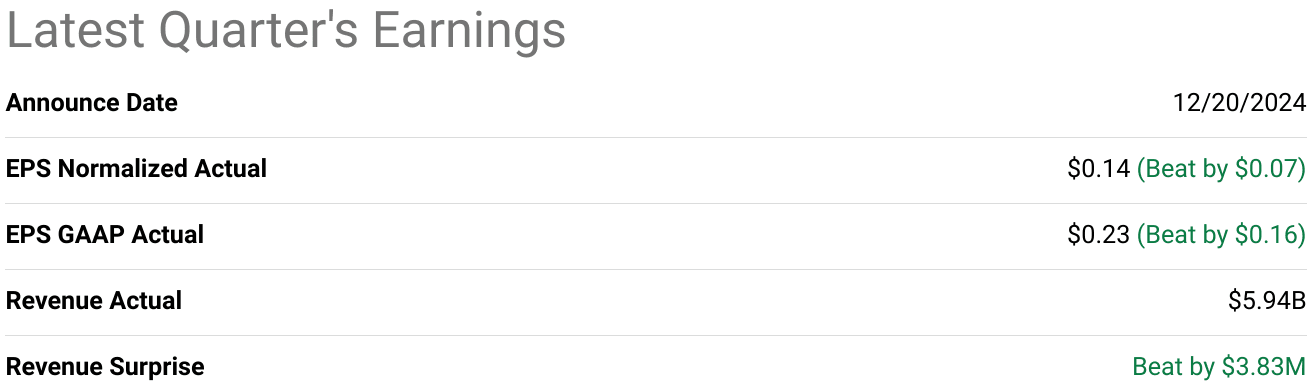

Carnival Corporation reported Q4 2024 revenue at $5.73 billion, meeting projections. EPS (both GAAP and normalized) stood at $0.02, aligning with expectations. Net income saw a substantial YoY improvement of over $250 million, surpassing forecasts by $125 million, primarily driven by higher yields and onboard spending. Gross margins expanded due to elevated ticket prices and onboard revenue growth. Operating margins improved YoY as costs stably aligned with guidance, despite inflationary pressures. Net margins reflected the combined benefits of revenue outperformance and cost-control measures.

Source: SeekingAlpha

Carnival Earnings Q4 2024 Revenue Drivers and YoY Growth

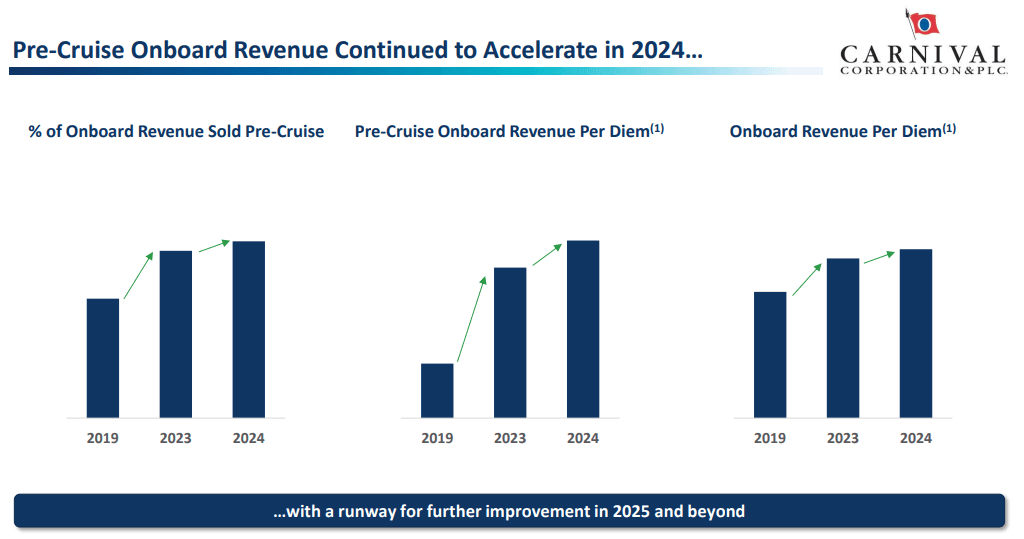

Core revenue growth was fueled by broad-based demand across brands and geographies. Yields rose by 6.7% in Q4, exceeding prior guidance by 1.7 points. This growth resulted from strategic pricing and optimized onboard spending, pushing per diems up by over 5% YoY. Notably, onboard spending accelerated sequentially throughout 2024, driven by enhanced marketing strategies targeting high-value customer segments.

For the full year, revenues hit $25 billion, marking record highs. A consolidated yield increase of 11%, with 250 basis points surpassing initial projections, underscores Carnival's ability to sustain pricing power amid rising demand. This strength was reflected across all major brands, where ticket prices grew mid-single to mid-teen percentages. Onboard revenue further supported growth, with an increase in per passenger spending contributing considerably to top-line performance.

Source: Q4 2024 Earnings Presentation

Margin Analysis

Margins benefitted from cost efficiencies and improved revenue quality. Gross margins expanded, reflecting higher ticket pricing, while operating margins grew due to effective cost management initiatives, which achieved a 100-basis-point improvement against initial guidance. Unit costs per ALBD grew at 7.4%, but this was offset by revenue growth exceeding cost escalation by threefold. Consequently, EBITDA margins reached record levels, contributing to an $8 billion reduction in debt since 2023.

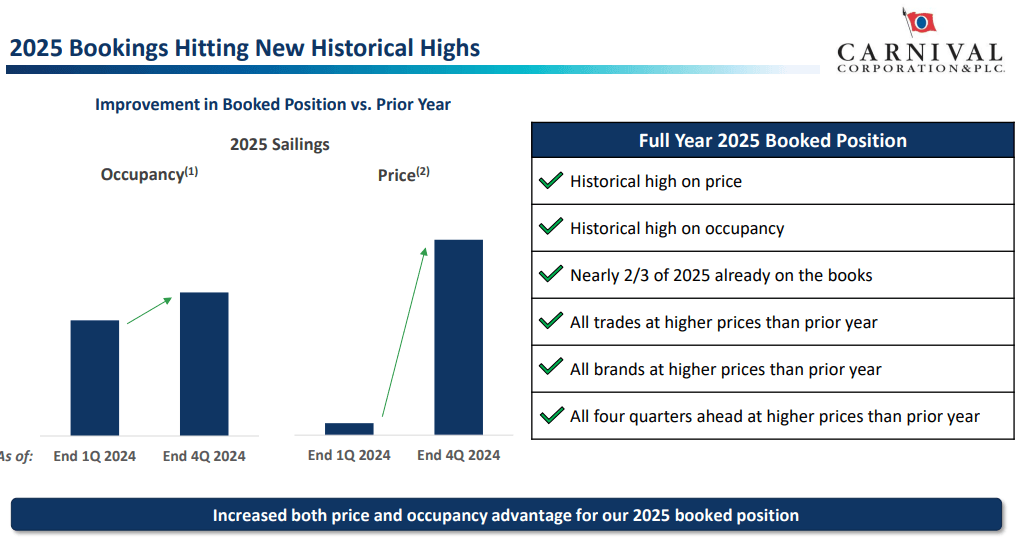

Record booking volumes for 2025, coupled with higher prices and longer advanced booking windows, highlight Carnival's enhanced market standing. The company's focus on brand-specific marketing, advanced yield management, and high-demand destinations such as the upcoming Celebration Key demonstrates its capability to maintain competitive advantages. This quarter underscored Carnival's steady recovery trajectory, marked by a blend of demand-driven revenue and disciplined cost management, setting the stage for continued performance into 2025.

Source: Q4 2024 Earnings Presentation

II. Carnival Product & Market Dynamics

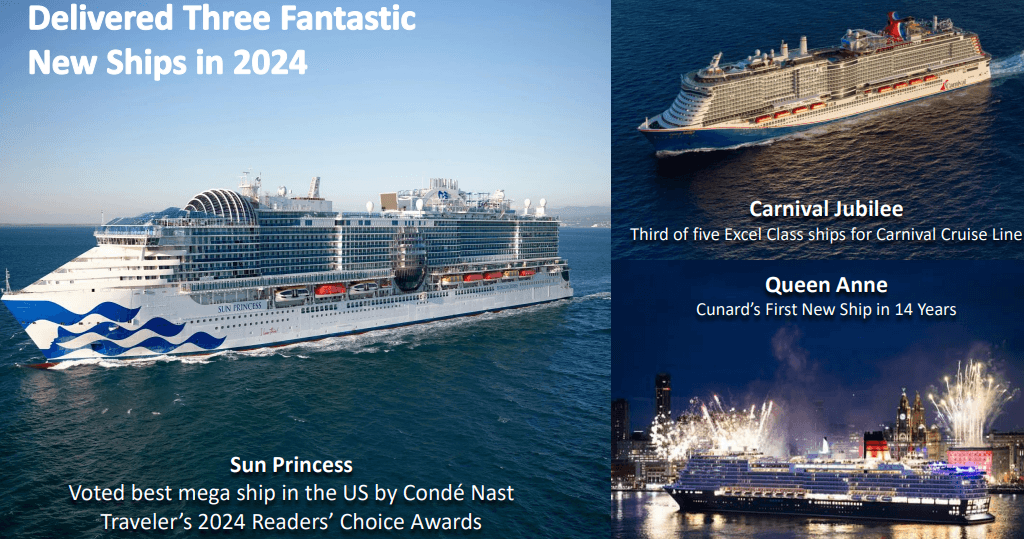

New Products & Innovations

Carnival introduced three major ships in 2024: Carnival Jubilee, Sun Princess, and Queen Anne. These vessels brought premium pricing benefits, although most revenue growth was tied to higher demand for existing ships. The Carnival Jubilee operates out of Texas, while the Sun Princess won accolades, marking success for the next-generation design. Queen Anne expanded Cunard's fleet after a 14-year gap, solidifying its position in the luxury market. Carnival is also evolving destination strategies, exemplified by its upcoming Celebration Key, expected to generate significant appeal with proprietary access and reduced operational costs.

New marketing campaigns, including the refreshed Love Boat theme for Princess Cruises, yielded record Black Friday bookings, underscoring the effectiveness of targeted advertising. Such efforts not only converted new customers but also increased web traffic and elevated ticket prices across segments.

Source: Q4 2024 Earnings Presentation

Competitive Landscape

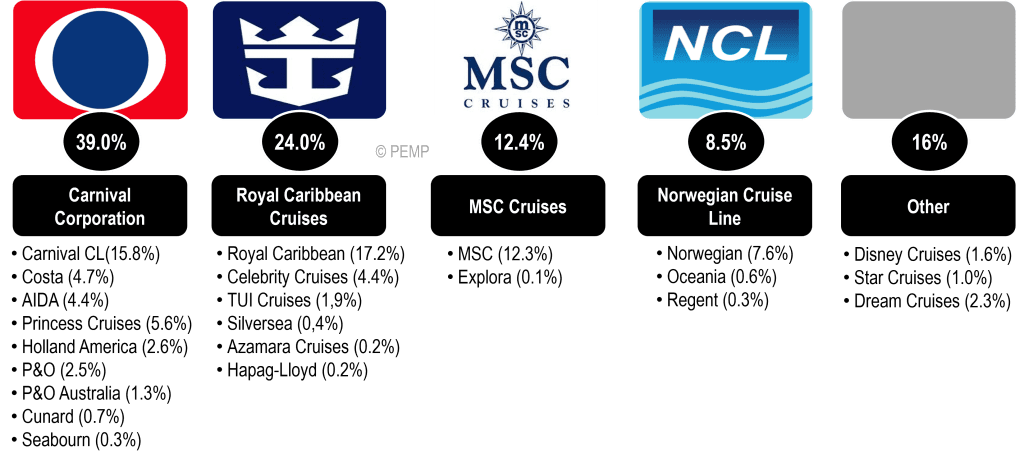

Carnival Corporation maintained its dominant market position with a 39% share in 2023, well ahead of Royal Caribbean at 24%, MSC Cruises at 12.4%, and Norwegian Cruise Line at 8.5%. Carnival's strategy centers on leveraging demand growth, new offerings, and core market expansion, while targeting higher ticket prices and onboard spending. Royal Caribbean continues to trail Carnival, leveraging its focus on innovative ship designs and itineraries. MSC Cruises, despite holding a smaller share, has rapidly expanded through pricing aggressiveness and a strong presence in emerging markets. Norwegian Cruise Line focuses on specialized itineraries but struggles to gain ground due to higher cost structures and relatively limited fleet growth.

Carnival has maintained pricing advantages across segments, evidenced by its 11% yield growth in 2024, largely derived from ticket prices. Its ability to optimize booking curves and manage onboard spending enhancements has outpaced competitors, reflecting a highly efficient revenue model. Meanwhile, MSC and Norwegian have adopted discounting to sustain occupancy, leading to margin compression.

Carnival's focus on enhancing its Caribbean and exclusive destinations led to record customer deposits and the highest booking volumes for 2025, even with constrained inventory. The proactive approach to aligning offerings with customer preferences—both in shipboard experiences and unique destinations—has solidified its competitive edge. Future efforts, such as expanded beach experiences at RelaxAway, Half Moon Cay, are expected to further diversify Carnival’s appeal, capturing incremental demand and securing its market leadership.

Source: porteconomicsmanagement.org

III. CCL Stock Forecast

CCL Stock Forecast Technical Analysis

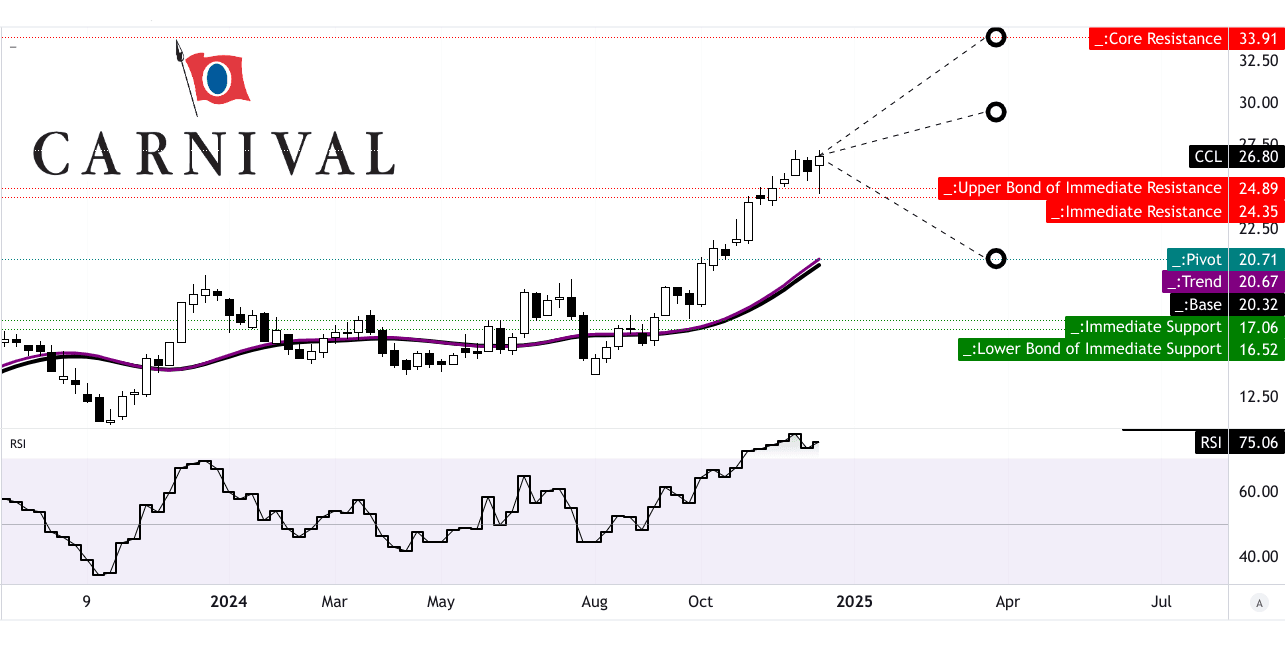

The stock currently trades at $26.80, slightly above its pivot level of $20.70. This pivot aligns with a baseline of $20.32 and a trendline of $20.67, derived from modified exponential moving averages. These values suggest the stock is in a delicate position between upward and downward price pressures. Momentum indicators like the Relative Strength Index (RSI) stand at 75.06, suggesting overbought conditions, but without clear bullish or bearish divergence. The RSI trend is sideways, implying limited immediate down directional movement.

Fibonacci retracement levels underpin the price projections for Q1 2025, revealing critical thresholds. The optimistic target of $33.90 reflects continued upward momentum driven by mid- and short-term swing strength, while a pessimistic target of $20.70 anticipates downside momentum retracing to the current price channel pivot. The average price target, $29.40, represents a balanced view considering the polarity shifts and the strong directional signals.

Source: TradingView [ Q1 2025 Targets]

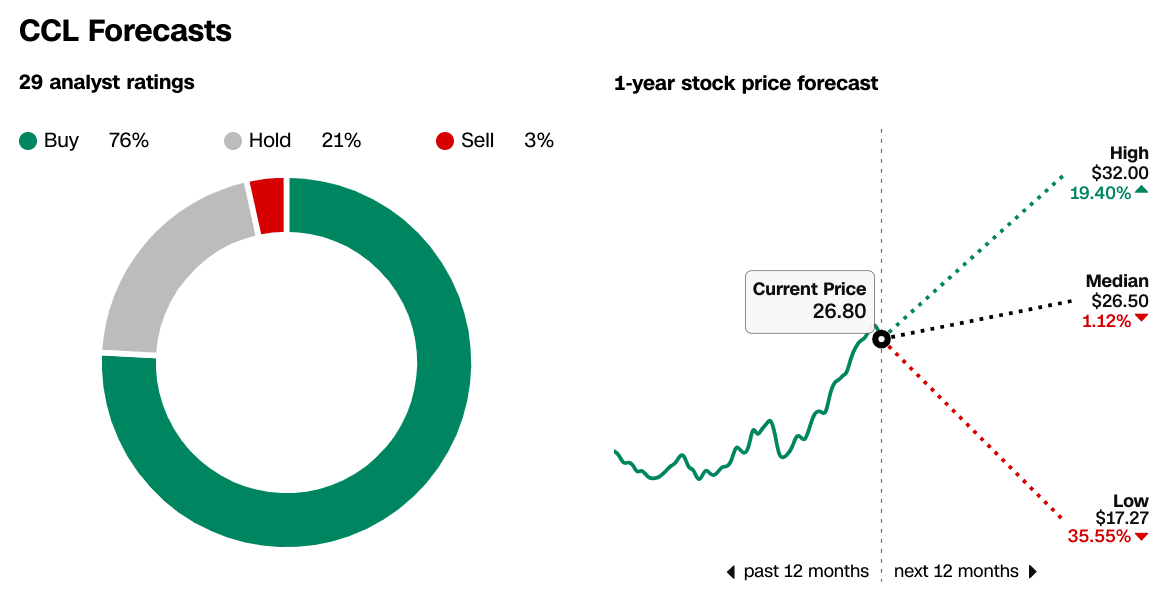

Carnival Stock Forecast: Market Analysts’ Expectations

Analysts remain generally favorable toward CCL, with 76% recommending a buy, 21% holding, and only 3% suggesting a sell. Among 29 ratings, the 1-year high target of $32 implies a 19.4% upside, while the median target of $26.50 positions the stock roughly in line with its current price, reflecting a stable near-term sentiment. On the downside, a $17.27 low projection highlights a potential 35.55% drop, should bearish scenarios materialize.

● Short-term momentum reflects sensitivity to broader market swings, as shown by Fibonacci extensions and RSI patterns.

● Analysts broadly expect stability, with price targets anchored near the current trading price, but variability exists based on broader market influences.

● Overbought RSI suggests limited upside in the near term unless market catalysts emerge.

Source: CNN.com

IV. Carnival Stock Forecast: Future Outlook

Management's growth forecasts and strategic initiatives

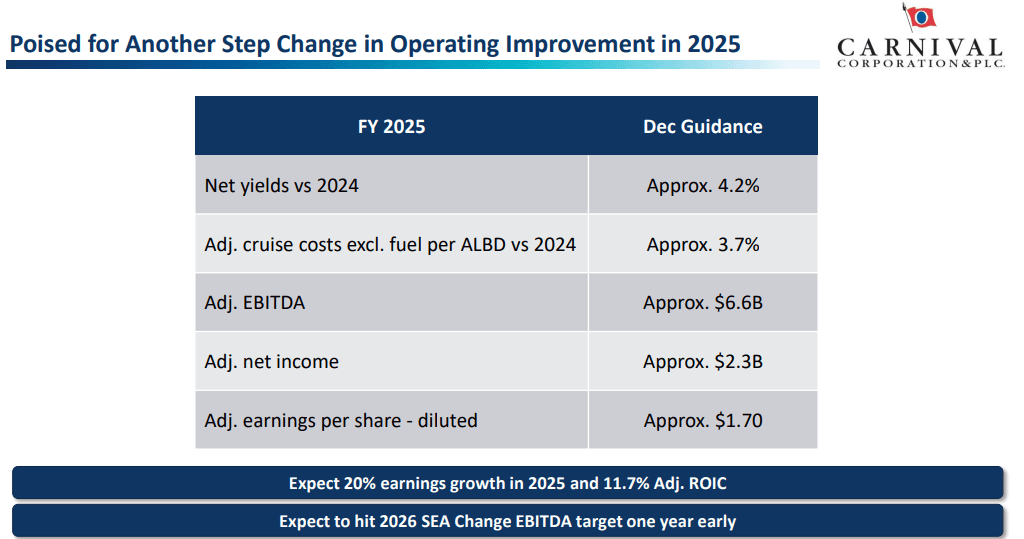

Carnival Corporation projects a cautiously optimistic trajectory, supported by robust demand signals and strategic initiatives. Management forecasts $5.73 billion in revenue for FQ1 2025, reflecting a 6.02% growth YoY, alongside a modest EPS estimate of $0.02. This aligns with upward revisions in both EPS and revenue estimates in recent months, underscoring market confidence in the company's positioning. Additionally, a projected 4.2% yield growth for 2025 builds on 2024’s 11% growth, translating into an incremental $0.60 per share, driven by higher ticket prices and onboard spending.

Operationally, Carnival's "SEA Change" targets for 2026 are advancing ahead of schedule. The company has already achieved 80% progress toward its EBITDA per ALBD goal and improved ROIC to 11%, nearing the 12% target. Booking volumes for 2025 remain solid despite reduced inventory, with higher prices and occupancy levels compared to prior periods. Carnival’s strategy includes enhancing existing fleet performance and leveraging newer vessels such as the Carnival Jubilee and Queen Anne to attract higher-spending customers. Meanwhile, the upcoming Bahamian destination, Celebration Key, is poised to boost mid-term revenue and guest satisfaction.

Source: Q4 2024 Earnings Presentation

Cruise Market Trends

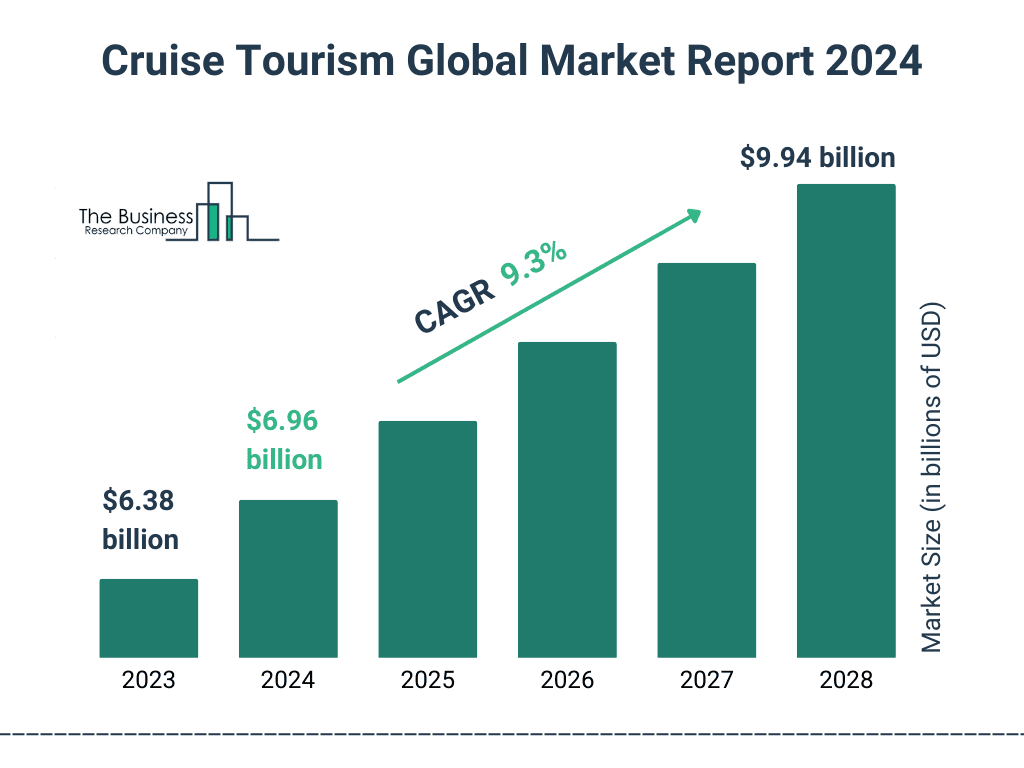

Market trends reflect favorable conditions (>9% CAGR for market revenue) for Carnival’s cruise-centric business model. Post-pandemic recovery remains a core tailwind, with consumer preferences shifting toward leisure experiences. Advanced bookings for 2026 already hit record levels, signaling durable demand. Carnival has also increased its marketing focus, with innovative campaigns targeting both new and repeat guests.

Sustainability remains a focal point as Carnival aims for a 20% reduction in greenhouse gas intensity by 2026, already achieving a 17.5% improvement. Operational measures, including reduced fuel consumption and enhanced destination strategies, align with evolving consumer expectations around environmental impact. Debt management is another priority. The company reduced debt by over $8 billion from its January 2023 peak, achieving a net debt-to-EBITDA ratio of 4.3x in 2024. Carnival aims to hit investment-grade leverage metrics by 2026 through ongoing cash flow improvements.

Source: thebusinessresearchcompany.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.