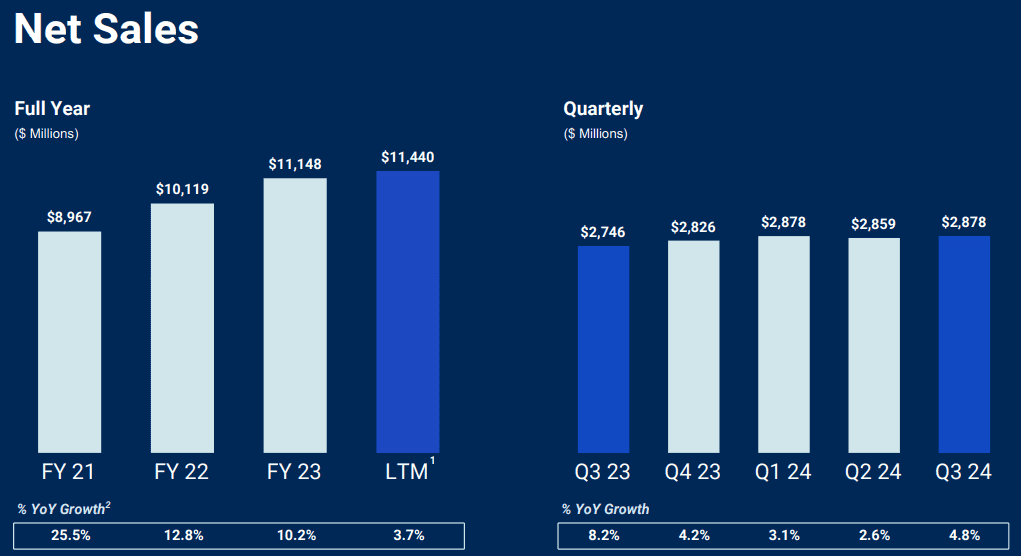

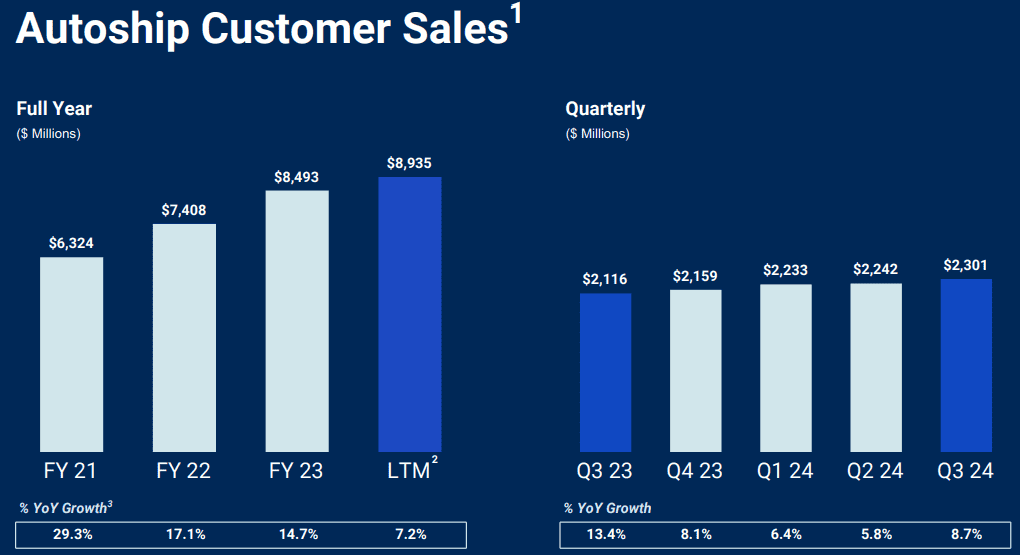

Chewy stock fell 1.75% post-Q3 earnings, reflecting mixed market sentiment despite stable operational metrics. Chewy’s Q3 2024 revenue hit $2.88 billion, below the $3.18 billion estimate but grew 4.8% YoY. Autoship sales, at $2.3 billion (80% of net sales), grew 8.7% YoY. Gross margin improved to 29.3% (+80 bps YoY), supported by premium categories and sponsored ads. Adjusted EBITDA margin expanded to 4.8% (+180 bps YoY), showcasing disciplined cost management.

Source: Ycharts.com

I. Chewy Earnings Overview Q3 2024

Revenue and Earnings Performance

Chewy's Q3 revenue hit $2.88 billion, falling short of the $3.18 billion estimate but reflecting a 4.8% YoY growth. Autoship sales, a critical driver of recurring revenue, stood at $2.3 billion, representing 80% of net sales and an 8.7% YoY increase. The non-discretionary categories, particularly consumables and healthcare, accounted for 85% of total revenue. Despite stable pricing and promotions, Chewy's top-line performance underwhelmed compared to projections.

On earnings, normalized EPS came in at $0.21, aligning with expectations, while GAAP EPS stood at $0.01. Net income of $3.9 million marked a YoY improvement but remained relatively modest. Adjusted EBITDA margin expanded 180 basis points YoY to 4.8%, highlighting disciplined cost management and operational scaling benefits.

Source: CHWY Q3 2024 Earnings Presentation

Margins Analysis

Gross margin improved by 80 basis points YoY to 29.3%, driven by a product mix shift toward premium categories, including consumables and pharmacy, and incremental revenue from sponsored ads. Operating expenses, excluding share-based compensation, showed sharpness, with SG&A at 19% of sales, reflecting a 90 basis point improvement. Marketing expenses accounted for 6.7% of net sales, on track to hit the high end of the 6%-7% full-year range.

CHWY Earnings Q3 2024 Revenue Drivers

Autoship programs remain pivotal, with a 9% YoY rise in sales driven by recurring orders in consumables and healthcare. Chewy's efforts to diversify its product catalog—adding premium brands and enhancing its mobile app—boosted customer retention and wallet share. Notably, app monthly active users grew by mid-teens YoY, signaling increased customer engagement through digital channels.

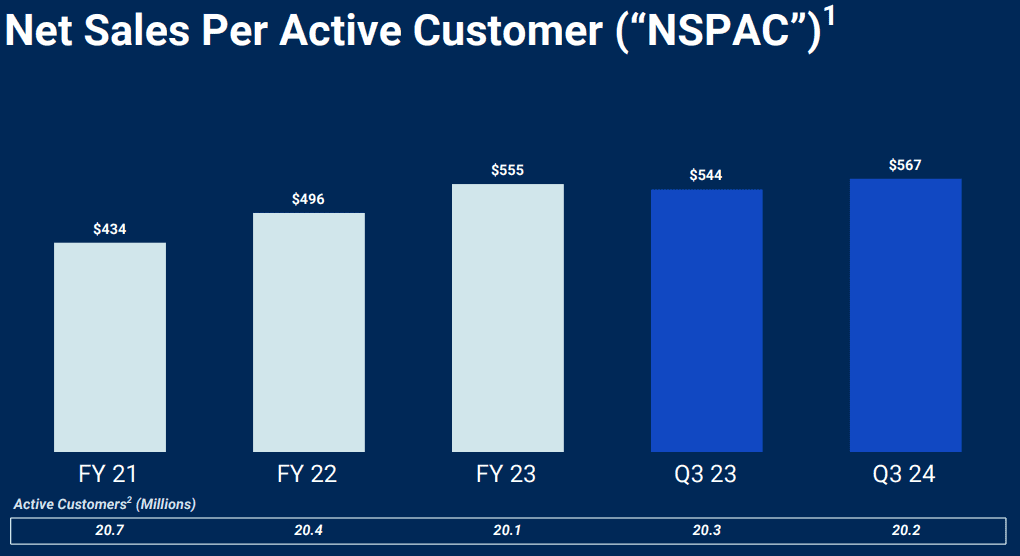

The active customer base stood at 20.2 million, reflecting a sequential gain of 160K. Average sales per active customer rose to $567, underscoring deeper penetration into consumer spending. Strategic initiatives, including Chewy Vet Care clinics and the Chewy+ membership program, aim to integrate healthcare with commerce and bolster loyalty, although these segments remain relatively small contributors.

Source: CHWY Q3 2024 Earnings Presentation

II. Product & Market Dynamics

New Products & Innovations

Chewy’s product and market strategies reflect a calculated effort to enhance its value proposition and maintain competitive footing. In Q3 2024, Chewy expanded its product portfolio by introducing premium brands and categories such as pet tech, wet food, and supplements, with several launched exclusively on chewy.com. This diversification has bolstered the company's position in the consumables and healthcare markets, which constituted 85% of total quarterly sales, hitting $2.88 billion, up 5% YoY. Notably, the Autoship program contributed $2.3 billion, representing 80% of net sales and marking a 9% increase. These figures underscore the impact of both product innovation and customer loyalty.

Customer engagement via the redesigned mobile app was robust, with unique order placements and monthly active users rising in the mid-teens YoY. Meanwhile, the Chewy+ membership program demonstrated promise by increasing order frequency, cross-category penetration, and Autoship adoption among its sample group. However, its enterprise contribution remains minor at this stage.

Source: CHWY Q3 2024 Earnings Presentation

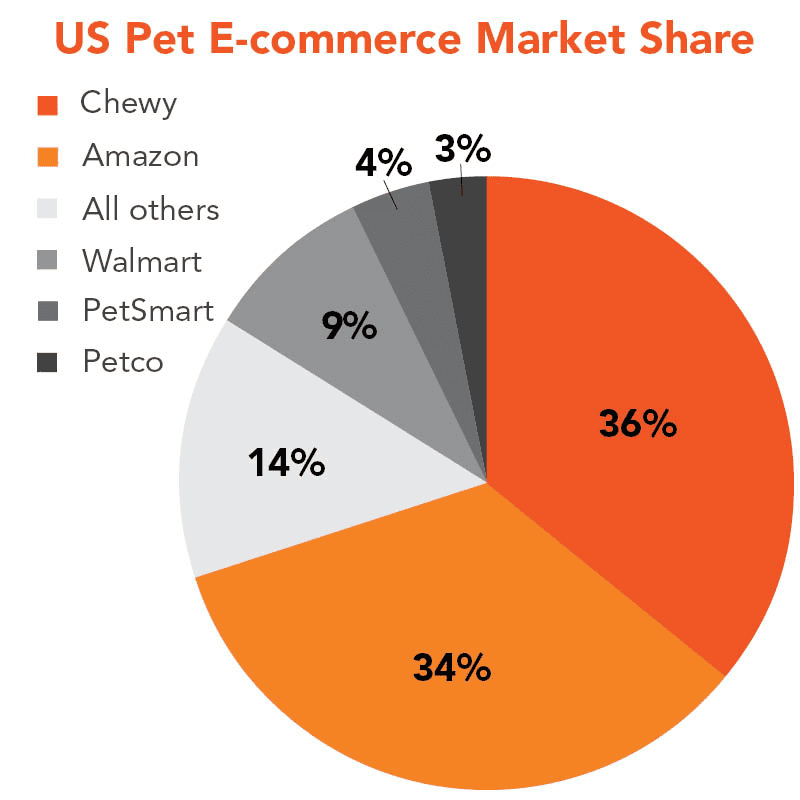

Competitive Landscape

The pet retail market is defined by intense competition from Amazon, Walmart, PetSmart, and Petco, each leveraging pricing strategies and omnichannel capabilities to capture share. Chewy’s focus on premium offerings and digital engagement positions it to counter these pressures. For example, while overall market share dynamics were not explicitly quantified in Q3, Chewy’s net sales per active customer (NSPAC) rose to $567, reflecting gains in wallet share driven by cross-category purchases and a targeted pricing strategy.

Pricing stability in Q3 suggests Chewy is maintaining margin discipline without excessive reliance on discounts, evidenced by an 80-basis-point gross margin expansion to 29.3%. Sponsored ads, now accounting for 1% to 3% of net sales, have also started to bolster profitability. Despite solid execution, the market’s broader normalization limits dramatic market share swings. The company’s strategic entry into Canadian markets and partnerships, such as with the Toronto Maple Leafs, aim to carve incremental growth. However, Chewy’s Canadian operations remain relatively small.

Source: petfoodprocessing.net

III. Chewy Stock Forecast

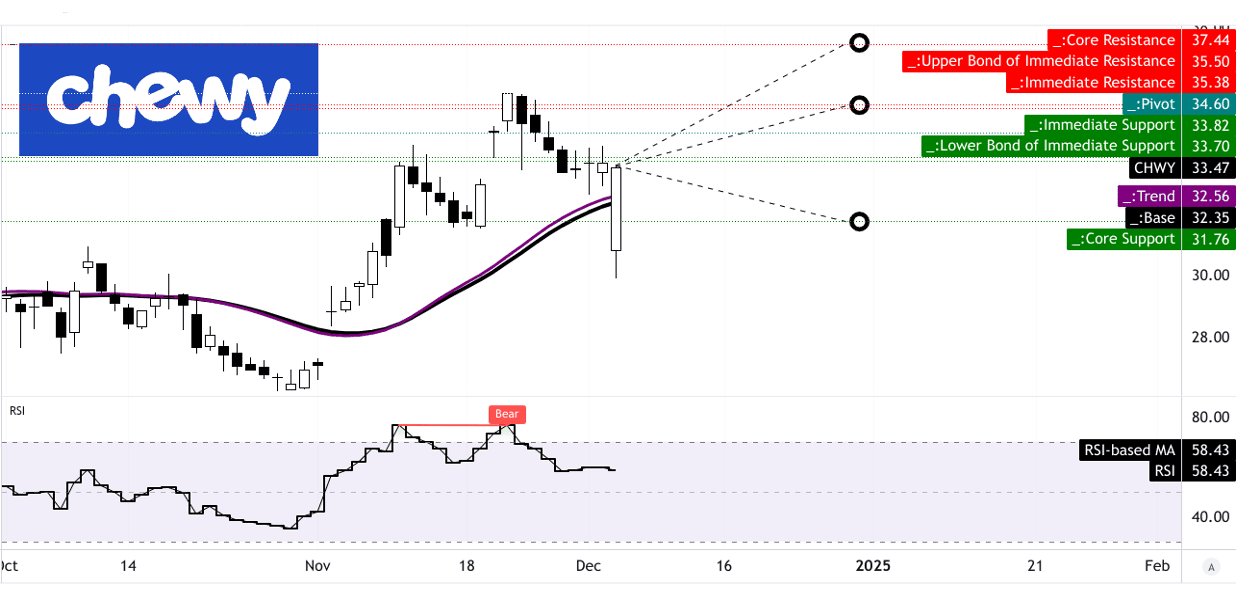

CHWY Stock Forecast Technical Analysis

Chewy's stock price currently trades at $33.47, sitting slightly above the modified exponential moving averages of $32.56 (trendline) and $32.35 (baseline). This indicates limited upward momentum but not a breakout scenario. The horizontal price channel pivots at $34.60, with the stock struggling to breach this resistance level.

The Relative Strength Index (RSI) of 58.43 points to a bullish but not overbought condition. The presence of bullish divergence strengthens the potential for price recovery, although the RSI trend remains sideways, suggesting cautious optimism. Fibonacci retracement projections define price targets:

- Optimistic scenario: $37.5, assuming momentum accelerates along the current upward swing.

- Pessimistic scenario: $31.8, based on short-term downward corrections.

- Average target: $35.5, aligning with moderate continuation of current trends.

Short-term traders should watch for volume spikes and RSI crossing above 60 to confirm momentum.

Source: tradingview.com

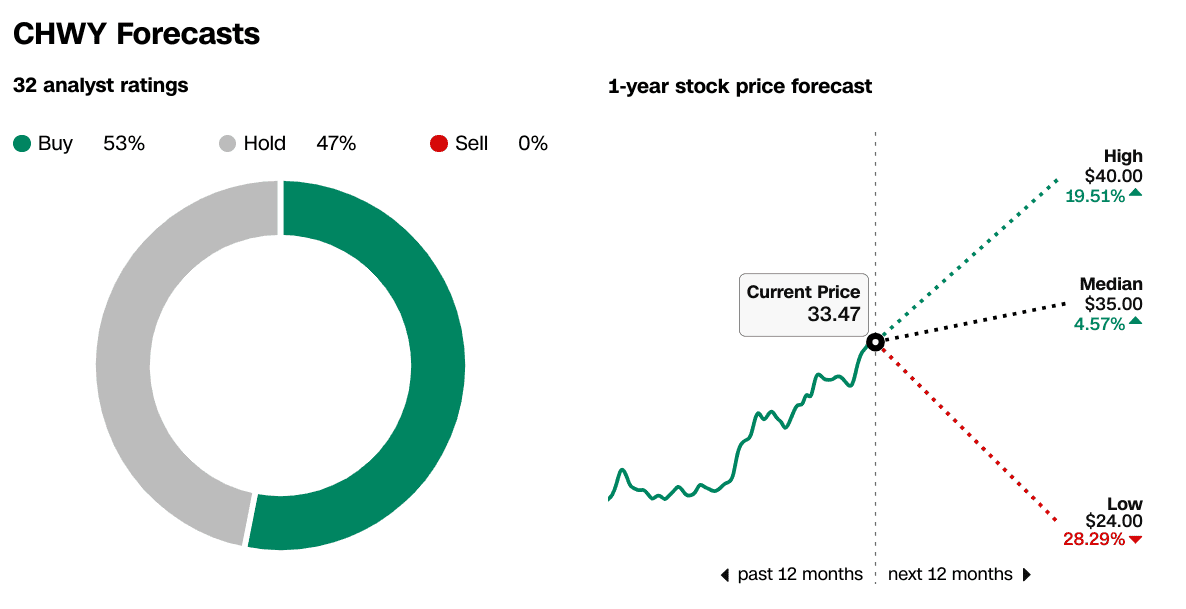

Chewy Stock Forecast: Market Analysts' Expectations

Consensus among 32 analysts is split between 53% recommending a "Buy" and 47% opting for a "Hold", with no "Sell" recommendations. Analysts have issued a one-year price target range:

- High: $40 (19.51% upside).

- Median: $35 (4.57% upside), aligning closely with technical targets.

- Low: $24 (28.29% downside), reflecting bearish pressures in a pessimistic market scenario.

CHWY stock has shown resilience near the $32-$34 range, supported by its Autoship program's consistent revenue generation and robust customer retention. However, its inability to firmly break above $34.60 highlights limited momentum. Market analysts’ optimistic outlook toward $40 hinges on Chewy’s successful expansion in premium categories and improvements in operational margins, as evident from the Q3 adjusted EBITDA margin of 4.8% (up 180 basis points YoY). Risks include broader macroeconomic pressures on discretionary spending and competitive pricing strategies from major players like Amazon and Petco, potentially weighing on valuation.

Source: CNN.com

Source: CNN.com

IV. CHWY Stock Forecast: Future Outlook

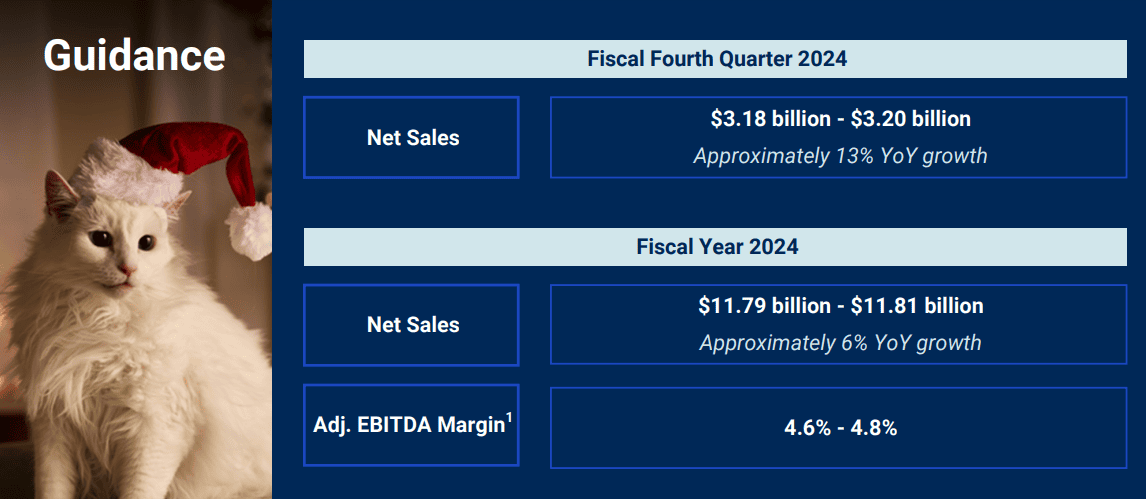

Chewy outlines a mixed but largely constructive outlook for its growth trajectory, reflecting key initiatives and evolving market trends. Management’s guidance for Q4 2025 sets consolidated revenue expectations between $3.18 billion and $3.20 billion, representing a YoY increase of 12.49%. Consensus EPS for the quarter is projected at $0.21, indicating a growth of 15.28% from the prior year, with a narrow range between $0.20 and $0.21 based on contributions from cost management and scale benefits. These projections align with Chewy’s strategic efforts to sustain profitability, exemplified by a raised full-year adjusted EBITDA margin outlook to 4.6%-4.8%.

Source: CHWY Q3 2024 Earnings Presentation

Key growth areas include the Autoship program, which accounted for 80% of Q3 2024 net sales at $2.3 billion, showing a YoY rise of 8.7%. Management underscores this program’s importance in driving customer retention and predictability. Chewy’s focus on consumables and healthcare products further supports its stable revenue base, with nondiscretionary categories making up 85% of Q3 sales. The sponsored ads business also emerges as a contributor, on track to hit 1%-3% of net sales in fiscal 2024.

Chewy’s expansion into healthcare, particularly the Chewy Vet Care (CVC) initiative, is promising. The company has opened six clinics, with plans to scale further, tapping into the $25 billion veterinary services market. Early performance metrics suggest cross-category benefits and heightened customer engagement, aligning care with commerce. Meanwhile, the Chewy+ membership program shows potential to enhance wallet share consolidation, with early adopters demonstrating higher order frequency and cross-category penetration.

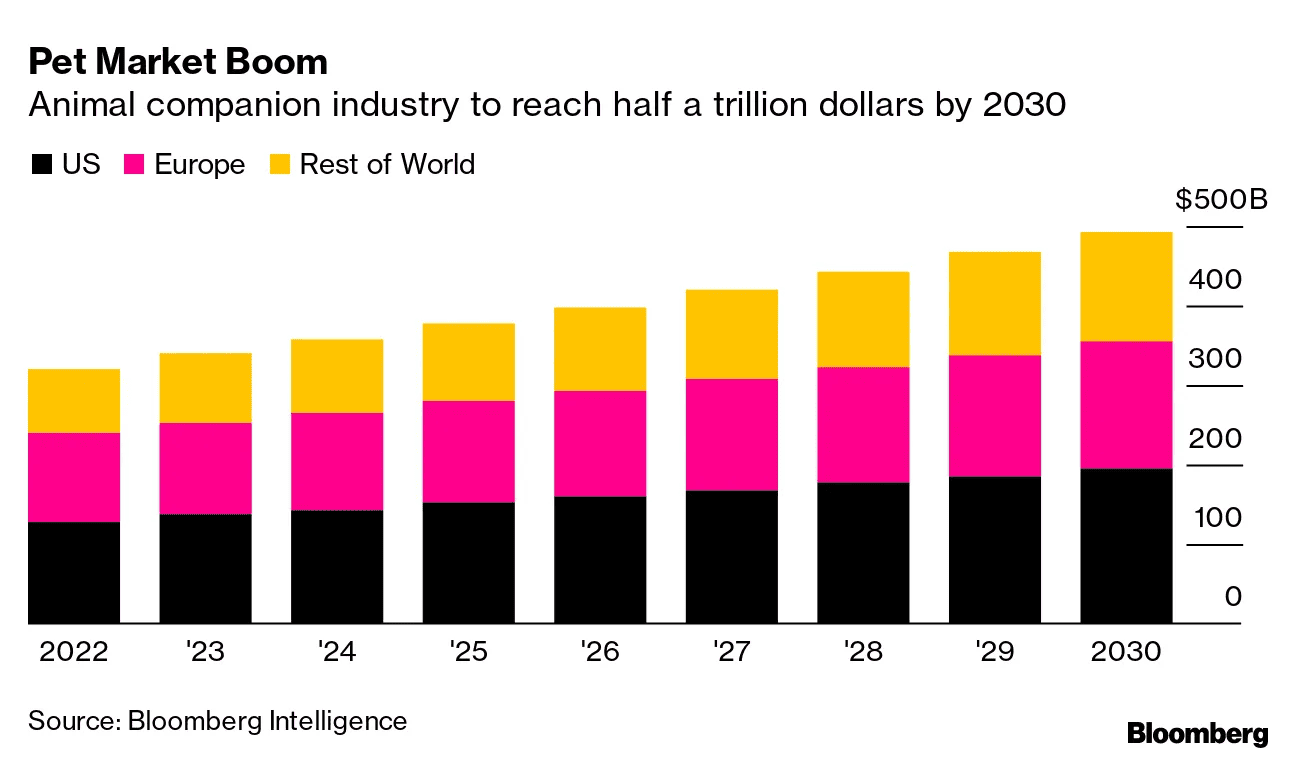

Broader market trends also favor Chewy’s e-commerce and pet care initiatives. Despite industry normalization, the projected compound annual growth rate (CAGR) of the pet care market remains healthy at 7%-8%. Increased adoption of premium products, coupled with a 13%-15% growth in online pet spending, complements Chewy’s strategic focus. However, challenges persist. In Q4 2024, EPS revisions in the last three months showed three downgrades, reflecting some concerns over profitability pressures and seasonal investments. While revenue estimates saw nine upgrades, competitive dynamics and consumer discretionary trends could pose headwinds.

Chewy’s ability to capitalize on its operational enhancements, customer loyalty programs, and strategic expansions will likely dictate its near-term performance. The company’s debt-free balance sheet and robust free cash flow generation, exceeding $360 million over 12 months, provide additional stability for continued growth investments. This dual focus on scaling profitably and exploring new revenue streams reinforces the company’s balanced outlook in the expanding pet market that may hit $0.5 trillion in annual revenue by 2030.

Source: Bloomberg.com