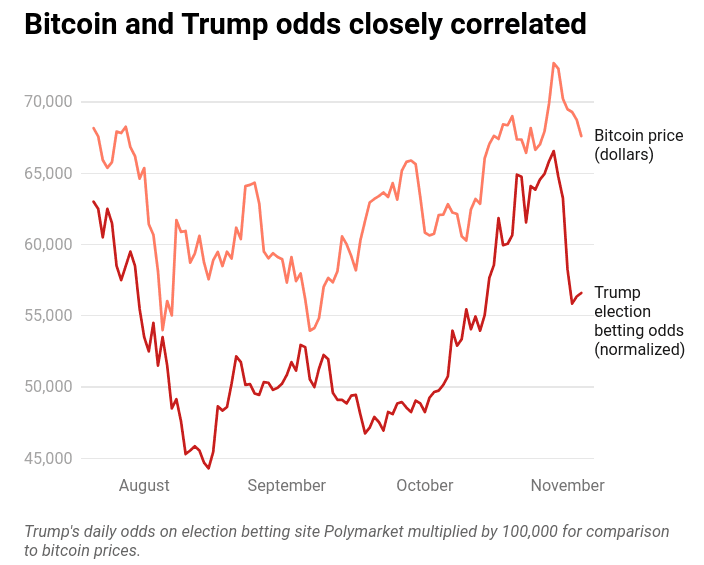

Coinbase's stock outlook is closely tied to current U.S. political and crypto market dynamics. With the 2024 presidential election approaching, candidates' crypto stances play a pivotal role in market sentiment. Analysts note that if Trump, who is seen as more crypto-friendly, wins, Bitcoin could surge to $80,000-$90,000. In contrast, a Harris victory might push Bitcoin down to $50,000 due to a stricter regulatory outlook. Such swings in Bitcoin prices directly impact Coinbase's performance, as higher prices generally boost trading volume. Coinbase also faces earnings pressures, missing Q3 revenue forecasts and adjusting for potential Q4 volatility amid regulatory uncertainties.

Source: Forbes.com

I. Coinbase Earnings Overview Q3 2024

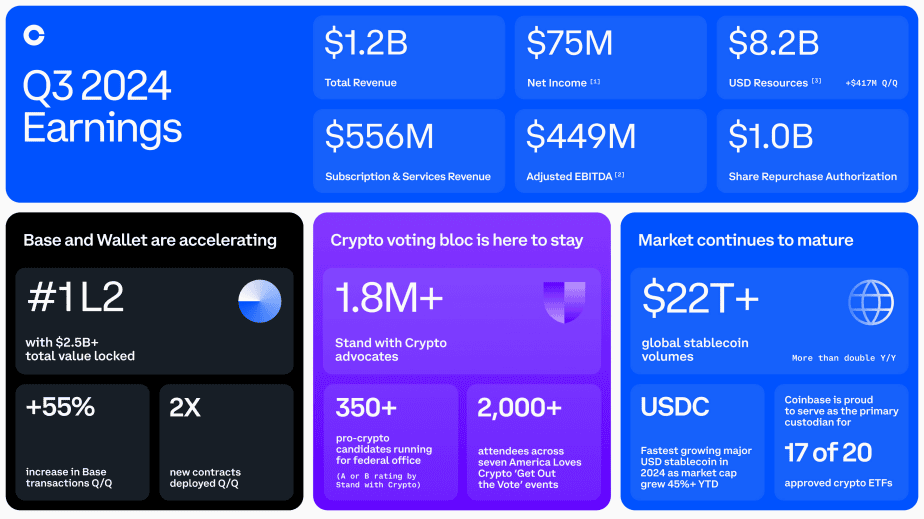

In Q3 2024, the company reported revenue of $1.21 billion, missing analyst expectations by $46.24 million. Earnings per share (EPS) fell short, with a normalized EPS of $0.28, undershooting forecasts by $0.14. Year-over-year, net income reached $75 million, though it was impacted by $121 million in unrealized losses in the crypto asset portfolio due to declining crypto prices. Adjusted EBITDA for the quarter was $449 million, marking the seventh consecutive quarter of positive adjusted EBITDA.

COIN Earnings Q3 2024 Revenue Drivers

Revenue was influenced primarily by transaction and subscription services. Transaction revenue, totaling $573 million, dropped 27% quarter-over-quarter (Q/Q), aligned with an 18% Q/Q decline in trading volume, heavily influenced by a 5% decrease in crypto asset volatility and a 10% drop in average crypto market capitalization. Subscription and services revenue was $556 million, down 7% Q/Q, affected by lower crypto prices. Key contributors included stablecoin-related revenue, which increased by 3% Q/Q to $247 million due to higher USDC balances (up 7%) and USDC market capitalization growth (up 5%). However, other segments like blockchain rewards and custodial fees declined by 16% and 8% Q/Q, respectively, due to lower crypto prices and custodial balances.

Source: Q3'24 Shareholder Letter

Profitability Analysis

The company’s cost management contributed to a 6% Q/Q reduction in total operating expenses to $1.0 billion. However, specific costs like technology and development expenses rose 4% Q/Q, reaching $377 million due to non-linear stock-based compensation expenses. Transaction expenses dropped 10% Q/Q, attributed to lower trading volumes and miner fees. Gross margins were squeezed by declining transaction revenues, although the company's product mix included a stronger focus on stablecoin adoption and institutional services, aiding resilience. The effective tax rate was -10%, partly due to stock-based compensation and R&D credits.

Additional Highlights

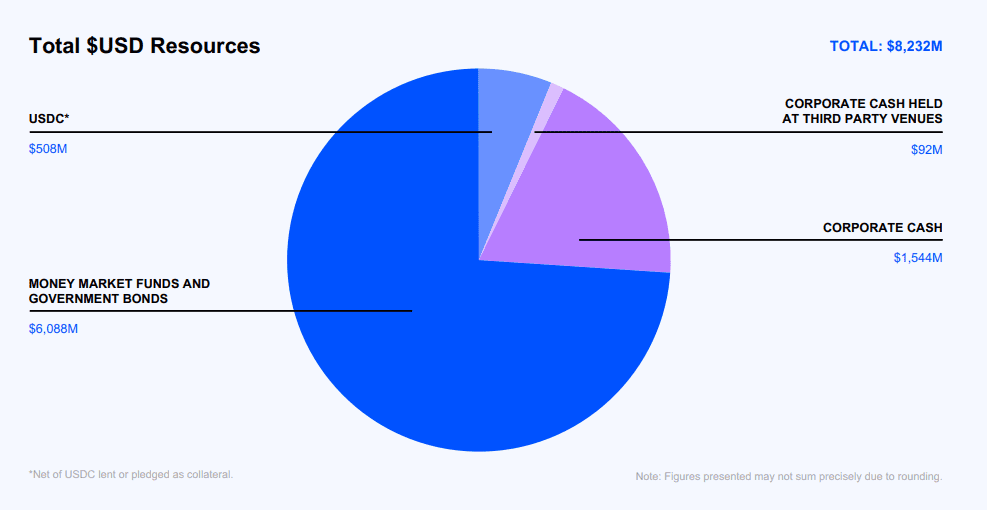

The company ended Q3 with $8.2 billion in cash resources, up $417 million Q/Q. It also announced a $1 billion share repurchase program authorized by the board in October 2024. Despite challenges in trading volumes, consumer transaction revenue remained relatively stable in market share, and subscription-based services like Coinbase One achieved record subscriptions, although revenue declined due to pricing changes. Lastly, institutional services outperformed Q/Q due to demand for Prime Broker and derivatives offerings, indicating strong institutional interest amid lower market volatility.

II. Product & Market Dynamics

New Products & Services

In Q3 2024, Coinbase expanded its offerings, aiming to enhance both revenue streams and crypto utility. The company’s Coinbase Derivatives Exchange launched new futures contracts in the U.S., covering assets like DOGE, SHIB, LNK, and others. This launch made Coinbase the only U.S. exchange offering margin futures outside BTC and ETH, attracting over 100,000 users to date. Internationally, the Coinbase International Exchange expanded to 89 perpetual contracts, covering 90% of global perpetual futures volumes, an increase from 83% in Q2.

Additionally, Coinbase introduced Coinbase Wrapped BTC (cbBTC), which enables users to engage Bitcoin in decentralized finance (DeFi) applications, providing a new avenue for BTC utility. Moreover, Coinbase’s Ethereum Layer 2 network, Base, grew rapidly in Q3, becoming the leading Layer 2 network by transaction count and total value locked. Transactions on Base rose 55% Q/Q, driven by low median transaction fees and increased developer engagement, solidifying its place as an efficient on-chain activity hub.

Stablecoins also remain central to Coinbase’s product strategy. The company continued its push for USDC adoption, which saw an 11% increase in market cap to $36 billion in Q3. Furthermore, Coinbase introduced EURC, a Euro-backed stablecoin, whose market cap nearly doubled to $69 million due to user-friendly features like free Euro-to-EURC conversions.

Competitive Landscape

In the increasingly competitive centralized exchange market, Coinbase holds a 6.1% market share (June 2024), ranking 6th behind leading players like Binance (44%) and Bybit (12.2%). Binance continues to dominate, offering extensive token listings and lower transaction fees, making it particularly attractive to retail and institutional traders globally. Kraken and OKX are also formidable competitors, focusing on both competitive fee structures and expanding international footprints.

Coinbase has responded to this competition by diversifying its services and expanding internationally, particularly into high-growth regions like Singapore, Canada, Australia, and Brazil. Furthermore, Coinbase’s strategic focus on compliant stablecoins, with USDC and EURC obtaining EU regulatory approval under MiCA, positions it to capture market share in the regulatory-sensitive European market.

By launching new derivatives products, boosting stablecoin utility, and expanding Base’s capabilities, Coinbase is positioning itself as both a secure platform for compliant crypto products and an innovator in emerging crypto applications. This strategy seeks to differentiate Coinbase from major competitors who, while strong in market share, may face challenges with regulatory compliance and product diversification.

Source: coingecko.com

III. Coinbase Stock Forecast

COIN Stock Price Performance Post-Earnings

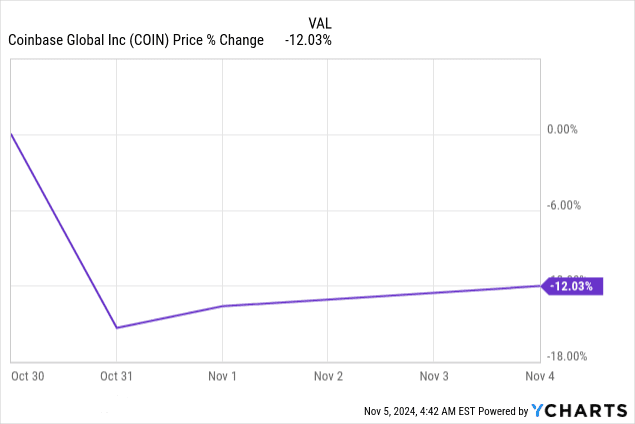

Following its Q3 2024 earnings release, Coinbase’s stock experienced a significant decline, dropping by 15.3% the day after, marking its steepest fall since May 2022. The market’s reaction stemmed from a revenue miss, with Coinbase reporting $1.21 billion in revenue, falling short of the $1.26 billion expected, and an EPS miss of $0.14. This weak performance, paired with a conservative revenue outlook for Q4, compounded investor concern, triggering a broad sell-off. Other crypto-related stocks also declined, with Robinhood dropping 16% and crypto miners Mara Holdings and Riot Platforms falling 8% and 11%, respectively, as market sentiment cooled on the sector.

Adding further pressure, Bitcoin—often a proxy for Coinbase’s performance—slid 2.78% to $69,918.66, briefly approaching its all-time high. Bitcoin’s movement typically influences Coinbase’s stock, as heightened BTC volatility often boosts trading volumes on the platform. However, despite recent Bitcoin price strength, the tepid crypto trading environment reflected in Coinbase’s results suggested underlying concerns about the stability of revenue growth.

Source: ycharts.com

COIN Price Forecast

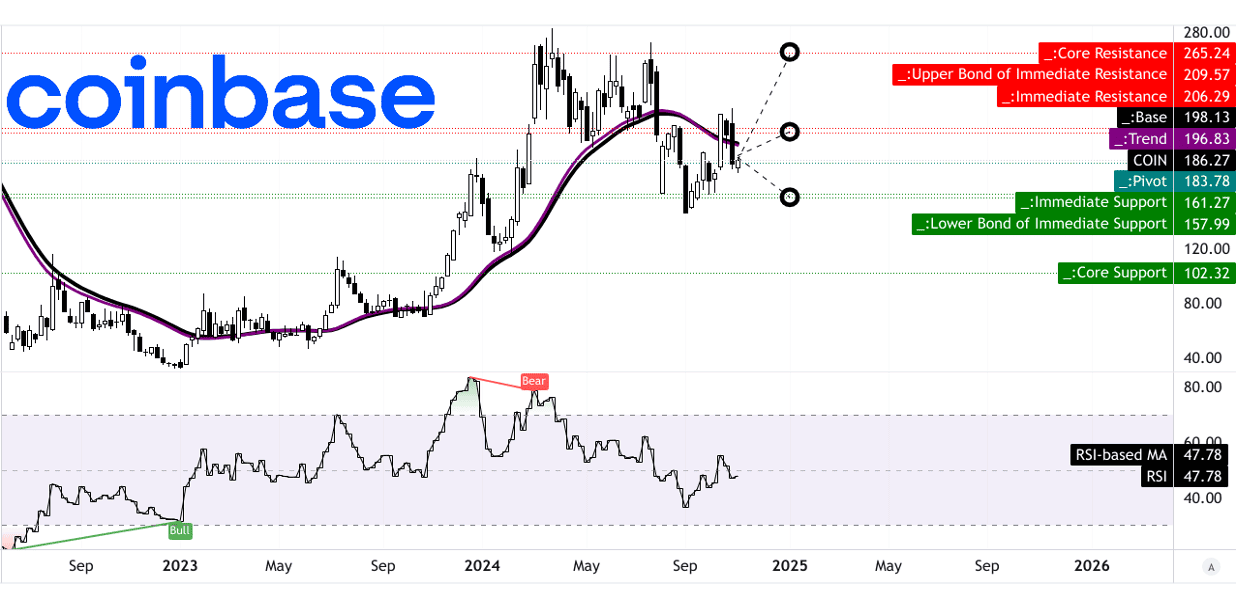

Technical analysis of Coinbase’s stock indicates near-term volatility within a defined horizontal price channel. The current price of $186.27 is below the exponential moving averages (EMAs) of $196.83 (trendline) and $198.13 (baseline), signifying resistance to upward momentum and a bearish sentiment. The pivot point at $183.78 serves as a support level in this channel; a break below could indicate further downside.

Looking at forecasted targets, the average price target by year-end 2024 stands at $206. This projection aligns with moderate price recovery expectations, drawing on Fibonacci retracement levels to gauge potential reversal points within the ongoing cycle. For a more optimistic scenario, the target reaches $265, assuming a sustained upward price momentum in crypto assets which would likely stimulate Coinbase’s revenue. Conversely, the pessimistic target of $158.00 considers potential continuation of downward trends from the recent earnings miss and the possibility of weakened crypto markets.

Relative Strength Index (RSI) analysis shows a neutral RSI of 47.78, with no significant bullish or bearish divergence, and a slight uptrend. This places Coinbase in a technical limbo, with no clear directional bias, indicating caution in both bullish and bearish entries. Given the stock’s sensitivity to crypto price swings and macroeconomic shifts, COIN may continue facing headwinds unless crypto markets and trading volumes rally significantly.

Source: tradingview.com

IV. Coinbase Stock Forecast: Future Outlook

Management's Growth Forecasts and Strategic Initiatives

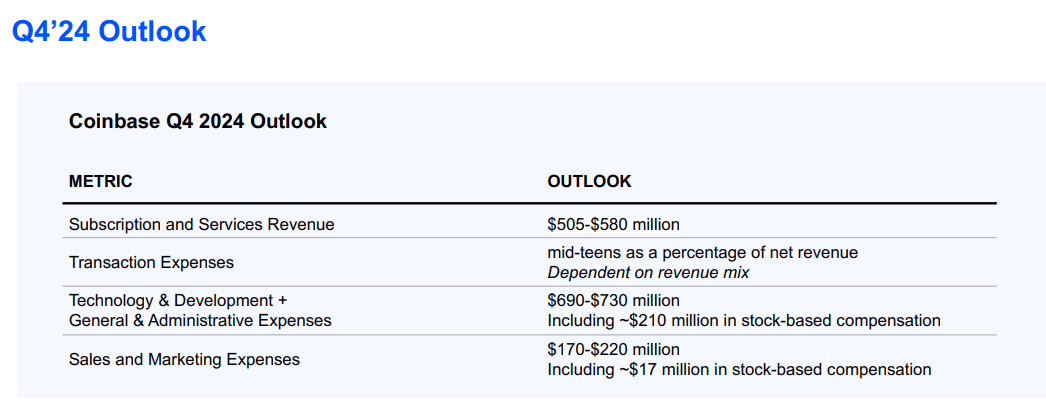

Coinbase has set growth-focused priorities for 2024, aiming to expand revenue streams and adapt to regulatory changes. Management’s recent guidance suggests a cautious approach amid market volatility. They anticipate Q4 subscription and services revenue between $505-$580 million, acknowledging headwinds like a 10% drop in Ethereum’s average price in October and reduced interest rates, which impact staking and custody returns. For transaction revenue, Coinbase projects $190 million for October, warning against extrapolating short-term trends given fluctuating crypto prices.

Coinbase is also managing expenses, expecting technology and development costs to range from $690-$730 million, reflecting a shift to linear expense recognition for stock-based compensation. Marketing expenses, estimated between $170-$220 million, are expected to rise due to higher USDC rewards and new NBA partnership costs, though these are flexible based on crypto market dynamics. Coinbase’s legal approach, especially in its ongoing SEC litigation, highlights a strategy to obtain regulatory clarity through court rulings, a process expected to continue through Q2 2025.

Source: Q3'24 Shareholder Letter

COIN Stock Forecast: Market Trends and Analyst Expectations

The cryptocurrency market remains highly volatile, with regulatory developments as a major influence. Coinbase’s stock performance is closely tied to market sentiment, influenced by the 2024 U.S. presidential election and bipartisan support for pro-crypto legislation. While the regulatory landscape appears favorable, the ongoing litigation with the SEC creates uncertainty. Additionally, global crypto adoption is projected to grow at a CAGR of 12.5% through 2030, underscoring potential long-term demand.

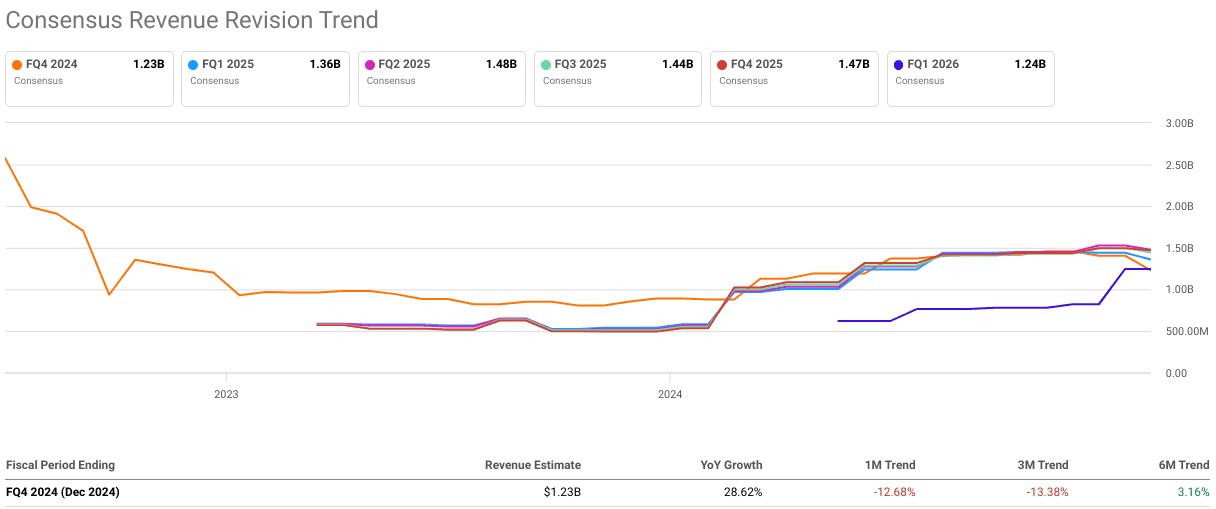

The consensus revenue forecast for Q4 2024 is $1.23 billion, marking a 28.62% YoY increase. However, earnings estimates reflect challenges, with an expected EPS of $0.46, down 55.41% YoY, as macroeconomic pressures and fluctuating crypto prices weigh on profitability. Recent analyst revisions reveal bearish sentiment, with nine downward EPS adjustments against three upward and eleven downward revenue revisions versus three upward.

Source: seekingalpha.com

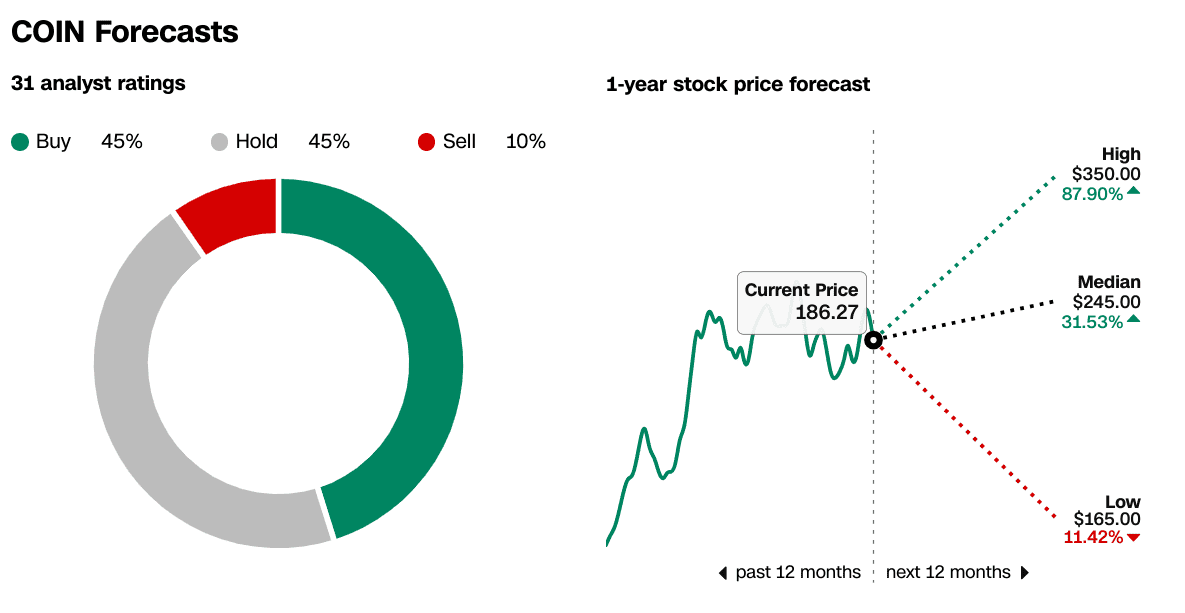

Analyst ratings show a balanced outlook, with 45% buy, 45% hold, and 10% sell recommendations. The 12-month price target median is $245, a 31.53% potential upside, while the high and low targets of $350 and $165 reflect differing views on Coinbase’s resilience in a volatile market.

Source:CNN.com

Source:CNN.com