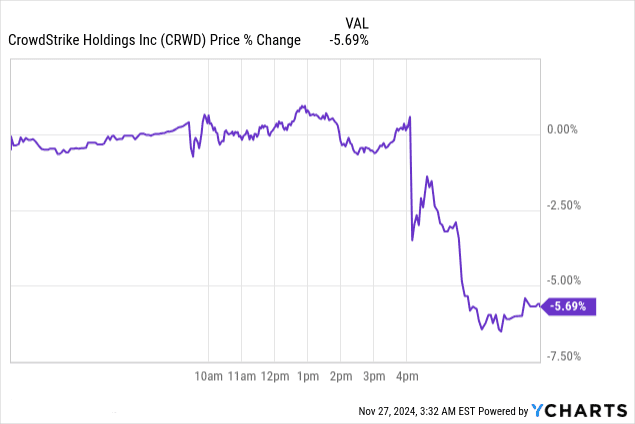

Following Q3 2025 earnings, CrowdStrike's stock dropped 5.7%, reflecting investor concerns despite exceeding revenue expectations by $27.08 million and hitting $1.01 billion, a 29% YoY increase. Normalized EPS of $0.93 beat by $0.12, but GAAP EPS missed at -$0.07 due to $33.9 million in one-time incident-related costs.

Source: 3Q25 Earnings Presentation

I. CrowdStrike Earnings Overview Q3 2025

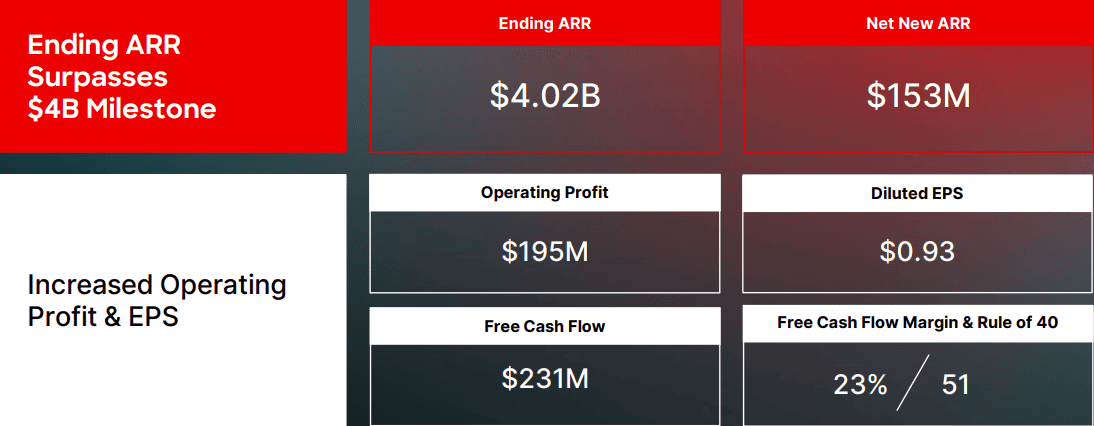

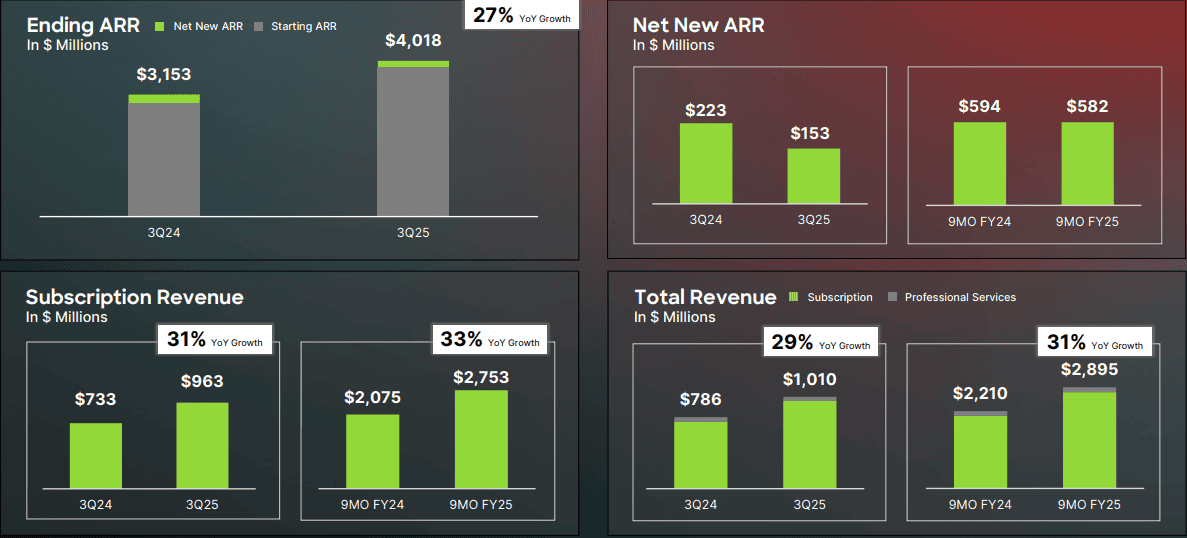

CrowdStrike’s Q3 2025 earnings showcased an outstanding performance despite operational challenges earlier in the fiscal period. The company surpassed Wall Street expectations on consolidated revenue and normalized earnings per share (EPS), signaling sharp execution amidst market headwinds. Revenue hit $1.01 billion, exceeding projections by $27.08 million, reflecting a 29% YoY growth. The subscription segment stood as a core contributor, generating $962.7 million, up 31% YoY. Professional services revenue, while smaller at $47.4 million, maintained a stable role in the overall revenue mix.

Normalized EPS landed at $0.93, beating expectations by $0.12, supported by strict cost management and steady module adoption rates among customers. Conversely, GAAP EPS remained in negative territory at -$0.07, missing estimates by $0.09, as CrowdStrike grappled with $33.9 million in expenses linked to the July 19 incident. This illustrates the dual narrative of operational strength alongside specific one-time challenges.

Gross margin remained constant at 78%, while subscription gross margin was 80%, highlighting stability in the cost structure. Operating margins, although at 19%, were impacted by increased investment in R&D, customer support, and quality assurance, rising to $591.7 million from $436.1 million YoY. Non-GAAP net income stood at $234.3 million, marking an 18% increase YoY.

Source: 3Q25 Earnings Presentation

CRWD Earnings Q3 2025 Revenue Breakdown and Market Dynamics

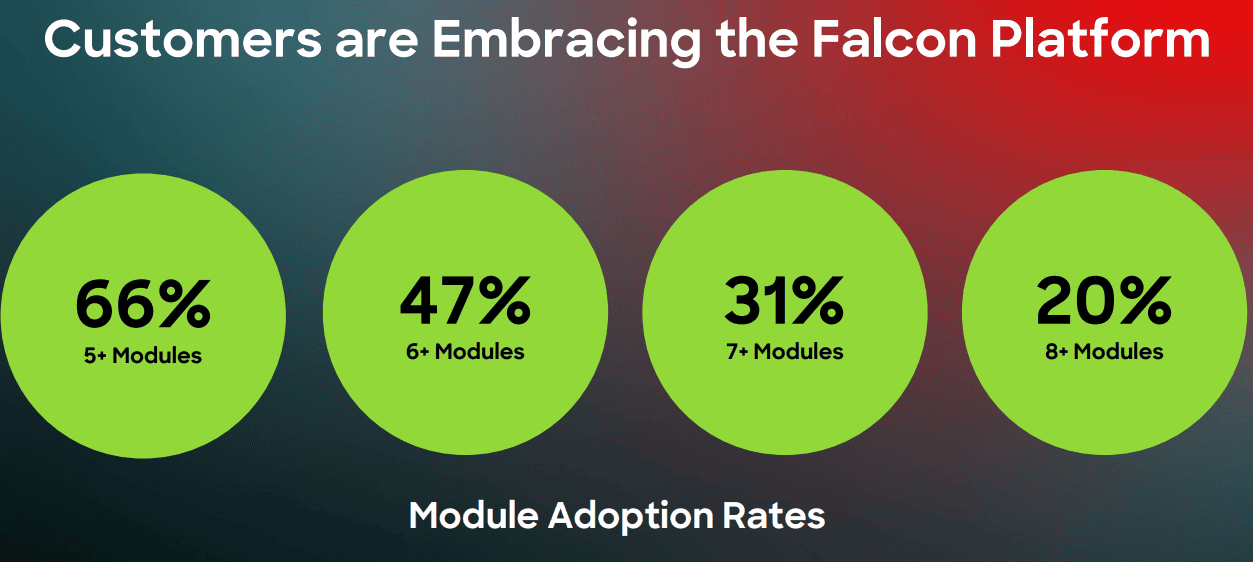

Revenue growth was supported by solid expansion in Annual Recurring Revenue (ARR), which surpassed $4 billion for the first time. ARR climbed 27% YoY, with $153 million in net new ARR added during the quarter. While customer adoption of eight or more modules rose to 20%, demonstrating the growing appeal of the Falcon platform, sales cycles extended by 15% YoY within enterprise accounts due to lingering hesitancy after the July incident.

Retention metrics remained steady, with a dollar-based gross retention rate above 97% and a net retention rate of 115%, showing minimal customer churn despite elongated sales cycles. However, net new ARR was constrained by $25 million due to customer commitment packages, reflecting muted upsell rates.

Free cash flow of $230.6 million represented 23% of revenue but faced pressure from flexible payment terms under customer commitment packages and incremental costs linked to July's operational challenges. Going forward, CrowdStrike's $10 billion ARR target by FY 2031 hinges on bolstering module adoption and executing its reacceleration strategy starting in FY 2026.

Source: 3Q25 Earnings Presentation

Source: 3Q25 Earnings Presentation

II. Product & Market Dynamics

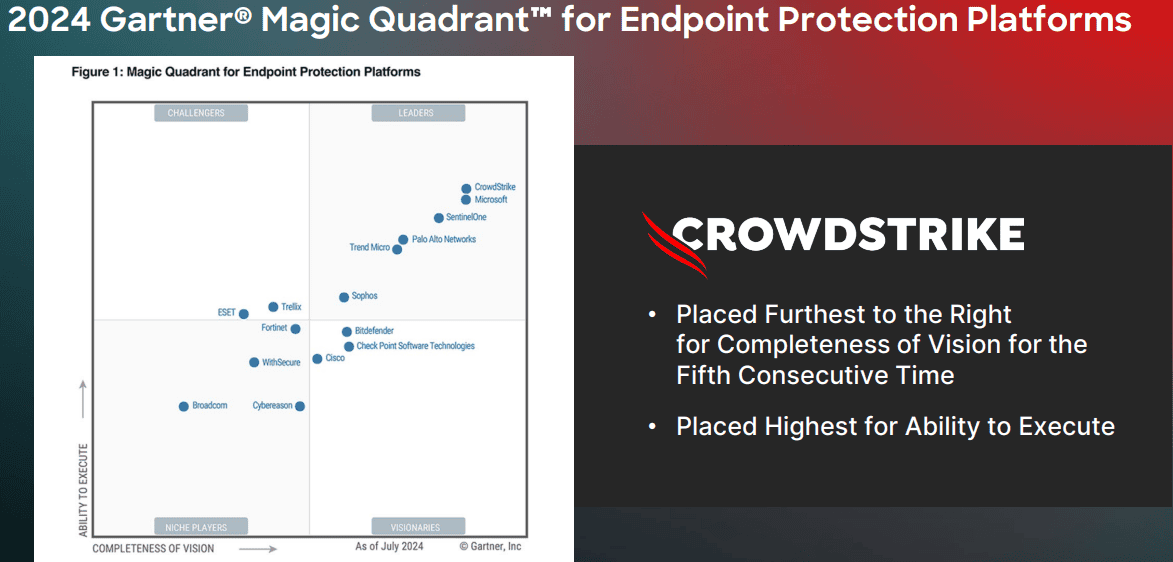

CrowdStrike has cemented itself as a leader in cybersecurity, boasting a 23.03% market share and ranking first globally. This dominance is rooted in its consistent technological advancements, competitive pricing strategies, and innovative models like Falcon Flex, which accounted for over $1.3 billion in deal value during Q3 2025. The model's success is evident in its adoption by over 150 accounts this quarter, representing larger and faster deal cycles, with customers often doubling or tripling module adoption within the initial 12 months.

The market reception to CrowdStrike's products is notably influenced by its aggressive event strategy. Fal.Con 2024 drew over 7,700 attendees globally, marking a significant pipeline boost. Events showcased key product advancements, including Adaptive Shield for SaaS Security Posture Management, enhancing CrowdStrike's holistic platform. Additionally, the integration of AI-driven features like Charlotte AI has been transformative, automating processes and addressing cybersecurity skill gaps. Charlotte AI's triple-digit growth illustrates its rising importance in reducing enterprise operational burdens.

Source: 3Q25 Earnings Presentation

CrowdStrike’s competitive landscape features formidable players like Palo Alto Networks, SentinelOne, and Fortinet. However, the company’s pricing flexibility and innovative strategies, particularly through Falcon Flex, differentiate it sharply. Flex customers enjoy preferred pricing and rapid platform adoption, enabling seamless consolidation of legacy tools. The average Flex customer spends multi-millions, contrasting sharply with the hundreds of thousands spent by traditional clients. Flex also aligns well with CFO priorities, highlighting its relevance in boardroom-level decisions.

CrowdStrike’s strategic acquisitions, such as Adaptive Shield and Bionic, bolster its cloud security ecosystem, allowing comprehensive protection from development to runtime. This integration has secured notable wins, including an eight-figure expansion deal with a Fortune 50 retailer and multiple displacements of legacy systems across industries. In Q3, its Next-Gen SIEM demonstrated hyper-growth, achieving over 150% YoY ARR growth and onboarding 2,000 customers, emphasizing the rapid shift towards its cost-efficient, scalable solutions. In terms of market share dynamics, SentinelOne holds a 9.11% share, while legacy competitors like McAfee ePO trail at 22.18%. CrowdStrike’s ability to surpass both newer and traditional players stems from a combination of innovative subscription models, relentless platform updates, and market-leading advancements in AI and cloud security. This focus continues to position CrowdStrike as the platform of choice for global cybersecurity needs.

Source: ir.crowdstrike.com

III. CRWD Stock Forecast

CrowdStrike Stock Forecast Technical Analysis

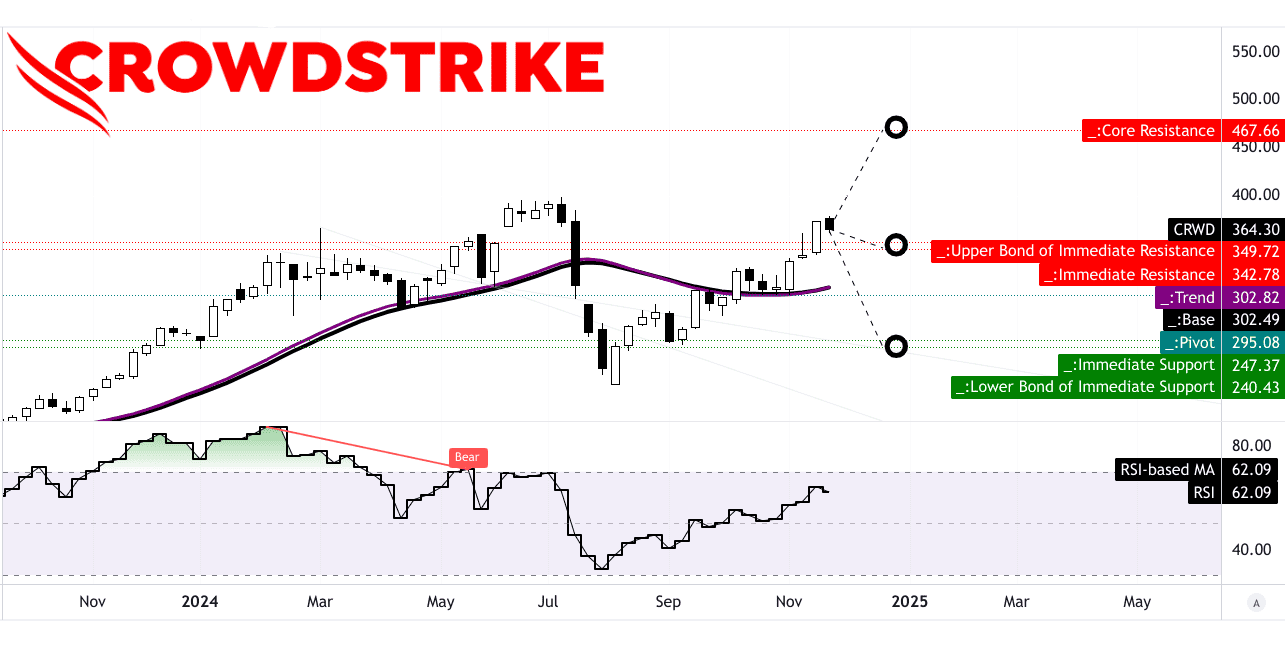

CrowdStrike’s stock (CRWD) demonstrates considerable momentum, supported by technical indicators that suggest both bullish and bearish scenarios. The current price of $364.30 is above the modified exponential moving average trendline of $302.82 and the baseline of $302.49, indicating upward momentum. However, the pivot of the current horizontal price channel stands at $295.08, serving as a potential support zone should the price reverse.

The Relative Strength Index (RSI) is at 62.09, signaling a bullish bias but not yet in overbought territory (above 70). The RSI trend is upward, but there is no divergence, indicating that the price movement aligns with momentum strength. Using Fibonacci retracement/extension levels, the stock’s trajectory suggests three scenarios by the end of 2024:

- Average price target: $648, derived from mid- to short-term momentum and retracement extension.

- Optimistic target: $350, reflecting the potential for a continuation of current upward swings.

- Pessimistic target: $248, based on possible downward pressure in the current swing.

These projections underscore the stock’s sensitivity to its current price channel and its reliance on maintaining bullish momentum.

Source: tradingview.com

CRWD Stock Forecast: Market Analysts' Expectations and Ratings

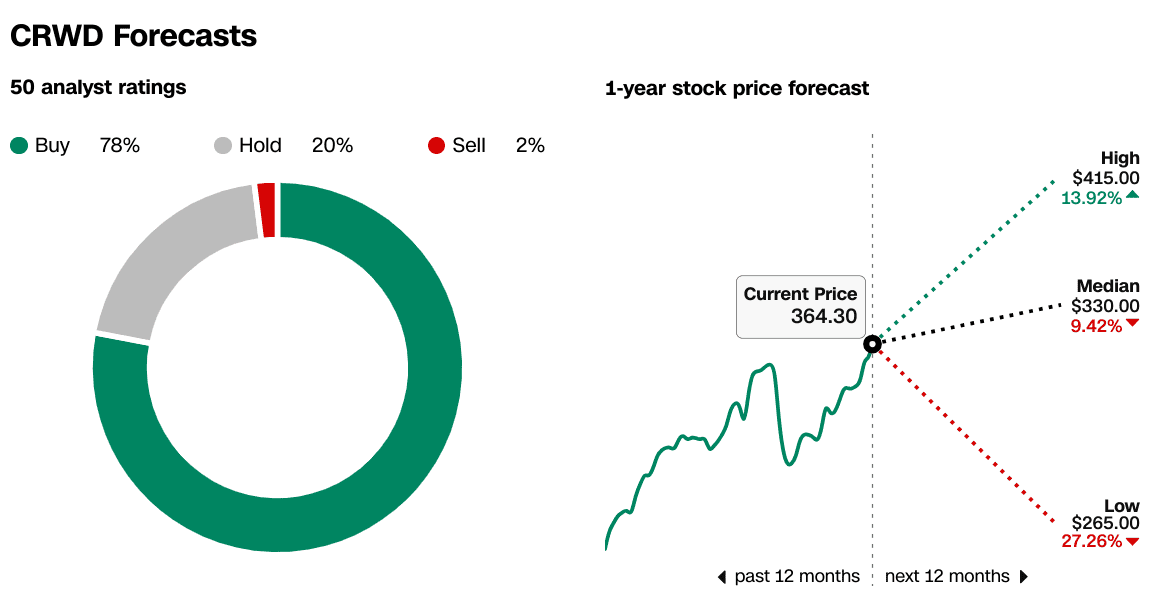

Market analysts broadly favor CRWD, with 50 ratings showing 78% buy, 20% hold, and 2% sell recommendations. This reflects confidence in the stock's growth potential, though the varying targets emphasize uncertainty about its capability to sustain recent highs. For the next 12 months, price forecasts reveal:

- High estimate: $415 (+13.92%)

- Median estimate: $330 (-9.42%)

- Low estimate: $265 (-27.26%)

These targets show a mix of bullish expectations at the high end and caution at the low end. The median projection of $330 aligns with the need for continued growth in CRWD's fundamentals to support valuation. CRWD’s technical indicators and analysts' targets suggest the stock has a mixed outlook for 2024. While upward momentum appears strong, sustaining or exceeding its current price will depend heavily on external market forces and CrowdStrike’s ability to match performance with expectations. Stockholders may face volatility, particularly if bearish scenarios materialize or the pivot support at $295.08 is tested.

Source: CNN.com

Source: CNN.com

IV. CrowdStrike Stock Forecast: Future Outlook

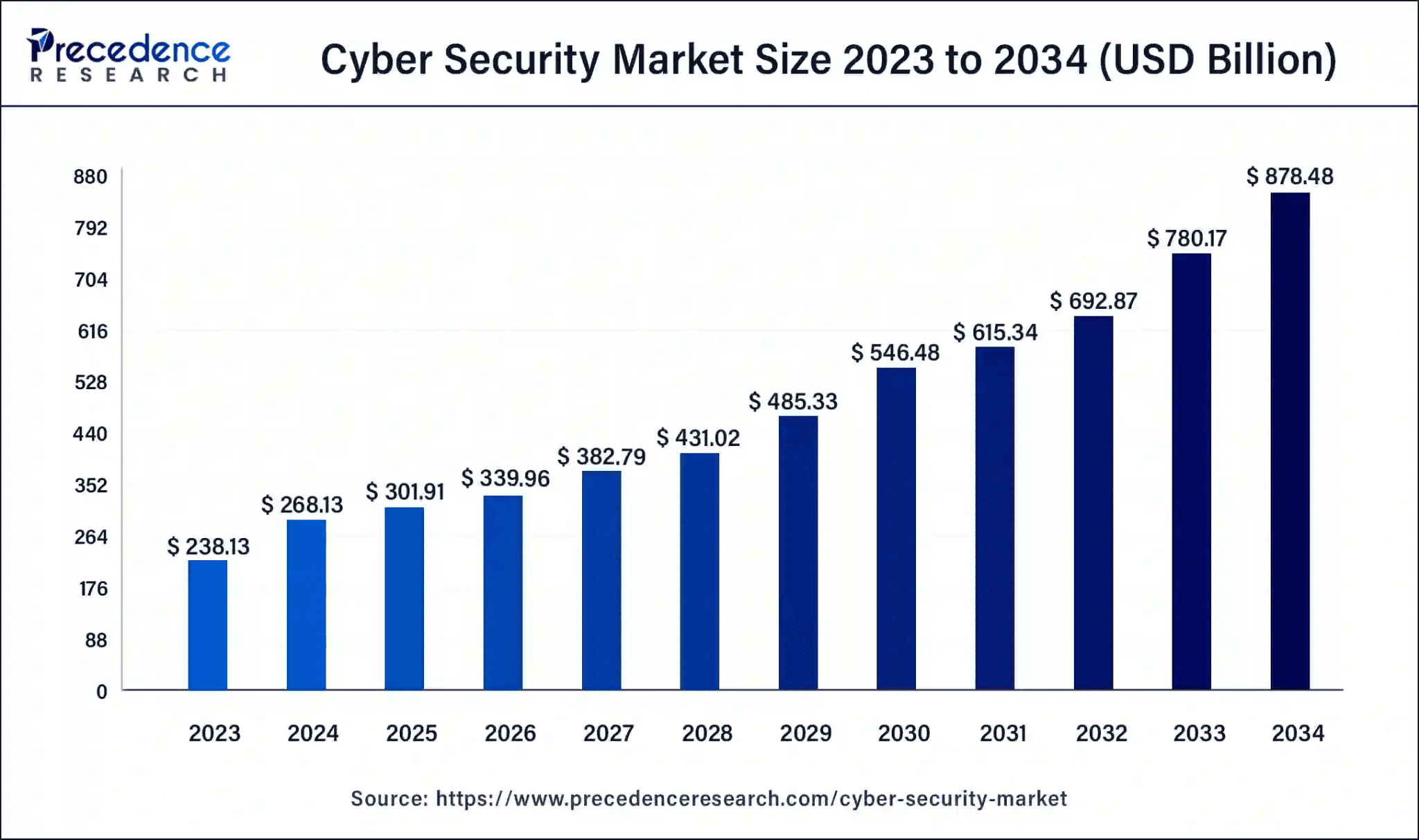

CrowdStrike’s future trajectory reflects a blend of strategic innovation, robust platform adoption, and market-driven demand in cybersecurity. Management has emphasized its focus on scaling growth and evolving its product suite, underpinned by revenue guidance of $1.03 billion for FQ4 2025, representing a 22.01% YoY rise, though EPS is expected to dip by 9.17% to $0.86. The divergence in revenue and earnings outlook suggests increased operational investments, possibly in product development and customer acquisition, to solidify its competitive position in the expanding cybersecurity market.

Source: precedenceresearch.com

From a strategic lens, CrowdStrike’s Falcon Flex model has emerged as a pivotal driver of platform adoption. By linking subscription flexibility with measurable ROI, Falcon Flex accounts for over $1.3 billion in deal value, reflecting accelerated client onboarding. For instance, the model facilitated two eight-figure transactions in Q3, including the replacement of legacy systems across multiple modules in a Global 2000 tech firm. Additionally, the acquisition of Adaptive Shield integrates SaaS posture management into CrowdStrike’s ecosystem, extending its cloud security capabilities. On a broader market scale, CrowdStrike projects a $250 billion TAM by CY29 for its AI-native security platform, highlighting the expansive growth potential within the cybersecurity and cloud adoption domains. The firm’s Q3 ARR of $4 billion, up 27%, aligns with these ambitions, supported by a 97% gross retention rate—underscoring customer loyalty amidst market volatility.

Source: 3Q25 Earnings Presentation

Source: 3Q25 Earnings Presentation

However, caution is warranted. Analysts have revised down EPS and revenue projections significantly over the last three months, with 39 and 36 downward adjustments, respectively. This suggests tempered near-term expectations due to potential challenges, such as heightened competition or macroeconomic pressures impacting enterprise spending. CrowdStrike’s innovation in AI-powered cybersecurity, particularly through its Charlotte AI agent and cloud-focused advancements, positions it to capitalize on emerging trends. Recent wins, including a Fortune 50 retailer’s multi-cloud deployment, exemplify its expanding footprint in high-demand cybersecurity verticals like healthcare and retail.