Delta Air Lines (DAL) stock surged post-Q4 2024 earnings, driven by record revenue of $15.56 billion (beat by $1.08B) and normalized EPS of $1.85 (beat by $0.11). Despite a GAAP EPS miss ($1.29, -$0.63), the stock gained on strong pre-tax profit of $1.6 billion (+$500M YoY) and operating margin expansion to 12%. Technicals remain bullish, with a Q1 2025 price target of $71.80, reflecting confidence in Delta’s growth trajectory.

I. Delta Earnings Overview Q4 2024

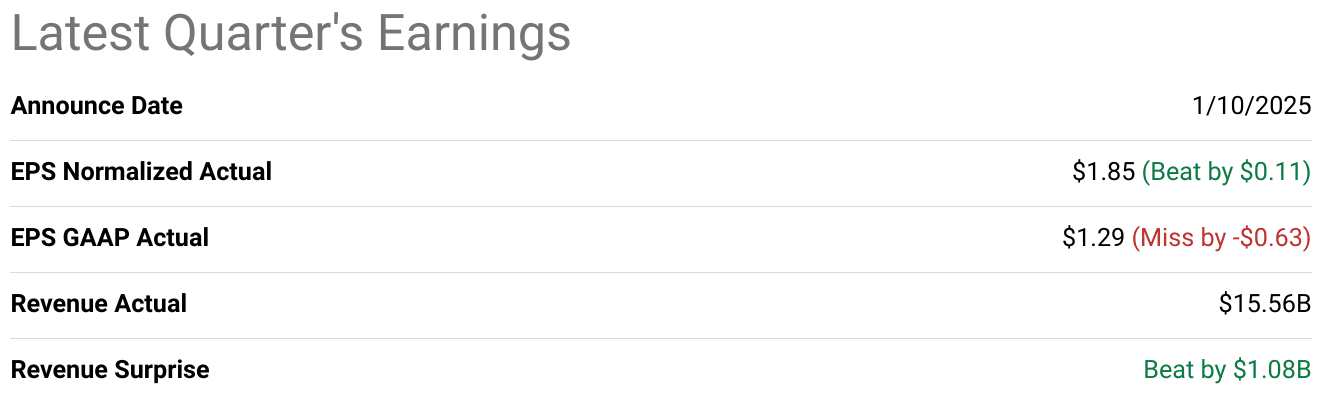

Delta Air Lines (DAL) delivered a strong performance in Q4 2024, with revenue of $15.56 billion, surpassing expectations by $1.08 billion and marking a 5.7% year-over-year increase. The company reported a normalized EPS of $1.85, beating estimates by $0.11, though GAAP EPS of $1.29 fell short by $0.63 due to one-time adjustments. Net income saw significant growth, driven by record revenue and operational efficiency, with a pre-tax profit of $1.6 billion, up $500 million compared to the previous year. Margins also improved, with the operating margin expanding to 12%, a 2-point increase year-over-year, reflecting disciplined cost management and strong performance in high-margin segments such as premium cabins, loyalty programs, and cargo operations.

Source: Seeking Alpha

For the full year 2024, Delta achieved record revenue of $57 billion, a 4% increase over 2023, driven by diversified revenue streams. Premium revenue grew by 8%, loyalty revenue by 9%, and cargo revenue by 14%, with American Express co-brand card remuneration reaching $7.4 billion for the year. The company reported full-year EPS of $6.16, exceeding the mid-point of its initial guidance range of $6 to $7, despite the impact of the CrowdStrike outage in Q3. Delta also delivered a double-digit operating margin and a return on invested capital (ROIC) of 13%, double the industry average. Strong cash flow generation enabled the company to repay $4 billion in debt, reducing its leverage ratio to 2.6x and restoring its balance sheet to investment-grade status at all three major credit rating agencies.

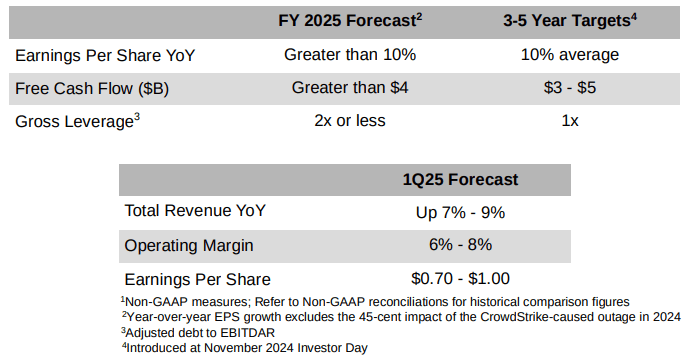

Looking ahead to 2025, Delta is optimistic about continued growth and profitability. The company expects Q1 revenue growth of 7% to 9%, driven by robust demand from both corporate and leisure travelers, with EPS projected to exceed $7.35, representing a 20% increase over 2024. Delta anticipates generating over $4 billion in free cash flow, which will support further debt reduction and strategic investments. Capacity is expected to grow by 3% to 4% reflecting Delta’s focus on high-margin revenue streams. The company also plans to expand its loyalty program and enhance customer experience through initiatives like Delta Concierge, a generative AI-powered virtual assistant, and new partnerships with YouTube and Uber. With a strong operational foundation and a clear growth strategy, Delta is well-positioned to deliver another year of industry-leading performance in 2025.

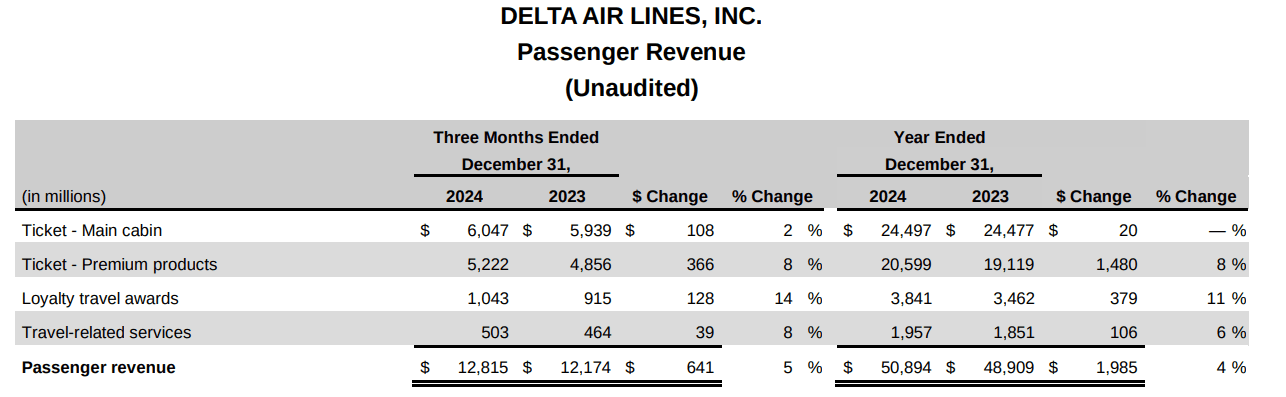

Source: DAL December Quarter 2024 Results

II. Delta Product & Market Dynamics

Delta Air Lines has continued to differentiate itself through innovative products and services, which have strengthened its competitive position in the airline industry. In 2024, Delta introduced Delta Concierge, a generative AI-powered virtual assistant integrated into the Fly Delta app, designed to streamline travel planning and reduce stress for customers. This innovation, alongside the evolution of Delta Sync, which now includes an exclusive partnership with YouTube to offer ad-free Premium and music streaming on board, has been well received by customers. Additionally, Delta’s new partnership with Uber, allowing SkyMiles members to earn miles on rides and deliveries, expands its loyalty ecosystem beyond air travel, enhancing customer engagement and satisfaction. These initiatives reflect Delta’s commitment to leveraging technology to elevate the travel experience and deepen customer loyalty.

Source: news.delta.com

Delta has also made significant strides in sustainability, investing in sustainable aviation fuel (SAF) initiatives and modernizing its fleet with fuel-efficient aircraft. These efforts align with growing consumer and regulatory demand for environmentally responsible practices, further enhancing Delta’s brand reputation. The airline’s focus on premium cabin growth, with 85% of new seats in 2025 allocated to premium classes, underscores its strategy to capture high-margin revenue streams and cater to the increasing demand for luxury travel experiences.

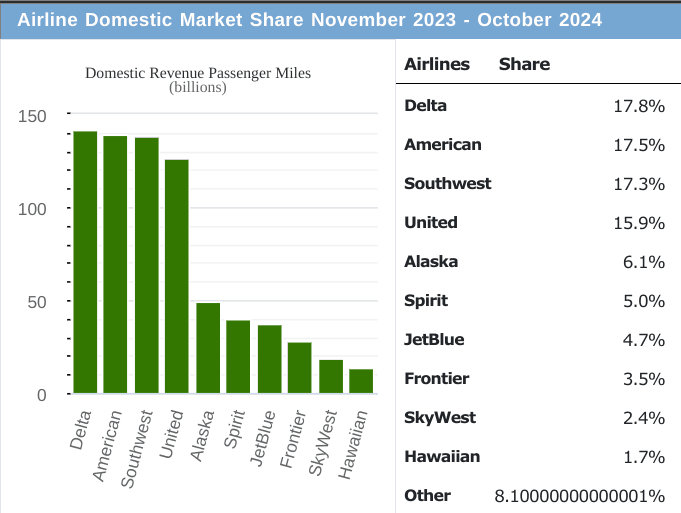

Competitive Landscape

In the competitive landscape, Delta faces strong competition from American Airlines, United Airlines, and Southwest Airlines. While American and United have also invested heavily in premium services and loyalty programs, Delta’s operational efficiency and customer-centric innovations have allowed it to maintain a leading position. Delta’s on-time performance and completion factor ranked first among its peers in 2024, earning it Cirium’s Platinum Award for operational excellence for the fourth consecutive year. This operational edge, combined with its focus on premium revenue and loyalty, has enabled Delta to achieve a double-digit operating margin, significantly outperforming competitors.

Source: transtats.bts.gov

Pricing strategies have also played a critical role in Delta’s market dynamics. The airline has maintained a balanced approach, leveraging its premium offerings to command higher fares while remaining competitive in the main cabin. This strategy has paid off, with premium revenue growing 8% year-over-year in 2024, outpacing main cabin growth. Delta’s loyalty program, driven by its partnership with American Express, contributed $7.4 billion in revenue, up 9% from 2023, further solidifying its competitive advantage.

Looking ahead, Delta’s focus on efficient growth, premium cabin expansion, and strategic partnerships positions it to maintain its leadership in a highly competitive market. By continuing to innovate and adapt to evolving consumer preferences, Delta is well-equipped to capture market share and drive sustained profitability in 2025 and beyond.

III. DAL Stock Forecast

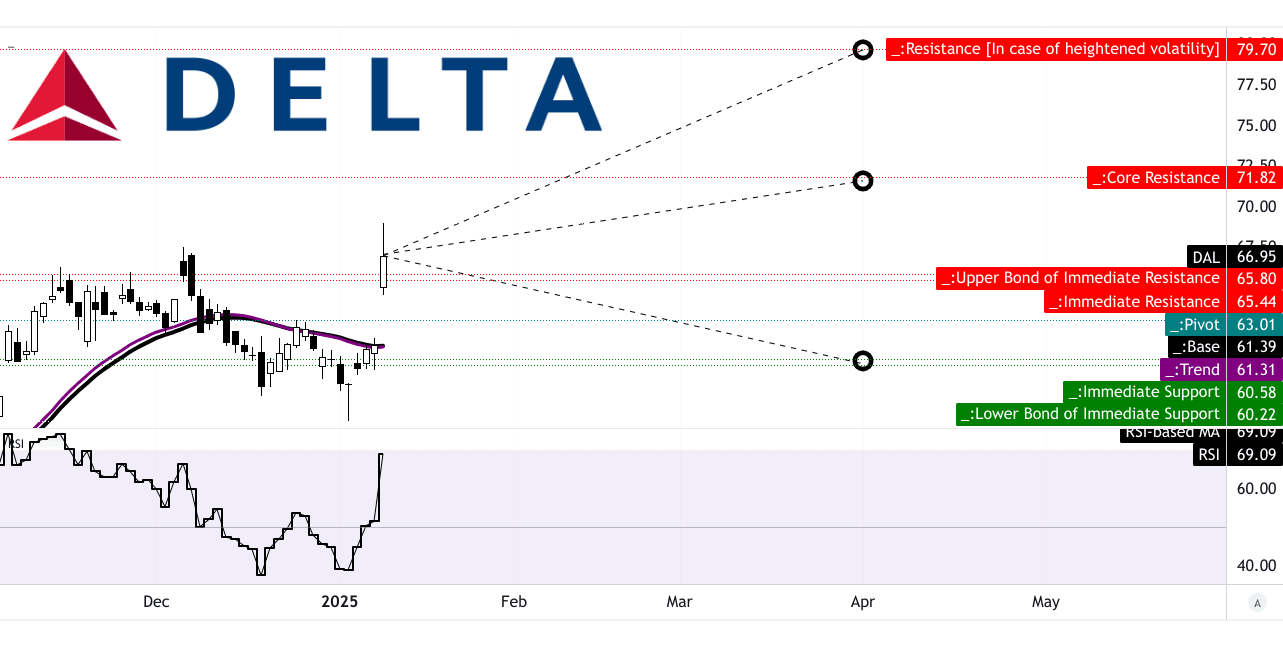

Delta Stock Forecast Technical Analysis

Delta Air Lines (DAL) stock is currently trading at $66.95, reflecting a strong upward trend supported by both technical indicators and positive analyst sentiment. The modified exponential moving average (EMA) trendline stands at $61.31, with a baseline of $61.39, indicating a solid support level. The stock is trading above its pivot point of $63.01, within a horizontal price channel, suggesting bullish momentum in the near term.

Moreover, the Relative Strength Index (RSI) is at 69.09, showing an upward trend and a bullish divergence, which signals potential for further price appreciation. However, the RSI is nearing overbought territory, which could lead to short-term consolidation. The average price target for Q1 2025 is $71.80, based on momentum and Fibonacci retracement/extension levels. The optimistic price target is $79.70, driven by strong upward price momentum, while the pessimistic target is $60.20, accounting for potential downward swings.

Source: tradingview.com

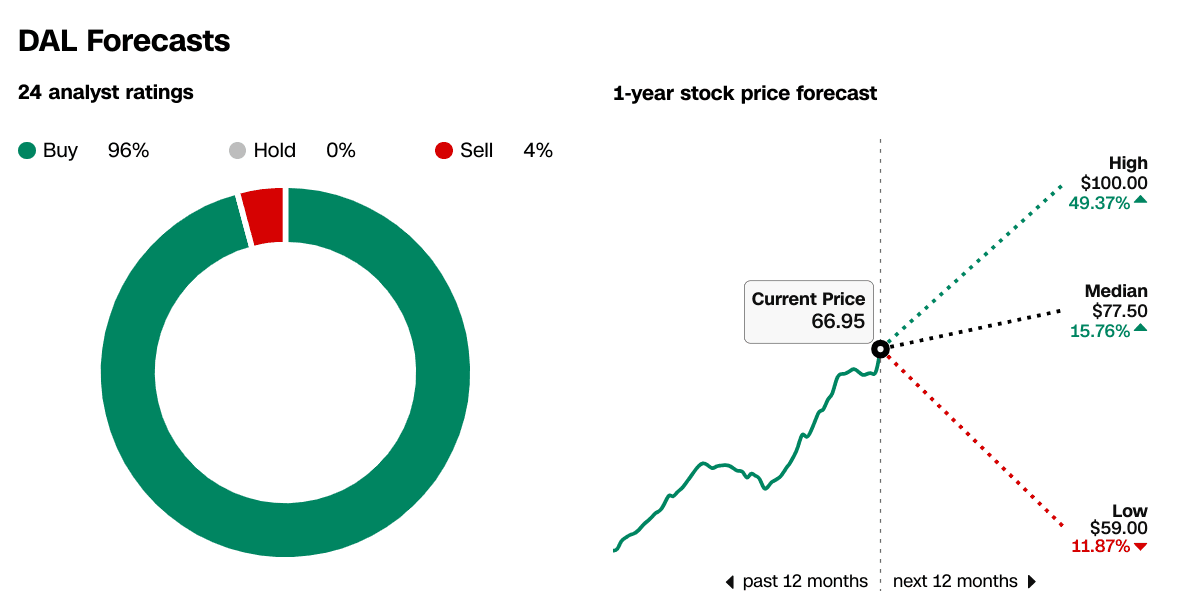

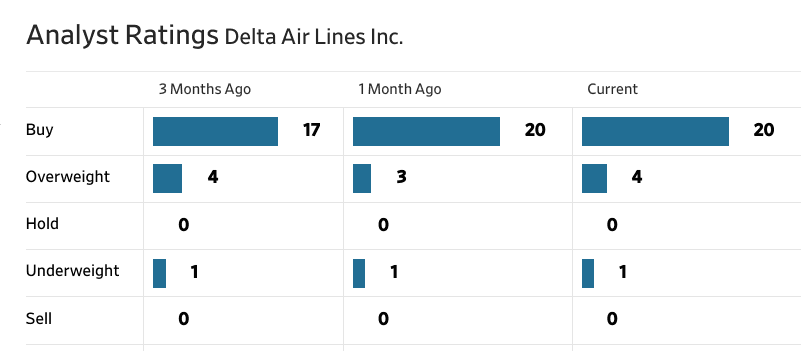

DAL Stock Forecast: Market Analysts' Expectations & Ratings

Analysts are overwhelmingly bullish on DAL, with 24 out of 25 analysts rating the stock as a "Buy" or "Overweight" as of the latest data. Over the past three months, the number of "Buy" ratings has increased from 17 to 20, reflecting growing confidence in Delta’s financial performance and market position. For the next 12 months, analysts project a median price target of $77.50, with a high of $100 (49.37% upside) and a low of $59 (11.87% downside).

Source: CNN.Com

Source: WSJ.com

IV. Delta Stock Forecast: Future Outlook

Delta Air Lines (DAL) has laid out a robust growth strategy for 2025, supported by strong financial performance and strategic initiatives. Management forecasts full-year 2025 earnings per share (EPS) greater than $7.35, representing over 19% growth year-over-year on a non-GAAP basis, or 10% growth when normalized for the $0.45 impact of the CrowdStrike outage in Q3 2024. This guidance reflects Delta’s confidence in its ability to sustain profitability through revenue growth, margin expansion, and operational efficiency. For Q1 2025, Delta expects revenue growth of 7%-9%, operating margins of 6%-8%, and EPS of $0.70-$1.00, nearly double the prior year’s earnings. These targets are driven by strong demand across both corporate and leisure travel, as well as the continued recovery of international travel, particularly in transatlantic and Latin markets.

Source: DAL December Quarter 2024 Results

Delta’s strategic focus on premium revenue streams is a key driver of its growth. In 2024, premium revenue grew 8% year-over-year, outpacing main cabin growth, and is expected to continue expanding in 2025. The company plans to allocate 85% of new seats to premium cabins, with 80% of domestic growth concentrated in its most profitable hubs. Internationally, Delta is capitalizing on strong demand in transatlantic routes, where unit revenues are expected to grow mid-single digits, and Latin America, where capacity investments are maturing. The airline’s partnership with LATAM and the integration of Korean Air’s acquisition of Asiana will further enhance its global connectivity and revenue potential.

Delta is also leveraging technology and innovation to differentiate itself in the market. The introduction of Delta Concierge, a generative AI-powered virtual assistant, and the expansion of Delta Sync with exclusive partnerships like YouTube Premium and Uber, are designed to enhance customer experience and deepen loyalty. These initiatives are expected to drive higher engagement with the SkyMiles program, which contributed $7.4 billion in revenue in 2024, up 9% year-over-year.

In terms of market trends, Delta is well-positioned to benefit from the ongoing recovery in international travel and the strong demand for experiential spending among U.S. consumers. The airline is also addressing sustainability through investments in sustainable aviation fuel (SAF) and fuel-efficient aircraft, aligning with global environmental goals and consumer preferences.

Source: news.delta.com

Financially, Delta expects to generate over $4 billion in free cash flow in 2025, supporting debt reduction and strategic investments. The company plans to repay $3 billion of debt maturities and reduce its leverage ratio to 2x or below, reinforcing its investment-grade balance sheet. With a clear focus on efficient growth, premium revenue, and customer-centric innovation, Delta is poised to deliver another year of industry-leading performance in 2025.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.