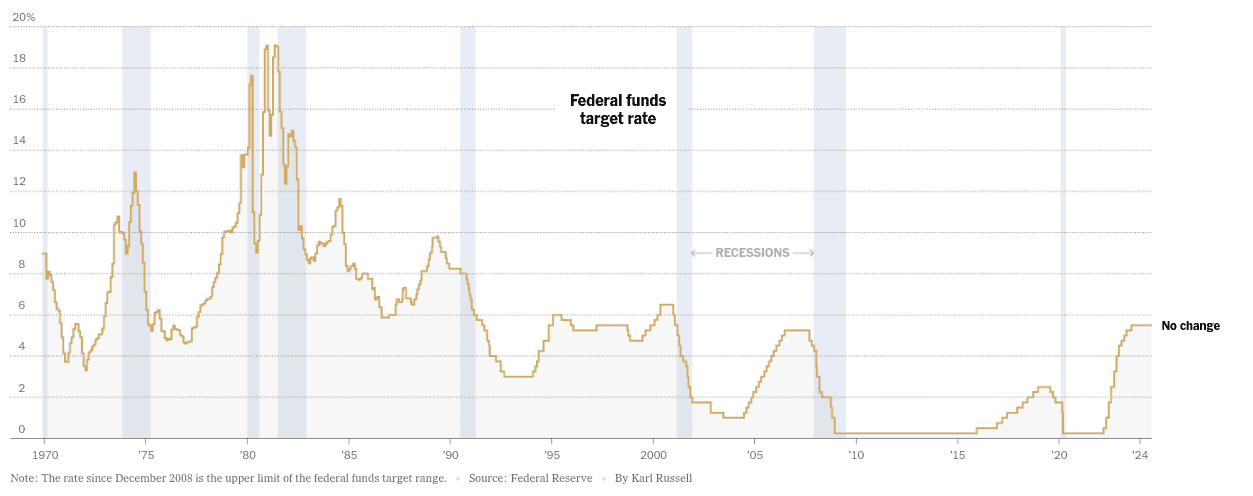

Interest rate cuts by the Federal Reserve create diverse opportunities for ETFs. Lower interest rates generally reduce borrowing costs, boost consumer spending, and spur economic growth. This impacts various sectors and asset classes differently.

Source: fortune.com

Bond ETFs: Bond ETFs typically benefit from falling interest rates. As rates drop, bond prices rise, leading to capital gains for investors in bond ETFs. The Vanguard Total Bond Market ETF (BND) is a prime example. It provides exposure to a broad range of U.S. bonds. Lower rates can enhance its performance due to rising bond prices.

Real Estate ETFs: Real estate investment trusts (REITs) are sensitive to interest rates. Lower rates reduce financing costs, which boosts profitability. The Vanguard Real Estate ETF (VNQ) could see gains. Lower mortgage rates increase demand for properties, positively impacting REITs.

Dividend ETFs: Dividend-paying stocks become attractive in a low-rate environment. Investors seek higher yields than what bonds offer. The Schwab U.S. Dividend Equity ETF (SCHD) focuses on high-dividend stocks. Lower rates can drive more investors to such ETFs for better returns.

Gold ETFs: Gold often performs well when rates fall. Lower rates reduce the opportunity cost of holding non-yielding assets like gold. The SPDR Gold Shares ETF (GLD) benefits from this trend. Investors might flock to gold as a hedge against currency devaluation.

Financial Sector ETFs: Banks and financial institutions face challenges with lower rates. Reduced lending margins can impact profitability. The Financial Select Sector SPDR Fund (XLF) may underperform in a falling rate environment. However, improved economic conditions could offset some negative effects.

Technology Sector ETFs: Tech companies often benefit from lower rates. Reduced borrowing costs can finance expansion and innovation. The Invesco QQQ ETF (QQQ), which tracks the Nasdaq-100 Index, could see positive effects. Increased consumer spending on tech products and services also boosts this sector.

Consumer Discretionary ETFs: Lower interest rates can increase consumer spending on non-essential goods. The Consumer Discretionary Select Sector SPDR Fund (XLY) stands to benefit. As borrowing costs decrease, consumers might spend more on luxury and leisure products.

Emerging Markets ETFs: Emerging markets often gain from a weaker U.S. dollar, a likely outcome of rate cuts. Lower rates can depreciate the dollar, making exports from emerging markets more competitive. The iShares MSCI Emerging Markets ETF (EEM) provides exposure to these regions. Rate cuts could enhance its performance by boosting economic activity in emerging markets.

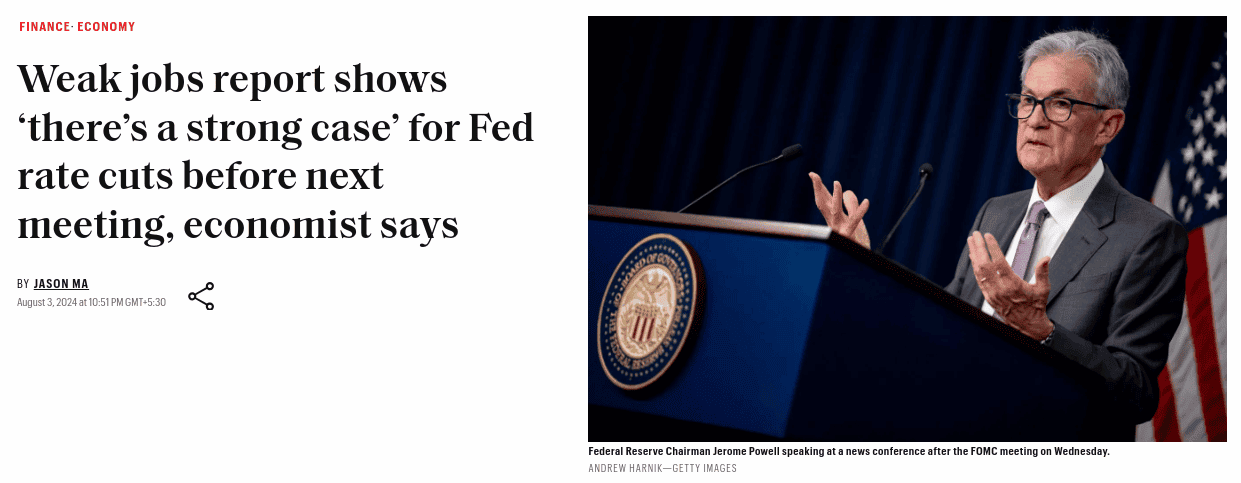

High Yield Corporate Bond ETFs: Lower rates make high-yield bonds more attractive. Investors seek higher returns than what low-rate government bonds offer. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) focuses on this segment. Rate cuts can drive more investment into high-yield bonds.

Source: tradingview.com

I. Introduction

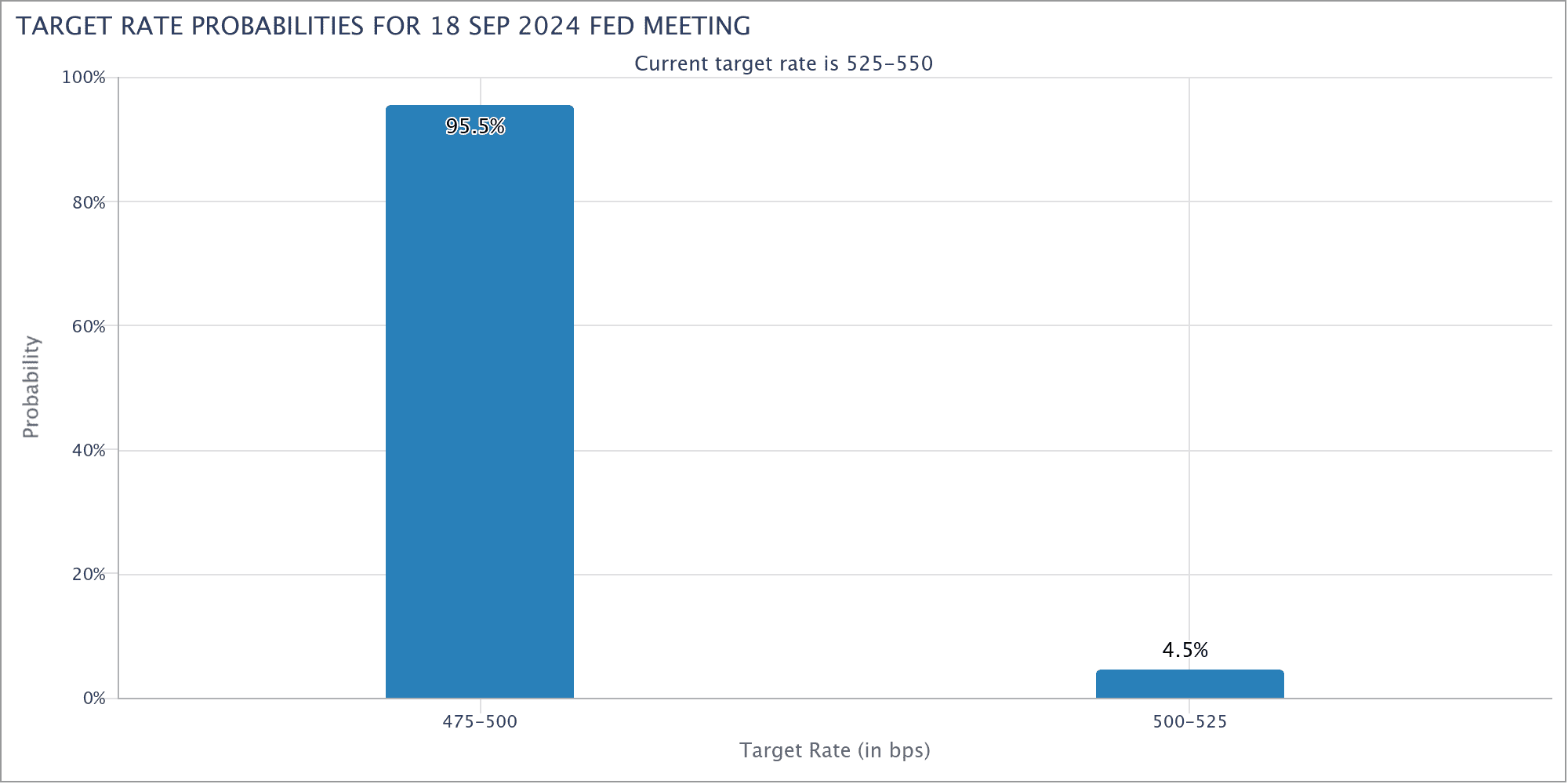

The Federal Reserve's upcoming interest rate decision holds significant implications for investors. In July 2024, the Fed decided to keep rates steady at 5.25% to 5.5%. This decision followed a prolonged period of high rates intended to combat inflation. Despite maintaining current rates, the Fed hinted at potential rate cuts in the near future, particularly in September. The street is expecting the same heavily.

This article explores the potential impacts of a rate cut on various economic sectors and investment strategies. Investors need to adjust their strategies in anticipation of this shift. Understanding the Fed's actions and their broader implications is crucial for making informed investment decisions.

Overview of the Fed's upcoming interest rate decision and its potential impacts

The Fed's decision to keep rates unchanged reflects a cautious approach. It aims to balance inflation control with economic stability. Jerome Powell, Fed Chair, indicated that while inflation has eased, further confirmation is needed before implementing rate cuts. This stance reflects the Fed's commitment to a data-driven approach.

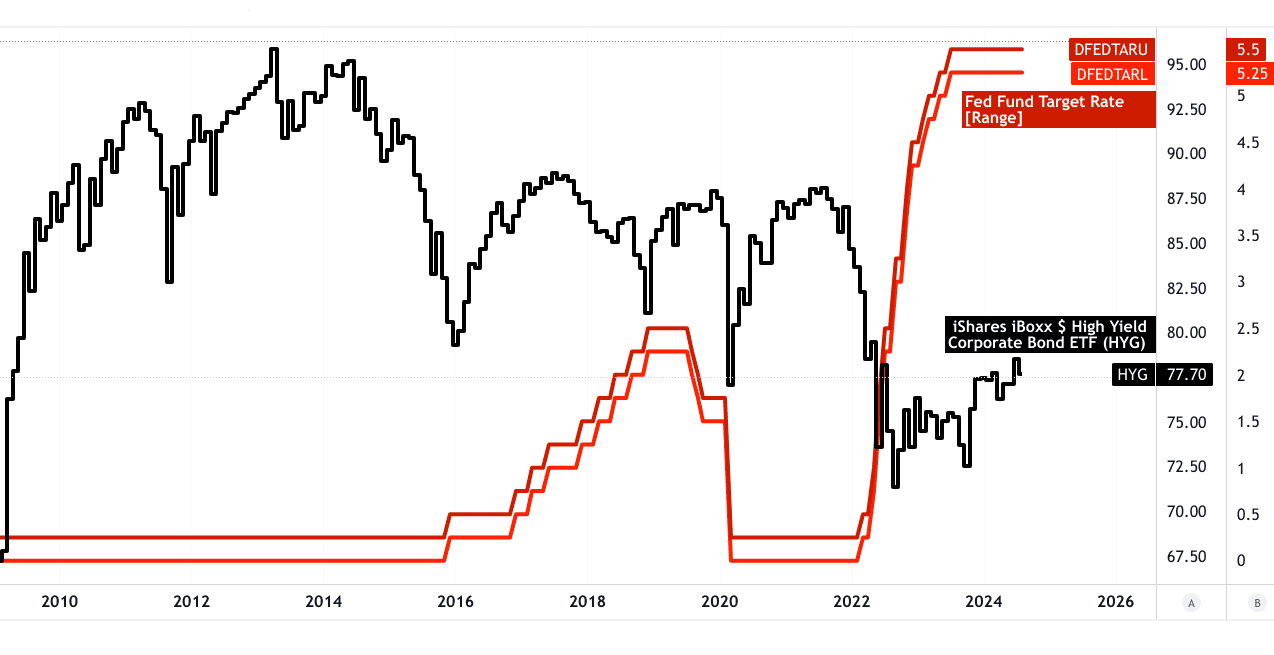

Recent economic indicators suggest that inflation is trending towards the Fed's 2% target. However, the labor market remains a key consideration. Powell emphasized that the Fed is monitoring both inflation and employment metrics closely. The Fed's July statement marked a shift from focusing solely on inflation to considering the impact of high rates on employment.

Source: reuters.com

Importance for investors to adjust their strategies in anticipation of rate cuts

Markets responded positively to the Fed's hints of a potential rate cut. The Dow, S&P 500, and Nasdaq saw gains following Powell's speech. This rally indicates investor optimism about future monetary easing. However, the rally's fade towards the end of the day highlights market uncertainty.

Investors should prepare for potential market volatility as the Fed approaches its September meeting. A rate cut could influence borrowing costs, consumer spending, and corporate investment. These factors will affect stock market performance and investment returns.

II. Market Anticipation and Reactions

Market Focus on Fed Meeting

The market's anticipation of the Federal Reserve's rate cut decision has been intense. The Fed has maintained its current interest rate of 5.25%-5.50%, signaling a potential cut soon. Investors and Wall Street are keenly awaiting the Fed’s next move.

Source: cmegroup.com

Fed Chair Jerome Powell’s recent statement suggests that a rate cut could be on the table for September if inflation continues to fall and the labor market remains steady. However, Powell left room for the possibility of holding rates steady if inflation worsens.

Wall Street has reacted positively to the Fed’s indication that a rate cut might be imminent. The NASDAQ and S&P 500 indexes saw significant gains following the Fed’s announcement. Analysts believe that the Fed’s cautious approach reflects a strategy to avoid premature rate cuts that could jeopardize progress on inflation. Economists and investors are divided on the timing of a rate cut. Some argue that even a July cut would have been too late, citing the need for quicker action given the inflation data. The PCE index, a key inflation measure, has been approaching the Fed’s 2% target, but economists are wary of declaring victory prematurely.

The market's anticipation of the Fed's rate cut decision

Powell emphasized the need for “more good data” to ensure inflation trends are stable. Investors agree that waiting until September provides additional time to assess economic indicators, such as CPI reports, which could confirm the disinflationary trend. Despite recent positive inflation data, including a slight dip in the consumer price index, inflation remains above comfortable levels for the Fed. The data has been inconsistent, making it challenging for the Fed to decide on an immediate rate cut without risking economic setbacks.

Economists like Paul Krugman and Oscar Muñoz criticize the Fed's caution, arguing that waiting too long could harm the labor market. Some economists believe that the Fed should have acted sooner to cut rates, while others support the Fed's wait-and-see approach, citing concerns about economic stability and inflation persistence. The Fed’s strategy involves balancing its dual mandate: controlling inflation and maintaining employment. Recent job data has shown a rise in unemployment, adding urgency to the Fed’s decision-making process. Powell has indicated that further cooling in the labor market could prompt a more immediate rate cut.

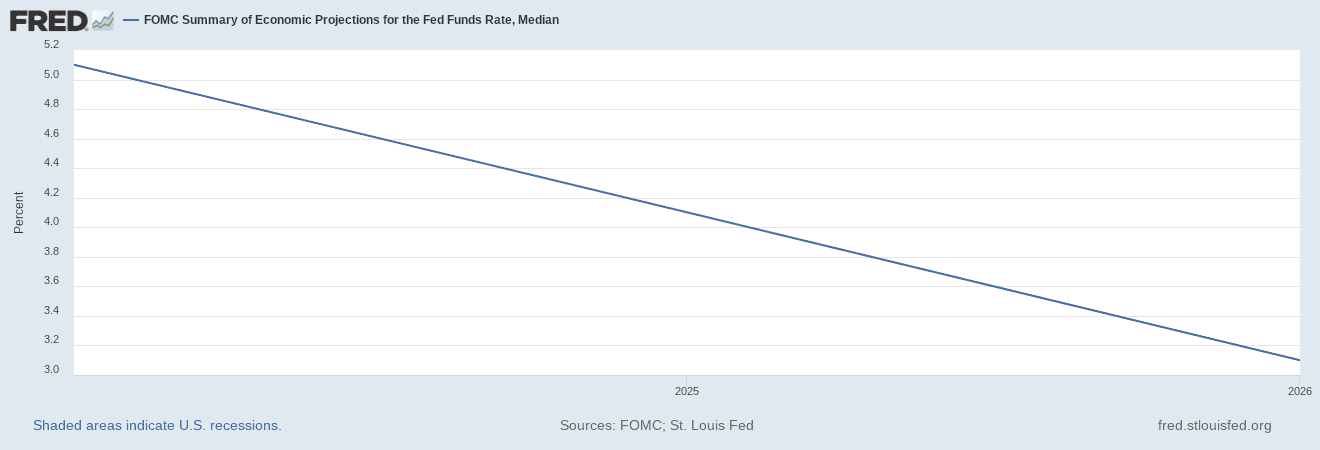

Source: fred.stlouisfed.org

How Wall Street is preparing for potential changes

Investors are preparing for potential rate cuts by adjusting their portfolios. Historically, lower rates stimulate economic growth and benefit sectors such as technology, real estate, and small-cap stocks. Lower borrowing costs can enhance profitability for companies and increase cash flow for real estate investment trusts (REITs). As the Fed’s decision looms, investors should be cautious about making drastic changes based on rate predictions. Instead, focusing on long-term investment strategies and monitoring broader economic indicators will be crucial in navigating potential rate cuts. Overall, the Fed’s decision-making process reflects a cautious approach aimed at ensuring inflation control while avoiding undue harm to the labor market. Investors are closely watching for further signals and data that could influence the Fed's next steps.

III. Historical Context and Current Trends

Historical Impact of Rate Cuts

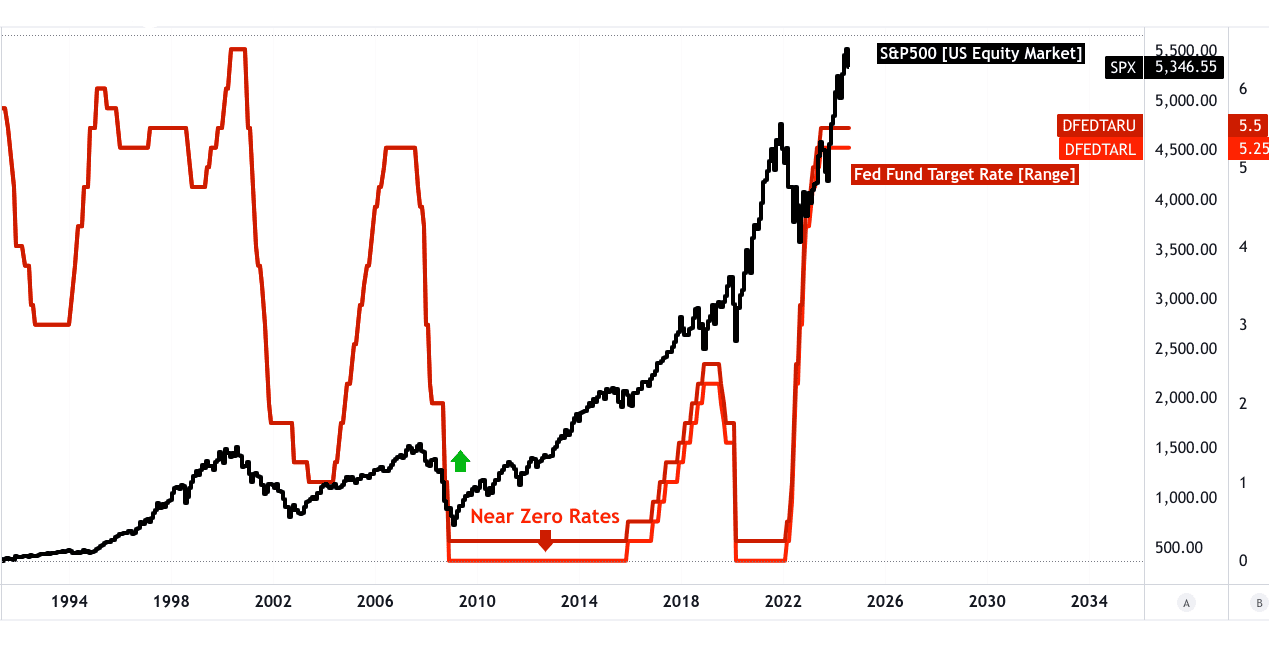

Historically, Federal Reserve rate cuts have had varied impacts on financial markets. In the 1980s, rate cuts were often implemented to combat high inflation. The cuts typically boosted stock prices as borrowing costs decreased, encouraging spending and investment. For bonds, lower rates usually led to price increases, as existing bonds with higher rates became more attractive.

During the 2008 financial crisis, the Fed slashed rates to near zero. This move aimed to stimulate economic activity. It led to a rise in both stock and bond prices as investors sought higher returns in a low-rate environment. The Fed's aggressive rate cuts helped stabilize the economy but also led to prolonged low interest rates and asset bubbles.

In 2020, the Fed cut rates in response to the COVID-19 pandemic. The swift reduction to near zero was designed to support economic activity during the lockdowns. The stock market initially fell but then rebounded sharply as liquidity increased and government stimulus measures were introduced. Bond prices soared as investors sought safety and higher yields in a low-rate environment.

Source: tradingview.com

Current Market Trends

Currently, U.S. Treasury prices have been rising, reflecting investor expectations of potential rate cuts. This trend suggests that investors are anticipating a more accommodative monetary policy in the near future. As the Fed holds rates steady, Treasury prices have been buoyed by demand for safe-haven assets amid uncertain economic conditions.

The rise in Treasury prices can be attributed to expectations of future rate cuts. Investors often buy Treasuries when they anticipate that interest rates will fall, as this increases the value of existing bonds. The current trend indicates a market belief that the Fed may soon lower rates to support economic growth.

The stock market's response has been mixed. Initially, high interest rates led to declines in stock prices, particularly in sectors sensitive to borrowing costs. However, as rates have stabilized and expectations of cuts grow, some sectors have begun to recover. Technology and growth stocks, which are more sensitive to interest rate changes, have seen improved performance.

IV. Impact on Various Asset Classes

US Treasuries

US Treasuries often rise during initial rate cuts due to investor behavior. When the Federal Reserve cuts rates, bond yields decrease. Lower rates make existing bonds with higher yields more attractive. Investors flock to these higher-yielding bonds. This increased demand drives up Treasury prices. Consequently, Treasury prices rise as yields fall.

Rate cuts usually signal economic concerns or a slowing economy. Investors seek safety in U.S. Treasuries during uncertain periods. Treasuries are considered safe-haven assets. They offer low risk compared to other investments. As investors move money into Treasuries, their prices climb.

The Bloomberg U.S. Treasury Index tracks the performance of Treasuries. This index includes U.S. government bonds of various maturities. Recent performance has shown notable increases. The index reflects higher demand for Treasuries amid economic uncertainty. Investors have gravitated towards Treasuries as the Fed cuts rates. This trend is evident in the index's recent upward trajectory.

In the past months, the Bloomberg U.S. Treasury Index has shown gains. Lower yields have boosted bond prices. Economic fears have led investors to Treasuries. These conditions have supported higher Treasury prices. The index's performance is a direct result of these investor actions.

Source: Bloomberg.com

The recent performance of U.S. Treasuries aligns with historical patterns. Rate cuts typically enhance Treasury demand. This effect is due to the lower yields offered by newly issued bonds. Existing bonds with higher yields become more desirable. The Bloomberg U.S. Treasury Index illustrates this trend clearly.

V. Specific ETF Recommendations

Medium and Long-Term U.S. Treasury ETFs

Attractiveness During Rate Cuts

Medium and long-term U.S. Treasury ETFs benefit from falling interest rates. Bond prices rise when rates drop. Longer-duration Treasuries gain more from rate cuts. They have higher price sensitivity to interest rate changes. Investors seek safety and yield during economic uncertainty. Rate cuts lead to increased demand for Treasuries. ETFs focusing on longer maturities offer higher returns. These ETFs become attractive during periods of declining rates.

Key ETFs

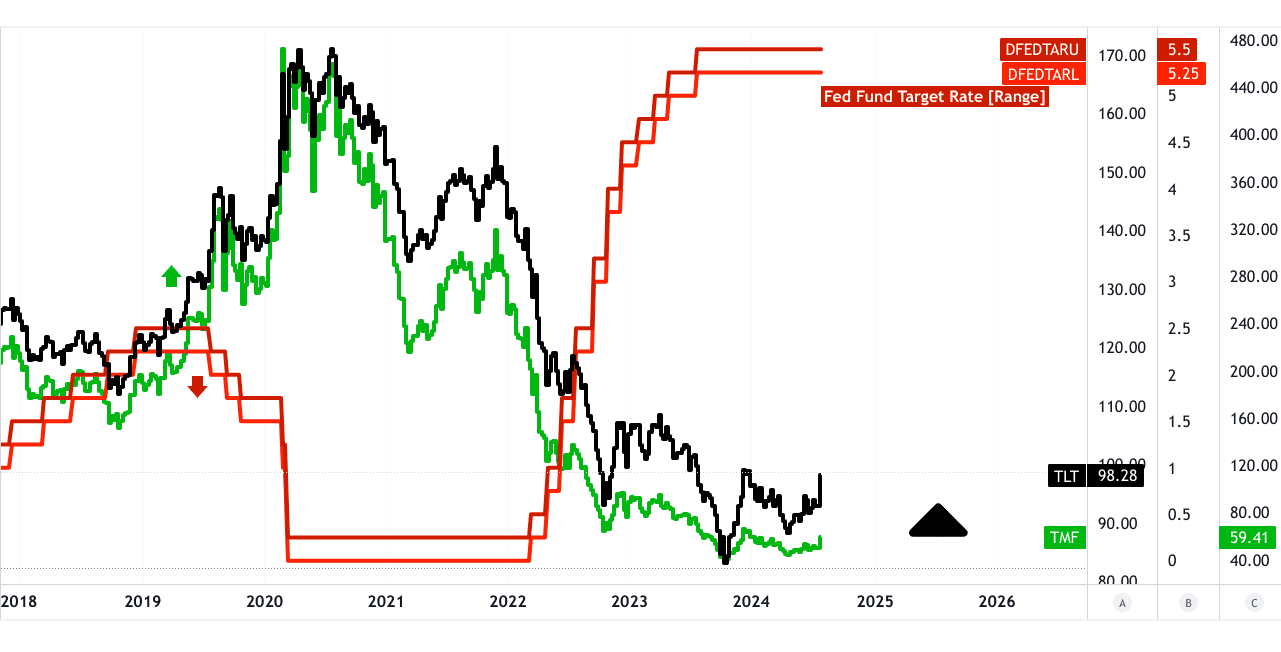

● iShares 20+ Year Treasury Bond ETF (TLT.US)

The TLT ETF targets long-duration U.S. Treasuries. It holds bonds with maturities over 20 years. Long-duration bonds are highly sensitive to interest rate changes. When rates fall, TLT’s bond prices increase significantly. This ETF provides high potential returns in a rate-cut environment. It is ideal for investors seeking exposure to long-term U.S. government debt. The TLT ETF offers a direct play on long-term Treasury yields.

● Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)

The TMF ETF is a triple-leveraged fund. It aims to amplify daily returns of 20+ year U.S. Treasuries. The ETF uses leverage to magnify price movements. It is designed for short-term trades and high-return potential. TMF offers greater volatility and risk due to its leverage. The ETF is suitable for aggressive investors. It capitalizes on short-term rate cuts with amplified returns. TMF is not for long-term holding due to its daily rebalancing.

Source: tradingview.com

These ETFs cater to different risk profiles and investment strategies. TLT provides steady returns with less volatility. TMF offers high-risk, high-reward potential in the short term. Both ETFs benefit from declining interest rates, but in different ways.

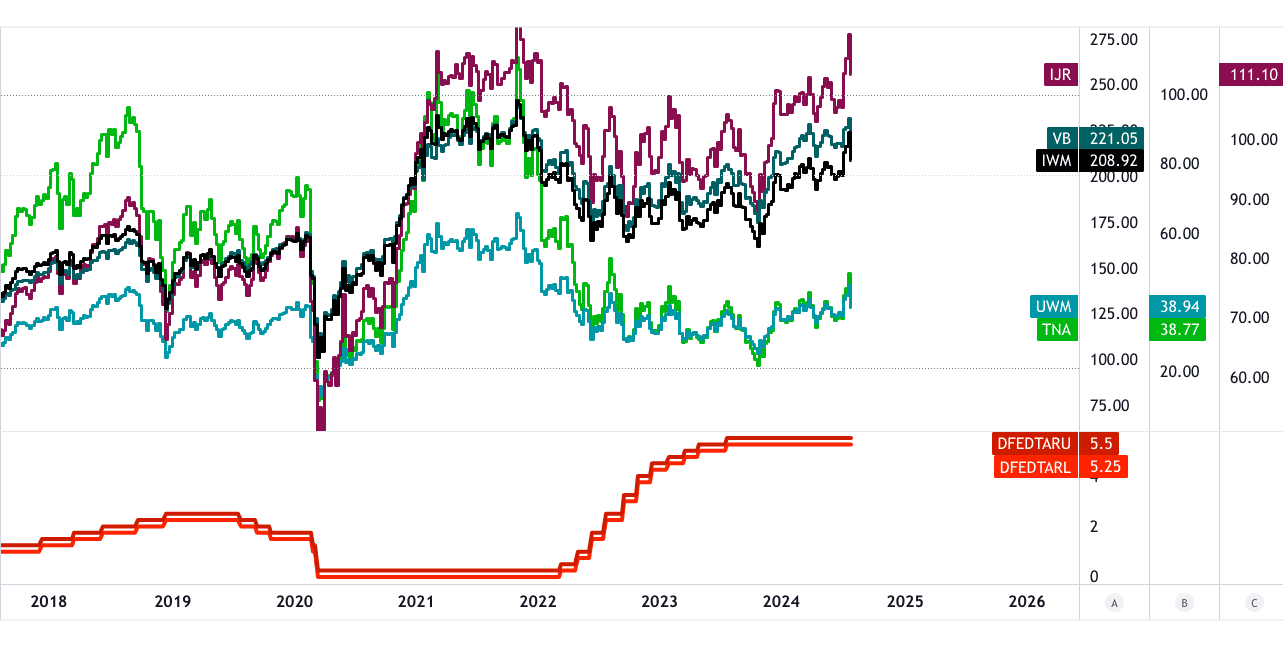

Small-Cap Stock ETFs

Benefits of Small-Cap Stocks in a Low-Interest-Rate Environment

Small-cap stocks often outperform during low-interest-rate environments. Lower rates reduce borrowing costs for small companies. Access to cheaper capital can drive their growth. Small-cap stocks generally benefit from increased consumer spending. Lower rates can stimulate economic growth, boosting small businesses. They tend to be more nimble and responsive to economic changes. Small-cap stocks usually offer higher growth potential compared to large-cap stocks. In a low-rate environment, their growth prospects can be enhanced. They may see significant price appreciation when capital is cheaper.

Key ETFs

iShares Russell 2000 ETF (IWM.US)

Tracks the Russell 2000 Index, representing small-cap stocks. Provides broad exposure to U.S. small-cap equities. Often used as a benchmark for small-cap performance. Reflects the performance of 2,000 small-cap U.S. companies. Includes diverse sectors and industries. Offers liquidity and ease of trading.

Vanguard Small-Cap ETF (VB.US)

Tracks the CRSP U.S. Small Cap Index. Includes small-cap stocks across various industries. Provides exposure to growth-oriented small-cap companies. Offers a lower expense ratio compared to peers. Focuses on a broad range of small-cap stocks.

iShares S&P Small-Cap 600 ETF (IJR.US)

Tracks the S&P SmallCap 600 Index. Focuses on small-cap stocks with growth potential. Provides exposure to 600 small-cap U.S. companies. Reflects companies across different sectors. Includes a mix of value and growth stocks.

Leveraged Small-Cap ETFs for Aggressive Strategies

ProShares Ultra Russell2000 (UWM.US)

Offers 2x leveraged exposure to the Russell 2000 Index. Aims to amplify daily returns. Designed for short-term trading strategies. High risk due to leverage but potential for high returns.

Direxion Daily Small Cap Bull 3X Shares (TNA.US)

Provides 3x leveraged exposure to small-cap stocks. Aims for three times the daily return of the Russell 2000 Index. Targets aggressive investors seeking high returns. Suitable for short-term, high-risk strategies.

Source: tradingview.com

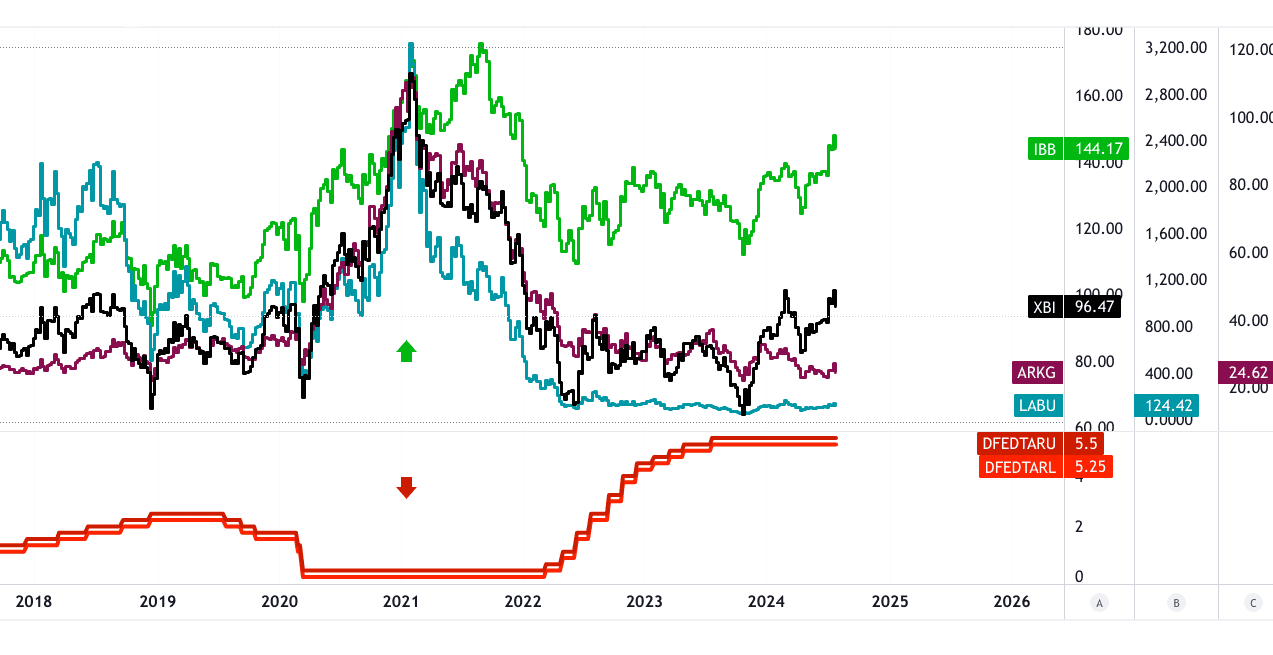

Biotechnology ETFs

Opportunities in the Biotech Sector During Low-Interest Periods

Biotech companies often require substantial capital for research and development. Low-interest rates reduce borrowing costs for these companies. Access to cheaper financing can accelerate innovation and drug development. Lower rates can facilitate mergers and acquisitions in the biotech sector. Increased merger activity can lead to higher valuations and growth potential. Active financing conditions improve the sector's investment attractiveness. Biotech firms benefit from reduced capital costs, enhancing their growth prospects. Low rates often lead to increased investment in high-risk, high-reward sectors like biotech. This environment supports biotech companies seeking expansion and new technologies.

Key ETFs

SPDR S&P Biotech ETF (XBI.US)

Tracks the S&P Biotechnology Select Industry Index. Provides broad exposure to biotech stocks. Includes small-cap, mid-cap, and large-cap biotech companies. Diversifies risk across various biotech firms. Focuses on companies involved in biotechnology research and development.

ARK Genomic Revolution ETF (ARKG.US)

Invests in companies involved in genomic research and technologies. Includes firms developing gene-editing and genomic therapies. Focuses on innovation in the field of genomics. Targets high-growth companies driving advancements in genetic technologies. Provides exposure to disruptive technologies in biotechnology.

iShares Nasdaq Biotechnology ETF (IBB.US)

Tracks the Nasdaq Biotechnology Index. Includes large and mid-cap biotechnology and pharmaceutical companies. Provides exposure to established biotech firms. Focuses on companies with significant drug pipelines and research activities. Reflects the performance of major biotech stocks listed on Nasdaq.

Leveraged Biotech ETF for Higher Risk

Direxion Daily S&P Biotech Bull 3X Shares (LABU.US)

Offers 3x leveraged exposure to the S&P Biotechnology Select Industry Index. Aims for three times the daily return of the biotech sector. Designed for aggressive investors seeking amplified returns. High risk due to leverage, suitable for short-term trading. Potential for substantial gains or losses based on biotech sector movements.

Source: tradingview.com

Gold ETFs

Favorable Outlook for Gold During Rate Cuts

Gold benefits during rate cuts due to its status as a non-interest-bearing asset. Lower interest rates reduce the opportunity cost of holding gold. The appeal of gold increases when real interest rates decline. Gold typically performs well when central banks cut rates. The inverse relationship with the dollar supports gold's price during rate cuts. Lower interest rates weaken the dollar, boosting gold’s appeal. Gold is seen as a hedge against inflation and currency devaluation. Investors flock to gold for safety during economic uncertainty. As rates drop, gold becomes an attractive investment for preserving wealth.

Key ETFs

SPDR Gold Shares (GLD.US)

Tracks the price of gold bullion. Designed to reflect the performance of gold. One of the largest and most liquid gold ETFs. Provides direct exposure to the price of gold. Holds physical gold bars in secure vaults.

iShares Gold Trust (IAU.US)

Seeks to reflect the performance of the price of gold. Provides a cost-effective way to invest in gold. Holds physical gold bullion to back the shares. Lower expense ratio compared to other gold ETFs. Offers high liquidity and transparency.

SPDR Gold MiniShares Trust (GLDM.US)

Tracks the price of gold, like GLD but at a lower cost. Designed to offer exposure to gold with lower fees. Holds physical gold bullion, similar to GLD. Smaller share size makes it accessible to more investors. Provides an efficient way to gain gold exposure.

Aberdeen Standard Gold ETF Trust (SGOL.US)

Seeks to track the price of gold bullion. Holds physical gold in secure vaults in Switzerland. Offers a hedge against inflation and currency risk. Provides exposure to gold with a focus on security. Lower expense ratio compared to other gold ETFs.

Leveraged Gold ETF for Aggressive Investors

MicroSectors Gold 3X Leveraged ETN (SHNY.US)

Offers 3x leveraged exposure to gold’s daily performance. Designed for short-term, high-risk, high-reward strategies. Aims to provide three times the daily return of gold. High volatility and risk due to leverage. Suitable for aggressive investors seeking amplified gains.

Source: tradingview.com

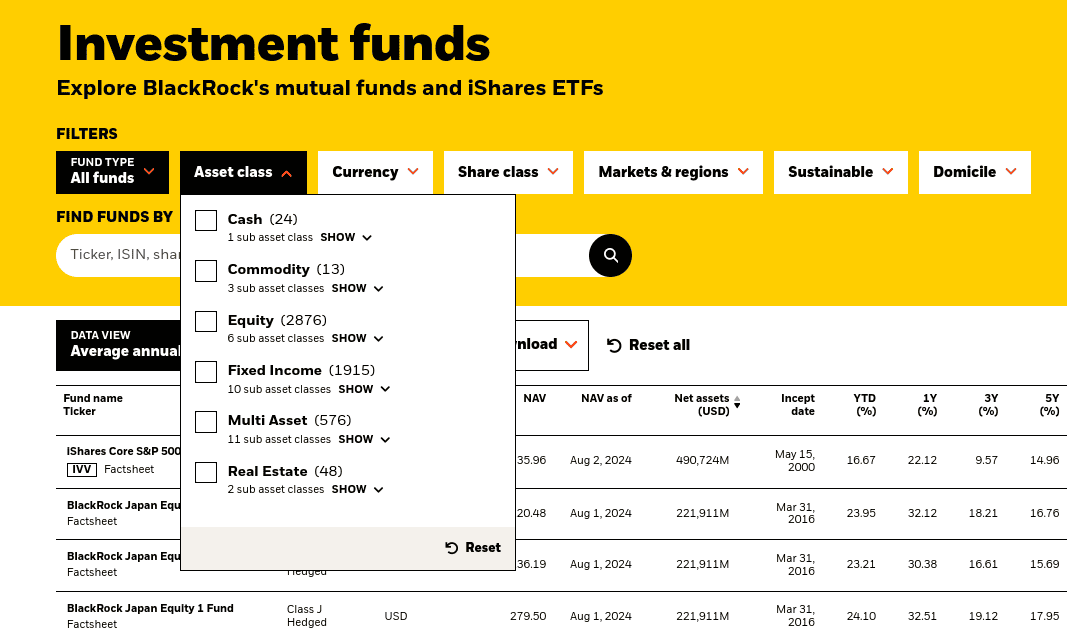

VI. Strategic Considerations for Investors

ETF Selection Strategies

Using ETF Screeners to Find Suitable ETFs

ETF screeners help identify ETFs based on specific criteria. Screeners can filter ETFs by performance, fees, and holdings. They allow investors to compare ETFs across various metrics. Useful for narrowing down options based on investment goals. Screeners can identify ETFs that match market sectors or asset classes. They provide data on historical returns and volatility. Screeners often include features for assessing liquidity and expense ratios. Investors should use screeners to refine their ETF choices efficiently.

Source: blackrock.com

Building a Strategy Based on Individual Risk Tolerance and Market Outlook

Investors should assess their risk tolerance before selecting ETFs. Risk tolerance determines how much volatility an investor can handle. Strategies vary from conservative to aggressive, based on risk appetite. Market outlook influences the choice of sector-specific or broad-based ETFs. A bullish market outlook might favor aggressive growth ETFs. A bearish or uncertain outlook may favor defensive or income-generating ETFs. Strategy should align with investment objectives and time horizon. Regularly review and adjust strategies based on changing market conditions.

Diversification and Risk Management

Importance of Maintaining a Diversified Portfolio

Diversification reduces the impact of poor performance from individual investments. A well-diversified portfolio spreads risk across various asset classes. It helps to mitigate risks associated with market volatility. Diversification can include stocks, bonds, and other asset classes. It can also involve different sectors and geographic regions. By diversifying, investors lower their overall portfolio risk. Diversified portfolios are less vulnerable to the performance of any single investment.

Managing Risks Associated with Leveraged ETFs

Leveraged ETFs use financial derivatives to amplify returns. They are highly sensitive to market movements. Leveraged ETFs can lead to significant gains or losses in short periods. Due to daily compounding, returns may deviate from the underlying index. They are designed for short-term trading, not long-term holding. Investors should understand the risks before investing in leveraged ETFs. Regular monitoring and rebalancing are crucial for managing risks. Avoid using leveraged ETFs as core investments in a portfolio.

VII. Conclusion

Fed rate cuts typically impact various asset classes differently. U.S. Treasuries often rise due to falling yields. Medium and long-term U.S. Treasury ETFs like TLT and TMF benefit from this trend. Small-cap stock ETFs gain in a low-interest environment due to increased risk appetite. Key ETFs include IWM, VB, and IJR. Leveraged small-cap ETFs, such as UWM and TNA, offer aggressive strategies. Biotechnology ETFs thrive during low-interest periods due to active financing and mergers. Notable ETFs are XBI, ARKG, and IBB. The leveraged ETF LABU provides higher risk for aggressive investors. Gold ETFs benefit from rate cuts due to their non-interest-bearing nature. Key ETFs include GLD, IAU, GLDM, and SGOL. SHNY offers leveraged exposure for aggressive strategies.

Stay Informed and Strategically Adjust Their Portfolios

Investors should stay informed about macroeconomic changes and market trends. Regularly review how rate cuts affect various asset classes. Adjust portfolios based on evolving market conditions and personal risk tolerance. Diversify investments to manage risk effectively and capitalize on opportunities. Leverage ETF screeners to identify suitable investment options. Maintain a balanced approach, especially when using leveraged ETFs. Stay aware of economic indicators and adjust strategies accordingly. Regular portfolio adjustments help align investments with financial goals and market dynamics.

Source: nytimes.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.