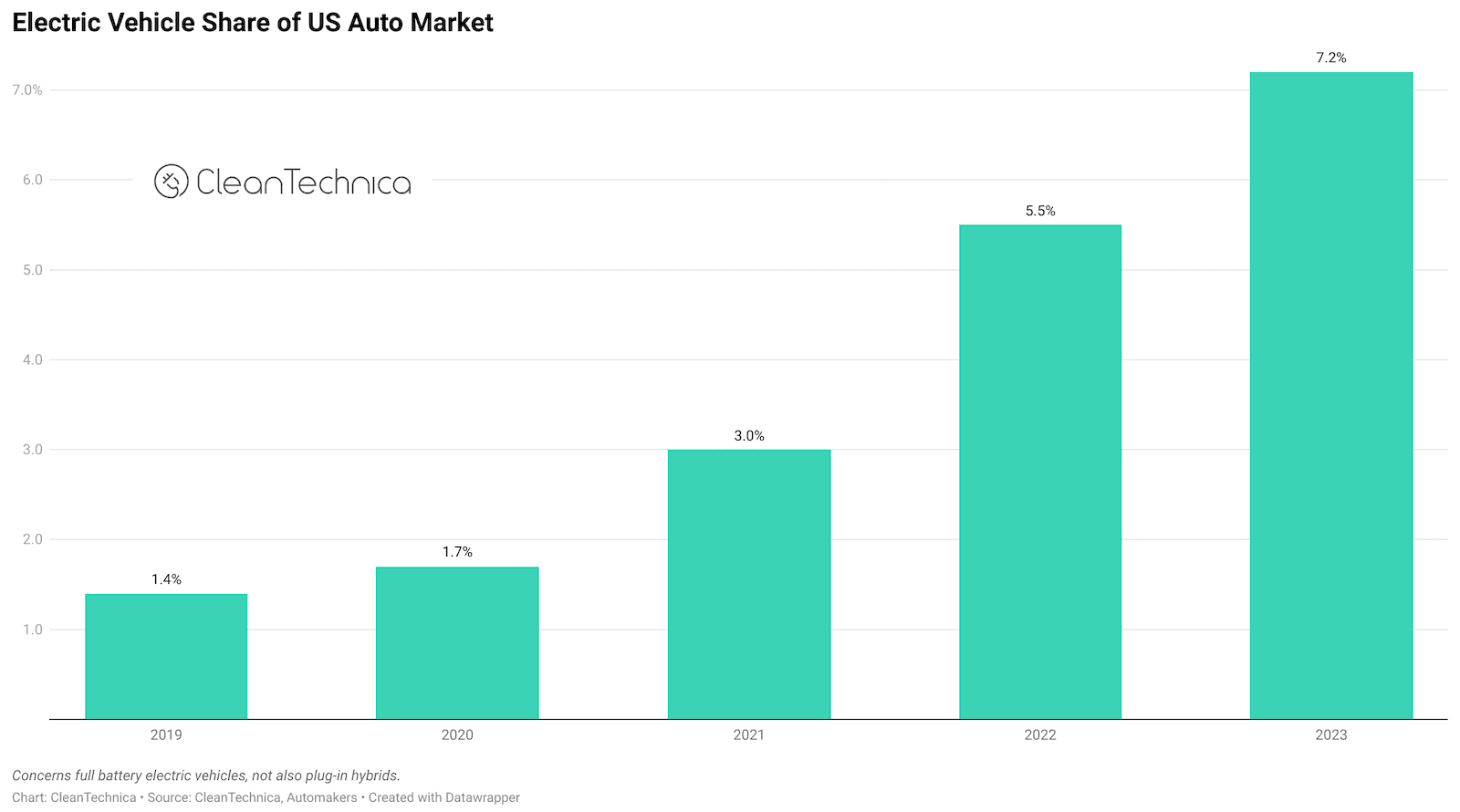

Electric vehicles (EVs) are powered by electric motors and rely on batteries for energy storage. They emit zero tailpipe emissions, reducing air pollution. As global concerns over climate change grow, EVs play a crucial role in transitioning away from fossil fuel dependency. This shift is essential for reducing greenhouse gas emissions and achieving climate goals. Governments worldwide are promoting EV adoption through subsidies, tax credits, and investments in charging infrastructure, driving the growth of the EV market.

Source: cleantechnica.com

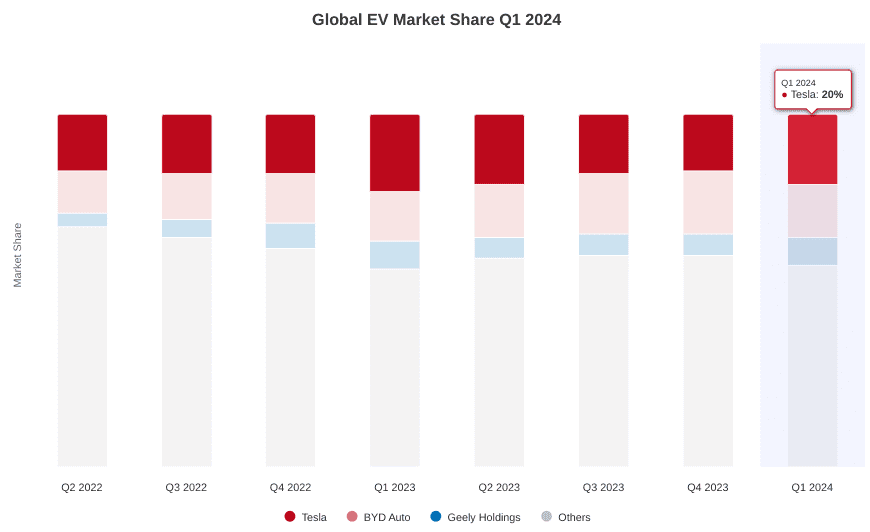

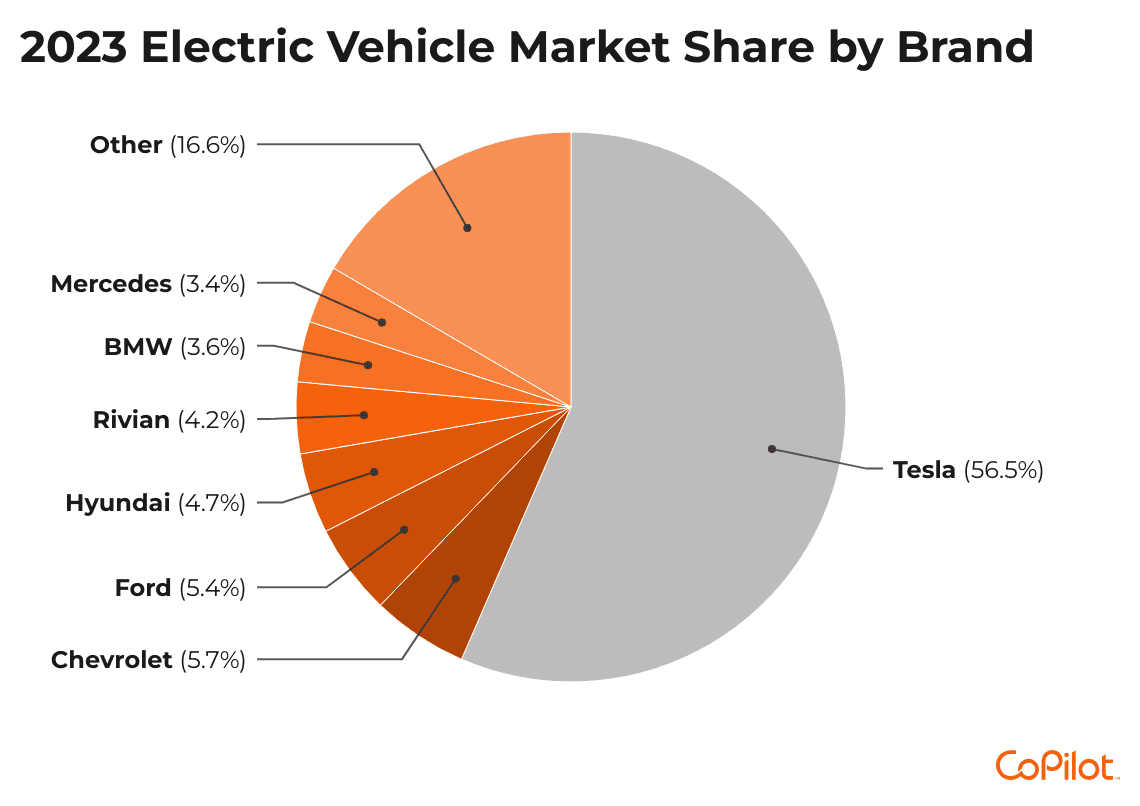

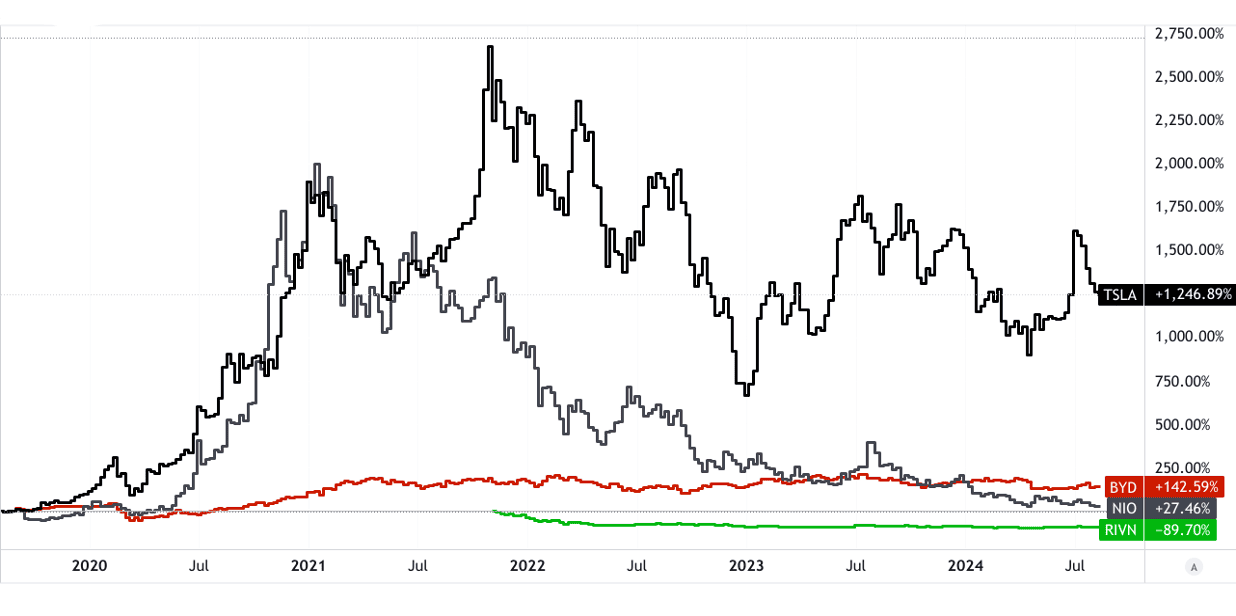

Major companies dominate the EV market, each contributing to its rapid expansion. Tesla (TSLA) is the most prominent player, known for pioneering the mass production of EVs. Its Model S, Model 3, and other vehicles have set industry standards. Nio (NIO), a leading Chinese EV manufacturer, specializes in premium electric SUVs and offers battery-swapping technology. Rivian (RIVN), an American startup, focuses on electric trucks and SUVs, targeting the adventure and off-road market segments. BYD, a Chinese company, is one of the world’s largest EV manufacturers, producing a diverse range of electric vehicles, including buses, which have significant market penetration globally.

Source: counterpointresearch.com

[2023 U.S. Electric Vehicle Market Share by Brand]

Source: reddit.com

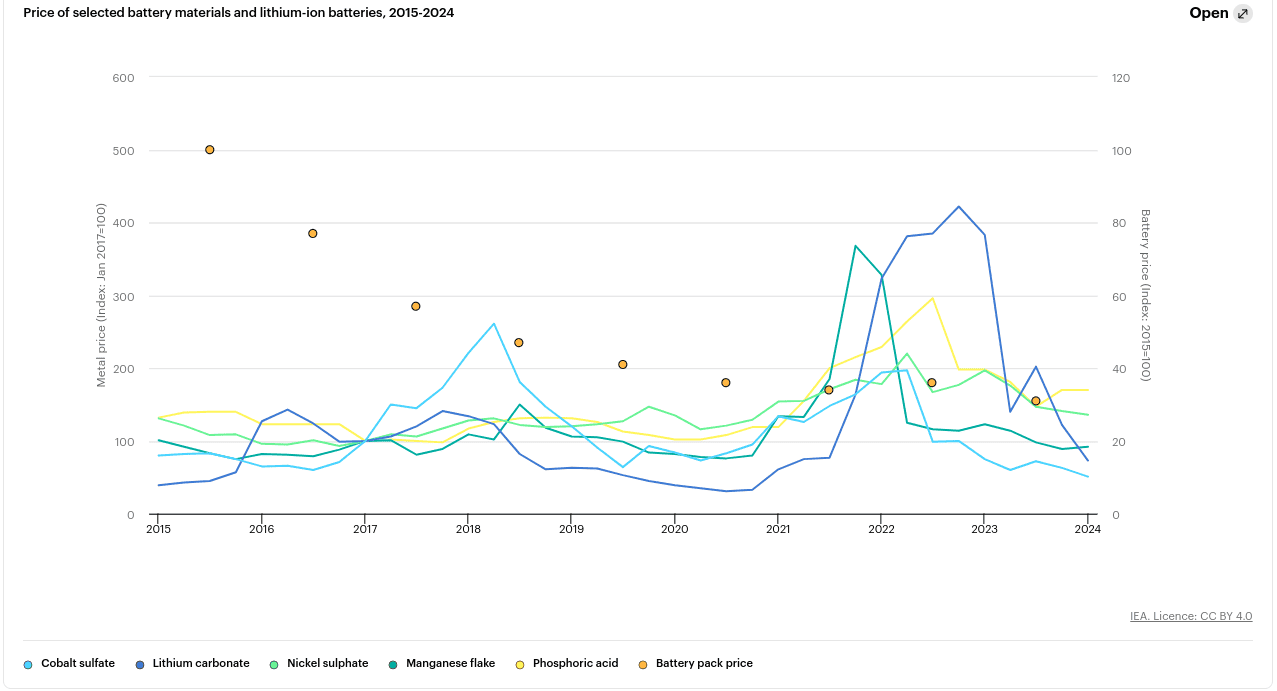

The significance of EVs extends beyond their environmental benefits. They are transforming the automotive industry, pushing innovation in energy storage, charging technology, and autonomous driving. The rise of EVs is also driving demand for new materials like lithium, cobalt, and nickel, essential for battery production. This demand is reshaping global supply chains, with regions rich in these resources gaining strategic importance. As EV adoption increases, the automotive industry is undergoing a profound shift, impacting manufacturing processes, labor markets, and the broader economy.

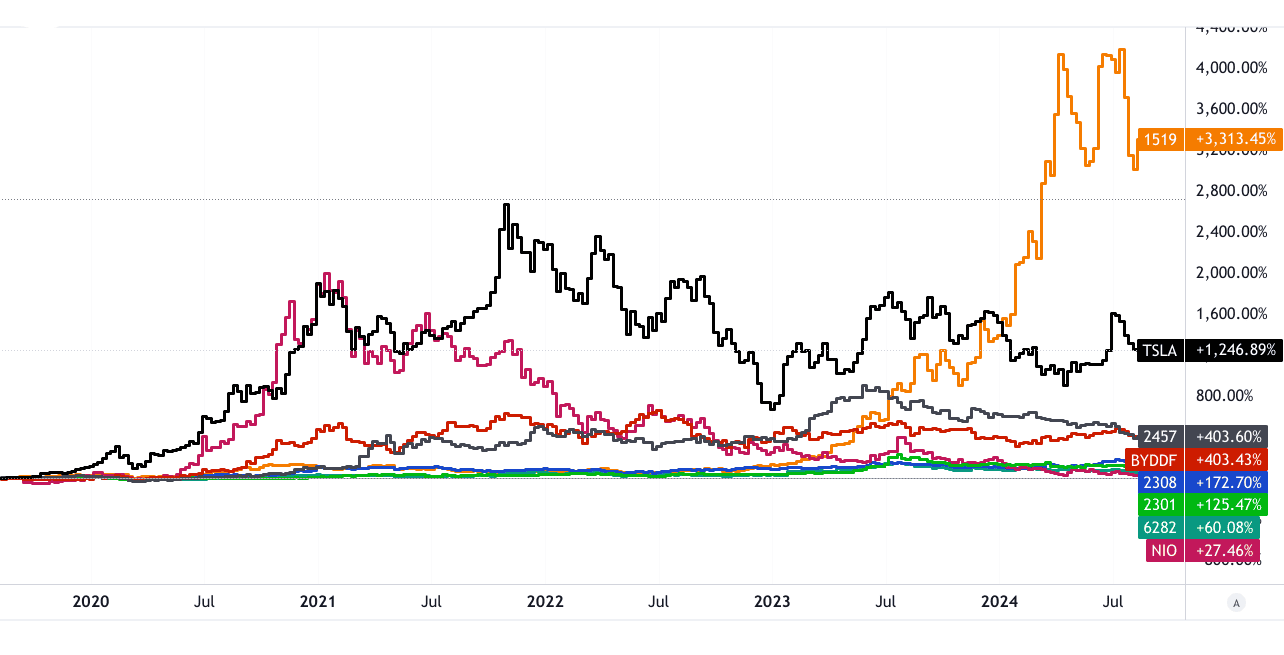

[EV Stocks 5Y Price Return]

Source: tradingview.com

The EV supply chain is complex, involving multiple stages that are interdependent. It begins with the extraction of raw materials such as lithium, cobalt, and nickel, crucial for battery production. After extraction, the materials undergo refining and processing to meet the specifications required for battery manufacturing. The refined materials are then used to produce battery cells, which are assembled into battery packs.

In addition to batteries, the EV supply chain includes the production of electric motors, power electronics, and other components specific to EVs. The final stage involves integrating these components into the vehicle during assembly. Beyond vehicle production, the supply chain extends to the development and deployment of charging infrastructure, essential for supporting EV adoption.

I. Electric Car Stocks: EV Industry Upstream Supply Chain

The electric vehicle (EV) industry heavily depends on a complex upstream supply chain that begins with the extraction and processing of critical raw materials necessary for lithium-ion battery production. This supply chain involves multiple stages, each presenting unique challenges, from environmental concerns to geopolitical risks. These stages include raw material extraction, refining, and manufacturing of batteries, which are essential for EVs.

Raw Materials

Lithium-ion batteries are at the core of EV technology. These batteries require several key materials: lithium, cobalt, nickel, manganese, and graphite. Lithium is the primary component and is predominantly sourced from the “Lithium Triangle” in South America, which includes Argentina, Bolivia, and Chile. This region holds more than 50% of the world’s lithium reserves, making it crucial to the EV supply chain. Lithium extraction, however, raises environmental concerns, particularly related to water usage. The extraction process requires large amounts of water, leading to water scarcity in these arid regions.

Source: iea.org

Cobalt is another vital material used in battery production. The Democratic Republic of the Congo (DRC) supplies nearly 70% of the world’s cobalt, making it a critical player in the EV industry. However, cobalt mining in the DRC is fraught with ethical concerns, including child labor and poor working conditions. These issues have prompted some companies to seek alternative sources of cobalt or reduce the amount used in batteries.

Nickel is essential for high-energy-density batteries, which are crucial for extending the range of EVs. Indonesia, Russia, and Canada are the leading producers of nickel, with Indonesia being the largest. However, nickel mining poses environmental risks, particularly in Indonesia, where mining activities have led to deforestation and habitat destruction.

Manganese is used to stabilize the battery structure, enhancing its performance and lifespan. Major manganese producers include South Africa, China, and Australia. Although manganese mining is less controversial than cobalt and nickel, it still presents environmental challenges, such as water pollution and land degradation.

Graphite is used in the anodes of lithium-ion batteries. China dominates global graphite production, accounting for more than 60% of the world’s supply. The environmental impact of graphite mining is significant, particularly in China, where it has led to severe air and water pollution. These environmental concerns have led to increased scrutiny and regulatory pressures on graphite mining operations.

Geopolitical challenges also play a critical role in the EV supply chain. The concentration of raw material production in a few regions creates significant supply chain risks. For example, political instability in the DRC could disrupt the global cobalt supply, affecting battery production worldwide. Similarly, trade tensions between China and other countries could impact the supply of graphite, leading to shortages and price increases. These risks highlight the importance of diversifying raw material sources and developing sustainable mining practices to ensure a stable supply chain.

Best EV Stocks: Major Players

Several major companies dominate the EV supply chain, each playing a crucial role in raw material sourcing, refining, and battery manufacturing.

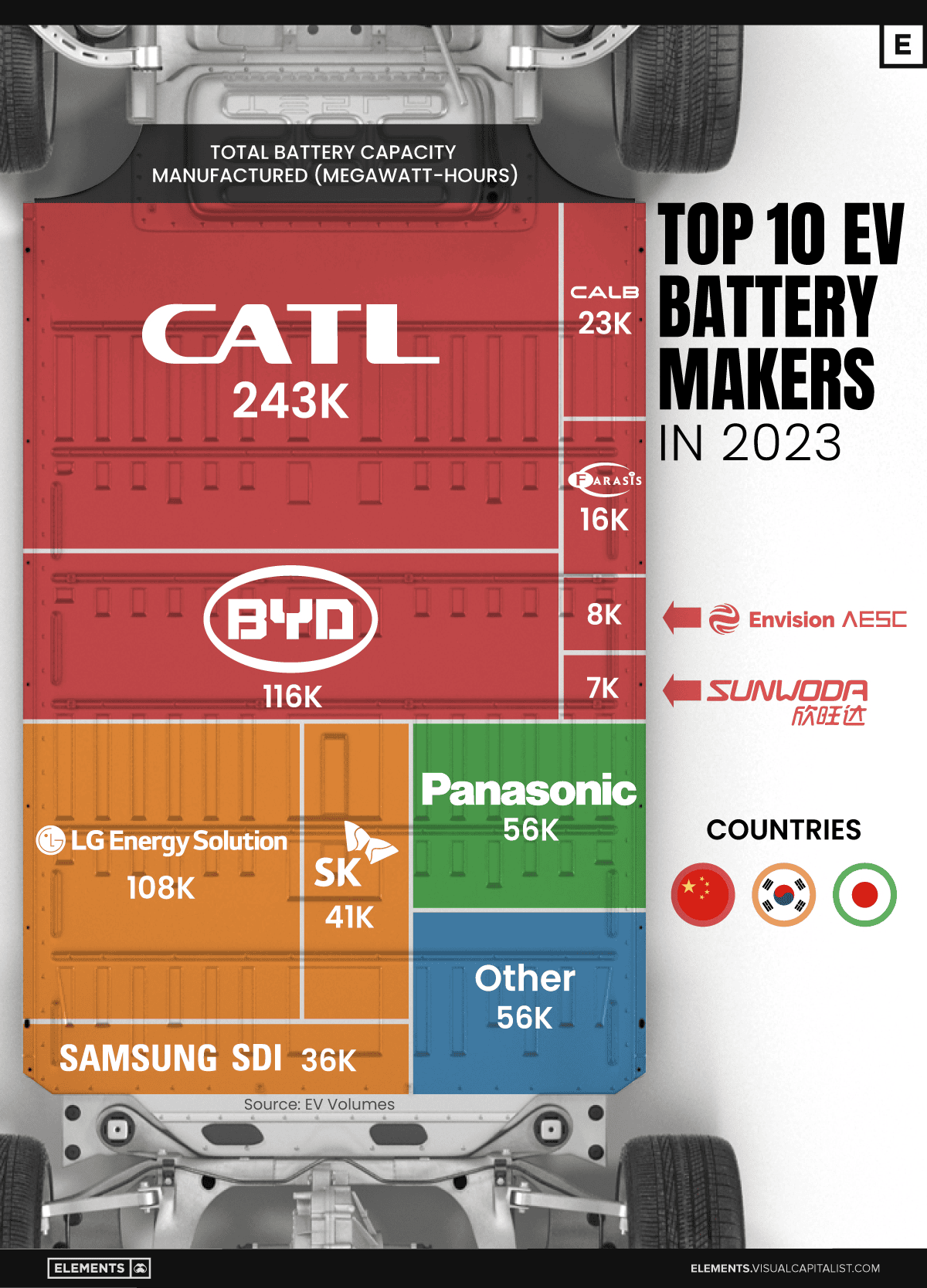

EV Battery Stocks: Battery Manufacturers

Contemporary Amperex Technology Co. Limited (CATL) is the world’s largest battery manufacturer, holding over 30% of the global market share. The Chinese company supplies batteries to major automakers, including Tesla, BMW, and Volkswagen. CATL’s dominance in the battery market is due to its extensive production capacity and strong relationships with key automakers.

BYD, another Chinese company, is both a leading EV manufacturer and a significant battery supplier. BYD holds a substantial market share, producing batteries for its vehicles and other automakers. The company’s vertical integration, where it controls both battery production and EV manufacturing, gives it a competitive edge in the market.

LG Chem, a South Korean company, is a key player in the battery market, supplying batteries to automakers like General Motors and Hyundai. LG Chem holds around 15% of the global market share and is known for its advanced battery technology and strong production capabilities.

Panasonic, a Japanese company, is a major supplier of batteries to Tesla and plays a critical role in Tesla’s Gigafactory in Nevada. Panasonic’s collaboration with Tesla has made it one of the leading battery manufacturers, with a significant market share.

Samsung SDI, another South Korean company, supplies batteries to various automakers, including BMW and Fiat Chrysler. Samsung SDI focuses on high-performance batteries and holds a notable share of the global market. The company’s emphasis on research and development has enabled it to produce batteries with improved energy density and safety features.

Source: visualcapitalist.com

Raw Material Producers

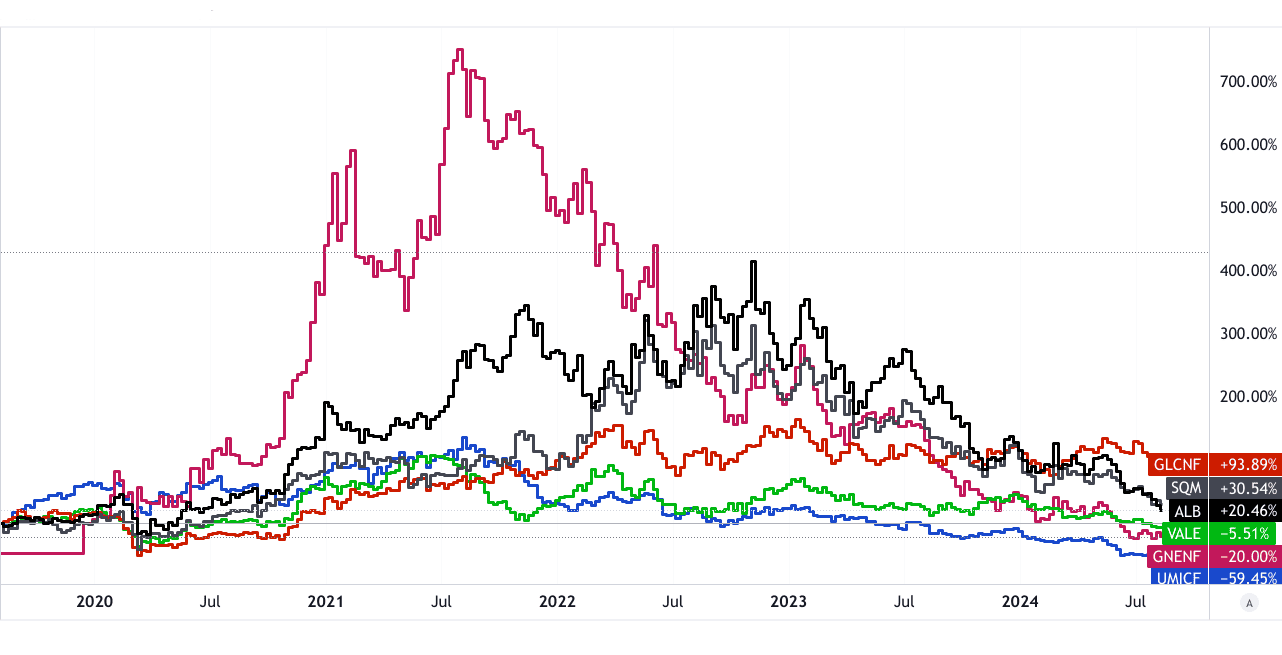

Albemarle Corporation (ALB) is one of the largest lithium producers globally, with operations in the United States, Chile, and Australia. Sociedad Química y Minera (SQM), a Chilean company, is another leading lithium producer, operating primarily in the Lithium Triangle.

Glencore (GLCNF), a Swiss-based commodity trading and mining company, is a major cobalt producer with mining operations in the DRC.

Vale (VALE), a Brazilian mining company, is a leading producer of nickel, with operations in Brazil, Canada, and Indonesia.

Ganfeng Lithium (GNENF) is a Chinese company and one of the largest lithium producers globally. Ganfeng Lithium has operations in China, Australia, and Argentina, supplying lithium to battery manufacturers worldwide.

Umicore (UMICY), a Belgian company, specializes in refining and recycling battery materials, including cobalt and nickel.

Norilsk Nickel (NILSY), a Russian company, is the world’s largest producer of nickel and palladium.

[5Y Price Return]

Source: tradingview.com

Battery Cathode and Anode Producers

Cathode and anode materials are critical components of lithium-ion batteries. Mechema (4721) specializes in cathode materials, supplying major battery manufacturers. China Steel Chemical (1723) is another key producer, focusing on anode materials. Coremax (4723) produces both cathode and anode materials.

Battery Separators and Electrolytes

Separators and electrolytes are essential for battery performance and safety. BenQ Materials (8215) and Semcorp produces battery separators, while Asahi Kasei and Mitsui Chemicals, are significant suppliers of both separators and electrolytes. Hopax (6509), Mitsubishi Chemical, and Shenzhen Capchem Technology specialize in battery electrolytes.

II. Electric Vehicle Stocks: EV Industry Midstream Supply Chain

The midstream supply chain in the EV industry focuses on producing and assembling essential components like batteries, electric motors, power electronics, and advanced driver-assistance systems (ADAS). This stage is critical because it integrates these components into a functional vehicle system, directly influencing the vehicle's performance, safety, and reliability.

Components and Systems

Batteries are the core of electric vehicles. They store the energy required to power the vehicle and significantly influence its range and performance. Lithium-ion batteries are the most widely used in EVs due to their high energy density and reliability.

Advanced Driver-Assistance Systems (ADAS) technologies are increasingly vital in modern electric vehicles, enhancing safety and paving the way for autonomous driving. These systems include features such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking. ADAS relies on sophisticated sensors, cameras, and control systems.

Source: converge.com

Electric motors convert electrical energy from the batteries into mechanical energy, which drives the vehicle. The efficiency and performance of electric motors are crucial because they directly impact the vehicle's acceleration, speed, and overall driving experience.

Power electronics are integral to managing and converting electrical energy within the vehicle. These components control the flow of electricity between the battery, motor, and other electronic systems, ensuring the vehicle operates efficiently. Power electronics include inverters, converters, and onboard chargers.

Transportation and Logistics

Transportation and logistics are critical components of the midstream supply chain, especially in the EV industry, where the complexity of moving large and heavy components like batteries and motors poses significant challenges. Batteries, due to their size, weight, and potential safety risks, require careful handling and transportation. They must be shipped under strict conditions to prevent damage and ensure safety, which includes maintaining temperature-controlled environments and using specialized packaging to avoid hazards like short circuits or fires.

Logistics also involves the coordination of delivering these components to assembly plants. The automotive industry often relies on just-in-time (JIT) manufacturing practices, where components must arrive precisely when needed to avoid production delays. Any disruption in the logistics chain can lead to costly production stoppages, making efficient logistics management essential. This need for precise timing and coordination underscores the importance of logistics in the EV supply chain.

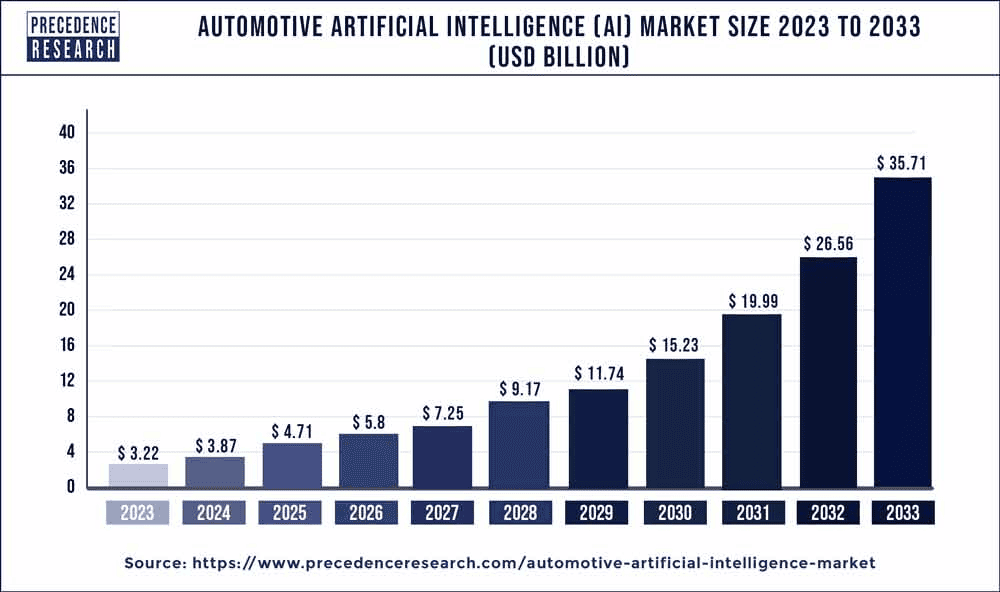

Automation and artificial intelligence (AI) are increasingly critical in addressing the challenges of transportation and logistics within the EV midstream supply chain. Automation technologies, such as robotics, are deployed in warehouses and distribution centers to expedite the handling and transportation of components, reducing human error and increasing efficiency. AI plays a crucial role in optimizing supply chain operations by predicting demand, managing inventory, and routing shipments more efficiently. By analyzing vast amounts of data, AI can predict potential disruptions in the supply chain and suggest alternative routes or suppliers, thereby ensuring a steady flow of components to assembly plants and minimizing the risk of production delays.

Source: precedenceresearch.com

EV Stocks to Buy: Major Players

The midstream supply chain in the EV industry involves numerous key players, each specializing in different components and systems essential for electric vehicles.

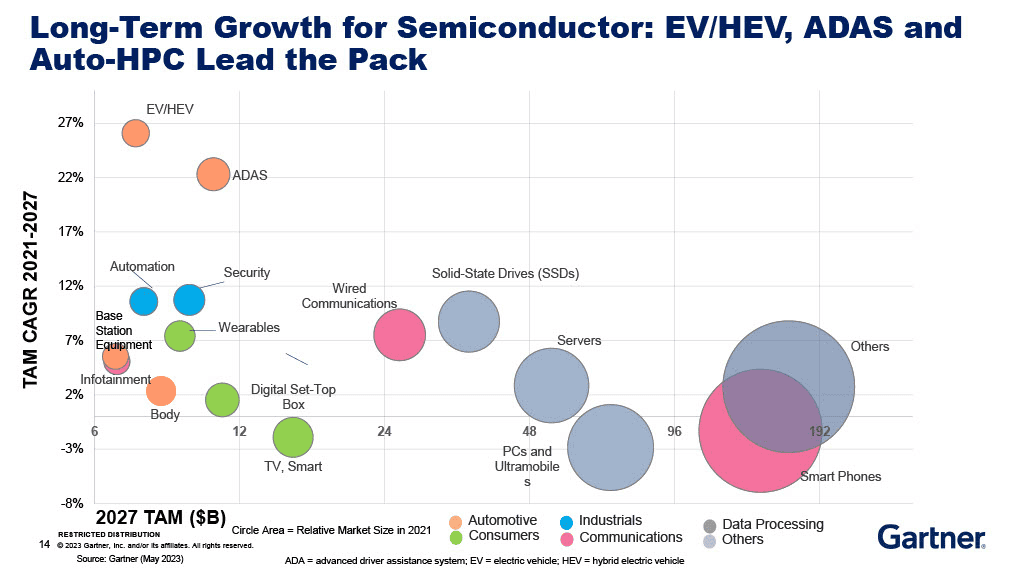

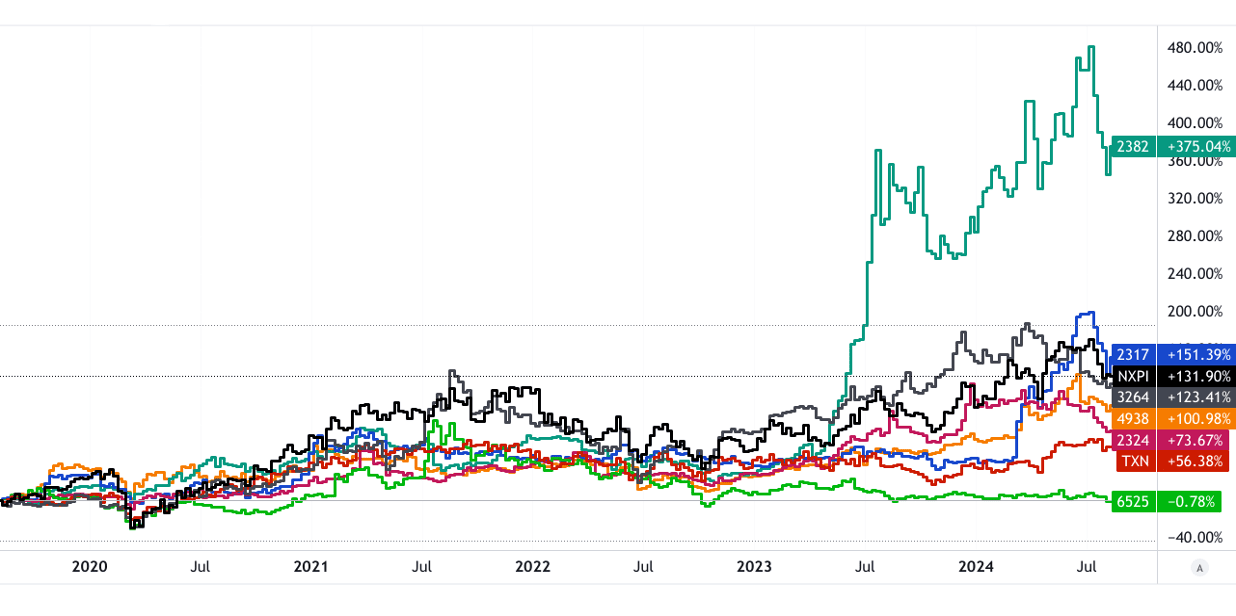

Automotive chips are vital for controlling various functions in an electric vehicle, including power management, safety systems, and infotainment. Texas Instruments (TXN) is a leading supplier of analog and embedded processing chips used in automotive applications. Infineon Technologies is another key player, specializing in power semiconductors and microcontrollers for electric vehicles. NXP Semiconductors (NXPI) produces chips for power management and in-vehicle networking, while STMicroelectronics supplies chips for power conversion, motor control, and battery management systems. Renesas Electronics is known for its microcontrollers and power semiconductors used in electric vehicles, making these companies essential in the EV midstream supply chain.

Chip testing is a critical part of the chip manufacturing process, ensuring that the chips meet the required specifications and performance standards. Ardentec (3264) is a leading provider of semiconductor testing services, specializing in wafer testing and final testing for automotive chips. GEM Services (6525) offers advanced testing solutions for automotive semiconductors, ensuring their high reliability and performance.

Control systems are essential for managing various functions of an electric vehicle, including power distribution, motor control, and safety features. Siemens is a major player in the EV control systems market, offering solutions for powertrain management and vehicle control. ABB is another key player, providing control systems for electric powertrains and energy management in electric vehicles.

JL Mag Rare-Earth is a leading producer of rare-earth materials used in electric motors, which are essential for producing high-performance magnets used in motors. Broad-Ocean Motor specializes in manufacturing electric motors for electric vehicles, supplying major automakers with high-efficiency motors that ensure the reliable operation of their vehicles.

The electronic control unit (ECU) is the brain of an electric vehicle, managing various systems and functions. Hon Hai Precision Industry (2317), also known as Foxconn, is a major supplier of ECUs and other electronic components for electric vehicles. Compal Electronics (2324) specializes in manufacturing ECUs and other computer components for electric vehicles, while Quanta Computer (2382) and Pegatron (4938) are also key players in this segment, producing ECUs and related components that are critical to the operation of electric vehicles.

[5Y Price Return]

Source: tradingview.com

Touch panels are used in electric vehicles for infotainment systems and other user interfaces. AU Optronics (2409) is a leading producer of touch panels, supplying major automakers with high-quality displays. Innolux (3481) specializes in touch panel technology for automotive applications, ensuring that electric vehicles have advanced and reliable user interfaces.

Complementary metal-oxide-semiconductor (CMOS) and image sensors (CIS) are critical for ADAS and other advanced systems in electric vehicles. ON Semiconductor is a major supplier of CMOS and image sensors used in ADAS and other automotive applications. Omnivision specializes in producing high-performance image sensors for ADAS, while Sony and Samsung Electronics are also leading suppliers of CMOS sensors for the automotive industry, contributing to the safety and efficiency of electric vehicles.

Packaging and testing are essential steps in semiconductor manufacturing. King Yuan Electronics (2449) is a leading provider of packaging and testing services for automotive semiconductors. Xintec (3374) specializes in wafer-level packaging and testing for automotive chips, while Tong Hsing Electronic Industries (6271) offers advanced packaging and testing solutions for the automotive industry.

Lenses are critical components for cameras and sensors used in ADAS, which are essential for the safety and functionality of electric vehicles. Asia Optical (3019) is a major supplier of lenses for automotive cameras and sensors, while Primax Electronics (4915) specializes in producing lenses for ADAS and other automotive applications. Chant Sincere (6205) supplies high-quality lenses that contribute to the effectiveness of ADAS in electric vehicles.

III. EV Stocks: EV Industry Downstream Supply Chain

The downstream supply chain of the EV industry covers vehicle manufacturing, distribution and sales, and after-sales services. This segment is where EVs reach consumers, and it significantly influences market adoption and customer satisfaction.

Vehicle Manufacturing

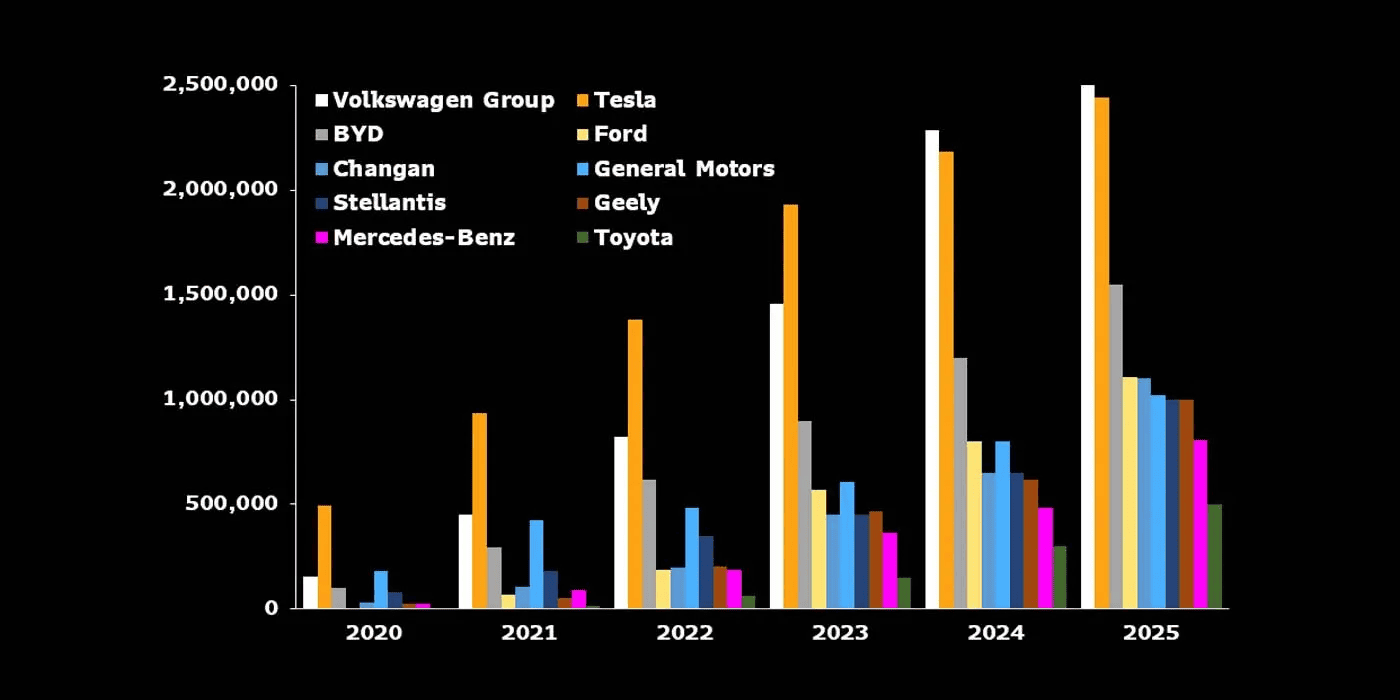

Traditional automakers, including Ford (F), Volkswagen, BMW, Hyundai Motor, Mercedes-Benz, Toyota, Honda, and Nissan Motor, are transitioning from internal combustion engine (ICE) vehicles to electric vehicles. This shift involves extensive retooling of factories, retraining of workers, and investment in new technologies. Traditional automakers have the advantage of established brands, production capacity, and global distribution networks. However, they face significant challenges in rapidly scaling EV production and integrating new technologies like battery management systems and electric drivetrains.

[Volkswagen’s EV sales will overtake Tesla’s by 2024]

Source: electrek.co

For instance, Ford has introduced the Mustang Mach-E and F-150 Lightning, leveraging its iconic models to enter the EV market. Volkswagen has committed to a full electric lineup under its ID. series, with the ID.4 being a significant player in Europe. BMW and Mercedes-Benz are similarly transitioning, with models like the BMW iX and Mercedes EQS targeting the premium segment.

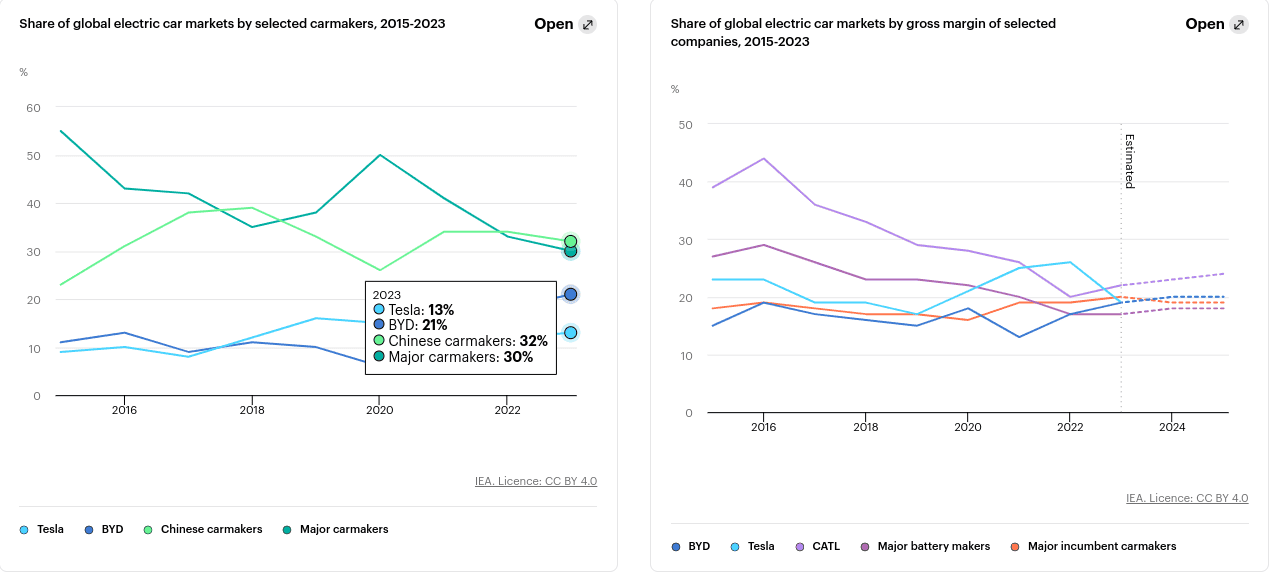

On the other hand, pure-play EV manufacturers like Tesla (TSLA), NIO (NIO), Rivian (RIVN), Lucid Motors (LCID), Li Auto (LI), and Xpeng Motors (XPEV) are built exclusively around electric vehicles. These companies often have a technological edge, with innovations in battery technology, autonomous driving, and vehicle software. Tesla, for example, leads the global EV market with a significant share, driven by its Model 3 and Model Y. NIO, with its focus on premium SUVs like the ES8 and battery-swapping technology, has captured a significant share of the Chinese market. Rivian targets the adventure and utility segments with its R1T electric truck, while Lucid Motors focuses on luxury with the Lucid Air.

Source: iea.org

Distribution and Sales

The distribution and sales model for electric vehicles is evolving. Traditional automakers have relied on extensive dealership networks, but the rise of digitalization and online sales platforms is transforming this landscape. Tesla pioneered the direct-to-consumer model, where customers can order vehicles online, bypassing traditional dealerships. This model allows for more control over pricing, brand experience, and customer data. Tesla's approach has influenced other automakers to enhance their online sales capabilities.

During the COVID-19 pandemic, the shift toward online sales accelerated, with virtual showrooms, online configurators, and digital marketing becoming standard. Companies like Rivian and Lucid Motors also adopted direct sales, while traditional automakers developed hybrid models combining online platforms with dealership networks. For example, Volkswagen offers its ID.4 through both online ordering and its established dealerships, giving customers flexibility.

Subscription services are another emerging trend in EV distribution. These services allow customers to lease vehicles for a fixed monthly fee, which typically includes insurance, maintenance, and other services. Companies like Porsche and Volvo have experimented with this model, targeting customers who prioritize flexibility over ownership. This model also provides manufacturers with a recurring revenue stream and deeper customer engagement.

After-Sales Services

After-sales services are crucial for the long-term success and adoption of electric vehicles. Charging infrastructure is a primary concern, determining how easily EV owners can recharge their vehicles. Tesla's Supercharger network is a key advantage, providing fast and reliable charging across major markets. NIO offers a unique battery-swapping service, which allows customers to exchange depleted batteries for fully charged ones in minutes.

Source: iea.org

Maintenance for EVs differs significantly from traditional vehicles due to fewer moving parts and the absence of an internal combustion engine. However, electric vehicles still require maintenance for components like brakes, tires, and software systems. Software updates are particularly important, as they can improve vehicle performance, enhance safety, and add new features. Tesla has set a standard with over-the-air (OTA) software updates, which allow the company to deliver updates directly to vehicles without requiring a service visit.

Electric Car Stocks: Electric Car Companies

Several companies dominate the EV market, each with unique strategies and product offerings:

● Tesla (TSLA): Tesla is the market leader, with a 16% global market share in 2023. Its Model 3 and Model Y are among the best-selling EVs worldwide, known for their range, performance, and technology.

● BYD (BYD): BYD holds about 12% of the global market share, leading in China with models like the Han EV and Tang EV. BYD also manufactures batteries, giving it a significant cost advantage.

● NIO (NIO): NIO focuses on premium electric SUVs and is known for its battery-swapping technology. Its models, such as the ES6 and EC6, are popular in China.

● Rivian (RIVN): Rivian targets the adventure and utility market with its R1T electric truck and R1S SUV, both designed for off-road and outdoor use.

● Lucid Motors (LCID): Lucid focuses on luxury with its Lucid Air sedan, which offers a long range and high-end features, positioning it as a competitor to Tesla's Model S.

● Li Auto (LI): Li Auto offers extended-range electric vehicles (EREVs), combining battery power with a gasoline engine to extend driving range. The Li ONE is its flagship model.

● Xpeng Motors (XPEV): Xpeng emphasizes smart technology, with features like advanced driver assistance systems (ADAS) and autonomous driving in models like the P7 sedan.

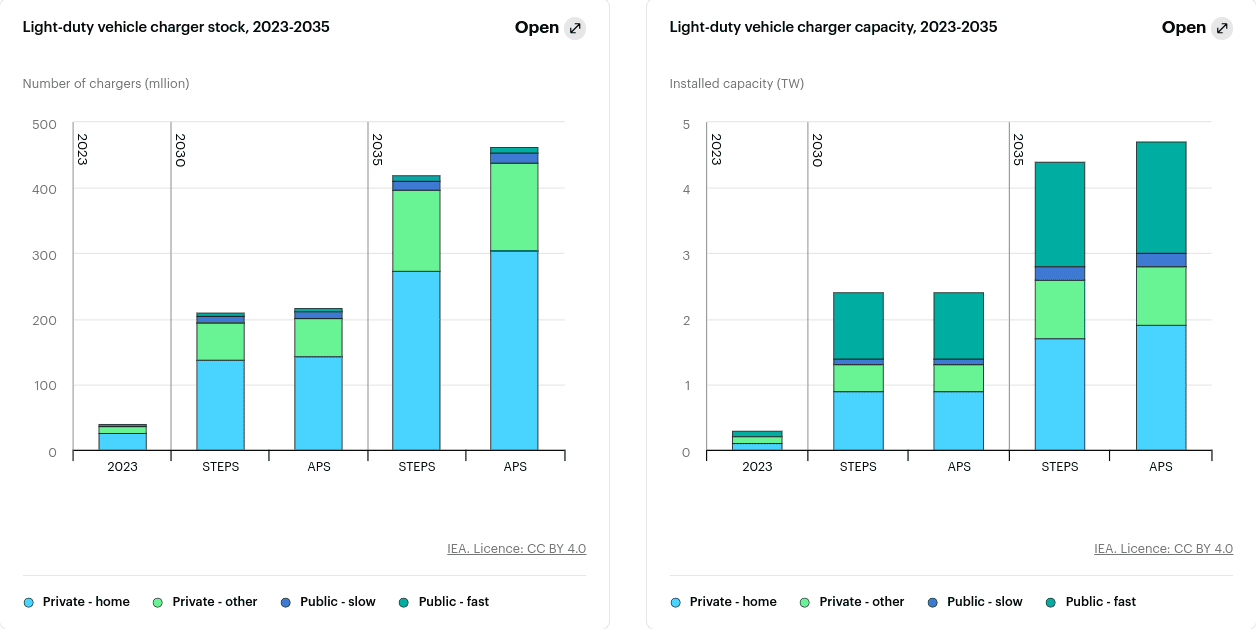

EV Charging Stocks: Charging Infrastructure

Charging infrastructure is a critical enabler of EV adoption, with several key players involved in its development:

● Tesla (TSLA): Tesla's Supercharger network is one of the most extensive and reliable, providing fast charging across key regions.

● ChargePoint (CHPT): ChargePoint operates a vast network of public and private charging stations, offering solutions for home, workplace, and commercial use.

● Blink Charging (BLNK): Blink Charging focuses on expanding its network of public charging stations, providing both residential and commercial EV charging stations, supporting a growing network of accessible charging points, often partnering with property owners to increase accessibility.

● Nio (NIO), BYD (BYDDF), Li Auto (LI), Xpeng Motors (XPEV): These companies are building charging infrastructure in China, often through partnerships or independent networks, supporting their growing EV sales.

● Fortune Electric (1519), LITE-ON (2301), Delta (2308), Phihong (2457), AcBel Polytech (6282), Schneider Electric: These companies supply key components for charging stations, including inverters, chargers, and electrical systems.

[5Y Price Return]

Source: tradingview.com

● EVgo operates a fast-charging network across the U.S., catering to various EV brands with an emphasis on urban areas.

● Electrify America is a key player in providing ultra-fast charging stations across the U.S..

Components and Modules

In the EV industry, components and modules play a critical role in ensuring the efficient operation and safety of electric vehicles. Companies below are key players in this segment:

● K.S. Terminals (3003) specializes in electrical connectors, crucial for power distribution in EVs. Their products ensure reliable connections between various electrical systems, which is vital for vehicle safety and performance.

● SINBON Electronics (3023) provides wiring harnesses and connectivity solutions, essential for transmitting power and data within EVs. Their products support the integration of complex electronic systems.

● Hotron (3092) produces precision electronic components that contribute to the stability and efficiency of EV power systems. Their components are integral to battery management and other critical functions.

● Bizlink (3665) focuses on cable assemblies and interconnect solutions, vital for EV charging systems and internal wiring. Their expertise ensures that EVs can safely and efficiently connect to charging infrastructure.

● Longwell (6290) manufactures power cords and connectors, key for both onboard electronics and charging systems, facilitating seamless energy transfer.

IV. EV Industry Trends & EV Stocks Outlook

The EV industry is undergoing transformative changes driven by technological advancements, evolving consumer preferences, and supportive government policies.

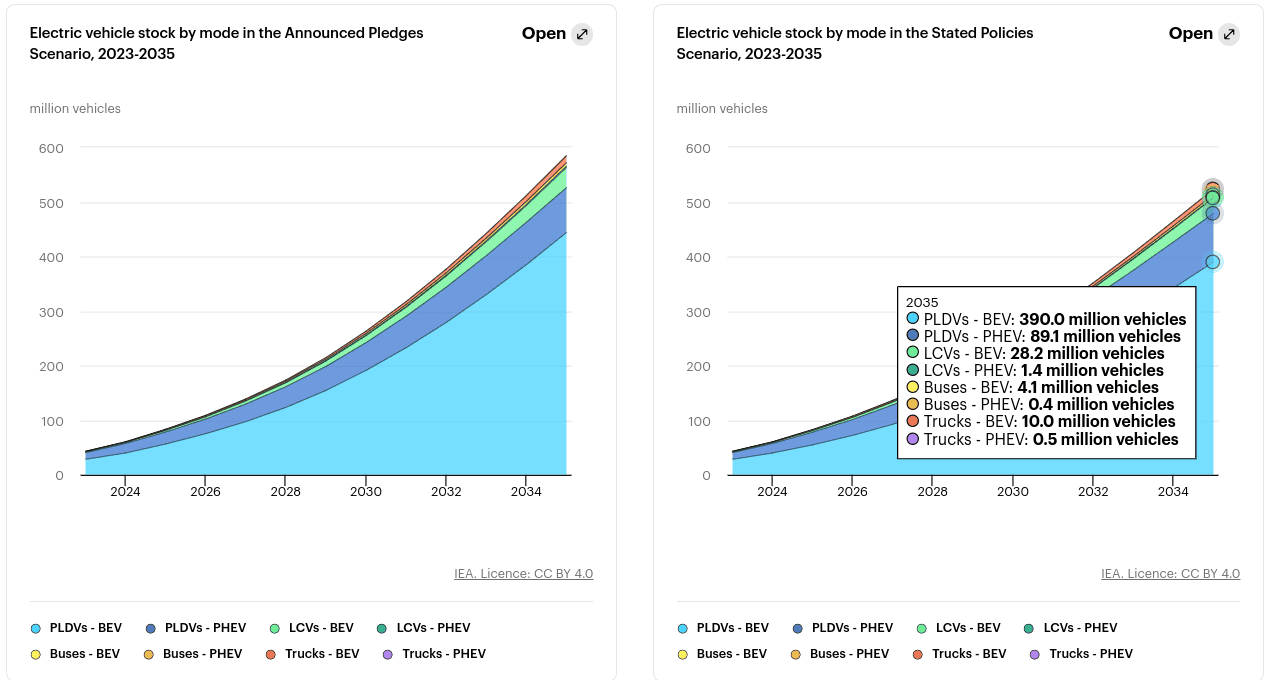

As of 2023, the global EV market is valued at approximately $250 billion. Market analysts project it will surge to about $1.5 trillion by 2030, marking a compound annual growth rate (CAGR) of over 20%. This growth trajectory reflects heightened consumer interest in eco-friendly transportation options, technological advancements, and robust policy support aimed at reducing carbon emissions.

Consumer inclination towards EVs is fueled by factors such as environmental awareness, lower total cost of ownership, and improved vehicle performance. EVs represented around 10% of global vehicle sales in 2023, up from 3% in 2019. The adoption rate is expected to climb further, with forecasts indicating EVs could account for 40% of global vehicle sales by 2030. Affordable models, such as those produced by Tesla and NIO, are accelerating this shift. Tesla’s Model 3 and NIO’s ES6 have become benchmarks for affordability and performance in the EV market.

Source: Bloomberg.com

EV Regional Market Analysis

In North America, particularly the U.S., the EV market is anticipated to expand significantly. The U.S. market is projected to grow at a CAGR of 18% from 2023 to 2030. Key drivers include federal incentives like the $7,500 tax credit for EVs and state-specific rebates. Tesla (TSLA) leads the market, bolstered by its Supercharger network and continuous innovation. Rivian (RIVN) is also gaining traction with its R1T electric truck and R1S SUV, addressing the growing demand for utility EVs.

Europe’s EV market is characterized by aggressive growth, driven by stringent emission regulations and ambitious sustainability goals. The market is expected to grow at a CAGR of 25% from 2023 to 2030. The European Union’s Green Deal mandates significant reductions in greenhouse gas emissions, propelling EV adoption. Volkswagen, BMW, and Renault are prominent players, with Volkswagen’s ID.3 and BMW’s i4 leading the charge in the compact and luxury EV segments, respectively.

Asia-Pacific, led by China, is the largest and most rapidly expanding EV market. China’s market is projected to grow at a CAGR of 30% from 2023 to 2030. The country’s substantial subsidies, extensive local manufacturing capabilities, and strong consumer demand are key factors. BYD, NIO, and Xpeng Motors dominate the Chinese market, with BYD’s Tang SUV and NIO’s ES6 being popular choices. Additionally, Japan and South Korea are emerging as significant players, with companies like Toyota and Hyundai making substantial investments in EV technology.

Future Trends in the EV Industry

Battery Chemistry:

Advancements in battery technology are crucial for the future of the EV industry. Solid-state batteries, which offer higher energy density and enhanced safety features, are anticipated to become mainstream by the mid-2020s. Companies like Toyota and QuantumScape are at the forefront of this innovation. Lithium-air batteries, still in research stages, promise to provide even greater range, potentially up to 1,000 miles on a single charge. Wireless charging technology, spearheaded by firms like WiTricity, is expected to simplify the charging process by eliminating physical connectors.

Autonomous Driving Technologies:

The integration of autonomous driving technologies is a significant trend influencing the EV industry. Companies like Tesla, Waymo (a subsidiary of Alphabet), and NIO are advancing self-driving capabilities. Tesla’s Full Self-Driving (FSD) system, while still in development, is among the most advanced commercially available. Autonomous driving is poised to revolutionize transportation by enhancing safety, optimizing traffic flow, and introducing new business models such as robotaxi services.

Government Policies Promoting EV Adoption

Government policies are critical in accelerating EV adoption. Key initiatives include subsidies, tax incentives, and regulatory mandates:

Subsidies and Tax Incentives:

Governments worldwide offer financial incentives to encourage EV purchases. The U.S. federal tax credit of up to $7,500 per vehicle and additional state incentives are significant motivators. In Europe, countries like Germany and France provide subsidies up to €6,000 for EV buyers. China’s substantial subsidies and preferential policies for EV manufacturers further bolster market growth.

Regulatory Mandates:

Regulatory frameworks are increasingly stringent, pushing automakers towards electric mobility. The European Union aims to cut CO2 emissions by 55% by 2030, while California has announced plans to ban new gasoline car sales by 2035. These mandates drive automakers to invest in EV technology and transition away from internal combustion engines.

Long-Term Outlook for EV Stocks

Source: iea.org

The long-term outlook for EV stocks is generally positive, given the robust market growth and technological advancements. Leading companies like Tesla (TSLA), BYD (BYD), NIO (NIO), and Rivian (RIVN) are well-positioned to benefit from the increasing demand for EVs. Tesla continues to lead with its innovative technology and expansive market reach. BYD’s extensive product lineup and vertical integration in battery production enhance its market position. NIO’s focus on premium EVs and unique battery-swapping technology offers a competitive edge. Rivian’s emphasis on electric trucks and SUVs caters to a niche yet growing segment of the market.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.