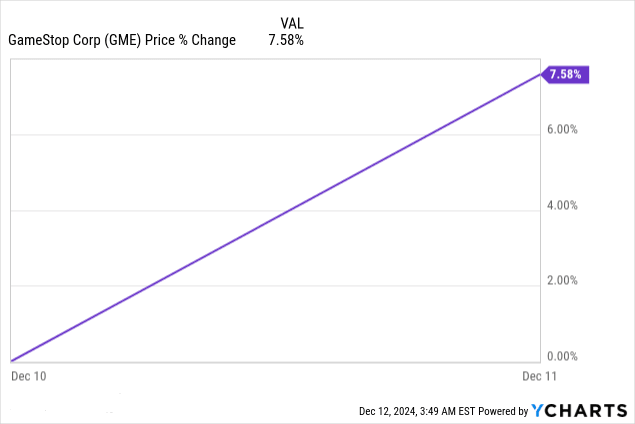

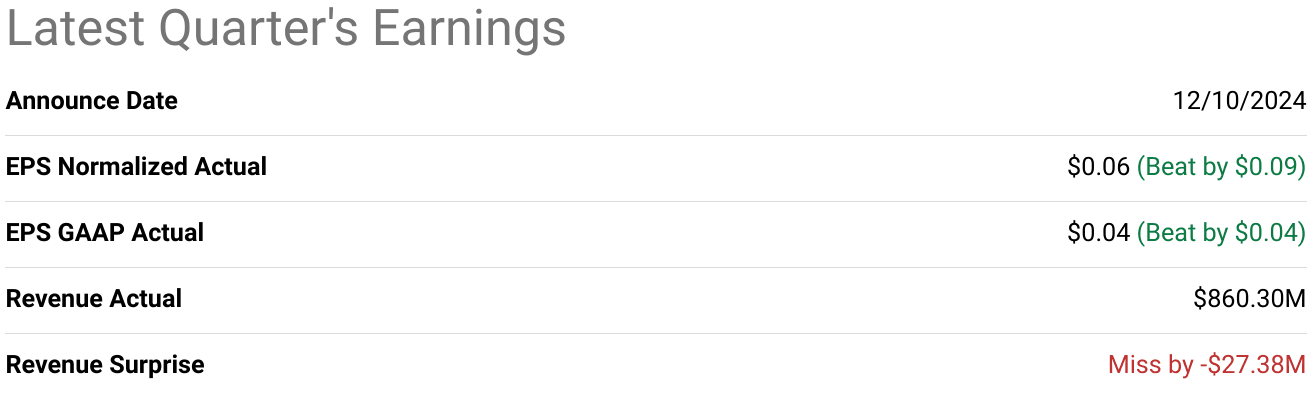

GameStop stock rose 7.6% post-earnings release, reflecting mixed investor sentiment. Q3 2024 results showed normalized EPS of $0.06, exceeding estimates by $0.09, while GAAP EPS hit $0.04, beating projections by $0.04. Revenue fell to $860.3 million, a YoY decline of 20.2%, missing estimates by $27.38 million. Operational inefficiencies persist despite tighter SG&A cost management.

Source: Ycharts.com

I. GME Earnings Overview Q3 2024

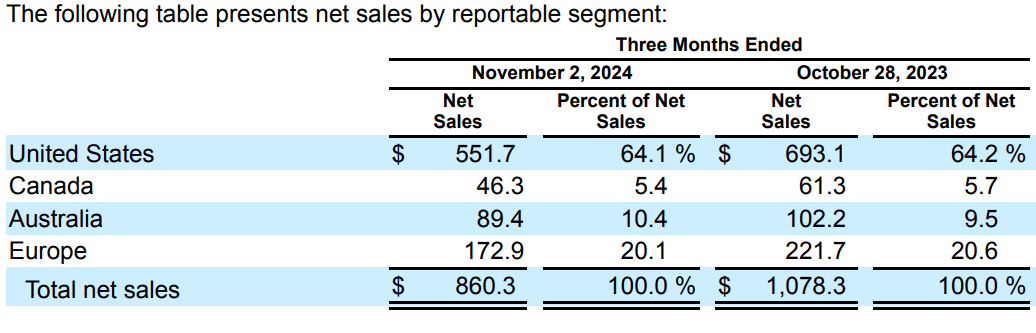

GameStop’s Q3 2024 earnings report shows mixed results against market expectations. The normalized EPS hit $0.06, exceeding projections by $0.09, while GAAP EPS reached $0.04, surpassing expectations by $0.04. However, revenue stood at $860.30 million, falling short by $27.38 million and marking a YoY contraction of approximately 20.2% compared to $1.078 billion in Q3 2023.

Source: seekingalpha.com

Gross margin shifts indicate a narrowing operational efficiency framework. While net income rebounded sharply to $17.4 million from a $3.1 million net loss YoY, the gross margin suffered under top-line pressure from reduced sales volumes. Operating margin trends followed a similar trajectory, influenced by selling, general, and administrative (SG&A) expenses of $282.0 million—down modestly from $296.5 million last year but insufficient to offset revenue declines.

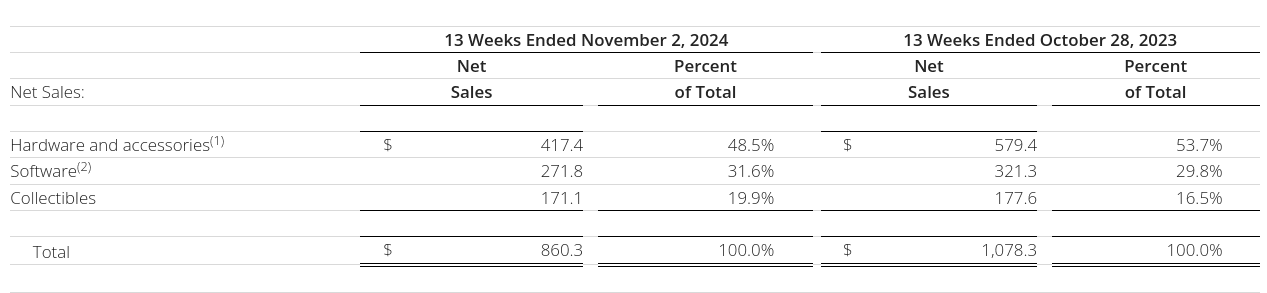

GameStop Earnings Q3 2024 Revenue Drivers and Trends

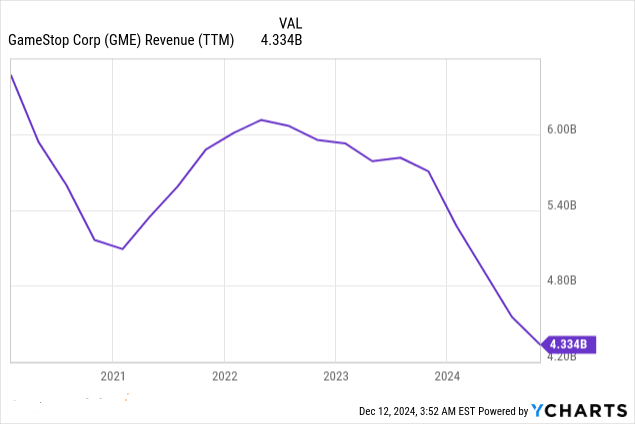

Revenue deterioration can be attributed to declining consumer engagement within GameStop’s retail channels and weaker-than-expected market performance across its core categories. Market trends indicate a slowdown in physical game sales, coupled with increased digital competition. YoY sales declines in the hardware and accessories segments compounded this contraction, further pressuring consolidated results.

On the positive side, SG&A reductions suggest tighter expense management. This contributed to the positive net income swing, but top-line struggles overshadowed these improvements. The equity offering during the quarter raised $400 million in gross proceeds, providing GameStop with a liquidity cushion. This boosted cash and cash equivalents to $4.616 billion, a pivotal metric that may offset the operational strain in upcoming quarters.

Source: Ycharts.com

II. GameStop Product & Market Dynamics

GameStop is leveraging its brand to align with evolving market conditions, though competitive pressures remain a hurdle. A strategic focus on omnichannel retail excellence and diversification of its offerings is evident. GameStop’s new collaboration with Collectors Holdings, Inc., through PSA, introduced autograph authentication and grading services for trading cards in select U.S. stores. This marks an entry into the graded collectibles market, expanding GameStop's addressable audience. However, consumer adoption data for this initiative remains unclear.

On the competitive front, GameStop faces substantial challenges from dominant players like Amazon, Walmart, and Best Buy, alongside digital-first platforms like Steam. Competitors benefit from broader ecosystems and pricing strategies that erode GameStop’s market share. Notably, while Amazon and Steam dominate digital game distribution, Best Buy and Walmart lead in hardware pricing competitiveness, placing downward pressure on GameStop's hardware sales and margins.

Source: Gamestop investor relation

GameStop’s pricing approach attempts to balance volume recovery with margin preservation. However, YoY revenue dropped 20.2% to $860.30 million in Q3 2024, suggesting the strategy struggles against competitors’ scale efficiencies and consumer loyalty programs. Hardware sales contraction further compounded this. Despite efforts to increase fulfillment speed via ship-from-store capabilities and tighter inventory management, these operational changes have not translated to a clear competitive edge.

International operations have been scaled back significantly. During fiscal 2024, GameStop exited Germany, Ireland, Switzerland, and Austria, and sold its Italian subsidiary. The move aims to eliminate redundancies and focus on core markets, but the closures highlight its reduced international competitiveness. While SG&A expenses fell to $282 million in Q3 2024 from $296.5 million YoY, these reductions are overshadowed by top-line challenges.

Investing activities indicate some reinvestment in marketable securities and European property divestments, while cash inflows of $400 million from an at-the-market equity offering bolster liquidity. This reflects efforts to stabilize capital structure amidst competitive and operational pressures.

Source: SEC Form 10-Q

III. GME Stock Forecast

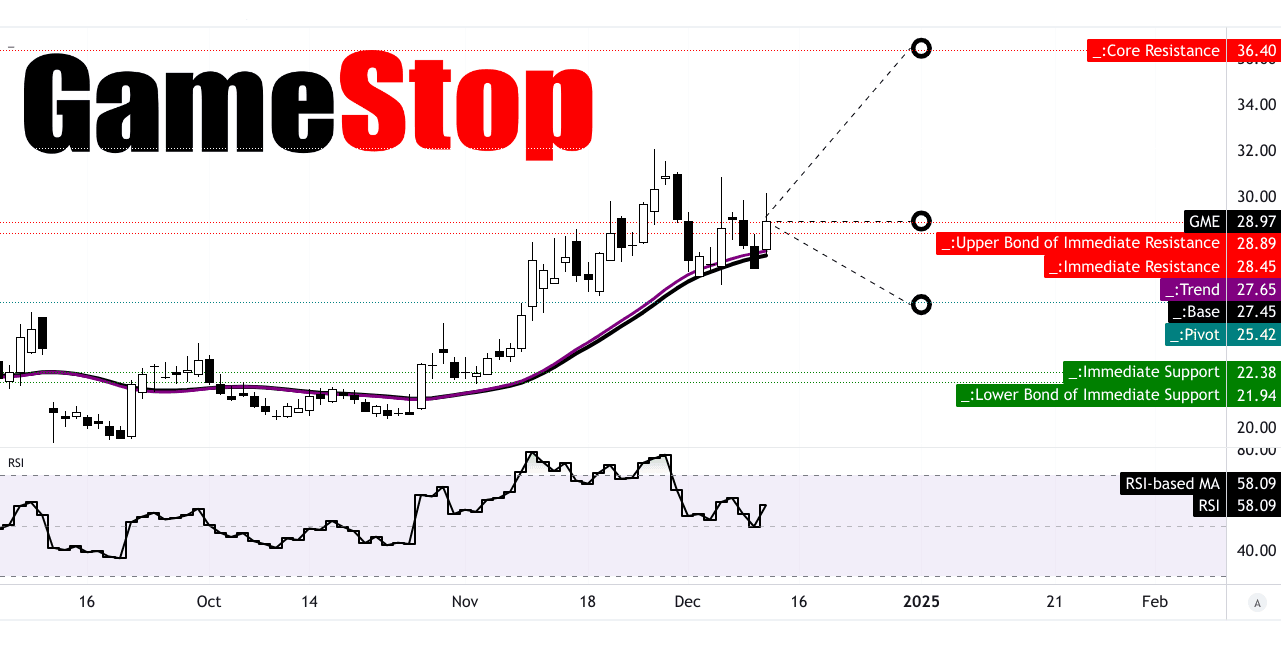

GameStop exhibits a technically stable setup, but analysts project substantial downside risk, aligning with market skepticism. At $28.97, GME trades above its modified exponential moving averages (EMAs), with the trendline at $27.65 and baseline at $27.45. This suggests mild bullish momentum in the short term, though the stock remains within a horizontal price channel pivoting around $25.42.

The Relative Strength Index (RSI) stands at 58.09, slightly below the overbought threshold of 70. This positions GME in neutral territory, indicating neither excessive buying nor selling pressure. However, a bullish divergence strengthens the potential for upward price movement. Despite this, the RSI’s sideways trend reflects uncertainty in sustaining momentum. Forecasts based on Fibonacci retracement and extension levels indicate varying price scenarios for the remainder of 2024. The average price target sits at $29, closely aligning with current levels. The optimistic projection of $36 assumes bullish momentum, but achieving this depends on sustained volume and market sentiment improvement. The pessimistic target of $25 reflects downside risk if bearish momentum intensifies, aligning with the pivot zone near $25.42.

Source: tradingview.com

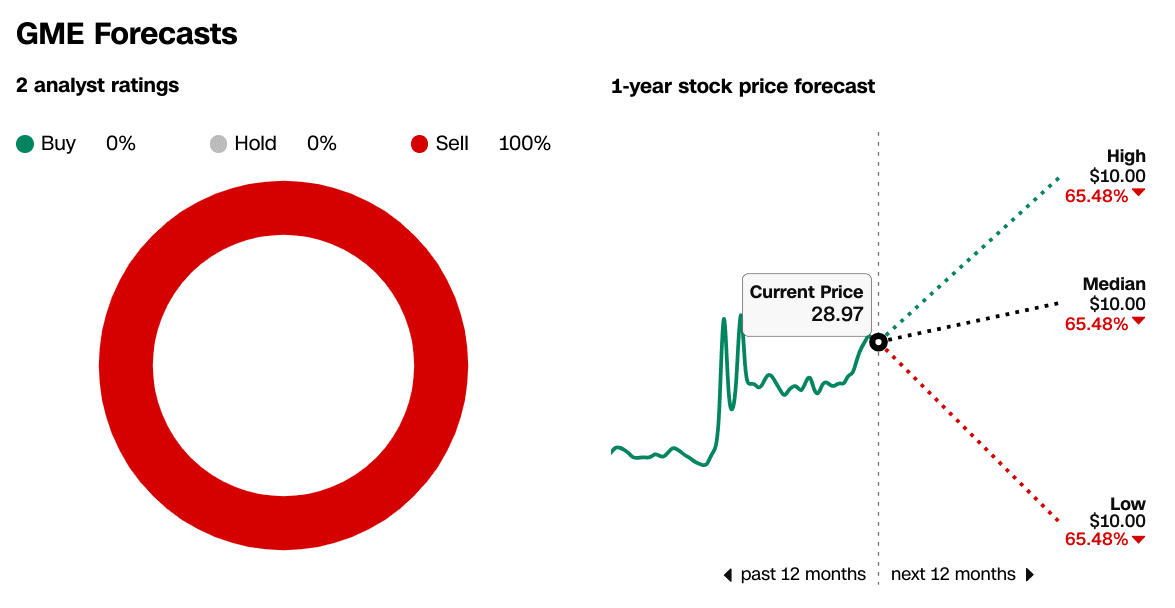

GME Price Prediction: Market analysts' expectations & ratings

Market analysts display a markedly bearish stance, with 100% of ratings recommending a sell. The 12-month forecast is grim, with high, median, and low price targets converging at $10, implying a staggering 65.48% downside from current levels. Analysts cite declining revenues, challenges in core market competitiveness, and ongoing restructuring efforts as significant risks.

Source: CNN.com

IV. GME Stock Prediction: Future Outlook

GameStop’s strategic initiatives and market position offer a mixed outlook, marked by aggressive restructuring efforts and significant revenue pressures. Management has prioritized operational streamlining and leveraging its brand equity to stabilize its declining performance, but forward guidance reveals considerable challenges.

Growth Strategies and Financial Guidance

Management has outlined an omnichannel retail strategy aimed at improving product availability and customer experience. Efforts include faster fulfillment via ship-from-store offerings and enhancing online and in-store integration. However, restructuring measures have resulted in geographic contraction, such as exiting operations in Germany, Ireland, and Italy, with anticipated store closures likely to outpace historical levels. These changes are part of a broader cost-containment strategy, but non-recurring restructuring costs are expected to weigh on short-term financials.

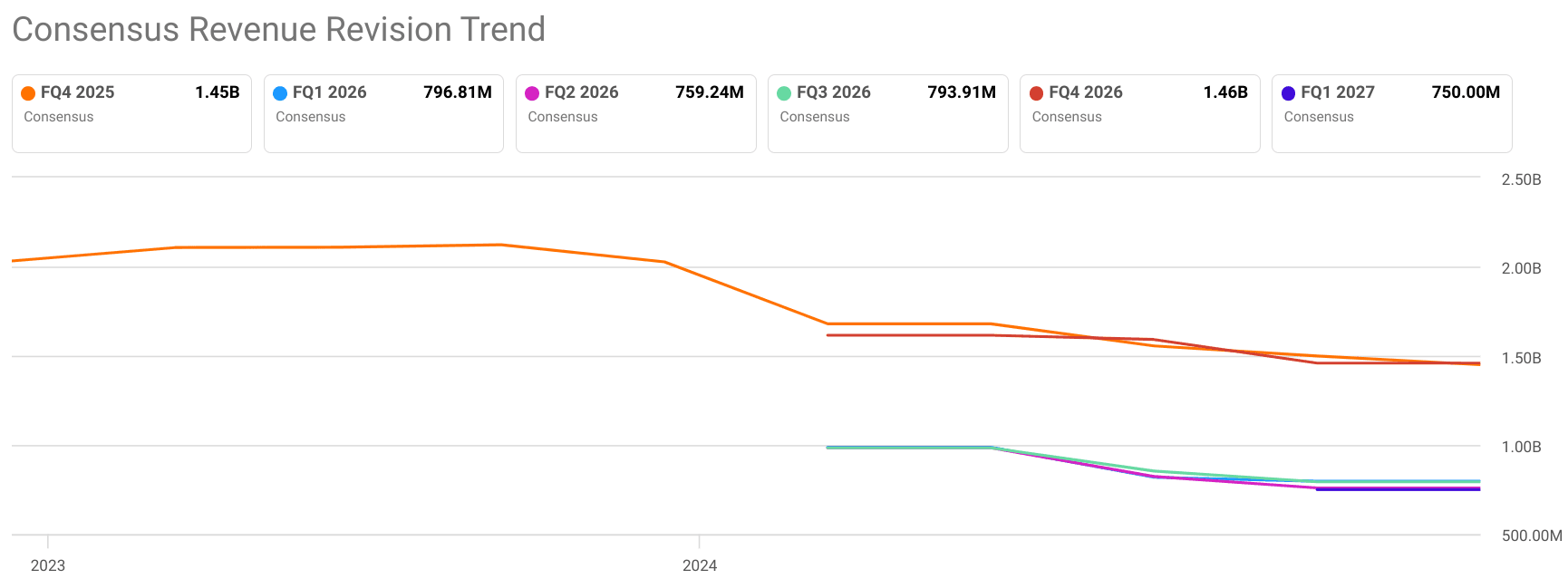

For FQ4 2025, consensus estimates suggest a 19.16% YoY decline in revenue to $1.45 billion, highlighting continued pressure on the core business. Similarly, EPS is projected at $0.09, a sharp 59.09% drop YoY, indicating difficulties in maintaining profitability despite lower selling, general, and administrative (SG&A) expenses, which fell from $296.5 million to $282.0 million in the third quarter of 2024.

Source: seekingalpha.com

Market Trends and Strategic Collaborations

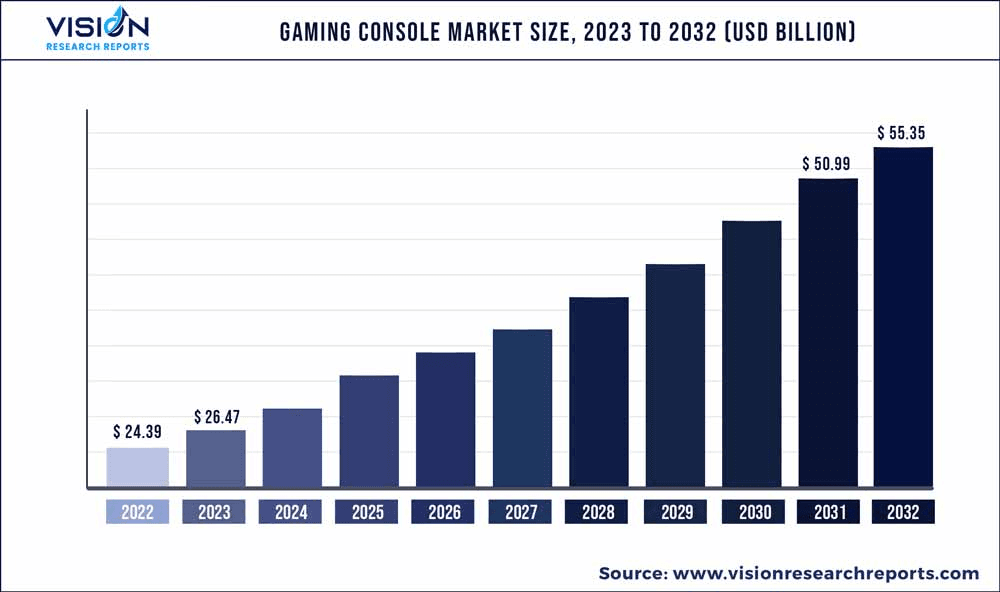

GameStop’s collaboration with Collectors Holdings, Inc. positions it to tap into the collectibles and trading card market through professional grading services. This aligns with broader trends in collectibles but represents a niche offering unlikely to offset core revenue losses. The shift towards next-gen console adoption, mobile gaming, and esports has been rapid, yet GameStop has struggled to capitalize on these trends effectively, with its revenue base still heavily reliant on physical game sales and hardware.

Source: visionresearchreports.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.