Source: Bloomberg

I. Introduction to Gold and Economic Cycles

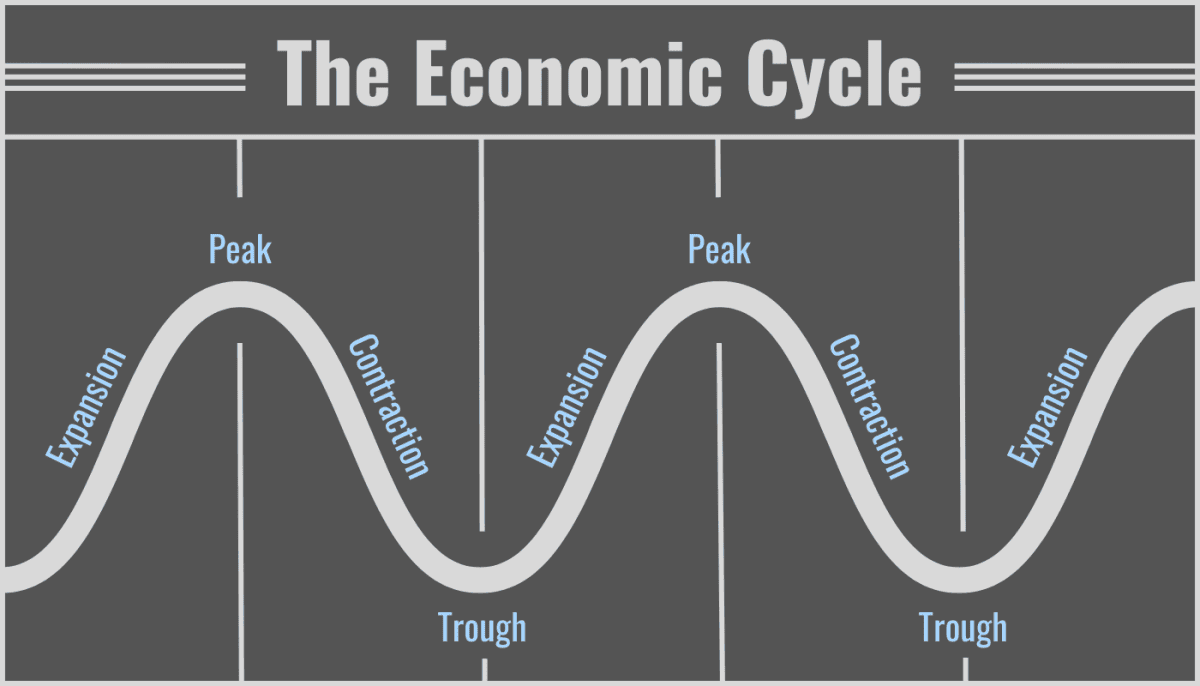

Economic cycles, consisting of expansion, peak, contraction, and trough phases, represent the fluctuations in economic activity over time. Expansion occurs when the economy grows, leading to increased production and employment. The peak is the point at which growth reaches its highest level before a downturn. Contraction, or recession, involves a decline in economic activity, characterized by reduced consumer spending and higher unemployment. Finally, the trough is the lowest point of the cycle, signaling the end of the recession and the beginning of a new expansion phase.

Source: thestreet.com

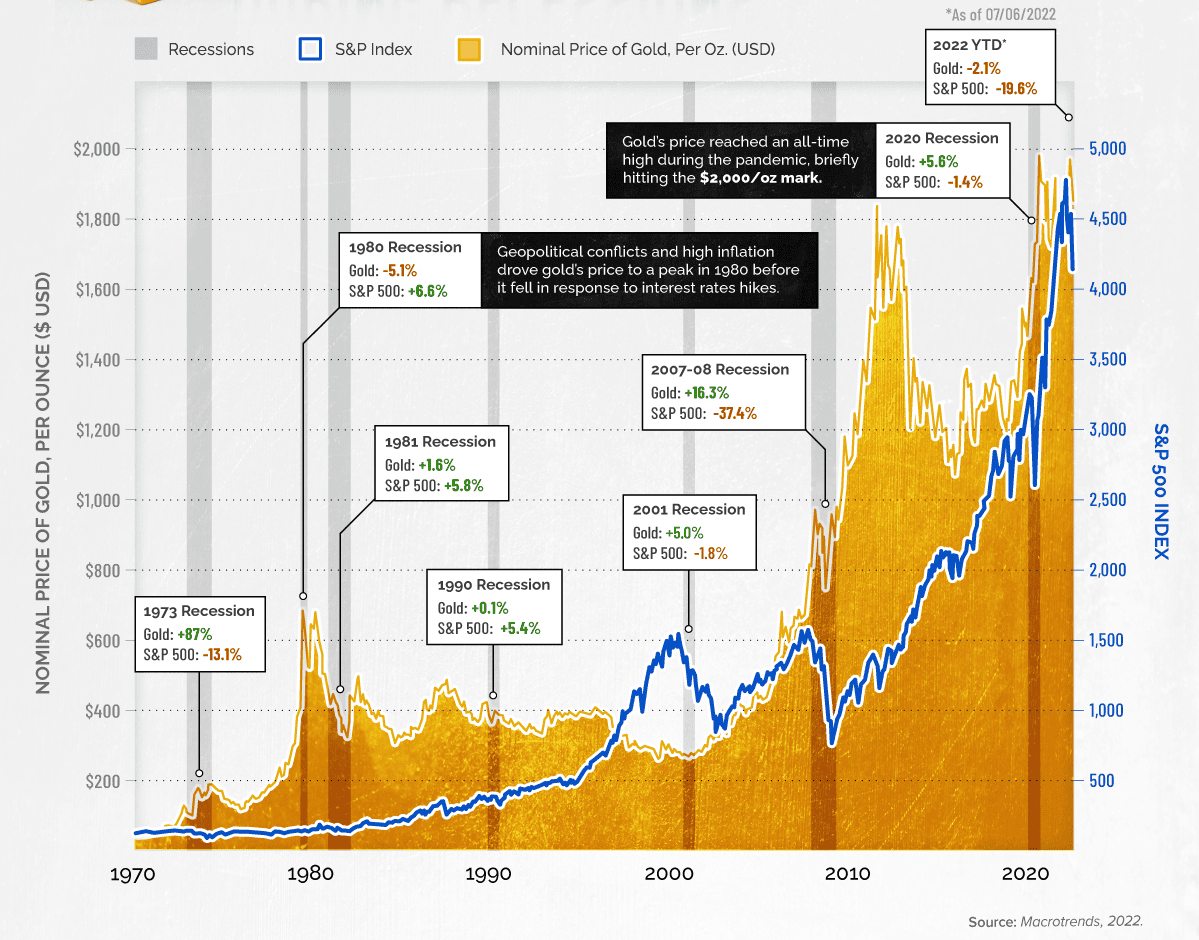

Gold has historically played a significant role in these economic cycles. During periods of economic expansion and peak, investor confidence is typically high, and the demand for gold often declines as people prefer higher-yielding investments. For instance, in the late 1990s during the dot-com boom, gold prices languished as technology stocks soared. Conversely, during economic contractions and troughs, gold often serves as a safe haven. The 2008 financial crisis is a notable example where gold prices surged as investors sought stability amidst the turmoil in financial markets.

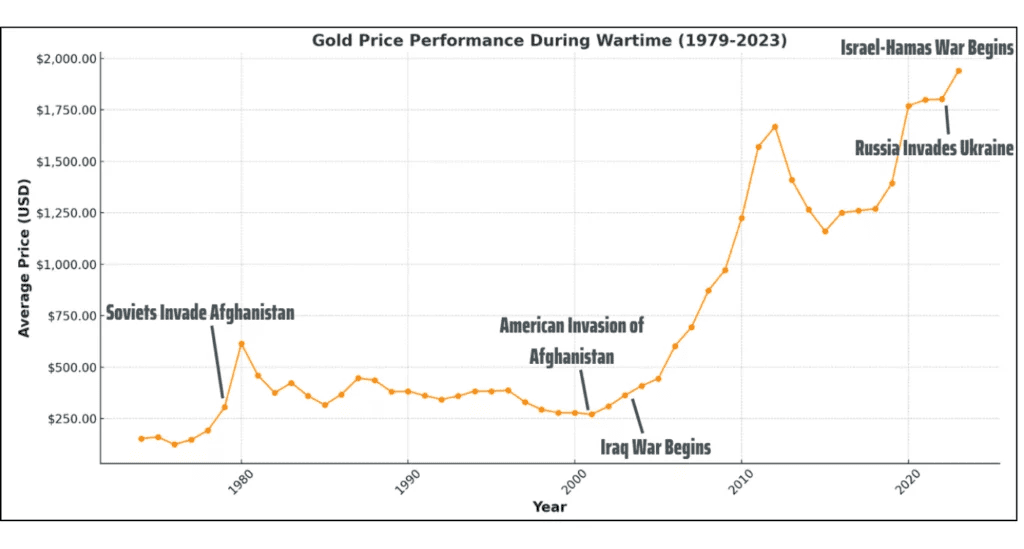

Gold's role as an economic cycle indicator stems from its inverse relationship with economic health. When economic uncertainty rises, such as during recessions or geopolitical tensions, gold tends to perform well. The COVID-19 pandemic is a recent example where gold prices spiked as global markets faced unprecedented volatility. Gold’s appeal as a safe haven is due to its intrinsic value and lack of correlation with other financial assets, providing a hedge against inflation and currency devaluation.

II. The Economic Cycle and Market Behavior

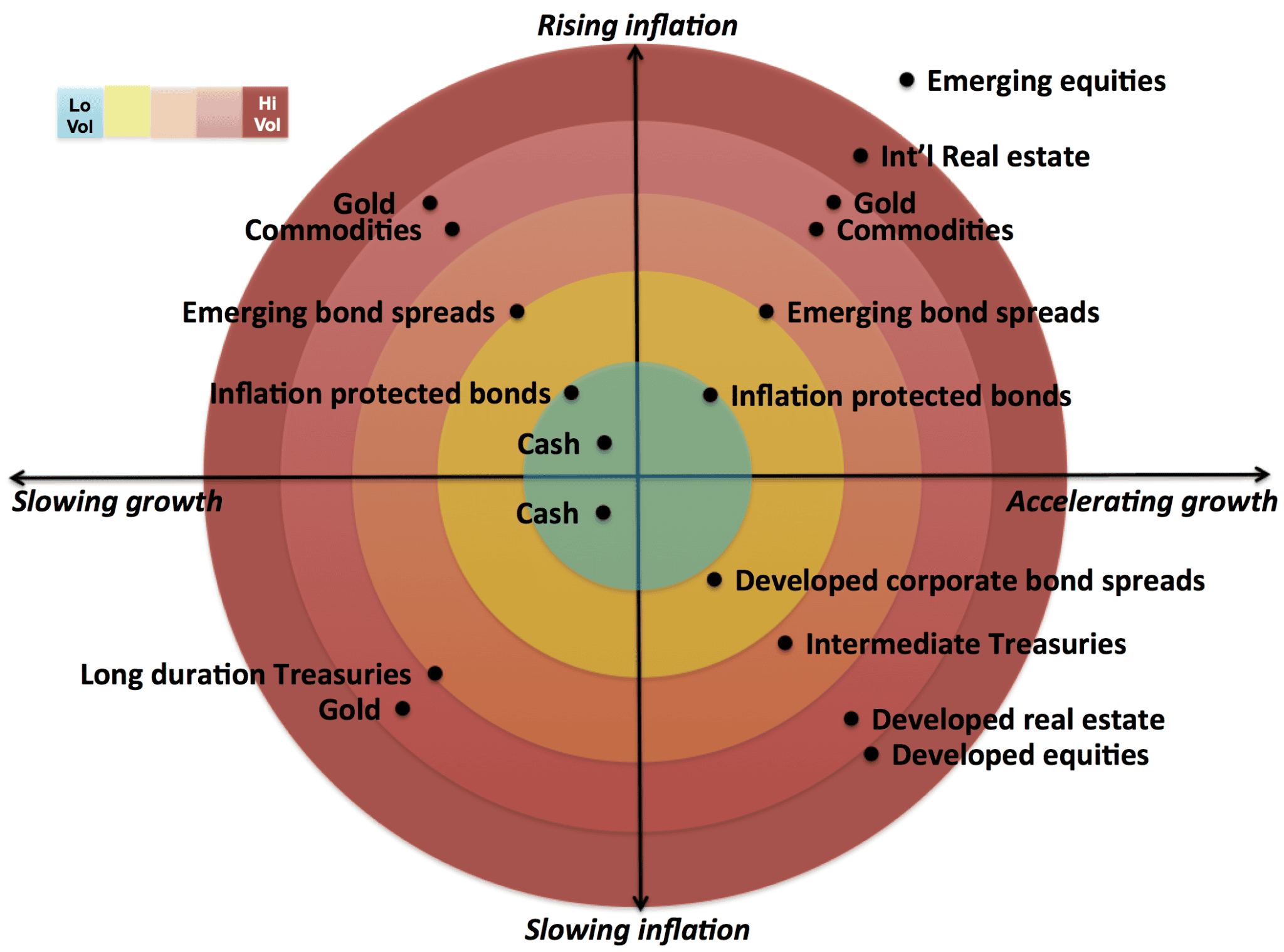

Economic indicators such as GDP growth rates, unemployment figures, and inflation data provide critical insights into the different stages of the economic cycle: expansion, peak, contraction, and trough. For example, during the expansion phase, rising GDP and low unemployment rates typically signal economic growth. Conversely, during contraction, GDP growth slows, and unemployment rates increase, indicating economic slowdown.

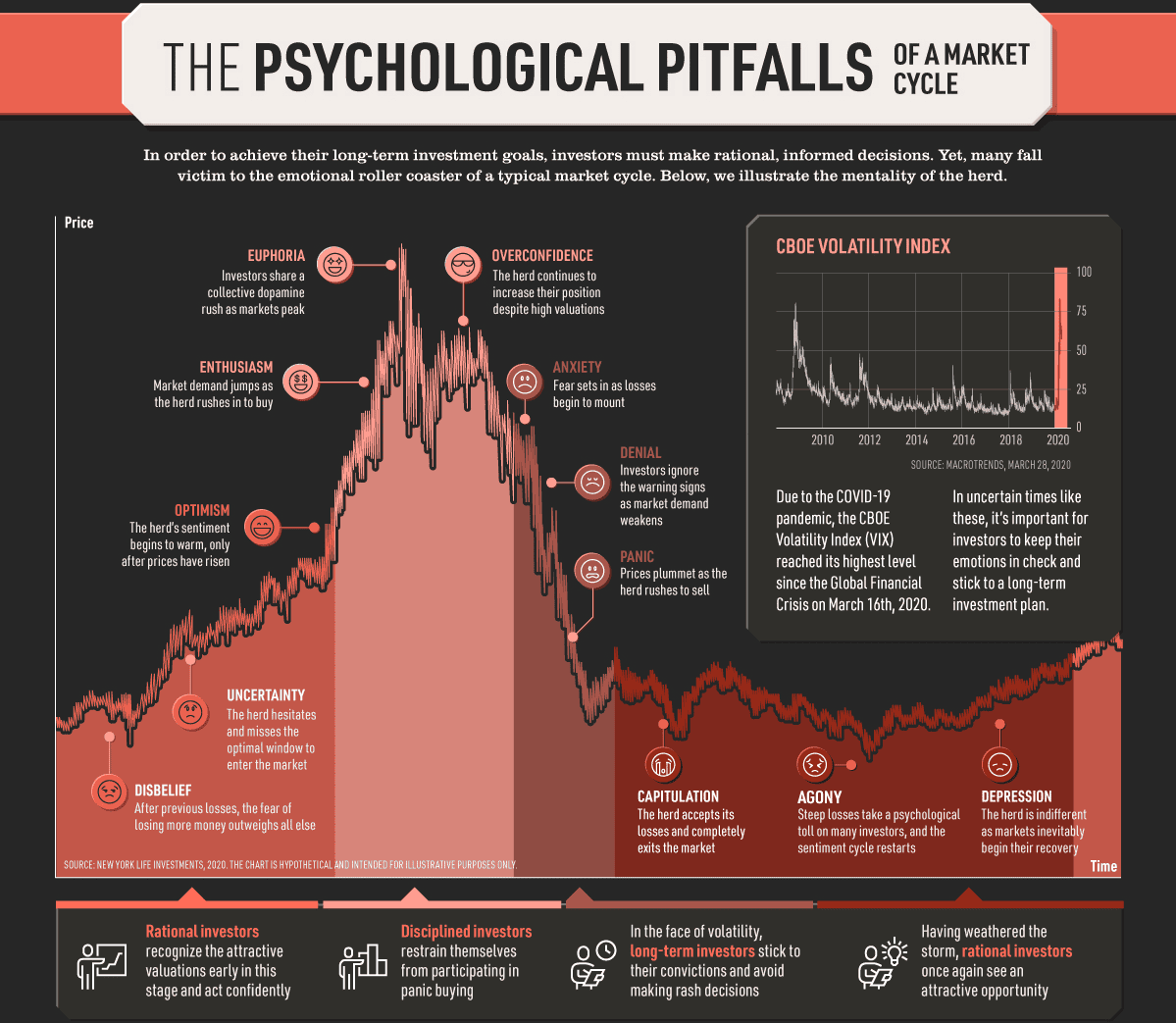

Market psychology plays a pivotal role in shaping investor behavior throughout these cycles. In the expansion phase, investor confidence is generally high, leading to bullish markets and increased investment in riskier assets. This behavior was evident during the mid-2000s housing boom, where optimism drove significant investments in real estate and mortgage-backed securities. As the cycle reaches its peak, exuberance can lead to overvaluation of assets, creating bubbles. The 2000 dot-com bubble exemplifies this, where excessive speculation drove technology stock prices to unsustainable levels before the subsequent crash.

Source: visualcapitalist.com

In the contraction phase, fear and uncertainty dominate, leading investors to seek safer assets. This shift in behavior is marked by a flight to quality, such as government bonds and gold. During the 2008 financial crisis, market participants moved their investments into gold and U.S. Treasuries as a hedge against the collapsing stock market and banking sector.

Asset classes respond differently to economic cycles. Equities typically perform well during expansions but struggle during contractions. Real estate values can also fluctuate significantly; for instance, the 2008 housing crisis led to a sharp decline in home prices. Conversely, assets like gold and government bonds often gain value during economic downturns as they are perceived as safer investments.

III. Gold in the Expansion Phase

During the economic expansion phase, characterized by robust GDP growth, low unemployment, and rising consumer confidence, gold's performance tends to diverge from other asset classes. Typically, gold does not perform as well during these periods due to the increased attractiveness of higher-yielding investments. For instance, in the late 1990s, as the technology sector experienced rapid growth and the dot-com bubble inflated, gold prices remained relatively stable or even declined. Investors were more inclined to invest in technology stocks, which offered substantial returns compared to gold's traditionally lower yields.

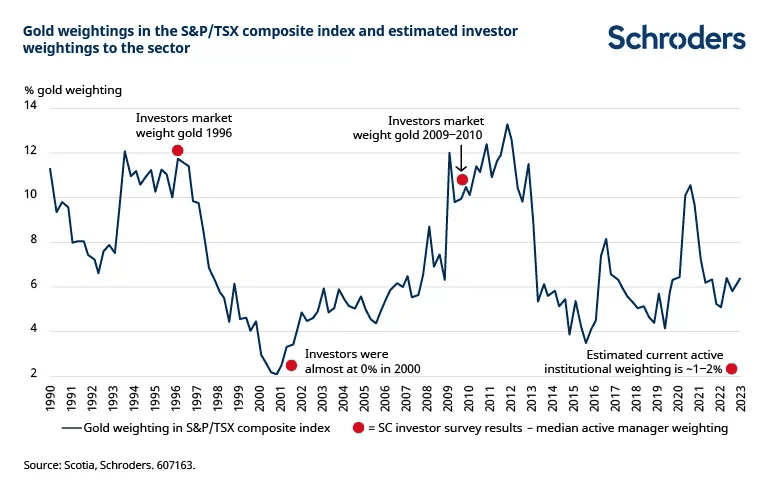

Gold's role as a diversification tool becomes more apparent during periods of prosperity. Even though economic growth might drive up stock prices and other assets, incorporating gold into an investment portfolio can provide a hedge against potential future uncertainties. For example, during the 2010s expansion, while equity markets surged, investors still allocated a portion of their portfolios to gold to mitigate risks associated with potential economic or geopolitical disruptions. Gold's low correlation with equities made it a valuable component of a diversified investment strategy, ensuring stability even if the market faced unexpected downturns.

Investor sentiment during economic booms often leads to reduced demand for gold. With increasing confidence in the economic outlook and higher returns from equities and real estate, investors may view gold as less attractive. For instance, in the mid-2000s, as global economies flourished and asset prices soared, gold prices faced downward pressure as investors shifted focus towards more lucrative investments, such as real estate and emerging market equities. This shift was further exacerbated by the strong performance of the U.S. dollar, which tends to negatively affect gold prices.

Source: linkedin.com

IV. Gold During Peak and Initial Contraction

At the peak of an economic cycle, market overconfidence often leads to inflated asset prices and speculative bubbles. During these periods, gold assumes a defensive role as investors begin to recognize the potential for market corrections. For example, at the height of the dot-com bubble in 2000, when technology stocks were highly overvalued, gold's price remained relatively stable compared to the dramatic swings in tech stocks. Investors started to see gold as a safeguard against an impending market downturn, even though the full impact of the bubble burst was not yet evident.

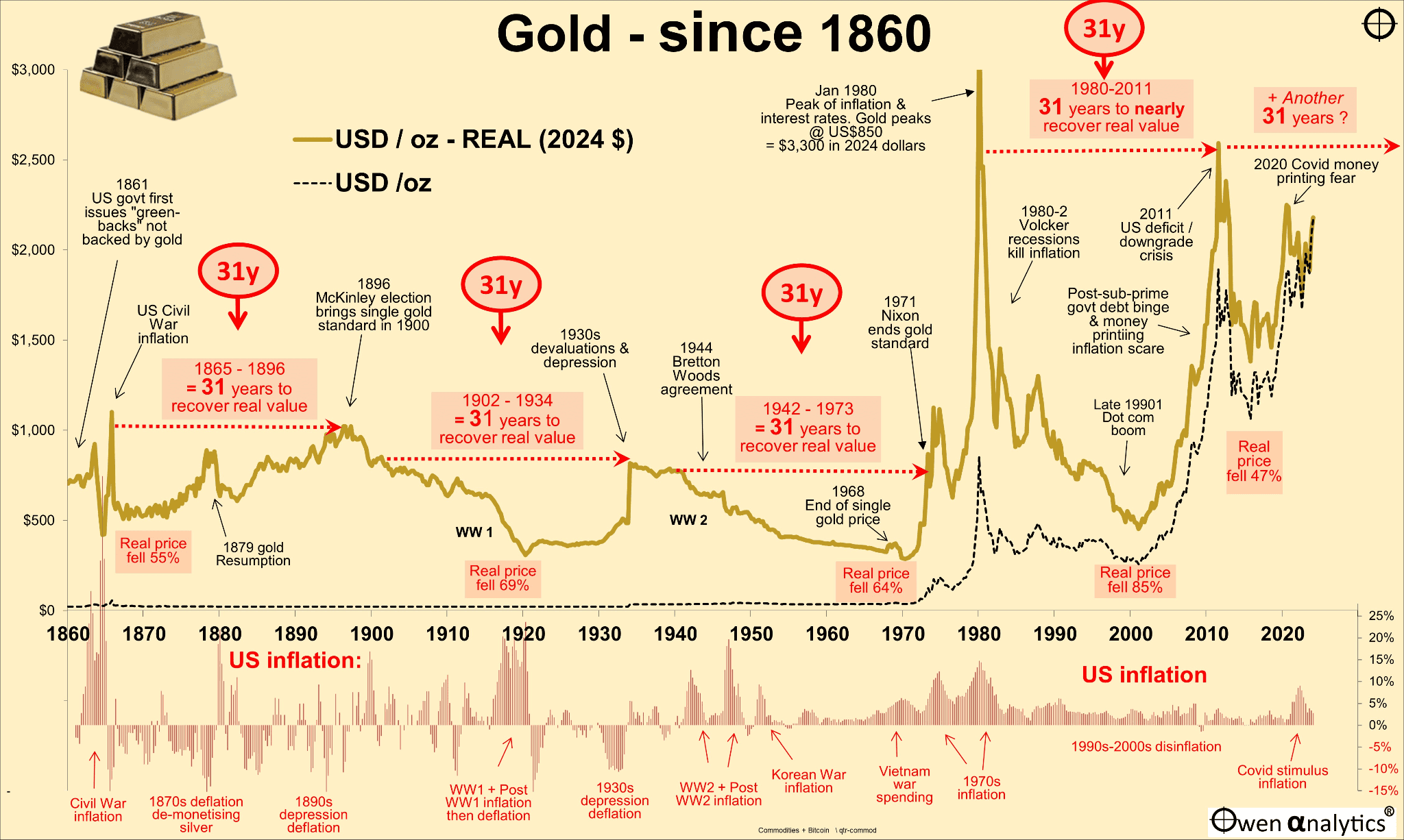

Source: owenanalytics.com.au

As the cycle transitions from peak to initial contraction, portfolio hedging becomes crucial. Investors, anticipating a slowdown, often reallocate assets to reduce exposure to equities and increase holdings in defensive assets like gold. During the 2007-2008 period, as the housing market peaked and signs of financial instability began to surface, gold prices began to rise as investors sought refuge from the declining stock markets and the looming financial crisis. This shift was a strategic move to hedge against losses in riskier assets and preserve wealth.

Early warning signs of economic downturn, such as declining consumer confidence, rising unemployment, or falling industrial production, can prompt an early response in gold markets. In 2008, as financial instability and rising concerns about the health of major banks became apparent, gold prices started to climb even before the full-blown effects of the recession were felt. This response reflected gold’s role as a barometer of economic stress and a reliable hedge against the anticipated turbulence in financial markets.

V. Gold in the Contraction Phase

During the contraction phase of the economic cycle, marked by declining GDP, rising unemployment, and reduced consumer spending, gold often shines as a safe haven. Economic indicators such as falling industrial production and deteriorating business confidence signal a recession, which typically boosts gold's appeal. For instance, during the 2008 financial crisis, as global economic indicators worsened with plummeting stock markets and escalating bank failures, gold prices surged. The metal provided a refuge from the financial instability and deflationary pressures affecting other asset classes.

Gold’s role as a safe haven becomes particularly pronounced amid market turmoil. In a recession, investor sentiment shifts from risk-taking to risk aversion. As stock markets and other investment vehicles suffer, gold is sought for its stability and intrinsic value. The 2020 COVID-19 pandemic serves as a recent example. As global economies faced lockdowns and uncertainty, gold prices increased significantly, peaking above $2,000 per ounce in August 2020. Investors flocked to gold to hedge against the economic disruptions and potential long-term impacts of the pandemic on financial markets.

Source: visualcapitalist.com

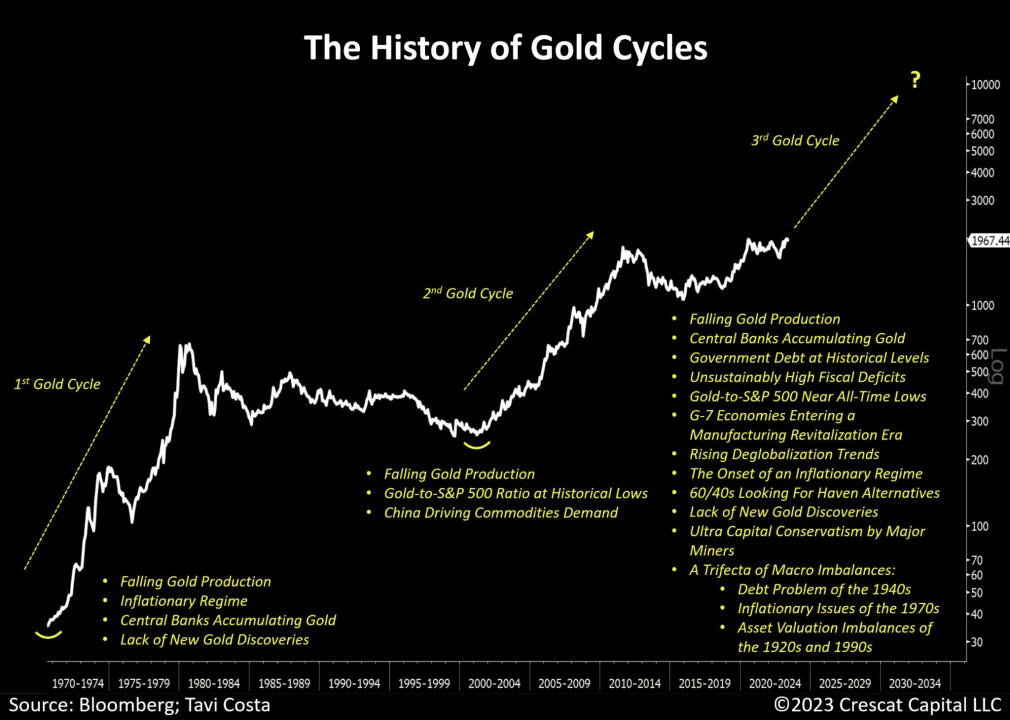

Case studies of gold's behavior during notable recessions further illustrate its role. In the early 1970s, during the stagflation period following the collapse of the Bretton Woods system, gold prices began to rise as inflation surged and economic growth stalled. Similarly, during the early 1980s recession, gold prices rebounded as high inflation and economic stagnation eroded confidence in traditional financial assets. Another key example is the 1990-1991 recession, where gold saw a price increase amidst geopolitical tensions and economic slowdowns.

VI. Gold in the Recovery Phase

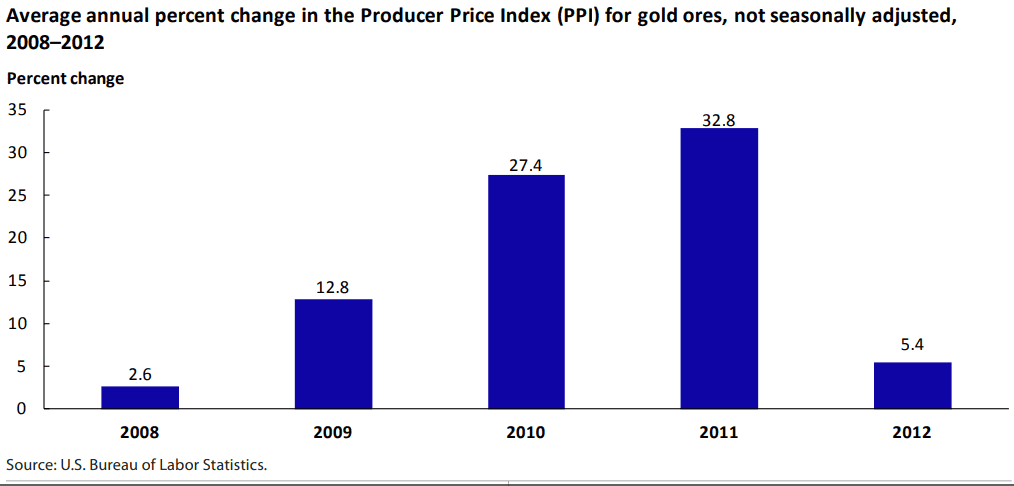

In the recovery phase of the economic cycle, characterized by improving GDP, decreasing unemployment, and rising consumer spending, gold's role and performance undergo significant changes. Early signs of economic revival, such as improving business sentiment and increasing industrial output, often lead to shifts in investment strategies. As the economy begins to rebound, gold's role as a safe haven diminishes, and investors may start reallocating funds towards higher-yielding assets. For instance, following the 2008 financial crisis, as the global economy began to recover in 2009, gold prices, which had surged during the downturn, started to stabilize and eventually decline as investor confidence returned and equities began to outperform.

Gold's performance in the post-recession period can vary between recovery and reversion to previous trends. During recoveries, gold may see diminished demand as investors seek higher returns from equities and real estate. For example, in the aftermath of the 2008 crisis, while gold reached record highs in the early years of the recovery, its performance plateaued as stock markets rallied and economic conditions improved. By 2012, as the U.S. economy gained traction, gold prices experienced volatility and downward pressure, reflecting the shift in investor focus from safe havens to growth-oriented assets.

Source: bls.gov

Investor confidence plays a crucial role in gold’s position as economies recover. As confidence in economic stability grows, investors often reallocate their portfolios away from gold to more growth-oriented investments. In the early 1990s, following the recession, investors shifted focus to emerging markets and technology stocks, leading to a decline in gold's appeal. Similarly, during the recovery phase from the COVID-19 pandemic, gold faced pressure as global economies reopened and equity markets surged, reflecting a shift in investor sentiment towards riskier, higher-yielding assets.

VII. Gold and Inflation Dynamics Across Cycles

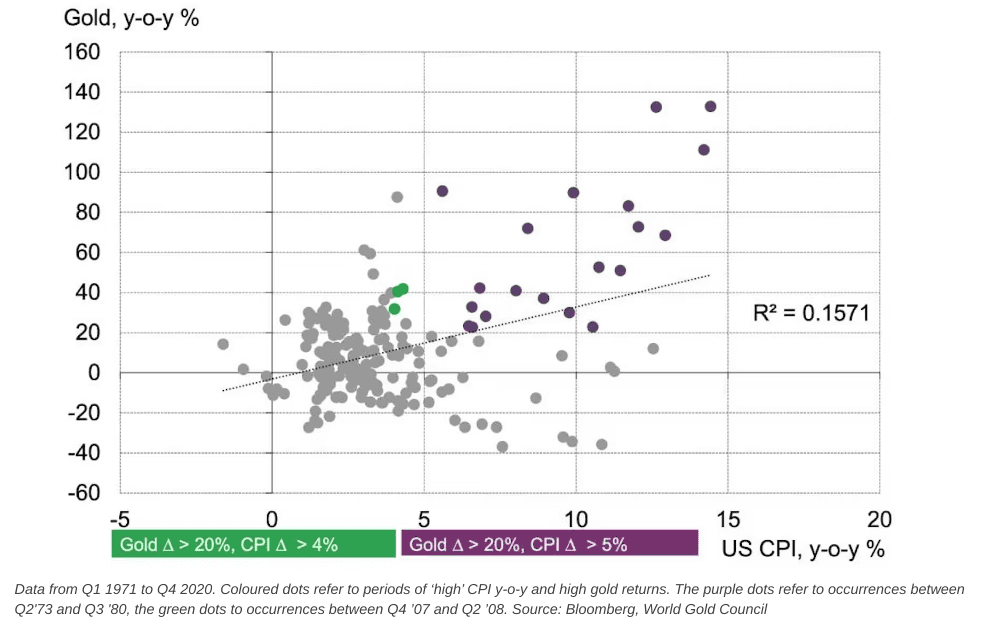

Gold has long been considered a hedge against inflation, with its performance often reflecting inflationary expectations and economic conditions. As inflation expectations rise, gold typically gains favor as a store of value that preserves purchasing power. For instance, during the 1970s stagflation, characterized by high inflation and economic stagnation, gold prices soared. The 1971 end of the Bretton Woods system, which led to the U.S. dollar being decoupled from gold, further fueled inflationary fears and drove gold’s price to unprecedented levels.

Gold’s correlation with inflation metrics varies across different economic cycles. During periods of low inflation, gold’s performance may be subdued as the real return on bonds and equities becomes more attractive. For example, in the mid-2000s, with inflation relatively low and stable, gold prices remained relatively flat as investors preferred higher-yielding investments. Conversely, during periods of high inflation, gold often shows a positive correlation with inflation metrics. For instance, during the 2008 financial crisis, despite deflationary pressures initially, gold prices eventually rose as inflationary concerns about the long-term effects of monetary stimulus measures took hold.

Source: reuters.com

Strategies for using gold to protect against inflationary pressure involve integrating it into a diversified portfolio. Investors typically allocate a portion of their assets to gold to hedge against inflation risks, particularly when inflation expectations are rising. During the early 1980s, when inflation was high and volatile, investors increasingly turned to gold as a safeguard, resulting in significant price increases. Similarly, in the late 2010s, amid rising concerns about potential inflation from expansive fiscal policies and low interest rates, gold prices began to climb as investors sought to protect their portfolios from eroding purchasing power.

VIII. Gold and Deflationary Risks

Deflation, characterized by a general decline in prices and a decrease in the money supply, can have profound effects on the economy and financial markets. Deflation often arises during severe recessions or economic slowdowns, where reduced consumer spending and declining asset prices create a cycle of economic contraction. For example, during the Great Depression of the 1930s, deflation led to plummeting commodity prices and widespread economic hardship, significantly impacting market behavior.

In deflationary environments, gold's performance can be somewhat counterintuitive. Unlike inflation, where gold typically excels as a hedge, deflation often leads to a strong dollar and lower gold prices. During the Great Depression, despite economic distress, gold prices fell due to the strengthening of the U.S. dollar and decreased demand for non-essential commodities. Similarly, in the early 2000s, despite the economic slowdown post-dot-com bubble and the threat of deflation, gold prices were relatively subdued as central banks maintained low interest rates and deflationary pressures were mitigated.

Portfolio allocation strategies during deflationary cycles need to consider gold’s less straightforward role. While gold is a traditional hedge against inflation, its effectiveness during deflation is mixed. Investors might favor assets that benefit from deflationary conditions, such as high-quality government bonds and cash, which retain value as prices fall. For example, during the 2008 financial crisis, despite fears of deflation, gold did not see significant gains as U.S. Treasury bonds and cash became more attractive to investors seeking safety and liquidity.

Source: gestaltu.com

However, in more recent instances, such as the early COVID-19 pandemic, central banks' aggressive monetary policies and fiscal stimulus measures created mixed signals, and gold did see some appreciation amidst global uncertainty and fears of potential deflationary pressures.

IX. Gold and Interest Rates Through Economic Cycles

Interest rates play a critical role in influencing gold prices and investment behavior. Gold generally exhibits an inverse relationship with interest rates: as rates rise, gold prices tend to fall, and vice versa. This is primarily because higher interest rates increase the opportunity cost of holding non-yielding assets like gold, making interest-bearing investments more attractive. For example, during the 1970s, gold prices surged as the Federal Reserve kept interest rates low amidst rising inflation. Conversely, in the early 1980s, as the Fed raised interest rates to combat inflation, gold prices declined sharply due to the higher opportunity cost of holding gold over interest-bearing assets.

Gold’s performance varies in different interest rate environments. During periods of rising interest rates, such as the late 1970s to early 1980s, gold struggled as rising yields made bonds and savings accounts more appealing. For instance, between 1979 and 1981, as the Fed hiked interest rates to curb inflation, gold prices fell from their highs, reflecting the diminished allure of gold in the face of rising yields. Conversely, in falling interest rate environments, gold often benefits due to lower opportunity costs and increased appeal as a hedge against potential inflation. For instance, during the aftermath of the 2008 financial crisis, central banks globally reduced interest rates to near-zero levels, contributing to a significant rise in gold prices as investors sought assets that could preserve value amidst low yields.

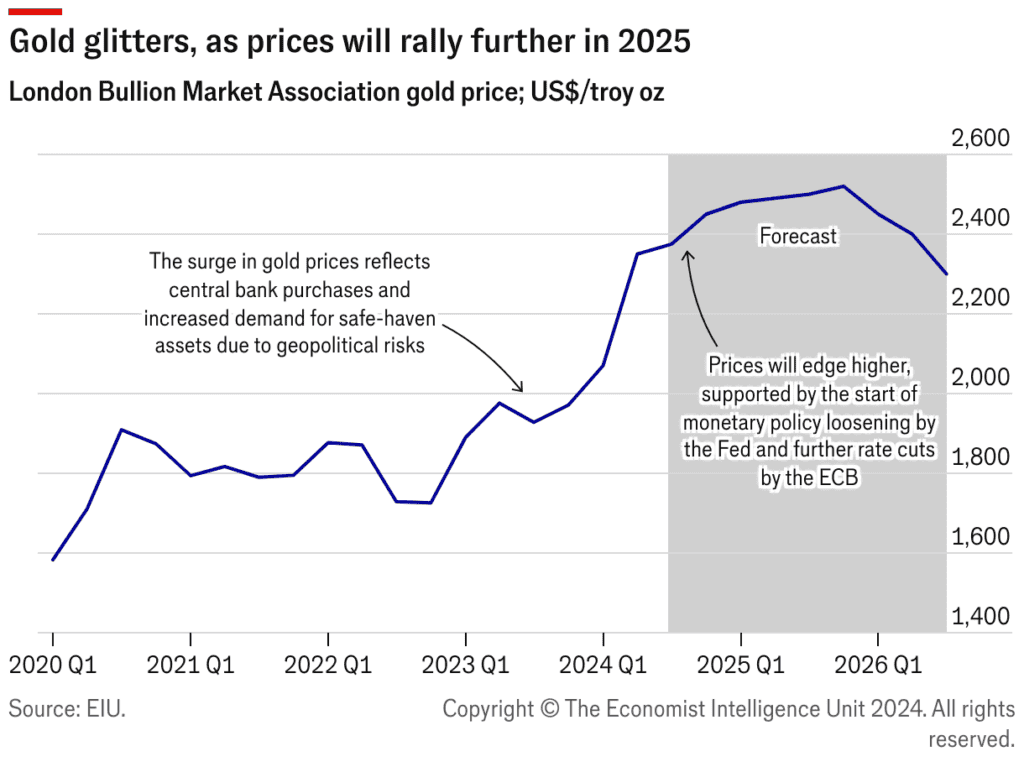

Central bank policies profoundly impact gold demand. Central banks' decisions on interest rates influence their own gold reserves and market sentiment. For example, in response to the 2008 crisis, central banks adopted expansive monetary policies, including low interest rates and quantitative easing, which fueled investor concerns about future inflation and currency devaluation, driving up gold prices. Similarly, recent central bank actions to lower rates and engage in substantial monetary stimulus during the COVID-19 pandemic contributed to rising gold prices as investors anticipated long-term economic uncertainty.

Source: services.eiu.com

X. Gold as a Leading Indicator

Gold has often been considered a leading indicator for economic changes due to its sensitivity to shifts in economic sentiment, inflation expectations, and financial stability. As a non-yielding asset, gold tends to react to changes in economic conditions before they are fully reflected in broader financial markets. For instance, gold prices often rise in anticipation of economic downturns or inflationary pressures, reflecting investor concerns about future instability.

Historical evidence demonstrates gold's ability to predict market shifts. During the early 1970s, as inflation began to rise significantly, gold prices started to climb well before inflationary pressures became widespread in the broader economy. This preemptive rise in gold prices was indicative of growing concerns about the value of paper currencies and future economic instability. Similarly, in the lead-up to the 2008 financial crisis, gold prices began to increase in 2007, signaling investor fears about the impending collapse of financial institutions and the potential for economic recession.

Using gold as a signal for portfolio rebalancing involves monitoring gold's price movements as an indicator of potential economic shifts. For example, when gold prices begin to rise significantly, it may signal that investors are anticipating economic instability or inflation, prompting a reassessment of asset allocation. In 2020, as the COVID-19 pandemic triggered global economic uncertainty and massive monetary stimulus, gold prices surged, indicating heightened concerns about inflation and currency devaluation. Investors using gold as a leading indicator might have adjusted their portfolios by increasing allocations to safe-haven assets or diversifying into sectors expected to perform well in volatile conditions.

Source: schroders.com

XI. International Factors and Gold

Gold’s performance is significantly influenced by international factors, including currency fluctuations, global demand and supply dynamics, and geopolitical events. Understanding these factors is crucial for comprehending gold's role and price movements in the global market.

Gold's Performance in Different Currencies and Economies

Gold is typically priced in U.S. dollars, so fluctuations in the value of the dollar can directly impact gold prices. When the dollar strengthens, gold prices in dollars often decline because gold becomes more expensive in other currencies. For example, in 2014, as the U.S. dollar appreciated due to strong economic data and monetary policy expectations, gold prices fell significantly. Conversely, when the dollar weakens, gold prices usually rise as gold becomes cheaper in other currencies, boosting demand. During the early 2000s, as the U.S. dollar depreciated, gold prices increased sharply, reflecting heightened demand for gold as a hedge against currency devaluation.

Global Demand and Supply Factors Affecting Gold Prices

Global demand for gold, driven by factors such as jewelry consumption, industrial use, and investment, plays a crucial role in determining prices. For instance, in emerging economies like India and China, high demand for gold jewelry and investment drove significant price increases in the 2000s. Supply factors also influence prices; disruptions in mining production or changes in central bank policies regarding gold reserves can impact the market. For example, in the early 1980s, South Africa, a major gold producer, faced mining strikes that reduced supply and contributed to rising gold prices.

Geopolitical Events and Gold's Safe Haven Appeal

Gold's role as a safe haven is particularly pronounced during geopolitical tensions and crises. For example, during the 2003 Iraq War and the 2011 Arab Spring, gold prices surged as investors sought refuge from geopolitical uncertainty. Similarly, during the 2019 U.S.-China trade war, gold prices climbed as trade tensions and potential economic disruptions spurred demand for safe-haven assets.

Source: herobullion.com

XII. Advanced Gold Investment Strategies for Economic Cycles

Advanced gold investment strategies leverage sophisticated approaches to optimize returns and manage risk across different economic cycles. These strategies include dynamic asset allocation, tactical trading with futures and options, and algorithmic and quantitative approaches.

Dynamic Asset Allocation with Gold

Dynamic asset allocation involves adjusting the proportion of gold in an investment portfolio based on economic conditions and market forecasts. During periods of economic uncertainty or market volatility, investors might increase their allocation to gold as a hedge against risk. For instance, during the 2008 financial crisis, many investors rebalanced their portfolios by increasing their gold holdings to offset losses in equities. Conversely, in periods of economic expansion, investors might reduce their gold exposure in favor of assets with higher growth potential. This flexible approach allows investors to adapt to changing economic conditions and optimize portfolio performance.

Tactical Trading Strategies Using Gold Futures and Options

Gold futures and options provide tools for tactical trading strategies, enabling investors to capitalize on short-term price movements and manage risk. Futures contracts allow investors to buy or sell gold at a predetermined price in the future, which can be used to speculate on price changes or hedge existing positions. For example, during the 2020 COVID-19 pandemic, traders used gold futures to profit from the surge in gold prices driven by economic uncertainty. Options contracts, on the other hand, give investors the right, but not the obligation, to buy or sell gold at a specific price before a certain date, offering flexibility in managing exposure to gold price movements. Investors might use call options to benefit from anticipated price increases or put options to hedge against potential declines.

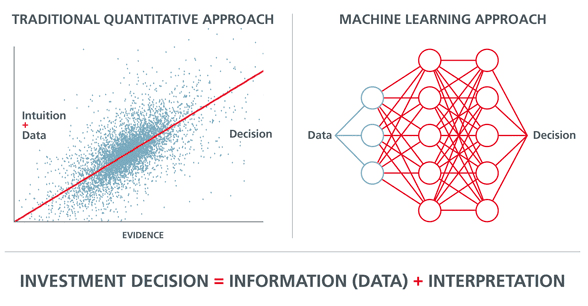

Algorithmic and Quantitative Approaches to Gold Investing

Algorithmic and quantitative approaches involve using mathematical models and algorithms to make investment decisions. These methods analyze large datasets to identify patterns and predict gold price movements. For example, quantitative models might use historical price data, economic indicators, and market sentiment analysis to develop trading signals for gold. Algorithmic trading strategies can automate buying and selling decisions based on predefined criteria, improving efficiency and potentially capturing more opportunities. During the 2015 gold price downturn, quantitative strategies that incorporated macroeconomic factors and technical indicators provided insights for adjusting gold exposure in response to shifting market conditions.

Source: eastspring.com

XIII. Conclusion: The Timeless Role of Gold in Economic Cycles

Gold has consistently demonstrated its unique role across various economic phases, solidifying its position as a crucial asset in investment portfolios. Throughout economic cycles—expansion, peak, contraction, and recovery—gold’s performance reflects its dual nature as both a defensive asset and a hedge against economic uncertainty.

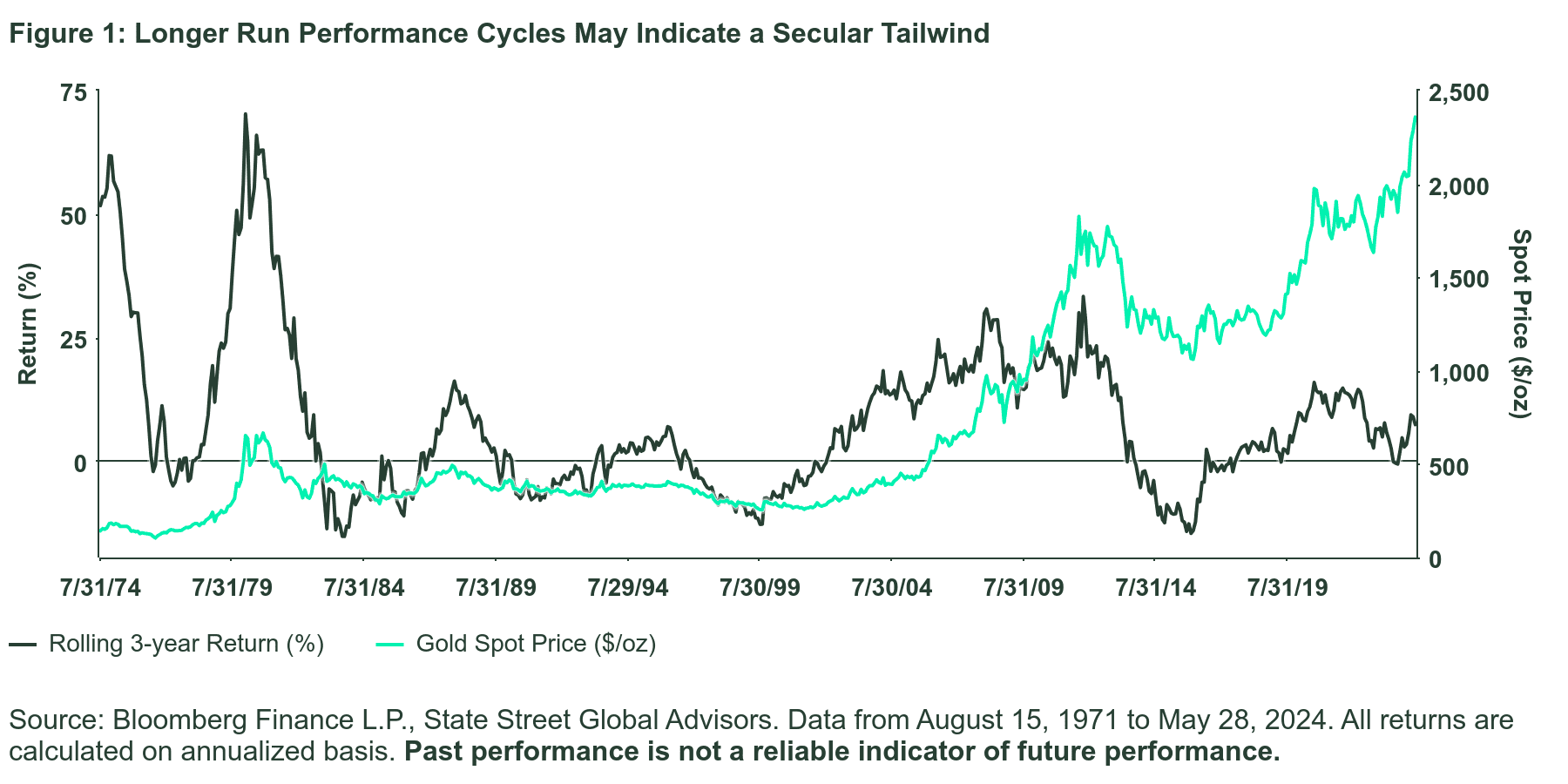

Source: ssga.com

During expansion phases, gold may see subdued demand as investors favor higher-yielding assets like equities. However, it remains a valuable diversification tool, protecting portfolios against unexpected market shocks. For instance, in the prosperous early 2000s, gold’s role as a hedge against geopolitical risks and inflation kept it relevant, even as stock markets soared. At economic peaks, when market overconfidence and asset bubbles emerge, gold becomes increasingly attractive as a safe haven. The 2007-2008 financial crisis exemplifies this, where gold prices surged as investors sought to hedge against looming financial instability.

In contraction phases, gold’s value is most apparent. As markets tumble and economic conditions deteriorate, gold serves as a refuge. The 2008 crisis and the 2020 COVID-19 pandemic are prime examples where gold prices spiked as investors fled to safety. During recovery phases, while gold may lose some appeal as risk appetite returns, its role as a store of value persists, offering protection against future uncertainties.

The enduring value of gold in investment portfolios lies in its ability to mitigate risk and preserve wealth across economic cycles. Unlike other assets, gold’s intrinsic value is not tied to any single economy or government, making it a reliable hedge against currency devaluation, inflation, and systemic risk. Historical evidence—from the stagflation of the 1970s to the global crises of the 21st century—underscores gold’s timeless role in providing stability and security in an ever-changing economic landscape. As such, gold remains an indispensable component of a well-diversified investment strategy, capable of weathering the full spectrum of economic conditions.