Gold Exchange-Traded Funds (ETFs) offer investors a convenient and efficient way to gain exposure to the gold market without the complexities of purchasing, storing, or securing physical gold. These financial instruments are designed to track the price of gold, allowing investors to benefit from movements in gold prices without dealing with the logistical challenges associated with physical gold ownership.

Source: outlookbusiness.com

One of the key advantages of gold ETFs is liquidity. Unlike physical gold, which can be cumbersome to buy and sell, gold ETFs trade on stock exchanges just like shares of a company. This means investors can buy or sell units of a gold ETF during market hours at prevailing market prices. This ease of trading makes gold ETFs an accessible option for investors seeking to quickly enter or exit a gold position.

Moreover, gold ETFs are cost-effective. They eliminate the need for storage, insurance, and security costs associated with physical gold. Management fees for gold ETFs are generally lower than the costs of physically storing gold, making them an attractive option for cost-conscious investors. Additionally, gold ETFs allow for fractional ownership, enabling investors to buy small amounts of gold according to their budget and investment strategy.

Transparency is another significant benefit of gold ETFs. These funds are required to disclose their holdings daily, ensuring that investors know exactly how much gold the ETF holds and how it is being managed. This level of transparency provides investors with confidence that their investment is truly backed by physical gold, and it reduces the risk of fraud or mismanagement.

Diversification is also a critical aspect of gold ETFs. Investors can easily add gold to their portfolios without the complications of dealing with physical commodities. This is particularly valuable in times of market uncertainty, where gold is often seen as a safe-haven asset. By including gold ETFs in a diversified portfolio, investors can hedge against inflation, currency fluctuations, and economic downturns.

Source: maxiomwealth.com

What are Gold ETFs?

Gold Exchange-Traded Funds (ETFs) are financial instruments that offer investors exposure to the price movements of gold without the need to own the physical commodity. Essentially, a gold ETF is a type of fund that is traded on stock exchanges, much like individual stocks. Each share of a gold ETF represents a fractional ownership of gold, typically measured in ounces or grams, stored in secure vaults by the fund’s custodian.

Gold ETFs differ significantly from other gold investment methods, such as purchasing physical gold (coins, bars, or jewelry), gold mining stocks, or gold futures contracts. Unlike physical gold, which requires storage, insurance, and security, gold ETFs eliminate these logistical challenges. In contrast to gold mining stocks, which are subject to company-specific risks like management performance and operational costs, gold ETFs are directly tied to the price of gold itself. Gold futures, while allowing leveraged exposure to gold prices, carry significant risk due to margin requirements and the potential for contract expiration without delivery. Gold ETFs provide a simpler, more liquid way to invest in gold compared to these alternatives.

Source: ssga.com

Operational Mechanism of Gold ETFs

The operational mechanism of gold ETFs revolves around tracking the price of gold as closely as possible. To achieve this, the fund manager purchases and holds physical gold, typically in large quantities, stored in secure vaults. The total value of the gold held by the ETF is divided by the number of shares issued, determining the value of each share. This share price fluctuates in real-time during market hours, mirroring the price movements of gold on global markets.

Gold ETFs are typically structured as open-ended funds, meaning that the number of shares outstanding can increase or decrease based on investor demand. When investors purchase shares of a gold ETF, the fund manager may buy additional physical gold to back these shares, ensuring that the ETF remains fully backed by gold holdings. Conversely, when investors sell shares, the fund manager may sell gold from the vaults to match the reduction in outstanding shares.

An essential feature of gold ETFs is their transparency. ETFs are required to disclose their gold holdings daily, providing investors with a clear view of the physical gold backing each share. This transparency is a key differentiator from other forms of gold investment, where the actual gold backing may be less clear.

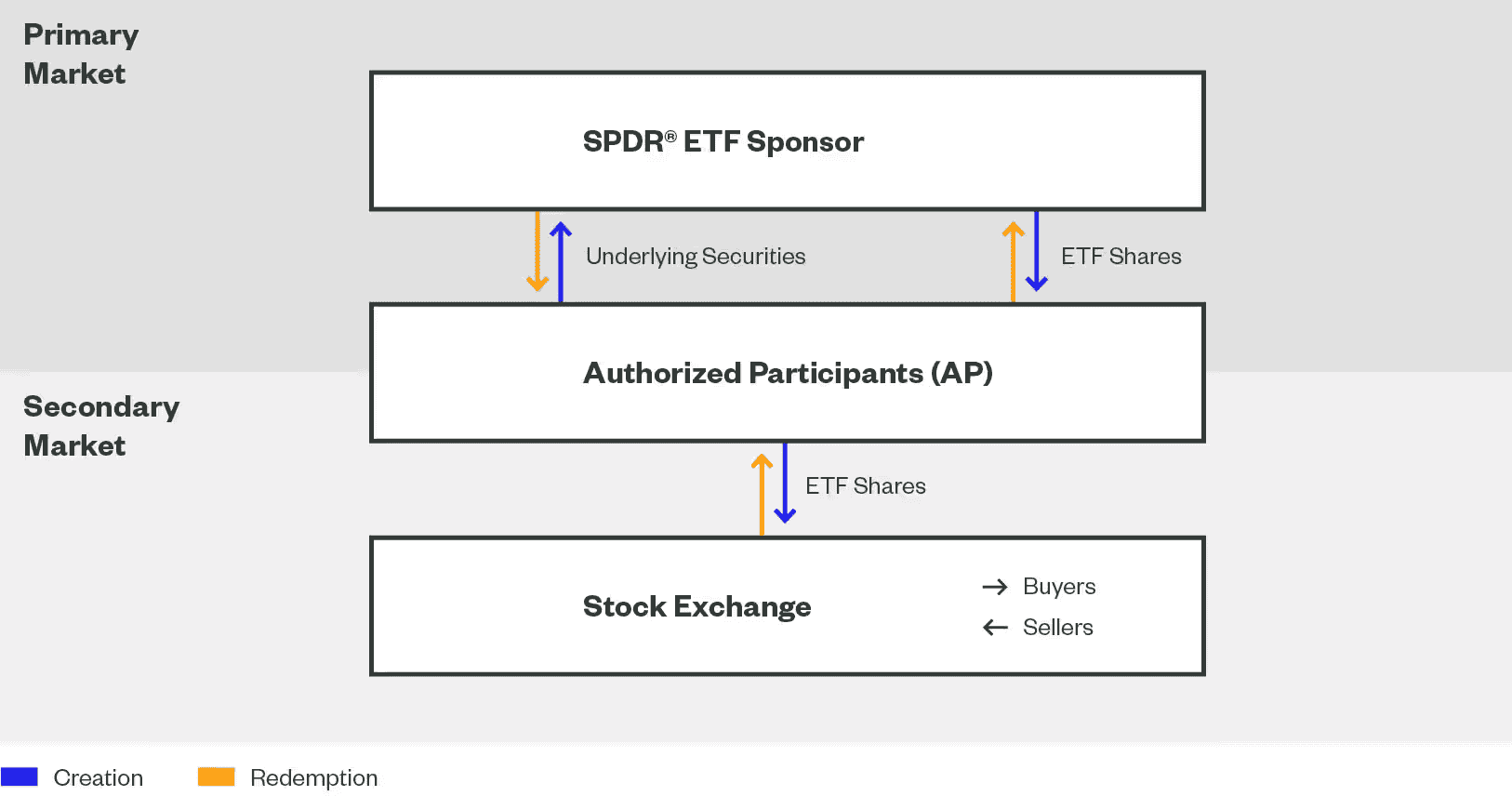

Additionally, gold ETFs often use a "creation and redemption" process to maintain alignment between the ETF's share price and the spot price of gold. If the ETF’s price deviates from the underlying gold price, large institutional investors, known as Authorized Participants (APs), can step in. They buy or sell gold in exchange for ETF shares, which either adds or removes shares from the market, bringing the ETF’s price back in line with the gold price. This mechanism ensures that gold ETFs accurately reflect the market price of gold, providing investors with a reliable and efficient way to invest in the precious metal.

Source: ssga.com

Advantages of Investing in Gold ETFs

Accessibility and Flexibility:

Gold ETFs provide a highly accessible entry point for investing in gold, especially for those who want exposure to the precious metal without the complexities of owning and storing physical gold. Unlike physical gold, which requires safe storage, insurance, and sometimes even verification of purity, gold ETFs eliminate these challenges. Investors can buy shares in a gold ETF through a standard brokerage account, just like they would with any other stock or bond. This ease of access makes gold ETFs particularly attractive for small and retail investors who might find the logistics of buying, storing, and selling physical gold cumbersome or cost-prohibitive.

Moreover, gold ETFs offer flexibility in terms of investment size. Investors are not required to purchase whole ounces or kilograms of gold, as is the case with physical gold. Instead, they can buy fractional shares of a gold ETF, allowing them to invest according to their budget and risk appetite. This fractional ownership model makes gold ETFs accessible to a wider range of investors, enabling them to adjust their holdings with relative ease in response to market conditions.

Cost Efficiency:

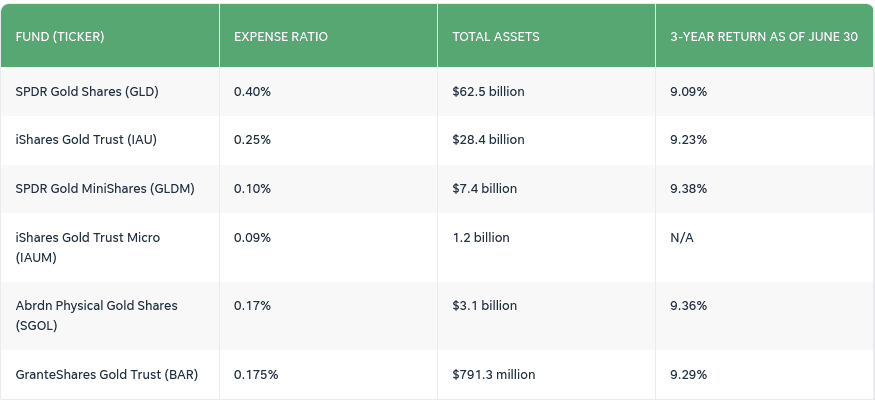

Another significant advantage of gold ETFs is their cost efficiency. Gold ETFs typically have lower expense ratios compared to mutual funds or other gold investment vehicles. The expense ratio of a gold ETF includes management fees and administrative costs, which are usually lower than the costs associated with mutual funds or the expenses related to purchasing, storing, and insuring physical gold.

[August 2024]

Source: usatoday.com

In addition to lower management fees, gold ETFs also eliminate the need for additional costs such as storage fees, security measures, and insurance premiums that physical gold ownership requires. This reduction in ancillary costs makes gold ETFs a more cost-effective option for investors seeking exposure to gold. Furthermore, because gold ETFs trade on stock exchanges, they also benefit from lower transaction costs compared to other gold investments. The simplicity of buying and selling gold ETFs through a brokerage account further enhances their cost efficiency, making them an attractive option for both long-term and short-term investors.

Liquidity:

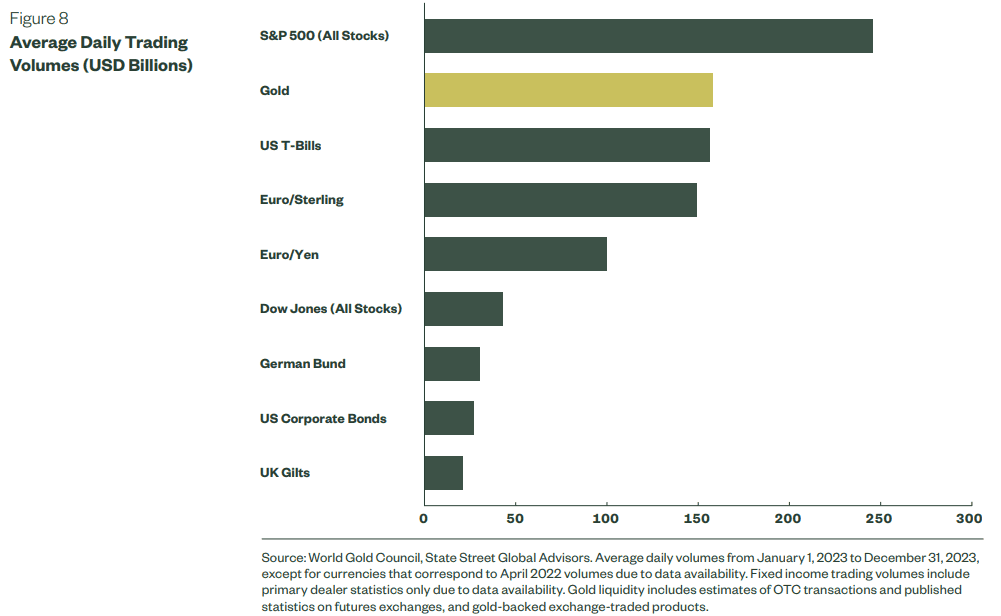

Liquidity is a critical advantage of gold ETFs, providing investors with the ability to buy and sell shares easily across various market conditions. Gold ETFs trade on major stock exchanges, offering continuous pricing and the ability to transact at any time during market hours. This high liquidity ensures that investors can enter or exit positions with minimal delay, making gold ETFs a more liquid investment compared to physical gold or even some gold mutual funds, which might have restrictions on redemptions.

The liquidity of gold ETFs is further supported by the presence of market makers and Authorized Participants (APs) who ensure that the ETF’s price remains closely aligned with the underlying price of gold. If the ETF’s price deviates from the spot price of gold, these institutions can step in to buy or sell ETF shares, maintaining the liquidity and price integrity of the fund. This mechanism ensures that gold ETFs can be bought or sold quickly and at fair market prices, even in times of market stress or heightened volatility.

Source: ssga.com

Best Gold ETFs in the Market

SPDR Gold Shares (GLD):

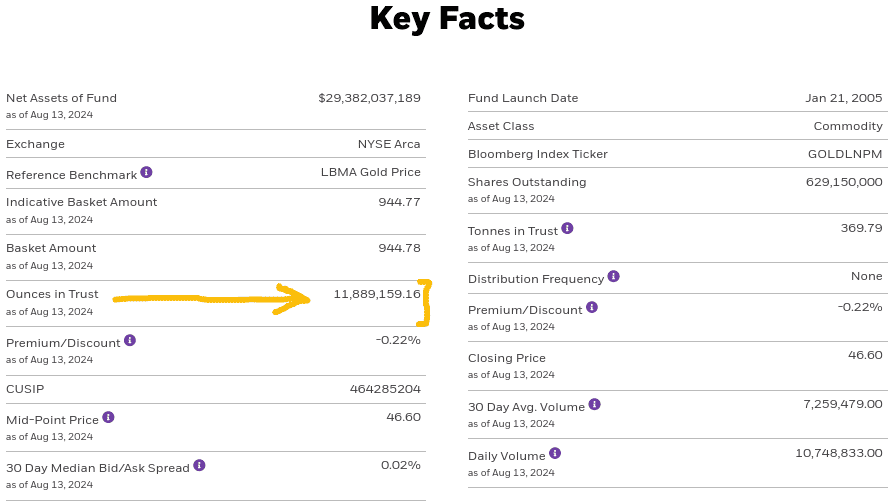

SPDR Gold Shares (GLD) is the largest and most traded gold ETF in the market, offering investors direct exposure to gold. Launched in 2004, GLD has become a benchmark for gold ETFs due to its size, liquidity, and reliability. As of the latest data, GLD holds billions of dollars in assets under management (AUM), reflecting the trust and preference of investors worldwide. The ETF’s immense size allows for deep liquidity, meaning investors can buy or sell large quantities of GLD shares with minimal impact on the market price.

[SPDR Gold Shares]

Source: ssga.com

GLD is structured to track the spot price of gold by holding physical gold bars in secure vaults. Each share of GLD represents a fraction of an ounce of gold, providing investors with a straightforward way to gain exposure to gold prices without the challenges of physical ownership. The ETF’s liquidity is a significant advantage, as it enables investors to trade GLD shares at any time during market hours at tight bid-ask spreads, reducing transaction costs and facilitating efficient portfolio management. Furthermore, GLD’s widespread recognition and institutional backing make it a preferred choice for both individual and institutional investors seeking a robust gold investment vehicle.

iShares Gold Trust (IAU):

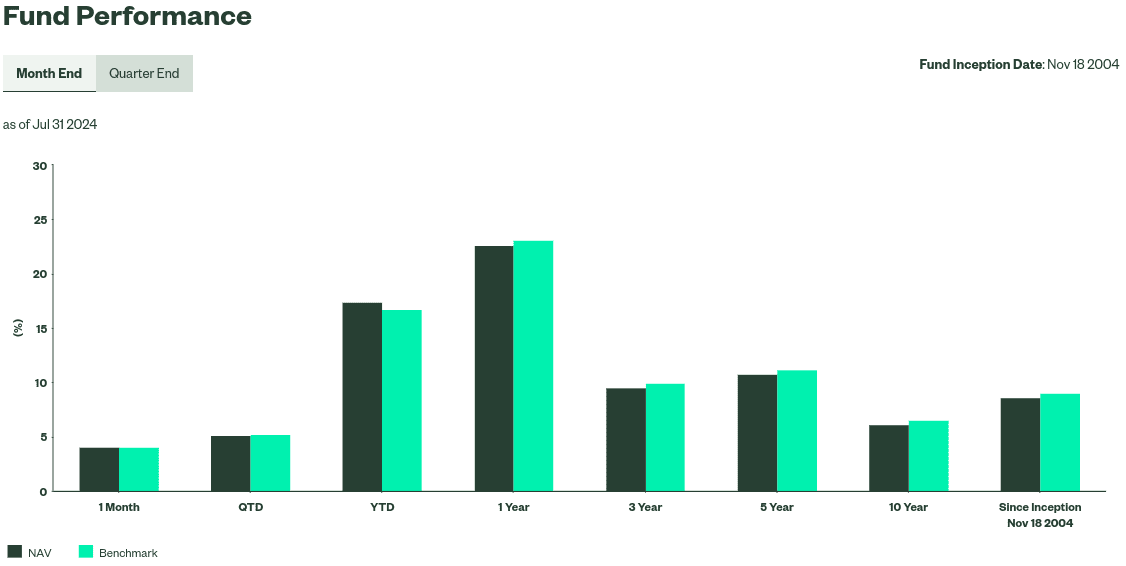

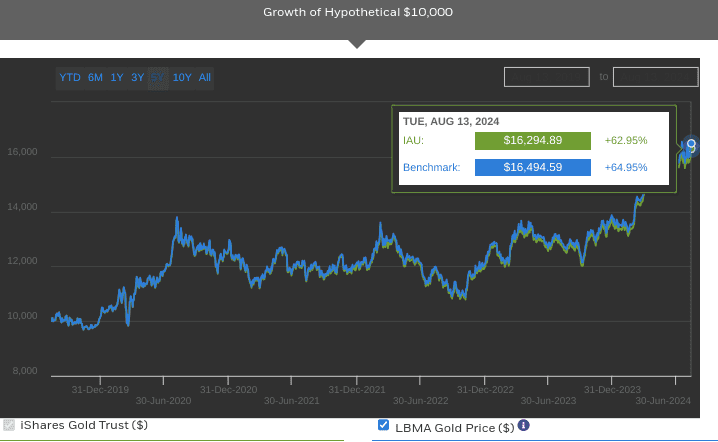

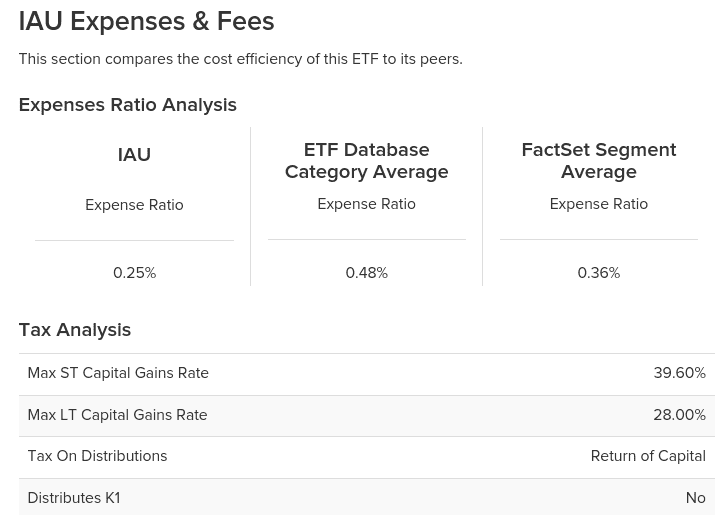

iShares Gold Trust (IAU) is another prominent gold ETF, known for its cost-effectiveness and liquidity. Managed by BlackRock, IAU offers investors a low-cost way to gain exposure to gold. One of the key differentiators of IAU is its lower expense ratio compared to GLD, making it an attractive option for cost-conscious investors. IAU’s expense ratio is among the lowest in the gold ETF market, which directly benefits investors by reducing the drag on returns over time.

Despite its lower fees, IAU maintains high liquidity, ensuring that investors can buy and sell shares with ease. The ETF holds physical gold in secure vaults, and each share represents a smaller fraction of an ounce of gold compared to GLD, allowing for greater accessibility, especially for smaller investors. IAU’s combination of low fees and high liquidity makes it a cost-effective alternative to GLD, appealing to both retail and institutional investors looking for efficient gold exposure. The ETF’s broad appeal is further enhanced by its transparency and regular updates on its gold holdings, ensuring that investors have clear insights into the fund’s assets.

[iShares Gold Trust 5Y performance]

Source: blackrock.com

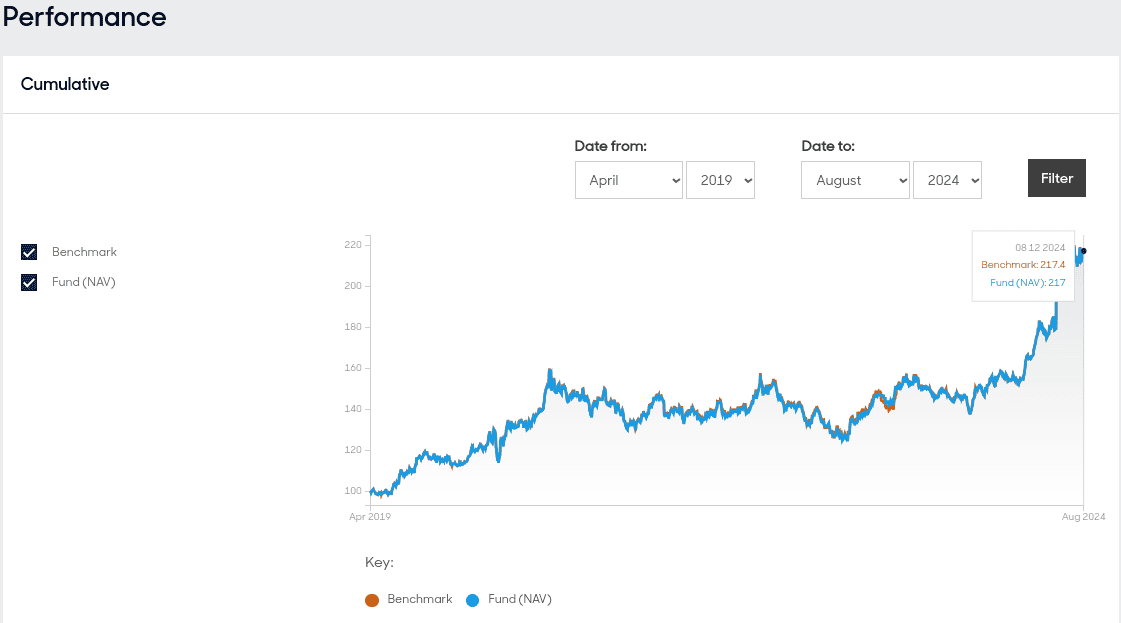

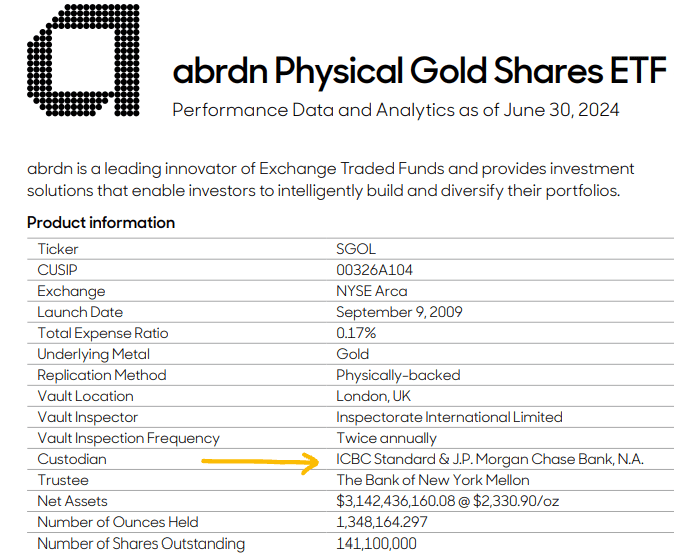

abrdn Physical Gold Shares ETF (SGOL):

abrdn Physical Gold Shares ETF (SGOL) is distinguished by its emphasis on transparency, security, and low fees. SGOL holds physical gold bars in secure vaults located in Switzerland and London, providing an added layer of geographic diversification and security. Each share of SGOL is backed by physical gold, and the fund is known for its rigorous auditing process, which includes regular inspections and public reports on the gold holdings. This focus on transparency reassures investors that their investment is genuinely backed by physical gold, reducing the risks associated with paper-based gold investments.

SGOL also offers a competitive expense ratio, making it a cost-effective option for investors. Its fees are comparable to, and sometimes lower than, other leading gold ETFs, which enhances its attractiveness to fee-sensitive investors. While SGOL may not be as large as GLD or IAU, it provides a strong balance of transparency, security, and low costs, making it a compelling choice for investors who prioritize these factors in their gold investment strategy. The ETF’s focus on storing gold in secure, well-audited vaults adds a layer of trust and credibility, appealing to investors seeking a high level of assurance in their gold investments.

[abrdn Physical Gold Shares ETF]

Source: abrdn.com

Transparency and Security of Gold ETFs

Transparency Measures:

Transparency is a crucial aspect of gold ETFs, as it directly impacts investor confidence and trust in the fund. Gold ETFs are designed to closely track the price of gold, and for this tracking to be accurate and trustworthy, investors need assurance that the ETF is indeed backed by the appropriate amount of physical gold. To achieve this, many gold ETFs implement rigorous transparency measures, including the regular publication of their gold holdings, the auditing of their assets, and the clear communication of their operations.

For instance, the abrdn Physical Gold Shares ETF (SGOL) and the GraniteShares Gold Trust (BAR) are known for their high levels of transparency. Both ETFs provide detailed, up-to-date reports on their gold holdings, listing the specific gold bars that back the shares. These reports typically include bar numbers, weights, and the refiner's name, offering investors a granular view of the physical gold that underpins their investment. This level of transparency is vital for ensuring that the ETF’s share price accurately reflects the value of the gold it holds.

[iShares Gold Trust]

Source: blackrock.com

Transparency in gold ETFs also extends to the auditing process. Regular third-party audits are conducted to verify the presence and quality of the gold holdings. For example, SGOL is subject to independent audits, where the physical gold stored in vaults is inspected and verified. These audits are usually conducted by reputable firms, adding another layer of credibility and trust. By publicly sharing the results of these audits, SGOL and BAR demonstrate their commitment to maintaining transparency, which is essential for building and maintaining investor confidence.

Security of Holdings:

The security of the physical gold backing ETFs is another critical factor that reassures investors about the safety of their investments. The gold held by these ETFs is typically stored in highly secure vaults managed by trusted custodians. These vaults are located in politically and economically stable countries, often in major financial centers like London, Zurich, and New York, where the infrastructure and regulations surrounding gold storage are robust.

For example, SGOL stores its gold in secure vaults located in Switzerland and London. The choice of these locations is strategic, as Switzerland is known for its strong tradition of financial security, and London is a global hub for gold trading. The gold stored in these vaults is fully insured, protecting investors against potential risks such as theft or damage. Additionally, the vaults are equipped with state-of-the-art security measures, including 24/7 surveillance, advanced access controls, and regular inspections.

The security of holdings also involves strict controls over the movement and handling of the gold. ETFs like SGOL and BAR ensure that the gold remains in the vaults unless it is being audited or when necessary for the fund’s operations. Even then, the movement of gold is meticulously documented and closely monitored, minimizing the risk of loss or fraud.

Moreover, the custodians responsible for the gold holdings are typically large, established financial institutions with a long history of managing precious metals. These institutions are subject to regulatory oversight and must adhere to stringent guidelines, further ensuring the security of the gold. For instance, the custodian for SGOL is JPMorgan Chase, a leading global financial institution with a solid reputation for handling precious metals.

[abrdn Physical Gold Shares ETF]

Source: abrdn.com

Strategies for Investing in Gold ETFs

Portfolio Diversification:

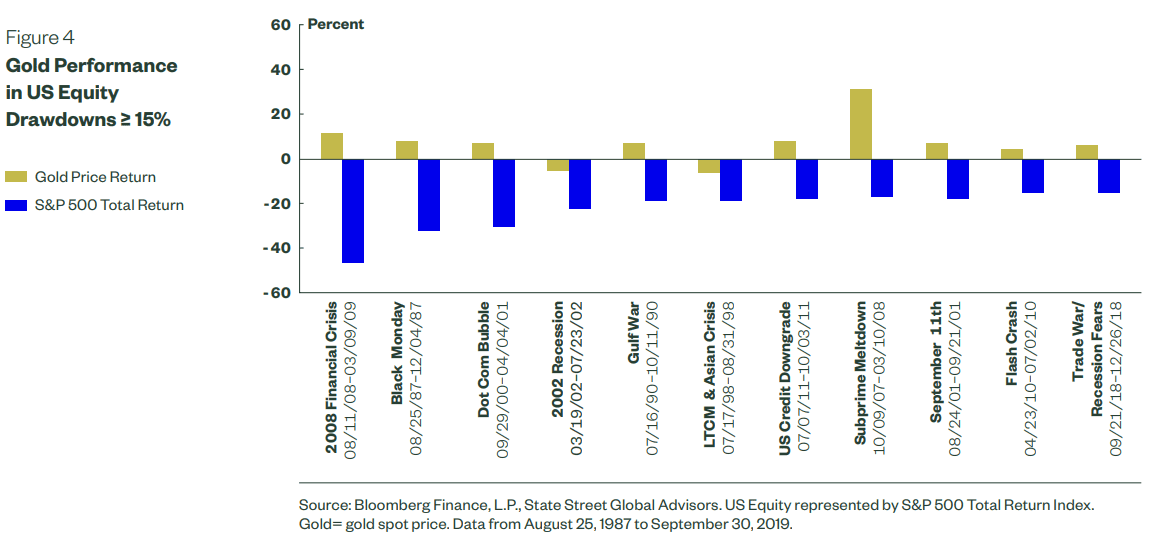

Including gold ETFs in an investment portfolio is a strategic way to enhance diversification and reduce overall risk. Gold has a historically low correlation with other asset classes such as stocks and bonds, meaning its price movements are often independent of or even inversely related to those of equities and fixed income securities. By adding gold ETFs to a diversified portfolio, investors can reduce the portfolio's volatility and potentially improve its risk-adjusted returns.

For instance, during periods of economic uncertainty or stock market downturns, gold prices often rise as investors seek safe-haven assets. This counter-cyclical behavior can help offset losses in other parts of the portfolio, providing a stabilizing effect. Gold ETFs, therefore, serve as a valuable tool for investors looking to protect their portfolios from significant drawdowns. Furthermore, because gold ETFs are traded like stocks, they offer the liquidity and flexibility needed for dynamic portfolio management, allowing investors to easily adjust their gold exposure as market conditions change.

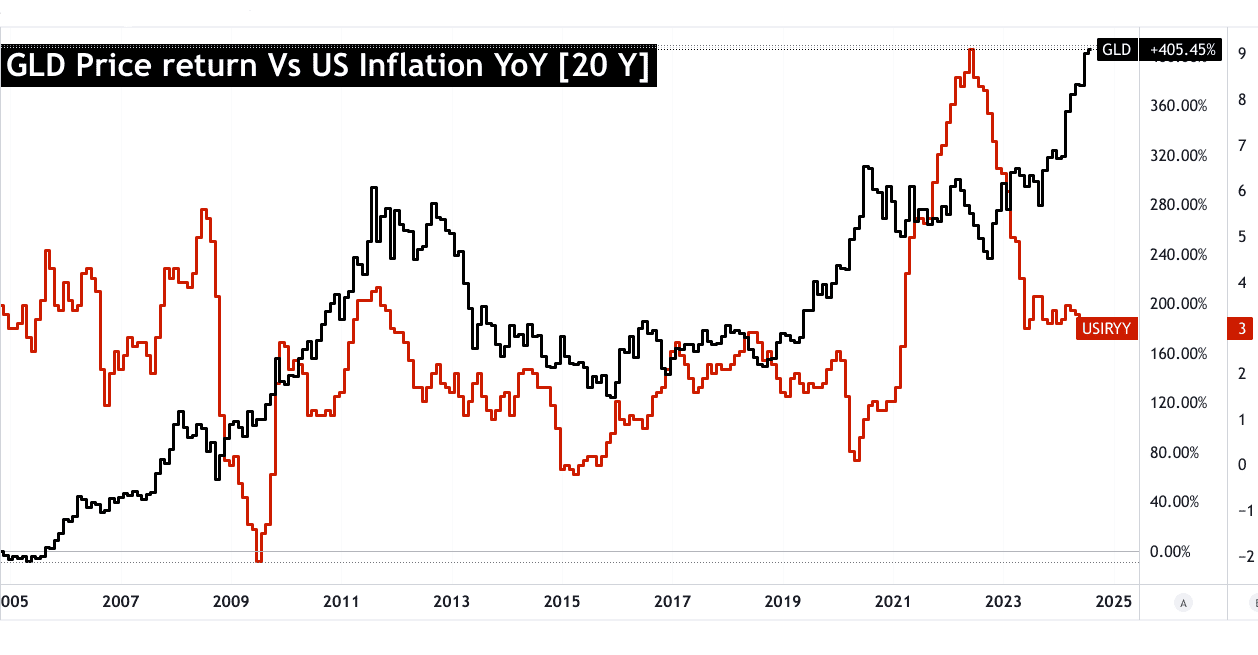

Hedging Against Inflation:

Gold is widely recognized as a hedge against inflation and currency fluctuations, and gold ETFs offer a convenient way to capitalize on this property. When inflation rises, the purchasing power of fiat currencies typically declines, eroding the value of cash and cash equivalents. Gold, however, tends to maintain its value or even appreciate during inflationary periods, making it an effective store of value.

Source: tradingview.com

Investing in gold ETFs allows investors to protect their wealth from inflation without the challenges of purchasing and storing physical gold. The underlying gold held by these ETFs preserves value in real terms, helping investors maintain their purchasing power. Additionally, gold ETFs can also serve as a hedge against currency risk, particularly for investors in regions experiencing significant currency devaluation. Since gold is priced in U.S. dollars on the global market, holding gold ETFs can provide protection against local currency depreciation, offering a safeguard for international investors.

Short-term vs. Long-term Investment:

Gold ETFs are versatile tools that can be employed in both short-term trading strategies and long-term investment planning. For short-term traders, gold ETFs offer an efficient way to capitalize on short-term price movements in the gold market. Due to their high liquidity and ease of access, traders can quickly enter and exit positions based on market trends, geopolitical events, or changes in monetary policy that affect gold prices. Short-term trading in gold ETFs can be particularly attractive during periods of market uncertainty, where gold often sees increased demand and price volatility.

On the other hand, long-term investors may use gold ETFs as a core component of their portfolio to preserve wealth and achieve steady growth over time. Gold’s role as a store of value makes it a suitable long-term investment, especially during periods of low real interest rates or economic instability. By holding gold ETFs over the long term, investors can benefit from gold’s historical appreciation and its ability to provide a hedge against long-term economic risks, such as prolonged inflation or financial crises.

Furthermore, long-term investors may also consider periodically rebalancing their portfolios to maintain the desired level of gold exposure, adjusting for changes in market conditions and investment goals. This strategy ensures that gold continues to play its intended role in the portfolio, whether it is for risk mitigation, wealth preservation, or capital appreciation.

Source: ssga.com

Considerations and Risks

Market Volatility:

Investing in gold ETFs comes with inherent risks, particularly related to market volatility. Gold prices can be highly volatile, driven by a variety of factors including geopolitical events, changes in interest rates, inflation expectations, and fluctuations in currency values. This volatility can lead to significant price swings, impacting the value of gold ETFs and potentially leading to short-term losses for investors.

For example, during periods of economic instability or political uncertainty, gold prices often rise as investors seek safe-haven assets. However, when these fears subside, gold prices can quickly retreat, leading to losses for those who entered the market at higher prices. Additionally, gold prices are influenced by global demand and supply dynamics, including central bank policies, mining production levels, and jewelry demand, which can create unpredictable price movements.

Investors in gold ETFs must be prepared for this volatility and understand that while gold can provide diversification and a hedge against inflation, it is not immune to sharp declines. Timing the market can be challenging, and relying on gold ETFs to provide consistent returns in the short term may expose investors to considerable risk. Therefore, gold ETFs should be considered within the context of a broader, diversified investment strategy, where they can serve to mitigate overall portfolio risk rather than act as a primary growth driver.

Cost and Management Fees:

Another critical consideration for investors in gold ETFs is the impact of costs and management fees on overall investment returns. While gold ETFs offer a cost-effective way to invest in gold compared to physical gold or actively managed mutual funds, they are not free from expenses. The most prominent cost associated with gold ETFs is the expense ratio, which is an annual fee expressed as a percentage of the fund's assets. This fee covers the costs of managing the ETF, including custody of the physical gold, administrative expenses, and other operational costs.

Source: etfdb.com

Even though gold ETFs generally have lower expense ratios than actively managed funds, these fees can still erode returns over time, especially for long-term investors. For example, a gold ETF with an expense ratio of 0.25% will reduce the fund’s return by 0.25% annually. Over extended periods, this seemingly small fee can compound, significantly affecting the overall return on investment.

Additionally, some gold ETFs may also incur other costs, such as transaction fees or bid-ask spreads when buying or selling shares. These costs can add up, particularly for investors who trade frequently or in large volumes. While ETFs like iShares Gold Trust (IAU) and abrdn Physical Gold Shares (SGOL) are known for their low expense ratios, investors must still account for these costs when evaluating the potential returns of their gold ETF investments.

It’s also important to note that while lower-cost ETFs like IAU offer more cost-effective exposure to gold, the lower fees might come with trade-offs in terms of liquidity or market coverage. Investors need to weigh these factors carefully when selecting a gold ETF, balancing the desire for low fees with other important attributes such as liquidity, transparency, and security of holdings.

Conclusion

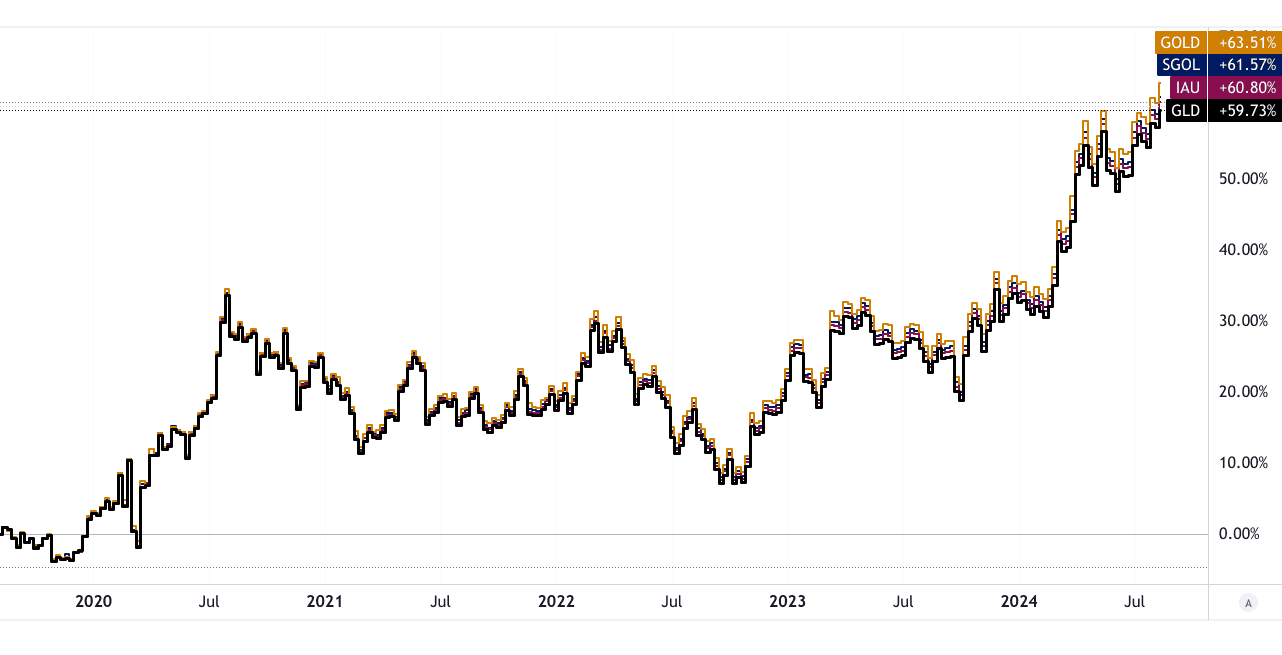

Gold ETFs offer a strategic, accessible, and cost-effective way to invest in gold, providing exposure to the metal without the challenges of owning physical gold. They enhance portfolio diversification, reduce risk, and serve as a hedge against inflation and currency fluctuations. Gold ETFs like SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and abrdn Physical Gold Shares (SGOL) stand out for their transparency, security, and low costs, making them reliable investment options.

[5Y Price Performance]

Source: tradingview.com

However, investors must remain mindful of the market volatility associated with gold prices and the impact of expense ratios on long-term returns. In essence, gold ETFs combine the benefits of gold investing with the flexibility and liquidity of exchange-traded funds, making them a valuable addition to a well-diversified investment portfolio.