Gold As A Timeless Investment

Gold has long been cherished for its beauty, but its value as an investment extends far beyond its physical allure. Unlike most other assets, gold possesses a unique characteristic that makes it especially attractive to investors: a low correlation with traditional financial markets. Whether in times of economic stability or turmoil, gold's price tends to move independently of stocks, bonds, and other commodities. This distinct behavior is what makes gold a timeless investment, providing stability and security when other assets may falter.

Source: wallpaper.forfun.com

Gold’s appeal as an investment lies in its ability to act as a hedge against inflation, currency devaluation, and economic uncertainty. Throughout history, gold has retained its purchasing power, even as paper currencies have fluctuated and sometimes failed. This enduring stability is one reason why gold is often referred to as a "safe haven" asset. During periods of market volatility or economic downturns, investors flock to gold as a means of preserving their wealth, pushing its price higher. This inverse relationship with other asset classes underscores gold's importance in a well-balanced investment portfolio.

Gold’s Unique Properties Make It An Essential Tool For Portfolio Diversification

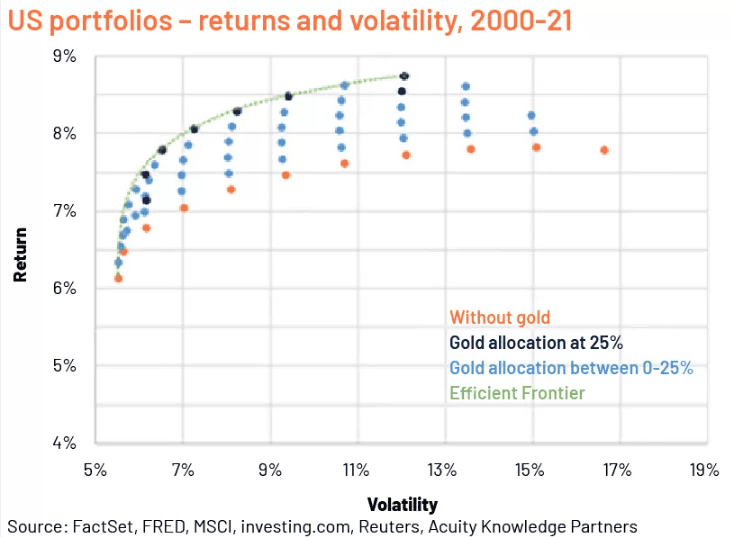

Gold’s unique properties make it an essential tool for portfolio diversification, offering reduced volatility and improved risk-adjusted returns. Unlike stocks, which can be influenced by company performance, market sentiment, or economic data, gold's price is primarily driven by supply and demand dynamics, geopolitical events, and investor sentiment. This means that gold often performs well when other assets are underperforming, providing a counterbalance to market fluctuations.

Furthermore, gold’s role in reducing portfolio volatility is well-documented. By including gold in a diversified portfolio, investors can smooth out the ups and downs of market cycles, as the price of gold tends to remain stable or even rise during periods of economic distress. This stability can be particularly beneficial for risk-averse investors who are looking to protect their portfolios from sharp declines in equity markets. Gold’s low correlation with other assets means that it often moves in the opposite direction of stocks and bonds, providing a natural hedge against market risks.

Source: ssga.com

In addition to reducing volatility, gold can also enhance a portfolio's risk-adjusted returns. Risk-adjusted return is a measure of how much return an investment generates relative to the amount of risk taken. Because gold tends to perform well during market downturns, it can help to mitigate losses in other areas of a portfolio, leading to a more favorable risk-return profile. For example, during the 2008 financial crisis, gold prices soared while equity markets plummeted, helping to offset losses for those investors who held gold in their portfolios.

Gold’s Unique Characteristics

Gold possesses several unique characteristics that distinguish it from other financial assets, making it a critical component for portfolio diversification. These characteristics, especially gold’s low correlation with global equities and fixed-income assets, set it apart in investment strategies. Additionally, historical data on gold’s performance shows its ability to provide stability and positive returns across diverse market conditions.

Low Correlation with Other Assets

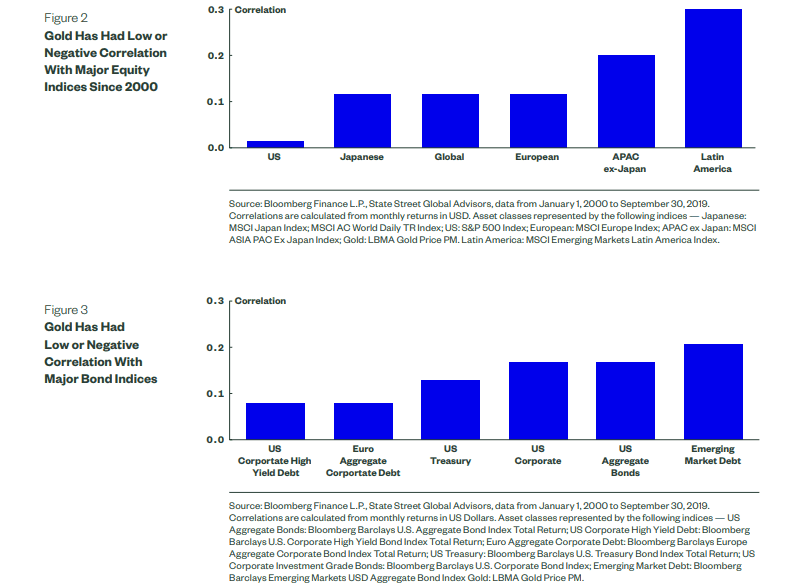

One of the most defining features of gold as an investment is its low correlation with traditional asset classes like global equities and fixed-income securities. Correlation measures how two assets move in relation to each other. A low or negative correlation means that when one asset declines, the other may remain stable or even increase in value. For instance, during periods of stock market volatility or declines in bond markets, gold often acts as a stabilizer. This is because gold’s price is not significantly driven by corporate earnings, interest rates, or economic data that typically affect stocks and bonds.

Gold’s price dynamics are largely influenced by macroeconomic factors such as inflation rates, currency values, and geopolitical tensions, which often do not directly impact other assets. For example, during inflationary periods when fixed-income assets may lose value due to eroding purchasing power, gold tends to maintain or increase in value as investors turn to it as a store of wealth. In this context, gold can serve as a hedge against both inflation and currency devaluation, making it a valuable counterbalance in times of economic uncertainty.

Empirical evidence supports gold’s low correlation with other asset classes. Over the past few decades, the correlation between gold and U.S. equities has typically been near zero, and with global bonds, it has often been negative. This means that gold’s performance does not move in tandem with stock or bond markets, providing diversification benefits. In multi-asset portfolios, the inclusion of gold can smooth out returns, reducing the overall portfolio’s risk.

Historical Performance

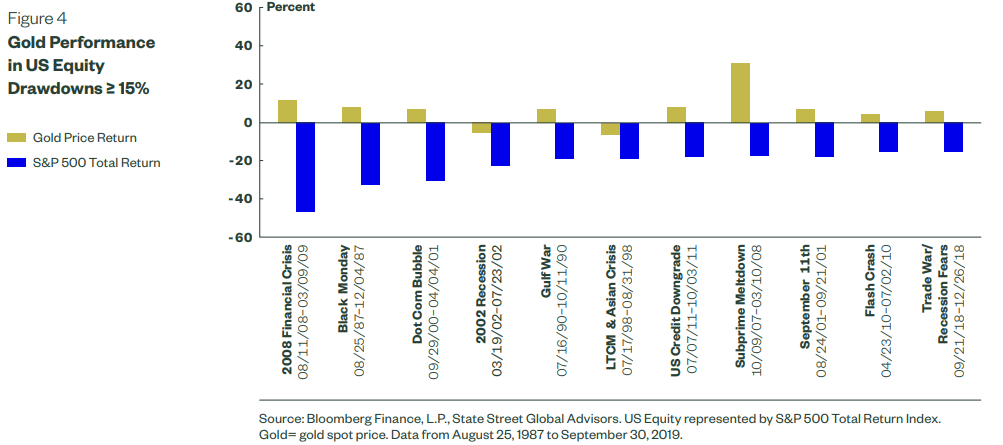

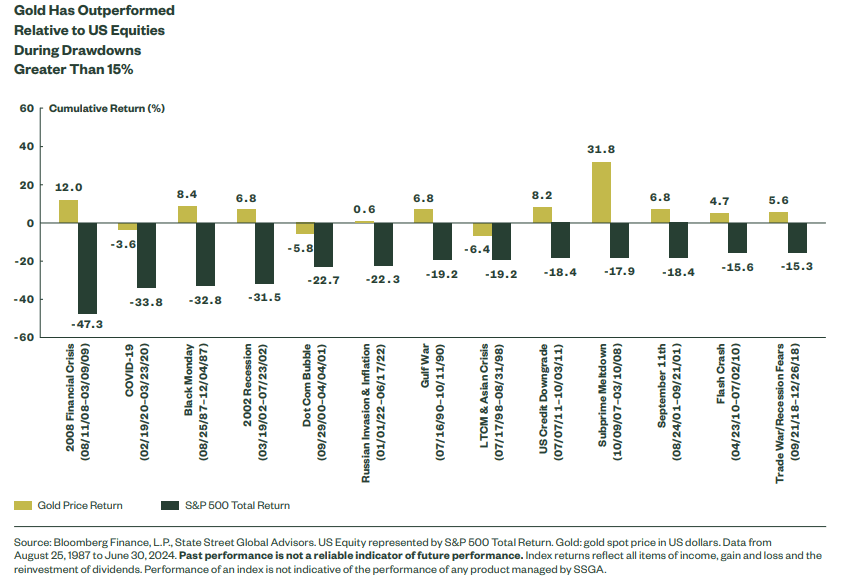

Gold’s historical performance further illustrates its value as a stable investment during various market conditions. One of the most notable periods showcasing gold’s strength was during the 2008 financial crisis. As global equities plummeted, gold prices soared, gaining approximately 25% by the end of 2008 while major stock indices experienced severe losses. This counter-cyclical performance demonstrated gold’s ability to provide a haven during extreme market volatility.

Source: ssga.com

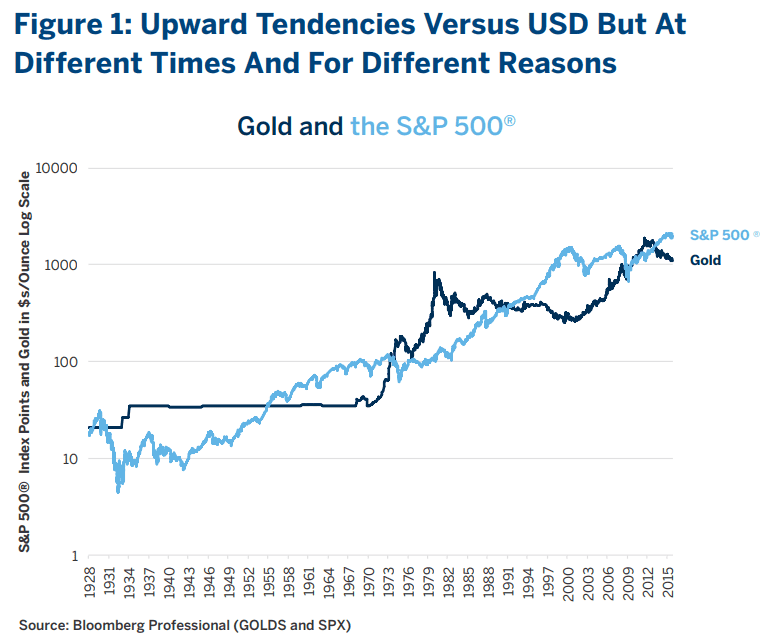

Between 2000 and 2011, gold experienced a sustained bull run, with prices increasing nearly 500%, largely driven by concerns over economic instability, inflation, and weakening currencies. During this period, stock markets were recovering from the dot-com bubble and the financial crisis, but gold consistently delivered strong returns, outperforming many traditional assets. This period cemented gold’s reputation as a reliable asset during both periods of expansion and contraction in global markets.

Even during less volatile times, gold has shown resilience and a tendency to perform well when traditional assets face headwinds. For instance, during 2020’s COVID-19 pandemic, global equities initially plunged as economic uncertainty spiked. In contrast, gold prices surged to all-time highs, reaching over $2,000 per ounce, as investors sought safe-haven assets amidst the global crisis. While equity markets eventually recovered, gold’s performance during the early stages of the pandemic exemplified its role as a stabilizing force in portfolios during crises.

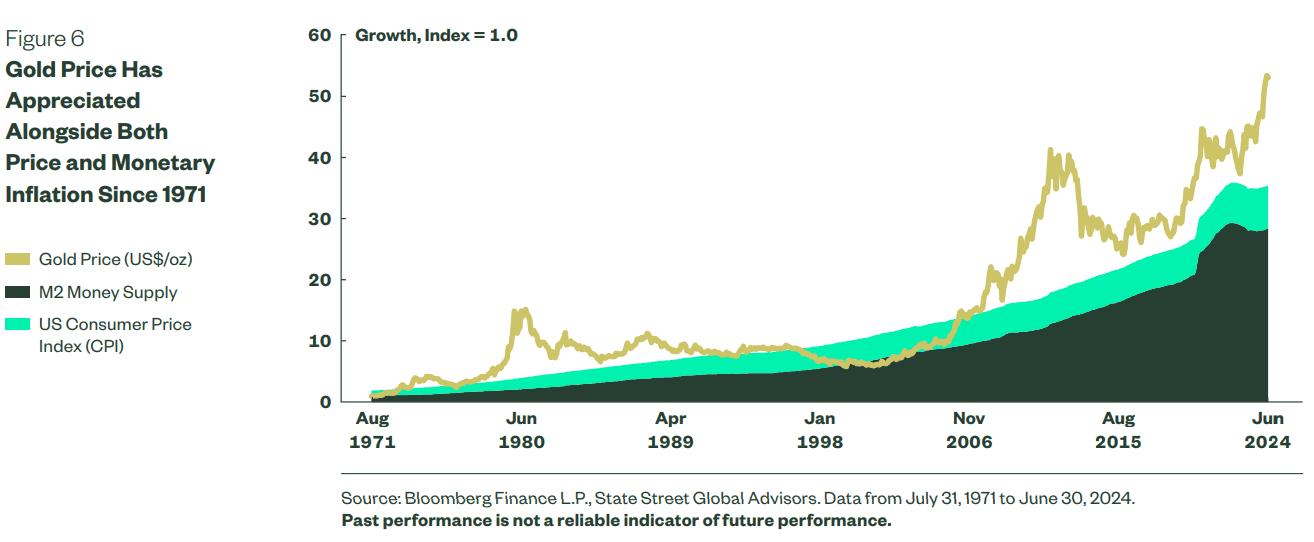

Moreover, historical data reveals that gold has not only provided downside protection but has also delivered long-term positive returns. Since the early 1970s, following the end of the gold standard, gold has appreciated at an average annual rate of about 7-8%. While this may not match the long-term returns of equities, it is comparable to the performance of fixed-income securities and bonds. Importantly, gold’s returns have often occurred during periods of stock market downturns, further reinforcing its diversification benefits.

Benefits of Including Gold in a Portfolio

Gold has long been recognized as an essential asset in investment portfolios, primarily due to its ability to mitigate risk and enhance overall portfolio performance. The strategic inclusion of gold helps reduce volatility, improves risk-adjusted returns, and provides a buffer against economic uncertainties. These benefits become clearer when viewed through the lens of portfolio diversification and supported by case studies demonstrating gold’s impact on performance.

Portfolio Diversification

Portfolio diversification is the practice of spreading investments across different asset classes to reduce risk and enhance returns. It is critical in investment strategy because different assets react differently to market conditions. Diversification helps protect against the risk of significant losses by ensuring that the poor performance of one asset class is counterbalanced by the stronger performance of others. The goal is to minimize unsystematic risk—the risk specific to individual investments—while optimizing the overall risk-return trade-off.

Gold plays a vital role in diversification due to its low or negative correlation with traditional assets such as equities and bonds. When stock markets are volatile, or when fixed-income assets are under pressure from rising interest rates or inflation, gold’s performance is often independent or even positive. This inverse relationship reduces the likelihood of a synchronized decline across an investor’s entire portfolio, helping smooth returns over time. Including gold in a diversified portfolio adds an extra layer of protection, especially during periods of economic uncertainty or financial crises.

Source: cmegroup.com

Volatility Reduction

Volatility is the degree to which an asset’s price fluctuates over time. A portfolio exposed to high volatility carries higher risk because the value of investments can swing dramatically in response to market conditions. Gold, however, is known for its stability, especially during times of market distress. As a result, its inclusion in a portfolio can help reduce overall volatility.

Gold’s price tends to remain relatively stable or even increase during market downturns. This characteristic makes it a safe haven asset, particularly during periods of crisis when stocks and other financial instruments experience heightened volatility. For example, during the 2008 global financial crisis, equity markets suffered significant losses, but gold prices rose by 25%. Similarly, during the early months of the COVID-19 pandemic in 2020, while stock markets faced substantial declines, gold surged to all-time highs, reaching over $2,000 per ounce.

By including gold in a portfolio, an investor benefits from the asset’s countercyclical nature, which helps cushion against sharp declines in other asset classes. This results in lower portfolio volatility, as gold’s stability mitigates the extreme swings caused by stock and bond price fluctuations. Lower volatility is especially important for risk-averse investors or those approaching retirement, as it reduces the likelihood of large losses that could jeopardize their financial goals.

Improved Risk-Adjusted Returns

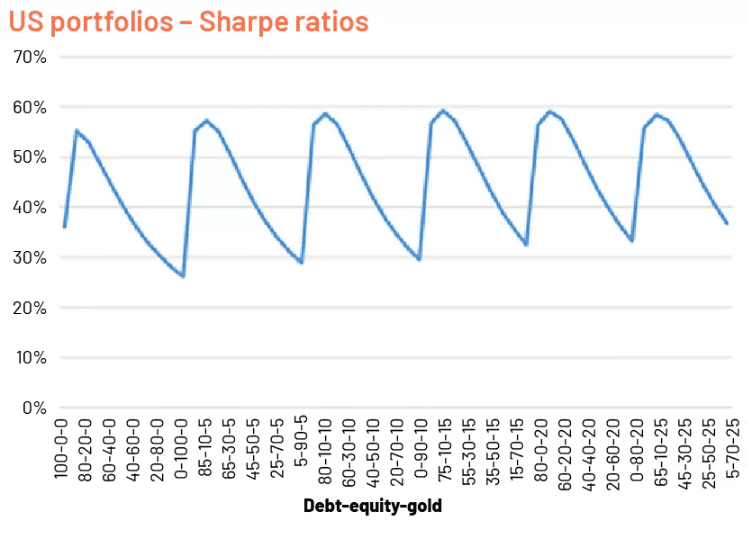

Risk-adjusted returns measure the profitability of an investment relative to the level of risk taken. A higher risk-adjusted return indicates that an investment has generated more return per unit of risk, making it more efficient. The Sharpe ratio, one of the most widely used metrics for evaluating risk-adjusted returns, calculates how much excess return an investment generates for each additional unit of risk. A higher Sharpe ratio indicates a more favorable risk-return trade-off.

Source: acuitykp.com

Gold’s inclusion in a portfolio can improve the Sharpe ratio and other risk metrics by enhancing risk-adjusted returns. Since gold performs well during market downturns or periods of high inflation, it helps limit portfolio losses, thereby boosting overall returns relative to the risk incurred. For instance, if a portfolio holds a large portion of equities and the stock market suffers a sharp correction, the inclusion of gold can offset some of those losses, leading to a more favorable risk-return balance.

Source: acuitykp.com

Additionally, gold’s low correlation with traditional assets means it often behaves differently than stocks and bonds during market downturns. This diversity in performance reduces the overall portfolio’s risk without necessarily sacrificing returns, thus improving the risk-adjusted metrics. Research shows that adding a small allocation of gold—typically between 5% and 10%—to a diversified portfolio can meaningfully increase the Sharpe ratio, especially during periods of heightened market volatility or economic uncertainty.

Case Studies

Case Study 1: The 2008 Global Financial Crisis

During the 2008 financial crisis, global equity markets experienced severe losses, with the S&P 500 dropping nearly 38% by year-end. However, gold outperformed most assets, delivering a return of approximately 5% for the year. Investors who had allocated a portion of their portfolios to gold saw a significantly smaller decline in overall portfolio value compared to those fully invested in equities. For example, a hypothetical portfolio consisting of 60% stocks, 30% bonds, and 10% gold would have experienced significantly less drawdown than one invested entirely in stocks.

By including gold in the portfolio, investors benefited from its stabilizing effect. Gold’s low correlation with equities cushioned losses during one of the worst market downturns in history, demonstrating its value as a diversification tool in times of crisis.

Case Study 2: COVID-19 Pandemic

The early months of the COVID-19 pandemic created widespread uncertainty in global financial markets. Between February and March 2020, the S&P 500 plunged by over 30%, while bond markets also faced disruption as central banks slashed interest rates and injected liquidity into the financial system. In contrast, gold prices surged, reaching a peak of over $2,000 per ounce by August 2020.

Source: ssga.com

Investors who held gold in their portfolios during this period were able to mitigate some of the losses from equities and bonds. A balanced portfolio with a 10% allocation to gold, 50% to equities, and 40% to bonds would have weathered the storm better than one invested entirely in stocks or bonds. Gold’s ability to rise in value while other asset classes struggled highlights its role as a protective asset during global crises.

Hypothetical Scenario: Long-Term Growth Portfolio

Consider a hypothetical portfolio designed for long-term growth, consisting of 70% equities, 20% bonds, and 10% gold. Over a 20-year period, this portfolio would have experienced strong returns during bull markets, while the inclusion of gold would have helped reduce drawdowns during bear markets. For example, during the dot-com bubble burst in the early 2000s and the 2008 financial crisis, the gold allocation would have provided a hedge against falling stock prices, resulting in smoother long-term returns.

Moreover, during periods of rising inflation, gold’s role as a store of value would help preserve the portfolio’s purchasing power, offsetting the negative impact of inflation on fixed-income securities. As a result, the long-term performance of the portfolio would be more consistent, with fewer sharp declines and a higher risk-adjusted return compared to portfolios without gold.

Strategies for Incorporating Gold

Incorporating gold into an investment portfolio requires thoughtful consideration of how much to allocate and through which investment vehicles. Gold can enhance diversification, reduce volatility, and improve risk-adjusted returns, but the amount and form of gold included should vary depending on an investor’s goals, risk tolerance, and time horizon. This section provides allocation recommendations and reviews the pros and cons of various investment vehicles such as gold ETFs, physical gold, and gold stocks.

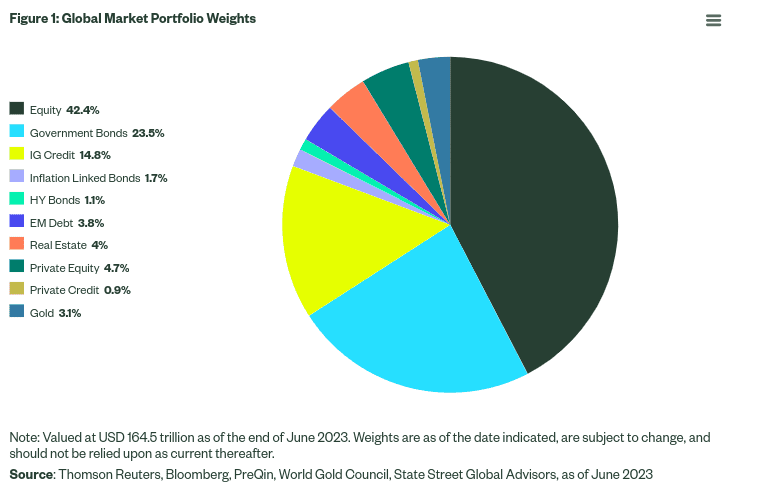

Allocation Recommendations

Determining the right amount of gold to include in a portfolio depends on the type of portfolio and the investor’s objectives. Financial experts generally recommend allocating 5-10% of a portfolio to gold, though this range can vary based on the level of risk the investor is willing to take and market conditions.

Source: ssga.com

- Conservative Portfolios (10-20% equities, 60-70% bonds, 5-10% gold): For conservative investors prioritizing stability and income, such as retirees or those close to retirement, a 5-10% allocation to gold can provide valuable downside protection without overly diminishing returns. Gold’s defensive characteristics are particularly beneficial in these portfolios, as they aim to limit losses during market downturns. During periods of rising inflation or economic uncertainty, gold’s low correlation with other asset classes helps preserve capital.

- Balanced Portfolios (40-60% equities, 30-40% bonds, 5-10% gold): In balanced portfolios that combine growth and income, a 5-10% allocation to gold can further enhance diversification. This allows for risk mitigation during market volatility without significantly sacrificing growth potential. Given gold’s ability to perform well during stock market corrections or rising inflation, holding gold alongside stocks and bonds helps smooth out returns over time.

- Aggressive Portfolios (70-90% equities, 0-10% bonds, 5% gold): Aggressive investors seeking high growth potential may allocate around 5% to gold. While the focus remains on equities for capital appreciation, gold serves as a hedge during volatile periods. In bull markets, aggressive portfolios typically outperform, but including a small gold allocation can help limit losses when equity markets falter. A 5% allocation strikes a balance between growth and risk management.

While these general recommendations offer a starting point, it is essential to periodically review and adjust gold allocations based on changing economic conditions, market cycles, and individual risk tolerance.

Investment Vehicles

When incorporating gold into a portfolio, investors can choose from several investment vehicles, each with its own set of advantages and disadvantages. The main options include gold ETFs, physical gold, and gold stocks.

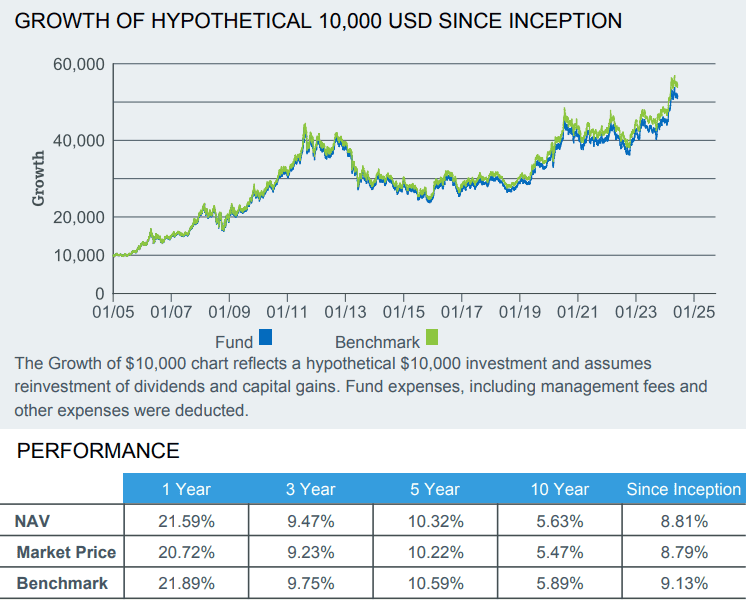

Gold ETFs (Exchange-Traded Funds)

- Pros: Gold ETFs offer an easy and liquid way to gain exposure to gold without dealing with the storage and insurance costs associated with physical gold. ETFs closely track the price of gold, providing direct exposure to its price movements. ETFs can be bought and sold on stock exchanges like regular equities, making them accessible to most investors. Additionally, ETFs are cost-effective, with low management fees compared to the costs of owning physical gold.

- Cons: While gold ETFs track the price of gold, investors do not physically own the gold. This means that during times of crisis or extreme economic uncertainty, investors may not have the tangible security that physical gold offers. Furthermore, some ETFs may involve counterparty risk if they are not fully backed by physical gold.

[iShares Gold Trust]

Source: blackrock.com

Physical Gold (Bars, Coins)

- Pros: Physical gold, in the form of bars or coins, offers the security of owning a tangible asset. In times of extreme economic distress or currency devaluation, having physical gold can be reassuring. Physical gold also serves as a long-term store of value, particularly for investors who prefer to avoid financial markets or seek protection against systemic risks.

- Cons: The primary drawbacks of physical gold are its storage and insurance costs. Storing gold securely requires safekeeping in vaults, which incurs ongoing fees. Additionally, physical gold is less liquid than gold ETFs or stocks. Selling large amounts of physical gold can take time, and the process might involve transaction costs and lower liquidity.

Gold Stocks (Mining Companies)

- Pros: Investing in gold stocks offers exposure to companies involved in gold production and mining. Gold stocks typically provide higher returns than physical gold or gold ETFs during periods when gold prices rise, as mining companies benefit from increased profitability. Additionally, some gold stocks pay dividends, providing income to investors. Gold stocks can also offer leverage, meaning that small increases in gold prices can lead to larger gains for the mining company.

- Cons: The performance of gold stocks does not always directly correlate with gold prices. Mining companies face unique risks such as operational challenges, regulatory issues, and geopolitical factors. As a result, gold stocks can be more volatile than physical gold or ETFs. Additionally, investing in gold stocks adds exposure to company-specific risks, such as poor management decisions or labor strikes, which can negatively impact stock performance even if gold prices are rising.

Gold in Various Economic Climate

Gold has historically demonstrated unique behavior during different economic conditions, particularly in recessionary and inflationary periods. Its low correlation with other assets makes it a valuable hedge and safe haven, offering protection when traditional investments like stocks and bonds underperform. This section critically analyzes gold’s performance during recessions and inflationary periods, emphasizing its role in preserving wealth and maintaining purchasing power.

Gold During Recessionary Times

Recessions are characterized by declining economic activity, rising unemployment, and shrinking corporate profits. During such times, stock markets typically experience significant volatility and downward pressure as investors become risk-averse and seek stability. In these environments, gold has proven to be a reliable safe-haven asset.

- Flight to Safety: During recessions, investors tend to move away from riskier assets such as equities and seek safer investments. Gold, due to its intrinsic value and history as a store of wealth, attracts inflows from those looking to protect their capital. This surge in demand can drive up the price of gold, providing positive returns at a time when stocks and bonds are losing value. For instance, during the 2008 global financial crisis, gold prices surged by over 25% as global markets tumbled.

- Hedge Against Market Volatility: Gold’s low correlation with equities and bonds means it often moves in the opposite direction of these assets during periods of economic stress. While the stock market might suffer heavy losses during a recession, gold prices tend to remain stable or even increase. This helps reduce overall portfolio volatility and provides a cushion against sharp declines in other asset classes. For example, in early 2020, as the COVID-19 pandemic triggered a sharp market decline, gold prices hit new highs, reaching over $2,000 per ounce.

- Preservation of Capital: In times of deep economic uncertainty, investors seek to preserve their capital rather than focus on growth. Gold’s historical role as a store of value has cemented its position as a key asset for capital preservation during recessions. Central banks also tend to increase their gold reserves during economic downturns, further reinforcing gold’s role as a stabilizing asset in times of crisis.

Gold During Inflationary Periods

Inflation erodes the purchasing power of currencies, making it harder for consumers and investors to maintain their standard of living. Gold has long been considered an effective hedge against inflation, primarily because its value is not tied to any currency or economy. As the prices of goods and services rise, gold’s value tends to increase as well, preserving purchasing power.

Source: ssga.com

- Intrinsic Value Preservation: Unlike fiat currencies, which lose value as inflation rises, gold’s intrinsic value remains constant. This makes it an attractive asset for investors looking to preserve their wealth in the face of rising prices. During inflationary periods, the purchasing power of paper money declines, but gold’s scarcity and universal demand support its value. Historically, gold has been used as a store of wealth precisely because it holds its value over time, even during periods of severe inflation.

- Inflation Hedge: Gold’s ability to hedge against inflation is particularly evident when inflation rises above expected levels. During such periods, interest rates often remain low, reducing the attractiveness of bonds and savings accounts, as real returns turn negative. Gold, on the other hand, maintains its value in real terms and can increase as demand for inflation protection grows. For example, during the high inflation of the 1970s, gold prices skyrocketed, rising from around $35 per ounce in 1971 to over $800 per ounce by 1980. This rapid increase was a direct result of investors seeking refuge from soaring inflation and a weak U.S. dollar.

- Currency Depreciation and Gold Demand: Inflation often leads to a depreciation of a country’s currency, further driving demand for gold as an alternative store of value. When the value of a currency drops, the cost of importing goods rises, leading to higher inflation. Investors in such scenarios turn to gold as a hedge, not only against rising prices but also against currency devaluation. As currencies weaken, the price of gold, which is denominated in those currencies, increases.

Conclusion

In summary, gold’s unique characteristics, such as its low correlation with other assets, make it a valuable tool for diversification. Its performance during recessionary periods provides protection when equities fall, while its role as an inflation hedge helps preserve purchasing power during periods of rising prices. By reducing portfolio volatility and improving risk-adjusted returns, gold strengthens overall investment strategy. Whether through gold ETFs, physical gold, or gold stocks, incorporating gold into portfolios can offer significant benefits.

Investors should assess their risk tolerance and financial objectives when deciding how much gold to allocate. Whether for stability during market downturns or protection against inflation, gold can be an essential part of a well-balanced portfolio. It is crucial to explore the various ways to invest in gold and integrate it into strategies that align with long-term goals. Consider taking action today to evaluate gold’s role in your portfolio and unlock its potential for greater financial security.