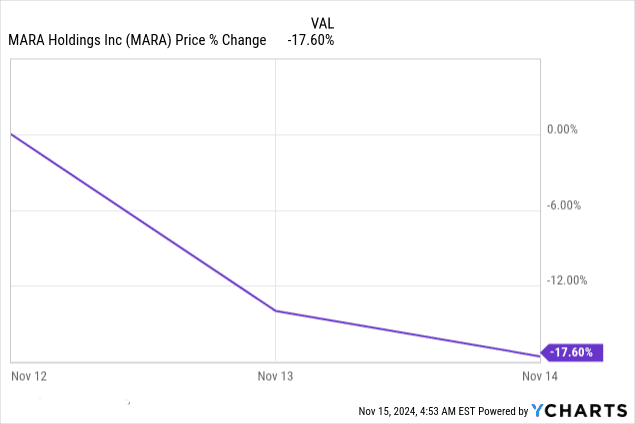

MARA Holdings (MARA) stock underperformed post-earnings, with a price return of -18%. Despite surpassing EPS expectations with a normalized loss of -$0.20, the company missed revenue estimates, reporting $131.65 million, $12.7 million below consensus. The decline in Bitcoin mined, due to the halving event, pressured performance, although a 116% increase in Bitcoin price helped mitigate revenue losses. The company's aggressive infrastructure expansion, including a major acquisition of Ohio data centers, aims to enhance operational efficiency and hash rate. However, rising competition and volatile energy costs pose risks, while Bitcoin price fluctuations remain a significant challenge.

Source: Ycharts.com

I. MARA Earnings Overview Q3 2024

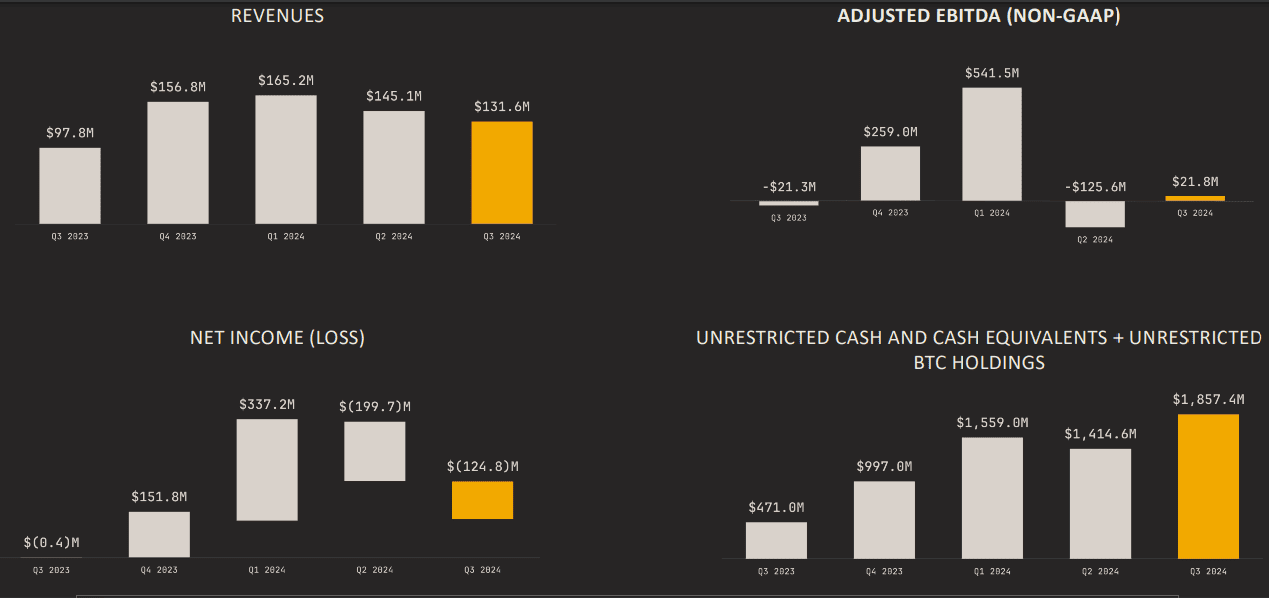

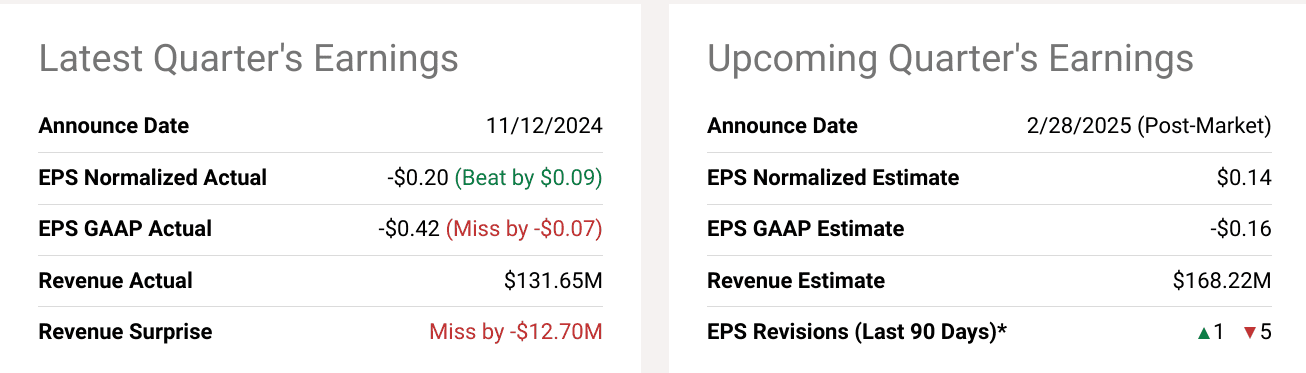

MARA Holdings, Inc. (MARA) reported a mixed earnings performance for Q3 2024, missing revenue expectations but surpassing earnings per share (EPS) estimates. The company reported a normalized EPS of -$0.20, exceeding the consensus estimate by $0.09, while the GAAP EPS of -$0.42 missed expectations by $0.07. Revenue for the quarter came in at $131.65 million, missing analysts' forecast by $12.7 million. The year-over-year revenue growth rate was likely impacted by fluctuations in Bitcoin mining operations, which the company continues to heavily rely on. Regarding margins, gross, operating, and net margins showed varying trends, though specific details were not disclosed. Given the volatility in Bitcoin's price and hash rates, it’s reasonable to assume that margins faced pressure despite expansion efforts.

Source: 3Q24 Earnings Deck

Revenue Drivers

Bitcoin mining operations were the major revenue driver, contributing heavily to the overall increase in revenue despite a production shortfall. The company mined 2,070 BTC in Q3 2024, a decrease from the previous year’s 3,476 BTC, largely due to the halving event. However, the average price of mined Bitcoin increased by 116%, leading to a $74 million revenue boost despite a drop in BTC output.

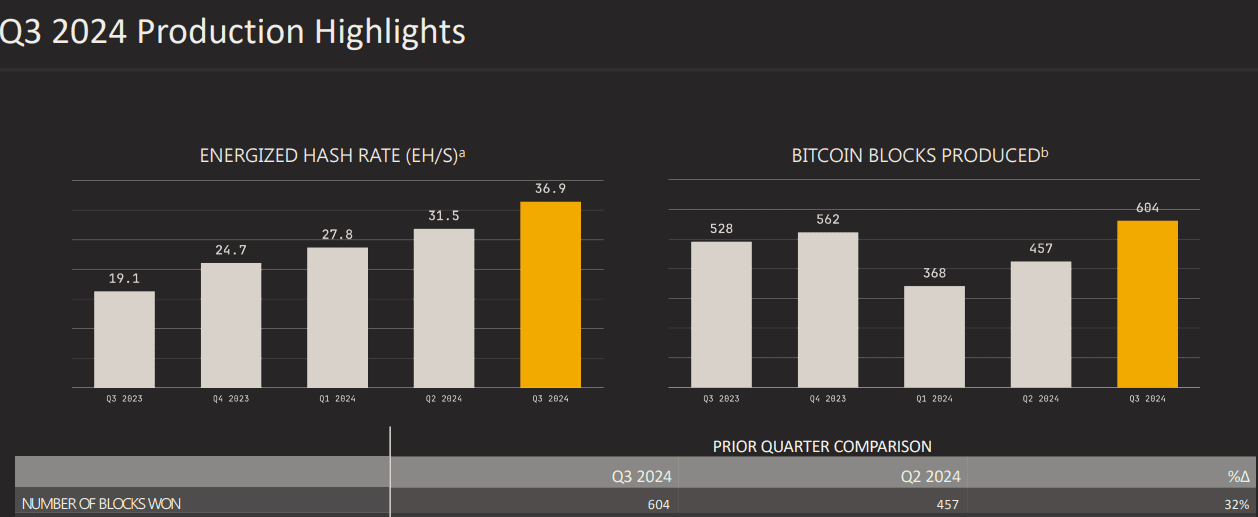

The company’s energized hash rate saw a notable 93% YoY increase, reaching 36.9 EH/s by the end of Q3 2024, up from 19.1 EH/s in the same quarter of 2023. This improvement was integral to maintaining a higher share of the global hash rate, leading to a 32% increase in block wins over Q2 2024. This increase in block wins partly offset the production decline, reflecting the company's ability to capitalize on its growing hash rate despite the network's increasing difficulty.

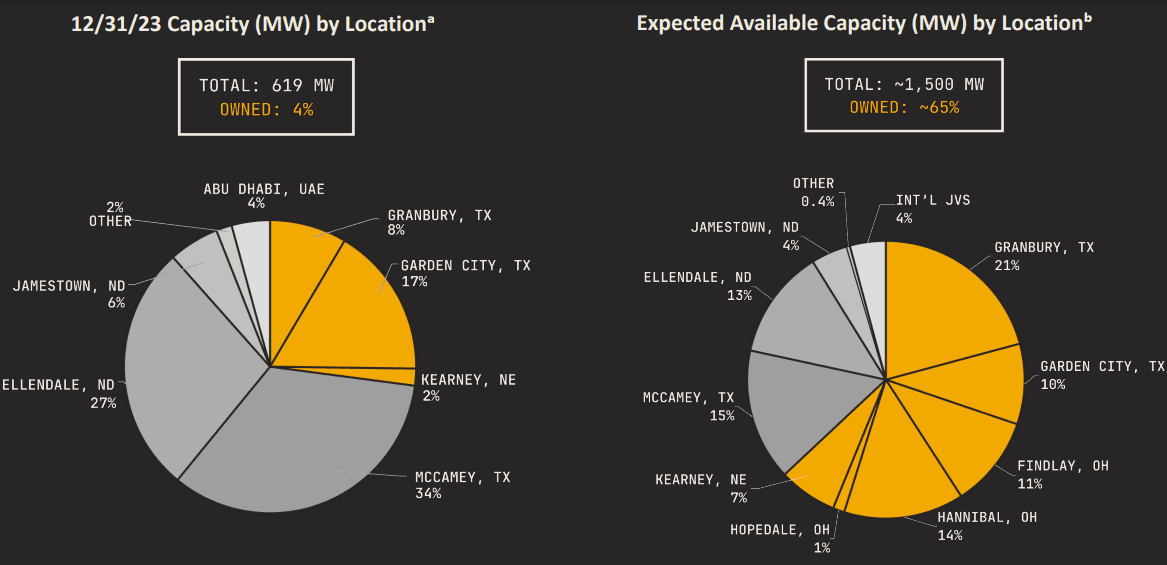

Energy costs, a significant factor for mining operations, showed positive trends as the company successfully reduced the cost of revenue per petahash per day by 10% for the quarter, building on an 18% year-to-date reduction. This was achieved through strategic data center acquisitions, including a major deal in Ohio, which pushed the company’s total nameplate capacity to nearly 1.5 GW, 65% of which it owns and operates. The company’s ability to reduce operating costs, particularly its cheaper-than-competitors’ acquisition costs for data centers, provides it with a strategic advantage in maintaining profitability amid fluctuating BTC prices.

Source: 3Q24 Earnings Deck

II. Product & Market Dynamics

MARA Holdings (MARA) has made substantial investments to expand its infrastructure, positioning itself for long-term growth. A key initiative is the acquisition and development of data centers in Ohio, which will add a total of 372 megawatts (MW) of capacity, significantly increasing its owned and operated assets. These acquisitions include two existing data centers in Hannibal and Hopedale with a combined 222 MW and a greenfield development in Findlay, which is expected to contribute another 150 MW. By the end of 2025, MARA aims to fully energize these facilities, boosting its compute capacity by over 70%. The company has secured these assets at an attractive multiple of $270,000 per megawatt, one of the lowest among its peers. This demonstrates MARA's strategic, disciplined approach to expansion, focusing on cost-effective acquisitions that can yield long-term value.

MARA's investments align with its strategic goal of positioning itself as one of the most efficient and cost-effective operators in the Bitcoin mining space. The added capacity, which will be diversified across multiple jurisdictions, allows MARA to mitigate risks associated with energy supply and pricing, which remain key challenges in the industry. Additionally, the focus on owning and operating more of its capacity offers operational control, which may lead to significant cost reductions and operational efficiencies, especially at the Hopedale site, where costs could potentially drop by 50%.

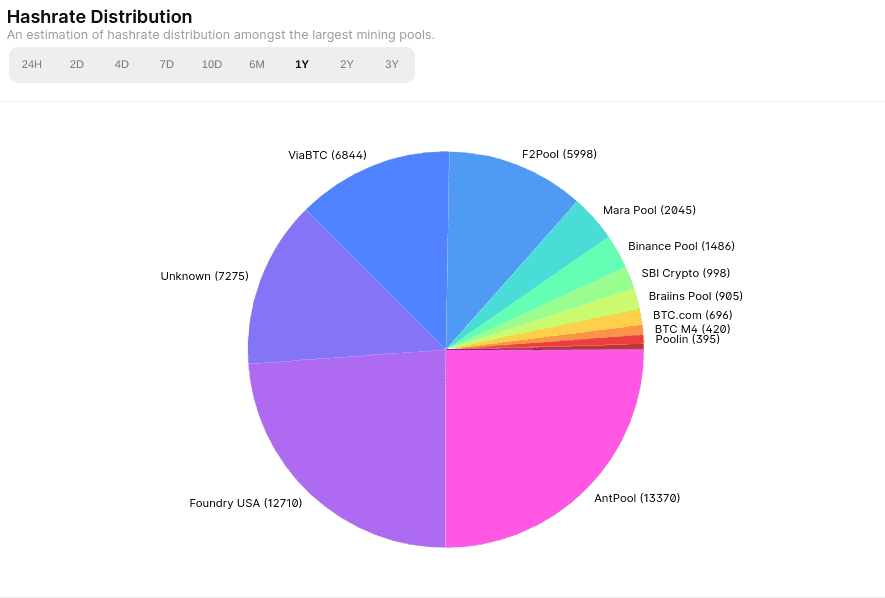

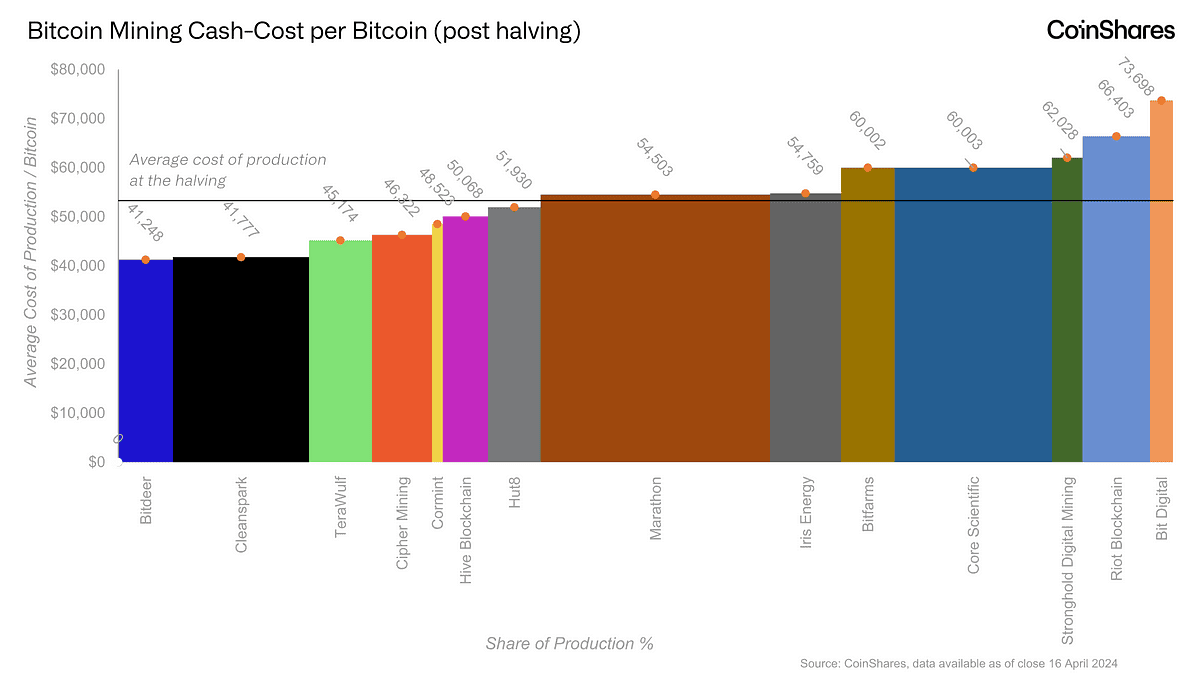

As of September 2024, MARA is the largest Bitcoin miner by deployed hashrate among Bitcoin miner companies, with 29.9 EH/s (exahashes per second), accounting for 4.98% of the Bitcoin network and +3% of mined Blocks in 1 year. This positions it ahead of major competitors such as Core Scientific (CORZQ) with 20.4 EH/s and Riot Platforms (RIOT) with 12.6 EH/s. However, its leadership in terms of network share comes with increased competition from other large miners like CleanSpark (CLSK) and Bitfarms (BITF), who also have significant hashrate deployments (17.3 EH/s and 7.0 EH/s, respectively). As the mining landscape becomes more competitive, companies are focusing on scale and efficiency, as demonstrated by MARA’s acquisitions and capacity expansions. Also, MARA holds its post-halving BTC mining cost basis near industry average.

Pricing strategies in the Bitcoin mining market are heavily influenced by energy costs, which make up a significant portion of operating expenses. MARA’s strategy of controlling energy costs through its data center acquisitions and focusing on low-cost, renewable energy sources gives it a competitive edge. Furthermore, its commitment to expand renewable energy investments, such as through its Ohio facilities, positions it well to capitalize on sustainability trends and potentially reduce energy costs in the long term. However, as Bitcoin’s market price remains volatile, miners like MARA face significant risk, with fluctuations impacting profitability and market share.

Source: coinshares.com

Source: coinshares.com

III. MARA Stock Forecast

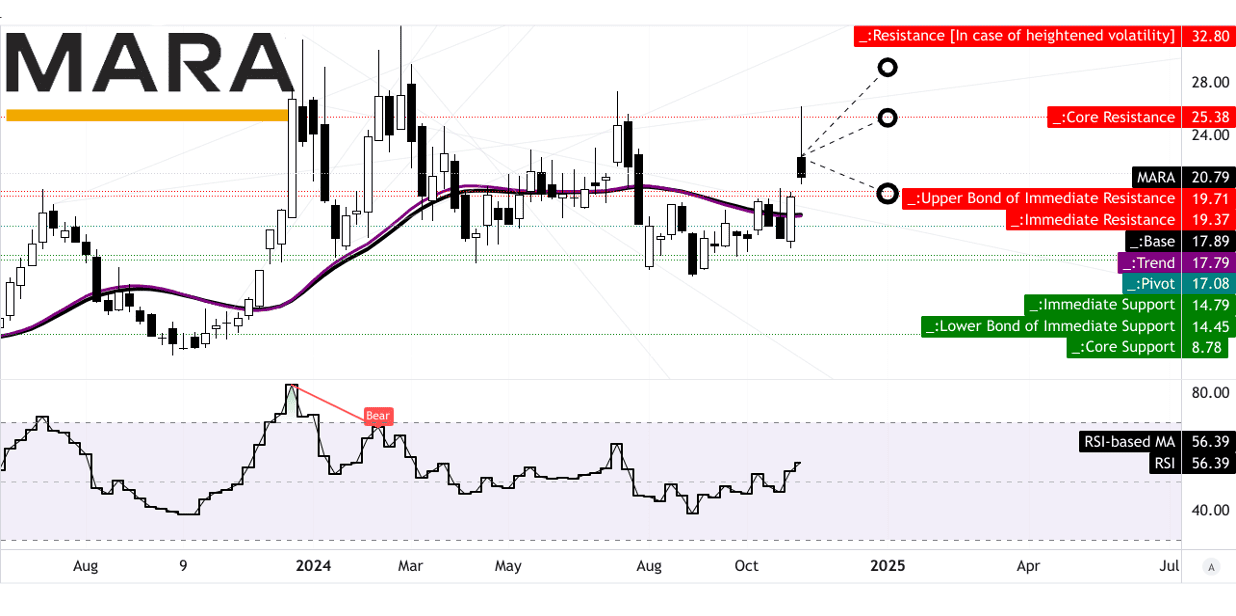

MARA Holdings, a cryptocurrency mining company, currently trades at $20.79. A technical analysis of its chart reveals key indicators such as the trendline and baseline, both using modified exponential moving averages (EMAs). The trendline is currently at $17.79, indicating a potential upward movement from this level. The baseline is slightly higher at $17.89, suggesting a strong support level. These indicators suggest that the stock could face resistance at these levels but has potential for further upward momentum.

The average price target for MARA by the end of 2024 is projected at $25.40, based on technical analysis of momentum and changes in polarity. This target considers Fibonacci retracement and extension levels, tools used to identify potential support and resistance levels in the stock's price movement. The optimistic price target is slightly higher at $29.10, driven by an expected continued upward price momentum in the mid- to short-term. This target is also supported by Fibonacci levels, which indicate the potential for the stock to break through existing resistance. On the other hand, the pessimistic target is $19.40, based on a downward price momentum projection.

The RSI value, a key indicator of price momentum, is 56.39, indicating a neutral to slightly bullish sentiment. Importantly, there is neither bullish nor bearish divergence at this stage, suggesting that the price movement is consistent with the RSI trend. The RSI line is trending upwards, which is a positive sign for the stock's near-term outlook, indicating that the stock may continue to gain momentum.

Source: tradingview.com

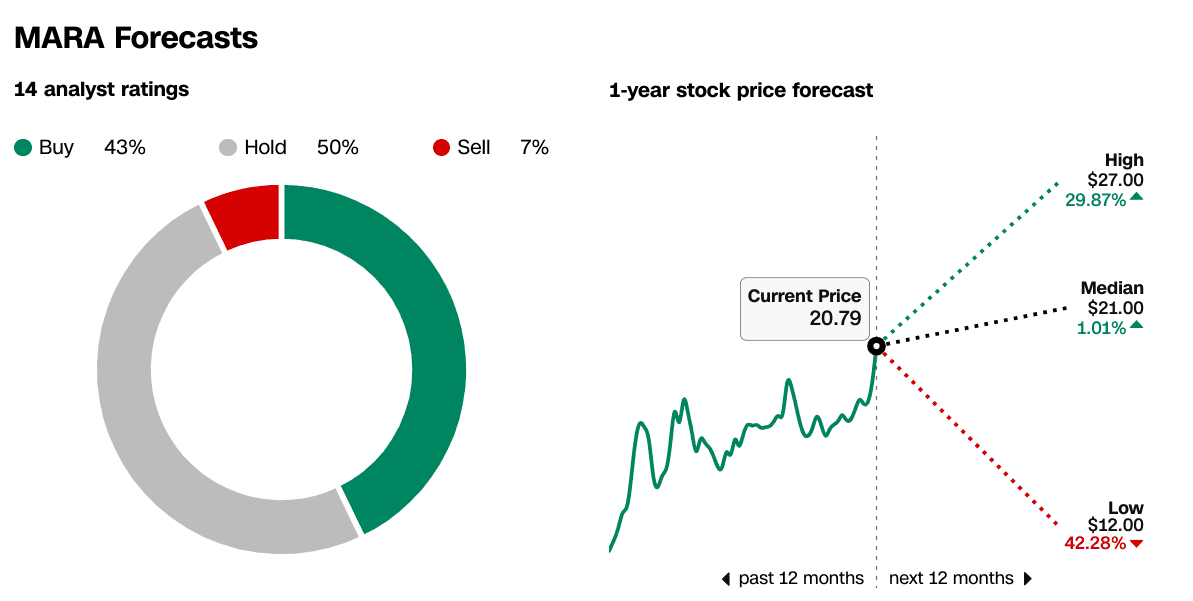

Market analysts are generally optimistic, with 43% of the 14 analysts recommending a "buy," while 50% suggest holding the stock, and 7% advise selling. The 1-year price forecast shows significant variability: the high forecast is $27, which represents a 29.87% potential upside from the current price, while the low forecast is $12, indicating a 42.28% downside risk. The median forecast stands at $21, aligning closely with the current price, indicating that analysts see limited short-term movement beyond current levels.

Source: CNN.com

Source: CNN.com

IV. MARA Stock Forecast: Future Outlook

Growth Forecasts and Strategic Initiatives

MARA's growth trajectory is underpinned by substantial infrastructure investments and strategic initiatives aimed at increasing mining capacity and operational efficiency. As outlined in their earnings call, MARA is focusing on expanding its portfolio of owned and operated mining sites, targeting areas with access to low-cost energy to reduce operational expenses. The company’s fleet expansion is notable, with a 7% increase in miners, reaching approximately 268,000 miners. This expansion is expected to push their operational hash rate to 36.9 EH/s, with plans to improve efficiency by deploying newer mining models like the S21 Pro and utilizing immersion cooling technology. MARA also anticipates that by Q4 2024, its fleet efficiency will improve to 19.5 J/TH, down from the current 22.7 J/TH.

A key development in the company’s strategy is the acquisition of data centers in Ohio, with a total interconnect-approved capacity of 372 megawatts. This expansion, expected to be completed by 2025, will increase MARA’s compute capacity by over 70%, contributing significantly to their 2024 target of 50 EH/s. Additionally, the company has focused on international expansion, aiming to derive 50% of its revenue from outside the U.S. by 2028, supported by global projects such as its Abu Dhabi site.

Source: 3Q24 Earnings Deck

MARA is also prioritizing cost-saving measures through energy independence. Their partnership with NGON to neutralize methane and transform flared gas into energy represents a novel approach to lowering power costs, positioning the company as a leader in sustainable, low-cost energy mining solutions.

Market Trends and External Factors

Bitcoin prices and cryptocurrency mining trends are pivotal to MARA’s future outlook. The company’s profitability is closely tied to the price of Bitcoin, and the ongoing volatility in cryptocurrency markets directly impacts earnings. As of the latest reports, Bitcoin's price volatility has been significant, influencing miner revenue fluctuations. Furthermore, global hash rate increases, especially from competitors, have raised mining difficulty, which has strained profit margins for all miners, including MARA. Despite these challenges, MARA’s efforts to enhance operational control, such as acquiring sites with abundant low-cost energy, provide a strategic hedge against fluctuating energy prices and mining difficulty.

Energy costs remain a critical factor, particularly in light of global shifts towards more sustainable and affordable energy sources. MARA’s investments in immersion cooling technology and its methane-neutralization project are seen as part of its long-term strategy to mitigate energy costs and optimize power consumption. These technological innovations are likely to provide MARA with a competitive advantage in an industry where margins are tightly squeezed by rising energy prices and environmental pressures.

Financial Outlook

For the upcoming fiscal periods, MARA’s financial guidance shows a challenging short-term outlook, with a consensus EPS estimate of -0.16 for Q4 2024, and a significant YoY decline of 93.53% expected in Q1 2025. Revenue estimates indicate modest growth, with Q4 2024 projected at $168.22 million, reflecting a 7.31% increase from the previous year, and Q1 2025 expected to surge by 30.13% to $214.98 million. However, quarterly revisions show a concerning trend, with a higher number of downward revisions for EPS and revenue, signaling investor caution.

Source: seekingalpha.com