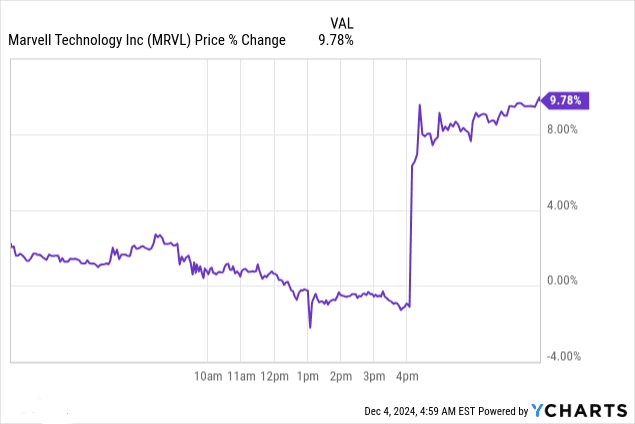

Marvell Technology's stock price saw a 10% surge post-Q3 FY2025 earnings release, driven by AI momentum and custom silicon adoption. Despite missing the revenue consensus of $1.65 billion, earnings beat projections, supported by a 98% YoY rise in data center revenues. Technical indicators forecast bullish trends with a near-term target of $101, reflecting optimistic market sentiment.

Source: Ycharts.com

I. MRVL Earnings Overview Q3 2025

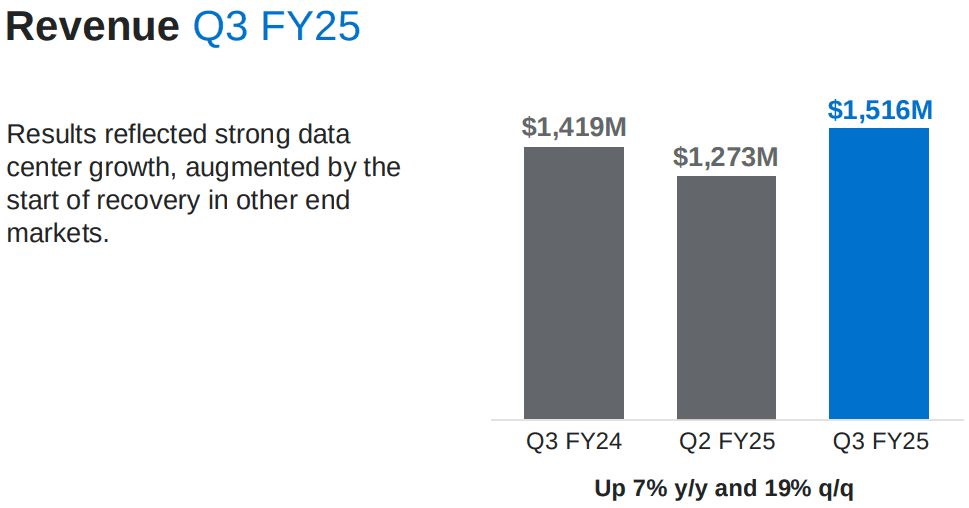

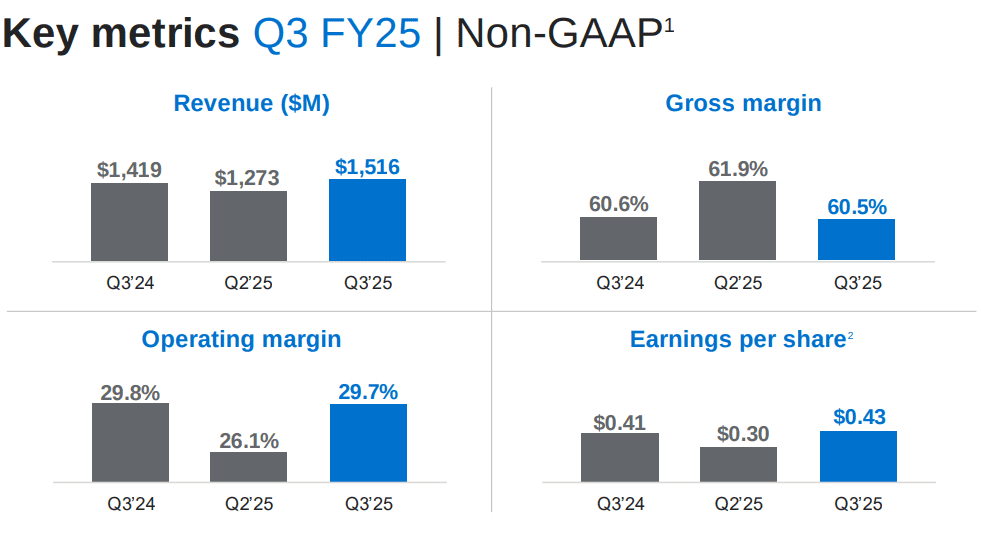

Marvell Technology’s Q3 FY2025 earnings reflected robust operational execution and sector-specific momentum. Revenue stood at $1.516 billion, falling short of the $1.65 billion consensus but exceeding the midpoint of guidance by $66 million. This represented a 7% YoY growth and a 19% sequential increase, primarily driven by AI demand and custom silicon production. Non-GAAP EPS came in at $0.43, surpassing the normalized estimate of $0.52 but trailing the GAAP estimate of $0.04, reflecting adjustments for restructuring and stock-based compensation. Gross margin (non-GAAP) stood at 60.5%, while GAAP gross margin dropped to 23%, primarily due to restructuring charges. Operating margin (non-GAAP) hit 29.7%, illustrating the leverage within Marvell’s business model, even as GAAP operating margin fell to -46.4%. Net income under GAAP metrics registered a diluted loss of $0.78 per share, while non-GAAP measures showed considerable sequential growth of 43%.

Source: Marvell_Q3_FY25_financial_business_results

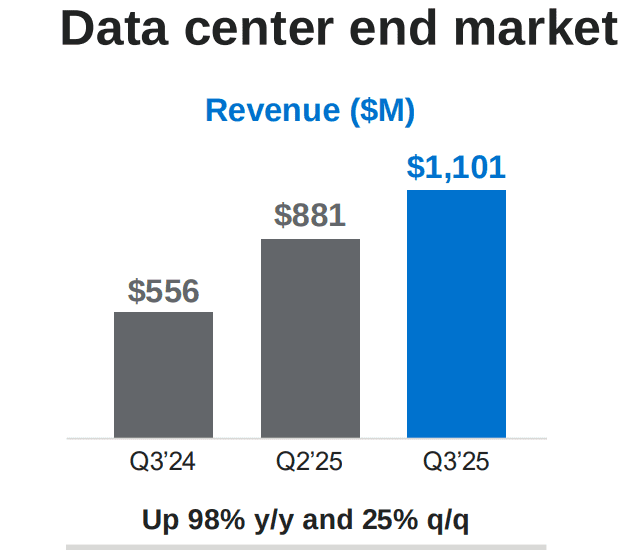

Marvell Earnings Q3 2025 Revenue Drivers: Data centers accounted for 73% of consolidated revenue, generating $1.1 billion—an impressive 98% YoY increase, driven by AI applications. Enterprise networking and carrier markets collectively contributed $236 million, growing 4% sequentially as recovery signs emerged. Automotive and industrial segments added $83 million, reflecting a 9% sequential uptick, while consumer markets contributed $97 million, marking similar sequential growth but anticipated seasonal declines ahead. The company's electro-optics business also experienced robust growth, with significant traction in its 800-gig and 1.6T DSP products, critical for AI workloads.

Performance Breakdown: The standout performance in data centers was bolstered by custom AI silicon solutions and high-transistor chip ramps. Custom AI revenues are projected to sustain sequential growth in the low-to-mid 20% range into Q4. Meanwhile, investments in optical DSPs and interconnect modules further diversified revenue streams. Marvell’s partnership with AWS, emphasizing multi-generational custom silicon for data centers, positions the firm to capture larger market share.

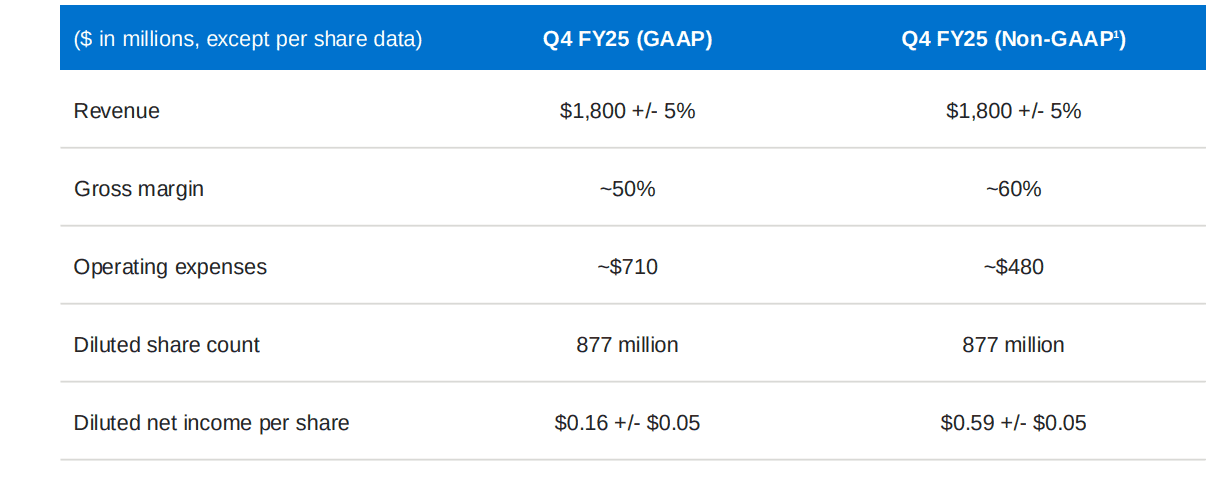

Margins Analysis: The company exhibited a strong operating leverage, with non-GAAP EPS growing 79% from Q1 to Q3 FY2025, versus a 31% top-line increase. This reflects efficient cost management, though GAAP results were affected by $750 million in restructuring charges. Q4 FY2025 guidance projects revenue between $1.71 billion and $1.89 billion, marking YoY growth of 26% at the midpoint. Non-GAAP gross margin is expected to stabilize at 60%, with operating expenses around $480 million. AI momentum, particularly in data centers, is expected to drive continued growth, supported by strategic realignment in R&D investment toward high-margin opportunities.

Source: Marvell_Q3_FY25_financial_business_results

Source: Marvell_Q3_FY25_financial_business_results

II. Product & Market Dynamics

New Products and Market Reception

Marvell Technology has demonstrated a robust launch pipeline and market traction, with AI-driven demand underpinning product success. The Q3 release of the industry's first 1.6T PAM DSP on a 5nm process and subsequent announcement of a 3nm version featuring 20% lower power consumption reflects Marvell's sharp innovation strategy. These developments align with the industry's need for high-bandwidth, energy-efficient solutions, capturing notable design wins across major customers. Electro-optics, a central growth area, experienced sequential double-digit revenue growth. The initial shipments of the 1.6T DSP are expected to scale into high production, bolstering Marvell’s lead in the fast-growing interconnect segment.

The custom AI silicon ramp, a cornerstone of Marvell's transformation into an "AI-first" data center semiconductor company, significantly contributed to the company’s $1.1 billion in data center revenue for Q3—up 98% YoY and 25% sequentially. This sector now comprises 73% of consolidated revenue, indicating solid market reception and positioning Marvell for sustained growth.

Source: Marvell_Q3_FY25_financial_business_results

Competitive Landscape

Marvell operates amidst fierce competition from Intel, Broadcom, Qualcomm, and NVIDIA. While NVIDIA dominates in AI GPUs, Marvell has carved a niche with custom silicon and electro-optics. Intel's delay in next-gen Ethernet solutions gives Marvell a time-to-market advantage, particularly with its 800G and 1.6T PAM DSPs. Broadcom, a leader in Ethernet switching, faces pricing pressure as Marvell ramps up its AI interconnect offerings.

On pricing, Marvell leverages value differentiation, focusing on custom AI and electro-optics products rather than commoditized segments. Strategic partnerships, such as its expanded collaboration with Amazon Web Services, underline its commitment to co-develop solutions tailored to hyperscaler needs, adding volume and margin security.

Marvell’s 19% sequential revenue growth and consolidated margin of 60.5% underscore its ability to capitalize on AI supercycle opportunities. However, maintaining this momentum will require continued investment in advanced nodes (e.g., 2nm platform) to fend off challengers. By Q4, Marvell anticipates low-to-mid 20% sequential growth in data center revenue, driven by both AI-specific solutions and Ethernet products, highlighting its competitive adaptability in an evolving semiconductor landscape.

III. MRVL Stock Forecast

Marvell Stock Forecast Technical Analysis

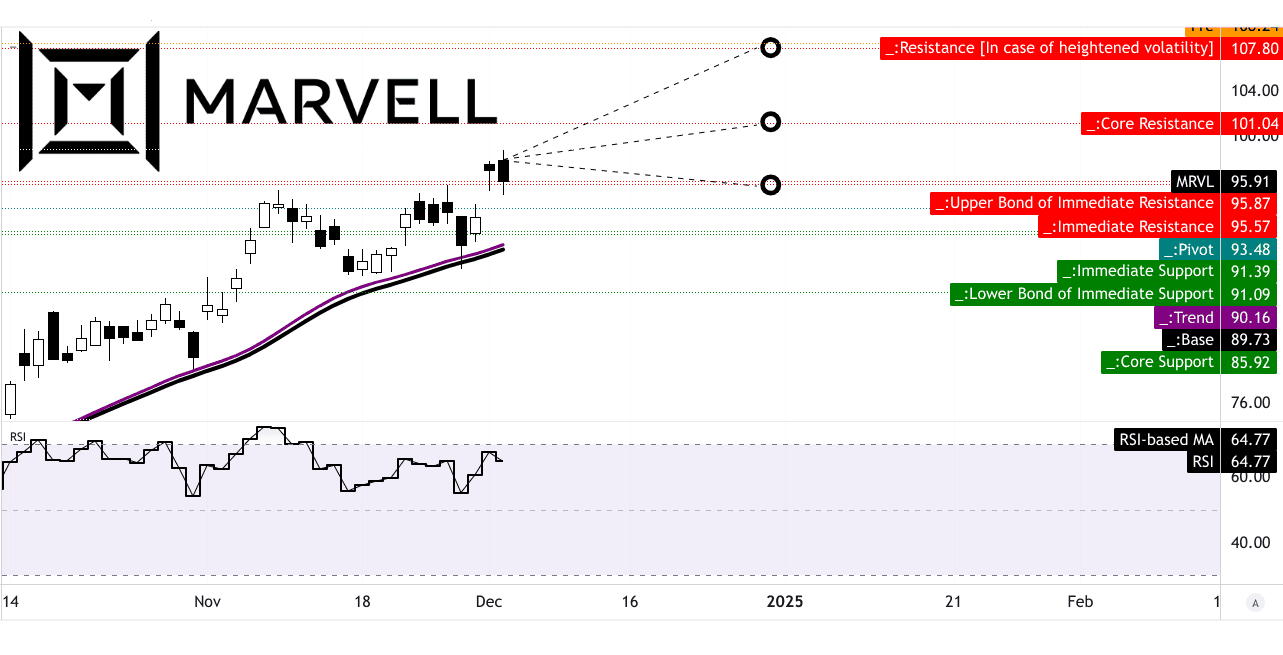

The technical outlook for Marvell Technology (MRVL) suggests bullish tendencies, supported by momentum-based indicators and chart patterns. The stock currently trades at $95.91, closely tracking its horizontal channel pivot of $93.48. Modified exponential moving averages set the trendline and baseline at $90.16 and $89.73, respectively, marking a stable foundation for upward movement.

The Relative Strength Index (RSI) stands at 64.77, indicating near-overbought conditions but not yet at a critical reversal threshold. The RSI trend is upward, showing bullish divergence with no bearish divergence present. This reflects strength in momentum, aligning with the observed upward swing within Fibonacci retracement/extension levels. The short-to-mid-term Fibonacci analysis places an average price target of $101 by year-end, with an optimistic scenario of $107 if the current bullish momentum sustains. A pessimistic target of $96 assumes minor downward pressure, which aligns with channel support near $93.48.

Recent adjustments to price targets and recommendations have shown slight upward bias. The underlying basis includes MRVL’s capability to capitalize on semiconductor demand, particularly in areas like AI and 5G. Analysts incorporate macroeconomic factors, such as interest rates and supply chain normalization, to justify their projections. The divergence between the optimistic ($107) and pessimistic ($96) targets stems from varying assumptions on the persistence of positive earnings revisions and sector tailwinds.

Source: tradingview.com

MRVL Stock Forecast: Market Analysts' Expectations and Ratings

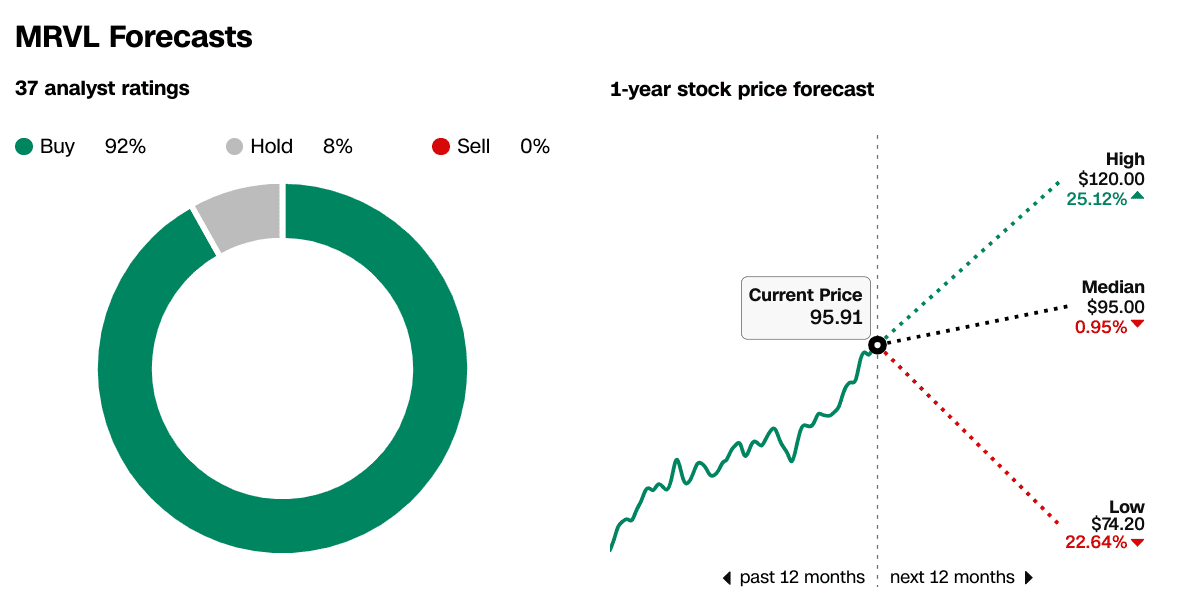

Market analysts largely favor a buy stance on MRVL, with 92% rating the stock as a buy and only 8% advising a hold. Notably, no analysts currently recommend selling. A high 1-year price target of $120 reflects confidence in strong sectoral trends and the company's strategic positioning. This high target represents a 25.12% potential upside from current levels. The median target stands close to the current price at $95, implying near-term stability. Conversely, the low target of $74.20, which represents a 22.64% downside, indicates a risk floor based on bearish scenarios or broader market disruptions.

Source: CNN.com

Source: CNN.com

IV. Marvell Stock Forecast: Future Outlook

Management's growth forecasts and strategic initiatives

Marvell Technology’s outlook showcases a solid growth trajectory underpinned by management’s strategic initiatives and favorable market dynamics. Management projects consolidated revenue for Q4 FY2025 to stand at $1.8 billion, marking a YoY increase of 26%. Non-GAAP earnings per share are expected in the $0.54-$0.64 range, representing 12.6% YoY growth. This guidance reflects the momentum derived from AI-driven demand in data center markets and the ramp-up of custom silicon programs. Marvell’s collaboration with Amazon Web Services (AWS), which encompasses a multi-year, multi-generational agreement, further solidifies its growth prospects by expanding its data center semiconductor solutions.

Marvell’s strategic pivot toward AI and data center markets is yielding results, with data center revenue constituting 73% of Q3 FY2025 revenue. This segment hit $1.1 billion, doubling YoY and growing 25% sequentially. The expansion of electro-optics offerings, including the industry-first 1.6T PAM DSP on a 5-nanometer process and a next-generation 3-nanometer DSP, ensures Marvell remains competitive in addressing AI’s bandwidth and energy demands. Meanwhile, enterprise networking and carrier markets showed signs of recovery, with Q3 revenue hitting $151 million and $85 million, respectively, and mid-teens sequential growth projected for Q4.

Analyst consensus supports Marvell’s optimistic outlook, with 24 upward EPS revisions over the last three months compared to five downgrades. EPS for Q4 FY2025 is projected at $0.52, while revenue is estimated at $1.65 billion, reflecting 15.36% YoY growth. These trends point to continued stockholder confidence and expectations of strong earnings scalability, supported by a 2.5x EPS growth relative to top-line growth in Q3.

Source: Marvell_Q3_FY25_financial_business_results

Source: Marvell_Q3_FY25_financial_business_results

Market Trends

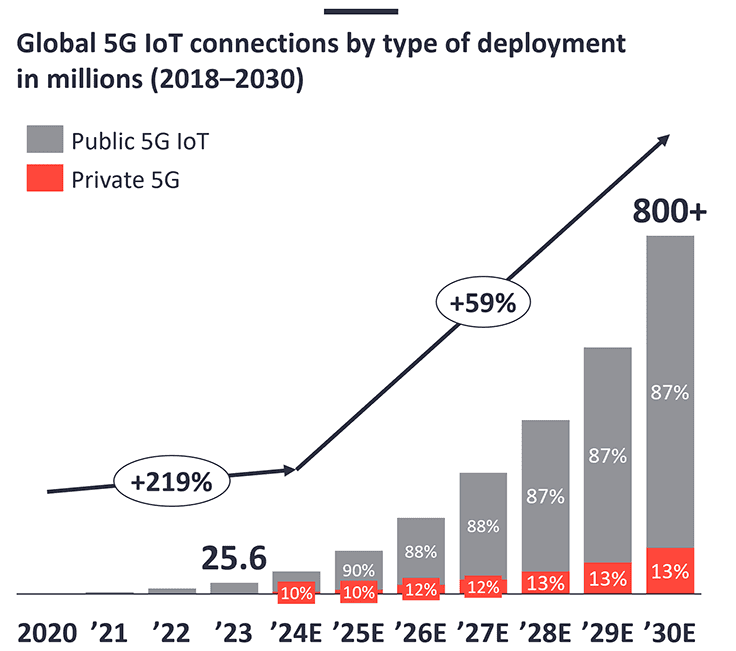

Market trends strongly align with Marvell’s focus areas. The global 5G deployment drives demand for its carrier infrastructure solutions, while data center expansion and AI applications underpin the robust growth in its largest revenue segment. Additionally, automotive electrification is beginning to contribute, with automotive and industrial markets growing by 9% sequentially in Q3 FY2025. However, seasonal gaming demand led to a mid-teens sequential decline in the consumer market forecast for Q4, tempering growth in non-data center segments.

Source: iot-analytics.com