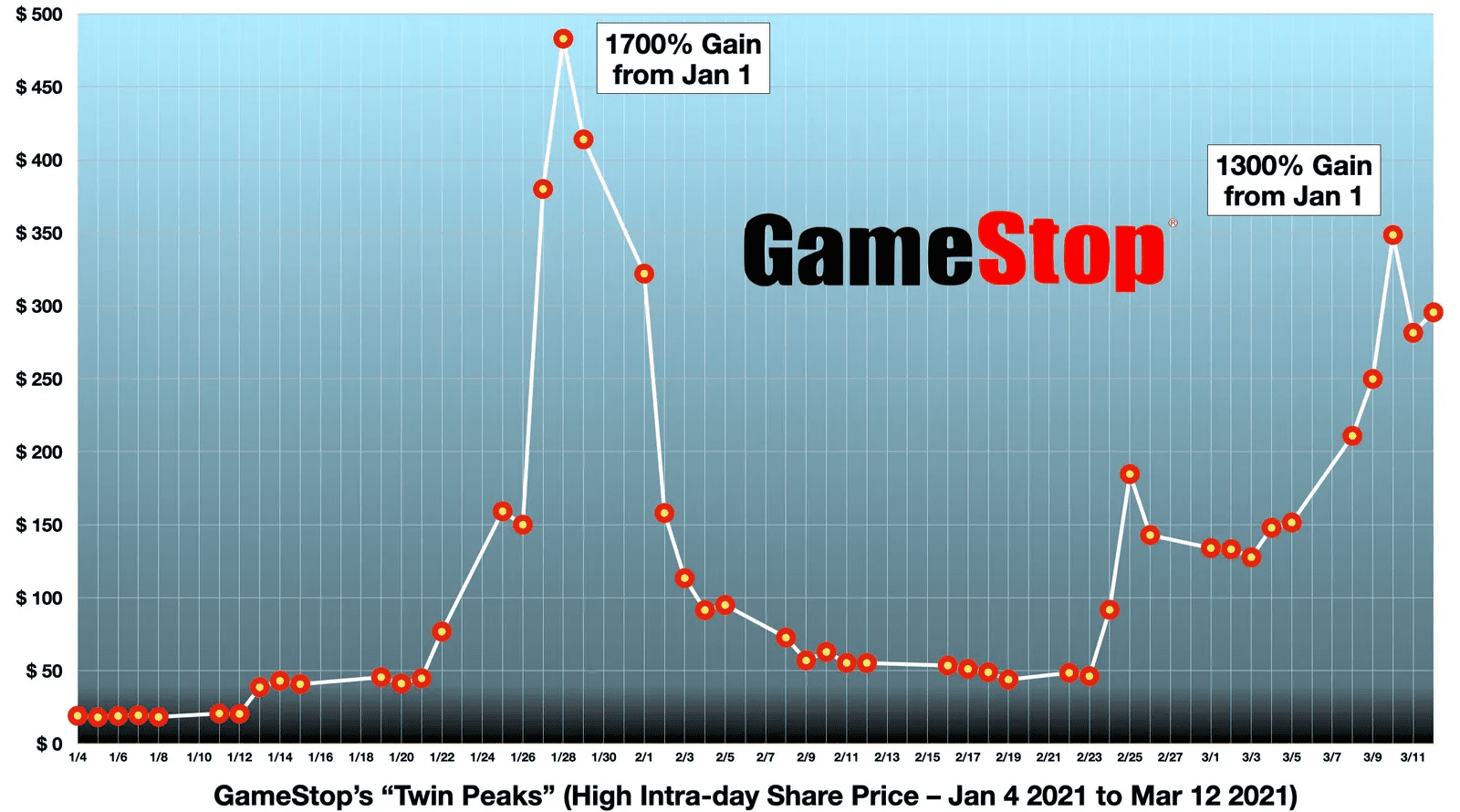

- Meme stocks are characterized by their extreme volatility, exemplified by GameStop's price surge from $20 to $483 in January 2021 and subsequent crash.

- Meme stocks often experience high returns driven by speculative trading, where rapid price increases can offer significant gains in a short period.

- Additionally, meme stocks are inherently speculative, with their valuations frequently detached from fundamental financial metrics, leading to unpredictable and erratic market behavior.

Source: unsplash.com

I. What is a Meme Stock

A "meme stock" refers to publicly traded shares of companies whose popularity and trading activity are significantly influenced by social media memes and online communities rather than traditional financial metrics. The term "meme," originally coined by Richard Dawkins in his 1976 book The Selfish Gene, describes an idea or behavior that spreads from person to person within a culture. In the context of finance, meme stocks are characterized by their viral nature and mass adoption among retail investors driven by internet trends.

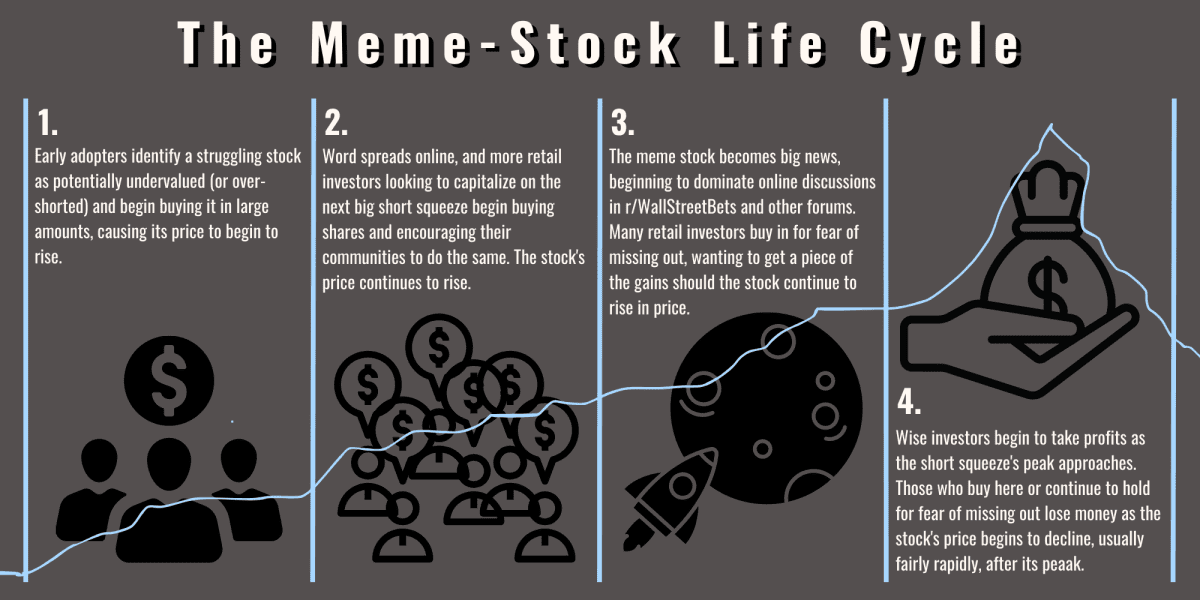

The rise of meme stocks became prominent in early 2021, with GameStop's short squeeze being a notable example. The GameStop saga began when users of the Reddit forum WallStreetBets identified that institutional investors, particularly hedge funds, had heavily shorted GameStop shares, betting that the stock price would fall.

Source: forbes.com

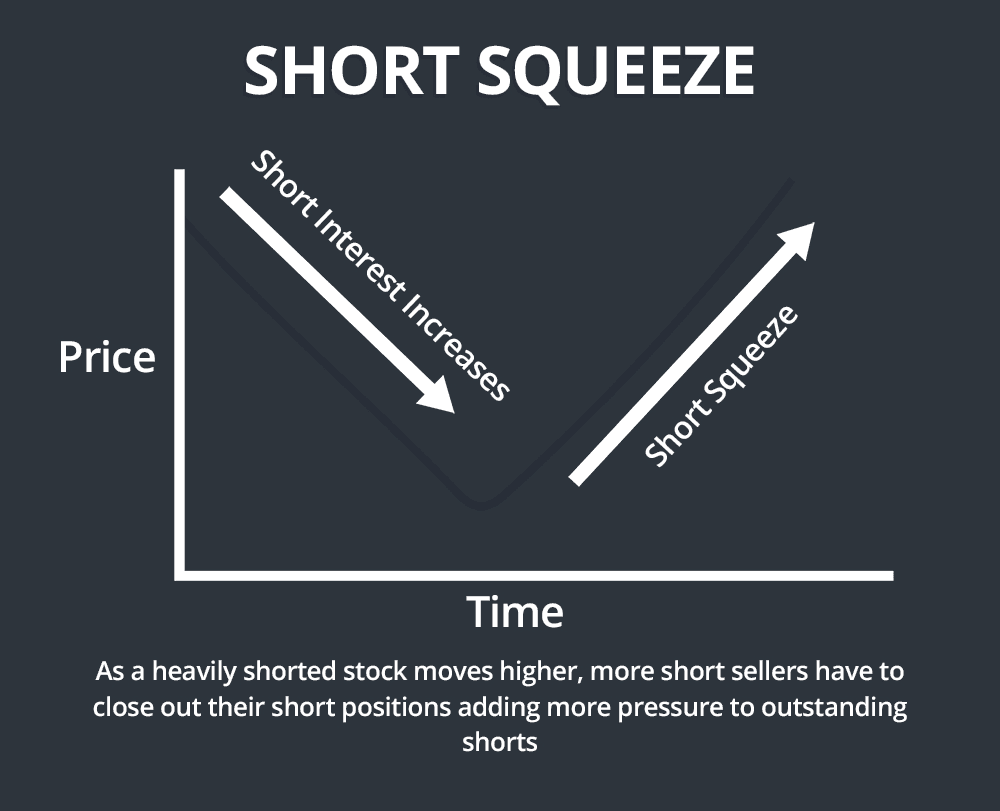

Short selling involves borrowing shares to sell them at a high price, with the intention of buying them back at a lower price. If the price rises instead, short sellers face potentially unlimited losses, as they have to buy back the shares at the higher price to return them to the lender.

Source: scanz.com

In January 2021, WallStreetBets users began buying up GameStop shares, driving the price up from around $20 to an intraday high of nearly $483. This surge forced short sellers to cover their positions by purchasing shares at elevated prices, further fueling the stock's rise—a phenomenon known as a short squeeze. This event highlighted the power of collective action in online communities and their ability to influence market dynamics.

Meme stocks are heavily influenced by online communities and social media platforms such as Reddit, X (formerly Twitter), and Facebook. These platforms facilitate the rapid spread of trading ideas and market sentiment. Terms like "Apes" refer to members of the WallStreetBets community, "Stonks" is a humorous misspelling of stocks used to indicate market enthusiasm, and "BTFD" stands for "Buy The F***ing Dip," urging investors to buy during market declines. "Diamond Hands" describes investors holding onto stocks despite price volatility, while "Paper Hands" are those who sell at the first sign of trouble. "Tendies" refer to gains or profits, and "Hold The Line" is a call to resist selling shares even when the stock price is falling.

Source: thestreet.com

The influence of community-driven trading can lead to rapid and extreme price movements, often detached from the underlying financial health of the companies involved. This behavior is driven by viral content and trends, with retail investors often acting on speculative information rather than fundamental analysis. Institutional investors and hedge funds may also engage in meme stock trading, either to hedge against losses or to capitalize on volatility. The convergence of social media trends with financial markets has introduced new dynamics in trading, emphasizing the role of online communities in shaping market outcomes.

II. Meme Stocks List: Best Meme Stocks

- GameStop (GME)

- Core Business: GameStop is a retail company specializing in video game sales and hardware.

- Meme Stock Journey: GameStop’s stock became a meme in early 2021 due to a short squeeze driven by WallStreetBets. The price surged from around $20 in January 2021 to an intraday peak of $483 on January 28, 2021.

- Recent Developments: As of August 2024, GME has seen significant volatility. The stock has fluctuated between $15 and $40, with ongoing speculation about its future due to the company's efforts to shift towards e-commerce.

- Future Outlook: The future of GME remains uncertain. Continued transformation into an e-commerce model and potential strategic partnerships will be crucial in determining its long-term viability.

- AMC Entertainment (AMC)

- Core Business: AMC operates as a movie theater chain and is one of the largest in the world.

- Meme Stock Journey: AMC’s meme stock status began in early 2021. The stock price jumped from about $2 in January 2021 to a high of around $72.62 in June 2021 due to retail investors rallying around the stock.

- Recent Developments: AMC’s stock has since settled between $5 and $15 as of August 2024. The company has been grappling with post-pandemic recovery and competition from streaming services.

- Future Outlook: AMC's future depends on its ability to adapt to changing consumer habits and recover from pandemic-related losses.

- BlackBerry (BB)

- Core Business: BlackBerry Limited is a software company focusing on cybersecurity and enterprise software solutions.

- Meme Stock Journey: BB became a meme stock in January 2021, with its price rising from about $6 to over $28 in a short span.

- Recent Developments: The stock has since stabilized around $4 to $10. BlackBerry continues to pivot towards software and cybersecurity, but its stock performance remains mixed.

- Future Outlook: The company’s success will largely hinge on its ability to gain traction in the cybersecurity market.

- Bed Bath & Beyond (BBBY)

- Core Business: BBBY operates retail stores specializing in home goods and personal care items.

- Meme Stock Journey: In early 2021, BBBY saw its stock price surge from around $20 to over $50, largely driven by retail investor interest.

- Recent Developments: By mid-2024, BBBY’s stock had plunged below $5 due to financial struggles and store closures.

- Future Outlook: BBBY faces significant challenges and its future is uncertain without substantial restructuring.

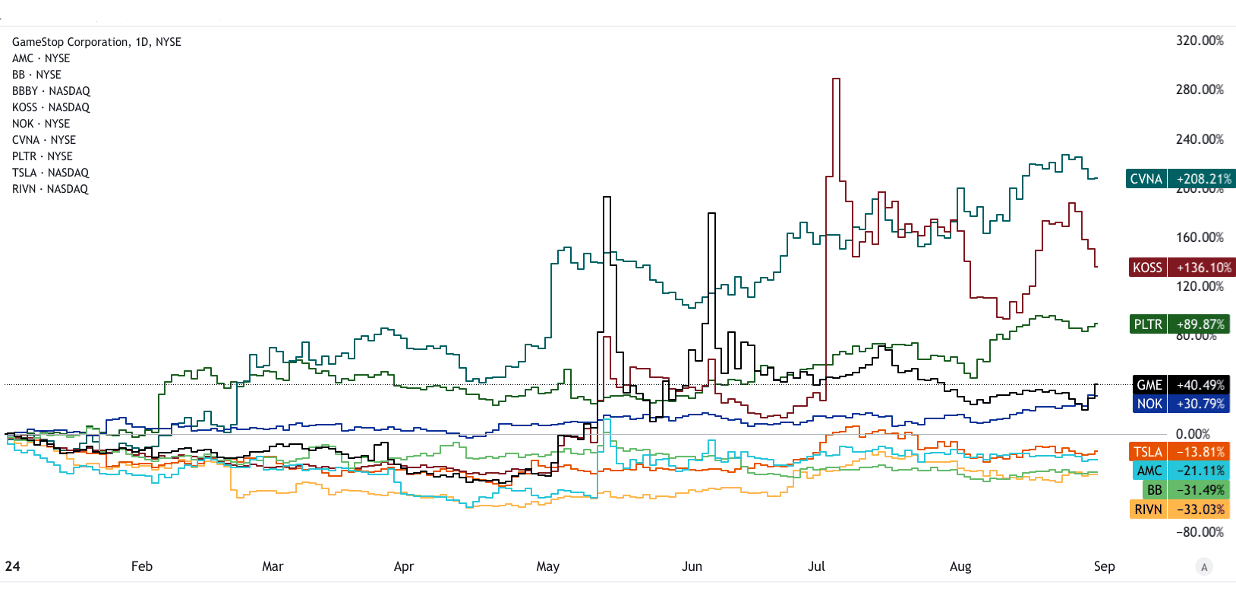

[YTD Price Return]

Source: tradingview.com

- Koss Corporation (KOSS)

- Core Business: Koss is a manufacturer of headphones and audio equipment.

- Meme Stock Journey: KOSS saw a dramatic price increase from under $5 to nearly $130 in January 2021 due to meme stock trading.

- Recent Developments: The stock price has since decreased, fluctuating between $5 and $10 as of August 2024.

- Future Outlook: Koss’s future will depend on its ability to innovate and compete in a crowded market.

- Nokia (NOK)

- Core Business: Nokia provides telecommunications equipment and services.

- Meme Stock Journey: NOK’s stock price surged from around $4 to over $10 in early 2021 due to meme stock enthusiasm.

- Recent Developments: The stock has since been stable, trading between $4 and $7. Nokia continues to focus on 5G technology.

- Future Outlook: Nokia's growth will likely depend on its 5G advancements and market positioning.

- Carvana (CVNA)

- Core Business: Carvana is an online platform for buying and selling used cars.

- Meme Stock Journey: CVNA experienced significant volatility, with prices rising from $70 to over $370 in early 2021.

- Recent Developments: The stock has since dropped to around $20 to $40 due to concerns over profitability and operational challenges.

- Future Outlook: Carvana’s future depends on addressing its financial and operational issues while maintaining its market share.

- Palantir Technologies (PLTR)

- Core Business: Palantir provides big data analytics and software solutions to government and commercial clients.

- Meme Stock Journey: PLTR’s stock rose from around $10 to over $45 in early 2021 as it gained meme stock attention.

- Recent Developments: As of August 2024, PLTR’s stock has stabilized between $15 and $20, with ongoing growth in its analytics business.

- Future Outlook: The company's prospects will largely depend on its ability to sustain its growth and expand its client base.

- Tesla (TSLA)

- Core Business: Tesla designs and manufactures electric vehicles and energy storage solutions.

- Meme Stock Journey: Tesla has been a meme stock for several years, with its price rising from about $200 in early 2020 to over $700 by mid-2021.

- Recent Developments: TSLA has seen fluctuations, trading between $600 and $800 as of August 2024, driven by production and market sentiment.

- Future Outlook: Tesla's future looks promising due to its innovation in electric vehicles and energy solutions.

- Rivian (RIVN)

- Core Business: Rivian is an electric vehicle manufacturer focusing on adventure-oriented vehicles.

- Meme Stock Journey: Rivian’s stock skyrocketed from its IPO price of $78 to over $170 in November 2021.

- Recent Developments: The stock has since fallen to around $20 to $30, as the company faces production and delivery challenges.

- Future Outlook: Rivian’s success will depend on overcoming production hurdles and gaining market share in the EV sector.

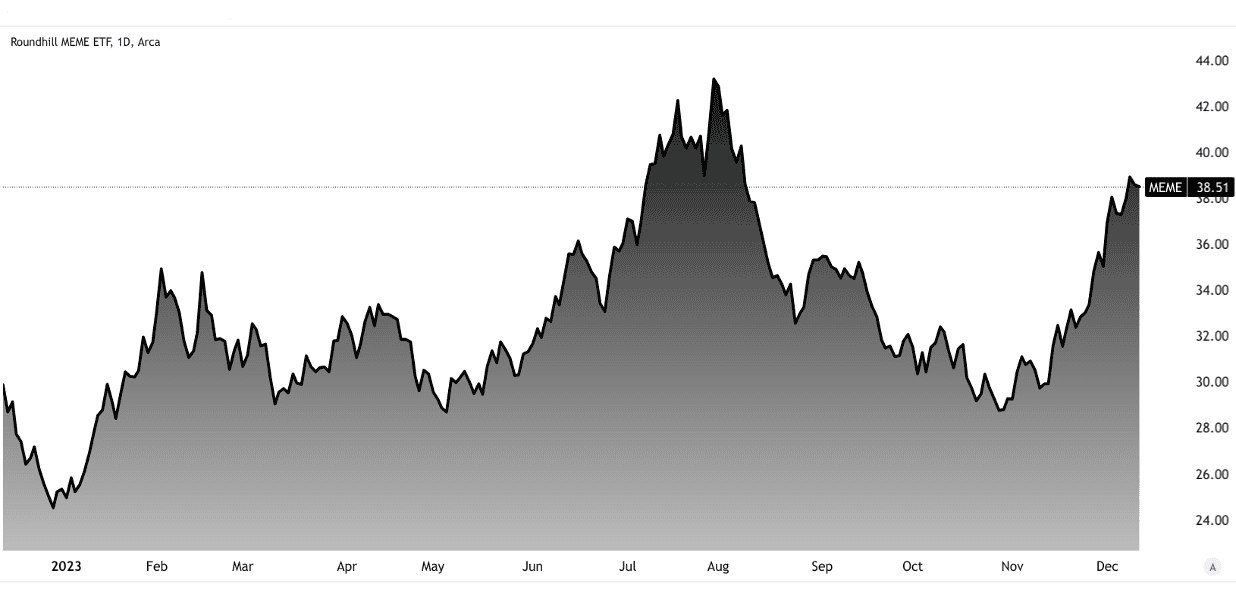

Roundhill Investments MEME ETF

- The Roundhill MEME ETF (MEME) was an exchange-traded fund (now delist) that aims to track the performance of meme stocks. It was launched to provide investors with exposure to companies that exhibit meme-like trading characteristics, offering a diversified way to engage with the meme stock phenomenon.

Source: tradingview.com [now delisted]

Source: tradingview.com [now delisted]

III. Factors to Consider When Investing in Meme Stocks

Volatility and Risks

Meme stocks are known for extreme price volatility. For instance, GameStop's price soared from $20 to $483 in January 2021, only to fall back to around $20 within months. This volatility presents a high risk of significant losses, especially if investors buy in during a price peak. Market manipulation, such as coordinated buying by online communities, can drive up prices artificially, leading to unsustainable valuations. Additionally, pump-and-dump schemes, where prices are inflated through misleading information and then sold off, can trap investors in losing positions. Regulatory risks also loom large as financial authorities may impose stricter regulations or crackdowns on the trading practices associated with meme stocks. For example, the SEC has been investigating trading activities and market manipulation related to meme stocks.

Company Fundamentals

Investors should carefully evaluate a company's financial health and long-term viability, as meme stocks often diverge from traditional financial metrics. For instance, BlackBerry's stock price surged to $28 in early 2021 despite its declining revenue and shrinking market share. Similarly, Bed Bath & Beyond saw its stock price increase to over $50, even as the company struggled with significant operational challenges and store closures. Meme stocks can become detached from their underlying business fundamentals, making it crucial for investors to analyze financial statements, earnings reports, and market conditions to assess the real value of the investment.

Source: cboe.com [no sustainability in Meme stocks]

Top Meme Stocks Investment Strategies

When investing in meme stocks, different strategies can be employed:

- Day Trading vs. Long-Term Holding: Day trading can capitalize on short-term price swings but requires constant monitoring and quick decision-making. In contrast, holding meme stocks for potential long-term gains may be riskier given their volatile nature. For example, those who held GameStop for a prolonged period from its peak in January 2021 faced substantial declines in value.

- Participating in the Community: Engaging with online communities can provide insights and trading tips, but it is important to avoid succumbing to fear of missing out (FOMO) and making impulsive decisions. Community-driven hype can lead to speculative bubbles.

Source: investor.gov

- Diversification: To mitigate risks, diversifying investments across various asset classes and sectors is crucial. Relying solely on meme stocks increases exposure to high-risk assets.

- Exit Plan: An exit plan should be established to determine when to sell or cut losses. This plan helps avoid emotional decision-making and ensures that investors can manage their positions effectively amidst market fluctuations.

In summary, investing in meme stocks requires careful consideration of volatility, company fundamentals, and strategic planning to navigate the inherent risks and opportunities effectively.

IV. Meme Stocks Outlook

Predictions and Trends

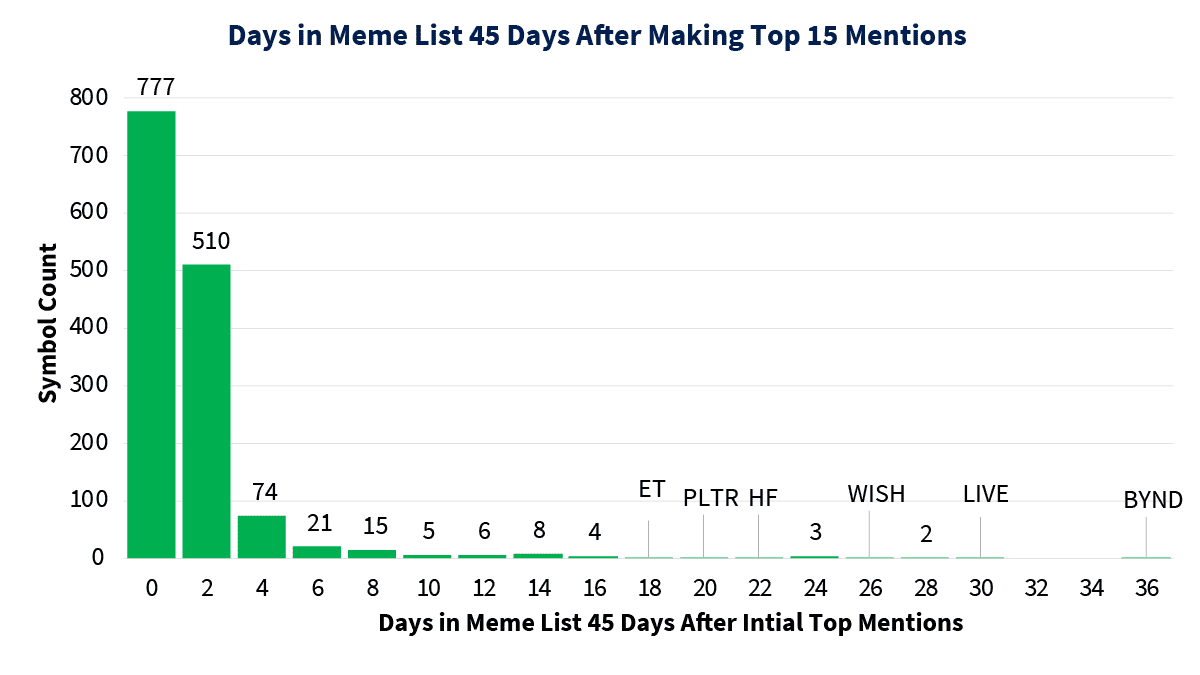

The sustainability of meme stocks remains highly contentious. Experts like Colorado State University's Hilla Skiba argue that meme stocks, driven by speculative momentum rather than fundamentals, pose significant risks. Stocks like GameStop and AMC, despite their occasional resurgence, continue to exemplify this trend, where prices are detached from underlying financial performance. The Federal Reserve has raised concerns about the echo chambers created by social media, which can amplify risky behavior, particularly among younger, debt-laden retail investors. These dynamics could potentially destabilize markets, although the Fed notes that, so far, broader financial stability has not been severely impacted.

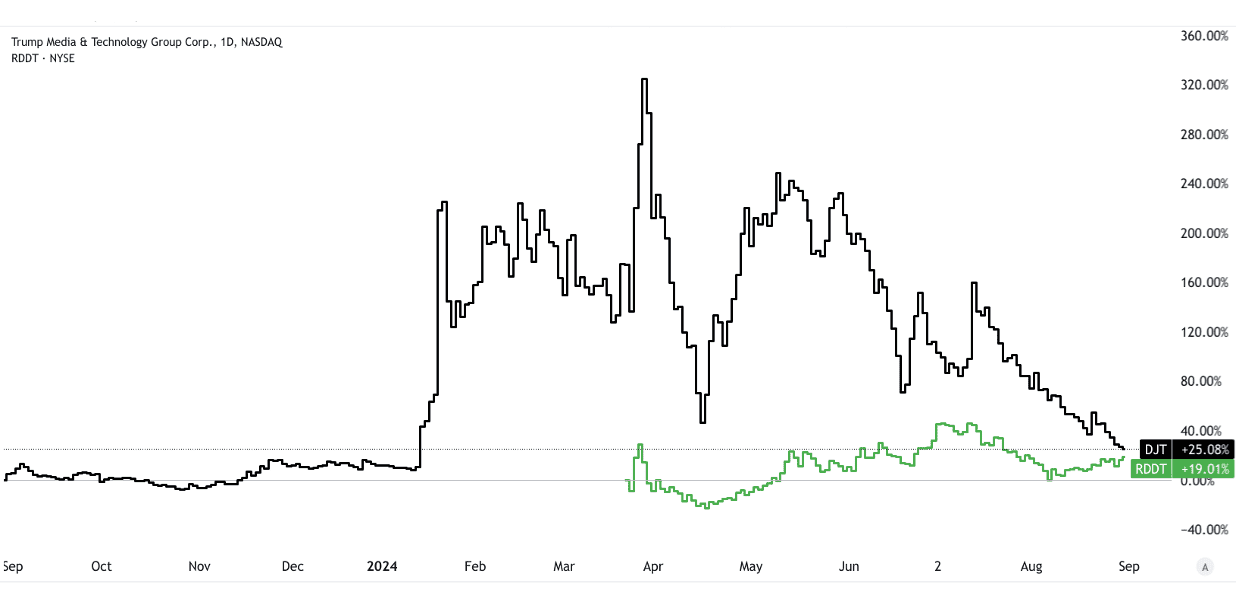

Looking forward, potential new meme stocks such as Trump Media & Technology Group (DJT) and Reddit (RDDT) are emerging, leveraging their social media presence. These stocks, like their predecessors, are highly speculative, with valuations far exceeding their earnings. For instance, Trump Media’s valuation is 1,600 times its 2023 revenue, highlighting the disconnect between market price and financial reality. The long-term sustainability of meme stocks is questionable, as they may erode trust in financial markets and exacerbate wealth inequality if massive volatility persists.

Source: tradingview.com [1Y Price Return]

Source: tradingview.com [1Y Price Return]

The Evolution of Retail Investing

Meme stocks have significantly altered the investing landscape by emphasizing the power of retail investors and online communities. The surge in meme stock trading has raised concerns about market fairness and abundance of liquidity, as coordinated buying can lead to extreme volatility and speculative bubbles. This has prompted regulatory scrutiny and discussions about potential reforms to protect investors and ensure market stability.

Social media's role in investing has grown, with platforms like Reddit, X (formerly Twitter), and Facebook playing a crucial part in shaping market trends and influencing stock prices. The future role of social media in investing will likely continue to expand, with increased emphasis on the impact of online communities and the need for effective regulatory frameworks to address emerging challenges and ensure fair market practices.