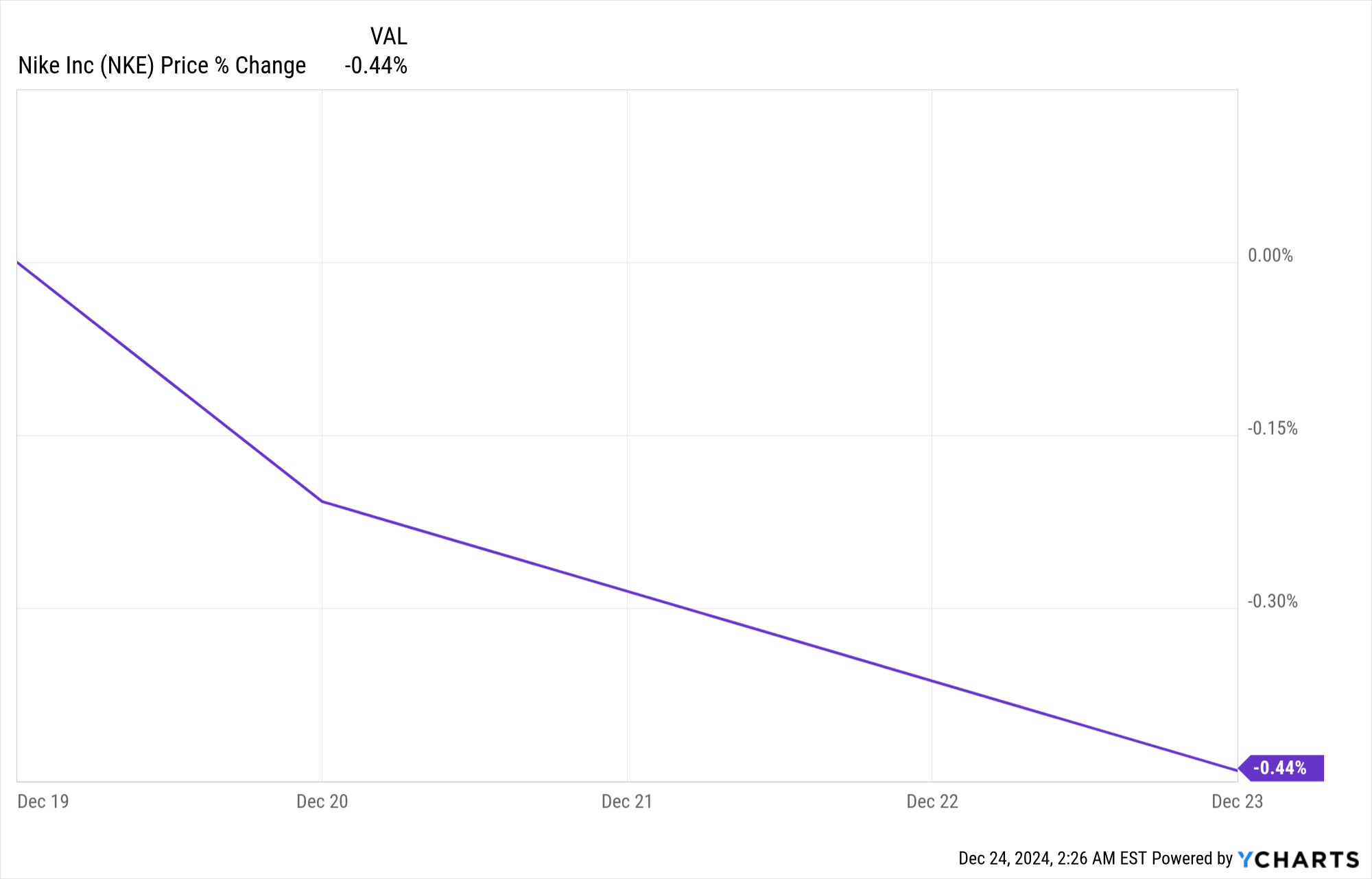

Following Q2 FY2025 results, NIKE (NKE) shares slipped 0.44%, reflecting cautious investor sentiment. Despite exceeding both EPS and revenue expectations, the market reacted to headwinds such as an 8% YoY revenue decline and margin pressures from inventory adjustments. The results underscored ongoing challenges in balancing growth strategies and operational recalibration amidst evolving market dynamics.

Source: Ycharts.com

I. Nike Earnings Overview Q2 2025

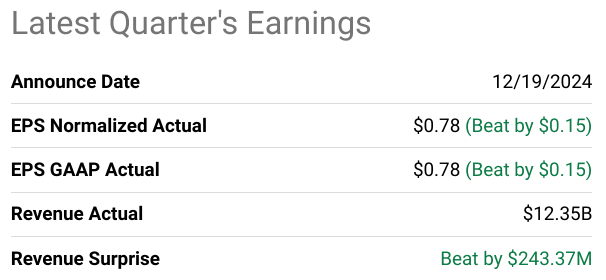

For Q2 2025, NIKE’s normalized EPS hit $0.78, beating consensus by $0.15, while revenue stood at $12.35 billion, surpassing estimates by $243.37 million. Net income demonstrated considerable stability, reflecting efficiency in cost management despite an 8% YoY decline in consolidated revenue, primarily driven by reduced sales in NIKE Direct and wholesale channels. Gross margin fell 100 basis points to 43.6%, pressured by inventory liquidations, wholesale discounts, and higher markdowns. Operating margin remained under strain due to lower volumes and promotional adjustments, while net margins echoed these challenges, further highlighting pricing and inventory adjustments.

Source: seekingalpha.com

NKE Earnings Q2 2025 Revenue Drivers and Market Trends

Revenue drivers reflected a mix of strategic repositioning and market headwinds. NIKE Direct experienced a sharp 14% drop, including a notable 21% decline in digital sales, while brick-and-mortar NIKE Stores slid by 2%. Wholesale revenue fell 4%, with macroeconomic challenges and strategic shifts weighing on performance. EMEA posted a 10% drop in consolidated revenue, while Greater China declined 11%, reflecting inventory pressures and weaker consumer demand. North America, NIKE's largest market, reported an 8% decline in consolidated revenue, despite a strong Black Friday performance in November. In APLA, revenue decreased by 2%, supported by gains in running and training categories, which mitigated broader headwinds.

Segment-level performance highlighted areas of strength and concern. Training categories performed well, with men's sales rising by high teens and women’s by high single digits. However, sportswear declined in double digits YoY, driven by adjustments to classic footwear franchises. Despite these declines, NIKE’s basketball segment saw growth, with Sabrina 2 emerging as the second-most-worn sneaker in the NBA, behind the Kobe 6.

Source: Q2-FY25 Deck

Geographic Trends and YoY Changes

● North America: Digital sales plunged 22%, while NIKE Stores reported a modest 3% decline. Kids’ and basketball segments provided a bright spot, demonstrating solid growth.

● EMEA: Wholesale sales slid 4%, compounded by a 32% decline in digital sales. Despite these challenges, the Pegasus and Phantom franchises posted double-digit growth.

● Greater China: Revenue contraction of 11% reflected weaker demand and higher markdowns. Notably, local designs like Express Lane products maintained robust full-price demand.

● APLA: The 2% decline was mitigated by a triple-digit surge in running franchises, signaling opportunities in category-specific growth.

NIKE’s Q2 showed mixed results, with its strategic focus on inventory reduction and product alignment potentially stabilizing margins in the near term but weighing on revenue growth.

II. Nike Product & Market Dynamics

New Products & Innovations

Nike’s product and market dynamics in Q2 2025 highlight both innovation in its portfolio and challenges within the competitive landscape. New product releases, including the Pegasus 41, Nike Shox, and the Kobe lineup, signal Nike's intent to revitalize its brand identity by reconnecting with its core focus on sports. Upcoming launches such as the Vomero 18 and Pegasus Premium further demonstrate Nike’s alignment with athlete-driven design and product storytelling. However, a critical observation from the market is that over-reliance on a narrow range of sportswear silhouettes has impacted newness and diluted consumer engagement. Nike is aiming to correct this by integrating deeper athlete insights and expanding its product depth in high-volume areas like running and training.

Source: nike.com

Collaborations and sports marketing remain central to Nike’s strategy. Recent re-signings with major leagues, including the NBA and NFL, and endorsements with high-profile athletes like Ronaldo and Erling Haaland bolster the brand’s presence. Events such as the Berlin and New York City marathons further exemplify Nike’s targeted approach to connect with communities through sport-driven campaigns. Despite these efforts, current sales data reveal declining traffic across Nike Direct and wholesale channels, driven in part by a promotional sales model that has undermined the brand’s premium positioning.

Competitive Landscape

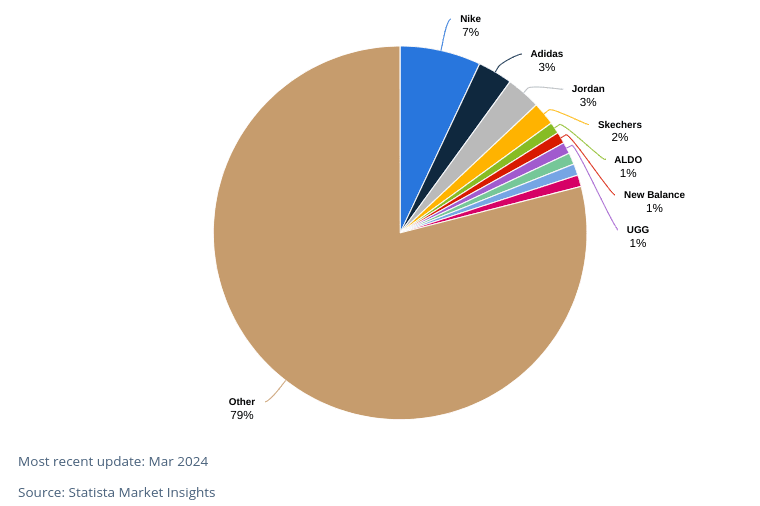

In the competitive landscape, Nike commands a dominant 10% (Nike 7%, Jordan 3%) share of the global footwear market, outperforming Adidas at 3%. However, pricing strategies remain a challenge. Nike’s shift to full-price strategies for digital and physical sales, coupled with selective markdowns, marks an effort to reclaim premium status. This strategy must contend with Adidas and Under Armour, which continue to innovate and compete aggressively in similar price brackets.

Market share shifts reveal nuanced challenges. Competitors like Puma and Lululemon have steadily gained traction in niche segments, capitalizing on consumer preferences for athleisure and functionality. Nike’s emphasis on creating an integrated marketplace, combining wholesale and direct-to-consumer channels, seeks to address these shifts while balancing inventory levels and fostering stronger partnerships with retailers like Dick’s and JD Sports. This collaborative focus aims to boost sell-through rates while ensuring premium brand representation.

Source: statista.com

III. Nike Stock Forecast

NKE Stock Forecast Technical Analysis

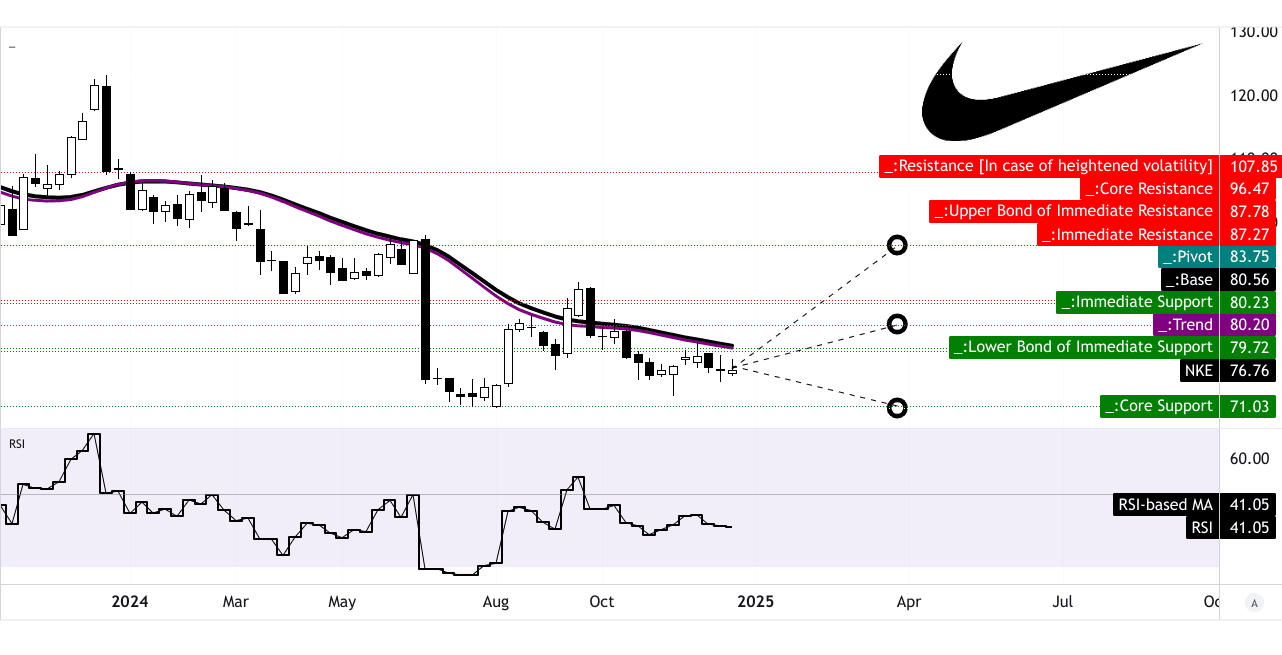

Nike’s (NKE) technical indicators present mixed signals about its near-term trajectory. Currently trading at $76.76, the stock sits below its modified exponential moving average trendline of $80.20 and baseline of $80.56, signaling bearish momentum in the short term. The RSI at 41.05 confirms this sentiment, trending sideways without divergence. This suggests the market lacks clear directional conviction.

Key levels are pivotal. The horizontal price channel pivot at $83.75 acts as a critical resistance, with the stock requiring sharp upward movement to break this threshold. On the downside, a breach below the $71 pessimistic target would indicate further weakness. However, should the price regain momentum, an optimistic target of $96.50 aligns with Fibonacci retracement and extension levels, signaling the potential for a 25.7% rally from the current price.

Source: tradingview.com

Nike Stock Forecast: Market Analysts' Expectations & Ratings

Market analysts remain divided, with a balanced 47% split between buy and hold recommendations. Only 5% advocate selling, reflecting a cautious optimism. For the next 12 months, forecasts exhibit considerable variation. The high-end projection of $120 suggests a 56.33% upside, reflecting bullish expectations tied to robust recovery in consumer discretionary spending or favorable macroeconomic conditions. Conversely, the low-end estimate of $57 marks a 25.74% downside, accounting for continued consumer demand softness or heightened cost pressures.

The median price target of $92 implies a 19.85% gain and aligns with the average Q1 2025 target of $83.50. Both estimates are supported by the current momentum and projected retracement patterns. Analysts are cautiously weighing risks such as inventory challenges and competitive pressures against opportunities like digital sales growth and cost-optimization measures.

Source: CNN.com

IV. NKE Stock Forecast: Future Outlook

Management’s Strategic Outlook

Nike’s leadership acknowledges operational missteps, primarily overreliance on sportswear styles and overly promotional digital sales, which diluted brand positioning. The company projects a return to a “pull market,” ensuring flagship products like Pegasus 41 and Jordan lines drive demand through organic excitement. Management is prioritizing investments in marketing to boost emotional resonance during sports moments, aiming for premium sales environments across both Nike Direct and wholesale. This shift is necessary, given high markdown levels: 50% of digital sales were promotions, damaging overall profitability. For fiscal Q3 2025, projections reflect headwinds, with EPS anticipated at $0.30 (a -69.4% YoY decline) and revenue expected at $11.04 billion, marking an -11.17% contraction YoY. These figures suggest intensified challenges in the near term, as strategic changes are unlikely to yield immediate financial results.

Source: nike.com

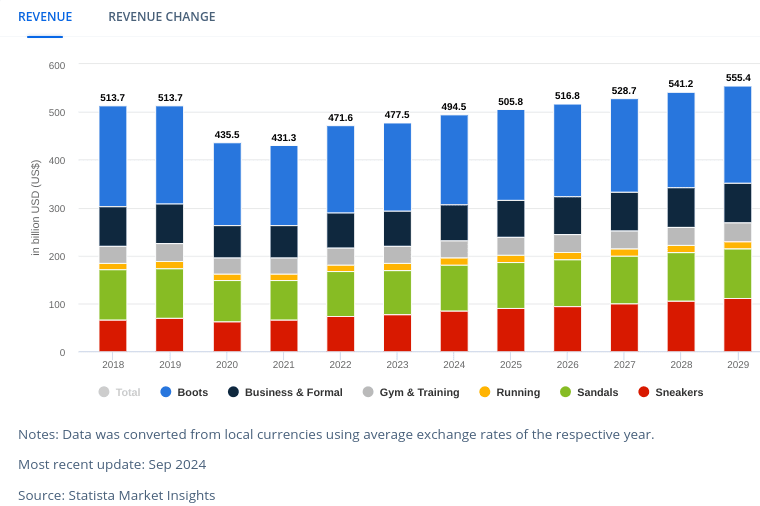

Key initiatives also include segmentation by “fields of play”—focused categories based on gender and sport. This targeted approach is expected to unlock incremental revenue and accelerate innovation. Additionally, Nike plans to reallocate resources geographically to empower local teams in critical markets like China, which leads global footwear revenues at $118 billion in 2024.

Market Trends and Growth Drivers

Broader athleisure and fitness trends remain supportive. The footwear market is projected to grow at 2.35% CAGR through 2029, reaching a volume of 14.9 billion pairs. While premium segments are critical, non-luxury sales are expected to account for 92% of market revenue in 2024. Hybrid work and home fitness continue to shape consumer behaviors, with increased interest in sustainable materials—areas where Nike's innovation pipeline can provide an edge.

China, as a core revenue driver, offers both challenges and opportunities. While 11/11 sales surpassed expectations, inventory pressures and promotional pricing persist. Nike’s success will hinge on balancing these dynamics and achieving inventory discipline. In summary, while Nike’s renewed focus on sport, premium brand positioning, and localized empowerment positions it for eventual growth, the company faces considerable short-term revenue and profitability constraints, amplified by industry shifts and internal recalibrations.

Source: statista.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.