Following the Q3 2024 earnings release, NIO's stock price rose by 1%, reflecting mixed investor sentiment. While results highlighted growth in vehicle deliveries and improved margins, challenges in pricing and operating losses tempered market optimism. Consolidated revenue of RMB 18.67 billion ($2.66 billion) fell short of forecasts by $71.05 million, despite sequential improvement.

Source: Ycharts.com

I. Nio Earnings Overview Q3 2024

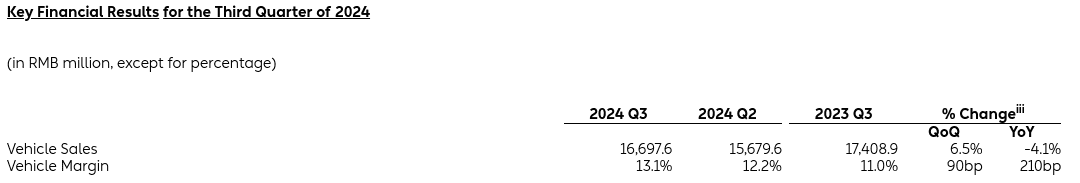

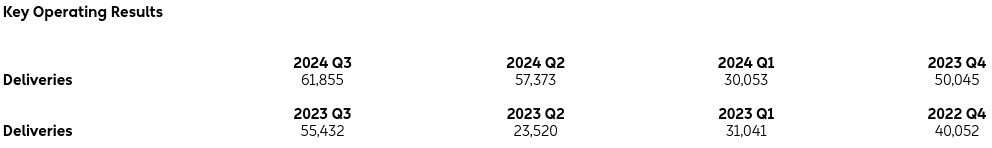

In Q3 2024, NIO's consolidated revenue hit RMB 18.67 billion (approximately $2.66 billion), missing expectations by $71.05 million. This represented a YoY drop of 2.1% but an improvement of 7.0% sequentially. Vehicle sales contributed RMB 16.70 billion ($2.38 billion), down 4.1% YoY but up 6.5% quarter-over-quarter. The company delivered 61,855 vehicles, showing an 11.6% YoY increase and a 7.8% rise sequentially, indicating expanding unit sales offset by pricing or mix-related challenges. Adjusted EPS came in at -$0.30, narrowly exceeding projections by $0.01, while GAAP EPS of -$0.35 missed by $0.04. Gross margin rose to 10.7%, up sharply YoY from 8.0%, and up slightly from 9.7% last quarter. Operating margin, however, slipped deeper into negative territory as losses climbed 8.1% YoY to RMB 5.24 billion ($746.4 million).

Source: ir.nio.com

Revenue Drivers and Market Assessment

Despite increased unit sales, revenue lagged YoY, primarily reflecting pressure on vehicle pricing or weaker sales in higher-margin models. NIO's premium brand delivered 61,023 units, while ONVO contributed 832 units, showing its emerging role in expanding the customer base. YoY growth of 11.6% in deliveries outpaced the broader electric vehicle market in China, which has seen slowing growth due to a competitive landscape and economic headwinds. This indicates NIO is holding market share effectively.

Source: ir.nio.com

Segment-specific margins highlight mixed results. Vehicle margins improved to 13.1% from 11.0% YoY, supported by operational efficiency gains, cost reductions, or shifts in product mix. However, consolidated gross profit rose 31.8% YoY to RMB 2.01 billion ($286.0 million), indicating an uptick in non-vehicle revenue contributions or cost optimizations.

Expenses remain a key concern. Adjusted operating losses narrowed slightly quarter-over-quarter, indicating cost-containment measures had some effect. Still, YoY losses reflect higher R&D spending or marketing investments to support growth in a challenging environment. NIO's net loss widened to RMB 5.06 billion ($721.0 million), with adjusted figures improving sequentially by 2.7%.

II. Product & Market Dynamics

NIO’s recent performance in China’s BEV market, particularly for vehicles priced above RMB 300,000, reflects strong product-market alignment. Dominating this segment with a 48% market share in Q3 2024, NIO capitalized on its premium positioning with models like the ET9, whose delivery begins in March 2025. This flagship showcases cutting-edge innovations and promises to reinforce NIO's luxury appeal. Concurrently, the ONVO brand made a splash in the mainstream market with the L60, combining a spacious design, high safety standards, and advanced charging/swapping capabilities. With a production ramp to 10,000 units/month by December and 20,000 by March 2025, ONVO targets families, gaining traction against competitors like Tesla’s Model 3, which constitutes a significant portion of its user conversions. NIO's upcoming third brand, Firefly, set to debut on December 21, 2024, underscores its ambition to penetrate the compact boutique car segment. Positioned for global reach, Firefly aims to diversify the company's portfolio and extend its technological footprint.

Source: nio.com/et9

NIO navigates a highly competitive environment dominated by BYD, Tesla, Li Auto, and XPeng. BYD leads in volume with an aggressive pricing strategy and vertical integration. Tesla, despite Model 3's recent price reductions, faces challenges in retaining market share against feature-rich alternatives like ONVO L60. Li Auto's L6 and XPeng's G6 offer stiff competition in SUVs and mid-range sedans. In response, NIO’s pricing strategy leverages differentiation rather than price wars. For example, the ONVO L60, priced at RMB 40,000 below Li Auto’s L6, strikes a balance between affordability and advanced tech. Additionally, NIO's power-swap stations (2,737 globally) and urban-focused Navigate on Pilot (78.4% adoption) provide unparalleled customer convenience, setting it apart in a crowded field.

Despite a brief dip in October deliveries due to reduced promotional spending, NIO forecasts Q4 deliveries of 72,000–75,000 units, a recovery supported by robust demand for both NIO and ONVO. International expansion, starting with the MENA region, signals strategic growth. Meanwhile, production ramp-ups across brands and improvements in supply chain efficiency are expected to elevate vehicle margins from 13.1% (Q3 2024) to a projected 20% in 2025. NIO’s multifaceted strategy—premium innovations, a diversified brand portfolio, and proprietary tech like urban vision-based smart driving—positions it strongly against competitors, aligning product development with shifting market dynamics.

III. Nio Stock Forecast

NIO Price Prediction Technical Analysis

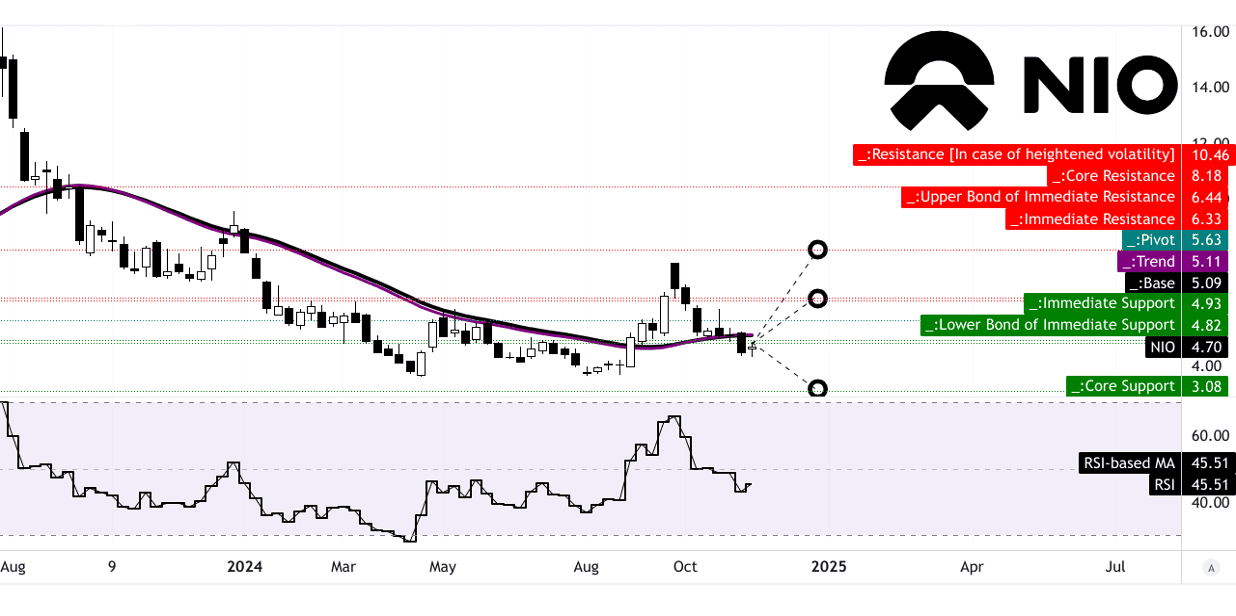

Nio stock (NIO) is currently trading at $4.70, operating within a horizontal channel marked by a pivot at $5.63. Technical indicators suggest mixed trends. The modified exponential moving averages (EMAs) set the trendline at $5.11 and the baseline at $5.09, showing proximity to current levels but a slight upward deviation in trend projections. Meanwhile, the Relative Strength Index (RSI) stands at 45.51, which indicates neutral momentum. No bullish or bearish divergence is present, and the RSI line's downward trend hints at prevailing selling pressure.

Using Fibonacci retracement and extension analysis, the forecasted average price target by the end of 2024 sits at $6.45, reflecting a 37.23% potential upside. The optimistic scenario projects $8.20, implying a 74.47% gain from the current price, driven by short- to mid-term upward momentum. Conversely, the pessimistic target is $3.10, translating to a 34.04% downside, reflecting vulnerability to bearish swings. These levels are grounded in change-in-polarity trends and momentum observed in Fibonacci-based frameworks.

Source: tradingview.com

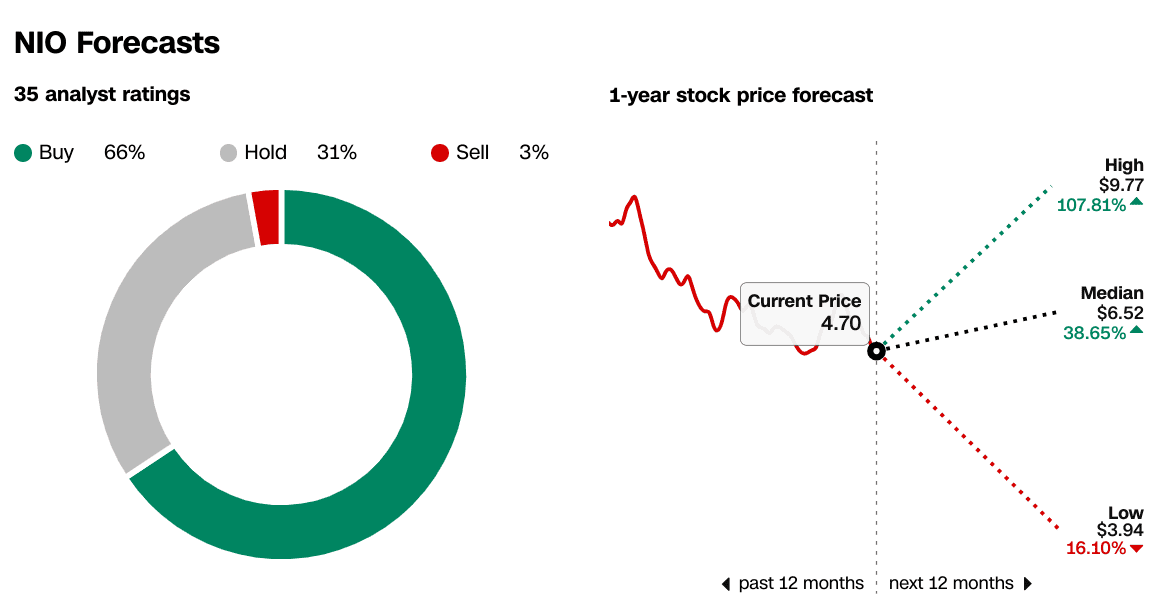

NIO Stock Prediction: Market analysts' expectations

Market analysts provide varied expectations. Among 35 analysts covering Nio, 66% recommend buying, 31% suggest holding, and 3% advocate selling. Their 1-year price forecast spans a wide range. The high estimate of $9.77 implies a 107.81% potential upside, the median target of $6.52 suggests a 38.65% gain, and the low forecast of $3.94 indicates a 16.10% decline. This wide dispersion reflects uncertainty in market sentiment, compounded by external factors such as sector performance and macroeconomic headwinds.

Despite short-term selling pressure, the potential for a turnaround exists, given Nio’s position within the channel and proximity to trendline support. However, to break into the $6.00 range, bullish momentum would need to reclaim dominance, particularly on stronger volume and shifts in market sentiment. Analyst consensus toward a median target of $6.52 aligns with technical findings, though optimistic and pessimistic targets underscore the risks and rewards of volatility.

Source: CNN.com

Source: CNN.com

IV. NIO Forecast: Future Outlook

NIO's strategic outlook integrates management's growth ambitions with a clear focus on market trends, particularly within the electric vehicle (EV) landscape. Key insights into NIO's strategic direction reveal a multi-tiered approach, encompassing new product launches, geographic expansion, and technology advancements. Management has laid out an aggressive expansion roadmap, starting with flagship models like the ET9, expected for delivery in March 2025. The ONVO brand targets a broader consumer base, with the L60 poised to hit a monthly production of 10,000 units by December 2024 and 20,000 units by March 2025. Further, the introduction of Firefly, NIO's third brand, focuses on compact vehicles and leverages existing SaaS networks. These initiatives, alongside an extensive physical and service network, underline NIO's goal of bolstering market presence. Revenue guidance for Q4 2024 stands at $2.96 billion, a 24.69% YoY rise, though EPS remains projected at -$0.32, reflecting a focus on scaling operations rather than immediate profitability.

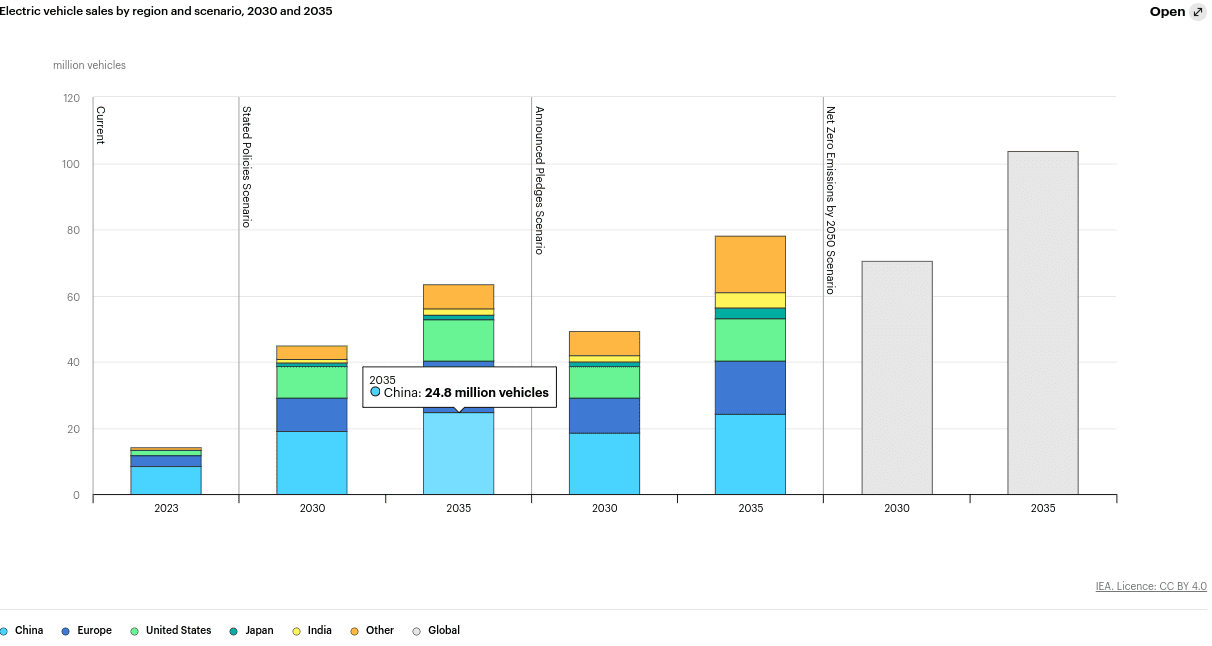

The broader EV market presents favorable dynamics. EV stock across modes is projected to grow at an average annual rate of 23% through 2035 under the STEPS scenario, hitting 525 million units by 2035, excluding two/three-wheelers. Sales growth accelerates even further in the NZE Scenario, achieving a 27% annual growth rate to reach 790 million units. By 2035, EVs are expected to comprise 30%-95% of vehicle sales depending on the scenario, with China playing a pivotal role in global adoption rates. NIO’s premium positioning in China, where it dominates the BEV market for vehicles priced above RMB 300,000 with a 48% share, provides a strong base to capture this growth.

Operationally, NIO delivered 61,855 vehicles in Q3 2024 and projects 72,000-75,000 units in Q4. Cost reductions in materials boosted vehicle margins to 13.1%, up from 12.2% in the prior quarter, with a Q4 target of 15%. Long-term gross margin ambitions stand at 20% for premium models. The ONVO brand aims to attain a 10% margin in 2025, with incremental gains anticipated through supply chain optimization. The company’s RMB 3.3 billion investment in NIO China solidifies its financial footing to sustain these growth ambitions. NIO’s strategy reflects a balance of aggressive growth with operational refinement, focusing on profitability through scale and product diversification while capitalizing on expanding EV market trends. These efforts align with the anticipated surge in EV adoption globally, setting a clear trajectory for future performance.

Source: iea.org