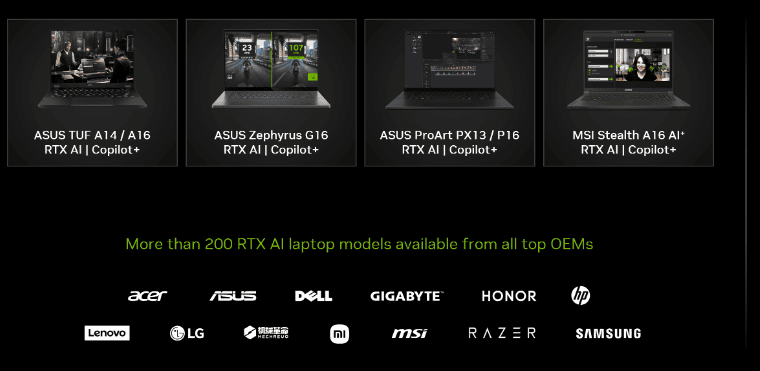

NVIDIA Corporation's post-earnings performance saw its stock decline in after-hours trading, dropping 2.50% to $142.25 on the NASDAQ. This reaction contrasts with its robust Q3 FY2025 earnings report, which showcased record-breaking revenue and growth.

Source: tradingview.com

I. Nvidia Earnings Overview Q3 2025

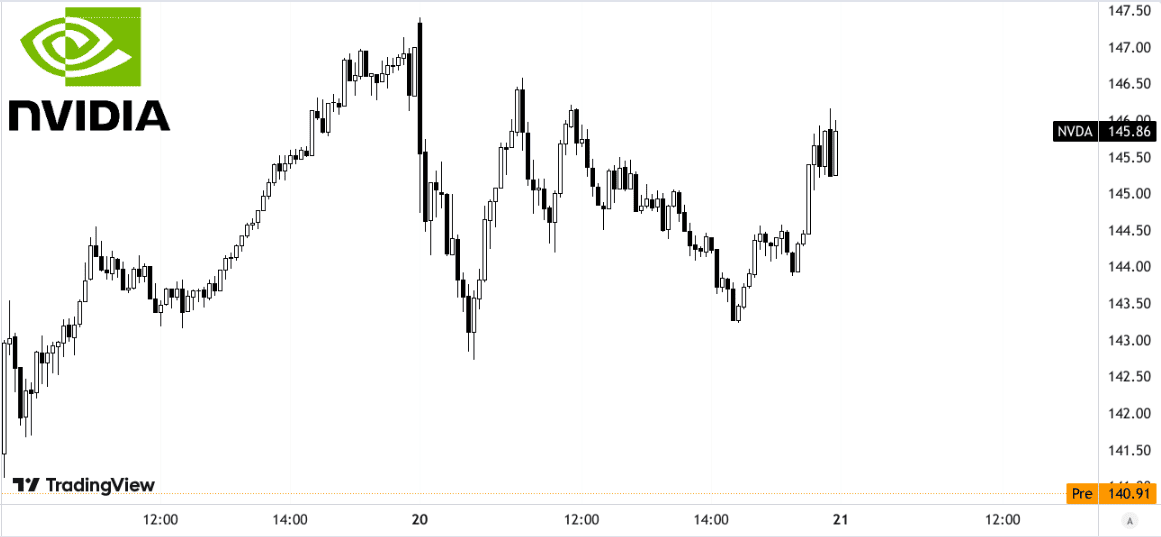

NVIDIA Corporation delivered a stellar performance in Q3 FY2025, with revenue of $35.08 billion, beating expectations by $1.95 billion. This represents a remarkable 94% year-over-year (YoY) growth and a 17% sequential increase, driven by robust demand across all segments. Adjusted EPS (Non-GAAP) came in at $0.81, surpassing estimates by $0.06, while GAAP EPS was $0.78, exceeding forecasts by $0.08. Margins remained strong, with a GAAP gross margin of 74.6% and a Non-GAAP gross margin of 75%, though slightly lower sequentially due to the mix shift toward higher-cost systems. Net margins expanded significantly to an impressive 41%, supported by robust revenue growth and operational efficiencies.

Source: nvidianews.nvidia.com

NVDA Earnings Q3 2025 Revenue Drivers

The Data Center segment accounted for 88% of total revenue, reaching $30.8 billion, a 112% YoY and 17% sequential increase. This growth was primarily driven by surging demand for NVIDIA’s H200 Hopper GPUs and the initial ramp-up of the new Blackwell architecture, which is seeing unprecedented adoption. Cloud Service Providers (CSPs) contributed to approximately half of Data Center revenue, growing over 2x YoY, as companies like AWS, Microsoft Azure, and Google scaled their NVIDIA-powered AI infrastructures. Regional growth was robust, with cloud revenues in North America, EMEA, and APAC doubling YoY, while China experienced sequential growth despite the impact of export controls.

The Gaming segment, representing 9% of total revenue, grew 15% YoY to $3.3 billion, fueled by strong demand for RTX GPUs and new AI PC launches. Seasonal demand, including back-to-school sales, and the upcoming holiday season further supported growth. Meanwhile, Automotive revenue achieved a record $449 million, up 72% YoY, driven by adoption of NVIDIA’s Orin platform in autonomous vehicles like Volvo’s electric SUVs.

Professional Visualization (ProViz) revenue rose 17% YoY to $486 million, with growth supported by demand for NVIDIA RTX workstations used in design, simulation, and AI-driven applications across various industries. Additionally, software and services revenue reached an annualized $1.5 billion, with expectations to exceed $2 billion by year-end, reflecting rapid uptake of NVIDIA AI Enterprise platforms such as NeMo and NIM microservices.

Source: nvidia.com

II. Product & Market Dynamics

NVIDIA's recent product launches underscore its dominance in AI and accelerated computing markets. The H200 Hopper GPU, now generating double-digit billions in revenue, has achieved the fastest ramp in NVIDIA's history, delivering 2x faster inference performance and 50% improved total cost of ownership (TCO) compared to its predecessor. The introduction of Blackwell GPUs marks a technological leap, offering 30x faster inference performance and cutting costs by 4x for tasks like GPT-3 training. Complementing this hardware are software innovations such as NVIDIA NIM, projected to enhance Hopper inference performance by 2.4x.

In automotive and robotics AI, NVIDIA's Orin platform has gained traction, driving 72% YoY growth in the Automotive segment. Companies like Volvo are deploying Orin in their electric vehicles, while NVIDIA Omniverse facilitates digital twins and industrial AI applications, enabling users like Foxconn to achieve 30% energy efficiency improvements. NVIDIA’s enterprise software, including NeMo and NIM, has expanded its footprint, with software revenue expected to exceed $2 billion annually by year-end.

Source: nvidia.com

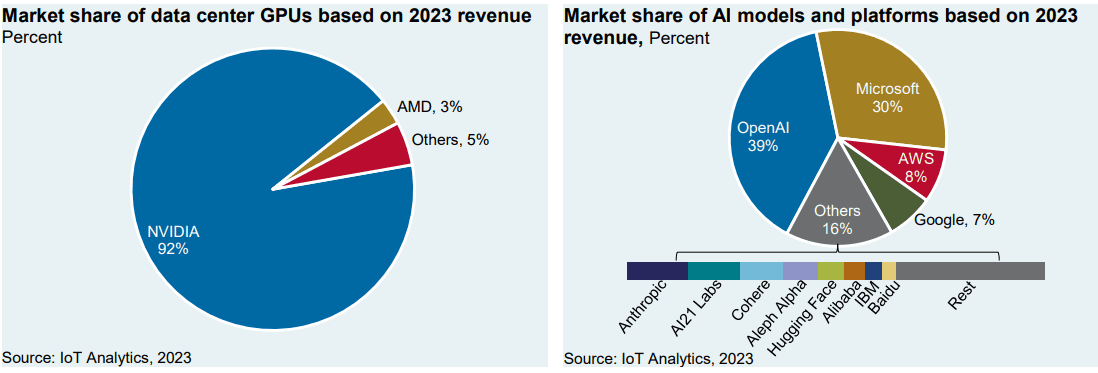

Despite its 90%+ market share in advanced AI chips, NVIDIA faces growing competition. AMD is advancing its ROCm platform to rival NVIDIA's CUDA, while its GPUs are gaining market acceptance. Intel's Gaudi 3, anticipated to be 1.5x faster and 30%-60% cheaper than NVIDIA's H100, threatens pricing leverage. Additionally, Google’s TPU v5p chips, priced at one-third the cost of NVIDIA’s H100, and AWS Trainium, promising 50% cost savings, intensify competition in cloud services. Emerging players like Cerebras and Groq also challenge NVIDIA with specialized AI accelerators.

To counter this, NVIDIA is leaning on ecosystem advantages, such as its extensive CUDA developer base and advanced networking solutions like Spectrum-X. However, cost pressures from rivals like Google and Microsoft—offering their proprietary chips at substantially lower prices—may constrain NVIDIA’s ability to sustain high margins.

Moreover, vertical integration by major players, including Apple, Tesla, and Meta, reflects a shift toward in-house chip development, diminishing reliance on NVIDIA. While NVIDIA’s software ecosystem and Blackwell’s customizable infrastructure provide a competitive edge, rivals' price-performance strategies and partnerships with manufacturers like TSMC and GlobalFoundries could erode its market share.

Source: am.jpmorgan.com

III. Nvidia Stock Forecast

NVDA Stock Forecast Technical Analysis

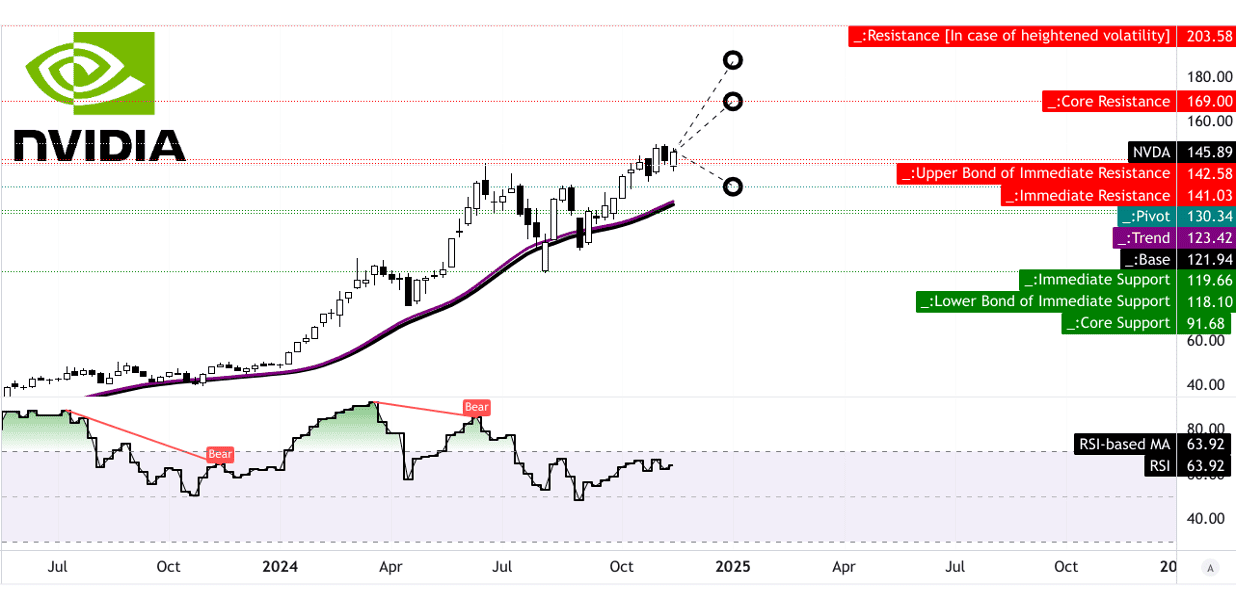

TradingView charts highlight key indicators suggesting a cautious but optimistic outlook for NVIDIA’s stock. The current price of $145.89 trades above its modified exponential moving averages (EMA), with a trendline at $123.42 and a baseline at $121.94, signaling potential support levels in the event of a pullback. However, the stock shows signs of overbought conditions as the Relative Strength Index (RSI) of 63.92 indicates a moderate risk of reversal. The presence of a bearish divergence warns investors of weakening momentum, as the RSI trend remains sideways.

Using Fibonacci retracement/extension levels, the average price target for 2024 is set at $170, reflecting continued optimism based on mid- to short-term momentum. The optimistic target of $187 assumes sustained upward swings, while a pessimistic target of $130 anticipates downward momentum dominating current trends. Notably, the pivot point at $130.34 acts as a critical level for monitoring breakout or breakdown scenarios in the horizontal price channel.

Source: tradingview.com

Nvidia Stock Forecast: Market Analysts’ Expectations & Ratings

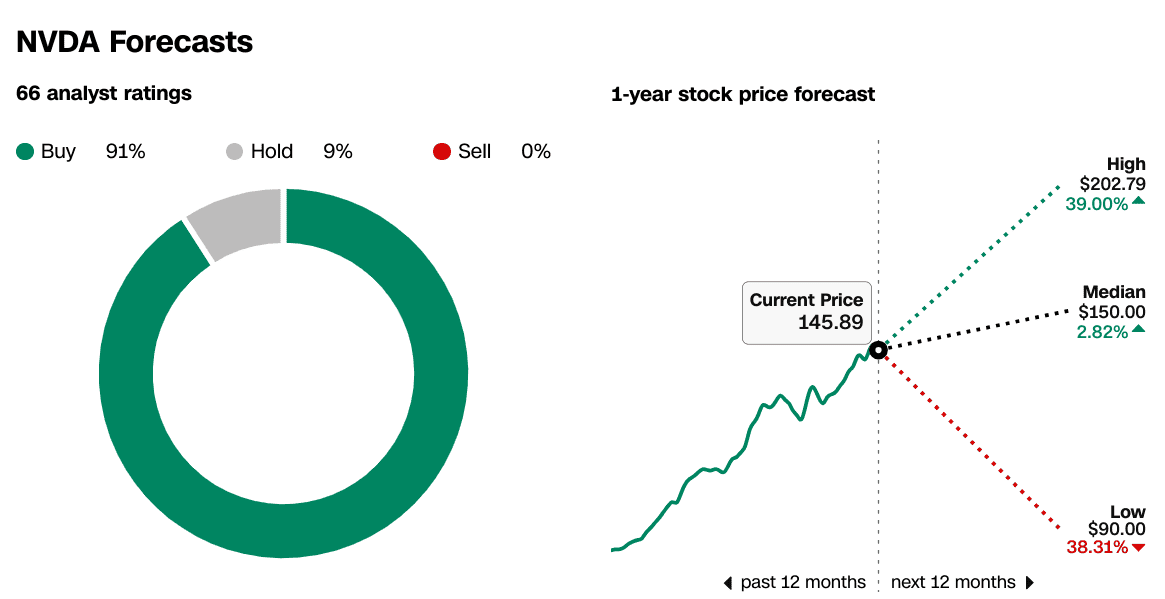

The broader market sentiment remains overwhelmingly positive. Out of 66 analysts, 91% recommend buying, 9% suggest holding, and none advise selling. This underscores confidence in NVIDIA’s growth potential, supported by strong fundamentals and leadership in the AI and semiconductor industries.

For the next 12 months, analysts provide a high price forecast of $202.79, implying a 39% upside from the current price. The median forecast of $150 represents a modest 2.82% increase, signaling a consensus expectation of steady growth. The low target of $90, which suggests a potential 38.31% downside, reflects bearish views tied to broader market risks or NVIDIA's vulnerability to intensifying competition.

The stock’s record-setting growth trajectory, as seen in its Q3 revenue, bolsters the bullish case. Analysts cite NVIDIA’s dominance in AI GPUs, partnerships with major cloud service providers, and robust adoption of Blackwell GPUs as key drivers of future valuation.

However, downside risks include a bearish RSI divergence, increasing pricing pressures from underperforming rivals like AMD and Intel, and the potential for economic or geo-political disruptions affecting the semiconductor supply chain. While the market consensus is positive, caution is warranted given the valuation's dependence on maintaining NVIDIA’s technological and market leadership.

Source: CNN.com

Source: CNN.com

IV. NVDA Stock Forecast: Future Outlook

Management’s Growth Forecasts and Strategic Initiatives

NVIDIA’s Q3 FY2025 earnings revealed record revenue, driven by exceptional demand for AI and accelerated computing solutions. The company’s Blackwell GPU architecture is at the forefront, with 13K units already shipped, enabling data centers to scale AI workloads efficiently. Cloud Service Providers (CSPs) like Microsoft and Oracle are integrating Blackwell GPUs into their infrastructure, with Oracle’s Zettascale AI Cloud expected to deploy over 131K GPUs.

For Q4 FY2025, NVIDIA projects revenue with gross margins between 73.0%-73.5%, underscoring robust profitability despite supply constraints. The company is racing to meet surging Blackwell demand while enhancing supply visibility. Future strategies include deploying NVIDIA AI Enterprise, expected to more than double its FY2025 revenue. Data center revenues powered by the adoption of Hopper and Blackwell GPUs. AI Enterprise platforms, like NeMo and Omniverse, are accelerating enterprise and industrial AI adoption.

Market Trends

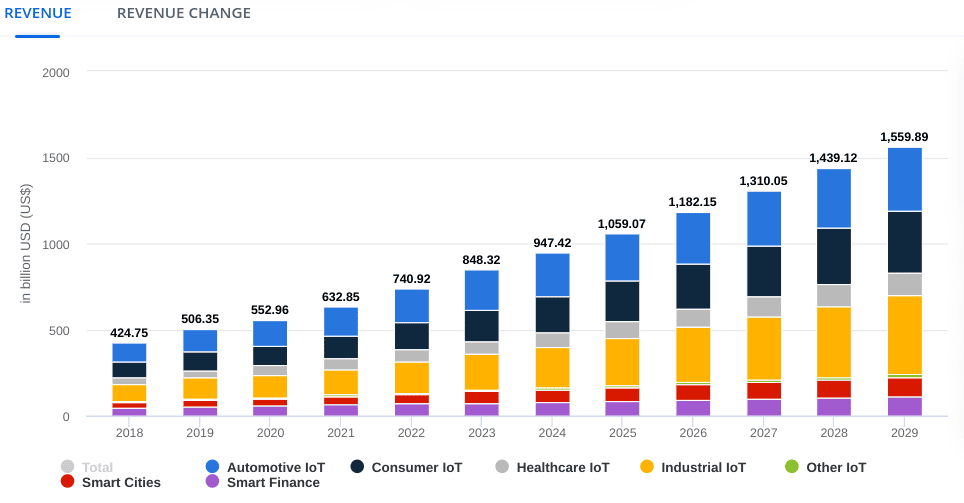

NVIDIA is positioned to capitalize on the AI market, projected to grow from $184 billion in 2024 to $826.7 billion by 2030 (CAGR of 28.45%). The U.S., with a forecasted $50.16 billion market size in 2024, remains pivotal. NVIDIA’s dominance in AI GPUs is reinforced by partnerships with AI startups and CSPs scaling Hopper and Blackwell architectures.

Gaming hardware demand remains strong, supported by AI-powered RTX GPUs and new AI PC deployments. Meanwhile, autonomous vehicle technology, where NVIDIA’s DRIVE platform is a leader, is anticipated to sustain its 30% sequential growth.

Despite its market leadership, NVIDIA faces challenges like geopolitical risks, export controls (notably in China), and potential saturation in mature markets. Supply chain constraints could also limit the pace of Blackwell's deployment. NVIDIA’s growth strategies, coupled with record-setting revenues and innovation, position the stock as a leader in AI and advanced computing. The management’s optimistic outlook, supported by analyst forecasts, anticipates continued upward momentum. However, investors should monitor global economic trends and competitive dynamics.

Source: statista.com [AI market size]

Source: statista.com [AI market size]