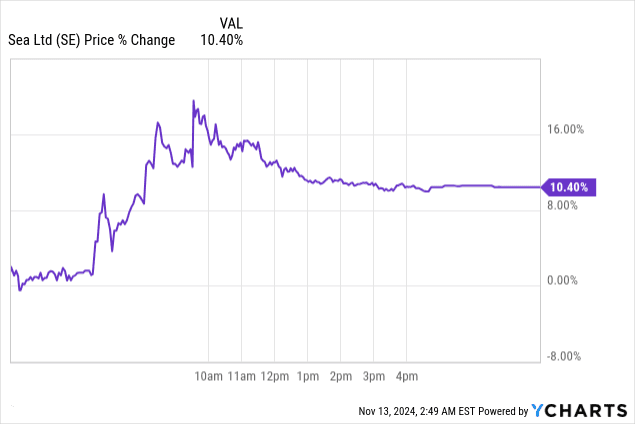

Following its Q3 2024 earnings report, Sea's stock price rose by 10%, indicating strong investor response to robust financial performance. The company exceeded revenue expectations by $246.17 million, achieving a GAAP revenue of $4.33 billion, marking a 31% year-over-year increase. Additionally, Sea posted positive net income of $153 million, reversing a $144 million loss from the previous year. Improvements across all major segments—Shopee, SeaMoney, and Garena—highlighted operational efficiency and market strength. Notably, adjusted EBITDA grew from $35 million to $521 million, showcasing significant profitability advancements and supporting optimistic market forecasts.

Source: Ychart.com

I. SE Earnings Overview Q3 2024

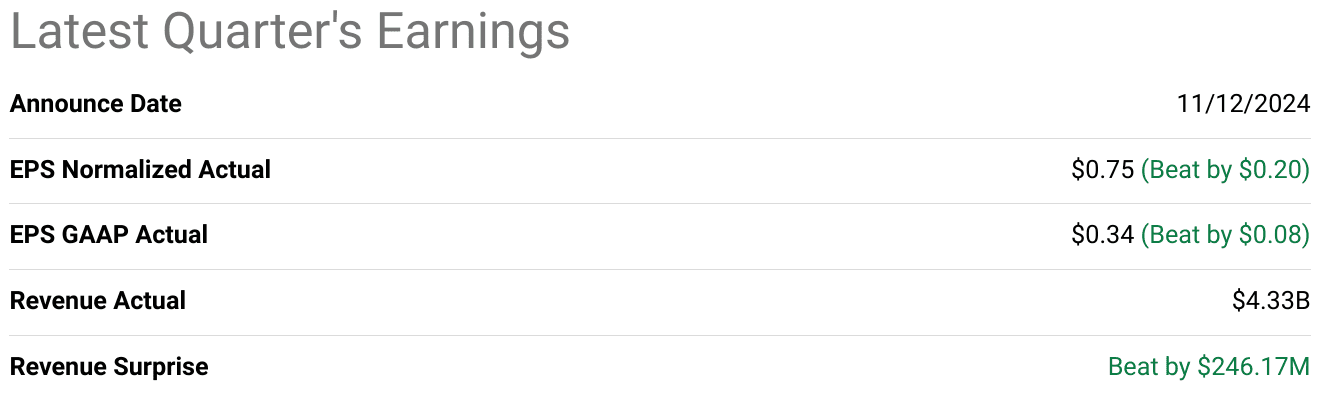

In Q3 2024, Sea Limited reported a GAAP revenue of $4.33 billion, surpassing expectations by $246.17 million and reflecting a 31% year-over-year growth. Normalized EPS was $0.75, beating expectations by $0.20, while GAAP EPS was $0.34, beating by $0.08. The company achieved a net income of $153 million, reversing a loss of $144 million from the same quarter last year. Gross, operating, and net margins all saw improvements, with a significant jump in adjusted EBITDA to $521 million from $35 million in Q3 2023.

Source: seekingalpha.com

Revenue Drivers and Segment Performance

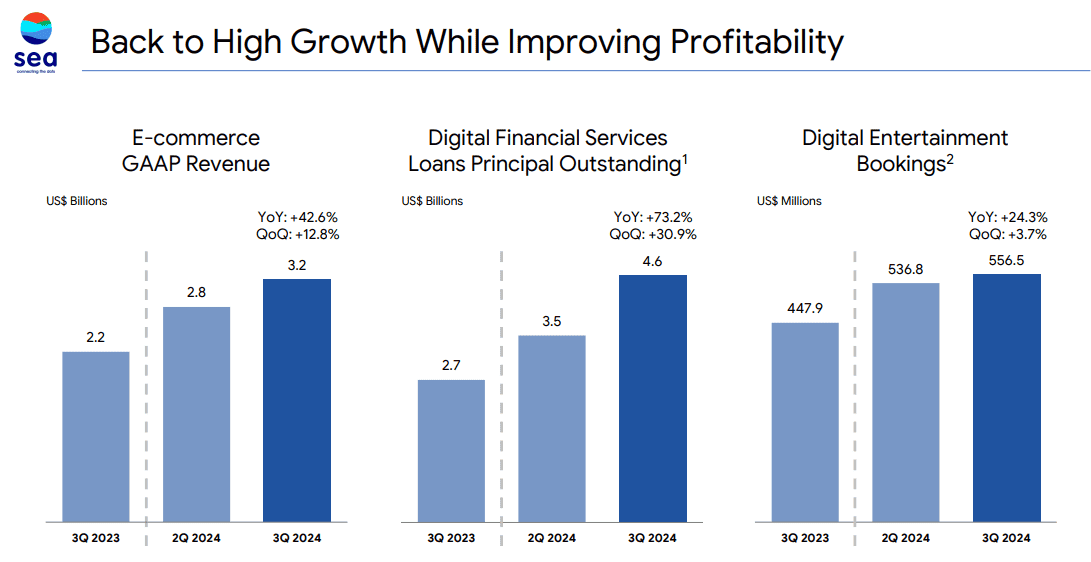

E-Commerce (Shopee): Shopee's gross orders and GMV rose by 24% and 25% year-over-year, driven by strong performance in Asia and Brazil. Shopee's GAAP marketplace revenue grew by 43% to $2.8 billion, supported by a 49% increase in core marketplace revenue (transaction and advertising fees) and a 29% rise in logistics services revenue. Notably, adjusted EBITDA for e-commerce turned positive at $34 million, up from a $346 million loss in Q3 2023. Key revenue drivers included a 20% growth in monthly active buyers, a 30 basis points rise in ad take rates, and improved logistics through SPX Express, which now handles half of Asian orders with delivery within two days.

Source: Sea Third Quarter 2024 Results Deck

Digital Financial Services (SeaMoney): Revenue in this segment grew by 38% year-over-year to $616 million, fueled by an expanding loan book that reached $4.6 billion (up 73% year-over-year). Adjusted EBITDA grew by 13% to $188 million, indicating increased profitability. With over 24 million active borrowers and a stable non-performing loan ratio of 1.2%, SeaMoney capitalized on credit demand, leveraging Shopee's data and ecosystem for improved risk management and targeting. Off-Shopee loans, such as credit for offline phone purchases in Indonesia, now form over half of its local loan book.

Digital Entertainment (Garena): Garena’s bookings grew by 24% to $557 million, and adjusted EBITDA increased by 34% to $314 million. Free Fire, one of the world’s largest mobile games, saw a 25% growth in daily active users to over 100 million, maintaining its top position as the most downloaded game globally. Strategic in-game updates, such as a collaboration with Thailand’s geological park, drove user engagement and local relevance, especially in new markets like North Africa.

II. Product & Market Dynamics

Sea has shown impressive performance in Q3 2024, driven by growth across its three key business segments—Shopee, SeaMoney, and Garena—reflecting its ability to navigate competitive dynamics and market shifts. In e-commerce, Shopee continues to dominate in Southeast Asia and Brazil, reporting a year-on-year GMV growth of 25% and 24% increase in gross orders. Shopee’s continued focus on enhancing monetization, particularly through advertising and commission rates, has paid off with a 49% increase in core marketplace revenue. This shift towards higher-margin revenue streams, combined with its logistics strengths, has helped Shopee achieve profitability in both Asia and Brazil, marking a significant achievement given the challenges in these regions' e-commerce ecosystems. Shopee's commitment to enhancing its logistics infrastructure with SPX Express, reducing delivery times, and optimizing costs, remains a competitive edge in a market where fast, cost-efficient delivery is a key differentiator.

SeaMoney, which leverages Shopee's extensive user base, is expanding rapidly with a 70% year-on-year growth in its loan book. By offering small-ticket, short-tenure loans, SeaMoney has tapped into a previously underserved market, particularly in Southeast Asia. The integration of Shopee’s data for risk assessment further strengthens its position, while the company explores off-platform loan growth in markets like Indonesia. This diversification into consumer and SME loans, along with low non-performing loan (NPL) ratios, positions SeaMoney well for sustainable expansion.

Source: Sea Third Quarter 2024 Results Deck

Garena’s digital entertainment arm also continues to thrive, particularly through its flagship game Free Fire, which maintained strong user engagement, with over 100 million daily active users in Q3 2024. The game’s localization efforts, including collaborations with local trends (e.g., the Thai pygmy hippo event), have contributed to its success across diverse regions like North Africa. This expansion into new geographies, along with the launch of new games like Need for Speed in Taiwan and Hong Kong, showcases Garena’s strategic focus on broadening its gaming portfolio.

In the competitive landscape, Sea faces significant rivals, including Amazon, Alibaba, and Tencent. While Amazon leads with 4.79 billion monthly visits globally, Shopee’s 559.6 million visits highlight its strong regional focus, particularly in Southeast Asia and Brazil, where it competes with Lazada (Alibaba) and local players like MercadoLibre in Latin America. Shopee’s emphasis on price competitiveness and its integration with live streaming have allowed it to capture substantial market share. In digital payments, SeaMoney’s growth contrasts with Tencent's WeChat Pay and Alibaba’s Alipay, with Sea’s strategy focusing on underserved markets to leverage its local knowledge and data advantage.

III. SE Stock Forecast

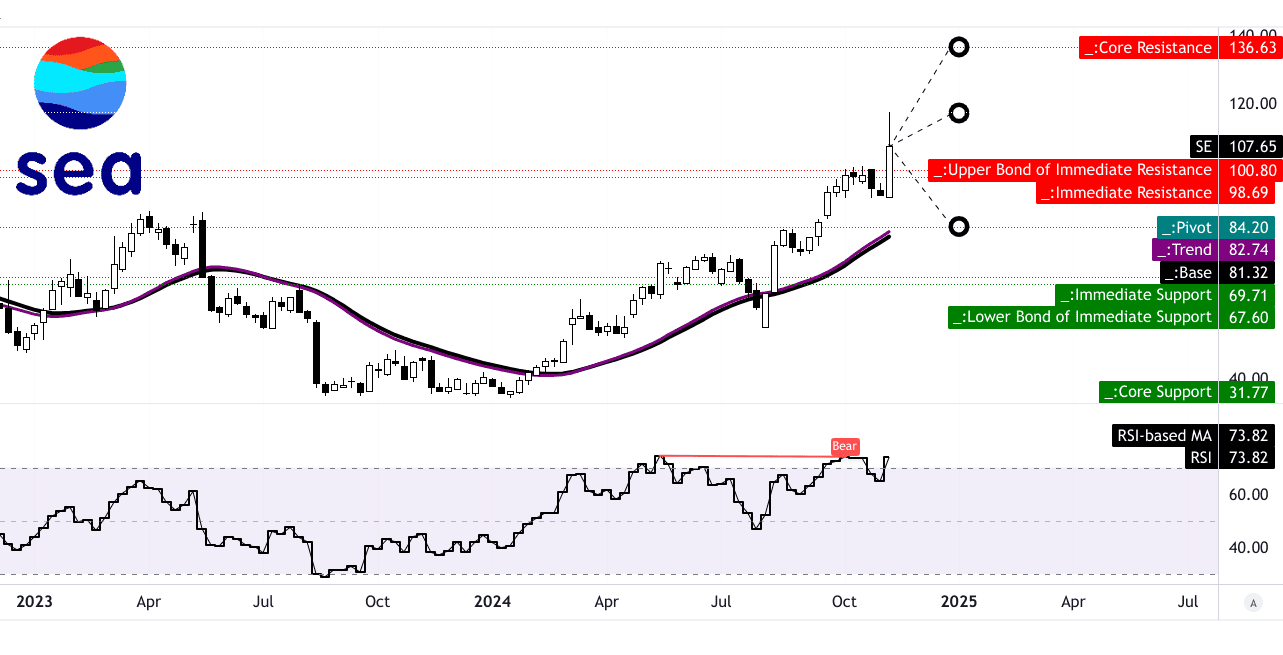

For Sea, technical analysis and market analyst expectations reveal mixed signals for its stock outlook. On TradingView, SE's current price sits at $97.46, with technical indicators suggesting a possible upward trajectory in the near term. SE's trendline, marked by a modified exponential moving average, is at $82.51, while the baseline is at $81.11. These lower moving averages indicate that, despite recent volatility, the stock may be trading above critical support levels. The stock's Relative Strength Index (RSI) sits at 67.88, nearing the overbought threshold of 70, signaling a potential pullback. Bearish divergence on the RSI suggests possible selling pressure, as the RSI line trend remains sideways. This divergence warns investors of reduced upward momentum, implying that SE may face resistance in the short term.

Analysts’ expectations for SE's stock are cautiously optimistic. The average price target by the end of 2024 is $108, a modest 10.8% upside from the current price, driven by mid- and short-term momentum based on Fibonacci retracement/extension levels. The optimistic scenario suggests a price of $123, indicating a 26.3% increase should upward momentum continue. However, a pessimistic forecast estimates a possible decline to $80, underscoring vulnerability to market shifts or decreased investor confidence. The horizontal price channel's pivot point of $80 serves as a support level, which may stabilize the stock if it encounters a downturn, according to the Fibonacci projections.

Source: tradingview.com

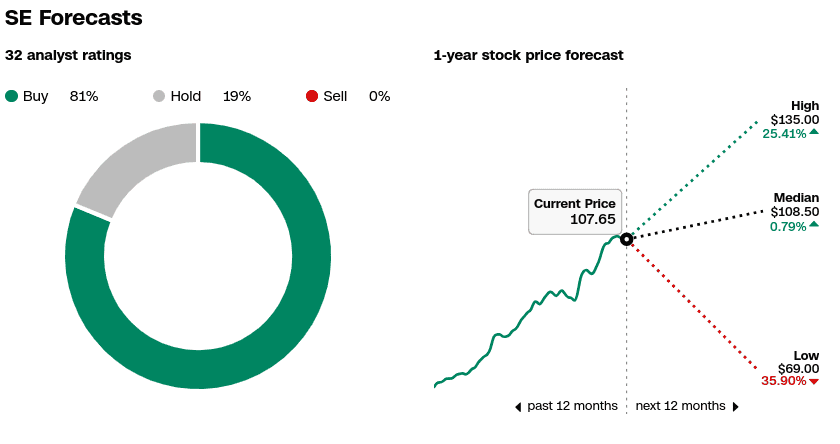

Among analysts, SE garners strong sentiment, with 81% rating it as a buy, 19% as hold, and none advising a sell. The one-year high price target of $135 represents a 25.4% potential increase, while the median target is $108.5, close to the current price, showing modest expected growth of 0.79%. The lowest price target of $69 represents a potential downside of 35.9%, suggesting some risk from macroeconomic headwinds or sector-specific challenges that could affect SE’s valuations.

Source: edition.cnn.com

IV. SE Stock Forecast: Future Outlook

Management's Growth Forecasts and Strategic Initiatives

Sea Limited's management has outlined robust growth expectations, driven by its focus on expanding its core business segments. In its Q3 2024 earnings call, Sea reported strong growth across all three business divisions. E-commerce platform Shopee is on track for mid-20% GMV growth in 2024, continuing to dominate in Southeast Asia and Brazil. The company plans to maintain a competitive edge by enhancing price competitiveness, improving service quality, and expanding its content ecosystem. Shopee's advertising and monetization efforts are showing success, with ad-paying sellers growing by 10%, and ad-revenue per seller rising by 25% YoY. Furthermore, Sea is improving its logistics services, especially with SPX Express, which saw faster delivery speeds and cost reductions.

Source: Sea Third Quarter 2024 Results Deck

The digital financial services arm, SeaMoney, continues to show impressive growth, with a 70% YoY increase in loan books. The company is expanding beyond Shopee transactions, with loans increasingly offered in markets like Indonesia, where off-Shopee loans now represent more than half of the portfolio. Garena, the digital entertainment arm, continues to benefit from its flagship game Free Fire, which saw a 25% YoY increase in daily active users and strong user engagement through in-game events. In Brazil, Shopee is breaking even on an adjusted EBITDA basis, showing its potential for long-term profitability.

Market Trends and Macroeconomic Factors

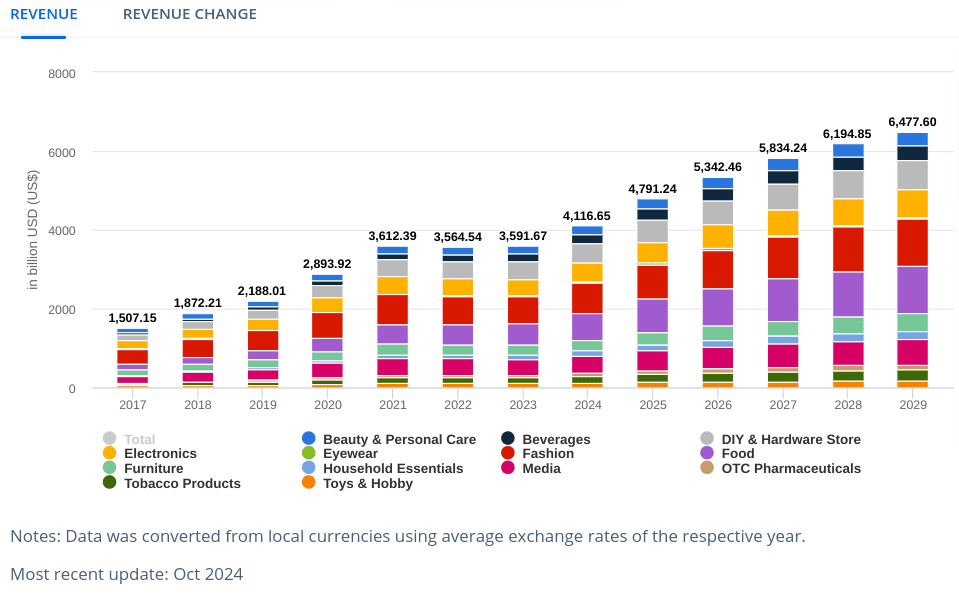

Sea operates in three key markets that are poised for substantial growth. The global e-commerce market, expected to reach $4.1 trillion in 2024, will grow at a 9.49% CAGR through 2029, suggesting continued expansion in Sea's core business. With Southeast Asia and Latin America having relatively low e-commerce penetration rates, Sea is well-positioned to benefit from this expansion. Shopee’s stronghold in these markets, combined with local investments in logistics and customer service, offers a competitive advantage.

Source: statista.com

Source: statista.com

In the digital payments space, SeaMoney’s growth is buoyed by an underserved market in Southeast Asia, with demand for credit lending outpacing supply. Macroeconomic factors, such as consumer spending and regulatory changes, will play a role in shaping this market. However, Sea’s diversified funding sources and risk management practices, including its data-driven approach to underwriting, provide a buffer against potential market volatility.