Semiconductors are materials with electrical conductivity between conductors and insulators. The most common semiconductor material is silicon. Semiconductors can control electrical current, making them essential for modern technology. They form the basis of microchips, transistors, and other electronic components.

![]()

Source: investopedia.com

Semiconductors play a crucial role in various industries. In electronics, they power computers, smartphones, and other devices. Semiconductors enable the functioning of processors, memory chips, and sensors. In the automotive industry, semiconductors are vital for vehicle control systems and sensors. They enable advanced driver-assistance systems (ADAS) and electric vehicle (EV) components. In healthcare, semiconductors are used in medical devices like MRI machines and pacemakers. They enable precise diagnostics and treatments, enhancing patient care.

Several major companies dominate the semiconductor industry. Nvidia (NVDA) specializes in graphics processing units (GPUs). Their chips are essential for gaming, artificial intelligence (AI), and data centers. Qualcomm (QCOM) focuses on wireless communication technologies. They provide chips for smartphones and Internet of Things (IoT) devices. Taiwan Semiconductor Manufacturing Company (TSMC) is a leading chip manufacturer. They produce chips for various technology companies, including Apple and AMD. TSMC’s advanced manufacturing capabilities are crucial for producing cutting-edge chips.

![]()

[1Y price return against SPX]

Source:trandingview.com

Semiconductor Supply Chain And Its Vulnerabilities

The semiconductor supply chain is complex and global. It involves several stages: design, fabrication, assembly, and testing. Design companies create the blueprints for chips. This involves creating the circuit layout and optimizing it for performance and efficiency. Foundries like TSMC fabricate the chips based on these designs. This stage requires advanced manufacturing technologies and facilities. Assembly and testing are done by specialized companies. They ensure that the chips meet quality standards before they are integrated into devices.

![]()

Source: semiconductors.org

The semiconductor supply chain has several vulnerabilities. Disruptions in one stage can impact the entire industry. For example, a shortage of raw materials can delay chip production. Political tensions and trade restrictions can also cause significant delays. Natural disasters, such as earthquakes and floods, can damage manufacturing facilities. These vulnerabilities can lead to supply chain disruptions and impact global technology production.

What is IC

An integrated circuit (IC) is a set of electronic circuits on a small chip. It combines transistors, resistors, and capacitors into a single unit. ICs are crucial for modern electronics. They are found in computers, smartphones, and many other devices. IC design is a critical aspect of semiconductor technology. It determines the performance and efficiency of electronic devices. Design involves creating the circuit layout and optimizing it for fabrication. The goal is to create a compact, efficient, and high-performing chip.

I. Semiconductor Industry Upstream Supply Chain

Raw Materials and IC Design

The semiconductor industry relies on high-quality raw materials. Silicon is the primary material used in semiconductor manufacturing. The process begins with mining and refining silica sand to produce high-purity silicon. Silicon is then melted and crystallized into cylindrical ingots. These ingots are sliced into thin wafers and polished to create silicon wafers.

Chip design and development are crucial steps in the semiconductor supply chain. Design companies create blueprints for the chips. These designs specify the functionality and performance of the chips. The design phase includes architecture planning, logic design, and physical design. Once the design is finalized, it is sent to a foundry for fabrication. Fabless companies focus on design and outsource manufacturing to foundries.

![]()

[Leading semiconductor companies worldwide as of June 5, 2024, by market capitalization(in billion U.S. dollars)]

Source: statista.com

Top Semiconductor Stocks: Major Players

Intellectual Property (IP) companies play a crucial role in semiconductor design. ARM Holdings provides processor designs used by many companies. Synopsys (SNPS) and Cadence Design Systems (CDNS) offer design software and services. Faraday Technology (3035) provides ASIC design services. Global Unichip (3443) offers custom chip solutions. eMemory Technology (3529) specializes in embedded non-volatile memory. Alchip Technologies (3661) provides design and manufacturing services. Andes Technology (6533) offers processor IP. M31 Technology (6643) focuses on analog and mixed-signal IP. Alcor Micro (8054) provides USB and flash memory controllers.

![]()

[YTD price return against SPX]

Source:trandingview.com

IC design companies are responsible for creating chip blueprints. In the GPU and CPU sector, major players include Nvidia (NVDA), AMD (AMD), Intel (INTC), and VIA Technologies (2388). These companies design high-performance processors for various applications. Nvidia and AMD are known for their powerful GPUs. Intel is a leader in CPU technology.

Source: trendforce.com

In multimedia communication, key players include Qualcomm (QCOM), Broadcom (AVGO), Marvell Technology (MRVL), ON Semiconductor (ON), NXP Semiconductors (NXP), Realtek Semiconductor (2379), MediaTek (2454), Novatek Microelectronics (3034), and Parade Technologies (4966). These companies design chips for wireless communication, networking, and multimedia applications. Qualcomm is a leader in mobile communication technology. MediaTek provides competitive solutions for smartphones and tablets.

DRAM manufacturers include Micron Technology (MU), Samsung, SK Hynix, Macronix International (2337), Winbond Electronics (2344), and Nanya Technology (2408). These companies produce dynamic random-access memory used in computers and other electronic devices. Micron, Samsung, and SK Hynix dominate the DRAM market.

Other significant players in IC design include Texas Instruments (TXN), ITE Tech (3014), and Fitipower Integrated Technology (4961). Texas Instruments designs analog and embedded processing chips. ITE Tech specializes in touch controller ICs and keyboard controllers. Fitipower Integrated Technology provides display driver ICs and power management solutions.

II. Semiconductor Industry Midstream Supply Chain

IC Manufacturing, IC Packaging, and IC Testing

The midstream supply chain of the semiconductor industry involves the fabrication of semiconductor wafers, IC packaging, and IC testing.

IC Manufacturing starts with the fabrication of semiconductor wafers. This involves several key steps:

1. Photolithography: A light-sensitive chemical layer is applied to the wafer, and a pattern is created using ultraviolet light.

2. Etching: The exposed areas of the wafer are etched away, creating the desired circuit patterns.

3. Doping: Impurities are added to the silicon to change its electrical properties.

4. Layering: Multiple layers of material are deposited on the wafer to build up the circuit.

![]()

Source: azonano.com

After fabrication, the wafers are sliced into individual chips.

IC Packaging involves encasing the semiconductor die in a protective package. The packaging process includes:

1. Die Attachment: The die is attached to a substrate or lead frame.

2. Wire Bonding: Tiny wires connect the die to the package leads.

3. Encapsulation: The die and wires are encased in a protective material.

4. Marking: The package is marked with identifying information.

IC Testing is conducted in two stages: wafer testing and product testing.

1. Wafer Testing: Also known as probe testing, this checks the functionality of individual chips on the wafer before they are sliced.

2. Product Testing: After packaging, final tests are performed to ensure the product meets performance and reliability standards. This includes burn-in testing and final test procedures.

Chip Stocks: Major Players

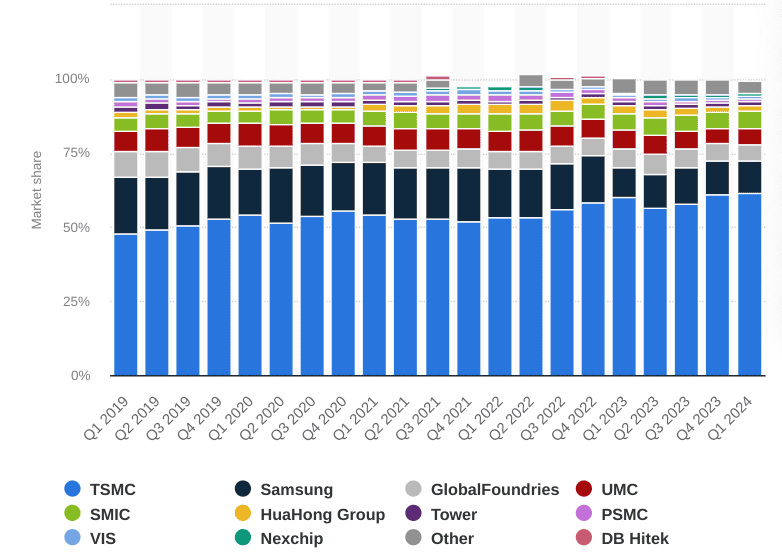

Wafer foundries are responsible for fabricating semiconductor wafers. Major players include:

● Taiwan Semiconductor Manufacturing Company (TSMC): The largest and most advanced foundry, holding a dominant market share.

● Intel (INTC): Manufactures its own chips and offers foundry services.

● Samsung: A leading foundry with significant market share in advanced nodes.

● GlobalFoundries (GFS): Provides comprehensive foundry services.

● United Microelectronics Corporation (UMC, 2303): A major player in the foundry market.

● WIN Semiconductors (3105): Specializes in gallium arsenide (GaAs) foundry services.

● Episil Technologies (3707): Focuses on power management ICs.

● Vanguard International Semiconductor (5347): Specializes in driver ICs for displays.

● Powerchip Semiconductor Manufacturing (6770): Provides foundry services for various applications.

● Sumco Corporation (SUMCF) and Siltronic AG (WAF): Leading suppliers of silicon wafers.

[Semiconductor foundries revenue share]

Source: statista.com

Chip packaging and testing companies ensure chip reliability and performance. Major players include:

● Amkor Technology (AMKR): A leading provider of packaging and testing services.

● ASE Technology Holding (3711): The largest provider of outsourced semiconductor assembly and test services.

● Ardentec (3264): Specializes in wafer probing and final testing.

● Xintec (3374): Focuses on wafer-level packaging.

● Chipbond Technology (6147): Provides packaging services for display driver ICs.

● Powertech Technology (6239): Offers a wide range of packaging and testing services.

● Tong Hsing Electronic (6271): Specializes in ceramic packaging.

● Formosa Advanced Technologies (8131): Provides IC packaging and testing services.

● ChipMOS Technologies (8150): Focuses on assembly and testing services.

● JCET Group: A major player in the packaging and testing market.

● Siliconware Precision Industries (SPIL): Provides a wide range of packaging solutions.

● PTI (Powertech Technology): Offers comprehensive packaging and testing services.

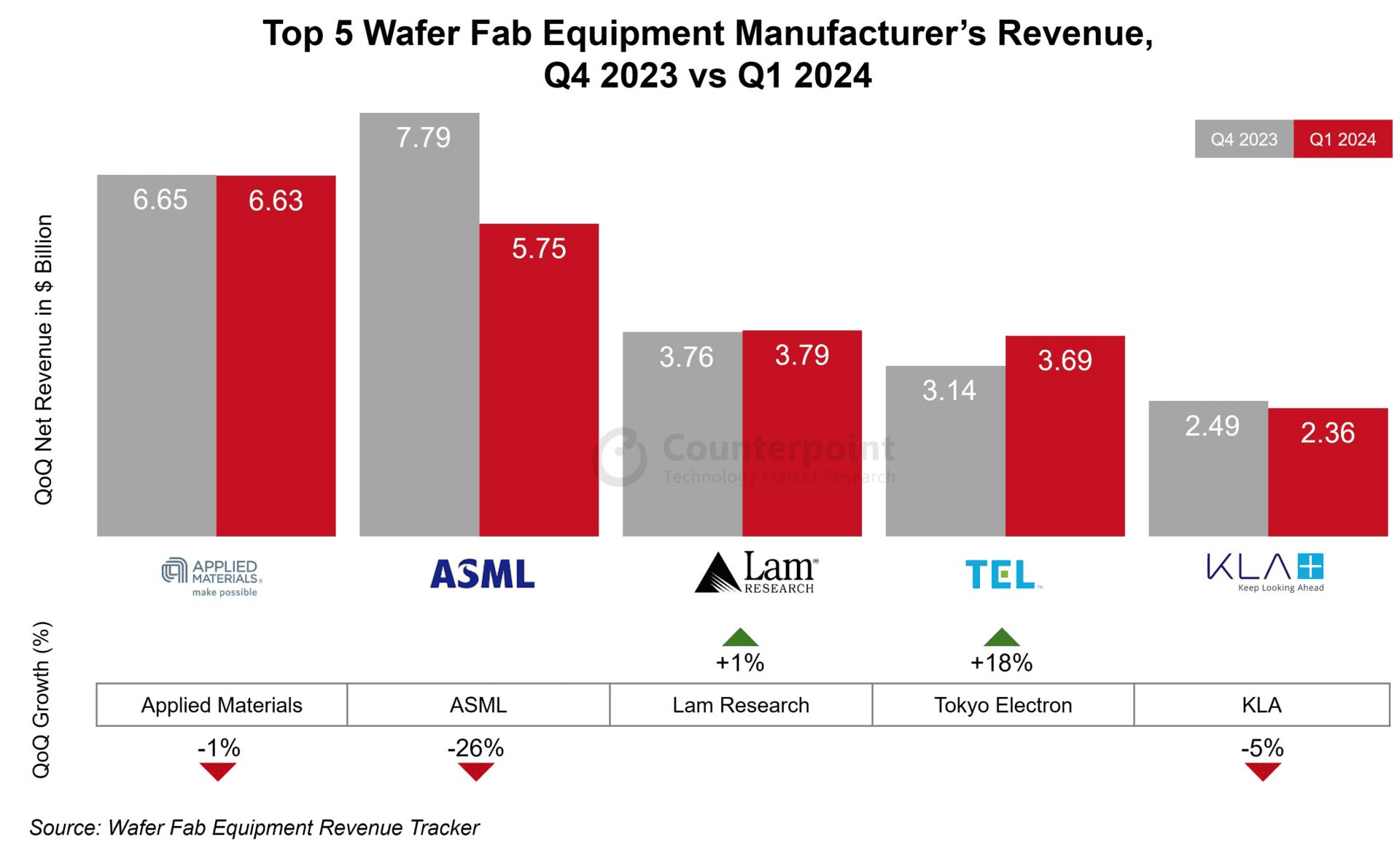

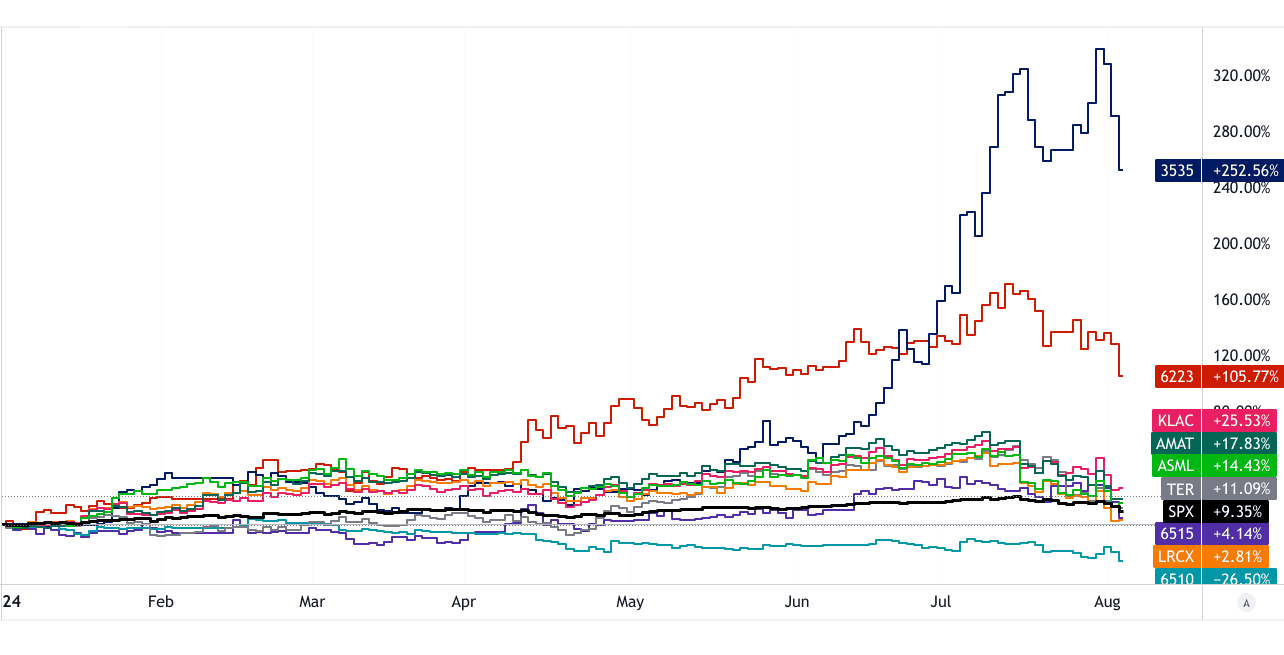

Equipment companies provide tools for manufacturing, packaging, and testing semiconductors. Major players include:

● ASML (ASML): Supplies advanced lithography equipment.

● Applied Materials (AMAT): Provides equipment for chip fabrication.

● KLA Corporation (KLAC): Offers process control and yield management solutions.

● Lam Research (LRCX): Supplies wafer fabrication equipment.

● Teradyne (TER): Provides automated test equipment.

Source: counterpointresearch.com

● Favite Inc (3535): Specializes in optical inspection equipment.

● MPI Corporation (6223): Provides probe cards and test solutions.

● Chunghwa Precision Test (6510): Focuses on semiconductor testing equipment.

● WinWay Technology (6515): Provides probe card solutions.

[YTD price return against SPX]

Source:trandingview.com

Raw material suppliers provide essential materials for wafer production. Major players include:

● Taiwan Mask Corporation (2338): Supplies photomasks for lithography.

● Episil-Precision (3016): Specializes in silicon wafers.

● Wafer Works (6182): Provides silicon wafers.

● GlobalWafers (6488): A leading silicon wafer supplier.

Consumable suppliers provide materials used in semiconductor manufacturing. Major players include:

● Entegris (ENTG): Supplies materials for wafer processing.

● Gudeng Precision Industrial (3680): Provides materials for semiconductor equipment.

Carrier board companies provide substrates for semiconductor packages. Major players include:

● Unimicron Technology (3037): A leading supplier of printed circuit boards.

● Kinsus Interconnect Technology (3189): Specializes in IC substrates.

● Nan Ya PCB Corporation (8046): Provides IC substrates and PCB solutions.

Lead frame suppliers provide metal structures for semiconductor packages. Major players include:

● SDI Corporation (2351): Supplies lead frames for various applications.

● Jih Lin Technology (5285): Specializes in lead frames.

● Chang Wah Technology (6548): Provides lead frames and packaging solutions.

III. Semiconductor Industry Downstream Supply Chain

Distribution and End-Products

The downstream supply chain in the semiconductor industry is crucial for delivering semiconductors from manufacturers to end-users. This process includes distribution, integration into final products, and the role of major players in each sector.

Distribution involves several key channels. Semiconductors are distributed through:

1. Direct Sales: Semiconductor companies sell directly to original equipment manufacturers (OEMs) and large enterprises. This channel allows for direct engagement between manufacturers and end-users, often involving large-volume transactions.

2. Electronic Component Distributors: Companies like Arrow Electronics (ARW) and Avnet (AVT) act as intermediaries between semiconductor manufacturers and various end-users. They stock a wide range of semiconductor products and provide logistical support. These distributors handle warehousing, inventory management, and order fulfillment, ensuring timely delivery of components.

![]()

[YTD price return against SPX]

Source:trandingview.com

3. Value-Added Resellers (VARs): VARs enhance semiconductor products by offering additional services such as system integration, customization, and technical support. They cater to niche markets or specialized applications, providing tailored solutions that meet specific customer needs.

Integration into Final Products: Semiconductors are essential in a broad array of final products, including AI, consumer electronics, and industrial systems.

1. Consumer Electronics: Semiconductors are integral to smartphones, tablets, laptops, and other personal devices. In these products, semiconductors manage processing, memory, display, and connectivity functions. For instance, Apple Inc. (AAPL) designs and uses custom semiconductors for its iPhones and iPads, optimizing performance and battery life.

2. Industrial Products: In the industrial sector, semiconductors are used in machinery, automation systems, and robotics. They enable precise control, data processing, and connectivity. Industrial applications rely on semiconductors for tasks such as real-time monitoring, process automation, and equipment control.

3. Automobiles: Modern vehicles integrate a range of semiconductor components. These include microcontrollers for engine management, sensors for advanced driver assistance systems (ADAS), and processors for infotainment systems. NVIDIA Corporation (NVDA), for example, provides GPUs and AI chips used in automotive applications for enhanced driving experiences and autonomous driving features.

Best Semiconductor Stocks: Major Players

Distribution

Arrow Electronics (ARW): As a major distributor, Arrow Electronics provides a broad range of semiconductor products and solutions. The company serves various markets, including aerospace, automotive, and telecommunications.

Avnet (AVT): Another leading distributor, Avnet offers extensive semiconductor distribution and value-added services. They support a wide range of industries, from consumer electronics to industrial automation.

![]()

Source: Ycharts.com

End-Products

Apple (AAPL): A key player in consumer electronics, Apple designs and manufactures a wide range of products. Their semiconductors are used in devices like the iPhone, iPad, and MacBook, featuring custom-designed chips for high performance and efficiency.

NVIDIA (NVDA): Known for its advanced graphics processing units (GPUs), NVIDIA also develops semiconductors for data centers and AI applications. Their GPUs are used in gaming, professional visualization, and AI-powered systems.

Semiconductor Stocks List: Vertical Integration

Integrated Device Manufacturers (IDMs) design, manufacture, and market their own semiconductor products. IDMs manage the entire production process, from design to final product integration. Major IDMs include:

![]()

[YTD price return against SPX]

Source:trandingview.com

● Intel Corporation (INTC): One of the largest IDMs, Intel designs and manufactures microprocessors and other semiconductor products. Their chips are used in personal computers, servers, and various embedded applications.

● Texas Instruments (TXN): A leading IDM in analog and embedded processing chips. Texas Instruments provides semiconductors for consumer electronics, industrial systems, and automotive applications.

● Samsung Electronics: A major IDM involved in memory and logic chip production. Samsung supplies semiconductors for smartphones, tablets, and other electronic devices.

● NXP Semiconductors (NXPI): Designs and manufactures semiconductor solutions for automotive, industrial, and consumer markets. NXP’s products include microcontrollers and communication processors.

● Analog Devices, Inc. (ADI): Specializes in analog, mixed-signal, and digital signal processing (DSP) integrated circuits. Analog Devices’ chips are used in communications, automotive, and industrial sectors.

● Macronix International (2337): Focuses on memory chips, including NOR and NAND flash memory. Macronix serves various applications, from consumer electronics to industrial systems.

● Winbond Electronics (2344): A Taiwanese IDM specializing in memory products. Winbond provides DRAM and NOR flash memory for diverse applications.

● Nanya Technology (2408): Produces DRAM memory chips for computers, smartphones, and other devices. Nanya is a key player in the DRAM market, known for its high-quality memory solutions.

IV. Semiconductor Industry Trends & Semiconductor Stocks Outlook

As per statista.com, the global semiconductor market is projected to reach $607.40 billion in 2024. Integrated circuits (ICs) dominate, with a forecasted market volume of $515.00 billion. The market is expected to grow at a compound annual growth rate (CAGR) of 10.06%, reaching approximately $980.80 billion by 2029. China will lead in revenue generation, with $177.80 billion in 2024. By 2032, the market is anticipated to expand to $1,307.7 billion, reflecting an 8.8% CAGR from $625.2 billion in 2023.

As per precedenceresearch.com, the global semiconductor market revenue may hit $584.17 billion in 2024 and may hit around $1,137.57 billion by 2033. It may grow at an annual growth rate (CAGR) of 7.64% during 2024 to 2033.

![]()

Source:precedenceresearch.com

Future Trends in the Chip Industry

Innovations in Lithography: Extreme ultraviolet (EUV) lithography is pushing the boundaries of semiconductor manufacturing. EUV technology enables the production of smaller and more powerful chips, crucial for maintaining Moore's Law. The adoption of EUV allows for advanced node sizes such as 7nm and 5nm, significantly enhancing chip performance and efficiency.

Transition from Silicon to Alternative Materials: The semiconductor industry is exploring materials beyond traditional silicon. Graphene is known for its high electrical conductivity and flexibility, which could revolutionize electronics. Gallium nitride (GaN) offers superior performance for high-voltage and high-frequency applications. GaN’s ability to operate at higher temperatures and voltages makes it ideal for power electronics and RF applications.

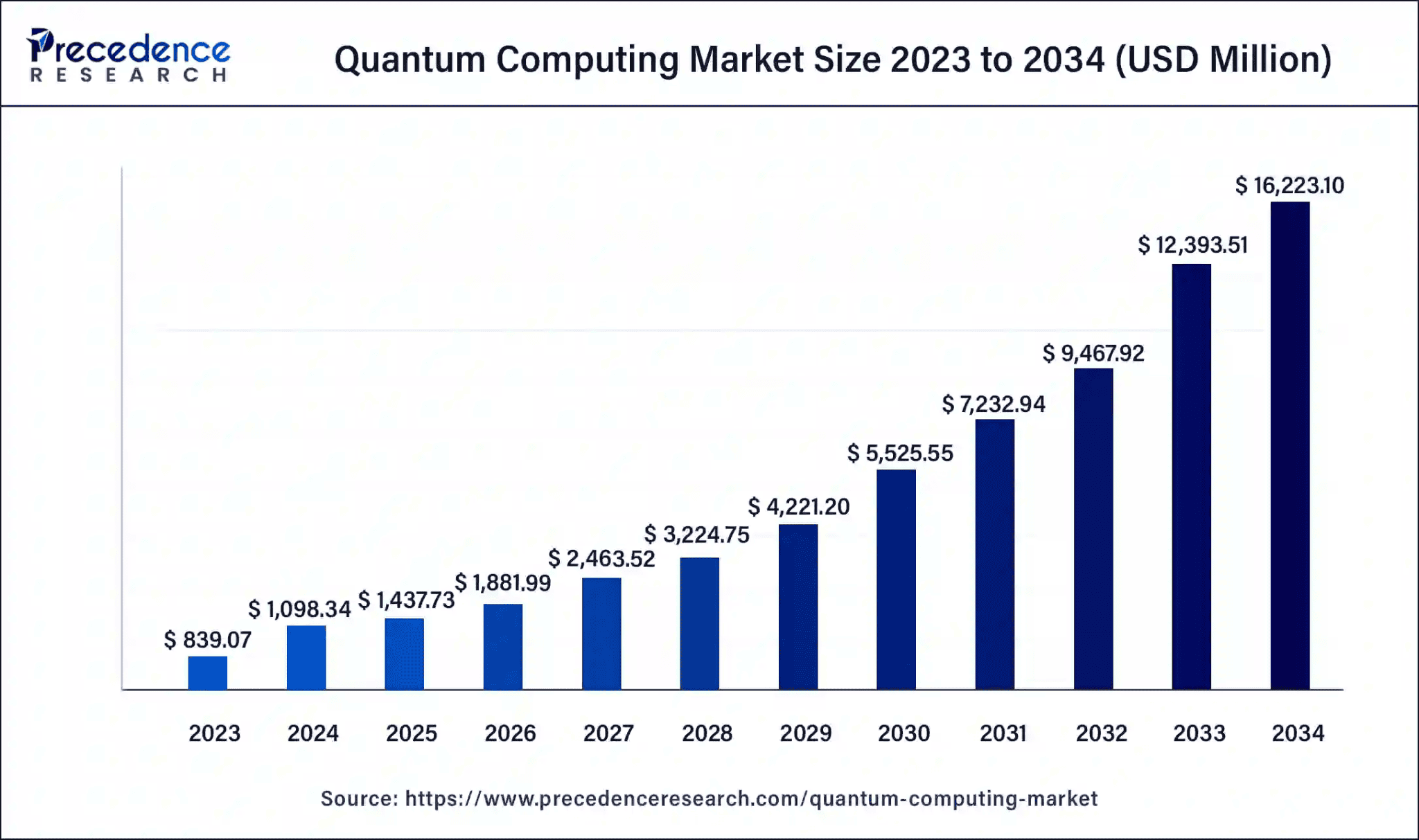

Quantum Computing: Quantum computing represents a paradigm shift in processing capabilities. Unlike classical bits, qubits in quantum computers can represent multiple states simultaneously. This allows quantum computers to solve complex problems much faster than traditional computers. Companies are investing heavily in quantum technology, aiming to achieve breakthroughs in cryptography, optimization, and material science.

Source:precedenceresearch.com

Custom AI Chips: The demand for custom AI chips is growing rapidly. Tensor Processing Units (TPUs) and Neural Processing Units (NPUs) are designed specifically to accelerate AI workloads. TPUs enhance performance for machine learning tasks, while NPUs are optimized for neural network processing. These chips are crucial for applications in deep learning, natural language processing, and real-time analytics.

Semiconductor Stocks Outlook

The value potential of individual semiconductor stocks will come from their product advancement, TAM, and critical-level of participation in the semiconductor supply chain and the market.

NVIDIA Corporation (NVDA): NVIDIA is a leader in GPU technology and AI processing. Its GPUs are widely used in gaming, data centers, and AI applications. The company's focus on AI and machine learning positions it for strong growth. NVIDIA’s stock is likely to benefit from its leadership in AI chips and continued innovation in GPU technologies.

Taiwan Semiconductor Manufacturing Company (TSMC): TSMC is a major foundry that manufactures advanced semiconductor nodes. The company is pivotal in producing chips using EUV lithography, which is essential for the latest generations of semiconductors. TSMC's extensive production capabilities and technological advancements make its stock a solid investment as demand for cutting-edge chips continues to rise.

Intel Corporation (INTC): Intel is a leading integrated device manufacturer (IDM) with a broad range of semiconductor products. The company is investing in new technologies such as quantum computing and advanced memory solutions. Intel's ongoing efforts to expand its semiconductor production and innovation in emerging technologies are expected to positively impact its stock performance.

Apple Inc. (AAPL): Apple invests heavily in custom semiconductors for its devices, including processors for iPhones and iPads. The company’s focus on integrating high-performance chips into its products supports its competitive position in the consumer electronics market. Apple’s innovation in semiconductor design and its strong market presence contribute to a favorable stock outlook.

Advanced Micro Devices (AMD): AMD is known for its competitive CPUs and GPUs. The company’s focus on high-performance computing and graphics solutions has led to significant market share gains. AMD’s innovations in semiconductor technology and its ability to compete with major players like Intel and NVIDIA position it well for future growth.

![]()

[YTD price return against SPX]

Source:trandingview.com

Qualcomm Inc. (QCOM): Qualcomm is a leading player in mobile communications and automotive semiconductors. The company’s advancements in 5G technology and automotive solutions are driving growth. Qualcomm’s role in developing next-generation mobile and automotive technologies supports a positive outlook for its stock.

Broadcom Inc. (AVGO): Broadcom has a diverse portfolio, including products for networking, storage, and wireless communications. The company’s strong position across multiple semiconductor markets enhances its growth prospects. Broadcom’s focus on innovation and its broad product offerings contribute to a favorable stock outlook.

Micron Technology Inc. (MU): Micron is a key player in the memory semiconductor market. The company’s products are essential for data storage and high-performance computing. Despite recent downturns in the memory market, Micron’s focus on technology advancements and capacity management supports its long-term growth prospects.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.