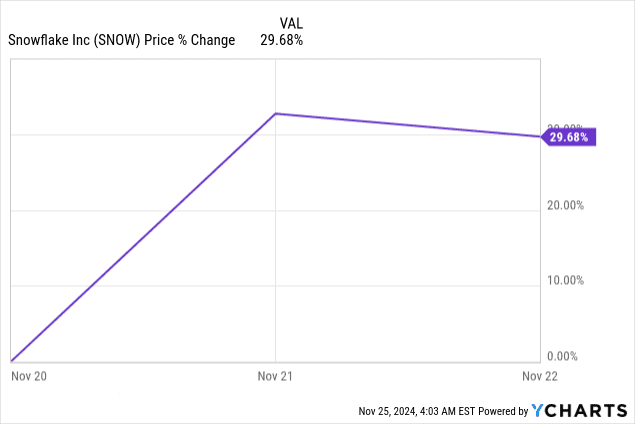

Snowflake's stock price surged 30% following its Q3 2025 earnings announcement, reflecting strong market optimism driven by revenue growth, product innovation, and steady customer adoption. The company exceeded both revenue and EPS expectations, marking robust execution despite competitive pressures and broader market concerns over IT spending trends.

Source: Ycharts.com

I. Snowflake Earnings Overview Q3 2025

Revenue vs. Expectations

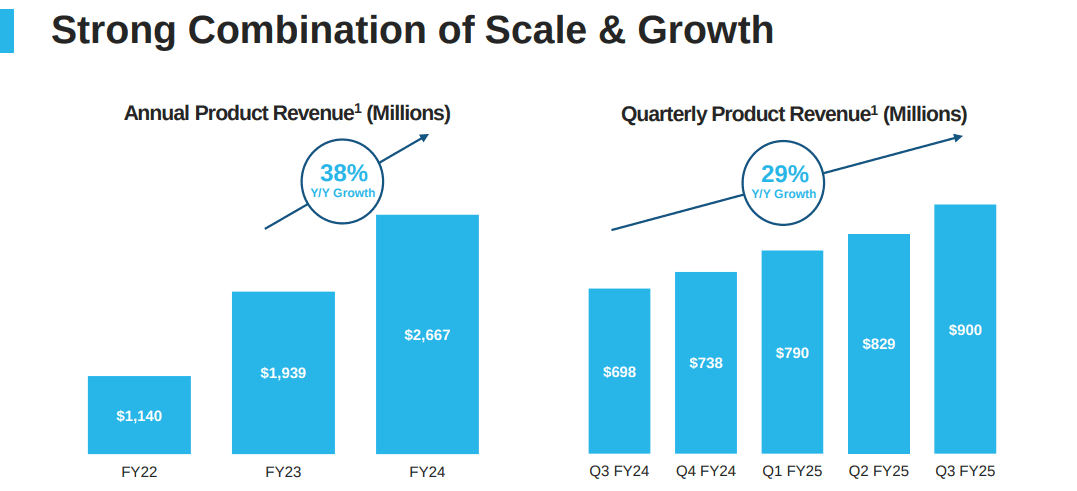

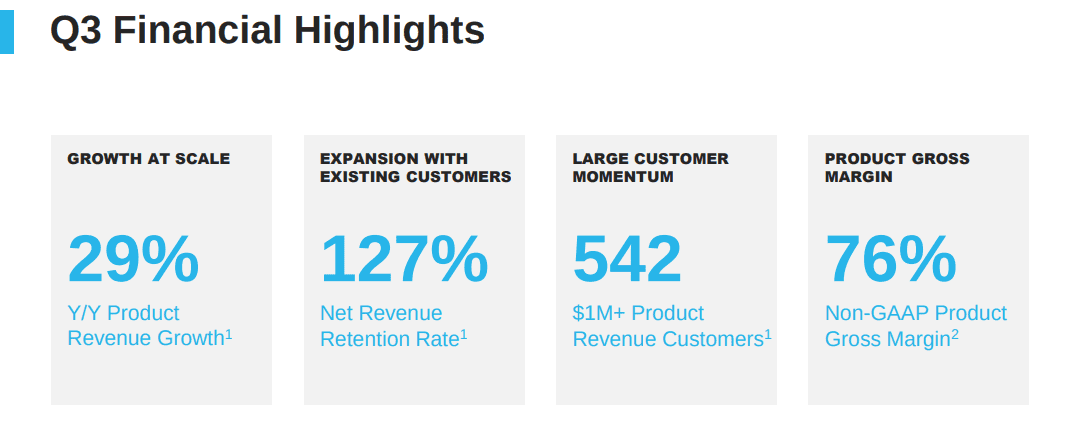

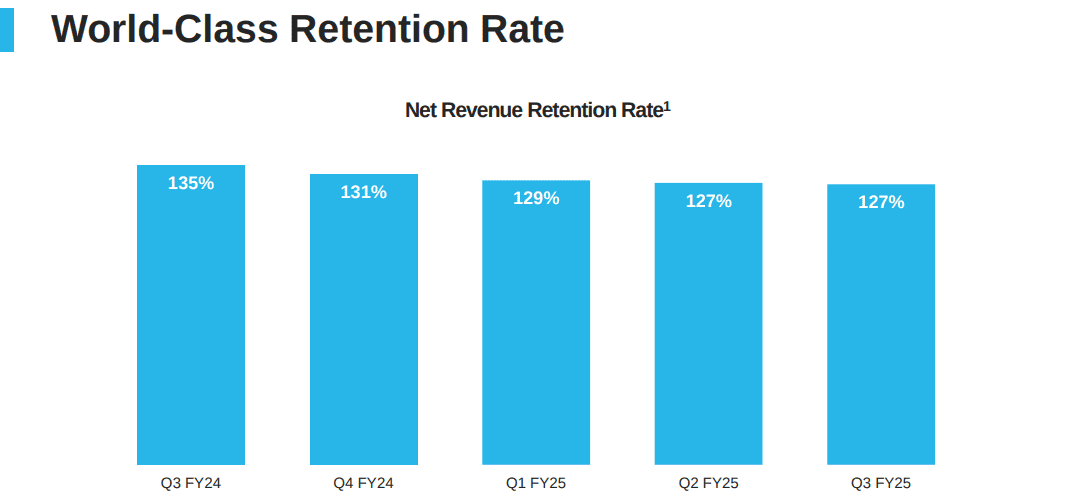

Snowflake delivered a consolidated revenue of $942.09 million in Q3 2025, outperforming expectations by $43.63 million, reflecting robust execution and stable consumption patterns. This represents an approximate 34% YoY growth in revenue, underscoring the strength in core product adoption and large deal closures, despite some market concerns over potential deceleration. Notably, the product revenue retention rate stabilized at 127%, marking consistent upselling to existing customers.

Source: Snowflake Investor Presentation

EPS Performance

Normalized EPS hit $0.20, beating expectations by $0.05, signifying stable operational cost management and revenue performance. However, GAAP EPS landed at -$0.98, missing by $0.03, due to continued investments in research and development, new office expenditures, and share-based compensation—expenses pivotal for scaling operations but weighing on profitability in the short term.

Net Income and Margins

Snowflake's non-GAAP product gross margin stood stable at 76%, while the non-GAAP operating margin hit 6%, surpassing earlier guidance. Net income margins remained compressed on a GAAP basis due to the aforementioned investments and adjustments. Non-GAAP adjusted free cash flow margin improved to 9%, bolstered by advanced customer payments and substantial bookings momentum.

Source: Snowflake Investor Presentation

SNOW Earnings Q3 2025 Revenue Drivers and Market Trends

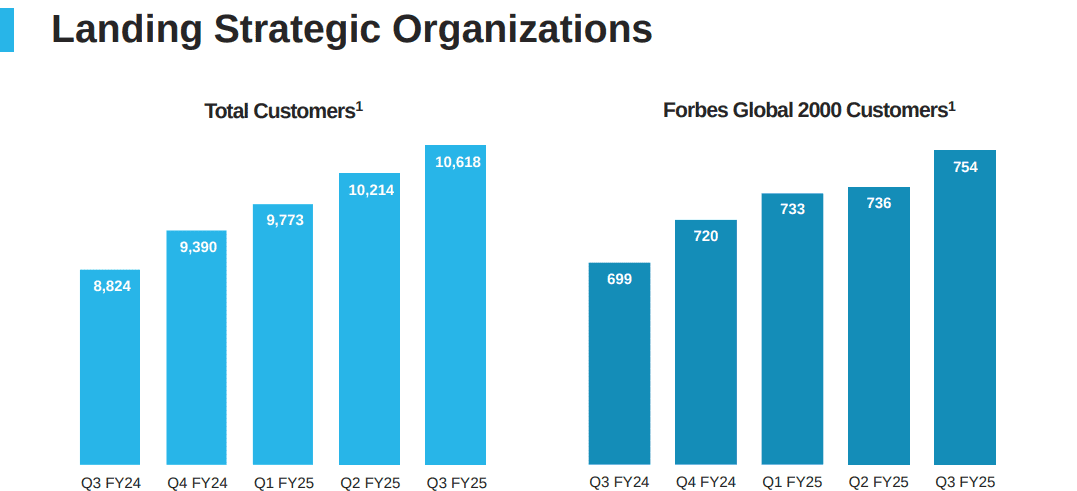

Snowflake's growth derived from expanding customer adoption of advanced data features like Snowpark, Iceberg, and Snowpipe Streaming, with Snowpark contributing 3% of product revenue. Additionally, bookings reached $350 million in total contract value deals, including 18 Global 2000 customers, pointing to growing traction among large enterprises. Storage revenue held at 11% of consumption despite shifts to Iceberg, and newer product functionalities helped offset potential headwinds.

II. Product & Market Dynamics

New Products and Market Reception

Snowflake accelerated product launches in Q3 2025, rolling out innovations such as Snowflake Cortex, driving adoption across over 3,200 accounts using AI and ML features. The Snowflake Intelligence platform, geared toward creating data agents, and new features like Unistore and Iceberg enhanced interoperability, particularly in previously untapped data workflows. These advancements bolstered the adoption of newer use cases, generating a $200 million annualized run rate by Q3’s end. Customers reported cost savings of up to 50% from migrating workloads to Snowflake, showcasing the platform's competitive edge in operational simplicity and efficiency.

Partnerships played a pivotal role in product uptake. Collaborations with AWS yielded $3.9 billion in bookings over the past four quarters, a 68% increase compared to the previous period. Meanwhile, the Anthropic partnership positioned Snowflake Cortex AI to deliver cutting-edge AI solutions with built-in governance, enhancing customer stickiness. These developments align with the company’s strategy to penetrate new segments such as enterprise AI and unstructured data.

Source: Snowflake Investor Presentation

Competitive Landscape

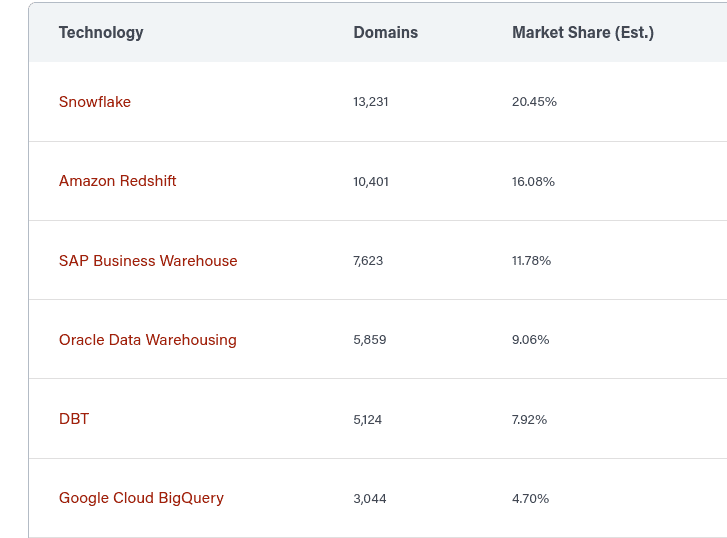

Snowflake's market share stands at 20.45%, outperforming major rivals like Amazon Redshift (16.08%), Google BigQuery (4.7%), and SAP Business Warehouse (11.78%). Key differentiators include an integrated architecture and ease of use. For example, Snowflake emphasizes that tasks requiring multiple steps on competitors’ platforms often take one step on Snowflake, minimizing complexity and operational risk.

Pricing strategy remains aggressive, focusing on reducing total ownership costs. This approach has helped secure prominent customers such as Comcast, Hyatt, and Toyota, who leverage Snowflake’s scalable solutions for personalized services and operational insights. The company also capitalizes on growing dissatisfaction with rivals’ complex, resource-intensive platforms, further displacing competitors like Databricks and AWS Redshift in large enterprise accounts.

Snowflake’s emphasis on open data formats like Apache Iceberg and advancements in AI-driven analytics align with broader industry shifts. This strategic foresight enhances its position as the go-to platform for enterprise data management. Snowflake's acquisition of Datavolo strengthens its capability to simplify data engineering, targeting both structured and unstructured workloads.

Source: 6sense.com

III. Snowflake Stock Forecast

SNOW Stock Forecast Technical Analysis

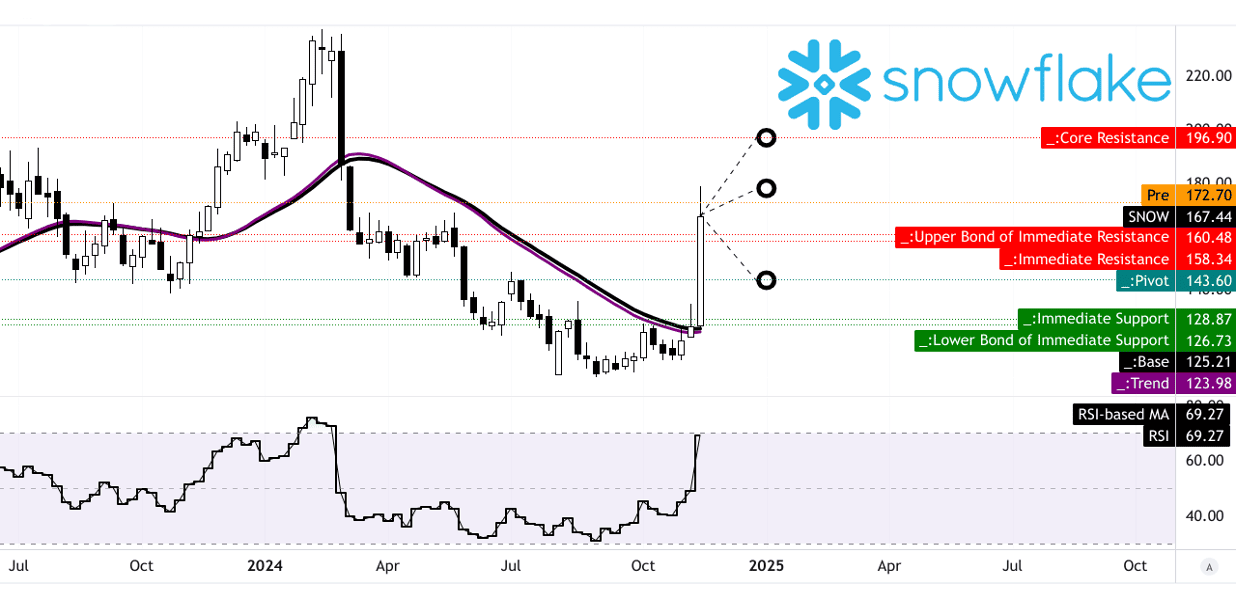

Snowflake's stock, currently priced at $167.44, demonstrates bullish momentum supported by technical indicators. The modified exponential moving average trendline at $123.98 and baseline at $125.21 reveal that the stock is significantly above its long-term averages. This divergence indicates strong upward momentum in the short to mid-term. The Relative Strength Index (RSI), measured at 69.27, approaches overbought levels, suggesting a potential slowdown if it crosses the critical threshold of 70. However, the RSI line trend remains upward, aligning with the price trajectory. Additionally, the pivot level of $143.60 within the horizontal price channel serves as a critical support point, providing stability if the price encounters bearish pressure.

Price targets derived from Fibonacci retracement and extension levels offer insights into Snowflake's potential movement by the end of 2024. The average price target of $179 represents a 6.9% upside, grounded in the stock's historical trend momentum. Optimistic projections reach $197, suggesting a 17.6% gain, assuming current bullish dynamics persist. Conversely, a pessimistic scenario estimates a decline to $144, representing a 14.0% downside in the event of a bearish shift. These targets account for the stock’s history of volatility and provide a structured framework for evaluating future price movements.

Source: tradingview.com

Snowflake Stock Forecast: Market analysts' expectations & ratings

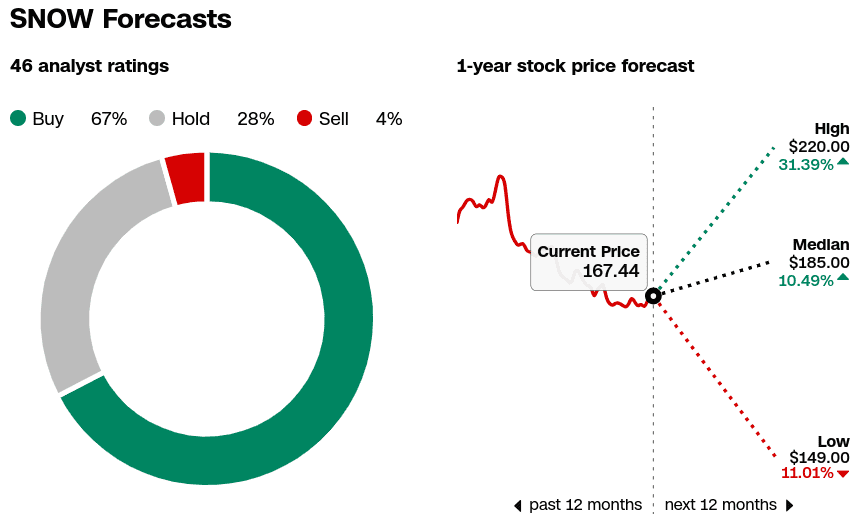

Market analysts’ perspectives further reinforce the bullish sentiment surrounding Snowflake. Out of 46 analysts, 67% rate SNOW as a buy, reflecting confidence in the company’s long-term growth prospects. Another 28% recommend holding, suggesting cautious optimism amid broader market uncertainties. Only 4% advocate selling, indicating minimal skepticism among market observers. Analysts’ price forecasts for the next 12 months include a high of $220, implying a 31.4% increase, while the median target stands at $185, representing a 10.5% upside. The low target of $149 would mean an 11% drop, factoring in potential risks tied to competitive pressures or macroeconomic challenges.

Source: CNN.com

IV. SNOW Stock Forecast: Future Outlook

Management’s Forecasts

Snowflake’s future trajectory is anchored in strategic initiatives and substantial market opportunities. Management has increased its fiscal 2025 product revenue guidance to $3.43 billion, reflecting a 29% YoY growth. For Q4 2025, product revenue is projected between $906 million and $911 million, a 23% YoY growth. Enhanced profitability remains a focus, with Q3 non-GAAP operating margin at 6% and adjusted free cash flow margin at 9%. Investments in product innovation, such as Snowflake Cortex and Iceberg, alongside efficiency measures like centralized teams and AI-driven processes, underscore management’s approach to scaling profitably while enhancing its offerings.

The Q3 earnings call emphasized Snowflake’s strong customer adoption, driven by its scalable, cost-efficient solutions. Its AI features boast 1,000+ production use cases, with Cortex AI projected to expand enterprise AI integration. Moreover, partnerships with AWS, Microsoft, and Anthropic are reinforcing its ecosystem, yielding $3.9 billion in bookings via AWS—a 68% increase YoY. Snowflake’s push for data interoperability and AI-centric innovations is expected to fortify its market lead and improve customer retention (127% net revenue retention rate).

Source: Snowflake Investor Presentation

Market Trends

The data analytics and cloud computing markets present substantial growth opportunities for Snowflake. The global data analytics market, valued at $57.66 billion in 2023, is projected to expand to $335.26 billion by 2031, at a CAGR of 24.79%. Similarly, the public cloud market is expected to hit $773.30 billion in 2024, with SaaS accounting for $328.20 billion. Between 2024 and 2029, the public cloud sector is projected to grow at an 18.49% CAGR, reaching $1.81 trillion. These robust market expansions align with Snowflake’s offerings, including AI-driven analytics and cloud-native solutions, setting the stage for further penetration.

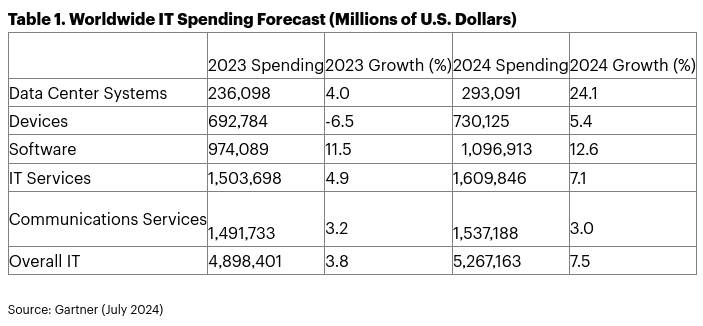

Moreover, Gartner predicts global IT spending will grow 7.5% in 2024 to $5.26 trillion, driven by enterprise digitization and AI. Snowflake is positioned to benefit from generative AI investments, with features like Snowflake Intelligence targeting data-driven decision-making. Additionally, its advancements in unstructured data handling via the intended Datavolo acquisition bolster its capability to capture a broader spectrum of data workloads.

Source: gartner.com