The 2024 U.S. presidential election is scheduled for November 5, 2024. Incumbent President Joe Biden initially announced his candidacy on April 25, 2023, with Vice President Kamala Harris as his running mate. However, Biden decided to exit the race in August 2024, citing the need to unite the Democratic Party and focus on defeating former President Donald Trump.

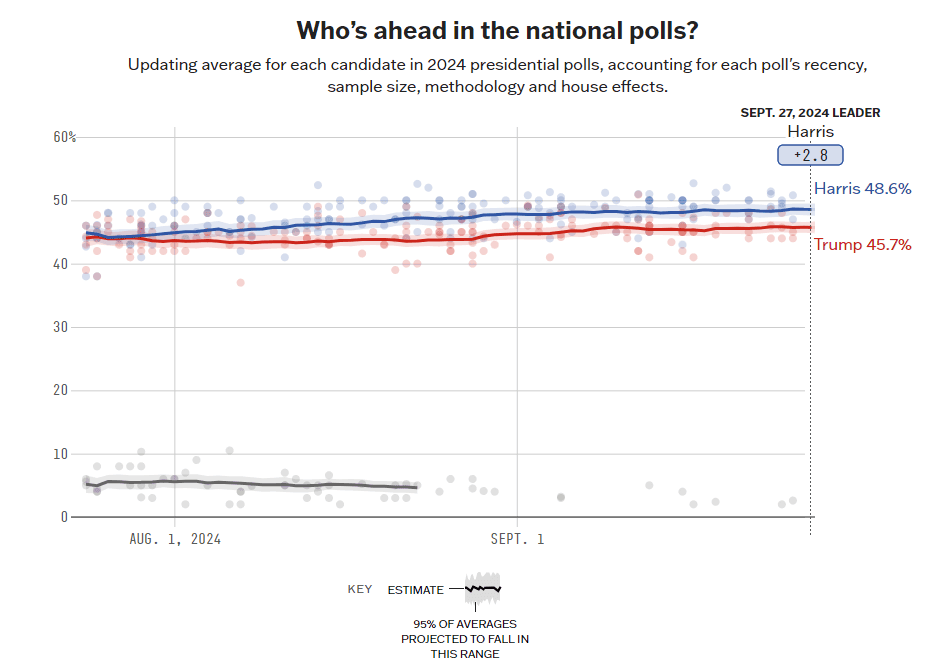

Following Biden's exit, Vice President Kamala Harris became the Democratic nominee. Harris has energized the Democratic base, and her support has grown significantly. As of early September 2024, Harris and Trump are essentially tied in national polls, with Harris holding a slight edge in some key battleground states.

The election will coincide with other significant elections, including those for the Senate, House, and state legislatures, making it a pivotal moment for U.S. politics. Key issues such as the economy, healthcare, and foreign policy continue to dominate the campaign discourse.

Source: projects.fivethirtyeight.com

How will the stock market react to Democratic Presidents?

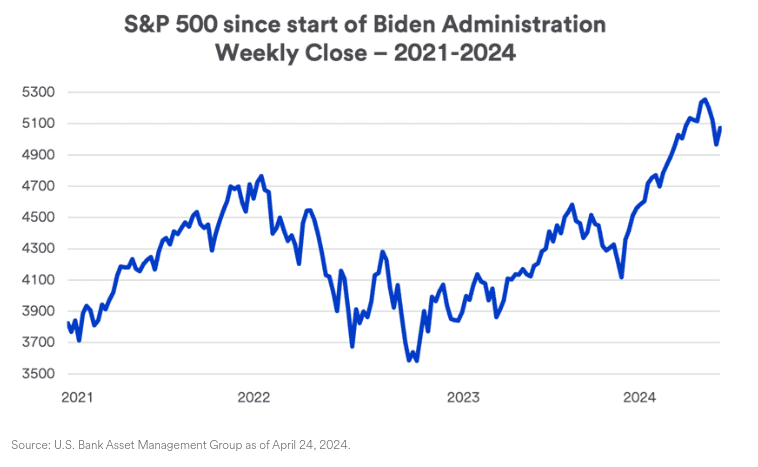

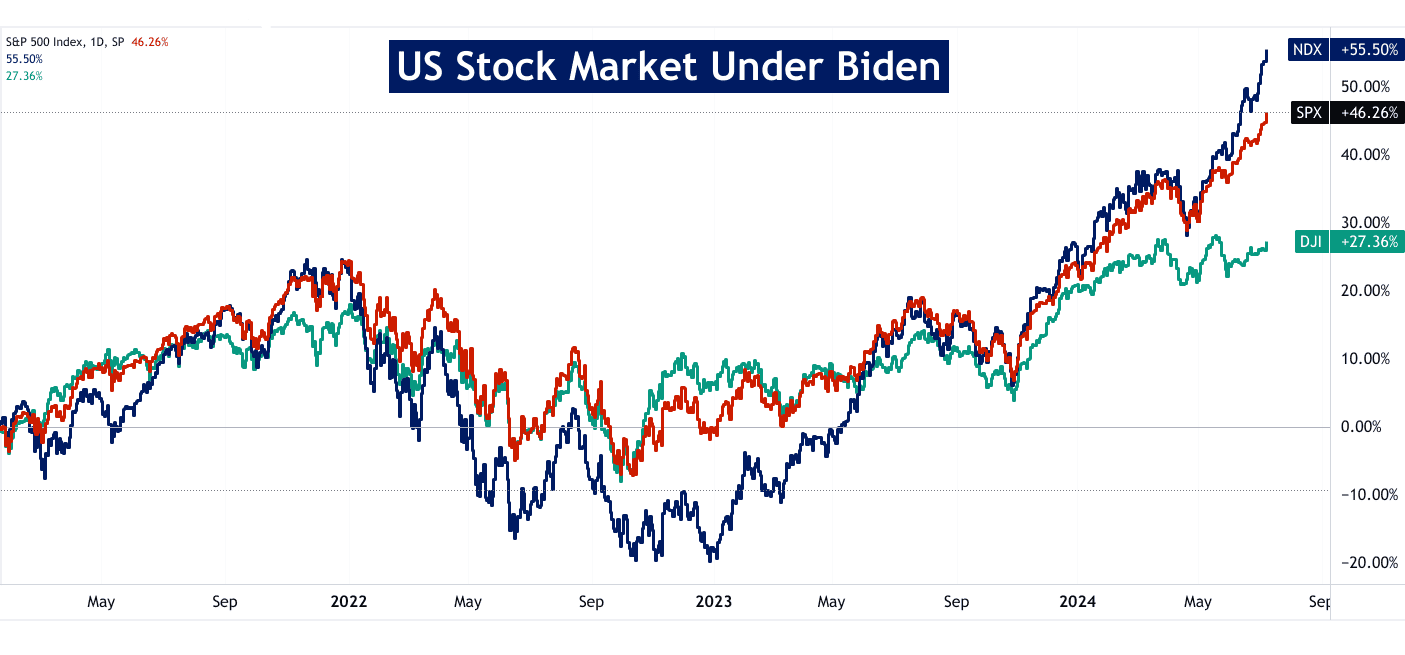

Democratic presidents have historically shown a positive impact on the stock market. Following Joe Biden's election win in November 2020, the S&P 500 experienced a notable surge, reflecting investor optimism. On the day after the election was called for Biden, the S&P 500 gained 1.2%, and from Election Day through the end of 2020, the index rose approximately 12.7%. Investors generally responded positively to Biden’s expected economic policies, including increased fiscal stimulus and infrastructure spending, which were seen as growth drivers.

However, the market also showed sensitivity to concerns about higher corporate taxes and increased regulation under a Biden administration. Despite these concerns, the overall trend during Biden's early presidency was upward, aided by substantial fiscal stimulus and a strong recovery from the COVID-19 pandemic. The S&P 500 delivered solid returns of 28.7% in 2021 and 26.29% in 2023. However, the S&P 500 dropped 25% in 2022.

Historically, the stock market tends to perform well during Democratic presidencies. According to a study by CFRA Research, the S&P 500 has averaged an annual gain of 10.4% under Democratic presidents compared to 6.8% under Republican presidents since World War II. This historical data, combined with the market's performance post-Biden's election, suggests that investors generally anticipate stable growth under Democratic presidents’ economic policies.

Source: usbank.com

When is the best time for investing in stocks during an election year?

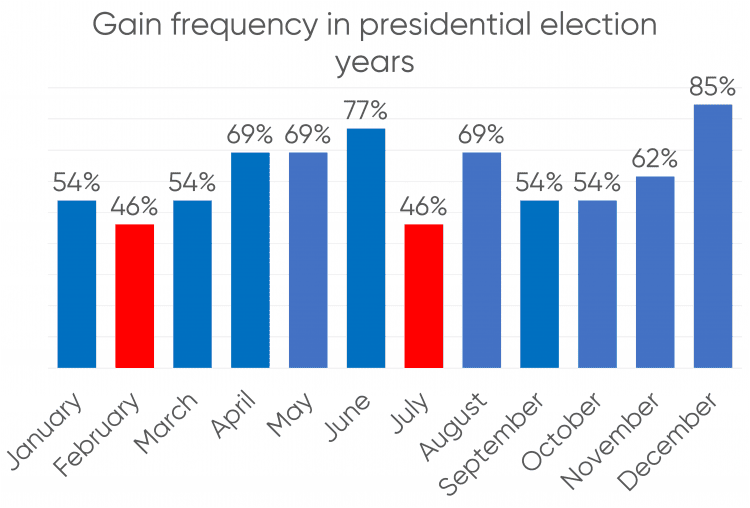

Investing in stocks during December of an election year can be strategically advantageous for several reasons. Historically, December has shown a tendency for stock market rallies, often referred to as the "Santa Claus Rally." This phenomenon is attributed to increased consumer spending during the holiday season, optimistic market sentiment, and institutional investors rebalancing portfolios before year-end.

In election years, December can offer additional benefits due to the resolution of election uncertainty. By December, election results are typically finalized, providing clarity on future economic policies and reducing market volatility. This post-election clarity can boost investor confidence, leading to a more stable and optimistic market environment.

Moreover, December is often marked by tax-loss harvesting, where investors sell off losing positions to offset gains, followed by reinvestment in the market. This practice can create buying opportunities at attractive prices.

Source: capital.com

Biden Presidency Major Economic Policies and Potential Impacts

Biden's Economic Agenda and Its Past Effects on the Stock Market (2021-Present)

American Rescue Plan Act (ARPA): Enacted in March 2021, the $1.9 trillion ARPA aimed to provide immediate economic relief from the COVID-19 pandemic. It included direct payments to individuals, expanded unemployment benefits, and funding for vaccine distribution. The stock market responded positively, with a significant boost in consumer spending and confidence driving a bullish trend.

Infrastructure Investment and Jobs Act (IIJA): Signed into law in November 2021, this $1.2 trillion bill focused on rebuilding America's infrastructure. It targeted sectors like transportation, broadband, and water systems. The IIJA's emphasis on infrastructure development spurred growth in construction and related industries, positively influencing the Dow Jones Industrial Average (DJIA) and S&P 500.

Build Back Better (BBB): Although not fully passed, parts of the BBB aimed to expand social safety nets and address climate change. Market reactions were mixed, with some concerns over increased spending and potential inflationary effects, though long-term benefits in clean energy investments were anticipated.

Tax Policies: Biden proposed increasing the corporate tax rate and taxes on high-income individuals. While initially met with resistance and fears of market downturns, the overall market remained resilient, buoyed by strong corporate earnings and economic recovery.

Stock Market Performance: Under Biden's presidency, the DJIA and S&P 500 experienced significant gains, particularly in 2021, driven by robust fiscal stimulus and economic reopening post-pandemic. However, concerns over inflation and interest rate hikes introduced volatility in 2022. From 2023 till date the US stock market is experiencing a prolonged bull run.

Source: tradingview.com

Sectors that Could See Growth Under Democrat Harris Presidency

Technology: Biden’s focus on innovation and the CHIPS Act, aimed at boosting semiconductor manufacturing in the U.S., has favored the tech sector. Increased federal support for research and development is expected to further drive growth.

Clean Energy: The Inflation Reduction Act allocated $390 billion to clean energy projects, aiming to reduce carbon emissions and promote renewable energy sources. Sectors involved in solar, wind, and electric vehicle production stand to benefit significantly.

Electrification: With policies promoting electric vehicle adoption and infrastructure development, including charging stations, companies in the electric vehicle supply chain, battery manufacturing, and related technologies are poised for growth.

Potential Economic Agenda for Democrat Harris Presidency

Tax Reforms: Harris may continue pushing for higher corporate taxes and taxes on the wealthy to fund social programs and reduce the deficit.

Healthcare: Expansion of the Affordable Care Act, introduction of a public option, and efforts to reduce prescription drug prices could be focal points.

Climate Change Initiatives: Further investment in renewable energy and green infrastructure, along with stricter regulations on emissions, could be expected.

Social Programs: Renewed efforts to expand the Child Tax Credit, implement universal pre-K, and enhance paid family leave are likely.

Immigration Reform: Policies aimed at increasing legal immigration to boost the labor force and economic growth may be pursued.

Source: whitehouse.gov

Unpacking Democrat Harris’ Potential Economic Plan

Legislative Achievements and Economic Recovery

Biden's first term saw significant legislative victories, including the ARPA and IIJA, which provided critical relief and infrastructure funding. The economy's recovery from the COVID-19 recession, marked by low unemployment and rising wages, is a cornerstone of his economic success. The Inflation Reduction Act and CHIPS Act further underscore his commitment to combating climate change and revitalizing manufacturing.

2025 Budget Proposal

Biden's proposed 2025 budget emphasizes increased taxes on corporations and the wealthy, aiming to raise $5 trillion over the next decade. This includes raising the corporate tax rate to 28%, increasing the corporate alternative minimum tax (CAMT) rate to 21% and increasing taxes on stock buybacks. The focus is on redistributing wealth to fund social programs like the Child Tax Credit and national paid leave.

Source: whitehouse.gov

Challenges and GOP Opposition

Despite economic successes, challenges remain, including rising costs of living and food insecurity. Addressing these issues requires continued social spending. Biden's agenda contrasts sharply with the GOP's focus on tax cuts and deregulation. The political landscape, with a divided Congress, complicates policy implementation.

Immigration and Social Spending

Biden’s budget includes tax credits to support affordable housing and healthcare, along with efforts to lower prescription drug prices. Increased funding for the IRS aims to enhance tax enforcement, while rejuvenating agencies like the NLRB and CFPB supports workers and consumers.

Stocks to Watch If Harris Wins the 2024 Presidential Election

The outcome of the 2024 Presidential Election could significantly influence various industries, especially if Harris wins. Biden's administration has already shown strong support for clean energy and infrastructure, which suggests a continued emphasis on renewable energy and sustainability initiatives. This could impact several key industries and stocks.

Industries Impacted by a Biden Presidency

- Renewable Energy:

- Solar Energy: Companies involved in solar energy production and technology could see substantial growth.

- Wind Energy: Firms engaged in wind power generation and related technologies might benefit.

- Electric Vehicles (EVs):

- Companies manufacturing EVs and EV infrastructure are likely to experience growth due to supportive policies.

- Energy Storage and Infrastructure:

- Firms involved in energy storage solutions and modernizing energy infrastructure could gain.

- Waste Management and Recycling:

- Businesses focusing on waste management and recycling may see increased demand and governmental support.

Stocks to Watch if Harris Wins the Presidential Election 2024

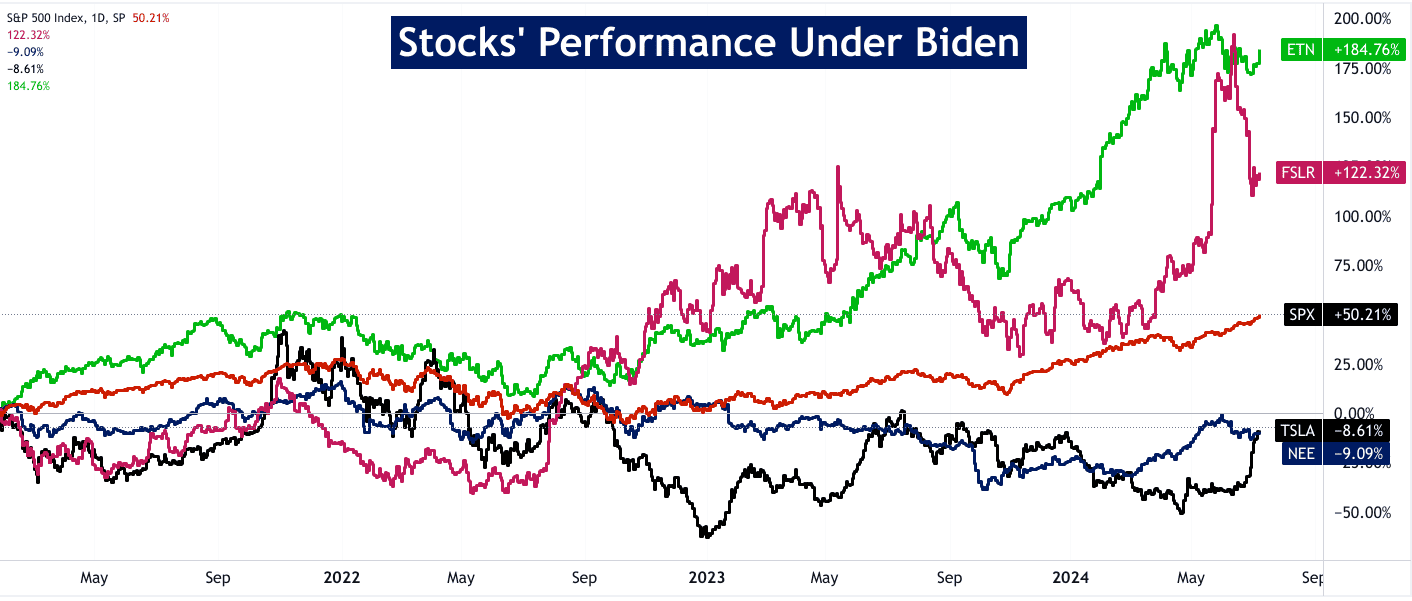

- First Solar (NASDAQ: FSLR):

- First Solar is a leading provider of solar energy solutions, specializing in photovoltaic (PV) solar energy modules and systems. The company is well-positioned to benefit from any expansion in solar energy investment.

- Potential Impact: Under a Biden administration, which emphasizes renewable energy, FSLR could see increased demand for its products. Policies promoting clean energy and infrastructure improvements could directly benefit First Solar's business model.

- NextEra Energy (NYSE: NEE):

- NextEra Energy is a diversified clean energy company, primarily engaged in generating renewable energy from wind and solar projects.

- Potential Impact: NextEra Energy could benefit from Biden’s clean energy agenda, which supports investments in renewable energy sources. With its strong focus on renewable energy, NEE is well-positioned to take advantage of any government incentives aimed at reducing carbon emissions and promoting sustainable energy solutions.

- Tesla (NASDAQ: TSLA):

- Tesla is a global leader in electric vehicles (EVs), energy storage solutions, and solar energy products.

- Potential Impact: Tesla stands to gain significantly from Biden's focus on clean energy and reducing greenhouse gas emissions. Increased support for EVs, including incentives for buyers and infrastructure developments like charging stations, would likely boost Tesla’s sales and market presence.

Source: tradingview.com

- Eaton Corporation (NYSE: ETN):

- Eaton Corporation is a power management company providing energy-efficient solutions to manage electrical, hydraulic, and mechanical power.

- Potential Impact: Eaton could benefit from a Biden presidency due to its involvement in modernizing the electrical grid and developing energy-efficient infrastructure. Policies aimed at upgrading energy infrastructure and promoting sustainability could drive demand for Eaton's products and solutions.

Additional Stocks to Consider

- Sunrun (NASDAQ: RUN): A residential solar energy company that could benefit from increased residential solar installations.

- Quanta Services (NYSE: PWR): Provides infrastructure solutions for electric power, renewable energy, and communications industries, potentially benefiting from infrastructure investments.

- Air Products and Chemicals (NYSE: APD): Engages in the production of hydrogen and other gases used in renewable energy applications.

- Johnson Controls (NYSE: JCI) and Trane Technologies (NYSE: TT): Both companies focus on building efficiency and sustainability, potentially benefiting from policies aimed at improving energy efficiency in buildings.

- Waste Management (NYSE: WM) and Republic Services (NYSE: RSG): These companies focus on waste management and recycling, which could see increased support from policies promoting environmental sustainability.

Investment Strategies for the 2024 Election

Hedging Strategies

To protect investments during the 2024 election, investors can utilize options and other hedging techniques. Options, such as puts and calls, allow investors to set predefined prices for buying or selling assets, mitigating potential losses from market volatility. For instance, purchasing put options can act as insurance against a drop in stock prices. Other hedging strategies include futures contracts, which lock in prices for assets to shield against market fluctuations, and inverse ETFs, which appreciate when the underlying index declines. These tools help investors manage risk by providing downside protection during periods of political uncertainty.

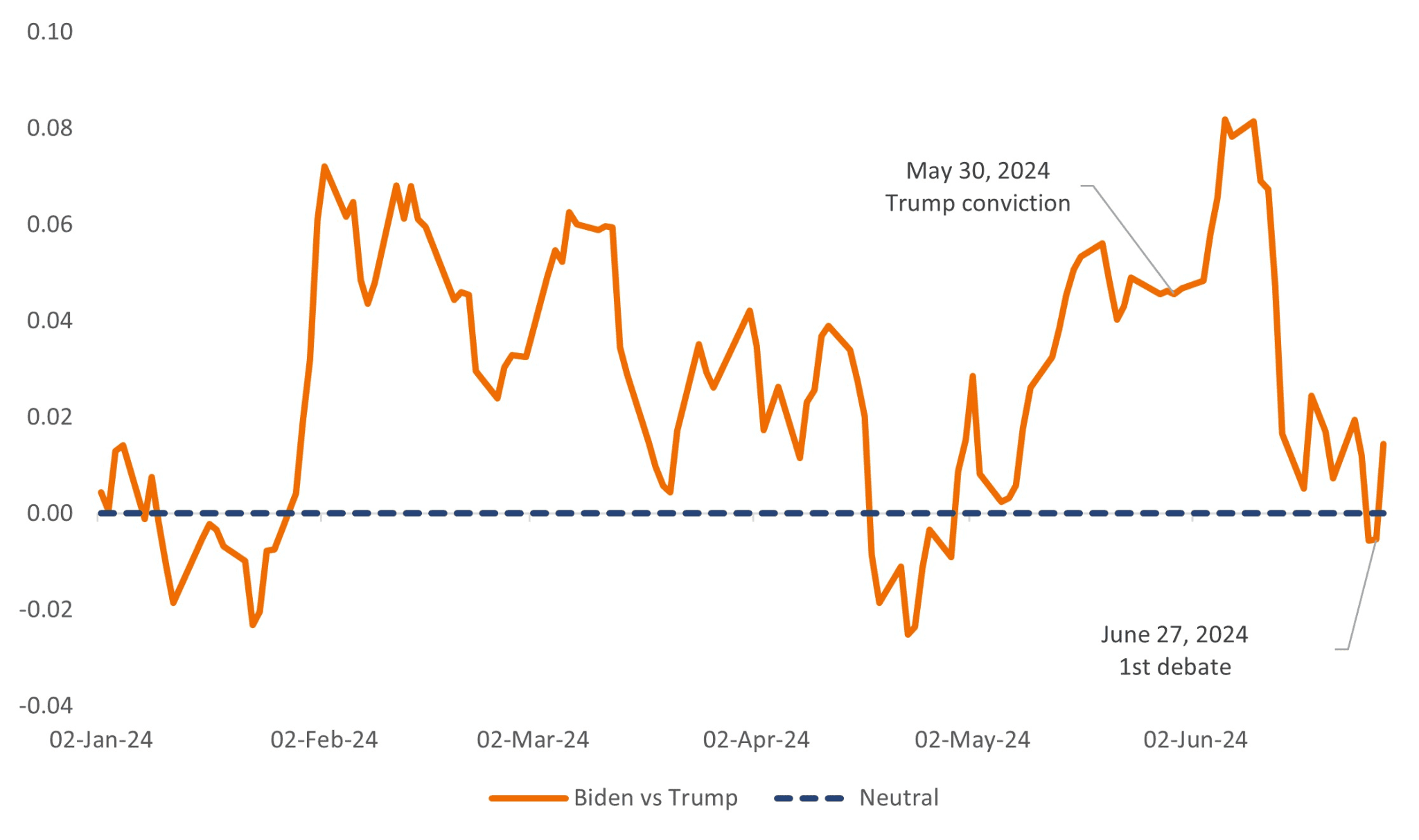

[Relationship to Democrat-to-Republican tail-Sharpe ratios: Options-based expectations for a Democrat victory in November have greatly diminished.]

Source: janushenderson.com

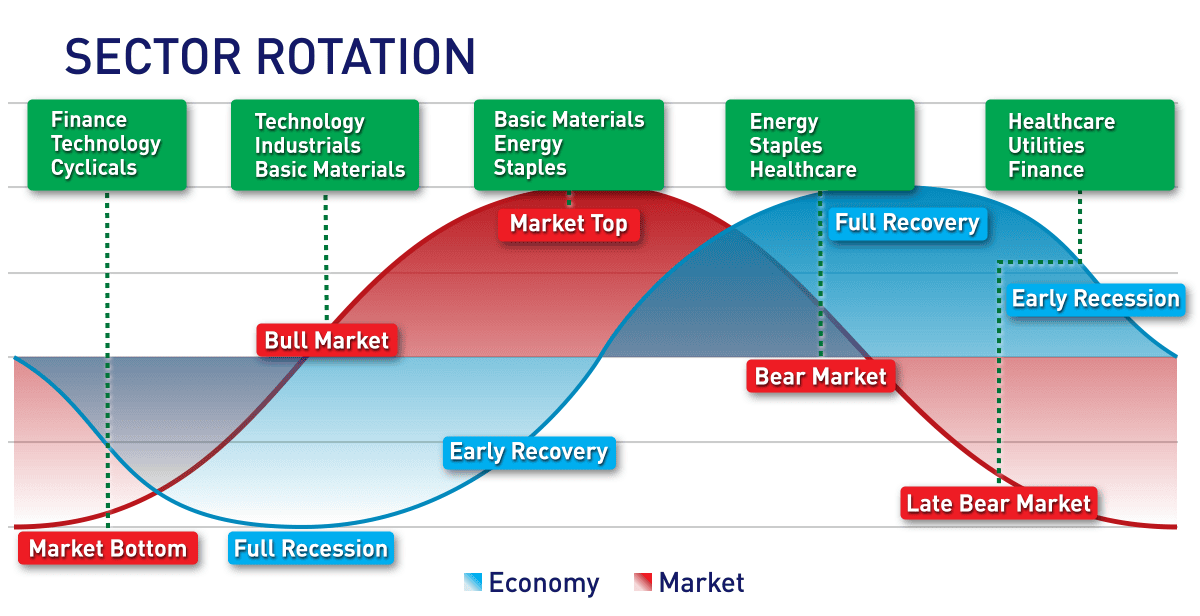

Sector Rotation

Sector rotation involves strategically shifting investments among various sectors based on anticipated policy changes resulting from the election. For example, if a pro-environment administration is expected to win, investors might increase exposure to renewable energy companies while reducing holdings in traditional energy stocks. Conversely, if policies favoring deregulation and defense spending are anticipated, sectors like industrials and defense might see increased investment. By analyzing potential policy impacts and economic implications, investors can rebalance their portfolios to capitalize on sectors likely to benefit from the new administration's policies, enhancing returns while mitigating risks associated with political transitions.

Source: linkedin.com

Diversification Portfolios

Diversification remains a cornerstone strategy to navigate the uncertainties of an election year. By spreading investments across various asset classes, sectors, and geographies, investors reduce exposure to any single risk. For instance, a well-diversified portfolio might include domestic and international equities, bonds, real estate, and commodities. This approach ensures that poor performance in one area can be offset by gains in another, maintaining overall portfolio stability. Additionally, incorporating assets with low correlation to traditional markets, such as gold or alternative investments, can provide further insulation against election-driven volatility. Diversification helps investors maintain steady growth while safeguarding against market swings influenced by political events.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.