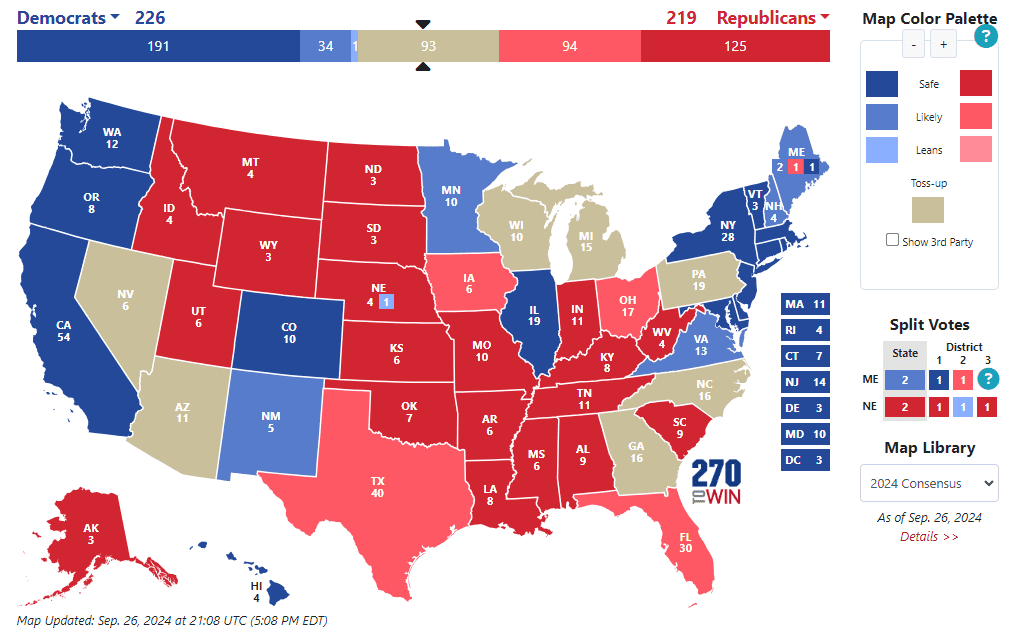

The 2024 United States presidential election features Vice President Kamala Harris running as the Democratic candidate, while former President Donald Trump is the Republican candidate seeking a second non-consecutive term. Trump's campaign has been marred by his conviction of 34 felonies related to falsifying business records. Based on the latest consensus forecast for the presidential election 2024, Harris has slightly higher chances over Trump to become the next US president.

Source: 270towin.com

How will the stock market react to a Trump presidency?

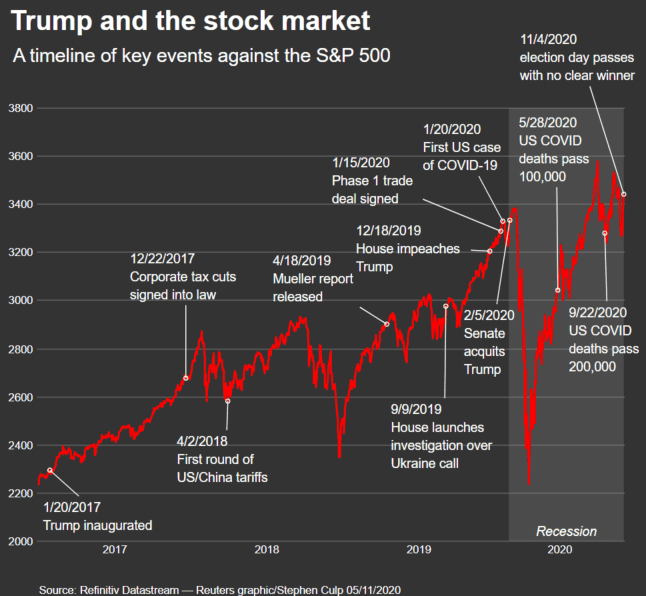

The stock market's reaction to a Trump presidency is shaped by his policies on deregulation, tax cuts, and tariffs. Historically, Trump’s pro-business stance, such as the 2017 Tax Cuts and Jobs Act, boosted investor confidence, leading to market rallies. However, his trade wars, especially with China, created volatility. Markets might initially react positively to Trump's election due to expectations of lower taxes and deregulation. Yet, concerns over trade policies and geopolitical tensions could temper enthusiasm. Sector-specific impacts are also notable, with traditional energy and financial sectors typically benefiting more under Trump’s policies, while sectors reliant on international trade might face challenges.

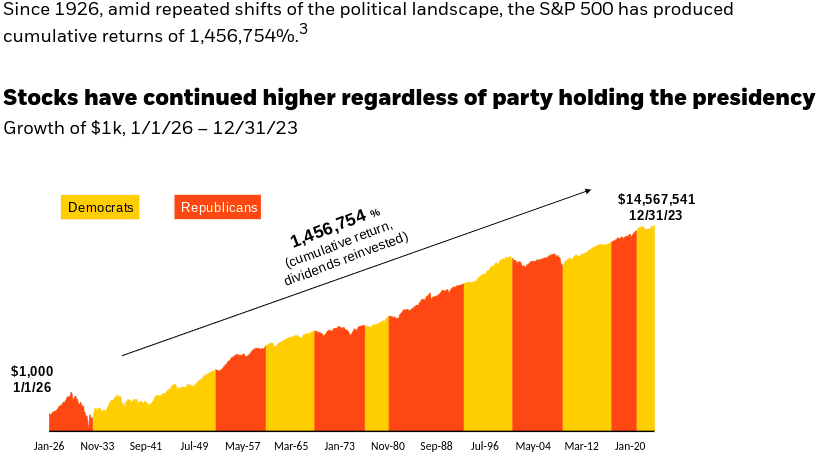

Source: blackrock.com

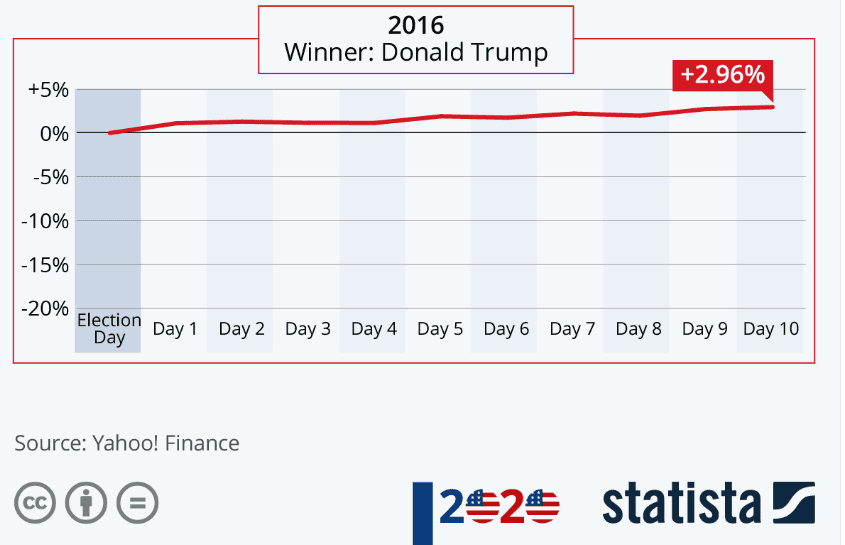

Following Trump’s 2016 election victory, the S&P 500 rose 1.1% the day after the election and continued to climb in the following days (+3% in next 10 days), reflecting investor optimism about his pro-business agenda. The market reaction was largely positive, driven by expectations of tax cuts and deregulation. However, the subsequent imposition of tariffs and trade disputes caused periods of increased market volatility. Historically, while the market initially reacted positively to Trump's election, the trade policies introduced during his tenure led to fluctuations, demonstrating that while elections can drive short-term market movements, policy implementations significantly influence long-term trends.

Source: statista.com

When is the best time for investing in stocks during an election year?

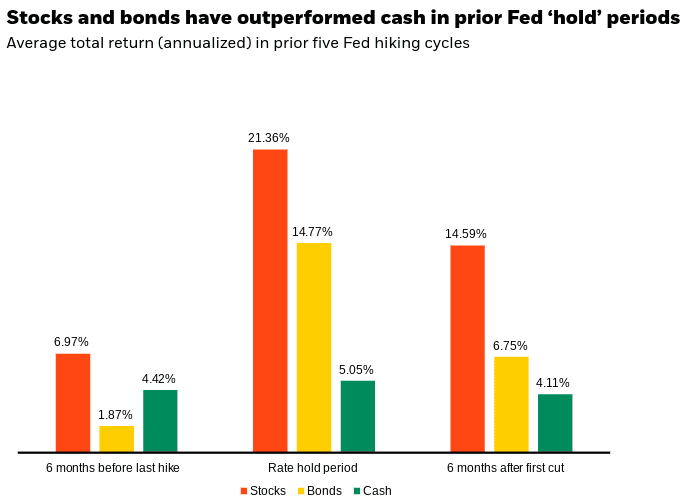

In an election year, August stands out as a strategic time for stock investment due to historical market patterns and economic factors. Typically, this period marks the transition between the Federal Reserve's last rate hike and its first rate cut, known as the "hold period." During these phases, bonds historically yield significant returns compared to cash, and stocks also perform robustly, surpassing both cash and bonds in returns. This is particularly pertinent in 2024, as expectations lean towards a Fed rate cut, making it opportune to shift out of cash holdings.

Source: blackrock.com

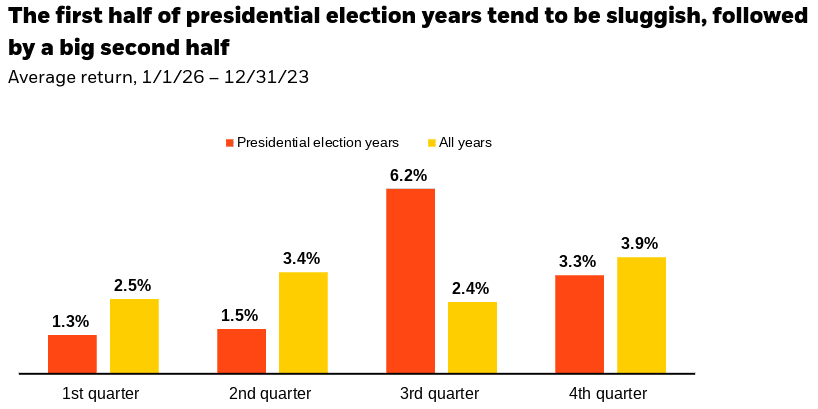

Moreover, election years historically favor stock investments despite political uncertainties. Since 1926, regardless of the party in power, the S&P 500 has shown substantial cumulative returns, reflecting the market's resilience to political shifts. Specifically, presidential election years tend to see a market rally in the latter half, with August often standing out as a positive month for the US stock market. This pattern holds true irrespective of electoral frontrunners, suggesting potential gains for one during this period.

Source: blackrock.com

Trump Presidency Major Economic Policies and Potential Impacts

Trump Presidency Major Economic Policies and Potential Impacts

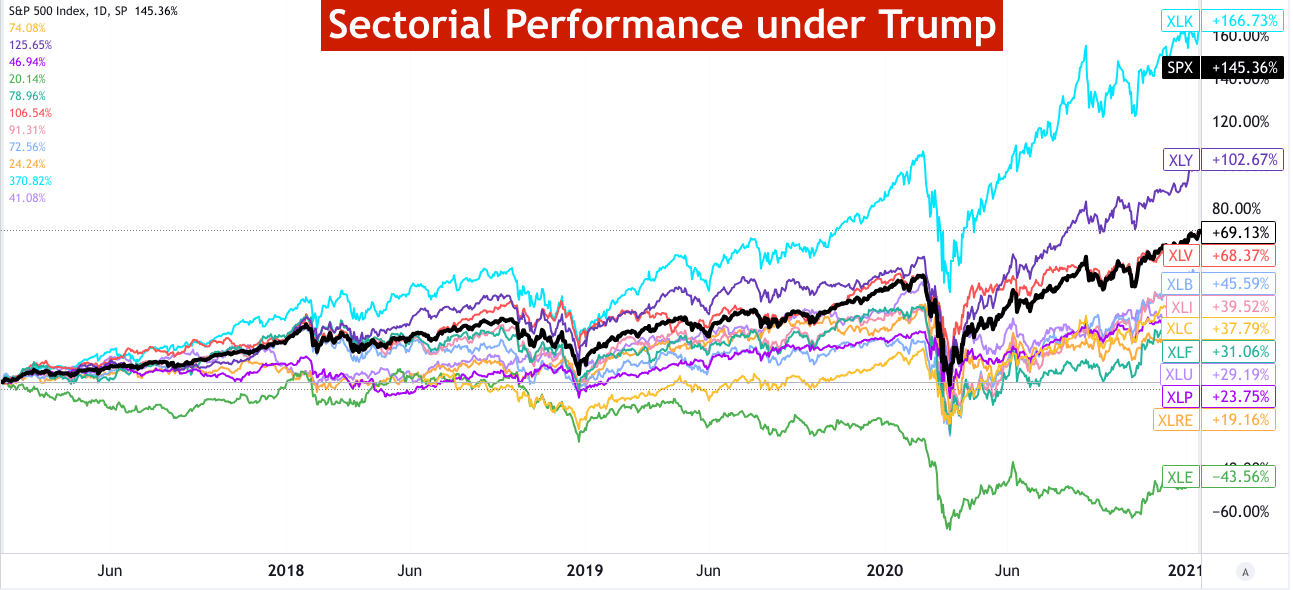

During his presidency from 2017 to 2021, Donald Trump implemented several major economic policies that had significant impacts on the U.S. economy and stock market. These policies primarily focused on tax reform, deregulation, and trade.

Tax Reform: One of the hallmark achievements of Trump's first term was the Tax Cuts and Jobs Act (TCJA) of 2017. This legislation reduced corporate tax rates from 35% to 21% and provided temporary tax cuts for individuals. The immediate effect of this tax reform was a boost in corporate profits, which in turn drove stock prices higher. The Dow Jones Industrial Average (DJIA) and the S&P 500 both experienced substantial gains, reflecting investor optimism about increased corporate earnings and economic growth prospects. However, critics argue that these tax cuts disproportionately benefited the wealthy and significantly increased the national deficit.

Deregulation: Another cornerstone of Trump’s economic policy was deregulation. His administration rolled back numerous regulations across various sectors, particularly in energy, financial services, and healthcare. These deregulatory measures were intended to reduce the burden on businesses, stimulate investment, and spur economic growth. The energy sector, for instance, benefited from relaxed environmental regulations, which allowed for increased oil and gas production. Financial services also saw a loosening of post-crisis regulatory constraints, which bolstered financial markets.

Trade and Tariffs: Trump adopted a confrontational trade policy, imposing tariffs on a wide range of imported goods, particularly from China. His administration aimed to reduce the trade deficit and promote domestic manufacturing through these measures. While some sectors, such as steel and aluminum, saw temporary gains, the tariffs also led to increased costs for manufacturers and consumers, contributing to economic uncertainty and market volatility.

Stock Market Under Trump: Overall, Trump's economic policies contributed to a bullish stock market environment. The DJIA and S&P 500 saw significant growth during his tenure, with the markets hitting record highs. However, this growth was accompanied by increased income inequality and a substantial rise in the federal deficit.

Source: reuters.com

Sectors Likely to Benefit from Trump's Policies

Several sectors were particularly poised to benefit from Trump's economic policies.

Technology: The tech sector experienced significant gains due to the favorable tax environment and deregulation. Reduced corporate tax rates allowed tech companies to repatriate overseas profits and invest in new technologies and innovation.

Energy: The deregulation of the energy sector spurred increased domestic oil and gas production. The rollback of environmental regulations also reduced operational costs for energy companies, contributing to higher profitability and stock performance.

Financial Services: Deregulatory measures in the financial sector provided a more favorable operating environment for banks and financial institutions. Reduced regulatory constraints allowed for greater lending and investment activities, boosting the sector's profitability.

Healthcare: While Trump's efforts to repeal the Affordable Care Act were unsuccessful, his administration's deregulatory approach benefited certain areas of the healthcare sector, particularly pharmaceuticals and medical devices, by reducing compliance costs and speeding up the approval process for new drugs and devices.

Potential Second-Term Economic Agenda for Trump Presidency

If re-elected, Trump plans to build on his first-term economic policies with an even more aggressive stance on trade and taxation.

Trade: Trump has proposed imposing tariffs on most imported goods, potentially as high as 10%, to boost domestic manufacturing and create jobs. He also plans to phase out Chinese imports of essential goods over four years, aiming to reduce dependence on China. While these measures may strengthen domestic industries, economists warn that they could lead to higher consumer prices and increased costs for businesses, potentially slowing economic growth.

Tax Cuts: Trump intends to extend the tax cuts from the TCJA, which are set to phase out in 2025. While this move aims to maintain lower tax rates for individuals and businesses, it risks exacerbating the federal deficit. The Congressional Budget Office estimates that making these tax cuts permanent could add $3.5 trillion to the national debt over the next decade.

Source: eiu.com

Energy: Trump’s second-term agenda includes further expansion of domestic fossil fuel production, encapsulated in his slogan "Drill, baby, drill." He plans to provide tax breaks for oil, gas, and coal producers and roll back portions of the Inflation Reduction Act, which supports clean energy initiatives. This approach could lower energy costs in the short term but poses significant environmental risks and may hinder progress toward renewable energy development.

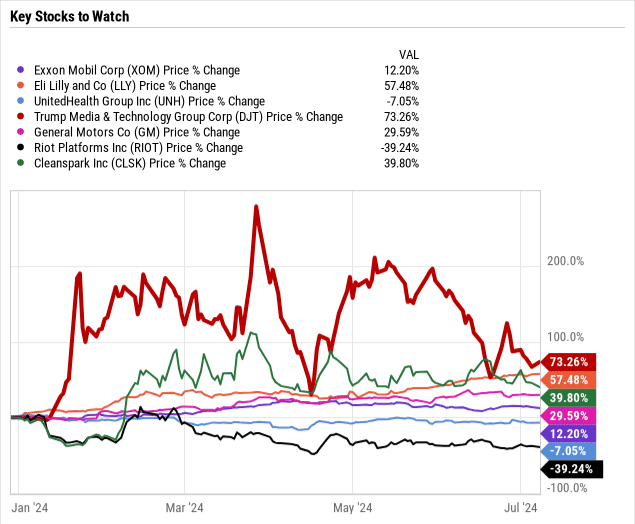

Stocks to Watch If Trump Wins the 2024 Presidential Election

If Donald Trump secures the 2024 presidential election, certain industries and stocks could see significant impacts based on his past policies and proposed agenda. Key sectors likely to benefit include finance, energy, healthcare, semiconductors, and technology. Here is a closer look at specific stocks within these industries:

Trump Trade: Key Stocks to Watch

1. Exxon Mobil (XOM): As a leading oil and gas company, Exxon Mobil stands to benefit from Trump's pro-fossil fuel policies. His administration's deregulatory stance and focus on increasing domestic energy production would likely favor Exxon Mobil's operations and profitability.

2. Eli Lilly and Company (LLY): Trump's approach to healthcare deregulation and emphasis on speeding up drug approval processes could benefit pharmaceutical giants like Eli Lilly. Reduced regulatory hurdles and favorable tax policies could enhance the company's growth and R&D capabilities.

3. UnitedHealth Group (UNH): As a major player in the healthcare sector, UnitedHealth Group could see positive impacts from Trump's healthcare policies aimed at reducing regulations and promoting competition in the insurance market.

4. Trump Media & Technology Group Corp (DJT): The company could benefit from a Trump re-election by potentially gaining increased user engagement and advertising revenue due to heightened media coverage and political activity, leveraging Trump's influence and base to expand its platform and audience reach.

5. General Motors (GM): GM might benefit from Trump's proposed tariffs on foreign imports and incentives for domestic manufacturing. The emphasis on American-made products and potential trade protections could support GM's market position.

6. Riot Platforms (RIOT): As a Bitcoin mining company, Riot Platforms could benefit from a favorable regulatory environment under a Trump administration, which might be less inclined to impose strict regulations on cryptocurrency operations.

7. CleanSpark (CLSK): Another Bitcoin mining company, CleanSpark could similarly gain from Trump's deregulatory stance and potential tax incentives for technology and energy-efficient operations.

Finance

JPMorgan & Chase (JPM), Bank of America (BAC), Wells Fargo (WFC): Major financial institutions like these could benefit from further deregulation in the financial sector. Trump's administration previously rolled back several Dodd-Frank regulations, which could continue, providing a more favorable environment for banks.

Discover Financial (DFS), KeyCorp (KEY), Synchrony Financial (SYF): These financial service companies could see growth from policies aimed at reducing regulatory burdens and promoting consumer spending through tax cuts and economic stimulus.

Energy

Exxon Mobil (XOM), Cheniere Energy (LNG), ConocoPhillips (COP): Trump's pro-energy policies would likely support these companies, particularly through deregulation and incentives for fossil fuel production and export.

Healthcare

Eli Lilly and Company (LLY), Merck (MRK), Humana (HUM), UnitedHealth Group (UNH): These healthcare companies might benefit from reduced regulatory constraints and favorable policies aimed at promoting innovation and reducing healthcare costs.

Semiconductor

Applied Materials (AMAT), KLA Corp (KLAC), Intel (INTC), Texas Instruments (TXN): The semiconductor industry could see benefits from Trump's focus on bolstering American manufacturing and technology innovation. Reduced regulations and potential tax incentives could support these companies' growth.

Others

Trump stocks: Companies like Trump Media & Technology (DJT), Phunware (PHUN), and Rumble (RUM) could see increased activity and investor interest due to their associations with Trump's brand and potential for policy favorability.

Mergers and Acquisitions (M&A): Firms such as Goldman Sachs (GS), Morgan Stanley (MS), Lazard (LAZ), and Evercore (EVR) might benefit from a pro-business environment that encourages corporate consolidation and expansion.

Tariffs: Companies like Ford (F), General Motors (GM), Nucor (NUE), and Steel Dynamics (STLD) could gain from protective tariffs aimed at boosting domestic production and reducing foreign competition.

Agriculture: Deere and Co (DE) and Tractor Supply Company (TSCO) might benefit from policies supporting American farmers and promoting agricultural exports.

Prison: Geo Group (GEO) and CoreCivic (CXW) could see increased contracts and support from a law-and-order-focused administration.

Bitcoin Mining: Marathon Digital (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) could thrive in a deregulatory environment with potential tax incentives for technological innovation and energy efficiency.

Investment Strategies for the 2024 Election

Diversification

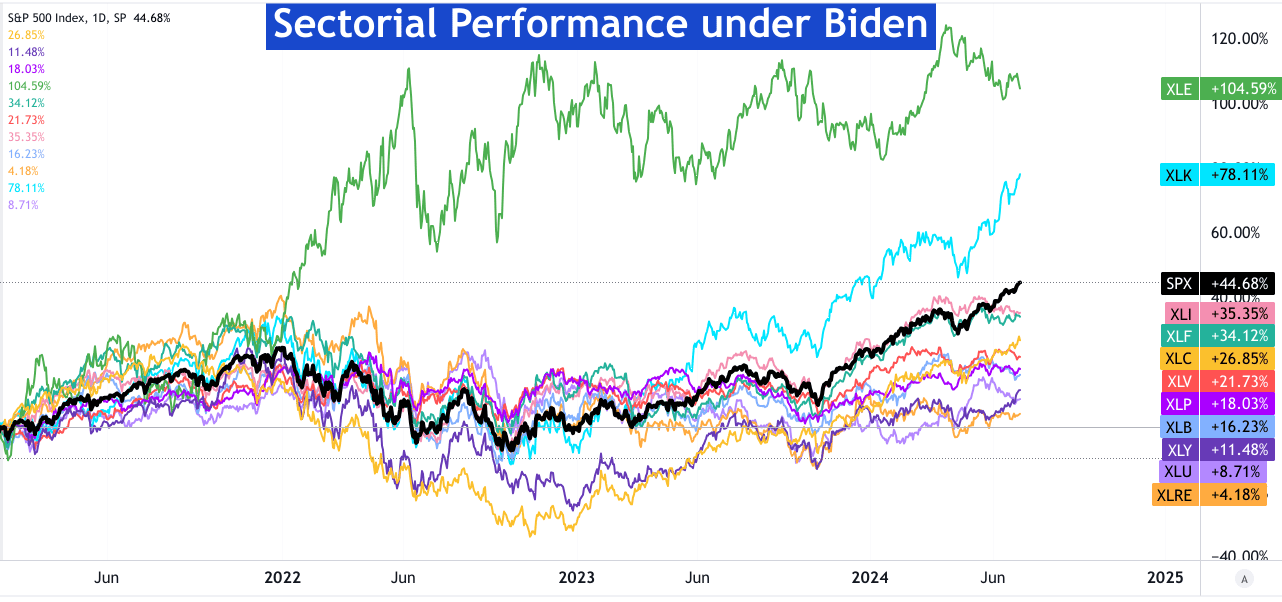

To mitigate political risk, diversification is essential. one should spread their portfolios across various asset classes, industries, and geographic regions. This strategy reduces reliance on any single sector that might be significantly impacted by political changes. For example, if policy shifts favor certain industries like defense or fossil fuels, a diversified portfolio will help offset potential losses in sectors that might suffer (see XLE below), such as green energy or technology. Including bonds, real estate, commodities, and international stocks can further shield against domestic political volatility, ensuring that the portfolio remains resilient under different political scenarios.

Source: tradingview.com

Source: tradingview.com

Long-term vs. Short-term Investments

Balancing long-term goals with short-term market movements is crucial during election periods. Long-term investments should focus on fundamentally strong companies with robust business models and growth prospects that can weather political changes. However, maintaining a portion of the portfolio in short-term investments allows for agility in responding to immediate market reactions and volatility often associated with elections. This dual approach ensures that one can capitalize on short-term opportunities or hedge risks while not deviating from their overarching financial goals. For instance, while long-term investments might include blue-chip stocks or index funds, short-term strategies might involve tactical trading or holding cash reserves to exploit market dips or surges.

Staying Informed and Flexible

Staying updated with political and economic developments is critical for adapting investment strategies based on new information. Regularly monitoring news, policy announcements, and economic indicators enables one to anticipate and react to changes that may affect their portfolios. Flexibility is key; being willing to adjust asset allocations, sector exposures, or even the overall investment strategy in response to political developments can enhance returns and manage risk. Utilizing financial news platforms, subscribing to economic analysis, and possibly engaging with financial advisors can provide the necessary insights and timely updates. In essence, a proactive and informed approach allows one to navigate the uncertainties of the election period with greater confidence and strategic foresight.

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.