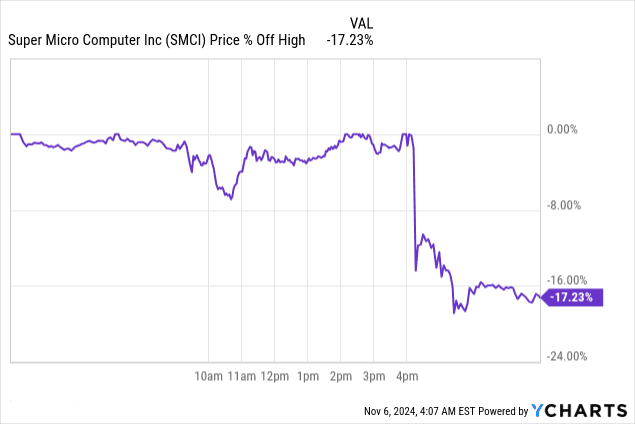

Super Micro Computer (SMCI) recently announced Q1 2025 earnings on November 5, highlighting robust revenue growth fueled by AI demand and innovation, though EPS fell short of expectations. AI-related products, especially Direct Liquid Cooling (DLC) systems, led revenue, marking a significant nearly 2X annual growth, underscored by the deployment of the world’s largest DLC AI supercluster. However, profitability faces pressures from high operating expenses. The stock dropped 17% post-earnings due to unresolved governance issues, auditor resignation, and potential Nasdaq delisting.

Source: Ycharts.com

I. SMCI Earnings Overview Q1 2025

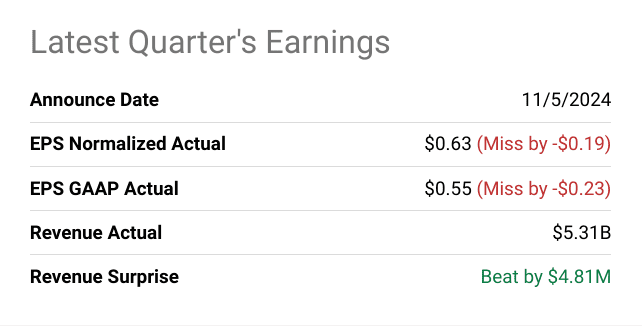

Super Micro Computer, Inc. (SMCI) reported Q1 2025 earnings on November 5, 2024, showcasing significant year-over-year revenue growth driven by AI demands and new product innovations, despite missing earnings per share (EPS) expectations. As per seekingalpha.com, Normalized EPS reached $0.63, missing estimates by $0.19, while GAAP EPS came in at $0.55, falling short by $0.23. Actual revenue totaled $5.31 billion, slightly surpassing forecasts with a revenue beat of $4.81 million. Year-over-year, net income increased, with a GAAP net income estimate ranging from $433 million to $443 million, compared to the previous year’s $216 million. However, EPS miss indicates profit challenges amid higher operational costs and expenses.

SMCI Stock Earnings Q1 2025 Revenue Drivers

The primary revenue sources were server systems, storage solutions, and software sales targeting key sectors such as data centers, cloud computing, and AI-driven solutions. Demand for AI-related products, particularly direct liquid-cooled (DLC) AI GPU platforms, drove over 70% of revenue across enterprise and cloud markets, contributing to an estimated $5.9 billion to $6 billion in preliminary Q1 revenue (company estimates) against the guidance range of $6.0 billion to $7.0 billion. This represents a substantial 181% year-over-year growth. Segment-specific highlights include the rapid adoption of DLC systems, where Super Micro deployed the world’s largest DLC AI supercluster, integrated with 100,000 NVIDIA GPUs. Additionally, SMCI’s proprietary Datacenter Building Block Solutions (DCBBS) are accelerating AI-driven data center builds, significantly reducing deployment times. The ongoing global shift toward sustainable, liquid-cooled data centers underpins the projected 10x increase in DLC market share.

Source: seekingalpha.com

Profitability Analysis

Profitability metrics saw improvements in gross and operating margins due to favorable product and customer mix and improved manufacturing efficiencies. Q1 non-GAAP gross margin was approximately 13.3%, up from 11.3% in the previous quarter, while the operating margin reached around 9.9%, an increase from 7.8% in Q4. Cost efficiencies were enhanced by streamlined supply chain dynamics, which included a decrease in expedited shipment costs for DLC components. Operating expenses, however, remained high, influenced by $67 million in stock-based compensation, which, though excluded from non-GAAP measures, pressures GAAP net income. Interest expense added $17 million to quarterly costs, though partially offset by $8 million in income. The closing cash position was $2.1 billion, with total debt at $2.3 billion, resulting in a net cash position of negative $0.2 billion, improved from the prior quarter’s negative $0.5 billion.

Strategic and Operational Developments

Operationally, SMCI has made significant advances in scaling production, particularly for DLC solutions, leveraging new manufacturing facilities. The upcoming Malaysia campus and expanded Silicon Valley facility aim to increase production capacity to over 1,500 DLC GPU racks monthly, with expansion plans in Europe and Taiwan to meet escalating demand. On the innovation front, the Super Cloud Composer (SCC) software, developed to manage DLC data center infrastructures, supports complex workload demands, further strengthening Super Micro’s DLC product line.

II. Product & Market Dynamics

New Products & Services

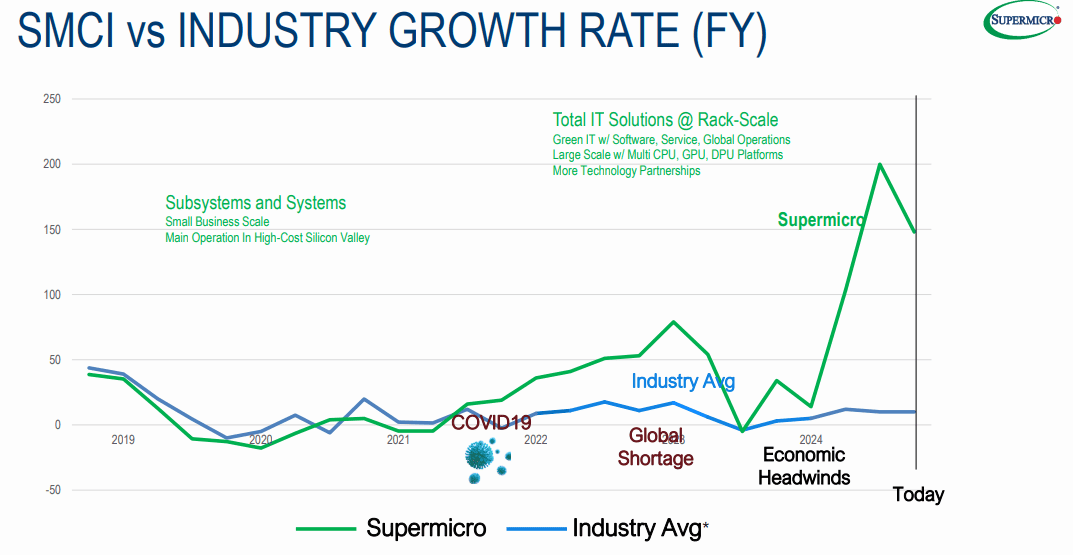

Super Micro’s recent launches, including advanced AI-focused products like the Datacenter Building Block Solutions (DCBBS) and Direct Liquid Cooling (DLC) systems, address the surging demand for AI server infrastructure. The company deployed the largest AI supercluster, equipped with 100,000 NVIDIA GPUs, underlining its capability to manage high-demand, complex AI deployments. Such offerings are highly relevant as AI continues to drive global server revenue growth, which saw a 35% year-over-year increase in Q2 2024, totaling $45.4 billion. Super Micro’s DLC solutions, projected to see a 10x increase in adoption, are a competitive advantage, helping customers cut operational costs and improve sustainability by reducing power consumption in AI server environments. Expansion in emerging regions is further bolstered by new manufacturing facilities in Malaysia and expansion in Silicon Valley, Europe, and Taiwan, supporting the growing AI market and solidifying Super Micro’s global production network.

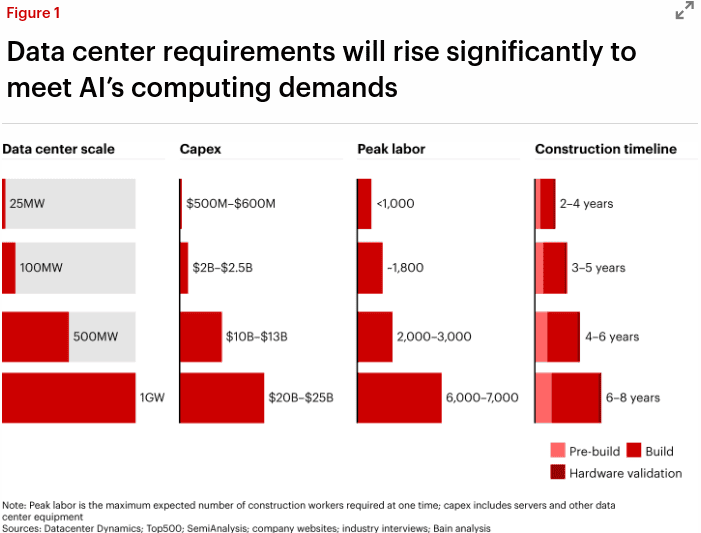

Source: bain.com

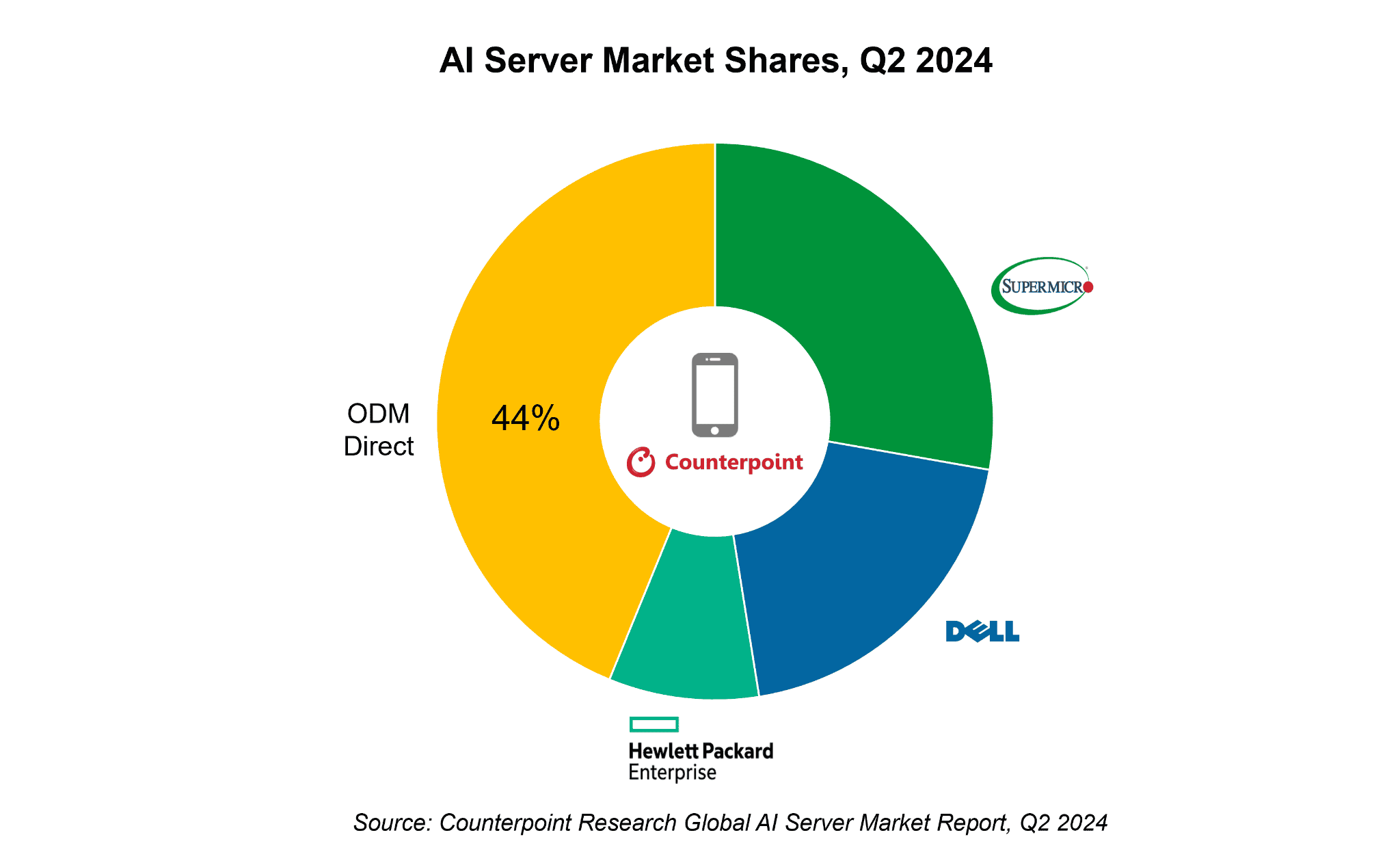

Competitive Landscape

The AI server market is notably competitive, with Super Micro vying for dominance, with ~28% market share, against heavyweights like Dell Technologies and Hewlett Packard Enterprise (HPE). While Super Micro, Dell and HPE control approximately +56% of the AI server market each, they face intense competition from "ODM direct" (44% market share) sales driven by tech giants like Microsoft, Amazon, Google, and Meta, which prefer custom-made server solutions. Super Micro's 181% year-over-year revenue growth in fiscal Q1 2025, driven by AI-related demand, highlights its upward trajectory amidst this competitive pressure. Additionally, Super Micro’s pricing strategy emphasizes cost-efficiency, especially with DLC offerings that lower operational costs through energy efficiency. In comparison, competitors like Dell and HPE are also increasing their focus on AI servers but have not scaled DLC solutions to the same extent, potentially offering Super Micro an edge in the high-performance, energy-conscious segment.

The DLC market is set for robust expansion, with 15-30% of new data centers expected to adopt liquid cooling within the next 12 months. Super Micro’s Super Cloud Composer (SCC), a management tool tailored for DLC environments, enhances its value proposition in AI server markets, allowing efficient data center management. The company’s projected Q2 fiscal 2025 revenue of $5.5-$6.1 billion, albeit with slight margin adjustments, reaffirms its competitive position as it capitalizes on AI-driven infrastructure needs while navigating ongoing challenges with financial reporting and auditor transitions.

Source: counterpointresearch.com

III. Super Micro Computer Stock Forecast

SMCI Stock Price Performance Post-Earnings

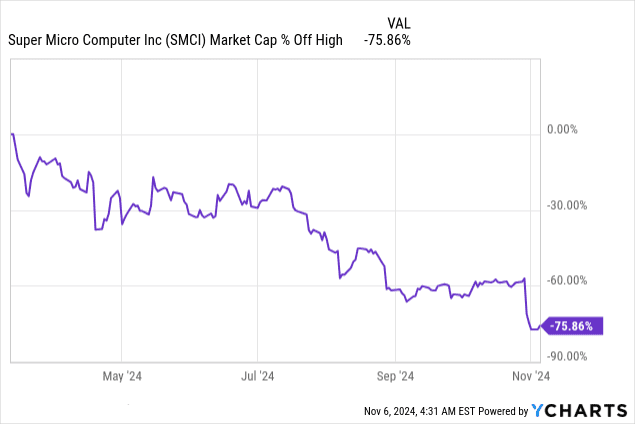

Following Super Micro’s recent earnings report, the stock saw a sharp 17% decline, reacting to weak guidance, unresolved corporate governance issues, and ongoing delays in filing annual results. The company’s preliminary Q1 revenue of $5.9-$6 billion missed analyst estimates of $6.45 billion, despite a robust 181% year-over-year increase. This discrepancy reflects underlying investor concerns about Super Micro's governance and operational stability, amplified by the recent resignation of Ernst & Young, its auditor. Additionally, with potential Nasdaq delisting if annual filings are not submitted by mid-November, investors responded negatively to the lack of a clear timetable for resolution. Over the last year, the stock's volatility is significant, peaking at $118.81 in March before plummeting nearly 76%, wiping out over $55 billion in market capitalization.

Source: Ycharts.com

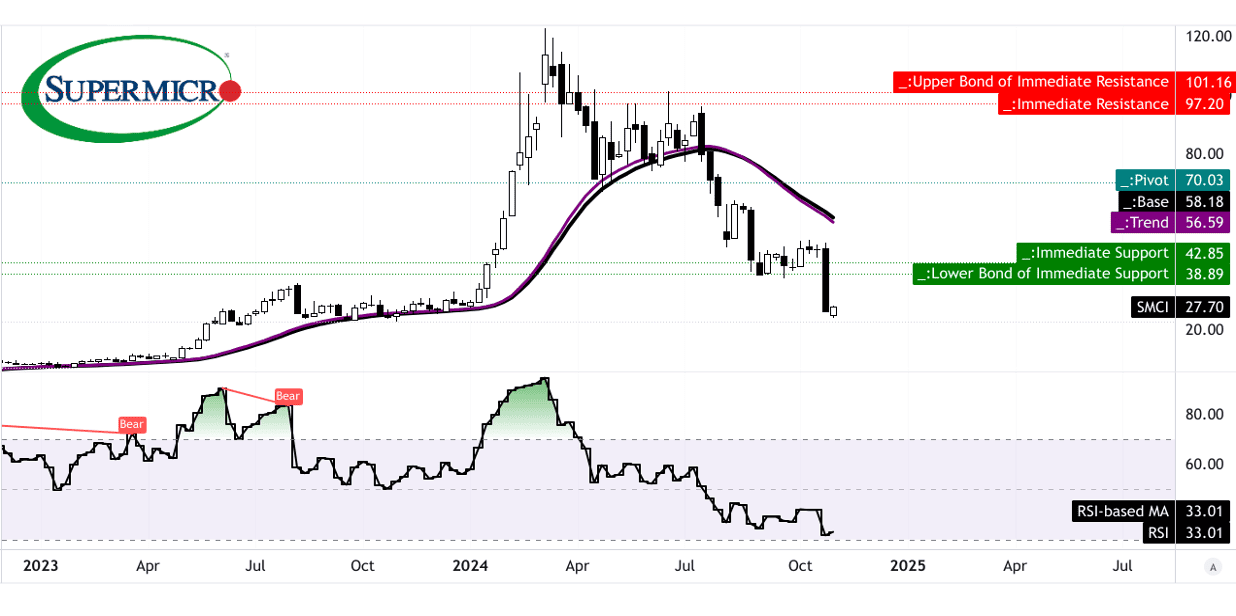

SMCI Stock Forecast

Technical indicators suggest mixed expectations for Super Micro’s stock performance. The Relative Strength Index (RSI) stands at 33.01, a level typically indicating oversold conditions. However, there is no bullish divergence, and the RSI trend remains downward, implying continued weakness. Current stock prices at $27.70 trail both the modified exponential moving averages of $56.59 (trendline) and $58.18 (baseline), signaling a bearish outlook unless momentum shifts significantly.

Three primary scenarios have emerged for Super Micro’s price target by the end of 2024:

- Average Price Target ($70) – This target is based on the potential for a gradual recovery, supported by a change in polarity (price reversal) projected through Fibonacci retracement levels. Achieving this would require Super Micro to stabilize its governance issues and meet earnings expectations consistently.

- Optimistic Price Target ($97) – This scenario hinges on strong upward price momentum and a favorable reception of new product lines, particularly if supply chain constraints with Nvidia are resolved. Achieving this would necessitate a renewed investor confidence and robust sales recovery.

- Pessimistic Price Target ($5.30) – If downward momentum persists, particularly under unresolved governance concerns or delayed filings, the stock could fall to this level based on continued bearish momentum in Fibonacci retracement projections.

Source: tradingview.com

IV. SMCI Stock Forecast: Future Outlook

Management's growth forecasts and strategic initiatives

The future outlook for Super Micro Computer (SMCI) shows mixed but cautiously optimistic growth prospects. Despite recent corporate governance challenges, including auditor turnover and potential Nasdaq delisting, SMCI’s management is emphasizing growth in AI-driven products, especially those leveraging Direct Liquid Cooling (DLC) technology. CEO Charles Liang highlighted key strategic initiatives, notably SMCI’s deployment of NVIDIA GPU-based AI superclusters, which bolsters the company’s positioning in the AI infrastructure market.

Source: Investor Presentation

Looking ahead, SMCI forecasts Q2 2025 revenue in the range of $5.5 billion to $6.1 billion, though this guidance falls short of analyst expectations of $6.86 billion, reflecting potential near-term headwinds. Adjusted EPS is expected to range between $0.56 and $0.65, again lower than analyst predictions. Despite these shortfalls, SMCI has been actively scaling production facilities in locations like Malaysia and Silicon Valley to meet anticipated demand growth. The expansion aligns with industry trends; according to Bain & Company, demand for data center components could rise by 30% by 2026 due to the increasing computational power required for AI applications.

Market Trends

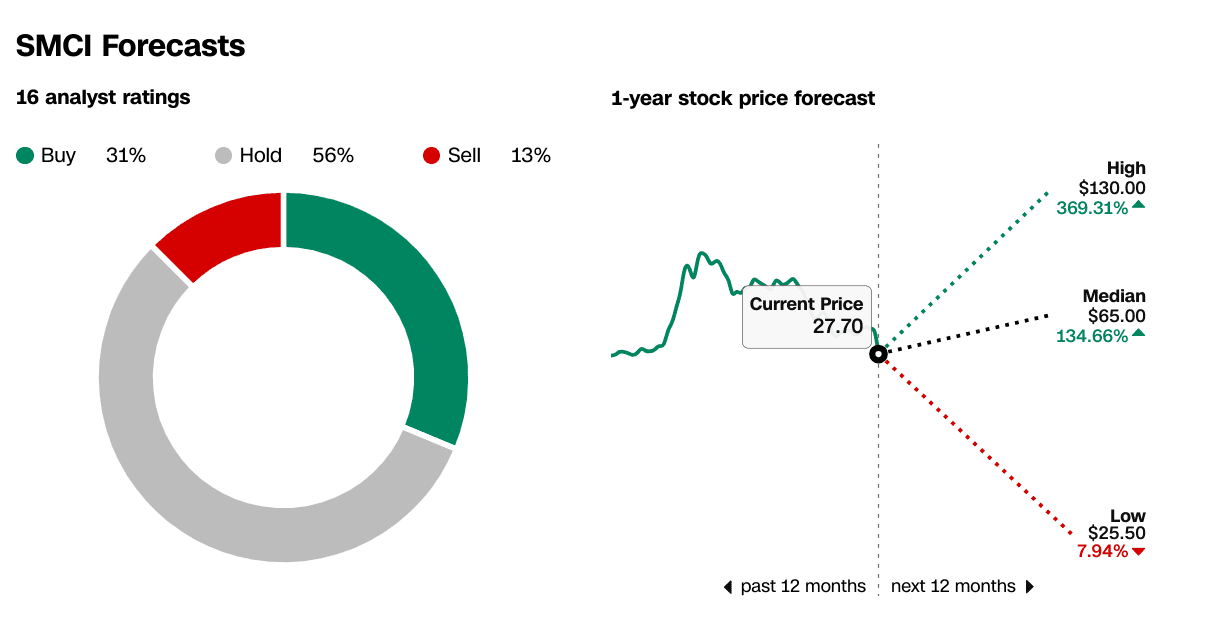

SMCI’s strategic focus on DLC technology may align well with market needs, as Bain projects that 15-30% of new data centers will adopt liquid cooling within the next year. Analyst sentiment remains mixed, with 31% issuing “buy” ratings, 56% holding, and 13% selling. Price forecasts range widely, with a high of $130 (369.31% potential upside) and a low of $25.50. The stock’s recent price of $27.70 is near this lower boundary, reflecting market concerns about governance and competitive pressures. Despite uncertainties, SMCI’s focus on DLC and AI hardware positions it to benefit from the projected 40–55% annual growth in the AI hardware market. However, challenges in sustaining high revenue growth amidst operational adjustments and industry supply chain pressures will likely influence near-term stock performance and investor confidence.

Source:CNN.com

Source:CNN.com