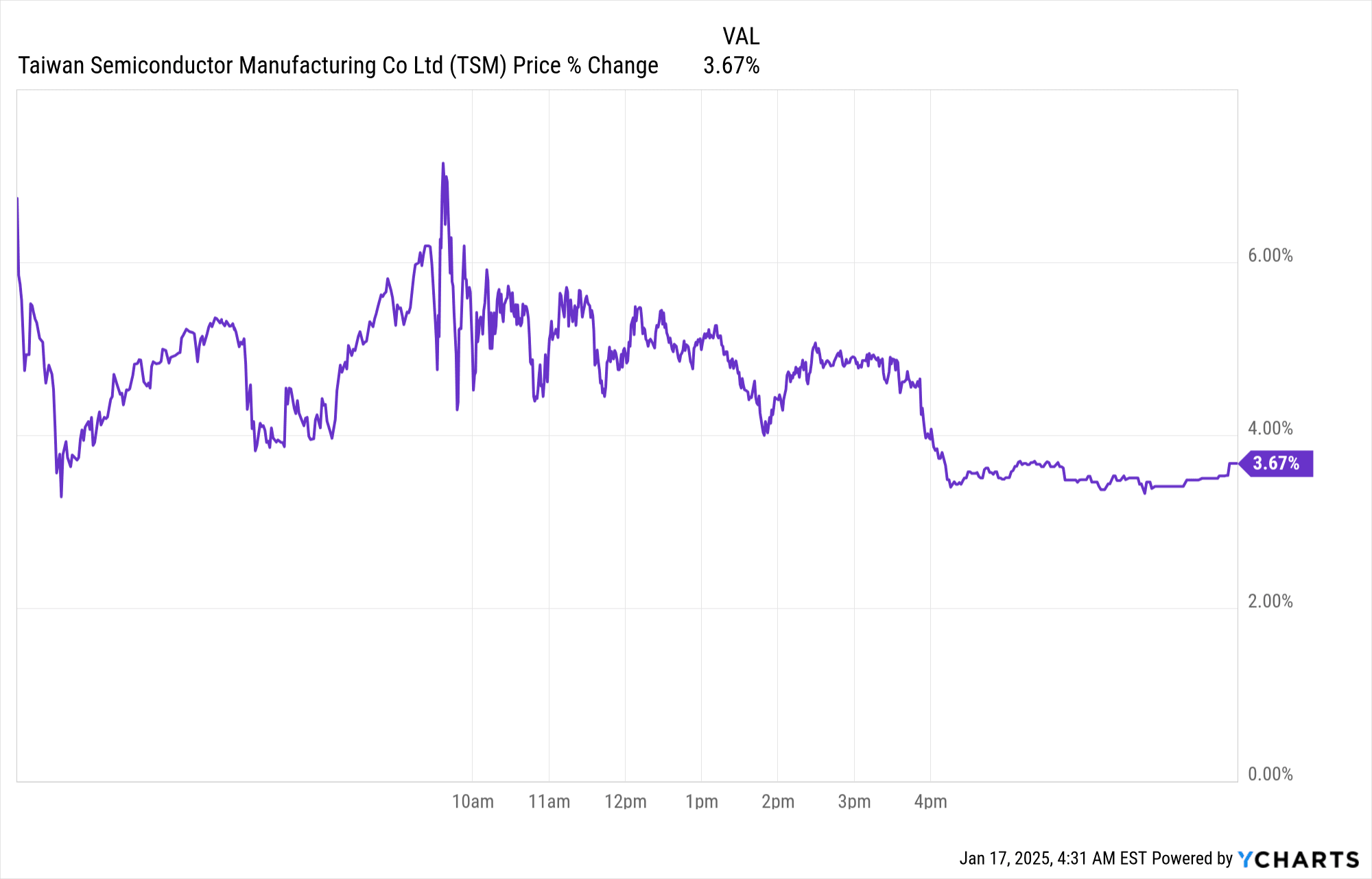

TSMC’s Q4 2024 earnings led to a ~4% stock price rise on the day following results, reflecting strong financial performance. Revenue exceeded estimates by $384.96 million, while EPS surpassed by $0.02, driven by 14.3% sequential revenue growth. Improved gross (59%) and operating margins (49%) further boosted investor confidence, supported by robust demand for advanced 3nm and HPC technologies.

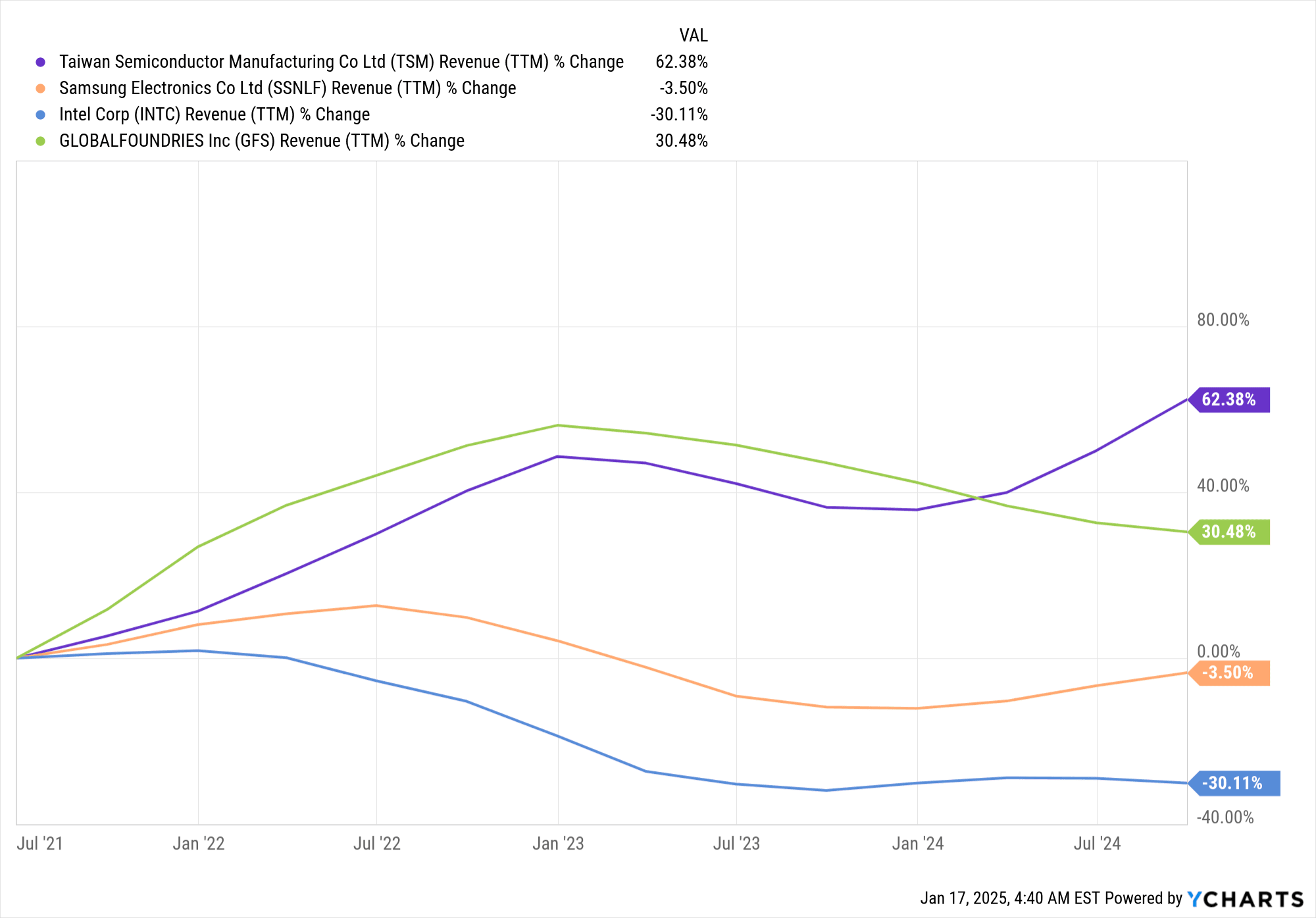

Source: Ycharts

I. TSM Earnings Overview Q4 2024

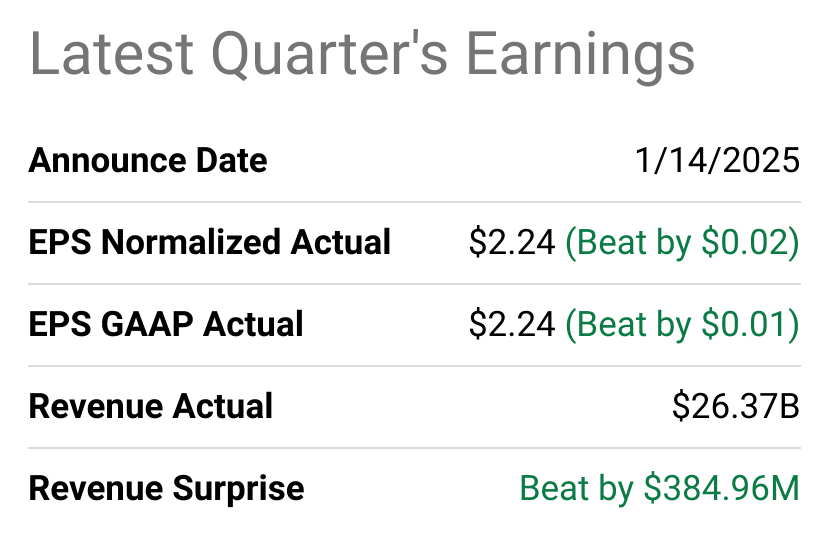

TSM reported revenue of $26.37 billion for Q4 2024, exceeding expectations by $384.96 million, with a sequential increase of 14.3%. Normalized EPS was $2.24, surpassing estimates by $0.02, reflecting improved operational efficiency. GAAP EPS also reached $2.24, slightly beating projections by $0.01. Net income exhibited strong year-over-year growth due to robust demand for advanced technologies.

Source: seekingalpha.com

Gross margin improved sequentially by 1.2 percentage points to 59%, driven by higher capacity utilization and productivity gains. Operating margin increased by 1.5 points to 49%, demonstrating effective cost management. TSM ended 2024 with a full-year gross margin of 56.1% (up 1.7 percentage points YoY) and operating margin of 45.7% (up 3.1 points YoY), indicating strengthened profitability.

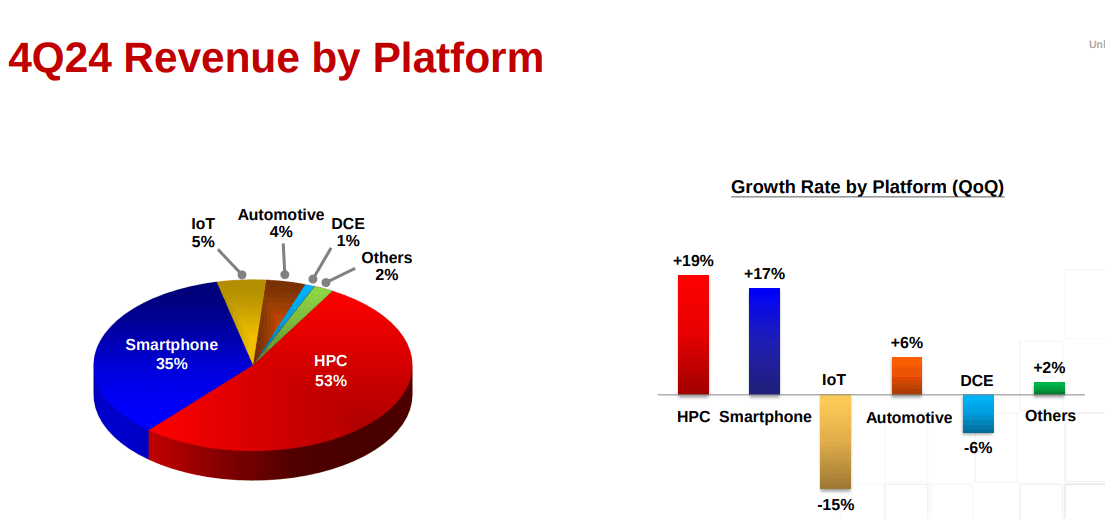

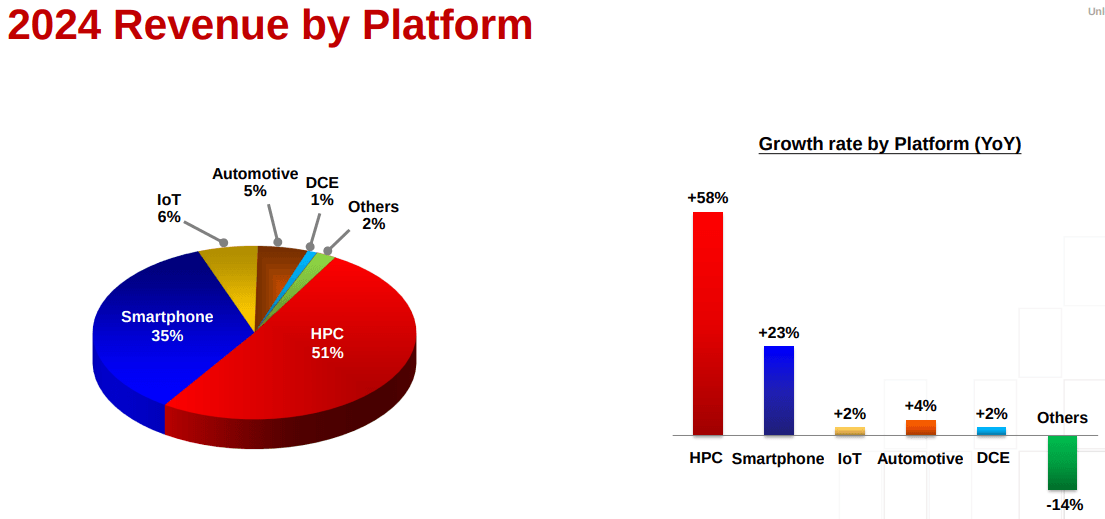

Advanced technologies (7nm and below) contributed 74% of wafer revenue, with 3nm alone accounting for 26% in Q4. Over 2024, advanced technologies grew to 69% of wafer revenue, up from 58% in 2023. The High-Performance Computing (HPC) platform led growth, increasing 19% sequentially and accounting for 53% of Q4 revenue. Smartphones grew 17% sequentially to 35% of revenue. However, IoT decreased by 15%, contributing 5%, while Automotive grew modestly by 6% to 4%. For the year, HPC revenue surged by 58%, reflecting robust AI and 5G demand.

TSM ended Q4 with $74 billion in cash and marketable securities. Operating cash flow for the quarter reached TWD620 billion, with capital expenditures at TWD362 billion ($11.2 billion USD). Free cash flow totaled TWD870 billion for the year, supporting a 24.5% YoY increase in dividends to TWD363 billion.

Source: Q4 2024 Presentation

II. TSMC Product & Market Dynamics

New Products & Innovations

TSMC’s 2024 results emphasize its robust technological advancements, with 3nm process technology contributing 18% of wafer revenue and 5nm contributing 34%. Advanced nodes (7nm and below) constituted 69% of wafer revenue, up from 58% in 2023, showcasing a 11%-point leap driven by demand in high-performance computing (HPC) and smartphones. The introduction of N2 (2nm) technology, scheduled for volume production in 2H 2025, promises 10–15% speed improvement or 20–30% power efficiency gains over N3E. Its extension, N2P, and the A16 technology—set for 2026—demonstrate TSMC’s commitment to innovation, offering chip density and energy efficiency boosts critical for HPC and smartphone applications. These technologies underline TSMC's dominance in semiconductor packaging and sustainable manufacturing, critical for AI and 5G applications.

Source: Q4 2024 Presentation

TSMC's innovation pipeline aligns with market needs, as seen in the HPC segment, which grew 58% YoY and contributed 51% of 2024 revenue. AI accelerators, accounting for mid-teens percentage of 2024 revenue, are projected to double in 2025. Smartphone platform revenues also increased 23% YoY, indicating positive market reception for TSMC’s leading-edge nodes.

Source: Q4 2024 Presentation

Competitive Landscape

TSMC outperformed competitors like Samsung, Intel, and GlobalFoundries in 2024, with a 30% YoY revenue increase to $90 billion. Gross margins improved to 56.1% despite higher costs from overseas fabs and the 3nm ramp-up. While Samsung’s efforts in 3nm Gate-All-Around (GAA) transistors highlight its competitive stance, TSMC’s yield stability and scalability in FinFET nodes provide a clear edge. Intel's delayed entry into advanced nodes like 3nm continues to cede market share to TSMC, especially in HPC and AI-related markets. GlobalFoundries and UMC, focusing on mature nodes, do not pose direct competition for advanced technologies.

TSMC's pricing strategy reflects its technological leadership. While higher overseas fab costs (adding up to 2-3% margin dilution in 2025) are a concern, TSMC leverages economies of scale and operational excellence to maintain margins above 53%. Market share gains in HPC (51% of 2024 revenue) underscore its leadership in AI-driven industries. Competitors like Intel have struggled to match TSMC’s pricing competitiveness at advanced nodes, further consolidating TSMC’s position as a foundry leader. TSMC’s investments, $38-42 billion in 2025, primarily target advanced nodes and packaging, underscoring its intent to maintain market leadership amidst evolving semiconductor dynamics.

Source: Ycharts

III. TSM Stock Forecast 2025

TSMC Stock Forecast Technical Analysis

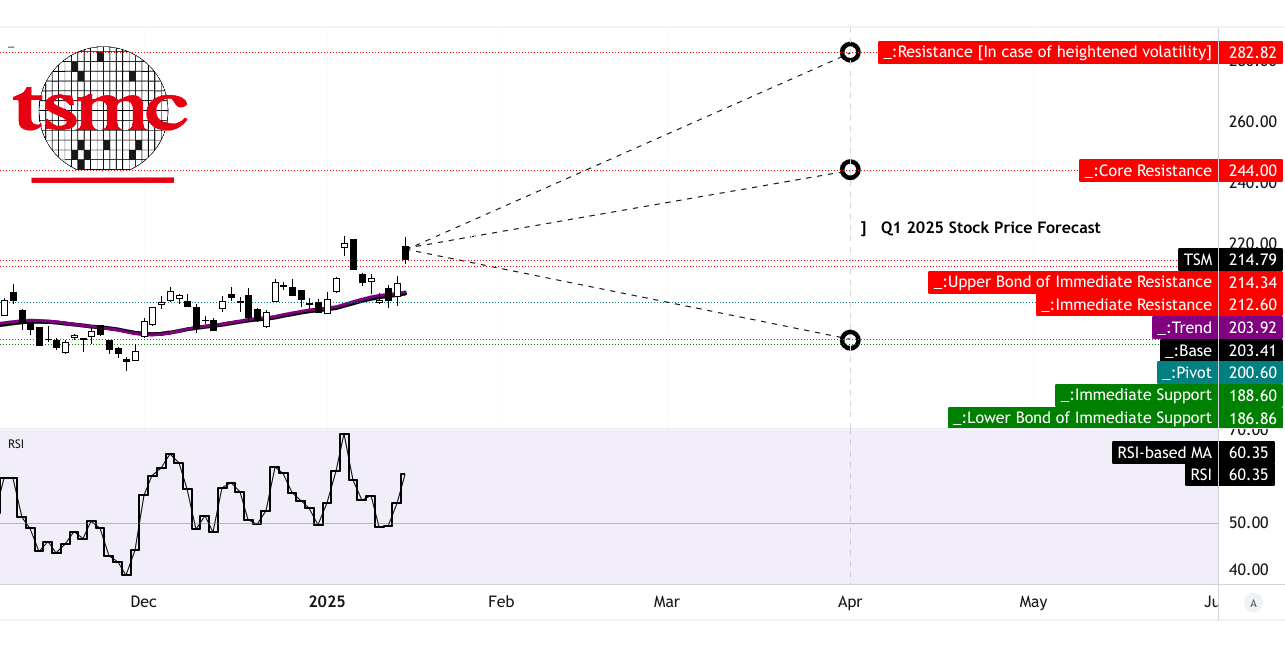

TSM stock is trading at $214.79, showing strong upward momentum as it remains above the trendline ($203.92) and baseline ($203.41), both based on modified exponential moving averages. The Relative Strength Index (RSI) of 60.35 indicates moderate upward pressure without signaling an overbought condition. The RSI line is trending upward, and a bullish divergence is present, reinforcing the likelihood of further price increases. Additionally, the stock is navigating a horizontal price channel pivoting at $200.60, with Fibonacci retracement and extension levels supporting optimistic projections.

By the end of Q1 2025, analysts have set several price targets for TSM. The average TSM price target stands at $244.00, representing a 13.6% increase from its current value, supported by mid- to short-term price momentum. An optimistic scenario sees the stock reaching $283.00, a 31.7% rise, assuming sustained bullish momentum and strong investor confidence. On the other hand, a pessimistic forecast estimates the price could decline to $188.00, a 12.5% drop, if bearish momentum within the current swing prevails. These targets highlight both the potential for growth and the risks tied to broader market volatility.

Source: tradingview.com

TSM Stock Forecast: Market Analysts' Expectations & Ratings

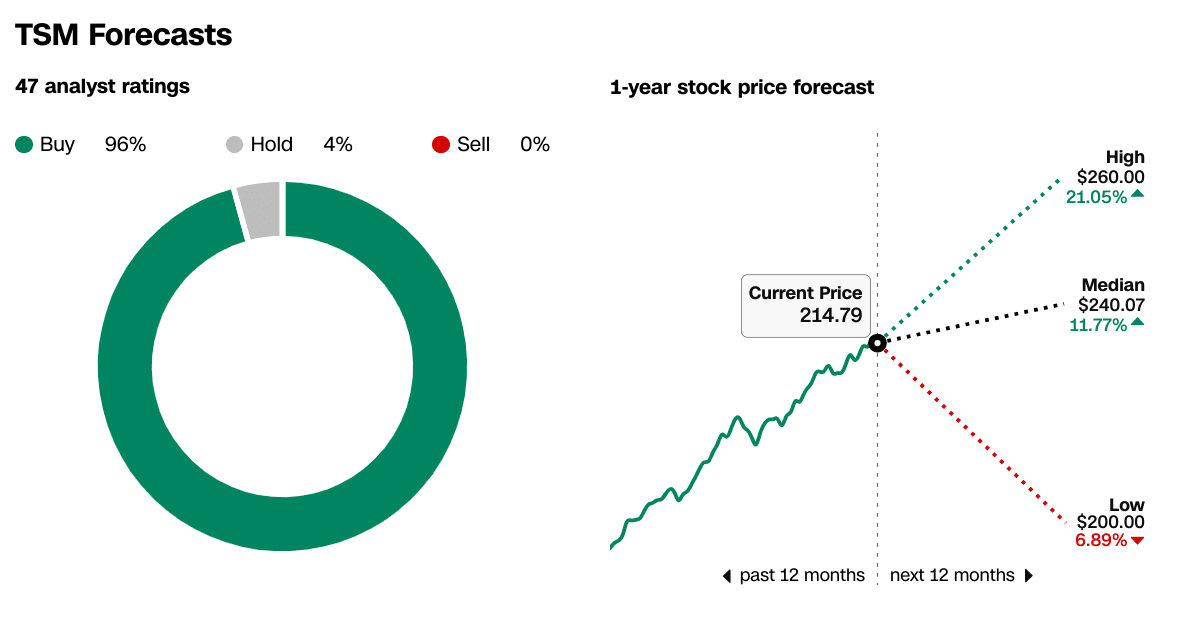

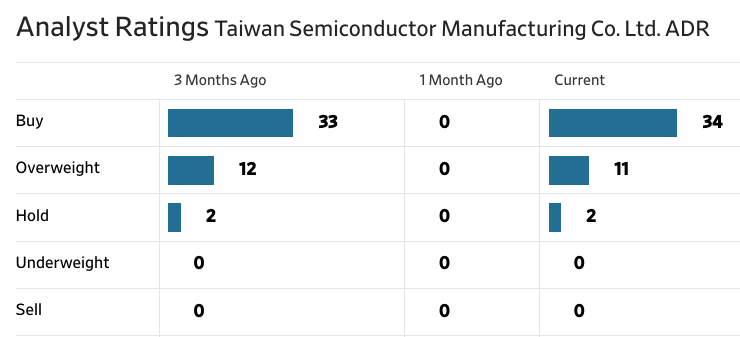

The stock enjoys widespread confidence among analysts, with 96% assigning it a "Buy" rating and 4% recommending a "Hold." Importantly, there are no "Sell" or "Underweight" ratings, underscoring the consensus on TSM's robust outlook. Over the next 12 months, the median price target is $240.07, reflecting an 11.77% upside, while the high and low targets are $260 (+21.05%) and $200 (-6.89%), respectively. This range suggests solid optimism tempered by caution regarding potential market fluctuations.

Recent trends in analyst recommendations further reinforce the bullish sentiment. Over the past three months, "Buy" ratings increased from 33 to 34, while "Overweight" ratings saw a slight decline from 12 to 11. "Hold" ratings remained constant, indicating consistent caution among a small minority. These adjustments reflect analysts' growing confidence in TSM's ability to capitalize on its leadership in semiconductor technology and anticipated growth in AI and high-performance computing demand.

Source: CNN.com

Source: WSJ.com

IV. TSMC Stock Forecast: Future Outlook

Management's growth forecasts and strategic initiative

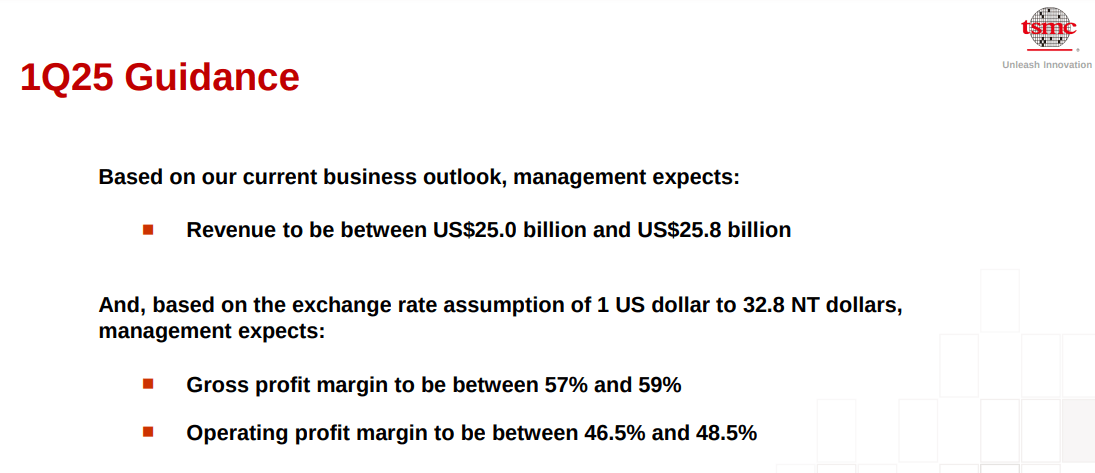

TSMC’s future outlook is bolstered by its robust management strategies and a favorable market landscape. The company’s management is prioritizing technological leadership and capacity expansion to sustain growth. For Q1 2025, TSMC projects revenue between $25.0 billion and $25.8 billion, reflecting a YoY increase of 34.7% at the midpoint. Gross profit margins are expected to range between 57% and 59%, while operating margins are forecasted at 46.5% to 48.5%. These figures highlight operational efficiency despite potential headwinds, including ramp-up costs for 2nm technology and overseas fab expansion.

The company’s 2025 CapEx budget is set between $38 billion and $42 billion, with 70% allocated to advanced process technologies. This significant investment underscores TSMC’s commitment to meeting escalating demand for cutting-edge nodes, including its 3nm and upcoming 2nm processes. Advanced technologies accounted for 74% of TSMC’s wafer revenue in Q4 2024, with 3nm technology alone contributing 26%. Management projects a gradual reduction in 3nm dilution costs in 2025, bolstered by strong customer demand.

Source: Q4 2024 Presentation

Market Trends

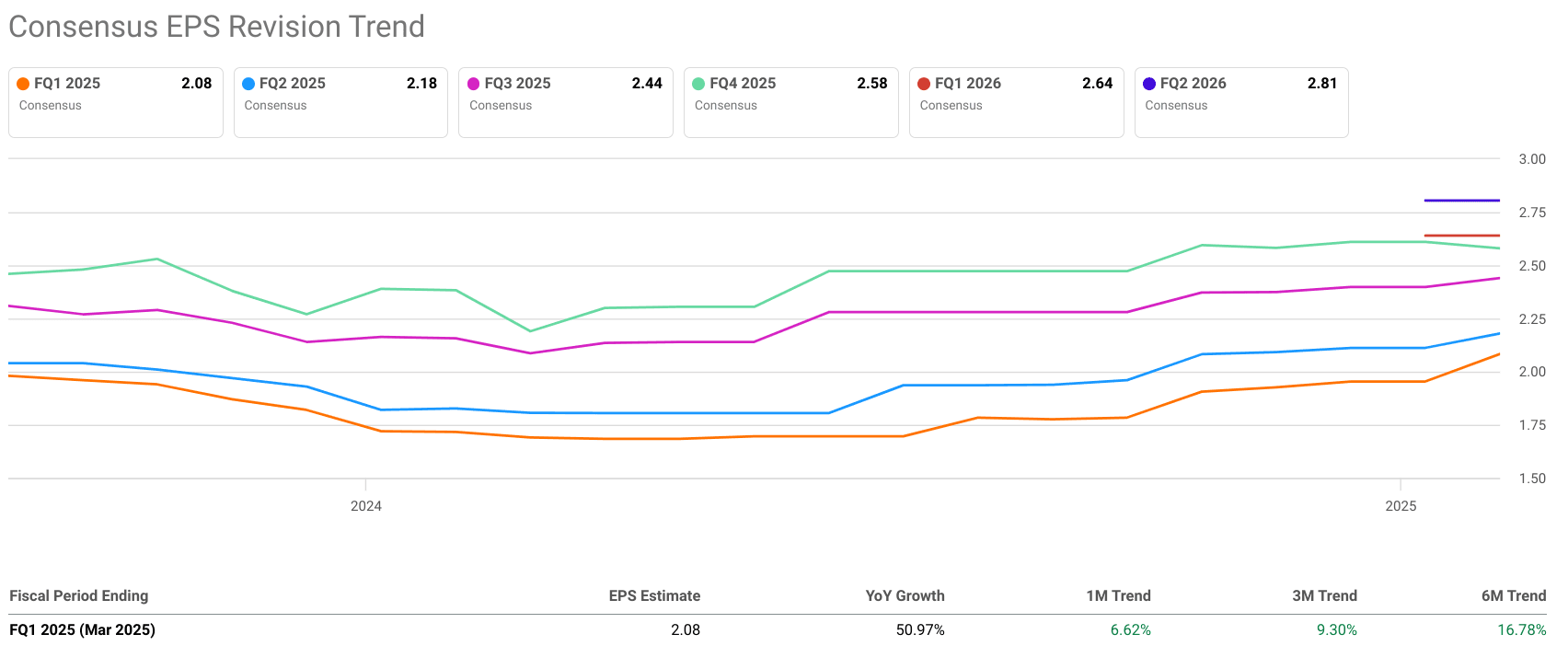

TSMC also expects rapid growth in AI-related applications. Revenue from AI accelerators, encompassing AI GPUs, ASICs, and HBM controllers, tripled in 2024, contributing mid-teens percentages to total revenue. Management forecasts this segment to double in 2025, with a mid-40% compound annual growth rate (CAGR) over the next five years. High-performance computing (HPC), the company’s largest revenue driver, accounted for 51% of 2024 revenue and increased 58% YoY. This growth trajectory aligns with global trends emphasizing AI, 5G, and HPC. These trends are reflected in positive consensus revisions for the upcoming quarter.

The semiconductor industry’s broader trends further support TSMC’s outlook. Market demand for semiconductors in AI, cloud computing, 5G, automotive, and consumer electronics is expected to rise. TSMC forecasts a 10% growth in the foundry market for 2025, surpassing 2024’s modest 6% increase. Notably, TSMC’s strategic initiatives in geographic expansion, including fabs in Arizona, Japan, and Germany, aim to address regional demand and geopolitical shifts.

Source: Seekingalpha.com

*Disclaimer: The content of this article is for learning purposes only and does not represent the official position of SnowBallHare, nor can it be used as investment advice.