Following XPeng’s Q3 2024 earnings release, the stock recorded a -3% price return, reflecting mixed investor sentiment amid strong revenue growth but continued operational losses and competitive pressures. This performance underscores market caution despite notable advancements in AI-driven technology and improved margins.

Source: Ycharts.com

I. XPeng Earnings Overview Q3 2024

Revenue and Earnings Performance

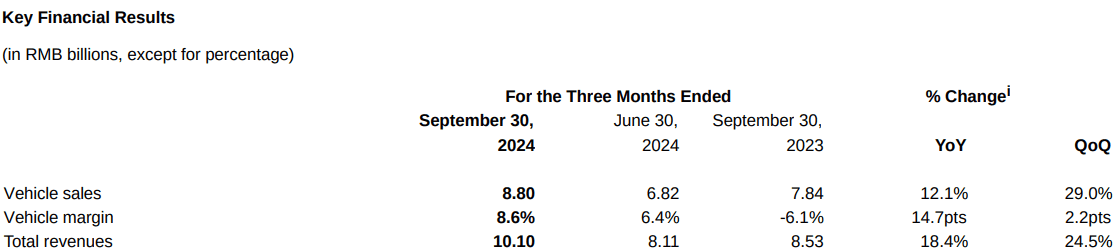

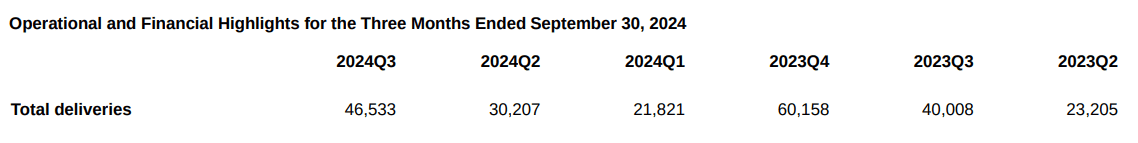

XPeng reported total revenues of RMB10.1 billion ($1.4 billion) for Q3 2024, an 18.4% year-over-year (YoY) increase and a 24.5% quarter-over-quarter (QoQ) rise. This result missed market expectations by $10.3 million. Adjusted earnings per share (EPS) came in at -$0.22, beating expectations by $0.01. GAAP EPS was -$0.26, similarly surpassing forecasts by $0.01. Net loss narrowed to RMB1.81 billion, a significant improvement from RMB3.89 billion YoY, though it grew from RMB1.28 billion QoQ.

Margins: Gross margin reached 15.3%, a stark improvement from -2.7% YoY and up from 14% in Q2 2024, reflecting cost optimization and an enhanced product mix. Vehicle margin increased to 8.6%, up from -6.1% YoY and 6.4% QoQ. Operating margin also improved, though the loss from operations (RMB1.85 billion) remains substantial, reflecting high R&D and SG&A costs.

Source: XPENG Q3 2024 Unaudited Financial Results

Revenue Breakdown: Revenues from vehicle sales amounted to RMB8.8 billion, representing a 12.1% YoY and 29% QoQ growth, driven by increased vehicle deliveries. Revenues from services and others surged 90.7% YoY to RMB1.31 billion, primarily due to technical R&D collaborations with Volkswagen on electric architecture (EEA), though QoQ growth was modest at 1.1%.

XPEV Earnings Q3 2024 Key Revenue Drivers and Trends

XPeng’s higher delivery volumes and product mix enhancements were central to growth. Total Q3 deliveries of vehicles were 46,533, 16.3% YoY revenue growth underscores robust market demand and operational efficiency. Collaboration with Volkswagen added a new revenue stream, positioning XPeng for future technology partnerships.

Source: XPENG Q3 2024 Unaudited Financial Results

Cost and Expense Analysis

- R&D Expenses: Up 25.1% YoY to RMB1.63 billion, driven by investments in new models and expanded product portfolios.

- SG&A Expenses: Down 3.5% YoY to RMB1.63 billion due to reduced employee compensation but up 3.8% QoQ due to higher franchise store commissions.

Cash Position: The company ended the quarter with RMB35.75 billion in cash and equivalents, ensuring a robust liquidity buffer to support R&D and operational scaling.

II. Product & Market Dynamics

Recent Vehicle Launches & Technological Advancements

XPeng's third-quarter performance in 2024 exemplifies its rising trajectory, marked by the launch of the P7+, the world's first AI-defined car. Within 24 hours of its release, firm orders exceeded 30,000 units, highlighting robust consumer reception. The P7+ features AI Hawkeye Visual ADAS, delivering Level 3 autonomous driving at Level 2 costs, and positions XPeng as a technology leader in intelligent mobility. Alongside the Mona M03 Max, XPeng aims to deliver AI-powered vehicles at price points as low as $20,000 (RMB 150,000). Future advancements include the Kunpeng Super Electric Drive System, offering a combined range of 1,400 km and high-voltage ultra-charging. By integrating cutting-edge AI into its product ecosystem, XPeng achieves differentiation through technology, aligning with the industry shift where luxury is increasingly defined by intelligence rather than configuration.

Source: ir.xiaopeng.com

Expansion of Supercharging Networks and Energy Innovations

XPeng's dual energy strategy, incorporating both pure electric and extended-range powertrains, aims to address diverse consumer demands globally. Their new 800-volt platform is a generation ahead, boasting exceptional energy efficiency and fast-charging capabilities. In response to increasing demand, XPeng’s strategic partnerships have expanded global supercharging networks and production capacity, ensuring scalability.

Competitive Landscape

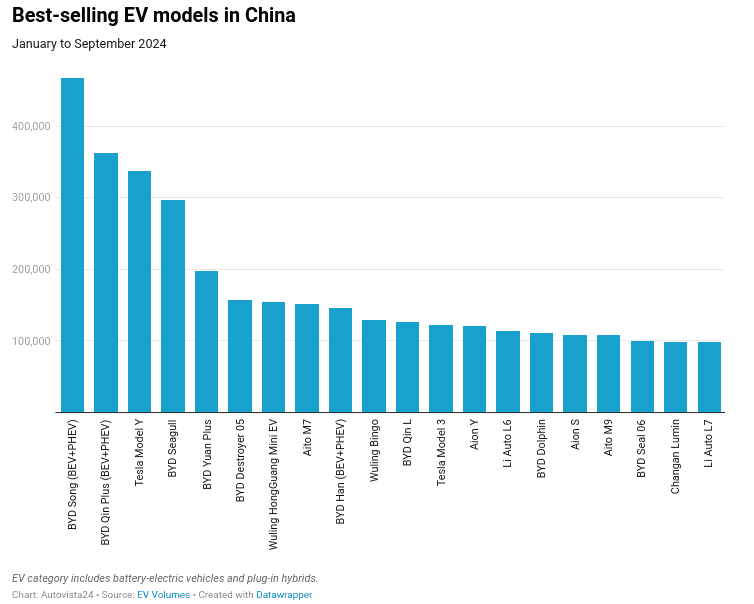

XPeng faces stiff competition in China’s highly saturated EV market, where rivals like BYD, Tesla, Li Auto, and NIO dominate. In September 2024, BYD achieved a record 419,426 deliveries, up 45.9% YoY, leveraging its scale advantage. Tesla's aggressive price cuts and dominance in Model 3/Y sales also pose a challenge. Li Auto, another formidable competitor, reached 53,709 sales in September, surpassing XPeng’s record 21,352. However, XPeng’s focus on affordable AI-defined vehicles differentiates it in the mid-market, while rivals emphasize premium segments.

Source: autovista24

Pricing Strategies & Market Share

XPeng’s emphasis on competitive pricing, exemplified by the Mona M03 Max, enhances its appeal in budget-conscious segments, offering advanced technology at unprecedented affordability. The overall Chinese EV market saw 53.9% penetration in August 2024, and XPeng aims to capture an expanding share through global expansions and AI innovation. Yet, competitors like BYD, with 65% of China's global EV sales share, and Tesla, remain dominant forces.

III. XPEV Stock Forecast

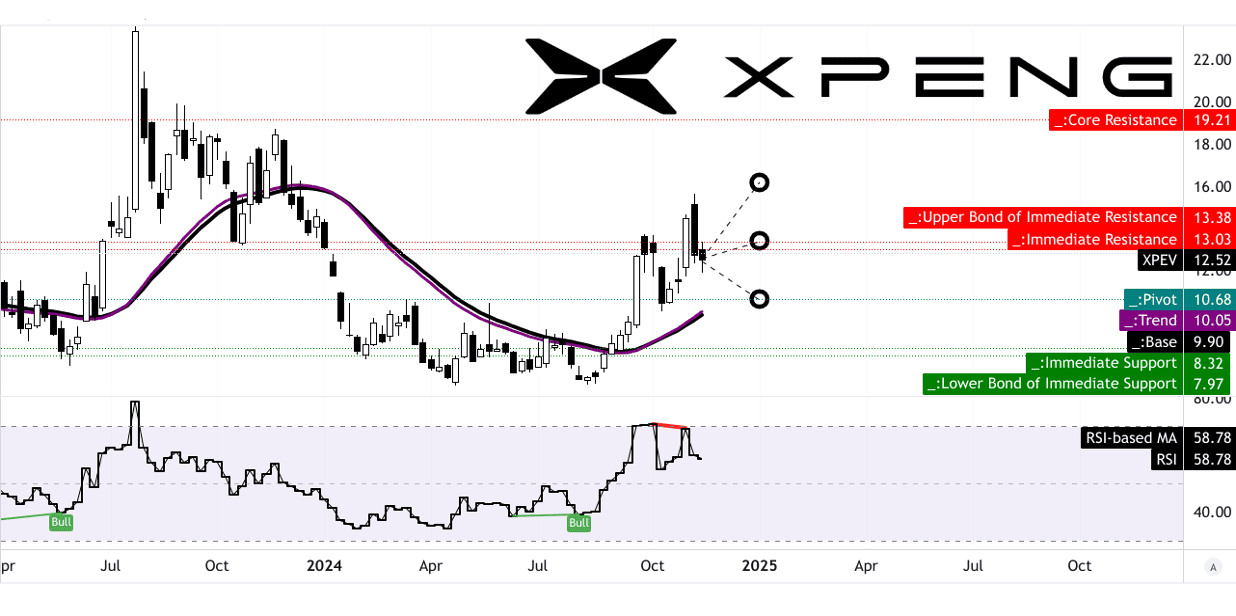

XPEV Stock Forecast Technical Analysis

XPeng Inc.'s (XPEV) stock shows mixed signals based on technical analysis. As of now, the stock trades at $12.52. The trendline value, calculated through a modified exponential moving average, lies at $10.05, slightly above the baseline of $9.90, indicating potential support levels but signaling limited upward momentum.

Key price targets for XPEV by the end of 2024 are split across three scenarios:

- Average Price Target: $13.00, driven by changes in polarity and Fibonacci retracement/extension levels.

- Optimistic Price Target: $16.00, projecting stronger upward momentum in short- to mid-term swings.

- Pessimistic Price Target: $10.00, aligned with downward momentum using the same Fibonacci techniques.

The stock operates within a horizontal price channel with a pivot point at $10.68, signifying a key area for price consolidation or breakout. However, the Relative Strength Index (RSI) stands at 58.78, close to overbought territory. A bearish divergence exists, as the RSI trend is downward, indicating weakening momentum and a potential correction ahead. This suggests caution, especially given the absence of bullish divergence.

Source: tradingview.com

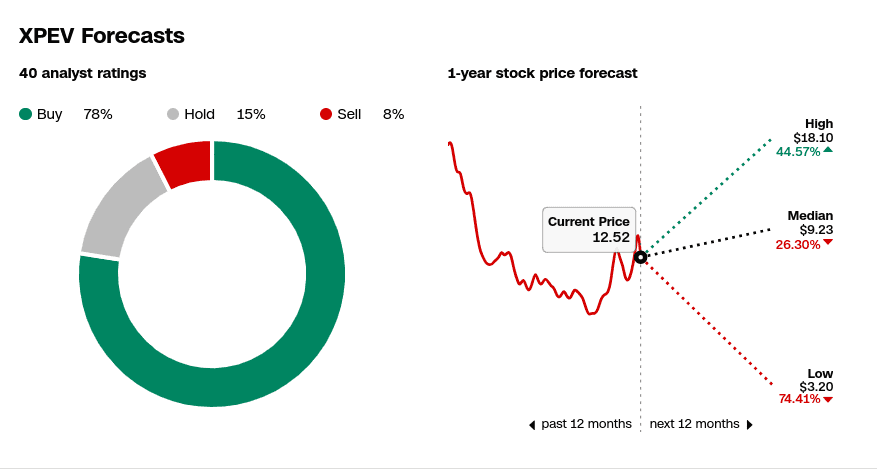

XPeng Stock Forecast: Market Analysts' Expectations and Ratings

Market sentiment leans heavily toward optimism. According to CNN's compilation of 40 analyst ratings:

- 78% recommend a "buy,"

- 15% suggest "hold,"

- 8% advocate "sell."

The one-year price forecast highlights significant volatility:

- High: $18.10 (+44.57% from the current price), reflecting the most bullish outlook for aggressive growth scenarios.

- Median: $9.23 (-26.30%), implying skepticism about sustained upward trends.

- Low: $3.20 (-74.41%), representing a severe downside risk under bearish market conditions.

The disparity between the high and low forecasts underscores uncertainty in XPeng's near-term prospects. Market optimism, as reflected in the high percentage of buy ratings, likely stems from XPeng's potential in the electric vehicle market, but concerns about macroeconomic headwinds and sector-specific competition temper expectations.

Source: CNN

IV. XPEV Stock Forecast: Future Outlook

Management’s Growth Forecasts and Strategic Initiatives

XPeng’s Q3 2024 performance highlights its strong position in the electric vehicle (EV) market, with deliveries reaching 46,533 units, a 54% quarter-over-quarter (QoQ) increase and a 16% year-over-year (YoY) growth. The company expects Q4 2024 deliveries to rise significantly, targeting between 87,000 and 91,000 units, reflecting a YoY increase of up to 51.3%. Gross margins have reached 15.3%, improving for five consecutive quarters. Revenue for Q4 2024 is projected between RMB15.3 billion and RMB16.2 billion, representing a YoY growth of up to 24.1%.

XPeng’s strategic pivot centers on AI-driven technologies. The P7+ model, hailed as the world’s first AI-defined car, received over 30,000 firm orders post-launch. By 2025, XPeng plans to launch four new models while updating existing ones. The AI Hawkeye Visual ADAS, a proprietary system eliminating reliance on LiDAR or HD maps, is poised to enhance XPeng’s competitive edge globally. The company anticipates a transformative increase in intelligent driving capabilities, aiming for Level 3 autonomous driving by Q4 2025.

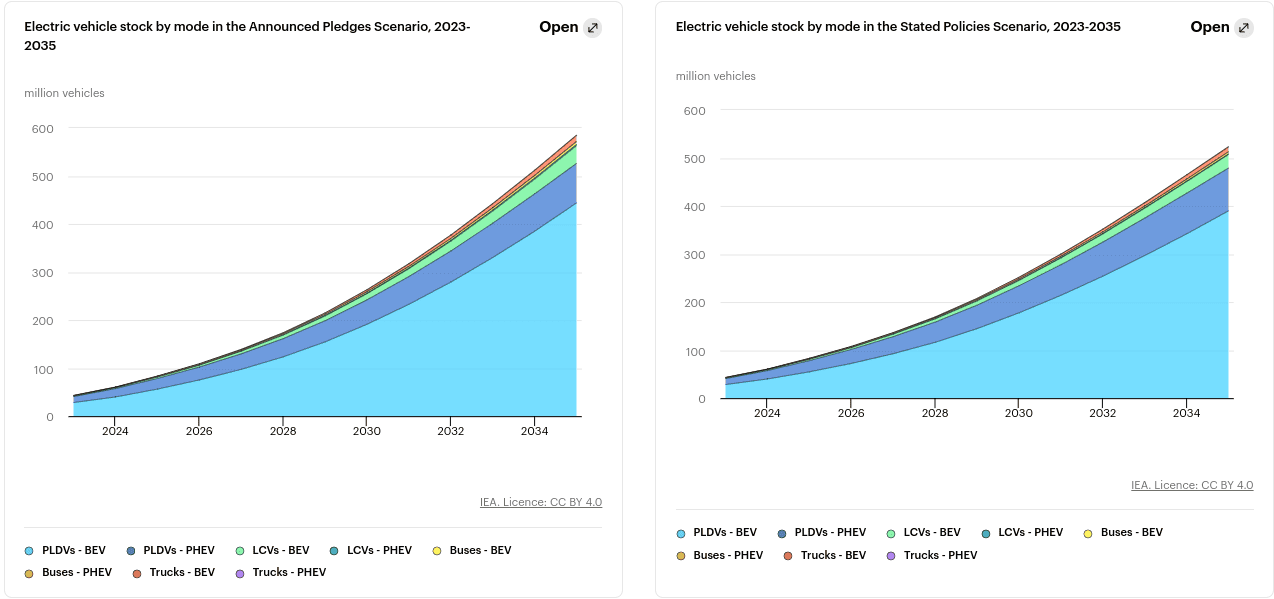

Market Trends

The EV sector’s growth trajectory is robust, driven by global policy mandates and technological advancements. Light-duty vehicles (LDVs), which dominate EV sales, are expected to reach 43 million units in 2030 and 60 million by 2035. In China, the penetration rate for new energy vehicles (NEVs) is projected to exceed 85% by 2027, with XPeng poised to capitalize on this trend.

Source: iea.org

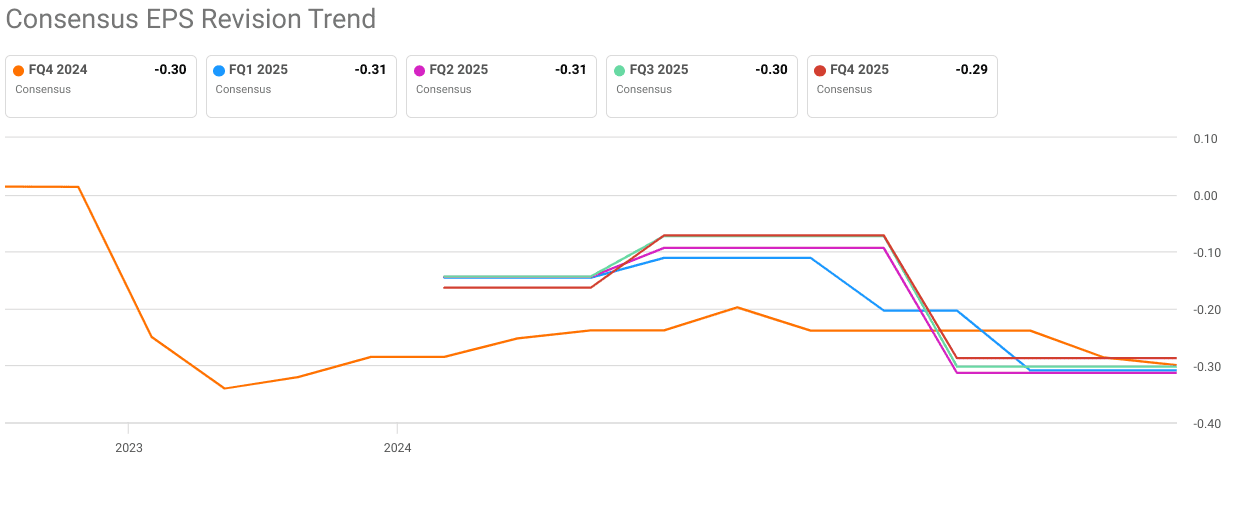

Quarterly Estimate Revisions And Outlook

EPS revisions show two upward and one downward adjustments, while revenue estimates have four downward and one upward revision. For Q4 2024, analysts predict an EPS of -$0.30, reflecting an 8.85% YoY improvement, and revenue of $2.08 billion, marking a 14.49% YoY increase. XPeng’s comprehensive R&D strategy, robust AI integration, and international expansion (15% of sales in Q3) underscore its growth potential. The company’s cash position, projected to exceed RMB40 billion by year-end 2024, enhances its ability to innovate and scale. However, challenges remain, including competitive pressures in the Chinese market and maintaining profitability amidst rapid expansion.

Source: seekingalpha.com