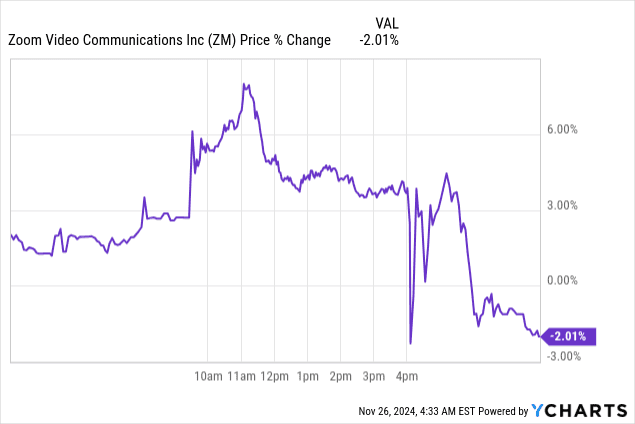

Zoom Video Communications (ZM) posted a -2% stock price return following its Q3 FY2025 earnings. Despite beating revenue and EPS estimates—hitting $1.178 billion and $1.38 (non-GAAP)—the market’s response reflects cautious optimism. Key highlights include 4% YoY revenue growth, strong enterprise gains, and ongoing innovation in AI-driven products and services.

Source: Ycharts.com

I. Zoom Earnings Overview Q3 2025

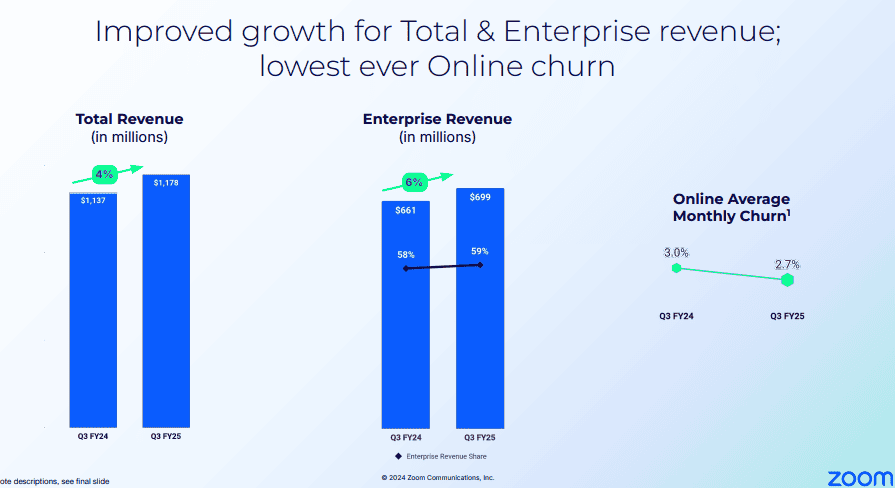

Zoom Video Communications, Inc. (ZM) delivered a stable performance in Q3 FY2025, with both revenue and earnings surpassing market projections. Revenue hit $1.178 billion, a 4% YoY growth, exceeding the high end of guidance by $13 million. The EPS on a non-GAAP basis came in at $1.38, $0.07 above expectations, while GAAP EPS stood at $0.66, beating estimates by $0.06. The revenue surprise of $13.57 million highlights improved performance in Enterprise and Online segments, reflecting positive demand trends.

Enterprise revenue grew 6% YoY, constituting 59% of consolidated revenue—an increase of 1 percentage point from the prior year. This segment also saw a 7% YoY growth in up-market customers, with nearly 4,000 customers contributing over $100,000 in trailing twelve-month revenue. These high-value customers now account for 31% of consolidated revenue, marking a 2-point increase YoY. Meanwhile, churn rates improved significantly, with the average monthly churn decreasing by 30 basis points YoY to 2.7%, the lowest in company history.

Source: Zoom Q3 FY25 Earnings Deck

Zoom's advancements in AI have gained traction, with AI Companion Monthly Active Users surging 59% quarter-over-quarter. Additionally, the expansion into adjacent markets is evident through Workvivo's 72% YoY customer growth, aided by its partnership with Meta, and the Zoom Contact Center's customer base exceeding 1,250, an 82% YoY growth. Regional revenue performance showed a 4% YoY increase in the Americas and 5% in EMEA, while APAC remained flat.

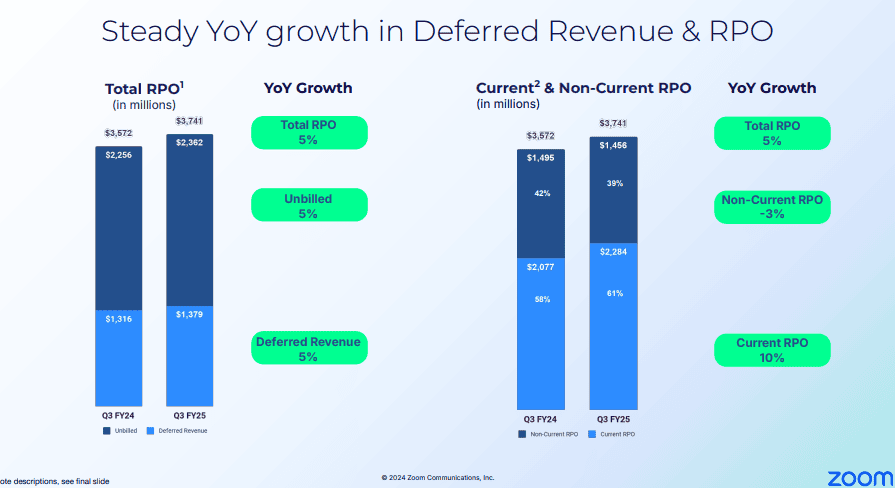

Operating metrics reflected stable profitability. Non-GAAP gross margin stood at 78.9%, slightly down from 79.7% a year earlier, mainly due to AI-related investments. Non-GAAP operating income reached $458 million, translating to a 38.9% margin, down marginally from 39.3% last year. Operating cash flow dropped 2% YoY to $483 million, while free cash flow rose 1% to $458 million, representing a free cash flow margin of 38.9%. The balance sheet remains robust, with $7.7 billion in cash and marketable securities. Deferred revenue rose 5% YoY to $1.38 billion, and RPO increased to $3.74 billion, with 61% expected to convert into revenue within 12 months.

Source: Zoom Q3 FY25 Earnings Deck

II. Product & Market Dynamics

New Products & Innovations

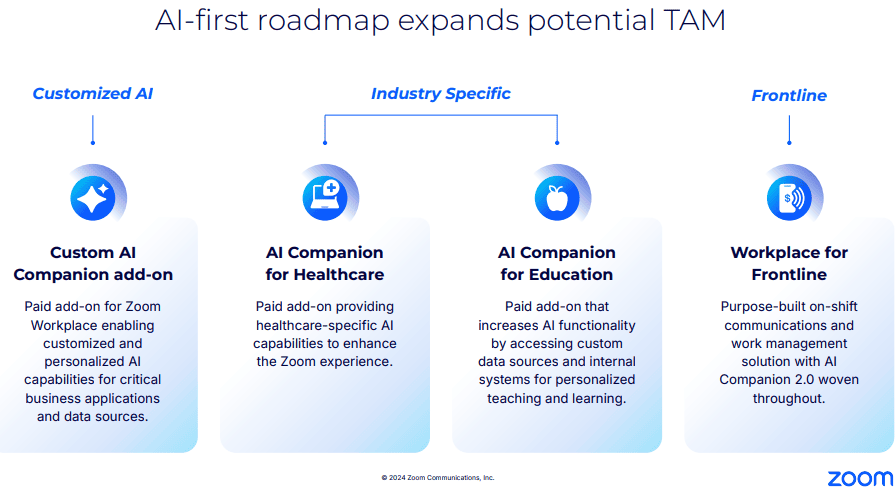

Zoom Video Communications is fortifying its competitive position through aggressive innovation, focused product diversification, and strategic market entries. In Q3 2025, the launch of its AI-first Work Platform, demonstrated at Zoomtopia, underscores the company's ambition to redefine collaboration by embedding advanced AI tools. The AI Companion 2.0, with features like Meeting Summary and Smart Compose, pushes beyond task automation toward a more integrated, agent-driven AI system. This evolution aligns AI solutions with existing workflows, highlighting efficiency without disrupting operations. The introduction of industry-specific AI add-ons for healthcare and education, alongside the upcoming Zoom Workplace for Frontline, signifies a tactical move to penetrate underserved markets, particularly in sectors like retail and manufacturing.

Zoom’s strategy appears effective in leveraging its vast user base for upselling. Notable growth in its Contact Center business includes securing a record-breaking deal of 20,000 seats with Agencia Tributaria, showcasing scalability in enterprise solutions. Workvivo, Zoom’s employee engagement platform, landed major accounts like a Fortune 10 company, indicating the increasing traction of its platform-based ecosystem. These successes validate Zoom's "better together" approach, where bundled services create cross-selling opportunities.

Source: Zoom Q3 FY25 Earnings Deck

Competitive Landscape

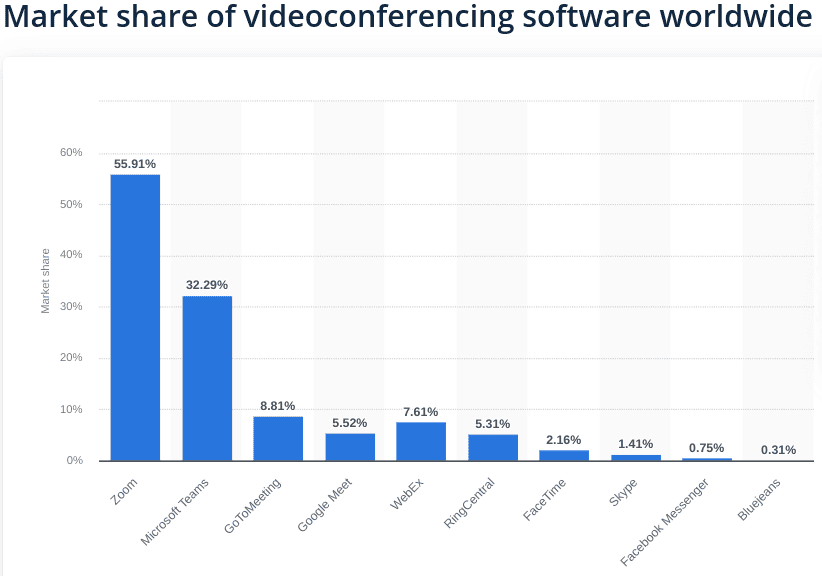

Despite its leadership in market share at 55.91%, Zoom operates in a fiercely contested environment. Microsoft Teams, holding 32.29%, remains a formidable rival with its deep integration into the Microsoft 365 suite. Similarly, Google Meet (5.52%) and Cisco WebEx (7.61%) are bolstered by their parent companies' ecosystems, threatening Zoom’s user acquisition in enterprise markets. Zoom's strategy to counter this involves distinguishing its platform through advanced AI capabilities and flexible, modular offerings.

Pricing strategies play a pivotal role in Zoom's competitive edge. The company’s freemium model, combined with tiered pricing for add-ons like Custom AI Companions, ensures accessibility while incentivizing upgrades. Its emphasis on ROI for AI deployments—showcasing productivity gains for clients like Zscaler and athenahealth—bolsters its value proposition against competitors often perceived as costlier or less customizable.

Source: statista.com

III. ZM Stock Forecast

Zoom Stock Forecast Technical Analysis

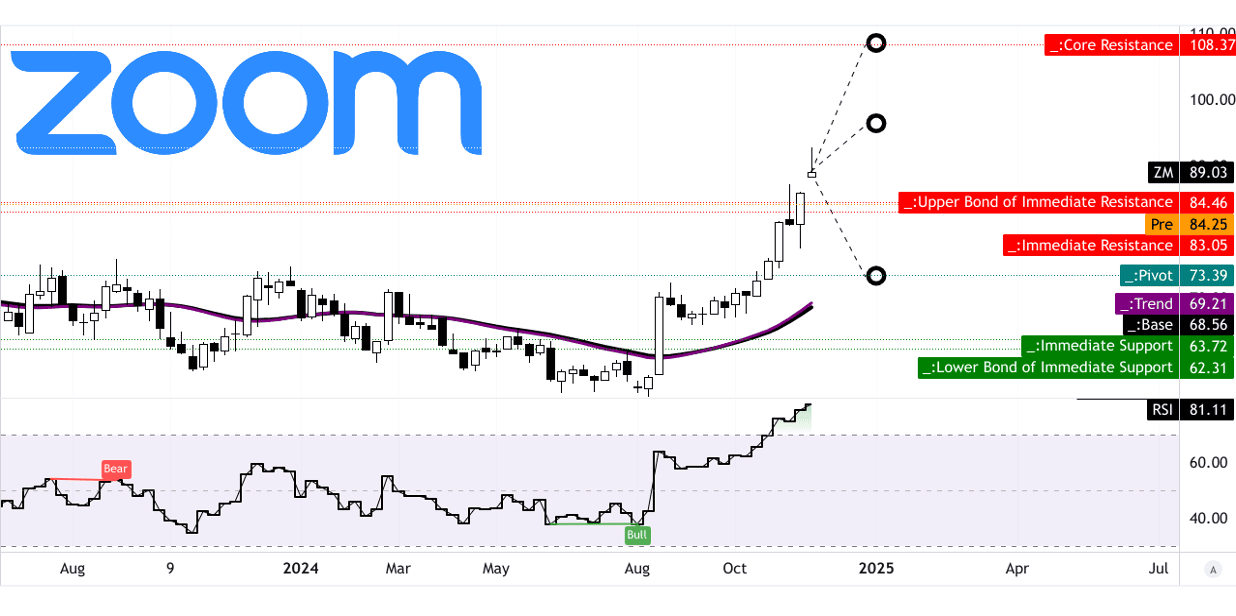

Zoom Video Communications exhibits a mixed outlook in its current stock performance and projections, with a balance of bullish indicators and potential downside risks. At $89.03, the current stock price stands well above both its trendline ($69.21) and baseline ($68.56), reflecting momentum-driven gains. However, the relative strength index (RSI) at 81.11 indicates an overbought condition, suggesting a potential pullback as the market may consider the stock overvalued in the short term.

The average price target by the end of 2024, projected at $108, suggests a potential upside of approximately 21.3% from the current price. This estimate stems from Fibonacci retracement/extension analysis applied to momentum shifts over mid- and short-term trends. The optimistic price target of $96 implies a more moderate 6.7% upside, consistent with sustained but less aggressive price momentum. Conversely, the pessimistic target of $74 reflects potential downside risks, particularly if downward price momentum prevails, representing a decline of 16.9%.

The pivot level for the current horizontal price channel is $73.39. A breach below this pivot could signal a bearish trend reversal, while sustained trading above it aligns with the bullish momentum currently observed.

Source: tradingview.com

ZM Stock Forecast: Market Analysts' Expectations & Ratings

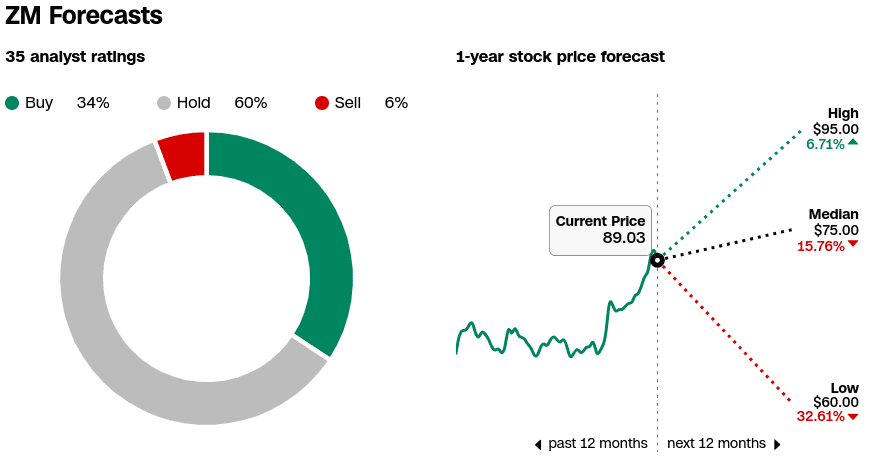

Analyst sentiment reinforces this cautious optimism. Among 35 ratings aggregated by CNN, 34% recommend a buy, while 60% advocate holding the stock. A mere 6% suggest selling, indicating general confidence in Zoom’s longer-term prospects. The 1-year median price forecast of $75 represents a downside of approximately 15.8%, underscoring the divergence in short-term expectations among analysts. The high-end forecast of $95 aligns closely with the optimistic target, reflecting modest growth, while the low-end prediction of $60 suggests a 32.6% drop, likely tied to macroeconomic headwinds or operational challenges.

The absence of bullish or bearish divergences in the RSI indicates that current price movements are consistent with underlying market sentiment. However, the RSI's upward trend, paired with its elevated value, warrants monitoring for a reversal that could coincide with price consolidation or declines.

Source: CNN.com

IV. Zoom Stock Forecast: Future Outlook

Management’s Growth Forecasts and Strategic Moves

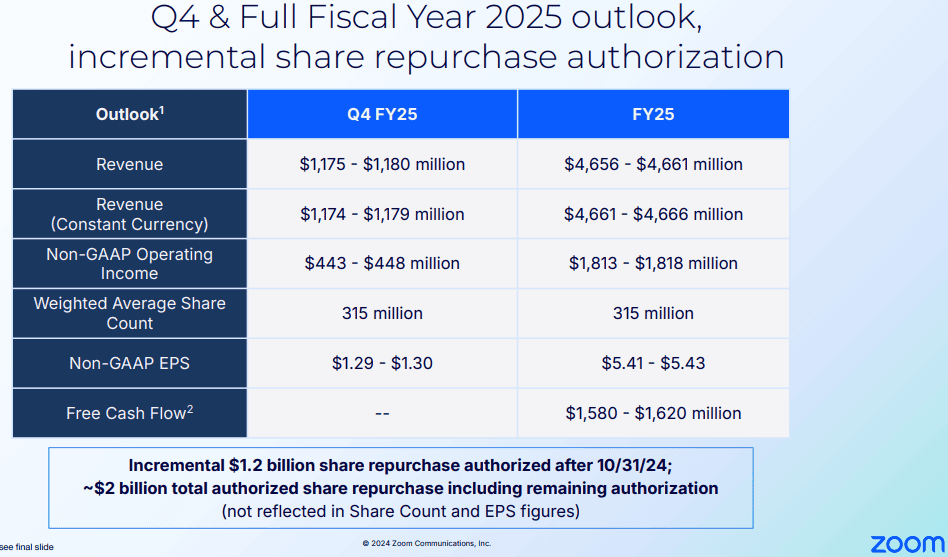

Zoom projects Q4 2025 revenue between $1.175 billion and $1.18 billion, reflecting 2.7% YoY growth at the midpoint. For FY25, consolidated revenue is estimated at $4.656 billion to $4.661 billion, up 2.9%. Earnings per share (EPS) for FY25 are forecasted at $5.41 to $5.43, driven by disciplined expense management and AI-focused investments.

The company’s vision to become an "AI-first Work Platform for Human Connection" is central to its strategy. AI Companion 2.0 and customized AI solutions tailored for sectors like healthcare and education are set to hit the market in early 2025. Zoom also plans to address the underserved frontline worker market with a mobile-centric solution, Zoom Workplace for Frontline, slated for the first half of 2025. These products align with a broadening addressable market, supported by recent customer wins in retail, healthcare, and manufacturing.

Source: Zoom Q3 FY25 Earnings Deck

Market Trends

Zoom is positioned at the intersection of major market trends, such as hybrid work adoption and rising demand for enterprise collaboration software. Hybrid work models are expected to dominate, with enterprises seeking scalable, secure, and AI-powered solutions to improve productivity. Zoom’s enhanced AI offerings address these demands by integrating seamlessly into existing workflows.

The market for enterprise collaboration software is forecasted to grow at a compound annual rate exceeding 10% through 2027, a potential tailwind for Zoom. Spending in this category is supported by digital transformation initiatives across industries, with AI solutions playing a pivotal role. Zoom’s partnerships, such as those with ServiceNow and Meta, highlight its strategy to deepen its ecosystem and integrate AI into broader enterprise platforms.

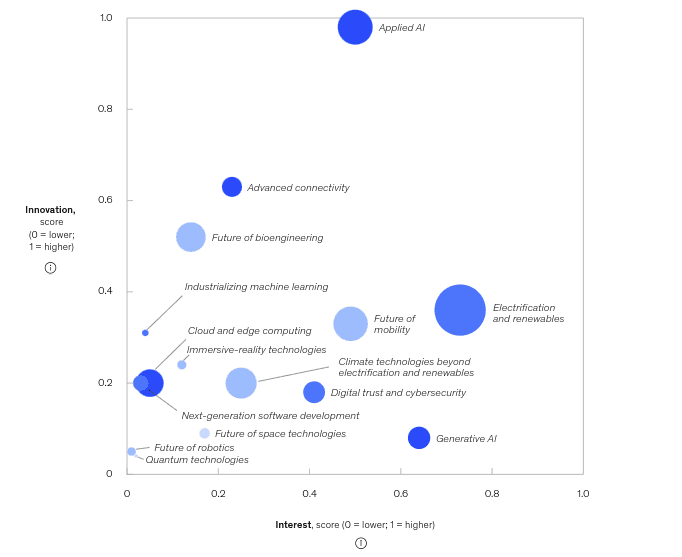

[Advanced connectivity, 2023 Compute and connectivity frontiers. Equity investment: $29 billion]

Source: mckinsey.com

Despite promising prospects, the company faces headwinds, including slower growth in some regions like APAC and fluctuating enterprise customer metrics. The shift in enterprise customer focus reduced the metric’s value as a performance indicator, requiring alternative measures like net dollar expansion rates, which stood at 98% in Q3. Furthermore, a mixed macroeconomic environment could pressure deferred revenue growth, projected at a modest 5%-6% YoY for Q4.