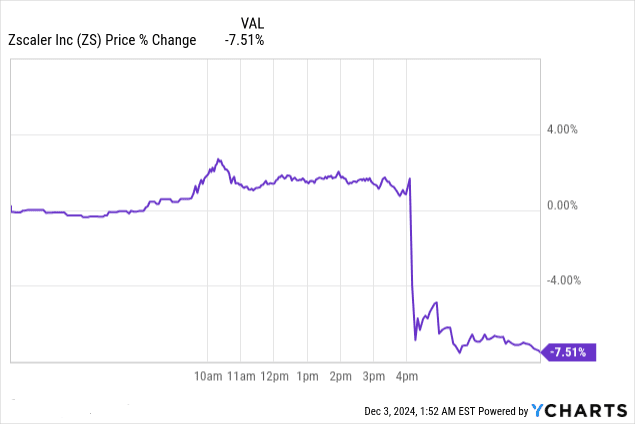

Zscaler’s Q1 2025 earnings release resulted in a -7.5% drop in stock price, signaling a mismatch between strong operational performance and market sentiment. While revenue grew 26% YoY to $628M, slightly missing expectations, EPS sharply surpassed forecasts at $0.73 vs. $0.68, reflecting operational gains. However, guidance raised concerns over profitability and moderated growth.

Source: Ycharts.com

I. Zscaler Earnings Overview Q1 2025

Zscaler's Q1 2025 performance outpaced both internal guidance and market expectations across multiple metrics. Revenue hit $628 million (in line with expectations, $633.13M), marking a 26% YoY increase and a 6% sequential gain, exceeding consensus estimates. Earnings per share (EPS) stood at $0.73, significantly above the projected $0.68. Net income showed sharp improvement, driven by stable revenue growth and cost management. Gross margins remained stable at 80.6%, while operating margins rose to 21%, a boost of 330 basis points compared to the previous year. The free cash flow margin set a record at 46%, emphasizing operational efficiency.

Source: Zscaler Q1'25 Earnings Call Presentation

ZS Earnings Q1 2025 Revenue Drivers and Market Assessment

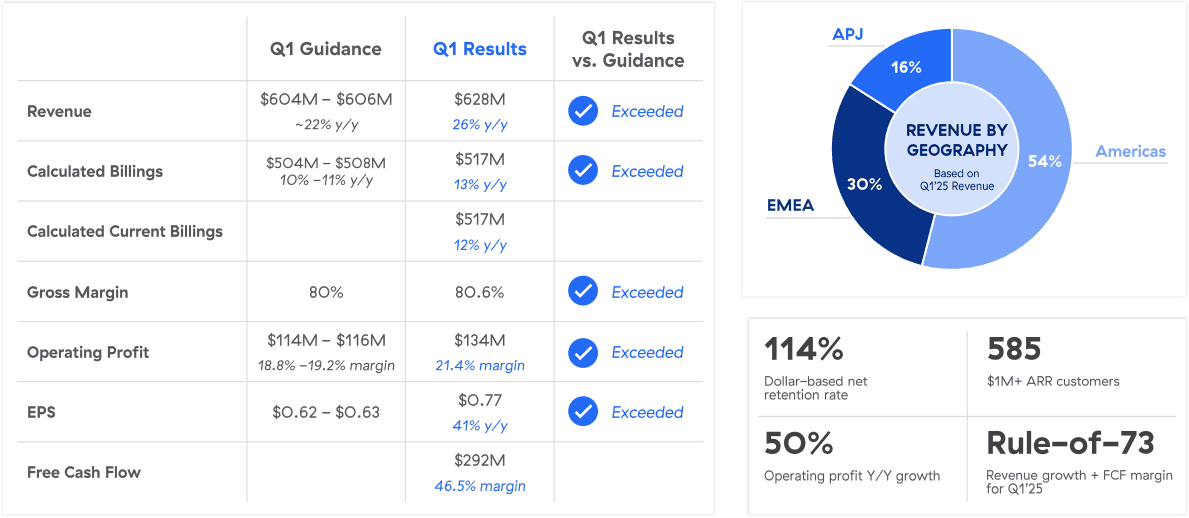

The revenue growth of 26% YoY stemmed from both geographic and product diversification. The Americas accounted for 54% of revenue, followed by EMEA at 30% and APJ at 16%. Core contributors included Zscaler’s Zero Trust Exchange platform and its expanding AI-powered offerings. Calculated billings, a leading growth indicator, reached $517 million, increasing 13% YoY, while unscheduled billings surged over 20%. Large deals contributed significantly; customers with over $1 million in annual recurring revenue (ARR) grew 25% YoY to 585.

Growth Dynamics by Product and Margin Trends

Product innovation, especially in AI-integrated solutions, fueled demand. High-margin products such as AI-powered data protection and ZDX Copilot led to meaningful upsells. For instance, a healthcare provider doubled its ZIA subscription and adopted ZDX Copilot, boosting ARR significantly. Similarly, new AI-enabled features addressing public and private AI app security attracted key enterprise deals, including a seven-figure agreement with a Global 2000 aerospace firm.

Operating expenses grew moderately at 19% YoY, reflecting disciplined investment. This balance between innovation and expense control was reflected in the operating profit’s 50% YoY increase. Consolidated RPO stood at $4.41 billion, growing 26% YoY, underscoring long-term revenue visibility.

Source: Zscaler Q1'25 Earnings Call Presentation

Source: Zscaler Q1'25 Earnings Call Presentation

II. Product & Market Dynamics

New Products and Innovations

Zscaler has aggressively expanded its portfolio with AI-driven features, emphasizing zero trust architecture. Notable advancements include AI-powered data protection and the ZDX Copilot, which improves operational efficiency by automating IT troubleshooting. For instance, ZDX Copilot adoption doubled spending from a healthcare client to over $5 million annually. Similarly, Zscaler secured a seven-figure contract with a Fortune 500 insurer by providing AI-enhanced workload security and application access controls. Additionally, the company’s Zero Trust Exchange integrates LLM proxies to secure public AI applications like ChatGPT and Microsoft Copilot. This innovation resulted in a major deal with a global technology client, accounting for half the annual contract value of a seven-figure deal.

Zscaler’s account-centric approach yields growth in high-value accounts, with $1 million+ ARR customers rising 25% YoY to 585. This aligns with a strong upsell strategy, as seen in the expansion of services to existing clients like a Fortune 500 insurance firm, nearly doubling annual commitments. Competitive pressures exist, but Zscaler’s bundling of data protection, zero trust, and AI capabilities enables pricing flexibility without sacrificing deal quality.

Source: Zscaler Q1'25 Earnings Call Presentation

Source: Zscaler Q1'25 Earnings Call Presentation

Competitive Landscape

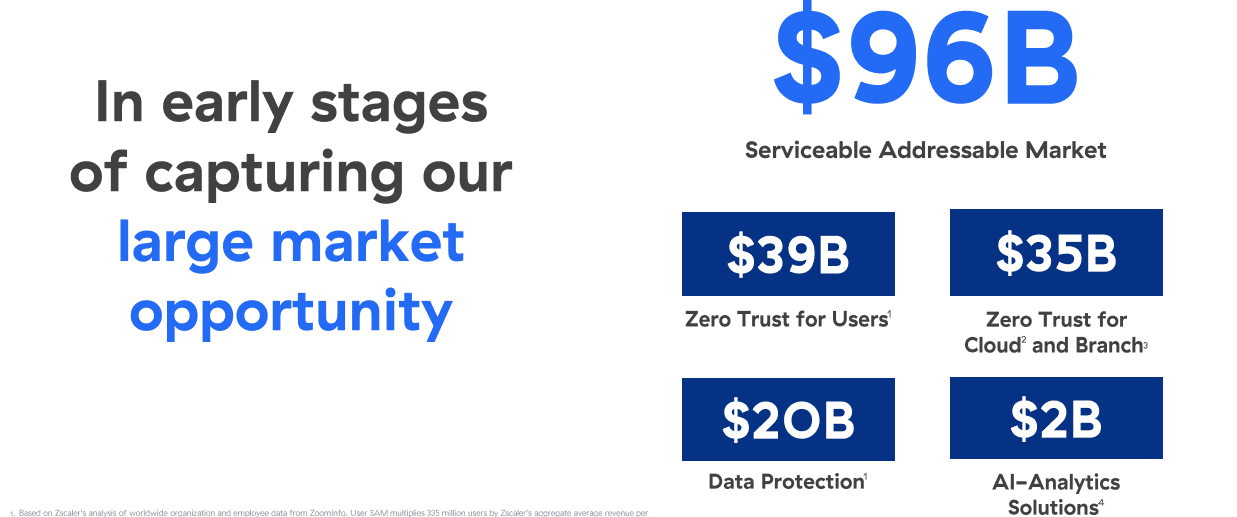

Zscaler operates in a crowded field with players like Palo Alto Networks, Cisco, Netskope, and Cloudflare. Despite this, Zscaler’s market share stands at 8.14%, reflecting growth fueled by differentiated offerings. Competitors rely on legacy solutions such as firewalls and VPNs, which Zscaler critiques as inherently flawed due to lateral threat vulnerabilities. In contrast, Zscaler’s pricing strategy bundles comprehensive AI capabilities, helping it secure large enterprise contracts, including 35% of Global 2000 and 45% of Fortune 500 companies. Case studies highlight transformative client wins—such as a Fortune 50 retailer overcoming failed legacy implementations by migrating to Zscaler.

III. ZS Stock Forecast

ZS Stock Forecast Technical Analysis

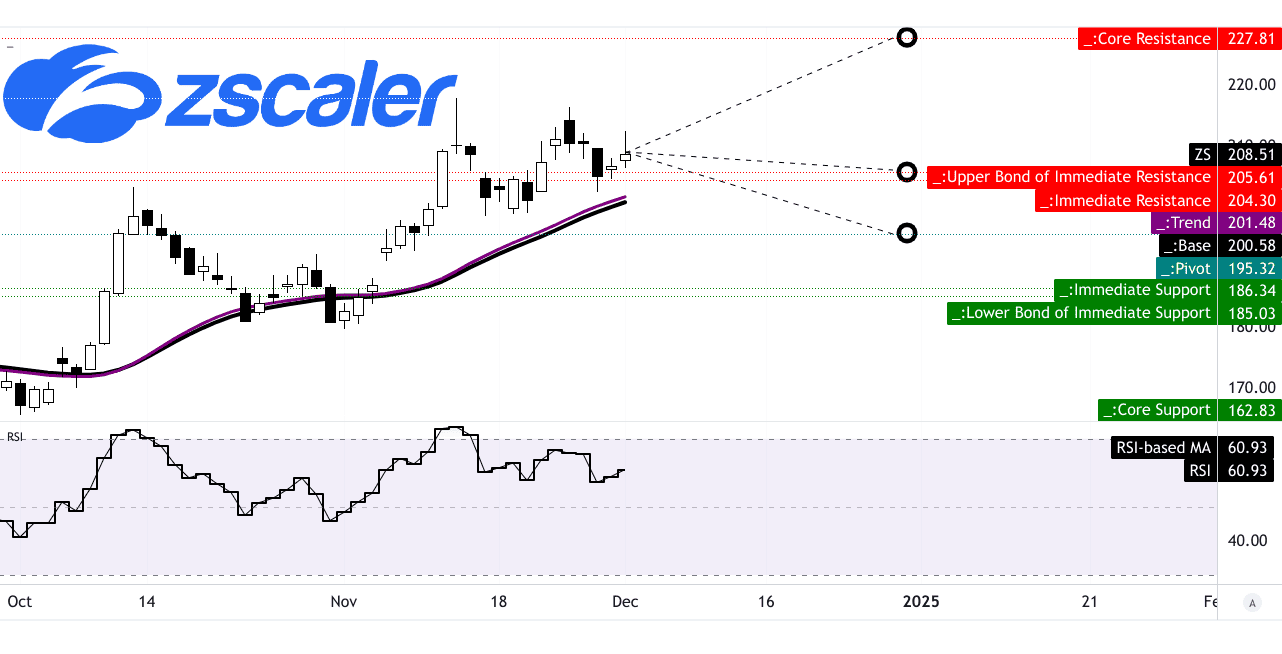

The current price stands at $208.00, while the trendline and baseline, derived using modified exponential moving averages, hover at $201.48 and $200.58, respectively. These averages imply ZS is slightly over its short-term fair valuation but maintains bullish momentum.

The pivot of the current horizontal price channel is $195.32, indicating $195 may act as a critical support level. If breached, further downside could materialize. RSI analysis reveals a value of 60.93, signaling mildly bullish momentum with no bearish divergence and a sideways trend in the RSI line. The presence of bullish divergence supports a potential continuation of upward movement.

Price Targets by End of 2024

The average price target is $206, aligning closely with current levels. This projection incorporates the momentum of change-in-polarity over Fibonacci retracement/extension levels. An optimistic target of $228 assumes continued bullish momentum, while a pessimistic target of $195 factors in potential downside risk. The narrow range suggests limited upside potential unless macroeconomic catalysts emerge.

Source: tradingview.com

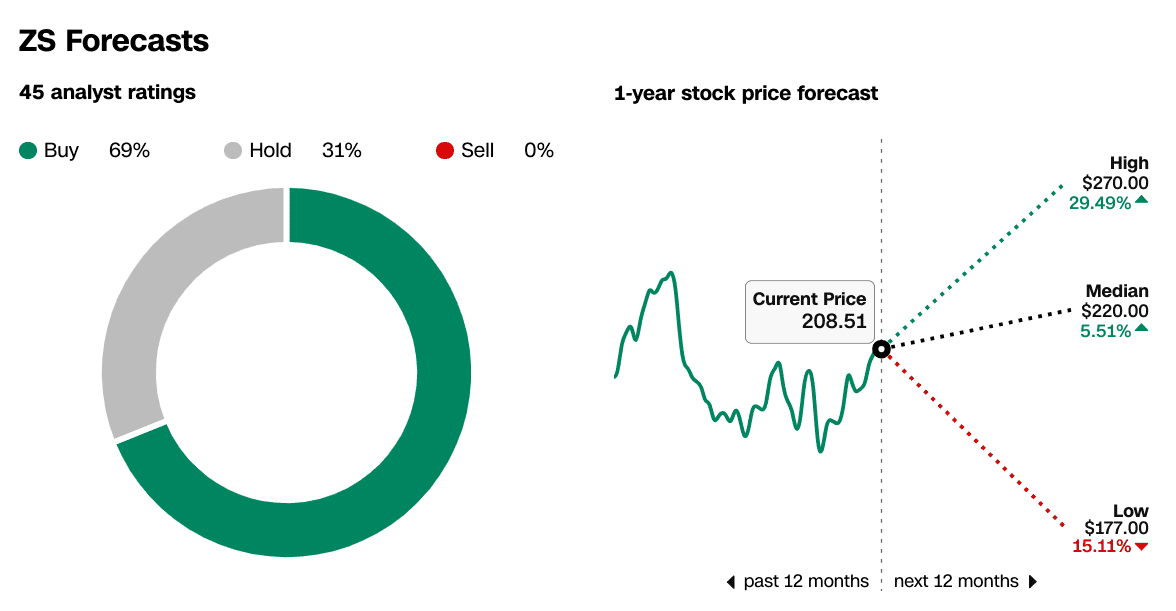

ZS Stock Forecast: Market Analysts’ Expectations

Analysts' consensus highlights a 69% buy recommendation, while 31% recommend holding, with no sell calls, reflecting optimism for ZS over the next year. Their 1-year forecasts project a high of $270 (a 29.49% upside), a median of $220 (a 5.51% upside), and a low of $177 (a 15.11% downside).

ZS operates in a price channel where $200–$210 functions as a consolidation zone. While the RSI and bullish divergence hint at upward potential, resistance near $220 (median analyst target) could limit gains. The consensus buy rating and high-end projection of $270 provide a bullish thesis, but caution is warranted given the proximity to the average target and the potential $195 downside, reinforcing a moderate risk-reward balance for mid-term investors.

Source: CNN.com

Source: CNN.com

IV. ZS Stock Forecast: Future Outlook

Zscaler's future outlook hinges on management's strategic initiatives and market trends shaping the cybersecurity landscape. Management remains optimistic about maintaining growth momentum, emphasizing the importance of Zero Trust adoption and AI-driven advancements. The company’s guidance for FQ2 2025 projects revenue between $633M and $635M, reflecting a YoY growth of 21%. Adjusted earnings per share (EPS) are expected between $0.68 and $0.69, albeit reflecting a 10.17% YoY decline in EPS. While this highlights potential compression on profitability, it underscores the focus on scaling innovative solutions.

Management Strategies

Zscaler's strategic priorities include expanding its AI portfolio and strengthening its Zero Trust Exchange platform. Notable customer wins, such as a seven-figure deal with a Fortune 500 insurance company for Zero Trust Private Access (ZPA) deployment, underline its strong enterprise penetration. The company has also showcased its ability to up-sell, as seen in cases where existing customers doubled their annual commitments. Innovations like AI-driven risk assessments and automated digital experience tools are integral to sustaining large deal volumes and improving operational efficiency.

The management's decision to emphasize account-centric sales over opportunistic approaches marks a tactical shift. This has contributed to a 25% growth in customers with $1M+ annual recurring revenue (ARR). Furthermore, Zscaler’s positioning as a pioneer in the Zero Trust and AI convergence aligns well with customer priorities, especially in securing AI applications and workloads.

Source: Zscaler Q1'25 Earnings Call Presentation

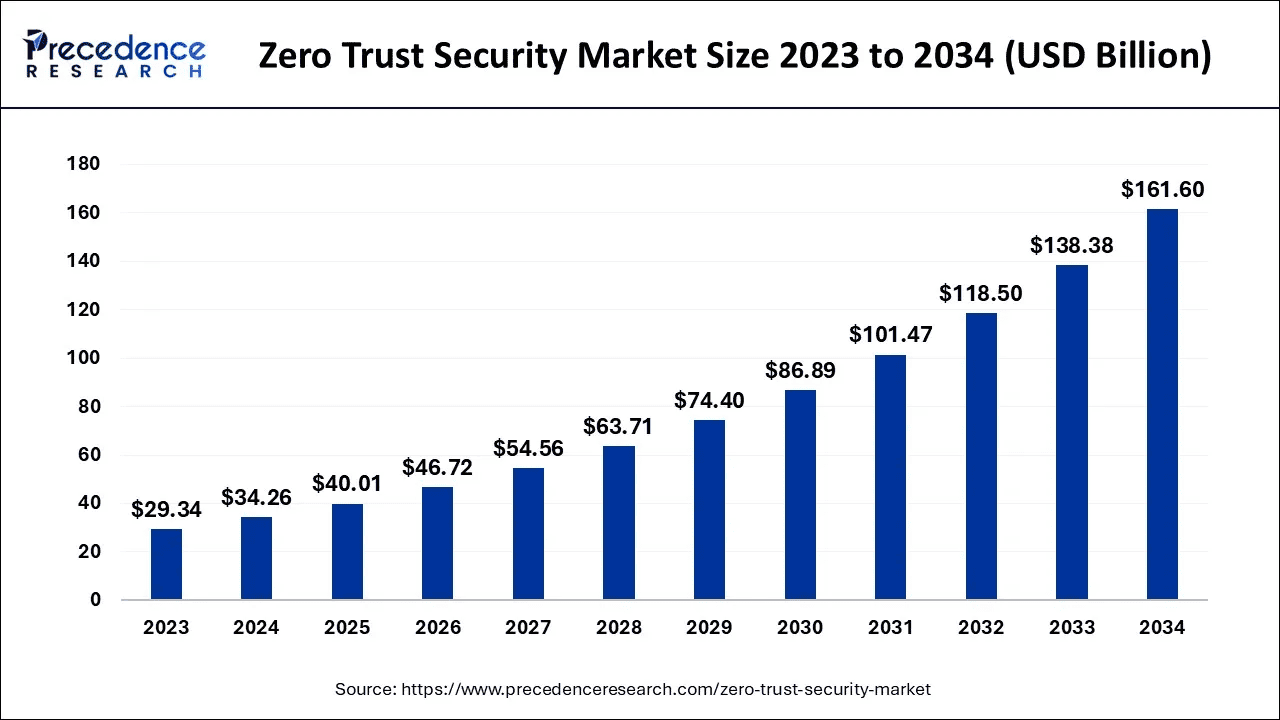

Market Trends

Macro trends such as increased adoption of Secure Access Service Edge (SASE) solutions, growth in Zero Trust frameworks, and rising cloud security spending favor Zscaler. The company benefits from its advanced AI capabilities, which align with enterprises' growing demand for securing public and private AI applications. Governments worldwide are also transitioning towards Zero Trust architectures, with Zscaler serving 14 of 15 U.S. cabinet-level agencies, signaling robust federal-sector growth opportunities.

Source: precedenceresearch.com

Source: precedenceresearch.com